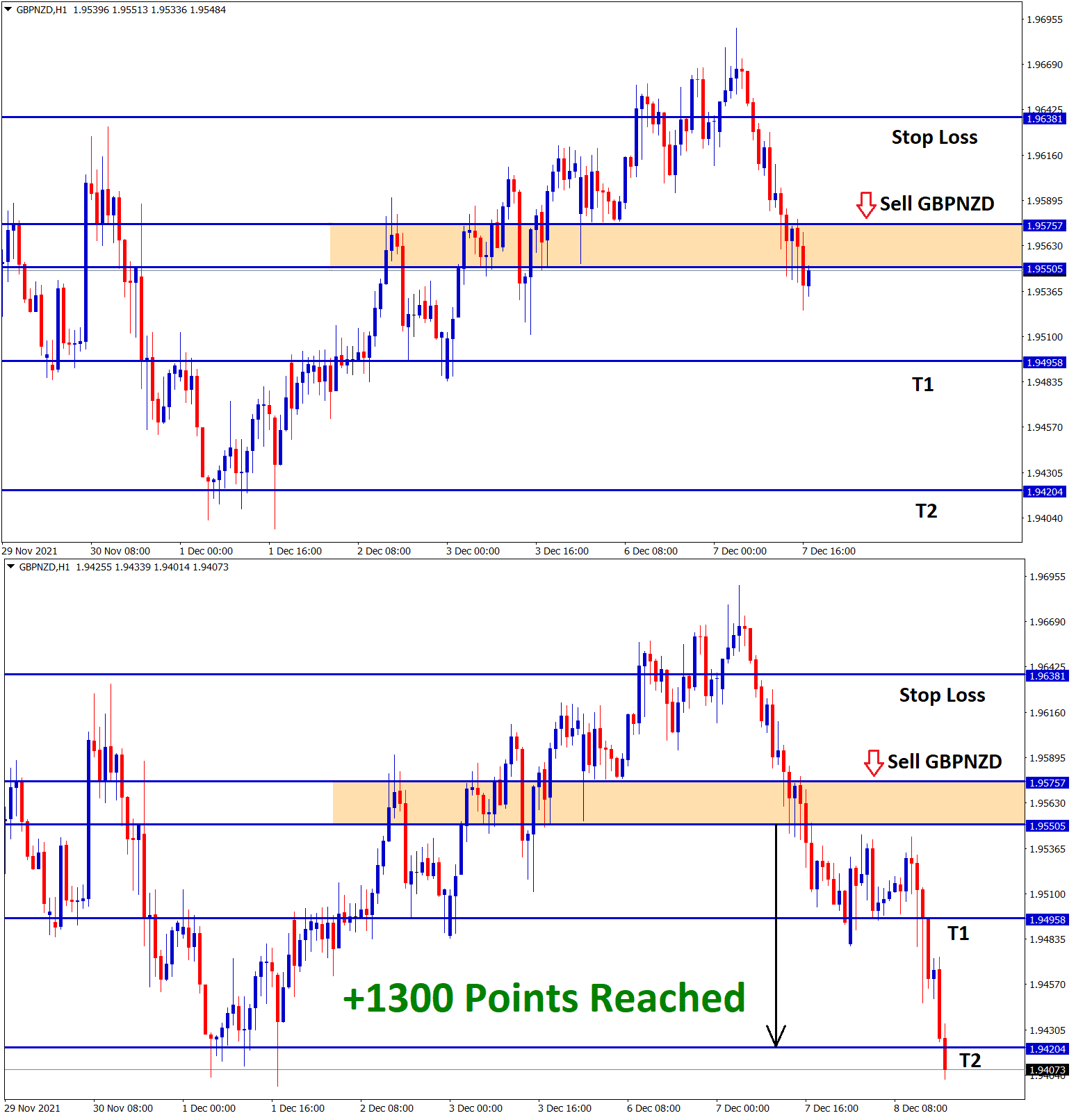

GBPNZD Analysis

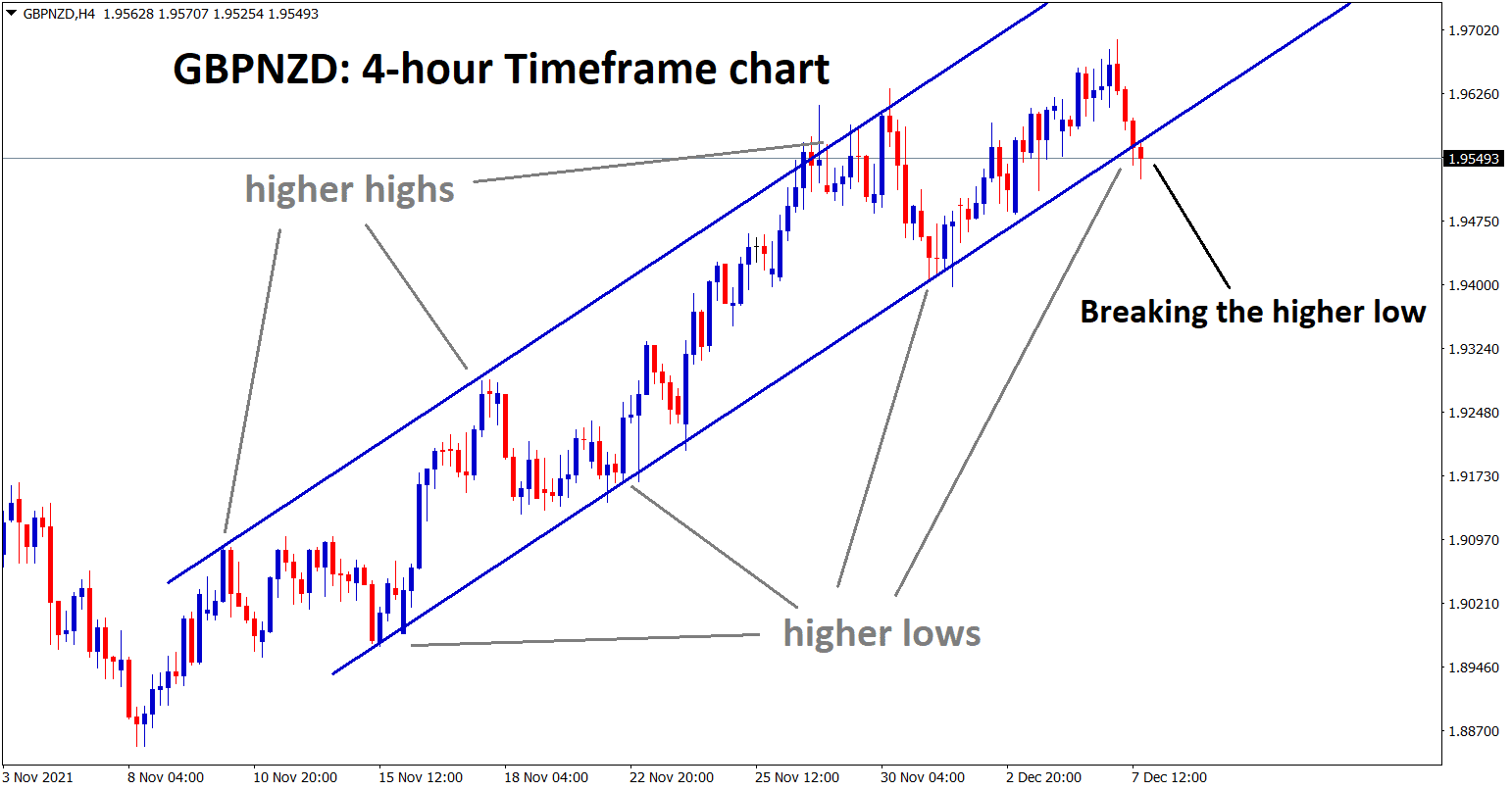

GBPNZD is breaking the higher low level of the Ascending channel in the 4-hour timeframe chart.

After the confirmation of downward movement, GBPNZD sell signal given.

GBPNZD reached the take profit target successfully.

UK POUND: UK and EU made closer to solving Northern Ireland Protocol

UK Pound like to benefit from UK and EU over Northern Ireland protocol to solve soon.

And Britain now granted licenses to French Fishermen last day, and this news subsided to UK and France talks.

Now UK and EU over Post Brexit deal talks on Northern Ireland Protocol are remaining.

US treasury yields made higher after FED hopes on tapering bets higher in the December meeting.

Due to this scenario, GBPUSD has been in consolidation for the last three weeks around the 1.3190-1.3350 range.

And the Geopolitical tensions between US and Russia takes charge this week; the US impose sanctions if Russia invades Ukraine anytime.

The Omicron variant crossed the 100 marks in the UK, but no one has died from the Omicron variant, so cases seem less deadly than the Delta variant.

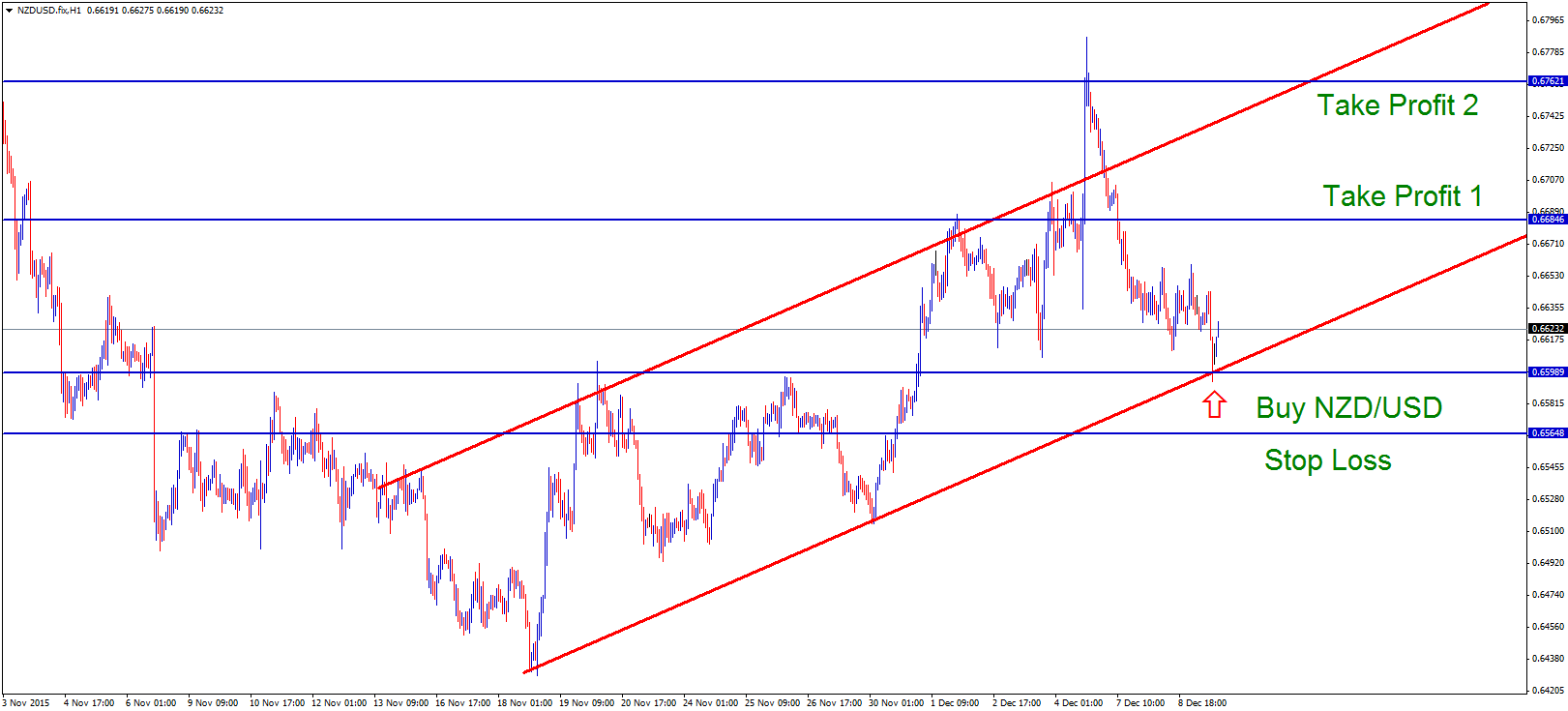

New Zealand Dollar: US Domestic data and Geopolitical tension

drives NZD Dollar this week

New Zealand Dollar shows correction from lows after hefty fell from highs as 5.0% correction.

The next RBNZ meeting will happen in February, and hopes of hawkish matters have subsided. So now, US Domestic data drives the NZDUSD market.

And Geopolitical tensions between US and Russia make it a Down tone for Riskier currencies like NZD.

New Zealand Dollar shows healthy correction after broad one year from 2020.

And China has overcome from liquidity crunch due to the real estate crisis and has made some relief for NZD and AUD Dollars.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/