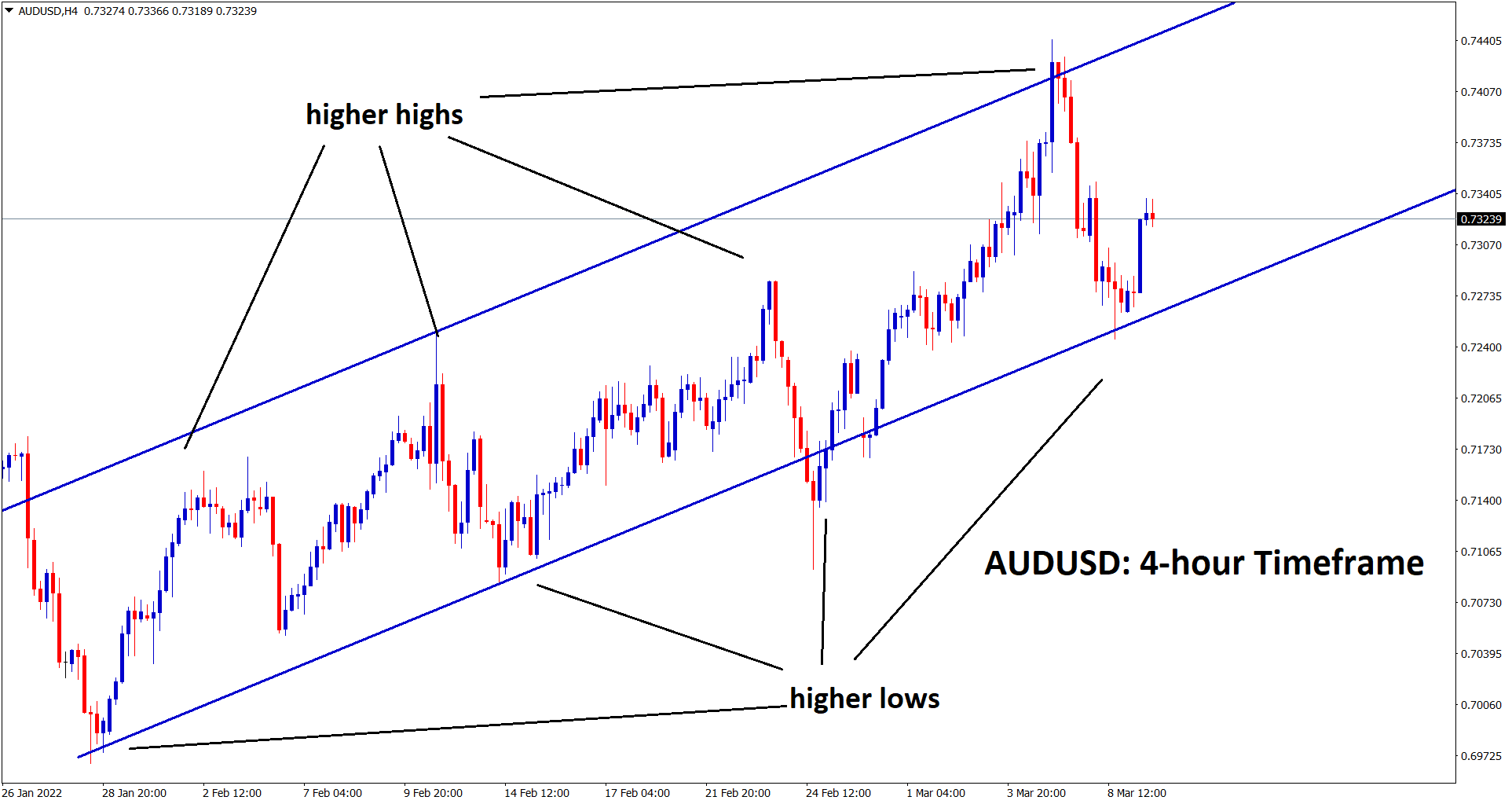

AUDUSD Analysis:

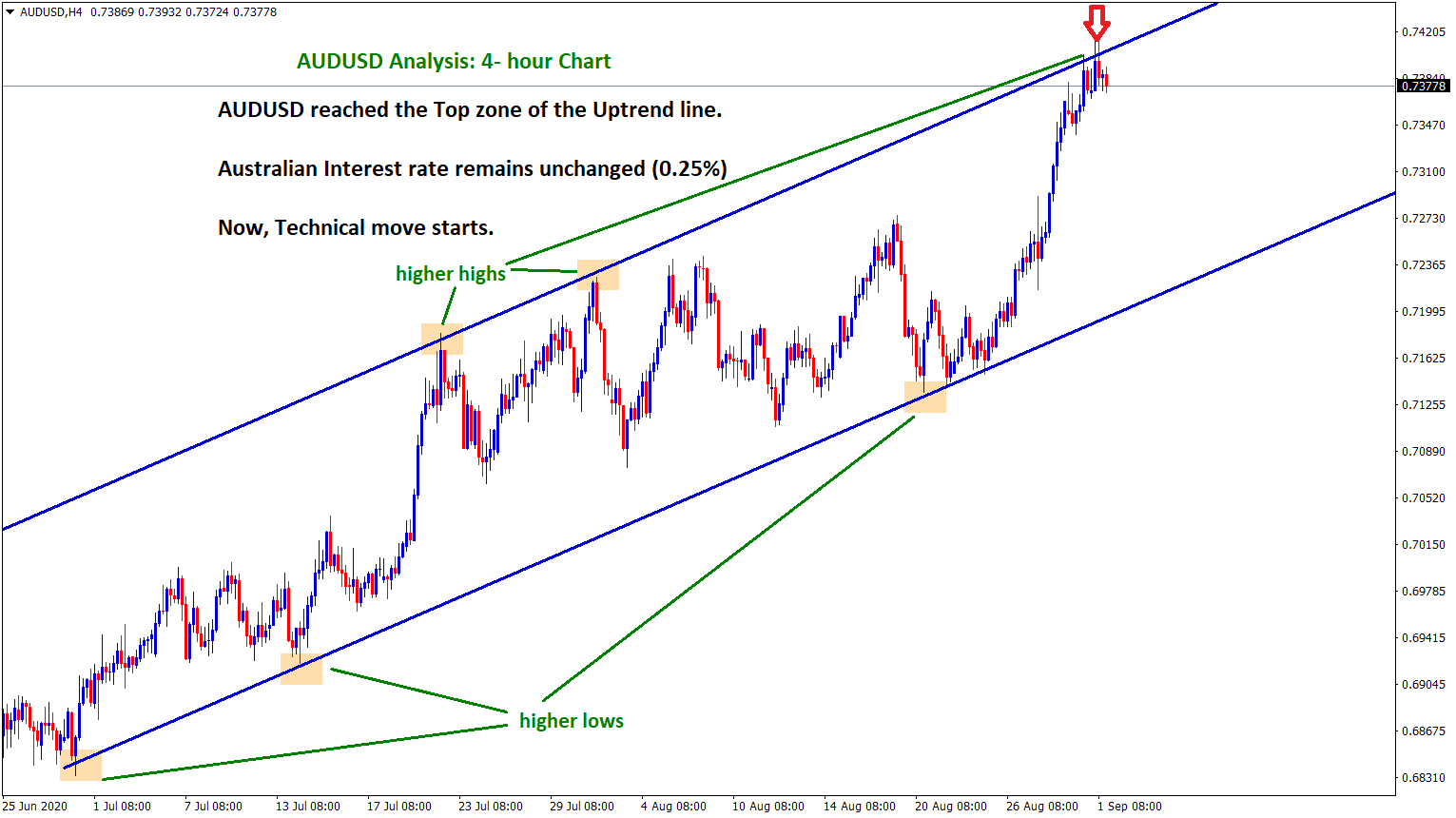

AUDUSD is rebounding from the higher low area of the uptrend line in the 4-hour timeframe chart.

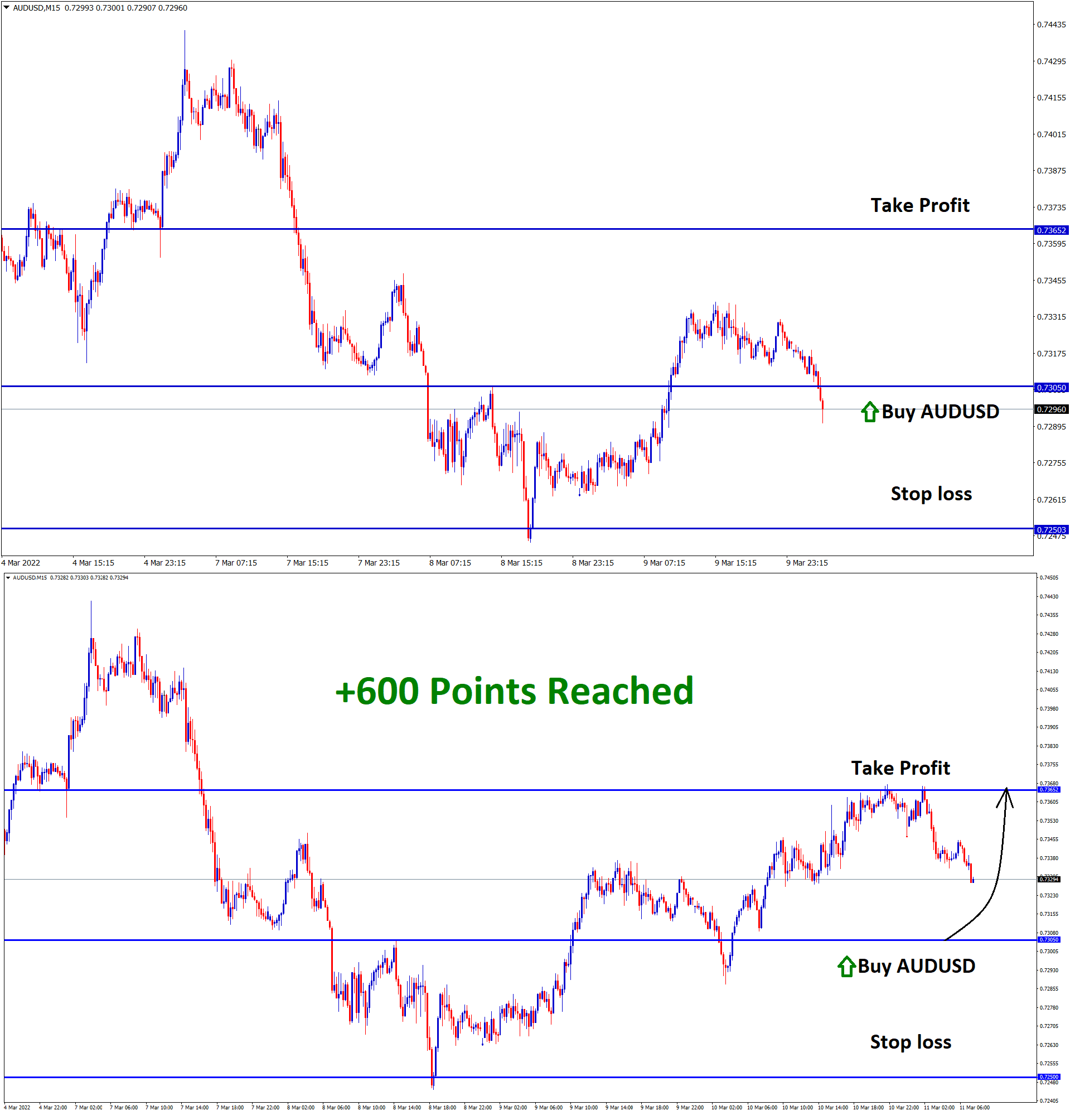

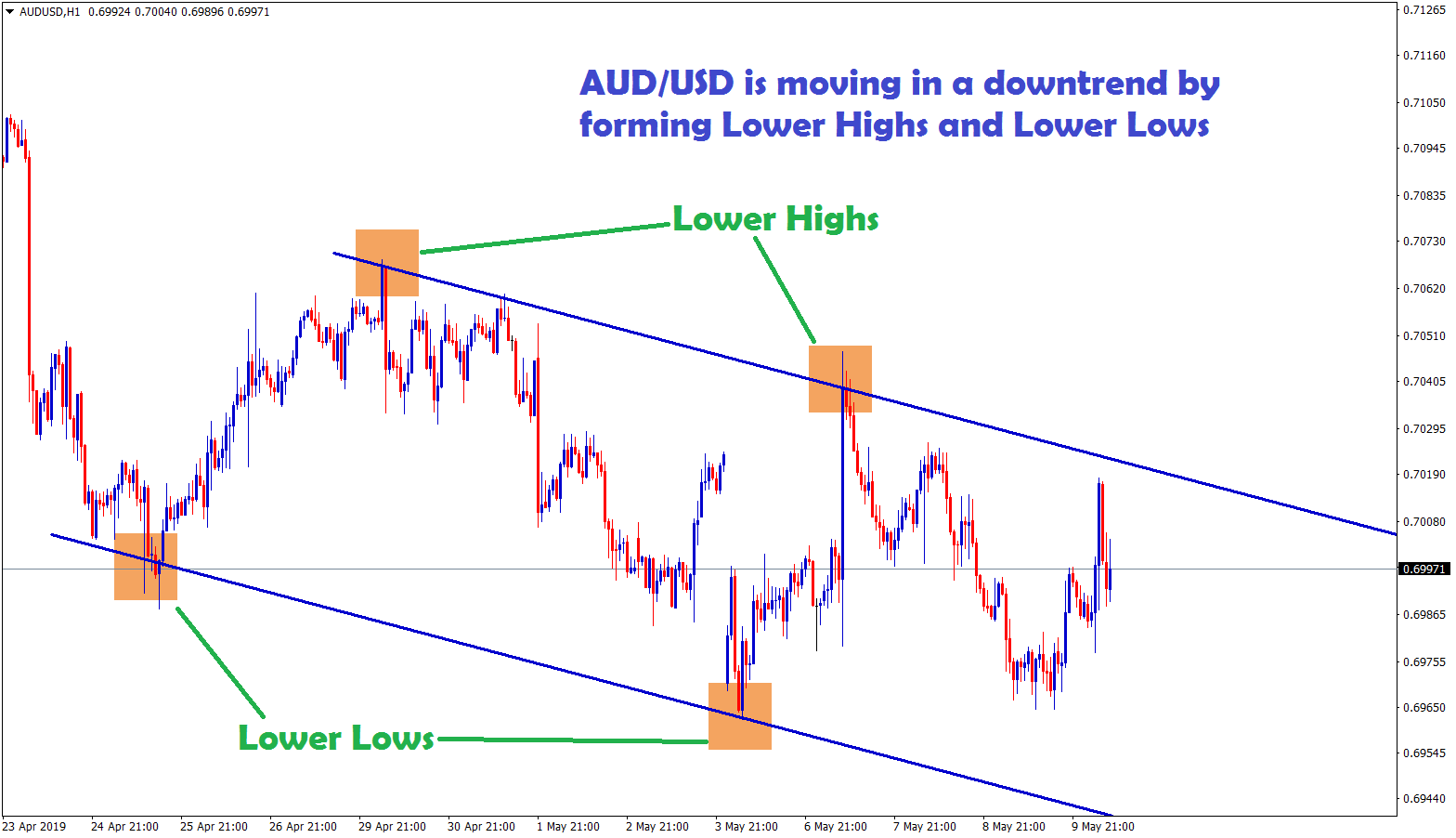

In the 1-hour timeframe, AUDUSD is rebounding from the higher low of the uptrend line and the horizontal support area.

After the confirmation of upward movement AUDUSD Buy signal given.

AUDUSD reached the take profit target successfully.

Australian Dollar: RBA expected to 2time rate hikes in 2022 as per Goldman Sachs’s expected

According to Goldman Sachs, analysts expected RBA to deliver Two consecutive rate hikes in August and September.

The main reason is inflation soaring higher due to the Russian invasion of Ukraine, oil prices soaring, and Major floods across Australia’s Eastern Coastline; this suggested that the annual Growth of CPI will be 5.3% by June 2022.

And the trimmed mean shows 3.9%, but the RBA target is 2-3% until early 2023 and 2.6% at the end of December.

The third-rate rise may be in November month, and RBA tightening cycle ends in the third quarter of 2024, and the Cash rate is 2.5% at the time completing the Tightening process in 2024.

Moody’s investor services predicted Australian mortgages are safe.

Moody’s investor services said Australian Mortgage delinquencies are normal not to panic.

And Mortgage delinquencies will hold in 2022 as Economy conditions stabilize.

Australian Economy shows Robust recovery from Covid-19 Crisis and Now just in consolidation mode.

And the GDP will grow to 3.5% in 2022 and support steady Mortgage performance.

US Dollar: US CPI Forecast

US Dollar index fell about 1% pullback as Ukraine President said we could talk for Diplomatic solutions to end the War.

This speech made calm in Commodity markets and Cheered up Riskier currencies.

ECB meeting scheduled today and expected no changes in Interest rates.US CPI data yet to be released now and expected 0.4% above from Last month this time.

Larger than expected CPI makes US Dollar slight weakness this week.

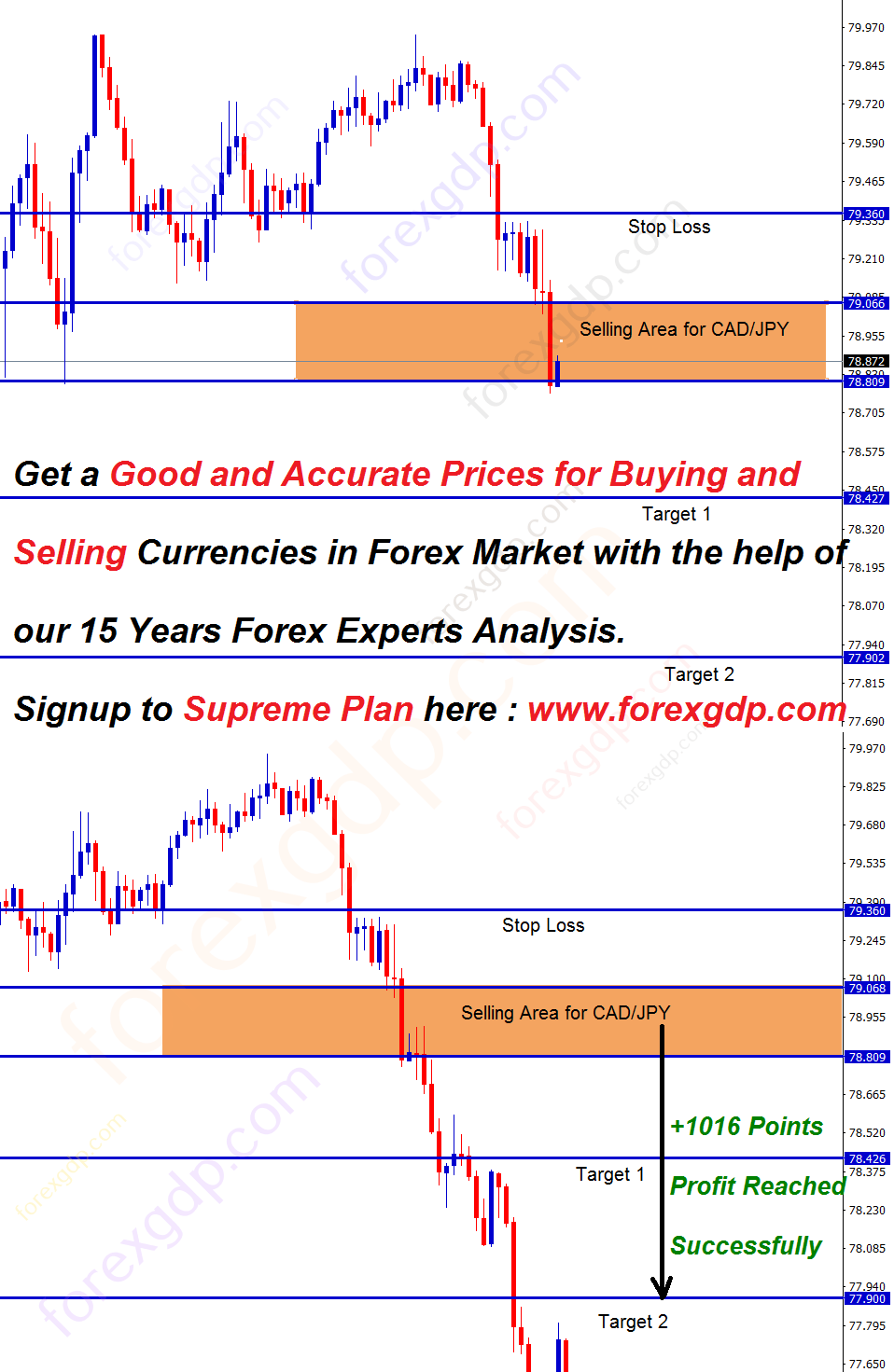

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade setups at Premium or Supreme plan here: https://signal.forexgdp.com/buy/