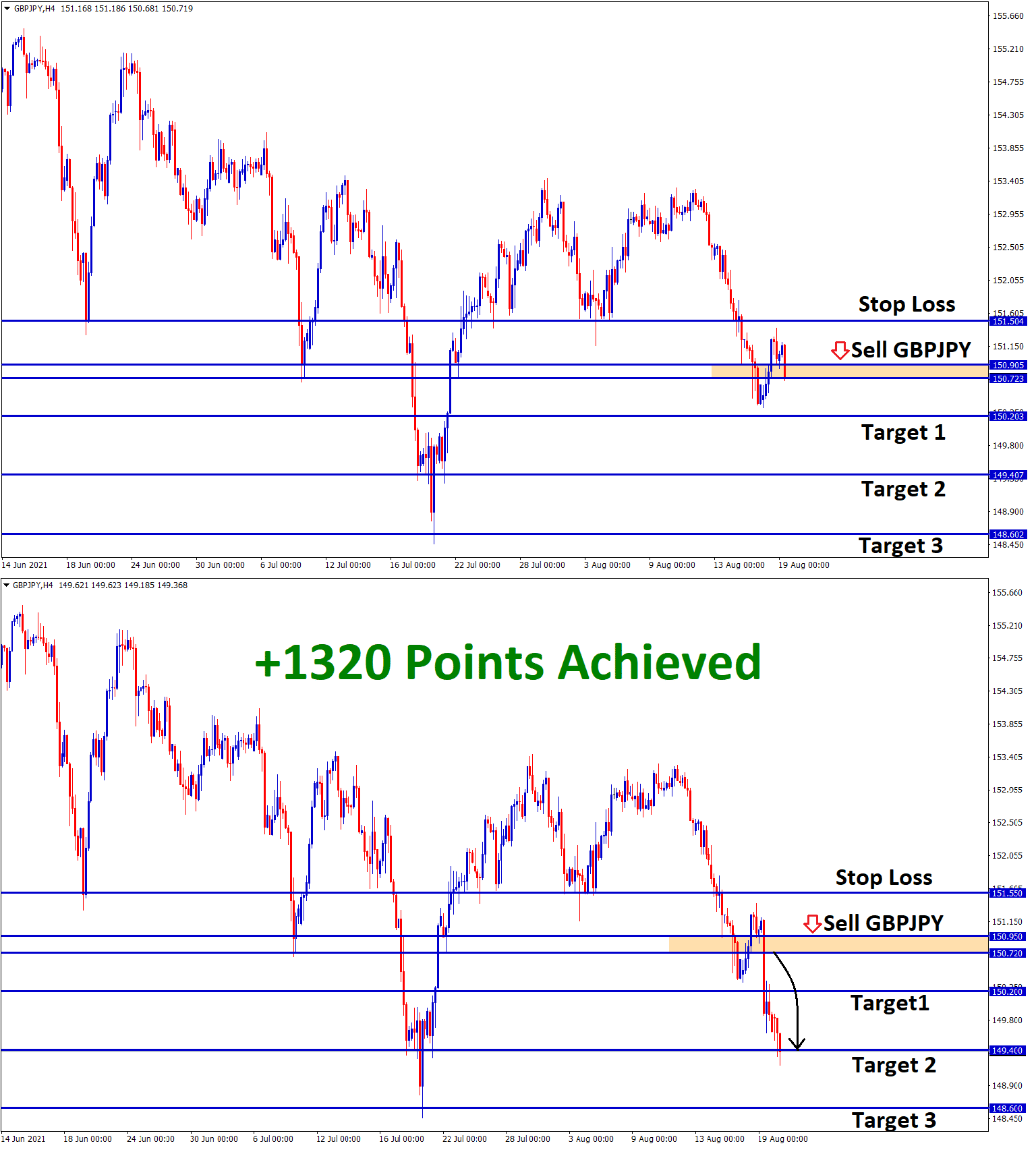

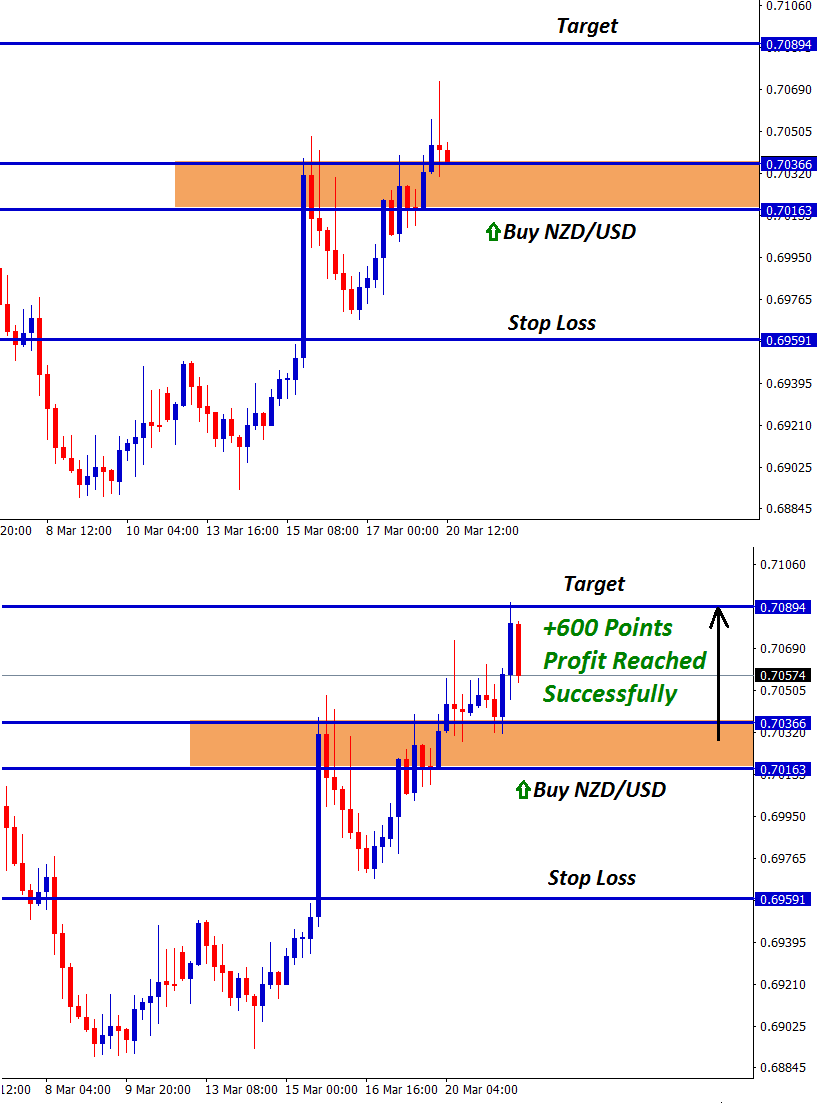

GBPJPY Analysis

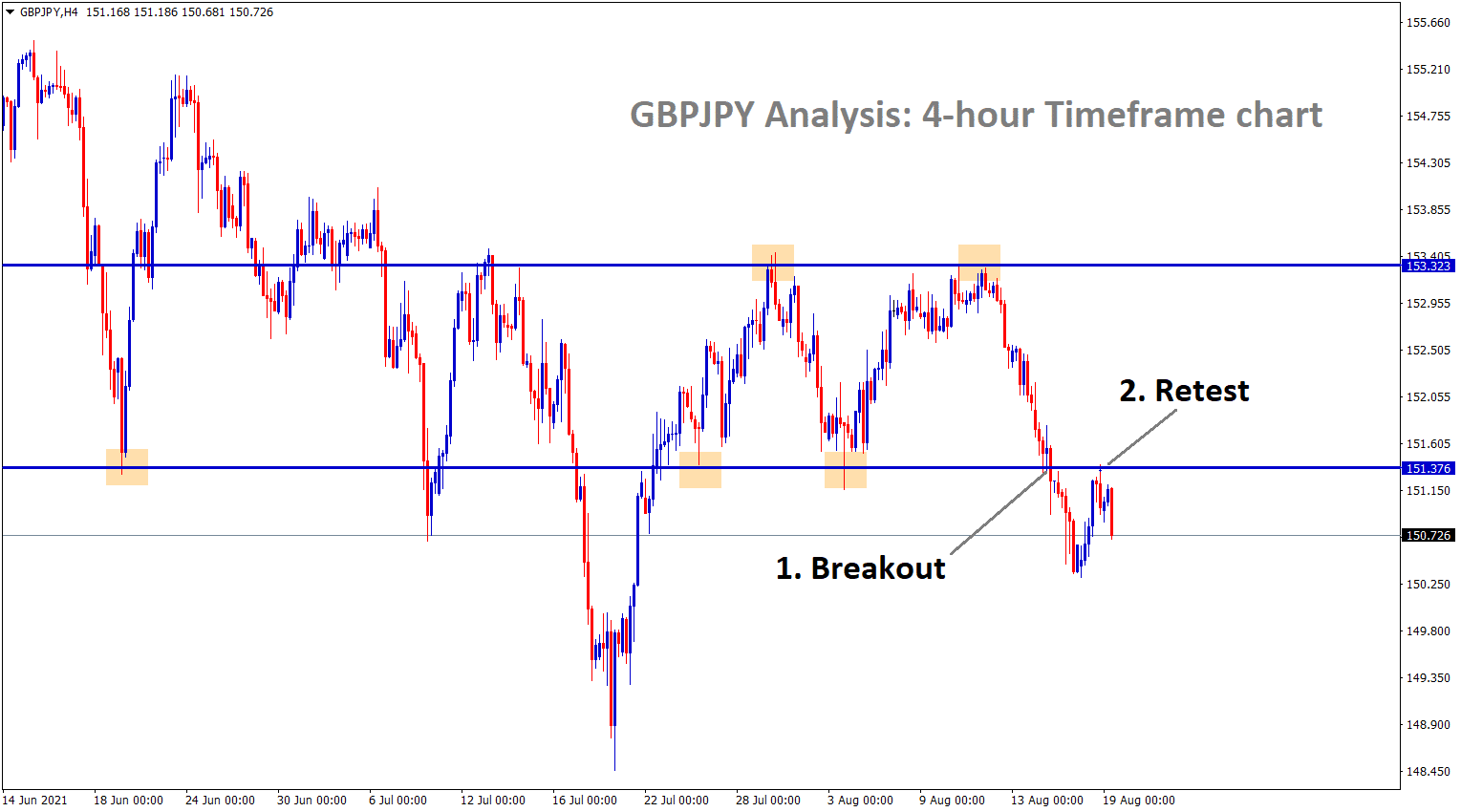

GBPJPY has retested the broken support level and starts to fall now in the 4-hour timeframe chart.

After the confirmation of downtreand movement, GBPJPY sell signal was given.

GBPJPY successfully Reached the take profit target.

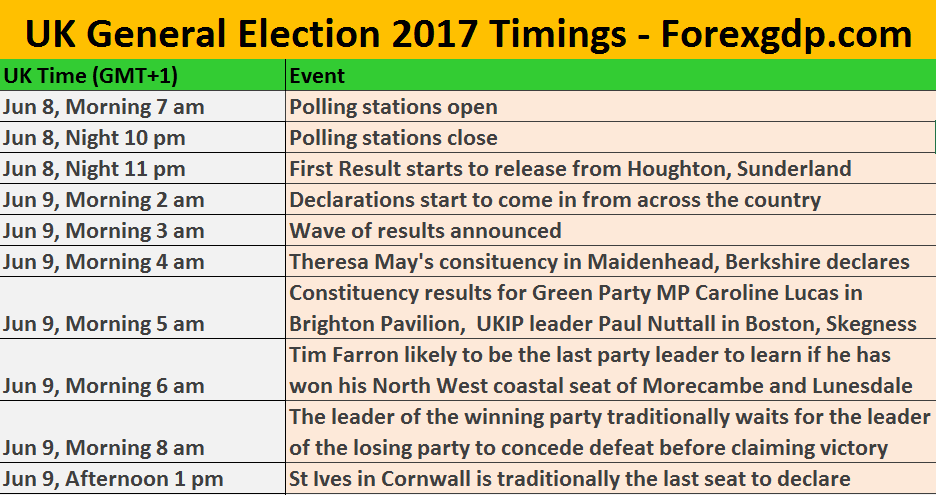

UK POUND: UK Gfk Consumer confidence data forecasted

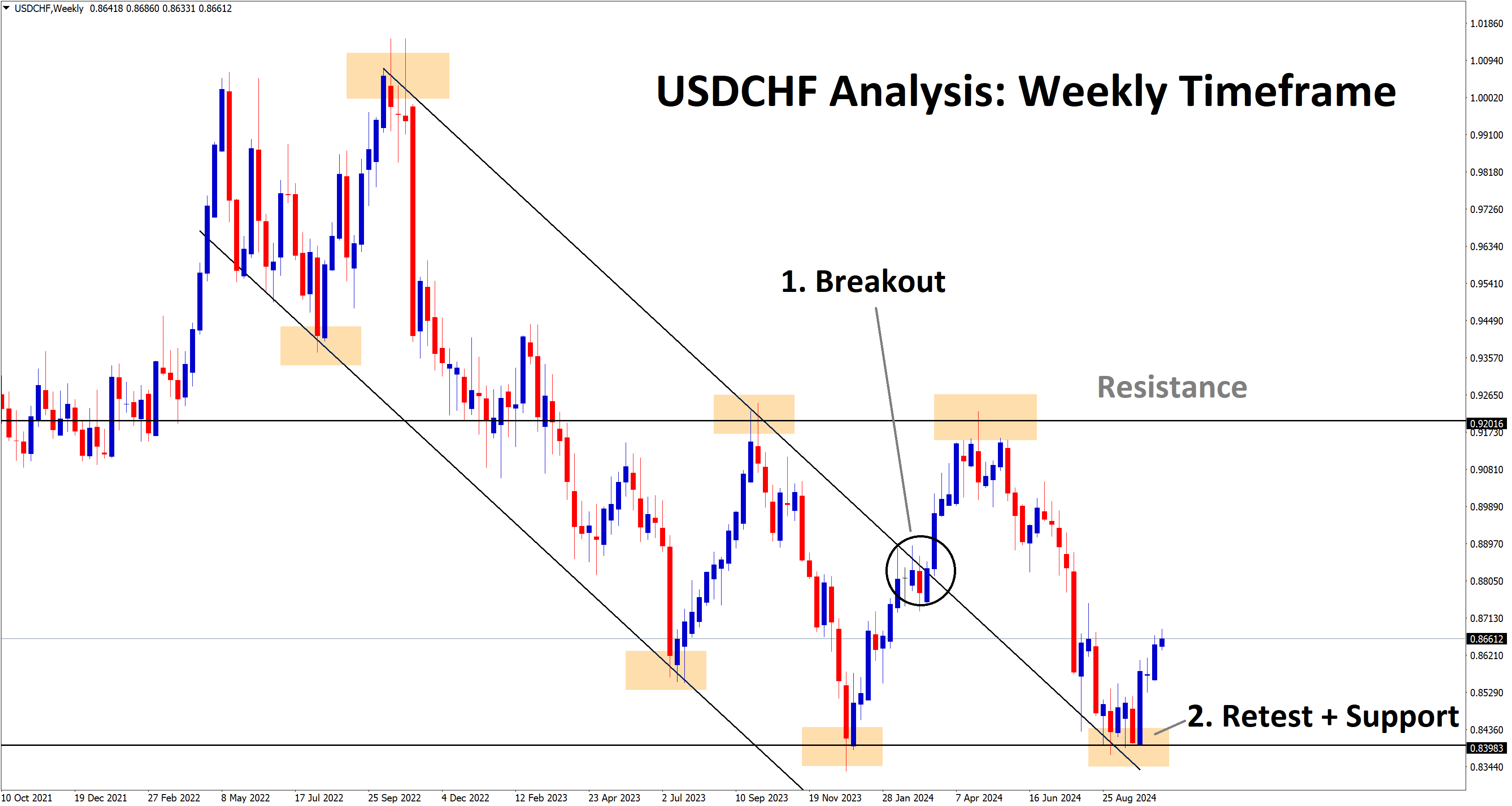

UK Pound dragged for 1.5% from a high level of 1.38 to 1.36500 as US Dollar continuous strong performance shown in the market.

And also, China Economy slowdown and Turmoil in Afghanistan, in addition to these US FED Powell, said the last day for tapering some assets purchases sooner by year-end.

This is officially released by FED Powell last day before analysts expected tapering as news. Now Official confirmation came out and now more confidence on US dollar to buy as Printing money reducing as Stimulus get back to Government.

And GfK Consumer confidence of UK and Retail sales data scheduled this week.

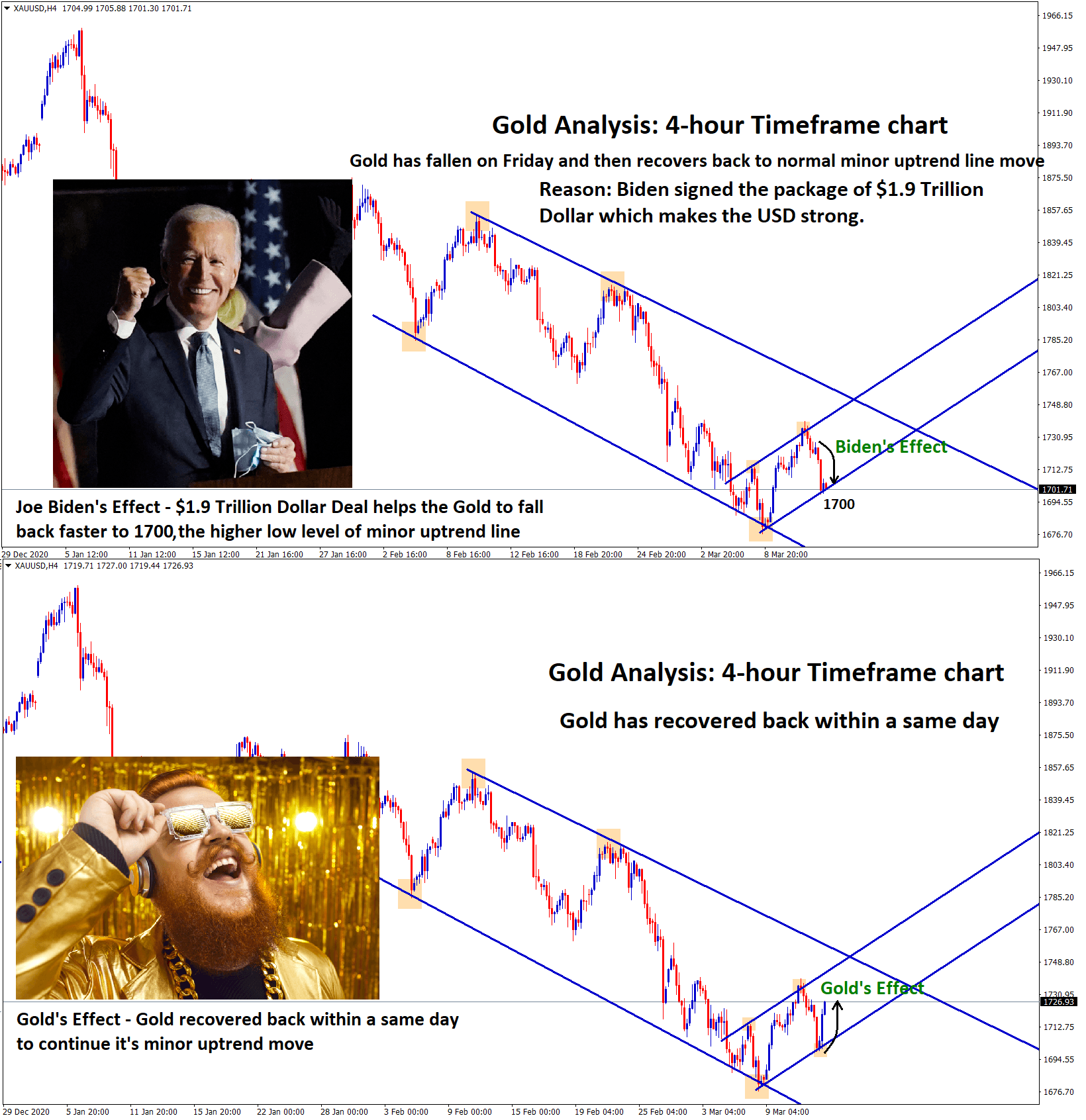

Japanese Yen: Delta variant panic in Asian Countries

Japanese Yen strengthen more as Panic was created in Asian countries in China, Australia and New Zealand, Japan.

And Japan Yen is not only seen as a Domestic currency but also looks like a safe currency from all over the world.

So, the Japanese Economy is underperforming, and Slow vaccination progress, Delta variant caused more, anyhow investors parks their funds to haven currencies like US Dollar and Japanese Yen.

Yesterday tapering speech by FED Powell impressed investors eyes for reducing printing the US Dollar notes soon.

Due to this scenario, USDJPY climbed higher to 0.50% from lower.

Trade forex market only at the confirmed trade setups.

Get Each trading signal with Chart Analysis and Reason for buying or selling the trade which helps you to Trade with confidence on your trading account.

Want to increase your profits in trading? Get the best trading signals at an accurate time. Try premium or supreme signals now: forexgdp.com/buy