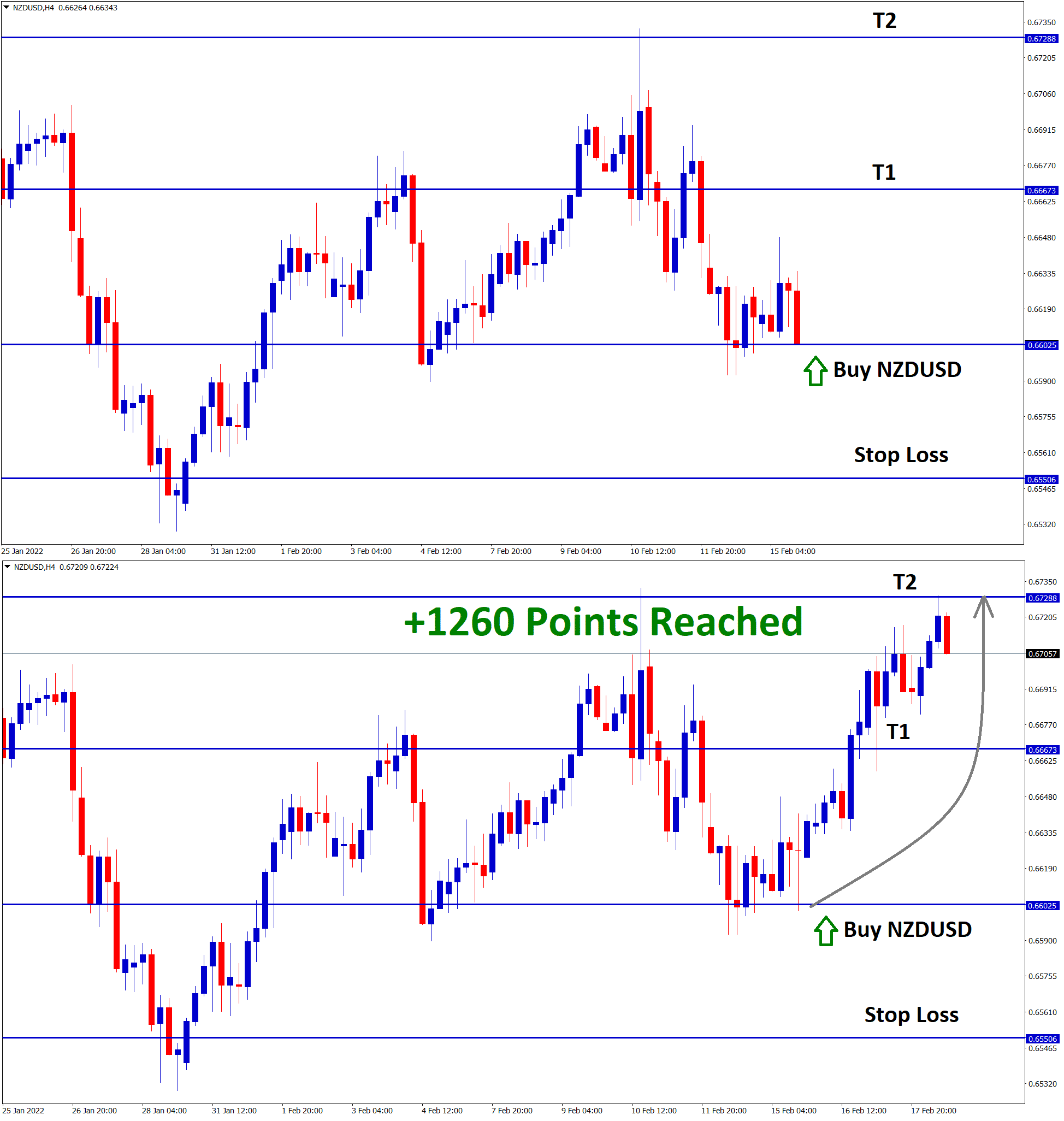

NZDUSD Analysis

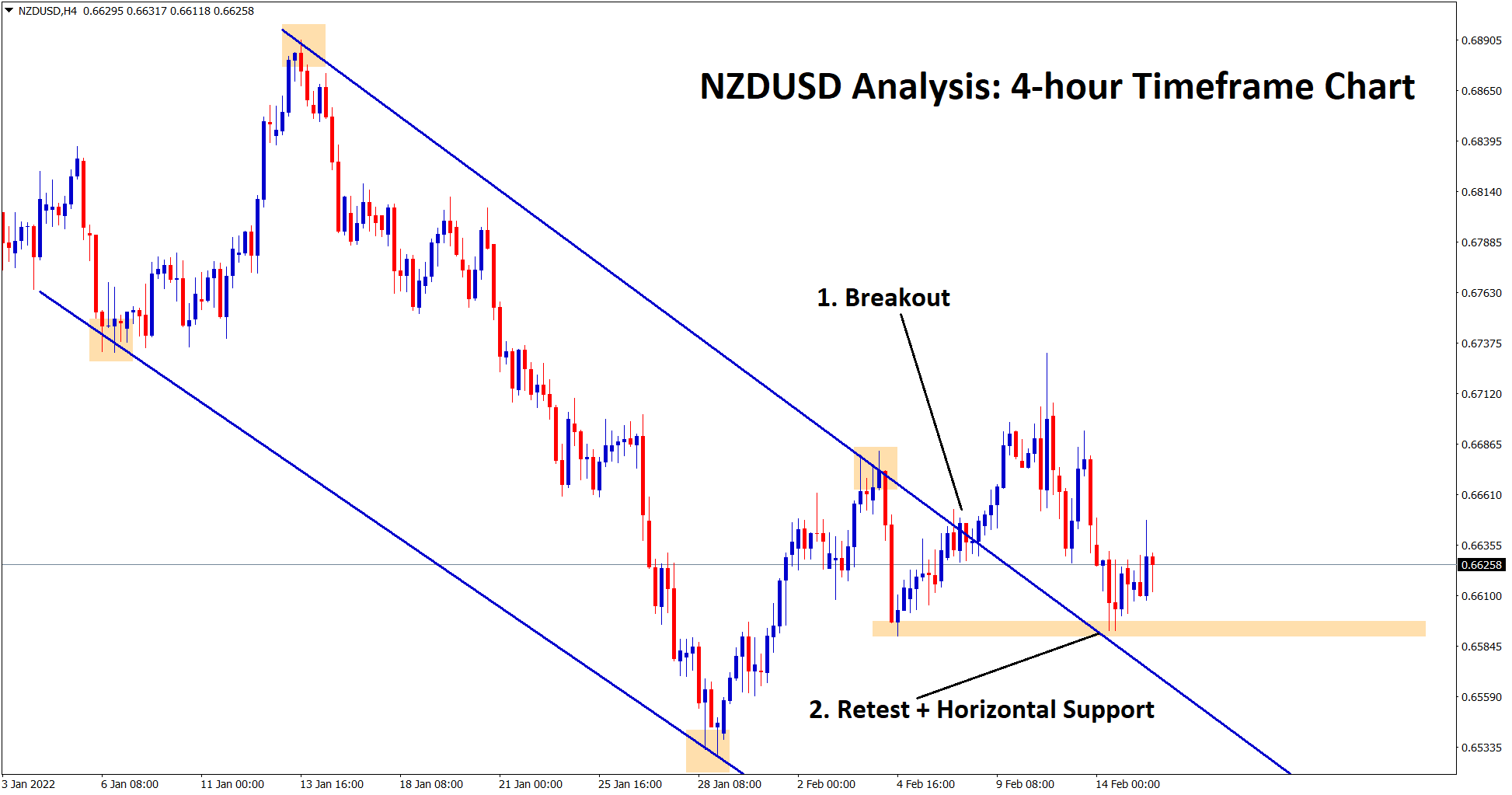

NZDUSD is rebounding from the retest zone and the horizontal support area in the 4-hour timeframe chart.

After the confirmation of upward movement NZDUSD buy signal given.

NZDUSD has reached the take profit target successfully.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade setups at Premium or Surpeme plan here: https://signal.forexgdp.com/buy/

New Zealand Dollar: War fears makes Worry for Riskier currencies

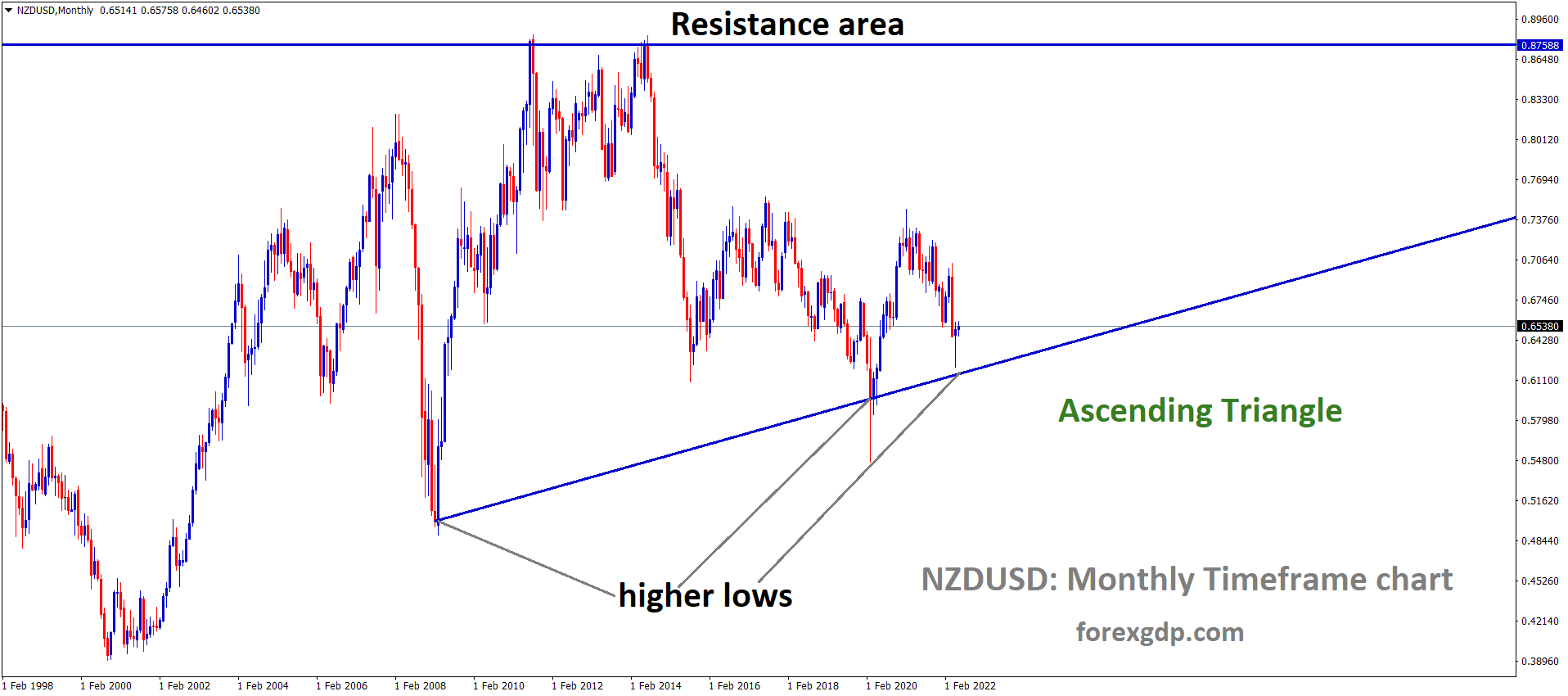

New Zealand Dollar seems to have a slight Upside in 2022, and marking towards 0.70 level is possible in 2022.

And Commodity prices are helping New Zealand Dollars by exports, and Rising European tensions with Russia makes Declines for New Zealand Dollar.

War type fears make more worry for Riskier currencies like New Zealand and the Australian Dollar.

And If any smooth agreement reached by no War makes Support for Riskier currencies.

In March, FED has to rate hikes by 25bps possible, and This month, RBNZ will hike 25 Bps.

US Dollar: FOMC meeting minutes outline

FED’s FOMC meeting minutes happened today, and a faster pace of Tightening accommodative policy stance will handle.

And 25Bps points rate hikes are expected 70% Polls and 30% polls suggested for 50Bps rate hikes in March.

Ongoing tensions between Russia and Ukraine make economic recovery doubtful and expenses more happening if War type escalated.

So, a rate hike from the FED side is mandatory and controlling the inflation rate is much more possible this year.

As US inflation rate hits 7.5%, which is 40 years high, and January NFP data shows Robust growth makes FED confident for Rate hikes in March.

US Treasury secretary Janet Yellen speech

US Treasury secretary Janet Yellen said the US economy faced a tough inflation rate in 40 years and peaked higher.

And FED has taken Proper actions to control the inflation readings, and rate hikes and the pace of tightening Asset purchases will escalate the inflation control points.

In the West, Russia shows more intention on Warlike appearance on Ukraine, and if war started, US Will made more sanctions on Russia in all business areas.

Already inflation hits higher if war happens, then an additional boost to the inflation rate ticked up higher.