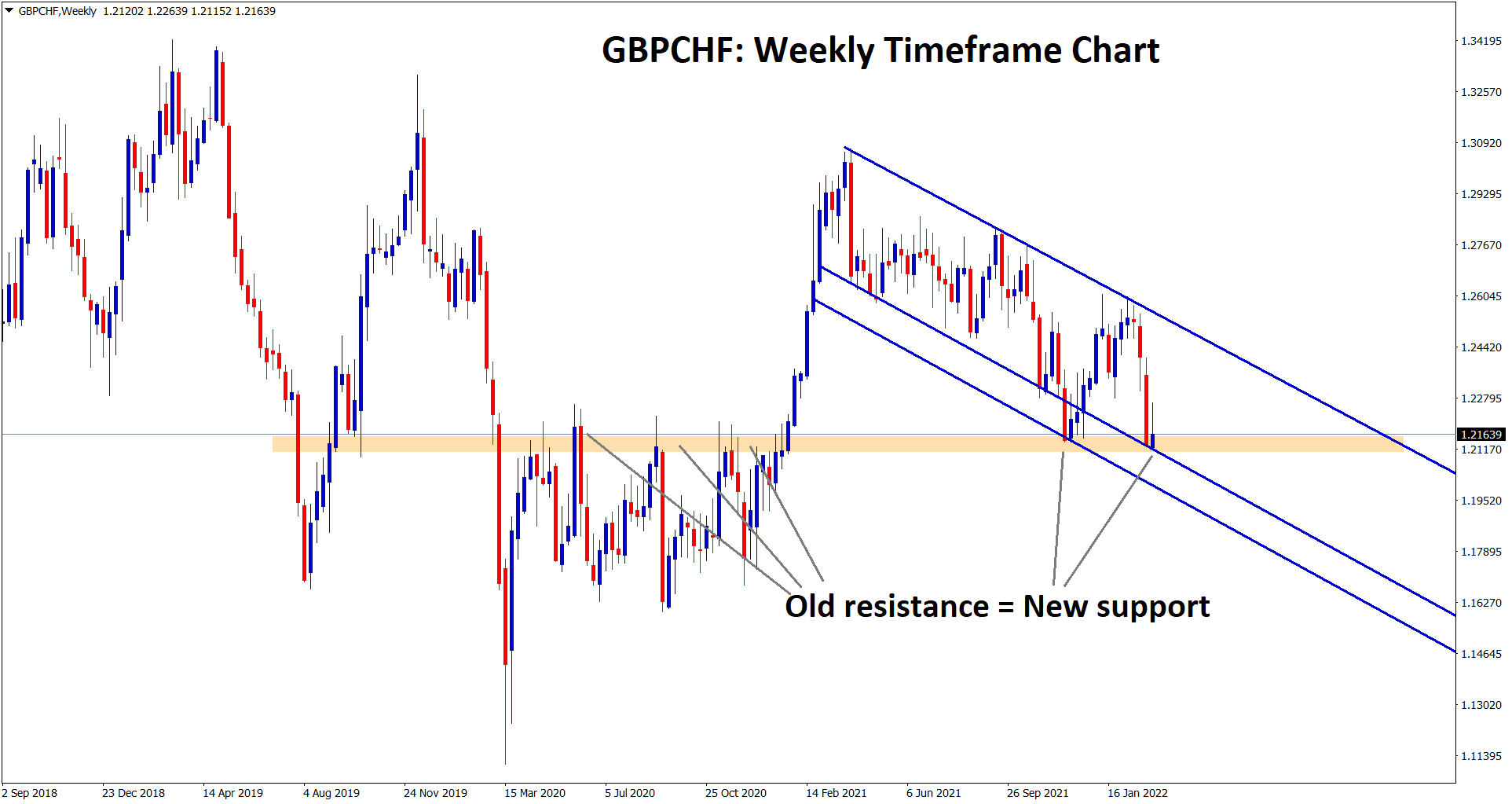

GBPCHF Analysis:

GBPCHF is standing at the strong support area in the higher timeframe weekly chart.

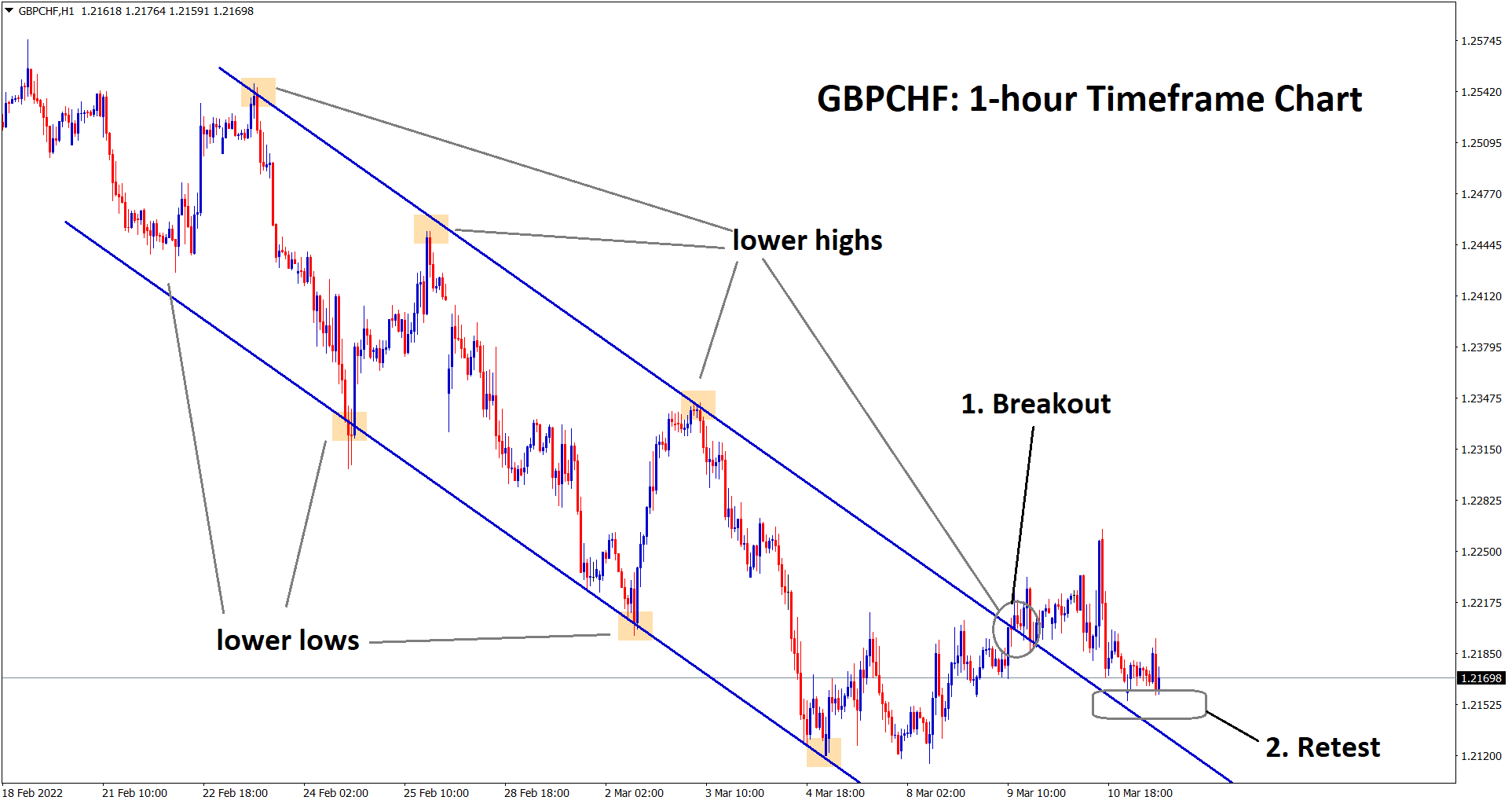

In the hour timeframe, After the descending channel breakout, GBPCHF is consolidating around the retest zone.

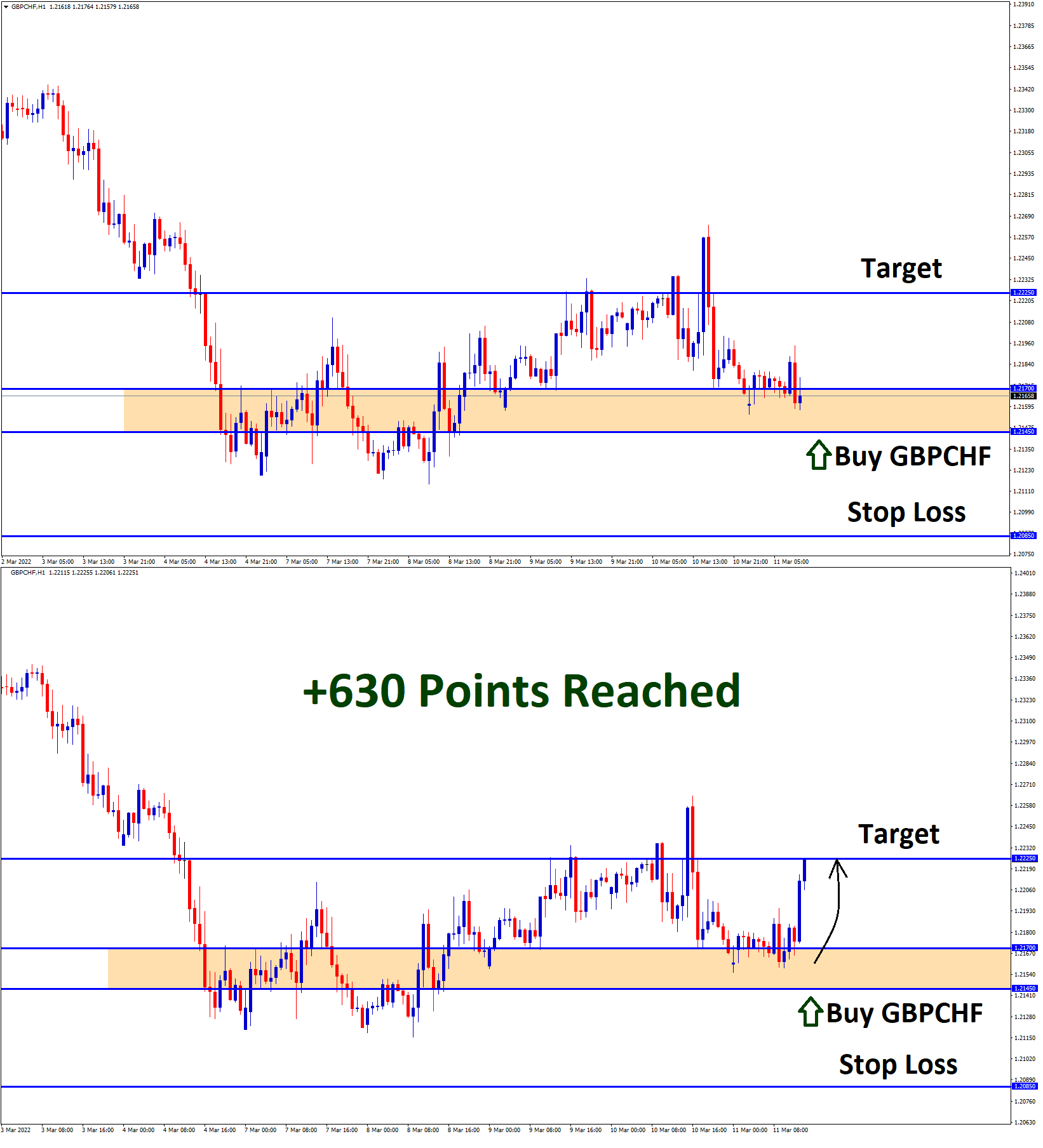

After the confirmation of upward movement GBPCHF buy signal given.

GBPCHF reached the take profit target successfully.

UK Pound: UK GDP rate increased above expectations

UK GDP rate rose to 1.1% on 3month Avg reading from 0.80% forecast, and All sectors grew up by proper rates.

- Construction up by 1.1%

- Services up by 0.80%

- Production up by 0.70%.

And the economy now recovers back to above the 2020 crisis level, and So the Bank of England bet for 50Bps rate hikes, but a 25bps rate is expected next week.

And GBPUSD Dropped to 1.3080 area from 1.3180 area after Ukraine negotiations failed to Russia.

But the UK made more sanctions on Russia, and So Oil prices are soaring higher, making the UK Pound weak.

Swiss Franc: US Dollar strengthens against Swiss Franc as War continues in Ukraine

Swiss Franc appreciated against counter pairs except for USD; due to higher inflation in the US, the FED rate hike is more basis points than expected.

This, in turn, USDCHF climbed to 0.9300 area, which was a weekly jump this month.

Russia and Ukraine negotiations in Failure mode, UN security council, called Moscow for usages of chemical and biological weapons in Ukraine War.

So Russia and Ukraine War goes in Serious way no ceasefire has yet now between the two countries.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade setups at Premium or Supreme plan here: https://signal.forexgdp.com/buy/