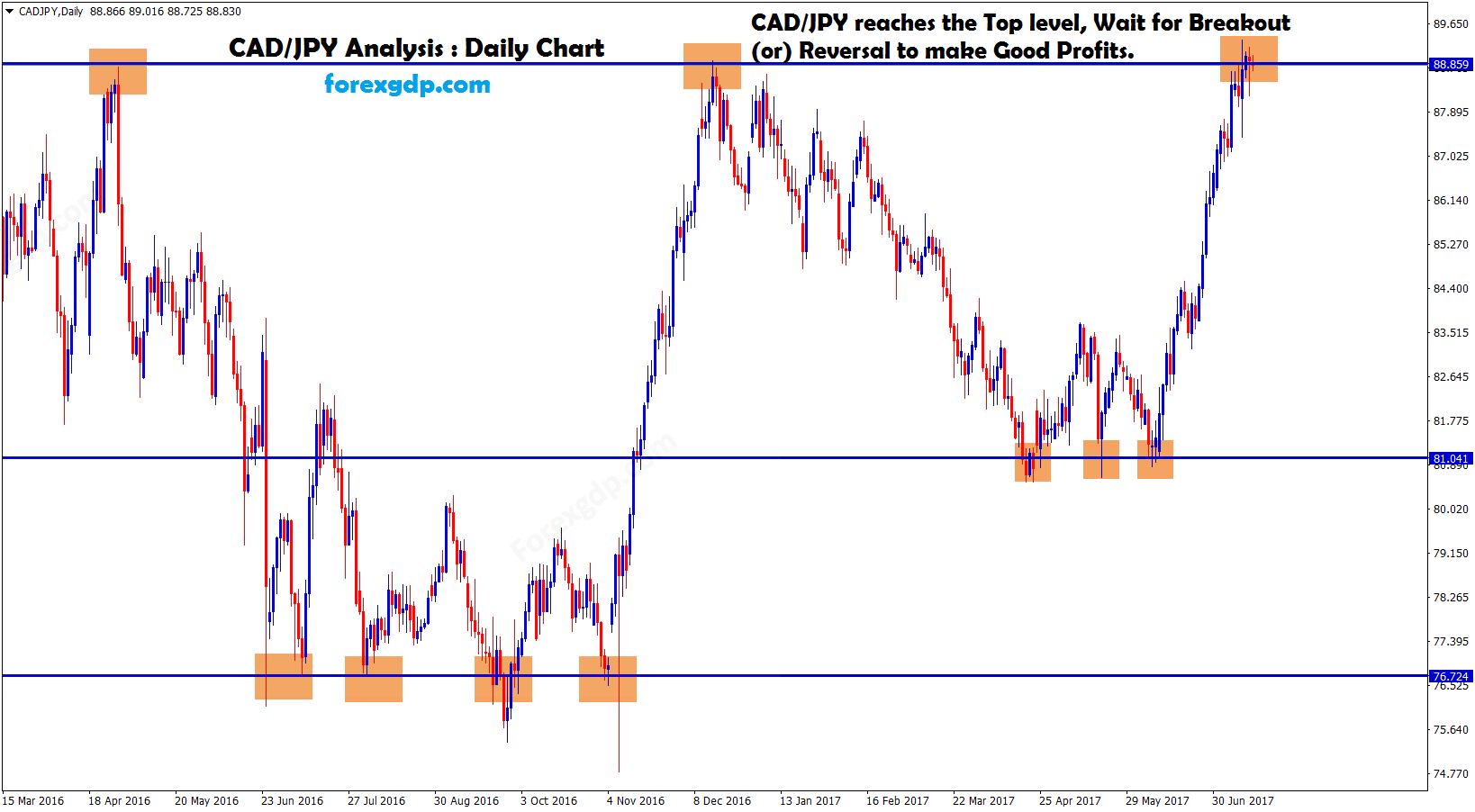

CADJPY Analysis

CADJPY broke the top of the Ascending Triangle

CADJPY Update

CADJPY has Re-Entered the Ascending Triangle, which leads to the SL price. However, CADJPY still have chances to to rebound from the broken the top of the Ascending Triangle.

Reason: Due to the release of more economic news mentioned below, the market is not making technical movements at this time.

Why CAD is Weaker

BoC Policy Uncertainty – Mixed signals on interest rate direction—some members support cuts due to weak growth, others are cautious due to high core inflation.

Slowing Economy – Q1 growth was strong but temporary; Q2 outlook is weaker with subdued domestic demand.

Rising Unemployment – Jobless rate hit 7% in May, the highest since 2016, signaling labor market weakness.

Trade Disruption – Tariff-related uncertainty and rising business costs are hurting confidence and inflation stability.

Why JPY is Stronger

Geopolitical Tensions – Rising conflicts like Israel-Iran are driving investors toward safe-haven assets like the yen.

Trade Uncertainty – Global trade worries are pushing markets into risk-off mode, boosting demand for the yen.

BOJ Policy Shift – The Bank of Japan is signaling a move away from ultra-low rates, making the yen more attractive.

Unwinding Carry Trades – Investors are closing yen-funded investments, increasing demand for the currency.

Please note In the forex market, technical works 80% of the time, and fundamental works 20% of the time. This time fundamental wins. It’s crucial to remain patient and wait for the next good opportunity signal.

We always want you to trade safe under all market conditions.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade signals at premium or supreme plan here: forexgdp.com/buy/

+2200% + 800% +400% +150% Growth in Live Real Trading account of our users, check here: https://www.forexgdp.com/realaccounts/