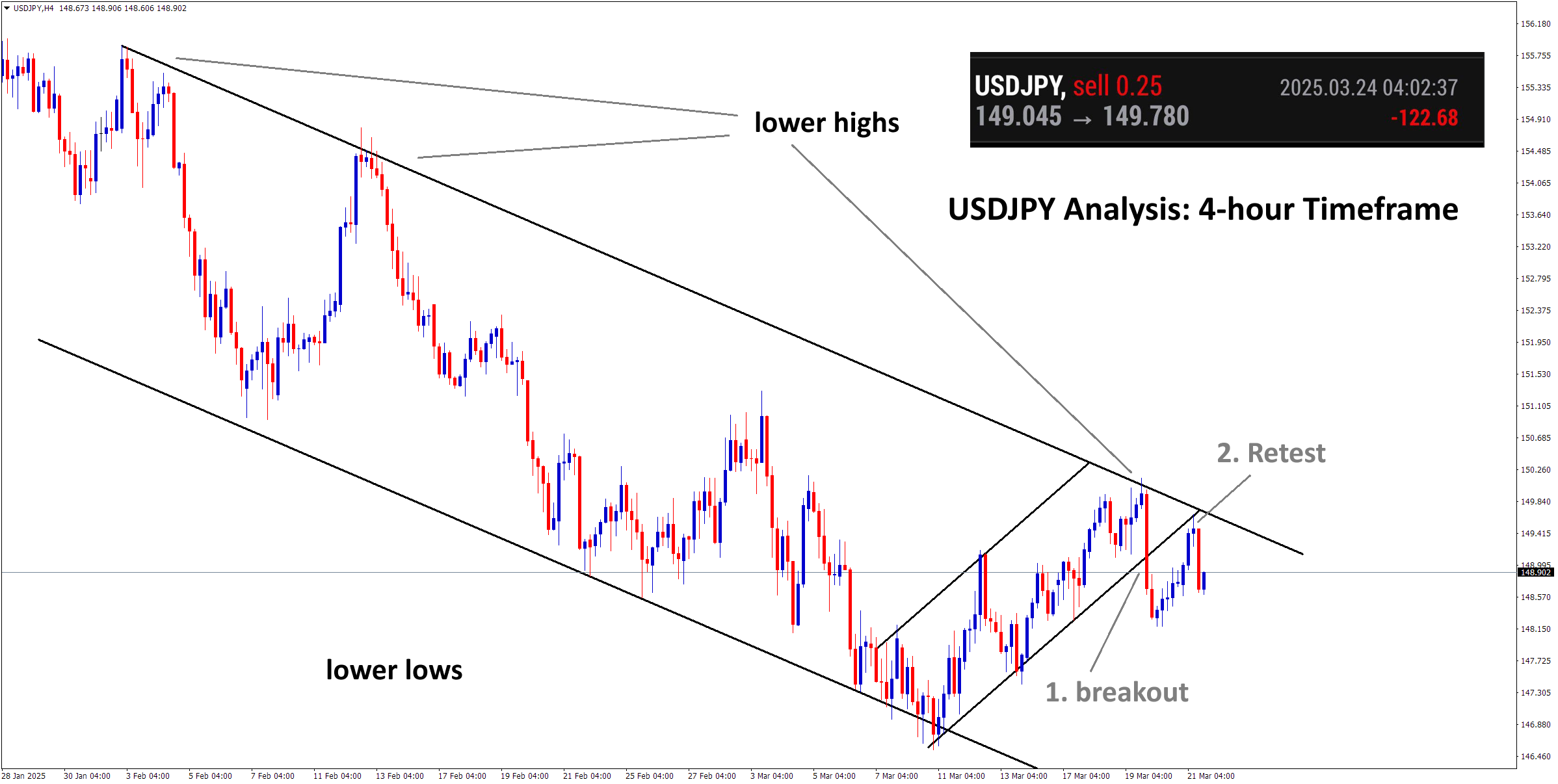

USDJPY Analysis

USDJPY is falling from a lower high area of the descending channel after breaking and retesting the minor ascending channel line

USDJPY Update

USDJPY is consolidating at the lower high area of the descending channel which leads to -745 points. However, USDJPY still has a chance to fall from the higher area.

Reason: Due to the release of more economic news mentioned below, the market is not making technical movements at this time.

Why JPY is Weaker

The Japanese yen weakened because the Bank of Japan (BOJ) decided to keep interest rates steady, signaling that they are concerned about rising food-driven inflation and the uncertainty caused by U.S. tariffs. BOJ Governor Kazuo Ueda highlighted that the impact of higher U.S. tariffs on the global economy remains unclear, and this caution suggests that interest rates in Japan could rise sooner than expected, which put pressure on the yen.

-

BOJ Rate Decision: The Bank of Japan kept interest rates steady at 0.5%, citing uncertainty due to U.S. trade policies.

-

U.S. Tariffs Impact: Japan’s manufacturers are worried about U.S. tariffs and China’s economy, dampening confidence.

-

Trade Surplus: Japan’s exports grew 11.4% in February, resulting in a trade surplus, but concerns about U.S. tariffs remain.

Please note In the forex market, technical works 80% of the time, and fundamental works 20% of the time. This time fundamental wins. Be patience and wait for the next good opportunity signal.

We always want you to trade safe under all market conditions.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade signals at premium or supreme plan here: forexgdp.com/buy/

+2200% + 800% +400% +150% Growth in Live Real Trading account of our users, check here: https://www.forexgdp.com/realaccounts/