USDJPY Analysis

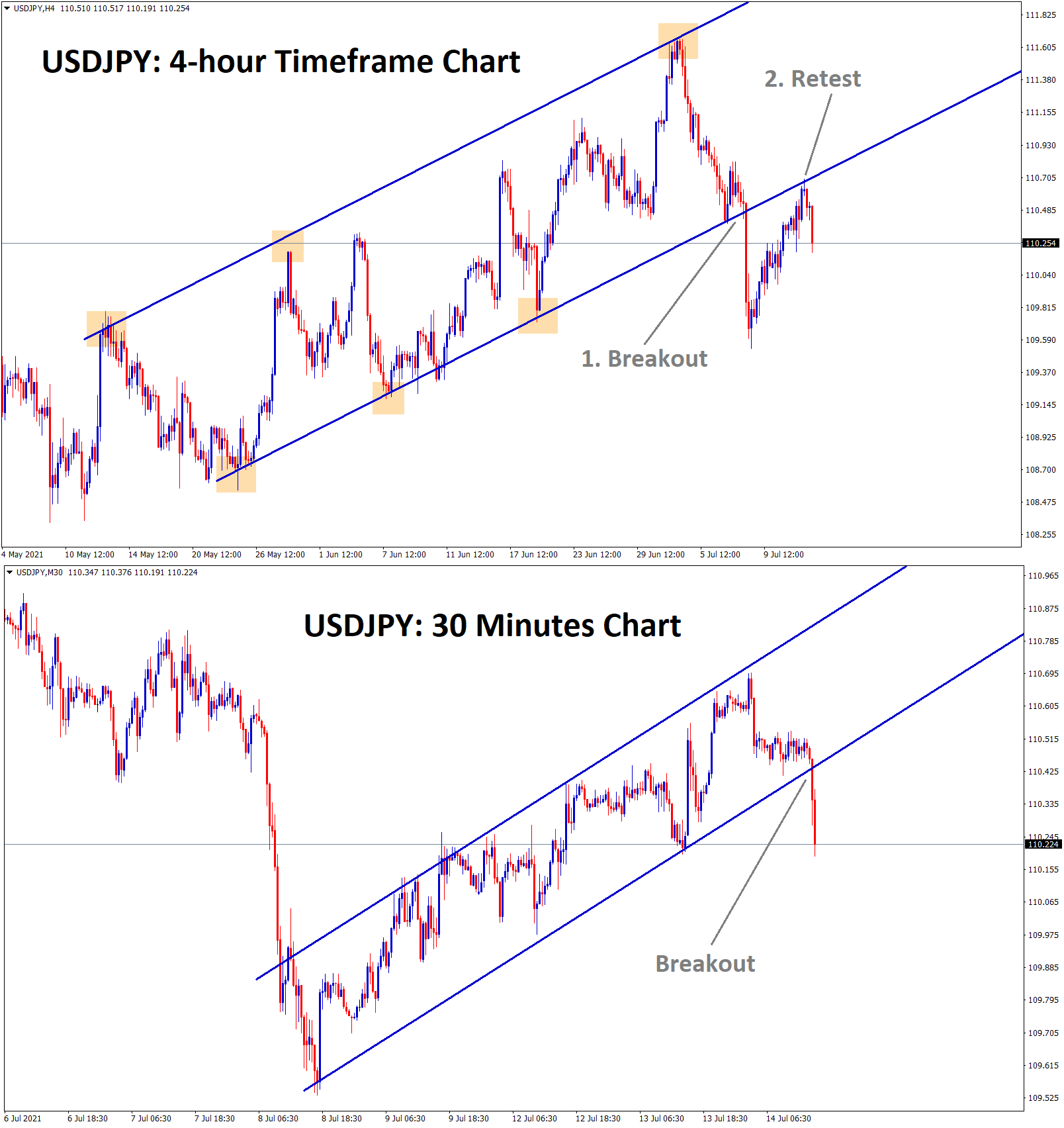

USDJPY has broken the bottom level of the ascending channel and Retested the broken level on this week (4-hour timeframe chart).

In the smaller timeframe (30 minutes chart), USDJPY has broken the bottom level of the Ascending channel which confirms the selling pressure on USDJPY.

After the confirmation of the Downtrend movement, the USDJPY sell signal is given.

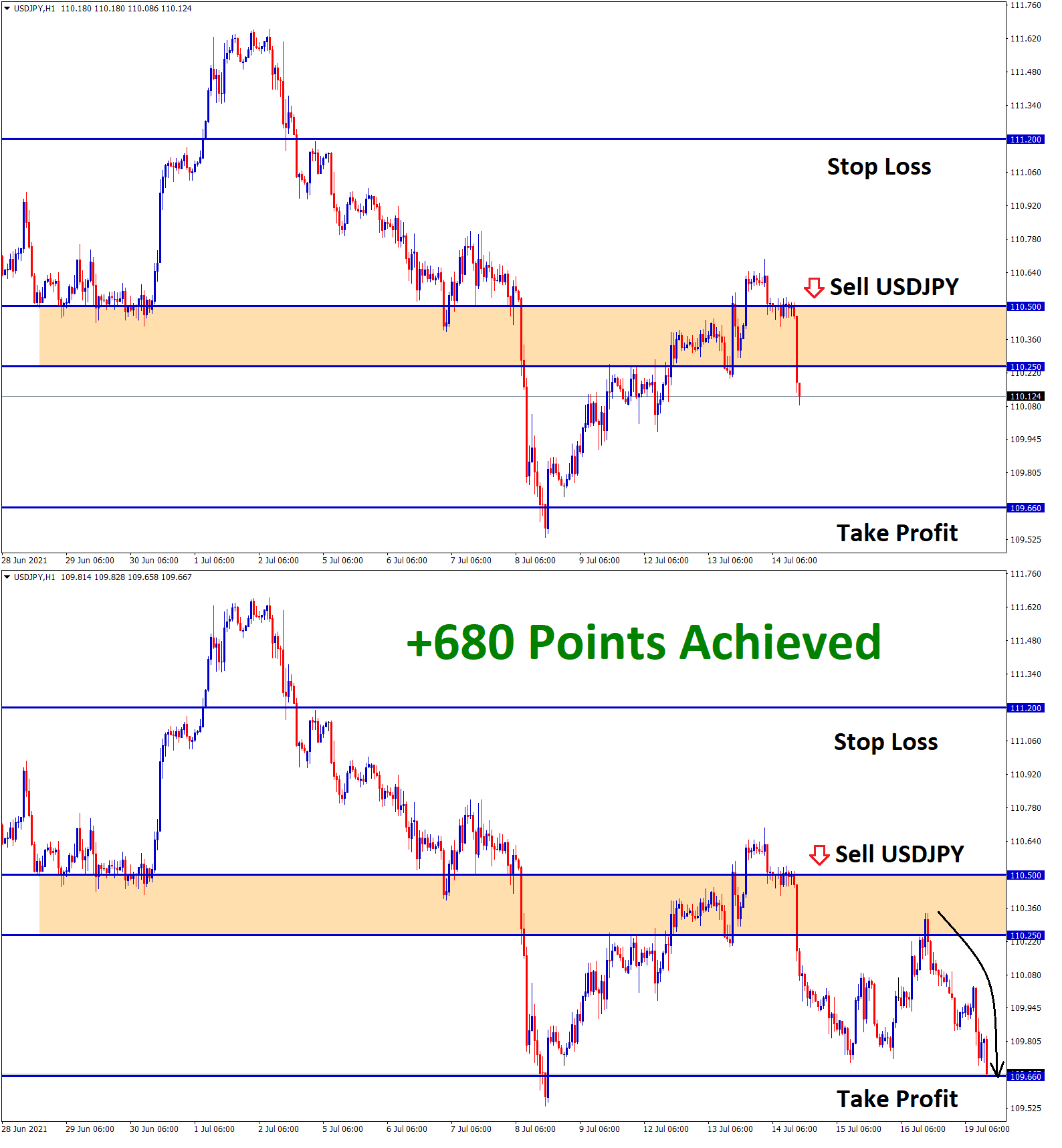

USDJPY reached the take profit target successfully.

US Dollar: Domestic data

US Dollar Index moved higher after Friday. US Retail sales data came at 0.6% versus -0.4% expected. Michigan Consumer sentiment dropped to 80.5 from 85.5 expected. This shows Solid domestic data in the US.

Joe Biden administration placing more billion in Infrastructure plans and More stimulus for Vaccination makes the US economy stronger, and inflation grows.

And 13-year high inflation sees more growth in US and FED will quickly make tapering assets and Hike rates in the coming months makes US Dollar stronger.

US treasury secretary Janet Yellen Speech

US Treasury Secretary Yellen said the US and China Trade deal impacted US Consumers more. The previous Government did not take more actions against Chinese officials in the agreement process.

But Chinese officials said the First phase deal is good for China, good for the US and good for the whole world.

Yellen comments on US-China Trade deal has not affected Forex markets, and the Covid-19 Delta Variant issue affects more in the FX market.

JP MORGAN View on US Inflation forecast

JP Morgan Forecasts US inflation data for 2022 and beyond will be 2-3% range only, Now the reading flying higher is only transitory as FED overview.

When inflation readings are made higher in the market, wages increases and impacted Interest rates to hikes quicker expectations.

Once rate hikes have been done, the inflation number will reach a normal level of 2-3% as in the Previous pandemic level. So, no fear of inflation levels flying higher and makes patience for rate hikes will be done by US FED.

JP Morgan View on Inflation to 2-3% for the long term supports investors’ panic view on markets.

Japanese Yen: US Domestic data

Japanese Government Trimmed GDP Forecast to 3.8% from 4% for the 2021-2022 year. Tokyo is now released with partial lockdown as the Olympic games starting on July 23rd. Once the Games started, the possibility of spreading delta Variant is fear among the Japanese Government.

Japanese Yen finds more positive from losing tone in the second quarter.

US Dollar gets mixed data of Friday report and makes stronger in coming weeks.

USDJPY dropped 0.30% from highs today after US Retail sales show positive numbers.

This seems Profit booking in the Market and the Japanese Yen remains stronger in the near term as Olympic games started in Japan as Lockdown releases in partial regions.

And Still, vaccination Rollout is very slower in Japan and Australia.

Trade forex market only at the confirmed trade setups.

Get Each trading signal with Chart Analysis and Reason for buying or selling the trade which helps you to Trade with confidence on your trading account.

Want to increase your profits in trading? Get the best trading signals at an accurate time. Try premium or supreme signals now: forexgdp.com/buy