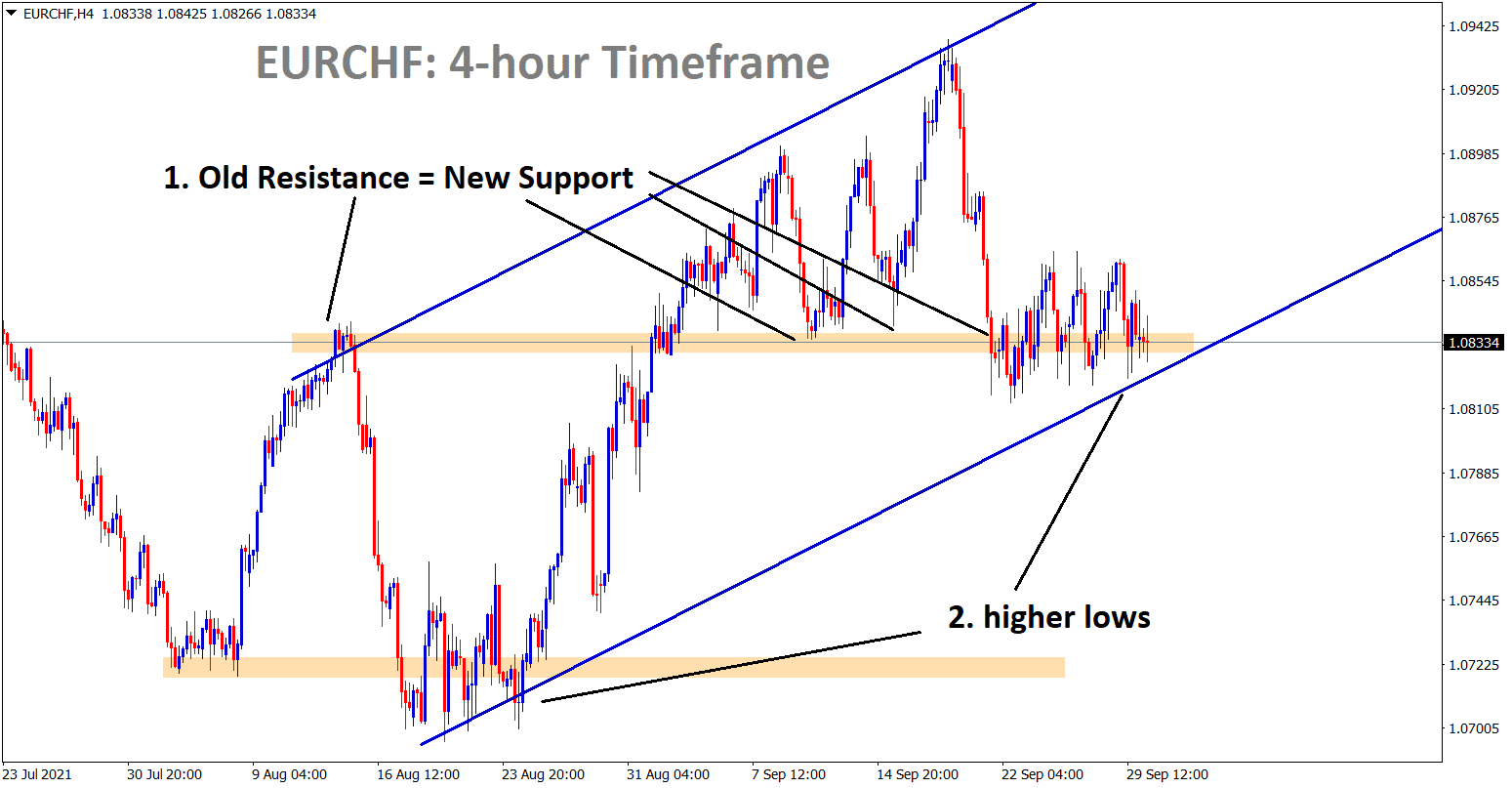

EURCHF Analysis

EURCHF is consolidating at the support area and the higher low level of an uptrend line in the 4-hour timeframe chart.

EURCHF buy signal given at higher low level of an uptrend line.

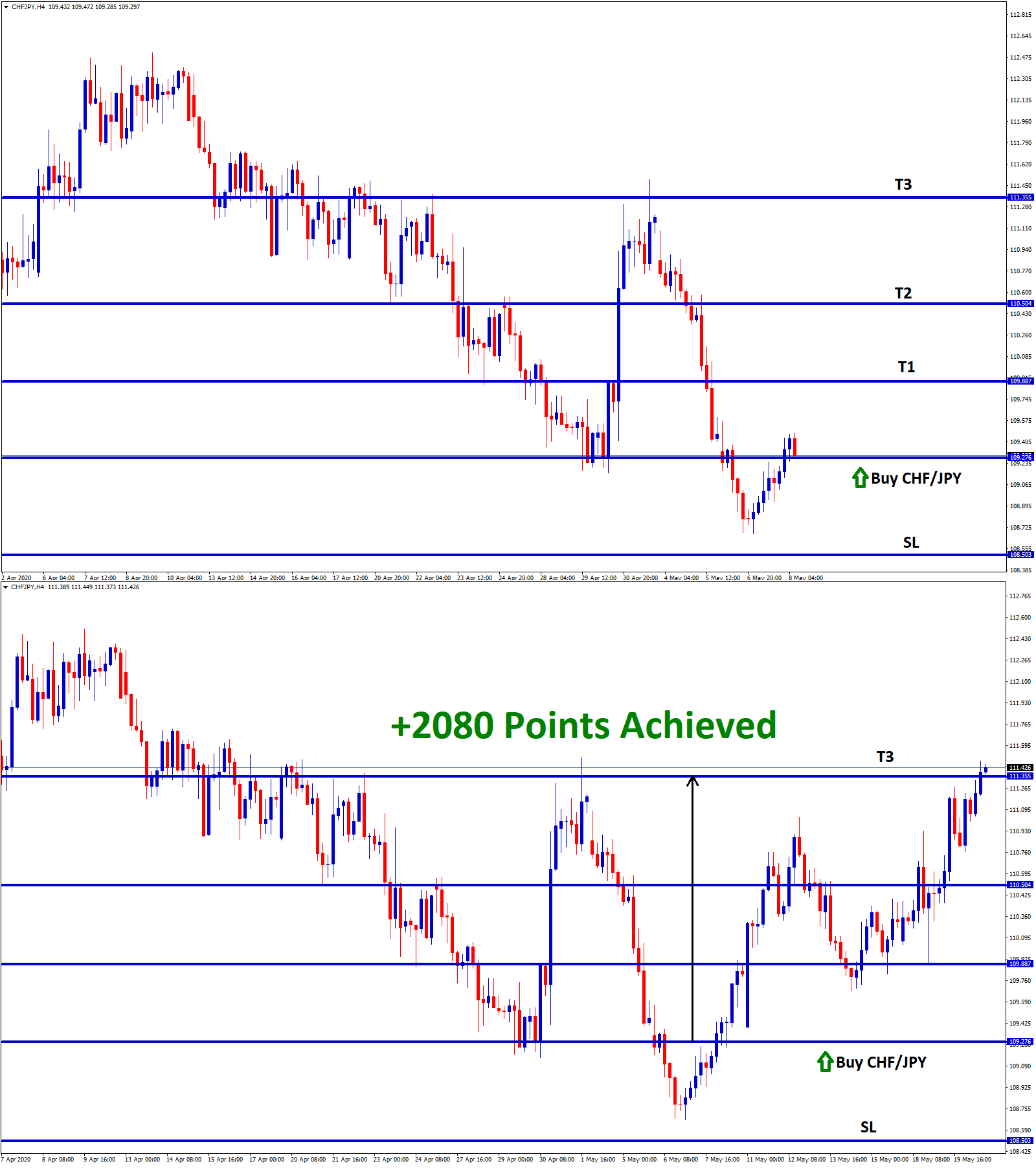

And breakout happened at bottom level, which led EURCHF to the SL price.

EURO: CPI Data came higher

Eurozone CPI Inflation data came at 1.9% from 1.6% previous reading, inflation rate (YoY) rising to 3.4% as September month.

Due to rising in energy prices in the winter season, inflation levels shoot up.

And ECB meeting will be held on October 6th; in that ECB will suggest tapering Pandemic emergency funds to control inflation levels.

And also, consumers are feeling the heat for consuming energy at higher prices.

Demand and supply mismatch causes Oil Prices to higher.

Swiss Franc: US FED Tapering Hopes

Swiss Franc makes higher as China Evergrande Crisis spread across Asian Countries.

And More liquidity was done by the People Bank of China to eliminate the liquidity crunch in China.

US FED will taper stimulus in coming November meeting, due to increasing hope, US Dollar makes stronger.

And USDCHF makes higher low after last week the strong pace of higher.

US Joe Biden plan of infrastructure bill makes delayed by the Republican party to reduce spending culture.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/