GBPAUD Breakout Analysis

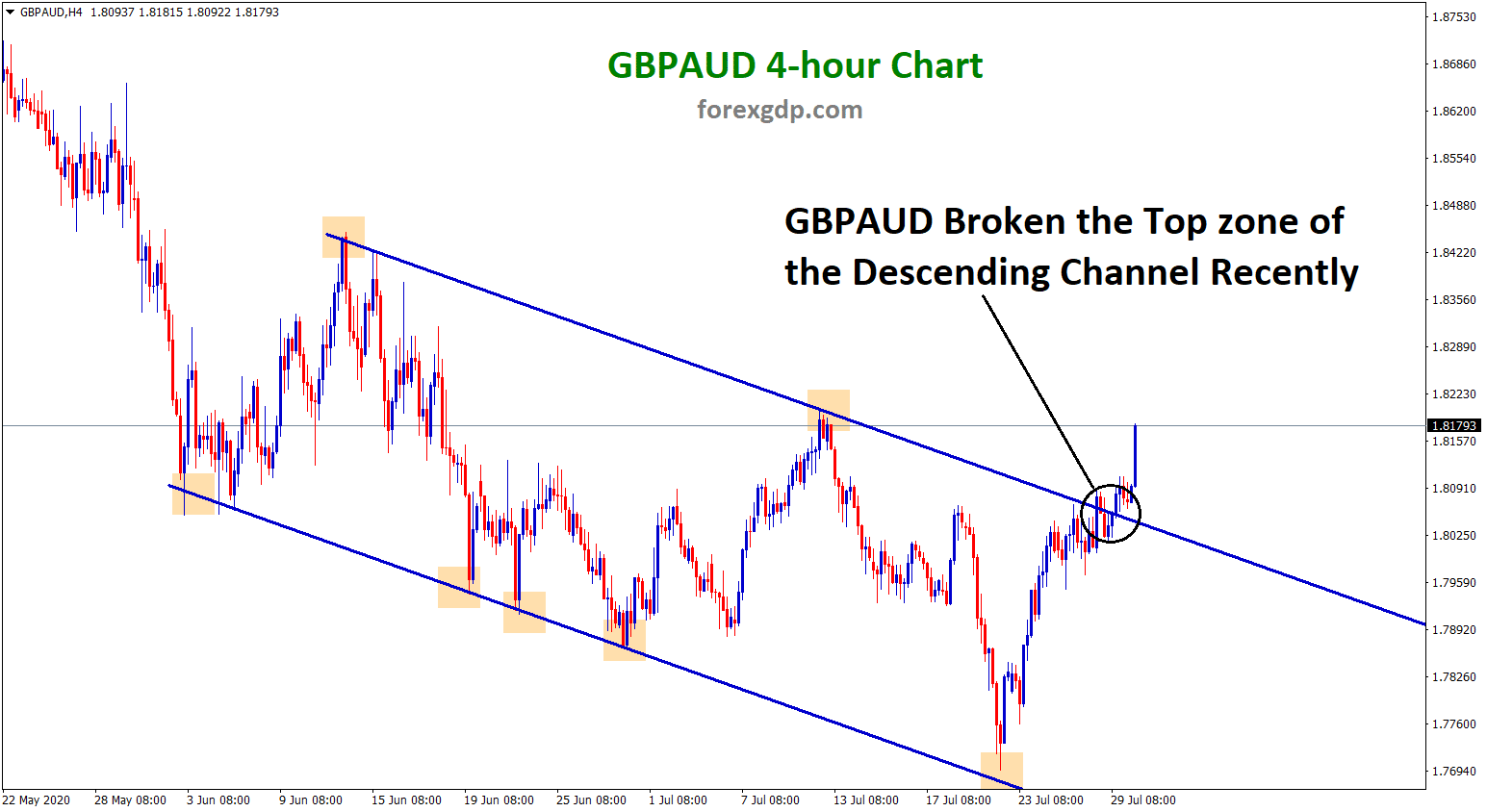

GBPAUD has created a descending channel by forming lower highs, lower lows in 4-hour timeframe chart.

Recently, GBPAUD has broken the top zone of the descending channel and market starts to pump up with buyers pressure.

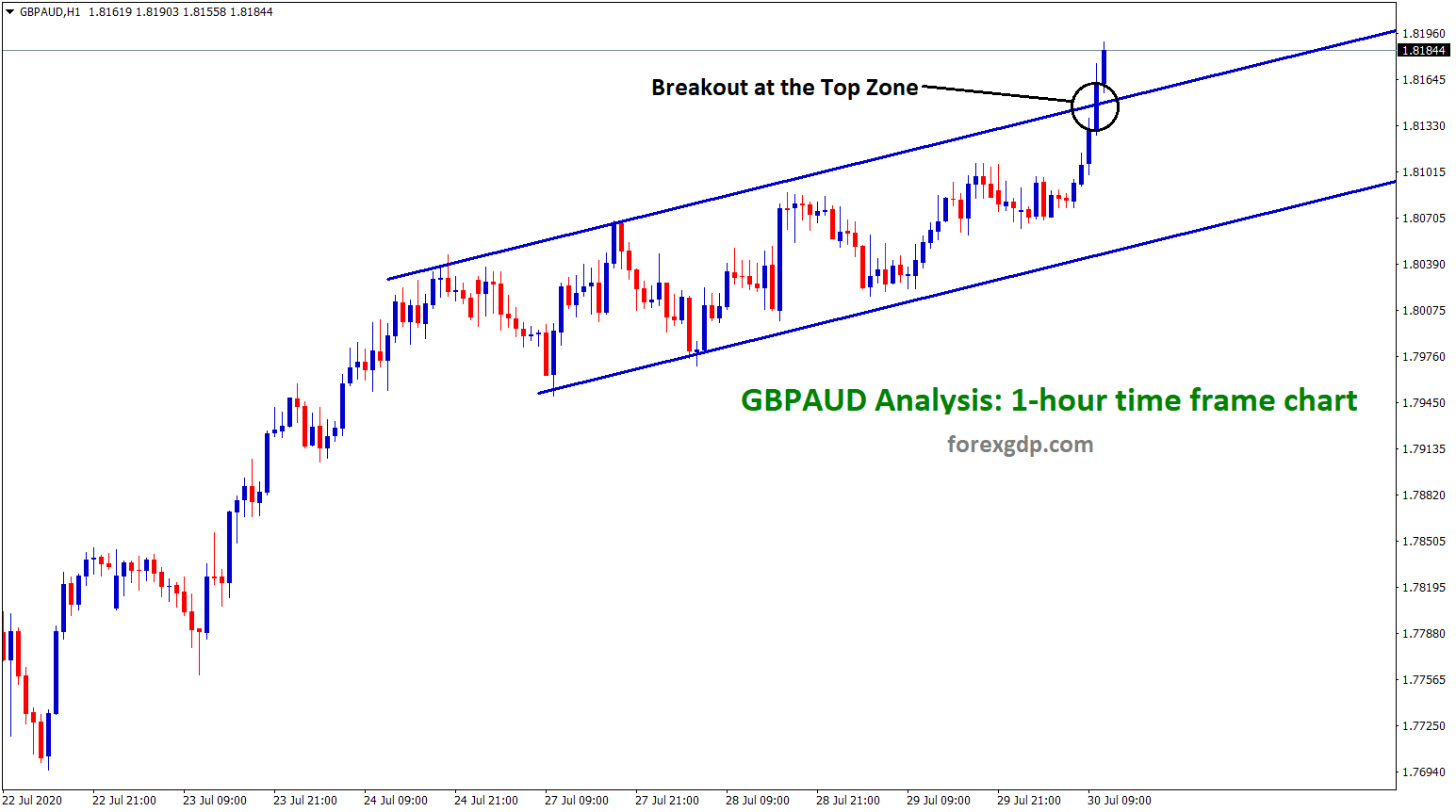

In the 1-hour time frame chart, GBPAUD broke the top zone of the Uptrend line. This shows that Buyers are increasing heavily.

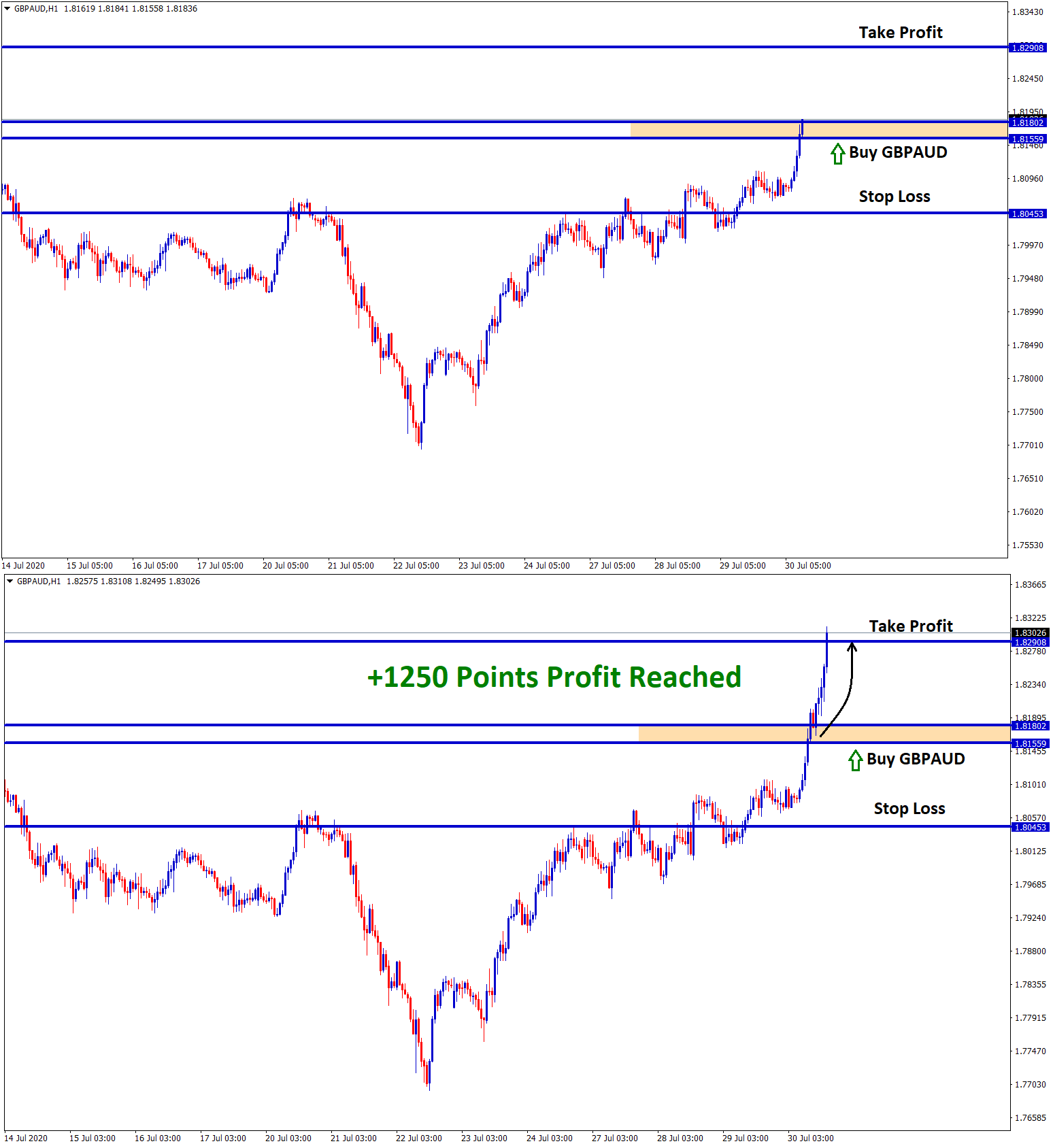

After the confirmation of Breakout, GBPAUD Buy signal is given.

GBPAUD reached the take profit target successfully.

Other Economic impacts of GBPAUD Are explained below:

Chinese Trade Tensions Australian Economy

China Trade Tension affects Australian Dollar (AUD) more.

Technically, GBPAUD is very strong due to the high demand created in the Pound.

Investors are interested to buy a pound to Australian dollar due to FED dovish stance yesterday and risks persists in the Australian dollar.

This week more solid bias uptrend in GBPAUD, already gained over a cent.

Pound rates benefit from US economic concerns and UK Gloom:

Pound (GBP) gaining this week due to Britain’s outlook unchanged and drive with uncertainties and pessimism, the pound is mainly supported by global market sentiments.

US coronavirus cases and the economic outlook remains weak. Hence, investors look for Britain’s outlook remain resilient for stronger. So pound benefiting from US dollar weakness.

On the other side, the pound is still facing concerns of Losses reported by Britain’s biggest high street bank.

Australian dollar fails to benefit from FED news

Global fears of the second wave of coronavirus infections and US-China tensions started keeps Australian dollar weak outlook.

Australian dollar weakness due to arising cases in Australia Victoria state and may expect lockdown extension.

Pound to Australian dollar gains may be limited.

Britain’s is now mixed handling of coronavirus infections, UK data, Brexit deal, hence pound climbing is limited in future.

Next week Bank of England policy decision is dovish stance will send the pound lower again, the possibility of negative interest rate is in doubts hence bank more dovish leads sterling to hit lower.

On the other hand, the Australian dollar fall or strong depends on next week July PMI status, next week Britain’s July PMI will publish that will affect GBPAUD prices.

Save your time on analyzing the market and take your trades only at good opportunities available in the market.

If you want to receive forex trading signals at best trade setup with chart analysis, subscribe now to our forex signals.