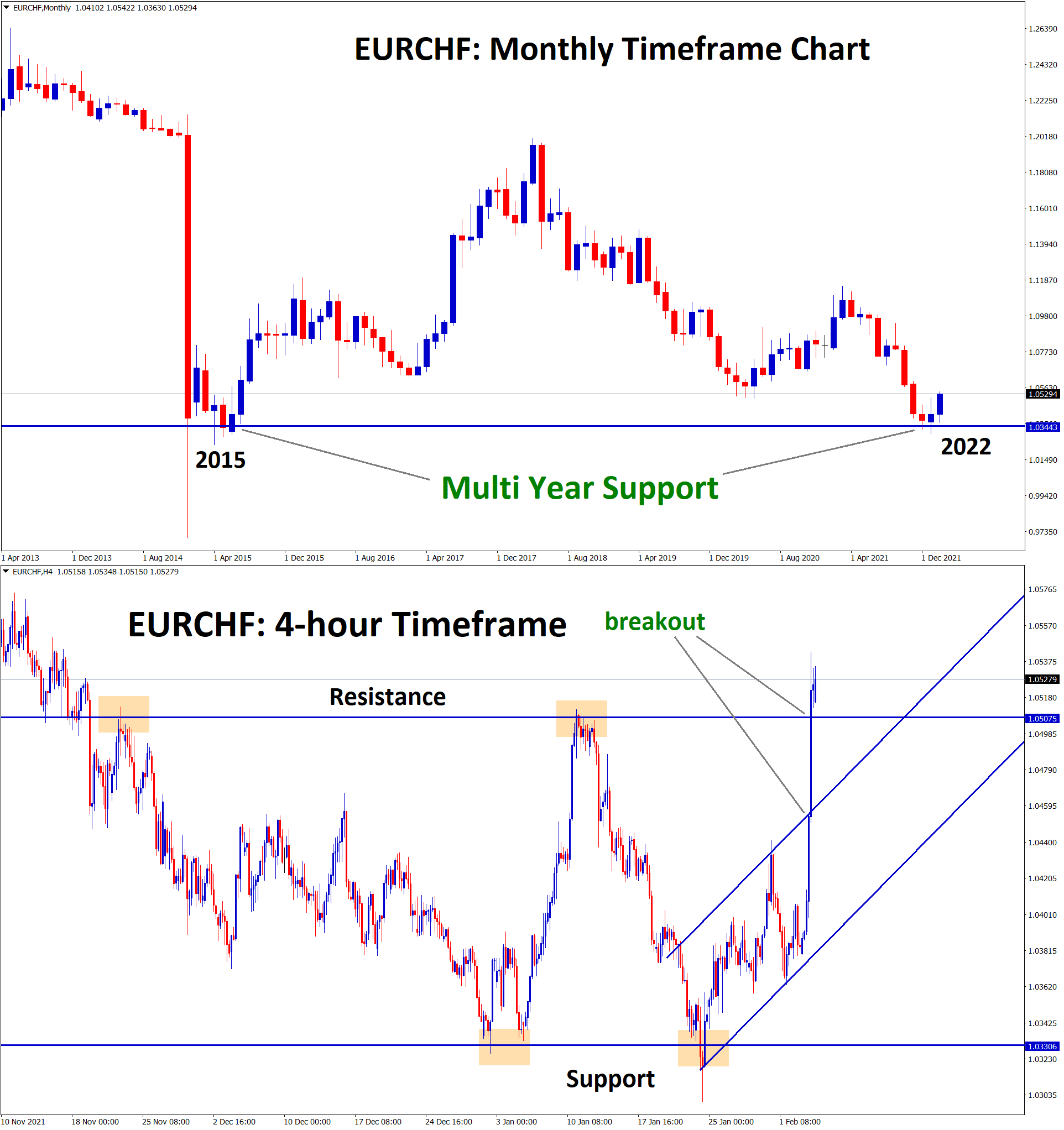

EURCHF Analysis:

EURCHF is rebounding from the Multi year major support area (2015th year support) and broken the recent resistance zones in the smaller timeframe(4-hour chart).

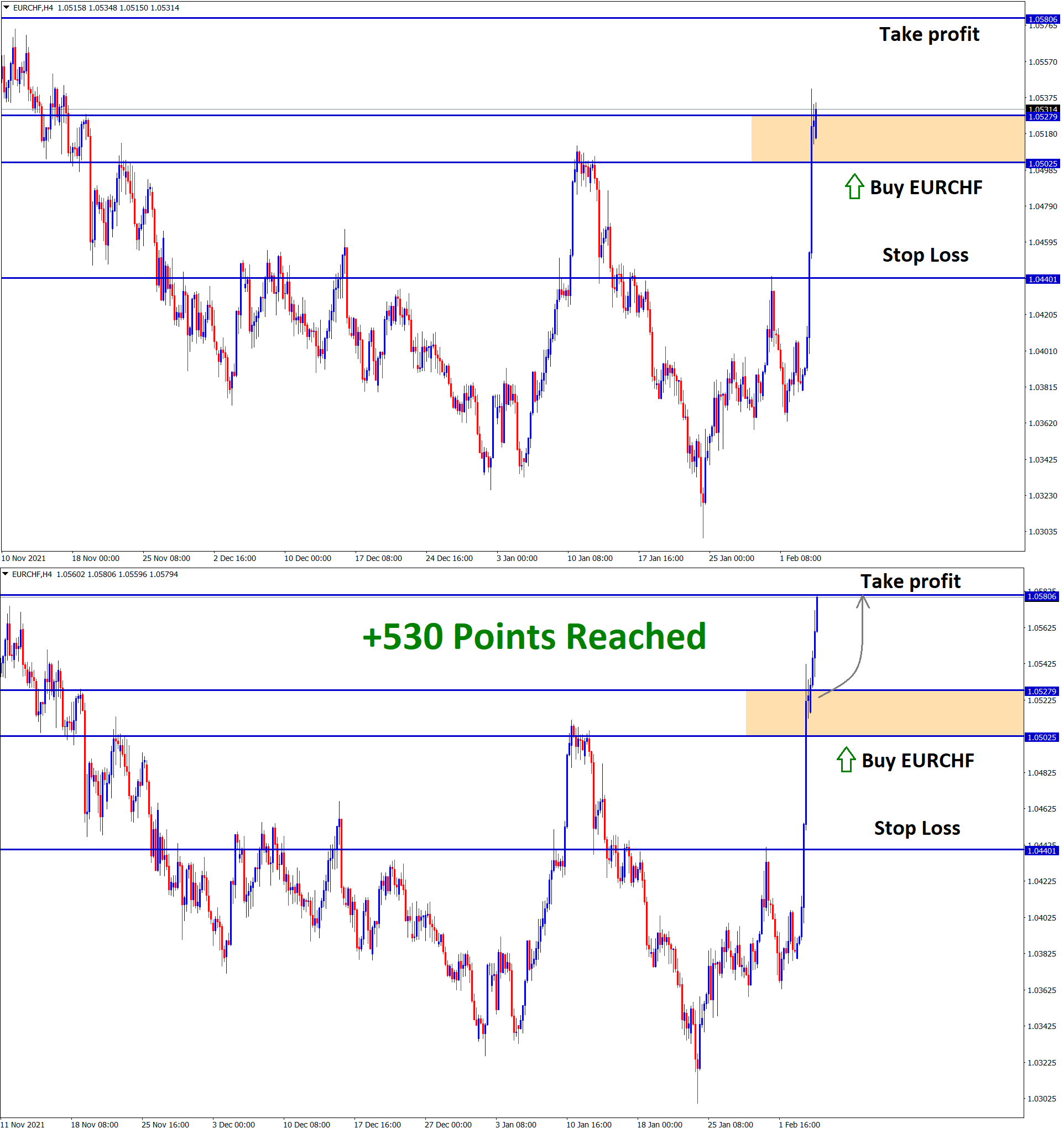

After the confirmation of upward movement, EURCHF buy signal given.

EURCHF reached the take profit target successfully.

EURO: Euro CPI came higher than expected

Eurozone CPI rate printed at 5.1%YoY and Shows higher in the Decade.

And ECB might do 10Bps rate hikes in July 2022, as Analysts expected.

And Bank of England is going to rate hike today as MPC Vote 9:0 shows, and this is back-to-Back rate hikes in the last 2004 year.

Bank of England and ECB have more Divergence in Policy settings, more climate change between UK and EU makes more Covid-19 affected than the UK.

Swiss Franc: Swiss Franc benefitted by Negative US ADP numbers

Swiss Franc gets more benefitted by US and Russia war Fears from Ukraine issue.

And Euro Zone is only more affected by Oil and Gas problems due to 80% of Supply from the Russian side.

US ADP shows disappointment numbers and -301K printed versus 207K expected. This shows pullback from highs in Employment data.

However, US FED strong thinking of rate hikes will be placed in March Month as All expected.

And Swiss Franc is the only currency that benefitted from Oil and War fears.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/