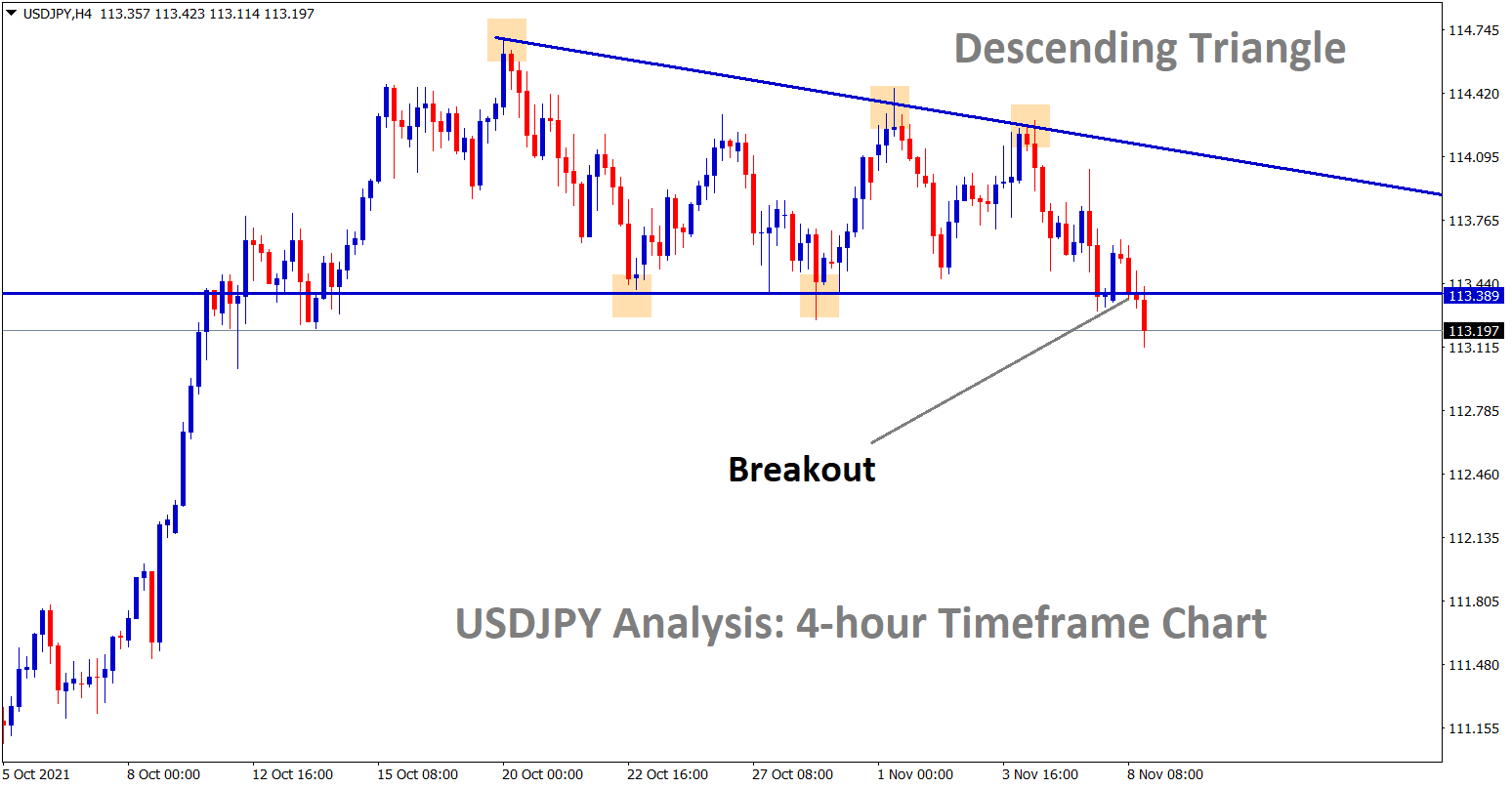

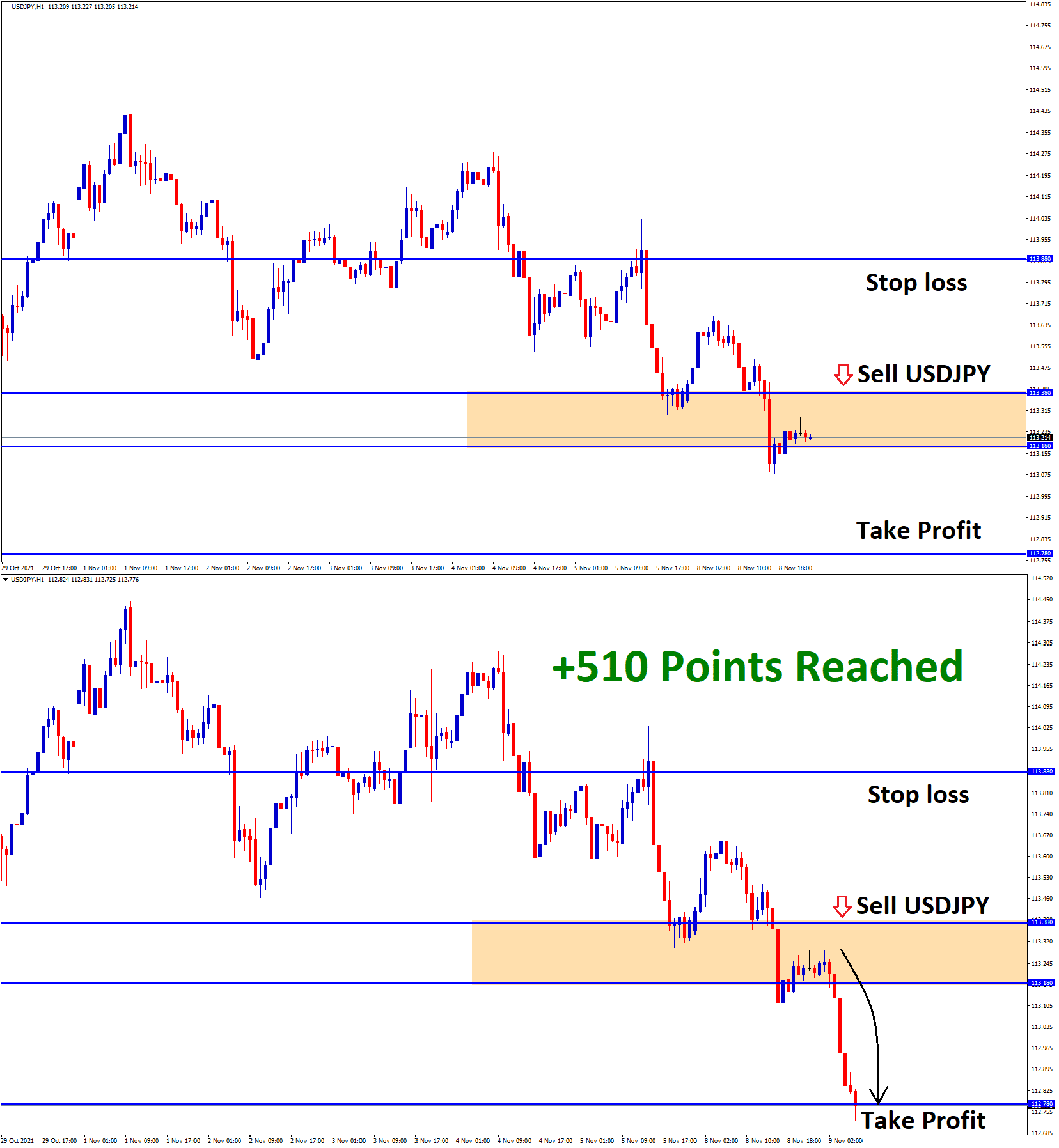

USDJPY Analysis

USDJPY has broken the bottom level of the descending triangle pattern in the 4-hour timeframe chart.

After the confirmation of downtrend movement, USDJPY sell signal given.

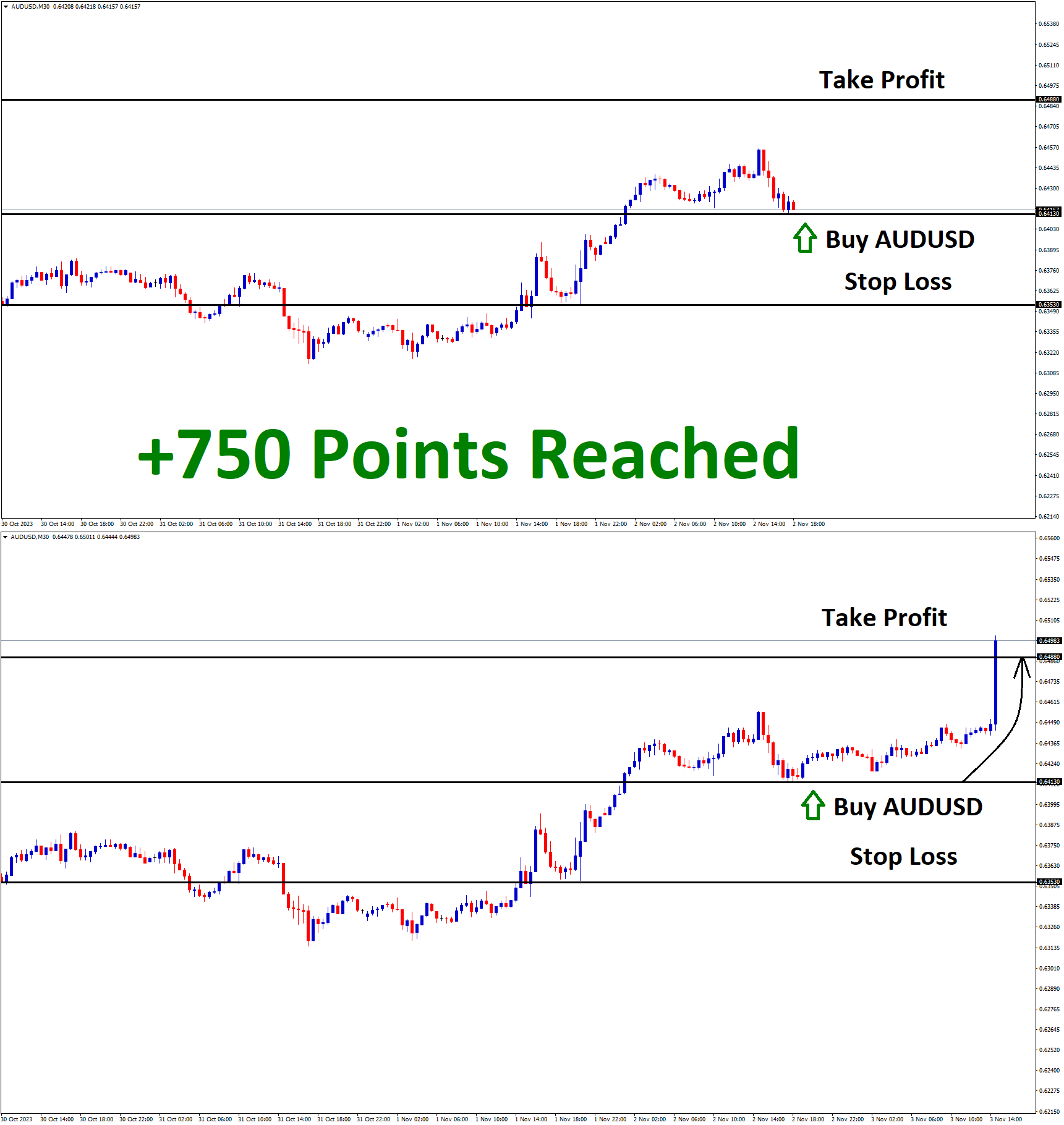

USDJPY reached the take profit target successfully.

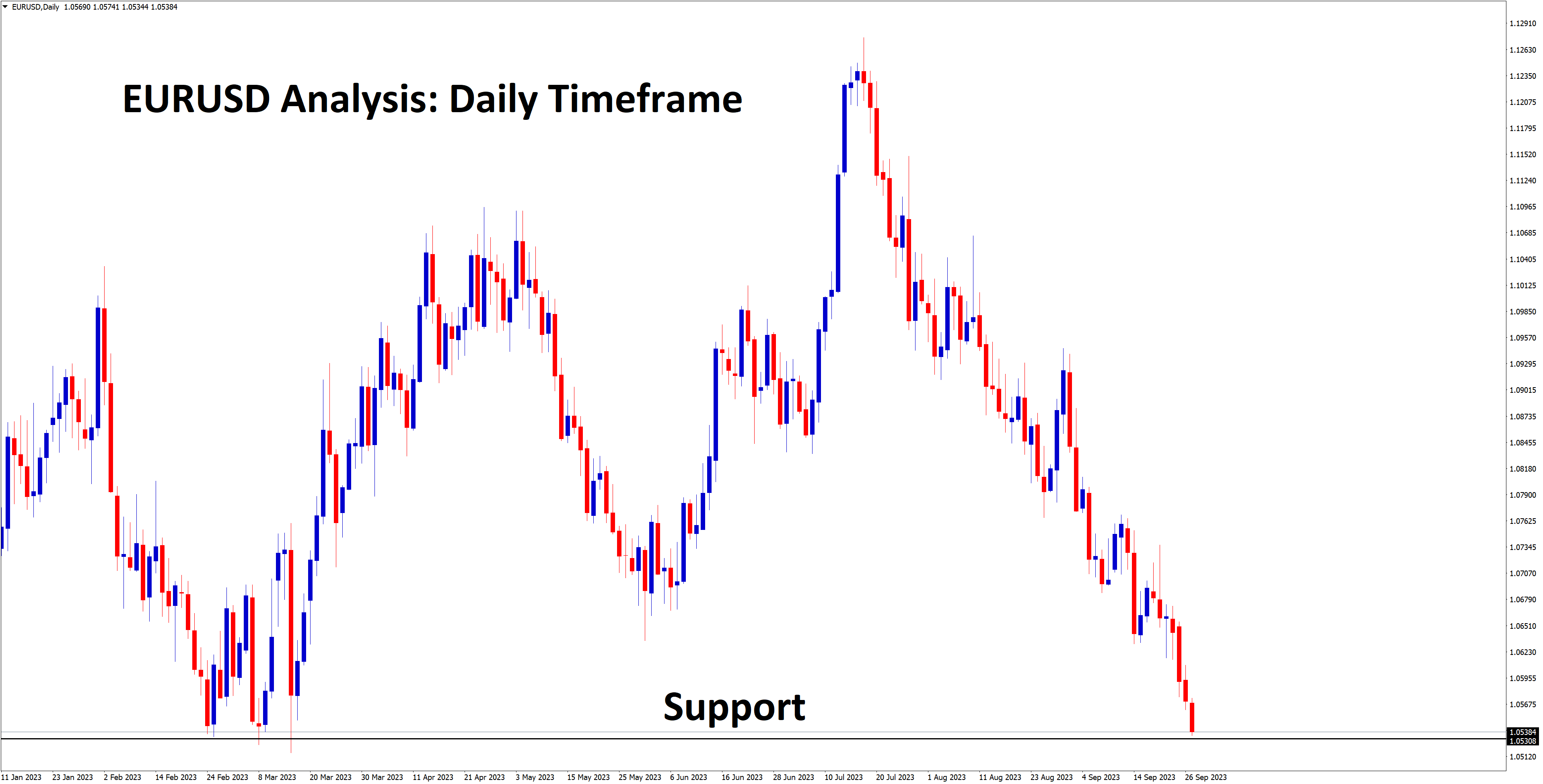

US Dollar: Strong NFP data printed

US Dollar index near the resistance area of 94.500 last week after US NFP data posted stronger gains than expected and the unemployment rate came higher than expected.

So, Jobs data came at higher in the US makes well appreciations for US Economy. Still, FED’s announcement of no rate hikes in the near term is a worry for investors, and tapering did for $15 billion per month from $120 billion Asset purchasing.

And now the US Dollar index shows more robust demand for US Dollar from Global level, and this week CPI, PPI and FED Powell speech is scheduled, based on comments market will move this week.

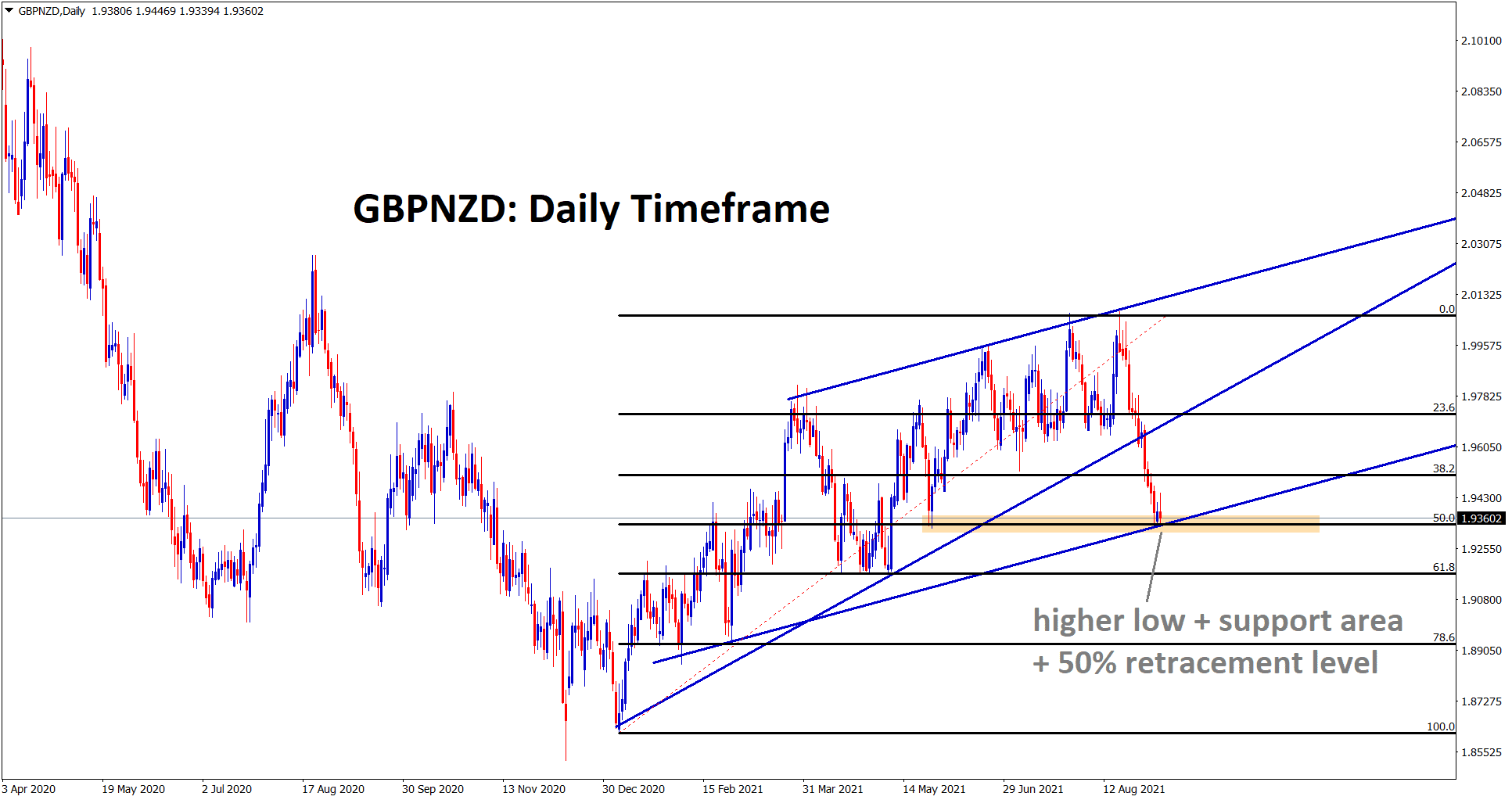

Japanese Yen: New stimulus discussion of Government

Japanese Government now discussing for Budget of 30 trillion yen ($265 billion) required for Covid-19 pandemic affected Economy to issue stimulus.

These funds may be collected from last year budget carried over funds as one type.

And the common instrument is issuing Bonds, and collecting funds to Government is the second type.

These Funds will be used for Domestic startup tourism and 10 trillion Yen for University research.

And Japanese Yen makes weaker if 30 trillion Yen will be issued for new debt bonds in Public.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/