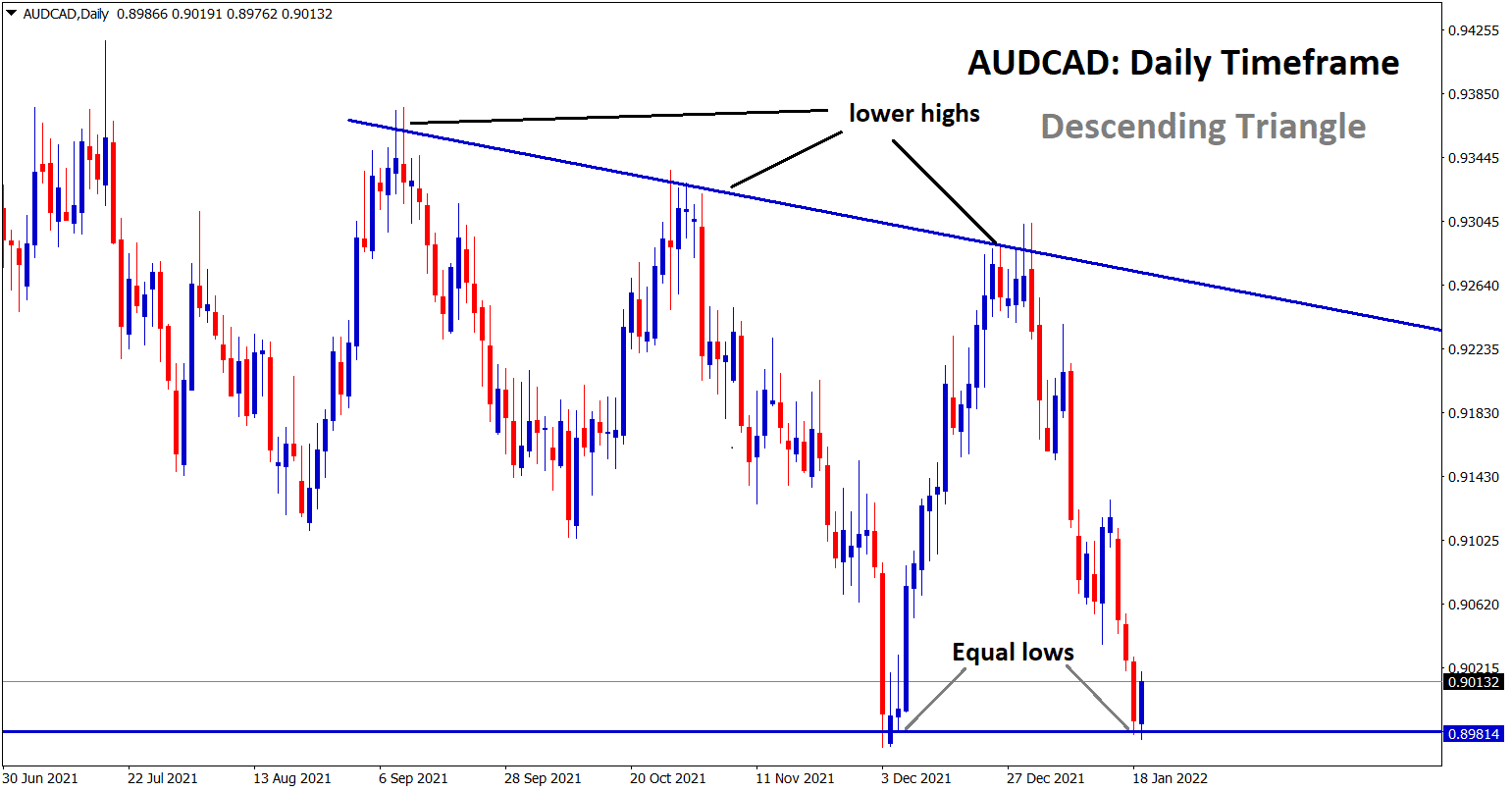

AUDCAD Analysis

AUDCAD is rebounding from the support area of the Descending triangle pattern in the 4-hour timeframe chart.

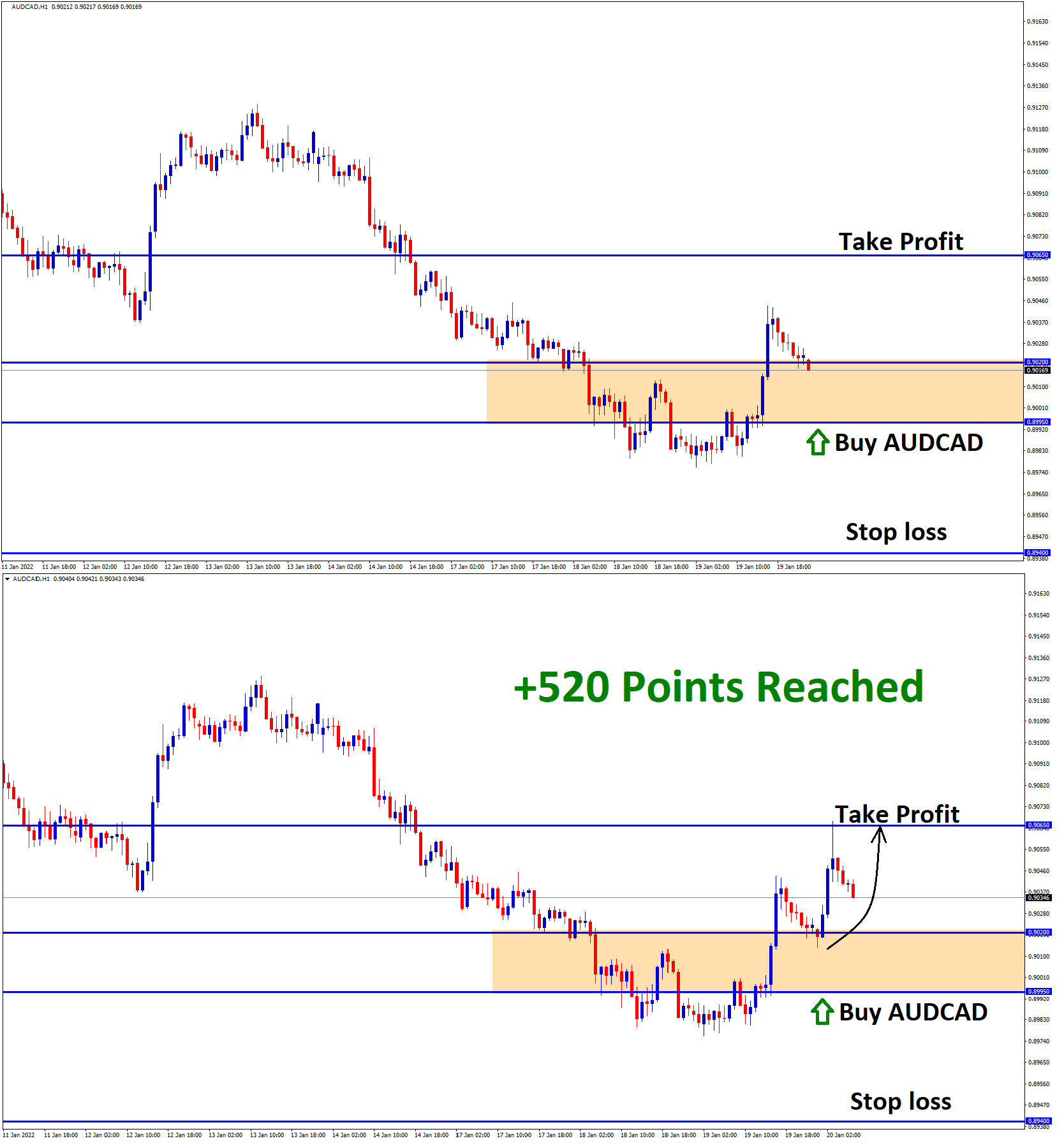

After the confirmation of upward movement, AUDCAD buy signal given.

AUDCAD reached the take profit target successfully.

Australian Dollar: Australia’s Westpac numbers came lower than expected

Australia’s Westpac consumer confidence for January crossed the wires at 102.2, down from December’s 104.3 printed.

And Omicron variant spread makes less enthusiasm on Australian Economy and more lockdowns make worry for Economy comeback in Australia.

In China Bond prices Tumble makes policymakers lower the five basis points in the short-term lending rate.

And to stabilize the housing market, China has taken the necessary steps to calm down the fears of liquidity crunch in Real estate.

Canadian Dollar: Credit Suisse predicted Bank of Canada would hike 25bps this month

Analysts at Credit Suisse predicted the Bank of Canada monetary policy would do 25bps rate hikes next week.

And Oil prices created more inflation numbers in US and Canada, So Policy rates are a divergence from FED and BoC at this time.

In March, the FED 50 bps rate hike will be adjusted to BoC rate hike by 25bps this month.

So USDCAD will stay on the price level of 1.2500 area, and rate hikes from the Bank of Canada will undershoot the USDCAD to 1.2300, which formed the next support area.

And also the oil pipeline has exploded in between Iraq and Turkey Port makes Supply fears of 450kBarrels per day to a shortage; that’s why Oil prices are surging day by day.

Canadian Dollar prices are higher as Oil revenues rose compared to last month; the Bank of Canada may be rate hikes to calm down the Canadian Dollar prices to support exports revenues.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/