What is arbitrage?

Arbitrage is the concurrent purchasing and offering of indistinguishable monetary instruments exploiting value inconsistencies between distinctive intermediaries, trades, clearing firms, and so forth and in this way looking in a benefit. On paper, arbitrage is a hazard less trading technique. In this present reality be that as it may, dangers flourish.

So why exchange arbitrage?

Indeed, if the dangers can be overseen, arbitrage can be greatly gainful in the event that you can discover the open doors and exploit the open doors before they vanish. All things considered, the arbitrage opportunity is available in light of the fact that one side is moderate to respond to market news, force, and so on. When it amends the open door is no more.

Why arbitrage forex choices?

All things considered, in light of the fact that the open door exists on the off chance that you look far it. The forex business sector is a money between bank/between merchant market. In least difficult terms, this implies the outside monetary standards exchanged the forex business sector are exchanged specifically between banks, remote money merchants and forex speculators wishing either to enhance, guess or to fence outside coin hazard.

The forex business sector is not a “business sector” in the customary sense because of the way that there is no brought together area for forex trading action and, in this way, exchanges put in the forex business sector are considered over-the-counter (OTC). Forex trading between gatherings happens through work stations, trades and over phones at a large number of areas around the world.

Consequently, the forex business sector is not as productive as the NYSE for instance. Value errors exist between trading stages, clearing firms, banks, and so on if just for a little timeframe. Alternatives valuing is additionally influenced for the same reasons however since there are different segments included in estimating a choice than simply the cost of fundamental money, they tend to exist for more timeframes.

A standout amongst the most widely recognized reasons for alternative estimating contrasts is the figuring of instability. Instability is by and large the standard deviation measured over a timeframe. Sounds sufficiently straightforward right? All things considered, if look at the unpredictability measure crosswise over distinctive forex alternative suppliers, you’ll likely discover contrasts as substantial as 2%. When you discover this you have additionally most likely discovered an arbitrage opportunity.

Since you’ve discovered an arbitrage opportunity, how would you exchange it?

All things considered, that is a bit trickier and this article can’t in any way, shape or form cover every one of the dangers connected with pulling off the exchange however I will show a few issues you ought to consider.

As a matter of first importance, are the choices truly the same? Are the agreement sizes, termination dates and times the same? American or European style?

You likewise need to consider execution hazard. Will there be slippage. Will there be a period delay in getting filled. Is the business sector moving too quick?

Exit system, how are you going to leave the exchange and still catch the benefit? What happens if the alternatives terminate in-the cash? Out-of-the-cash? Imagine a scenario where you get doled out a position on one alternative however not the other.

Bottom Line

These are only a couple of the issues one must consider when attempting to benefit from choice arbitrage. The way to alternative arbitrage is similar to some other exchange – arranging and hazard administration. Arrange the exchange, deal with the dangers, and execute the arrangement and you will be fruitful.

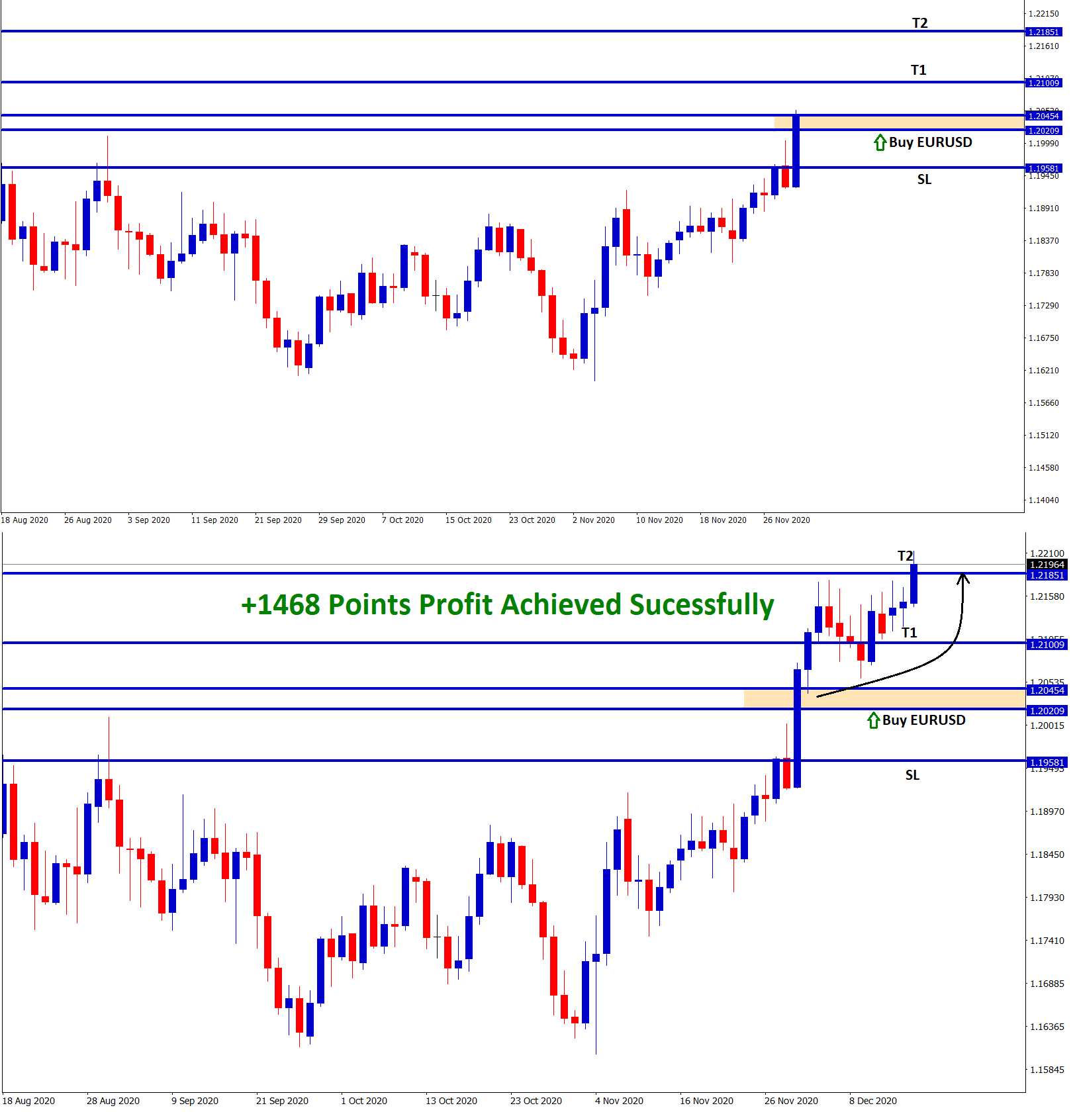

Save your time on analyzing the market and take your trades only at good opportunities available in the market.

If you want to receive forex trading signals at best trade setup with chart analysis, subscribe now to our forex signals.