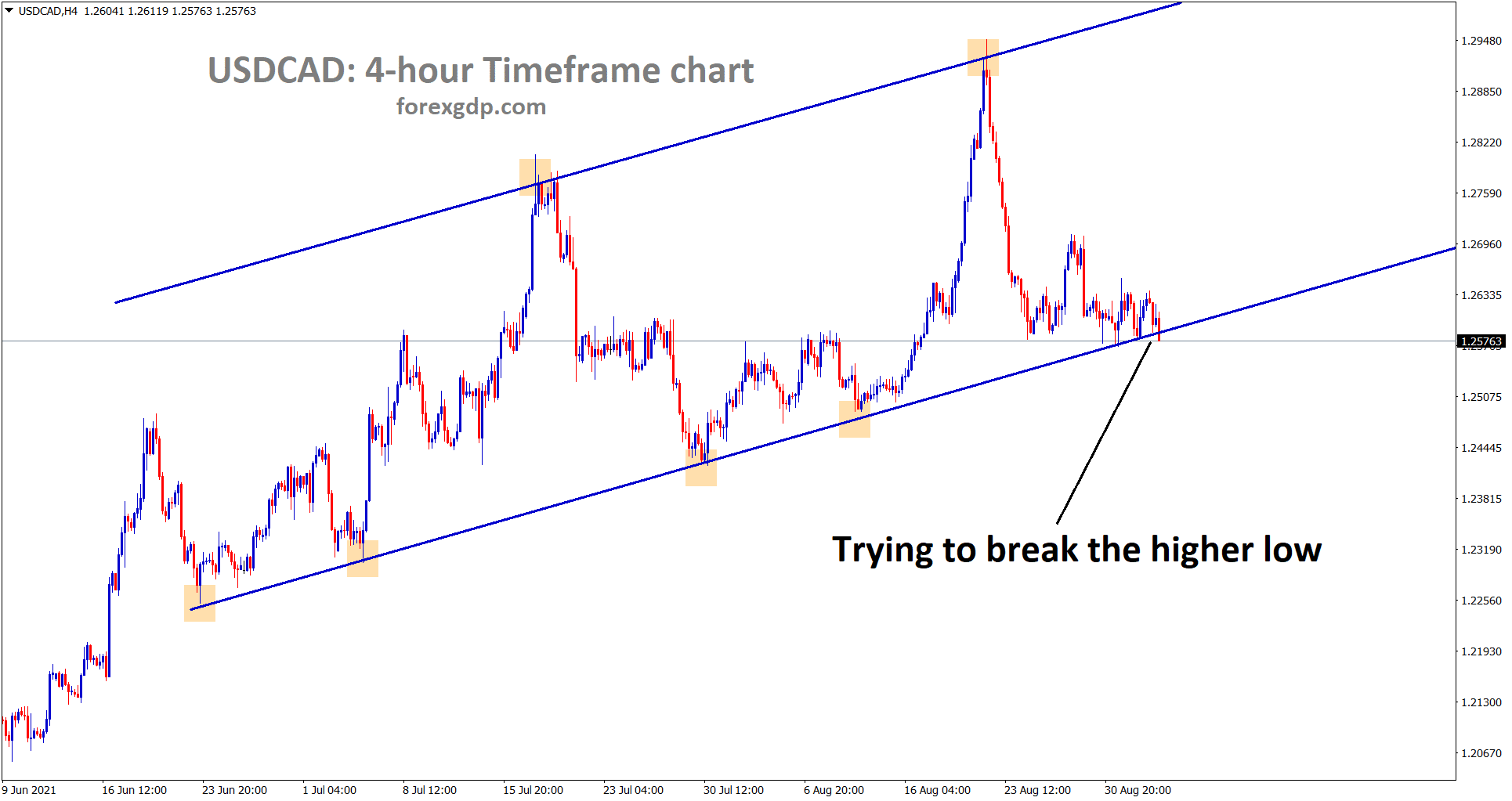

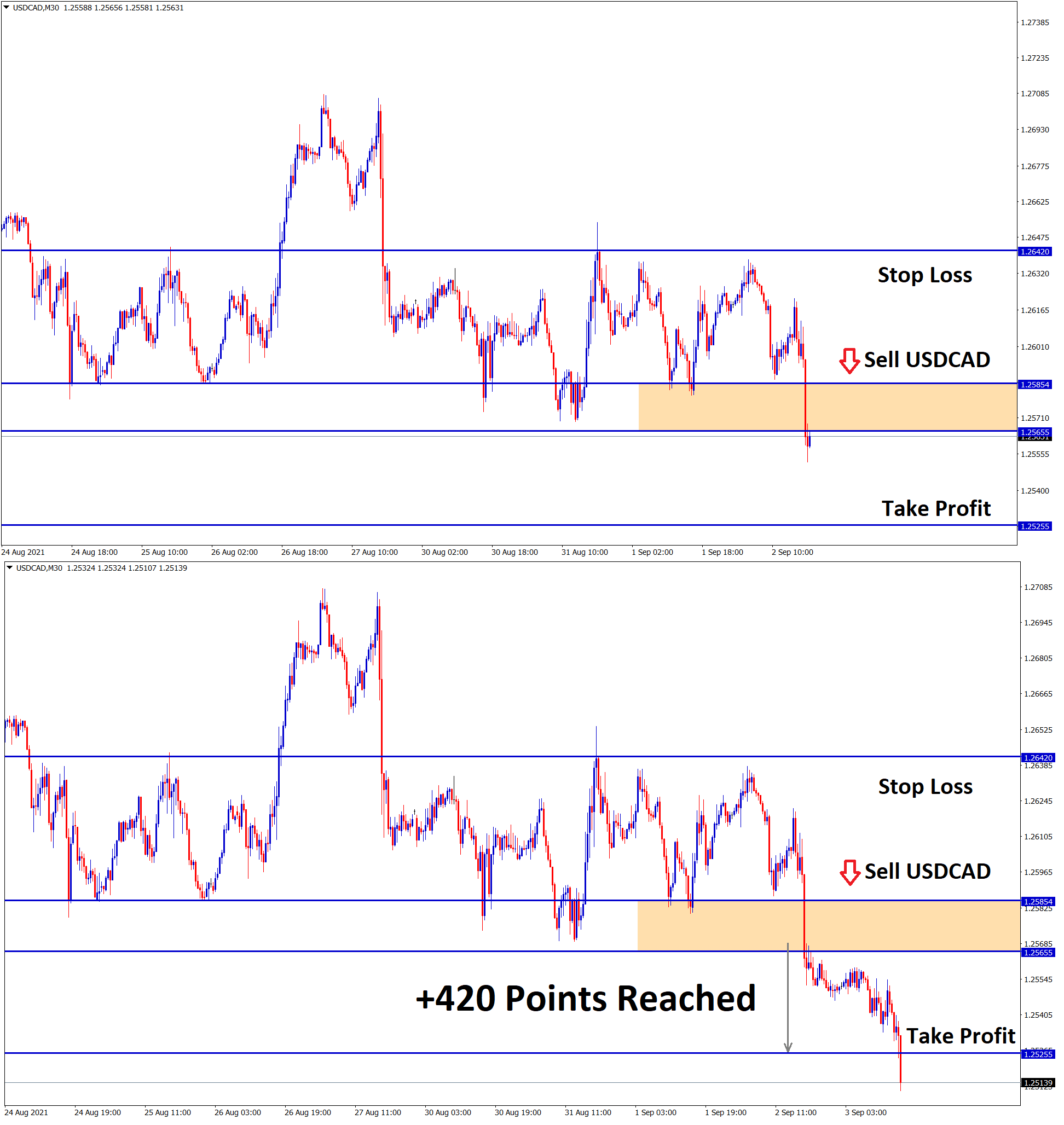

USDCAD Analysis

After a long time, USDCAD is breaking the higher low of an uptrend line in the 4-hour timeframe chart.

After the confirmation of downtrend movement USDCAD sell signal given.

USDCAD reached the take profit target sucessfullly

US Dollar: Unemployment rate forecast

US Dollar shows ranging market as 92-93 level this week, and non-farm payrolls data is a main key event marked today.

Based on expectations, US Dollar decided the right direction. Japanese Yen and Euro, GBP all pairs are stronger against USD.

As FED delaying tapering assets in the near end and want to do in long term period to reduce asset purchases makes worry for investors mind.

The unemployment rate is scheduled today, whether positive or negative numbers based on numbers FED Powell decided in this September month policy meeting for tapering or rate hikes.

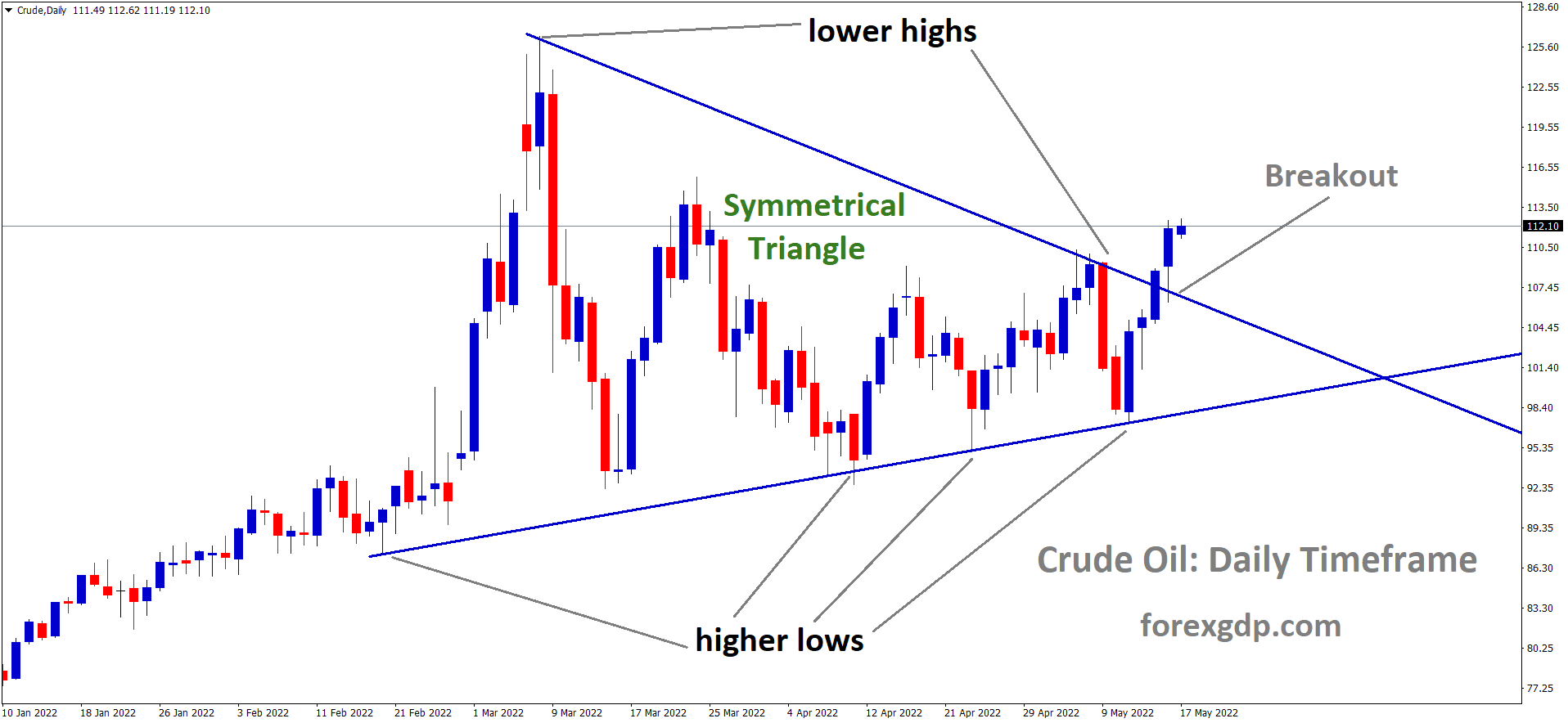

Canadian Dollar: OPEC+ extended Supply

Canadian Dollar is stronger more as Oil prices make higher again as Demand created more in Global level.

OPEC+ agreed to extend the Supply of 400k Barrels per day, which will support the Canadian Dollar to boost the economy.

And USDCAD makes fresh lows today ahead of NFP data releasing today evening.

Canadian Dollar stronger performance is due to the Bank of Canada is ready to taper assets soon in the upcoming meeting.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/