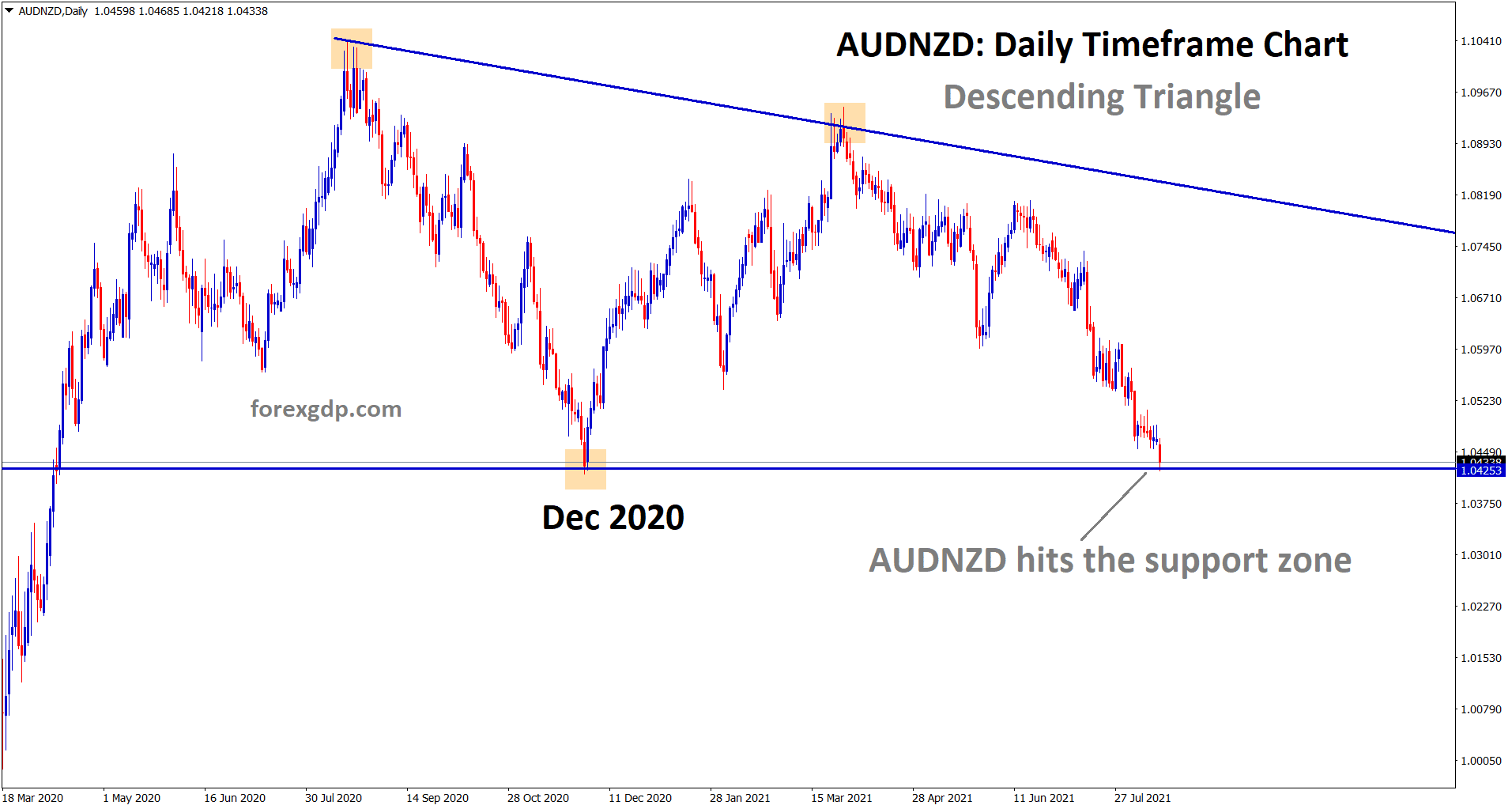

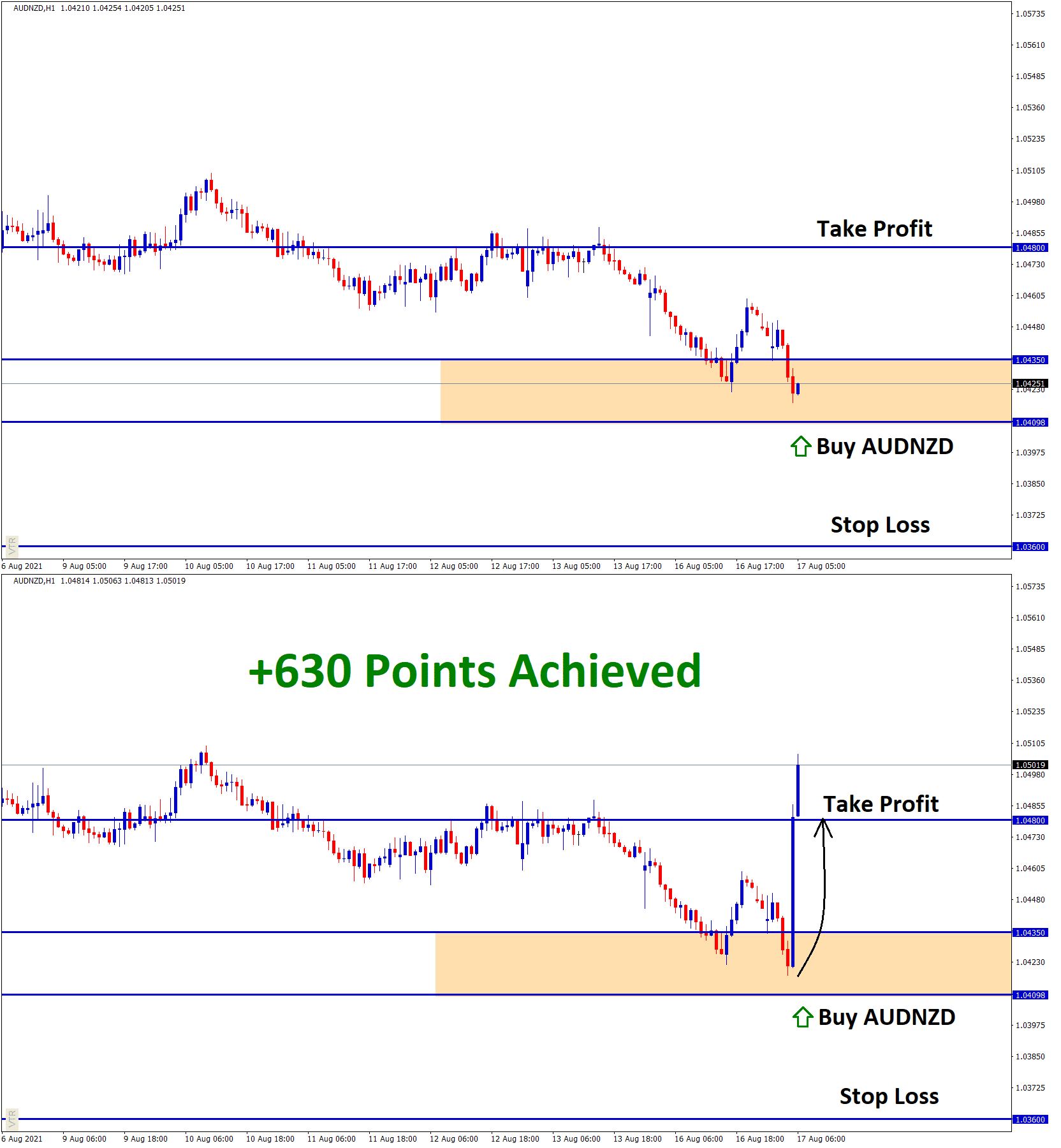

AUDNZD Analysis

AUDNZD has formed a descending triangle pattern. Now the market has reached the support zone exactly. Expecting rebound from this support zone.

After the confirmation of uptrend movement, AUDNZD Buy signal was given.

AUDNZD successfully achieved the take profit target.

Australian Dollar: Iron ore prices dropped as China domestic data underperformed

Australian Dollar losses more as more delta variant issues in major cities happening in the current situation.

Only 16% of the current population of Australia is only fully vaccinated, and now vaccination progress gained speed to avoid spread.

And Iron ore prices keep a quick drop to 130/MT as 5 months low as China made poor domestic data.

This week RBA meeting minutes happening, and July month Jobs data to publish; any positive news on Jobs data will boost the views of RBA could taper the Bonds and Hike rates soon.

New Zealand Dollar: RBNZ meeting this week

New Zealand Dollar shows a range-bound market as the Reserve Bank New Zealand Policy meeting happened this week.

Rate Hikes are expected in this policy meeting, and labour data was well-performed last week.

Goals of Labor data and Inflation data may support New Zealand central bank to hike rates and more tapering in this meeting.

And Chinese data of Retail sales and industrial production are lower than expected reading printed on Monday, which shows fewer export revenues for New Zealand Country.

Trade forex market only at the confirmed trade setups.

Get Each trading signal with Chart Analysis and Reason for buying or selling the trade which helps you to Trade with confidence on your trading account.

Want to increase your profits in trading? Get the best trading signals at an accurate time. Try premium or supreme signals now: forexgdp.com/buy