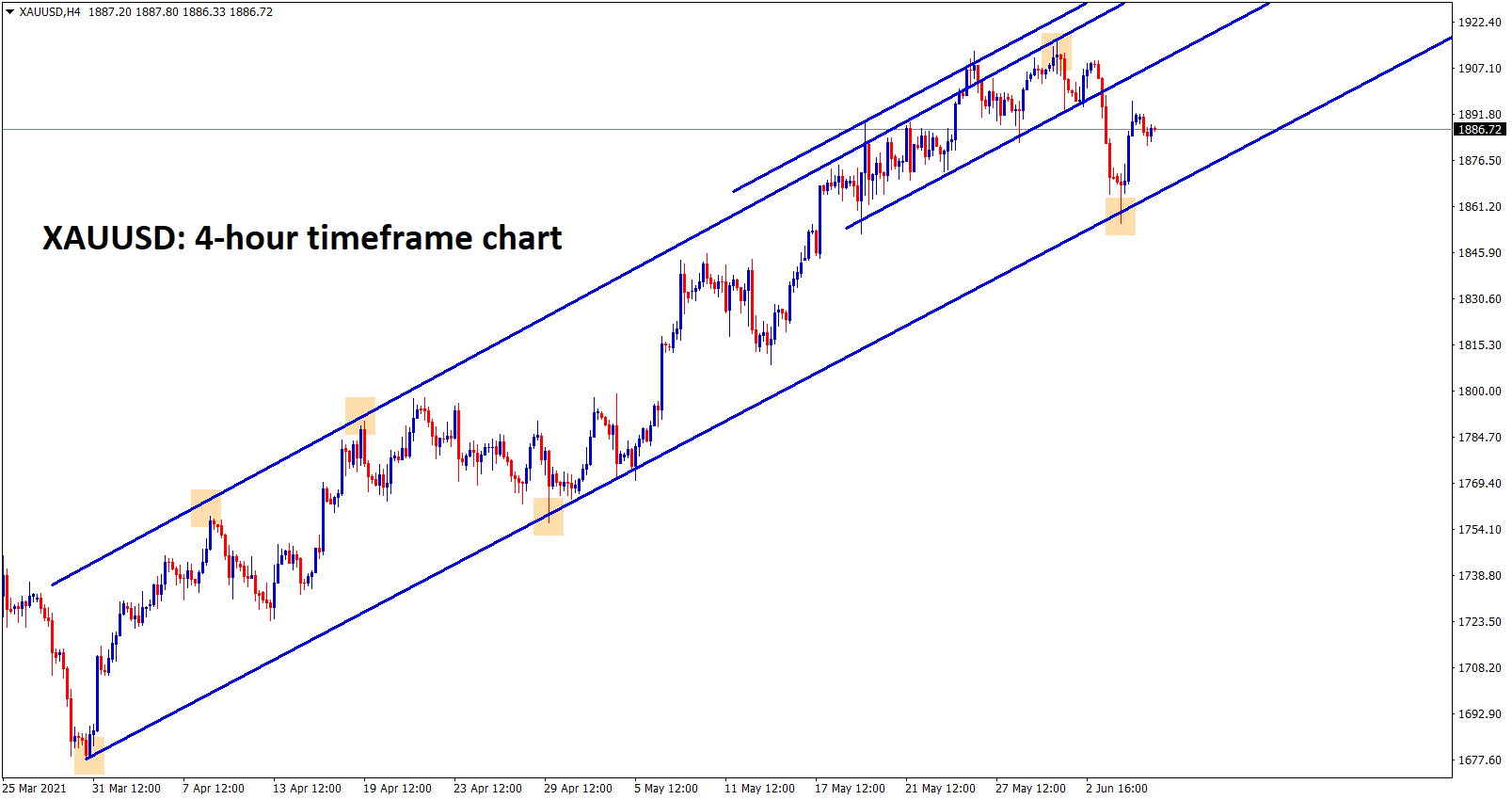

Gold

Gold is moving in a strong uptrend, recently bounced back from the higher low zone of the uptrend line.

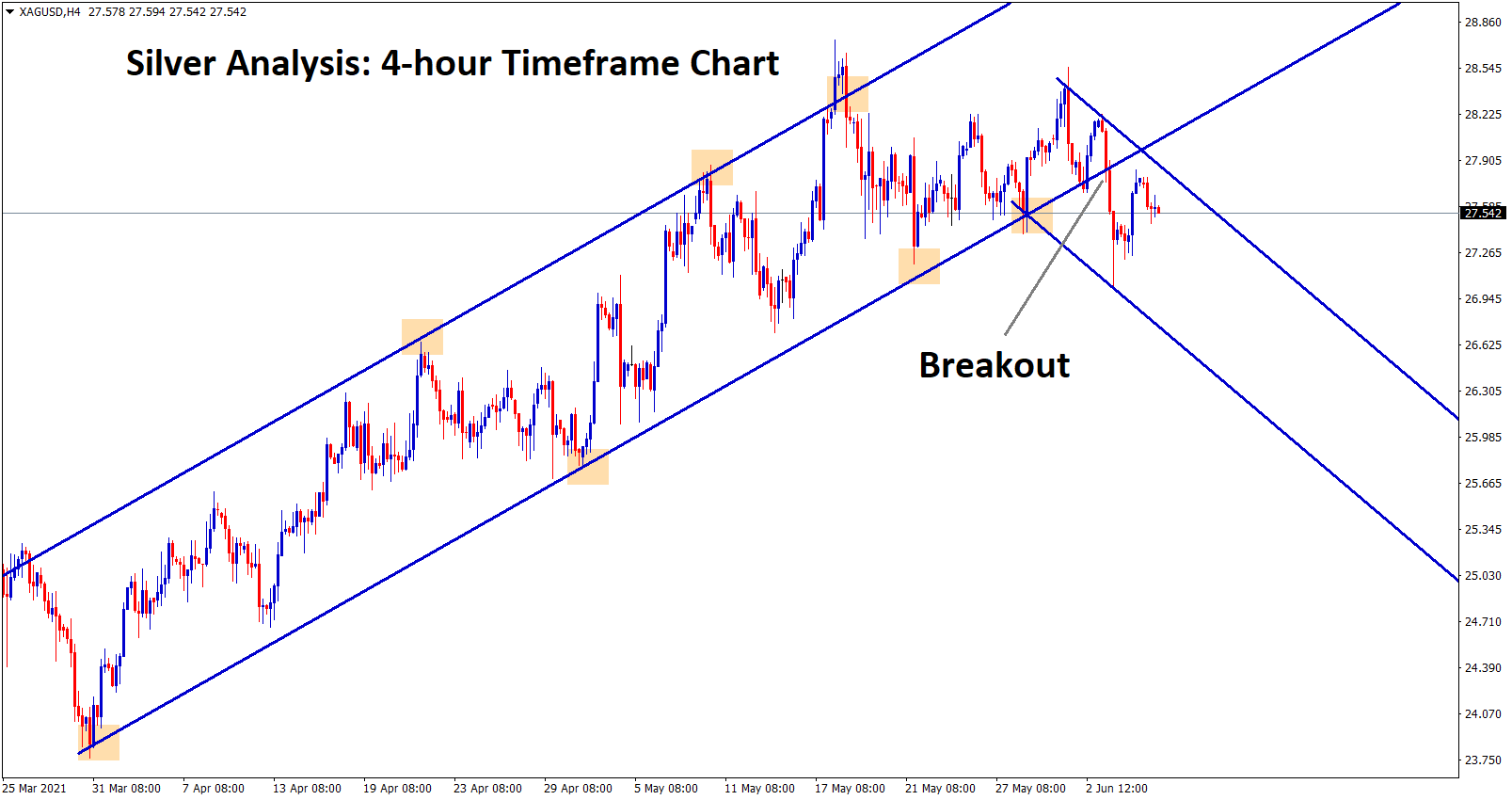

Silver XAGUSD has broken the bottom of the Uptrend line and starts to move in a descending channel range.

Gold prices ticked to 1% higher on Friday after Non-Farm payrolls missed expectations of 650K and came at 559k reading. Janet Yellen supports Biden plan of $4 trillion in spendings on the US economic recovery.

And Inflation may higher persist this year, and small rising interest rates will be better to support the economy to control inflation and now Tapering bets reigniting after Yellen Speaks.

Due to this, Gold prices again fell to 1% as US Dollar rebounds Higher.

Demand for Gold remains moderate as Covid-19 gets controlled in the US and Wear of No masks in the US if Vaccinated pays more attention to Work and Businesses.

USD

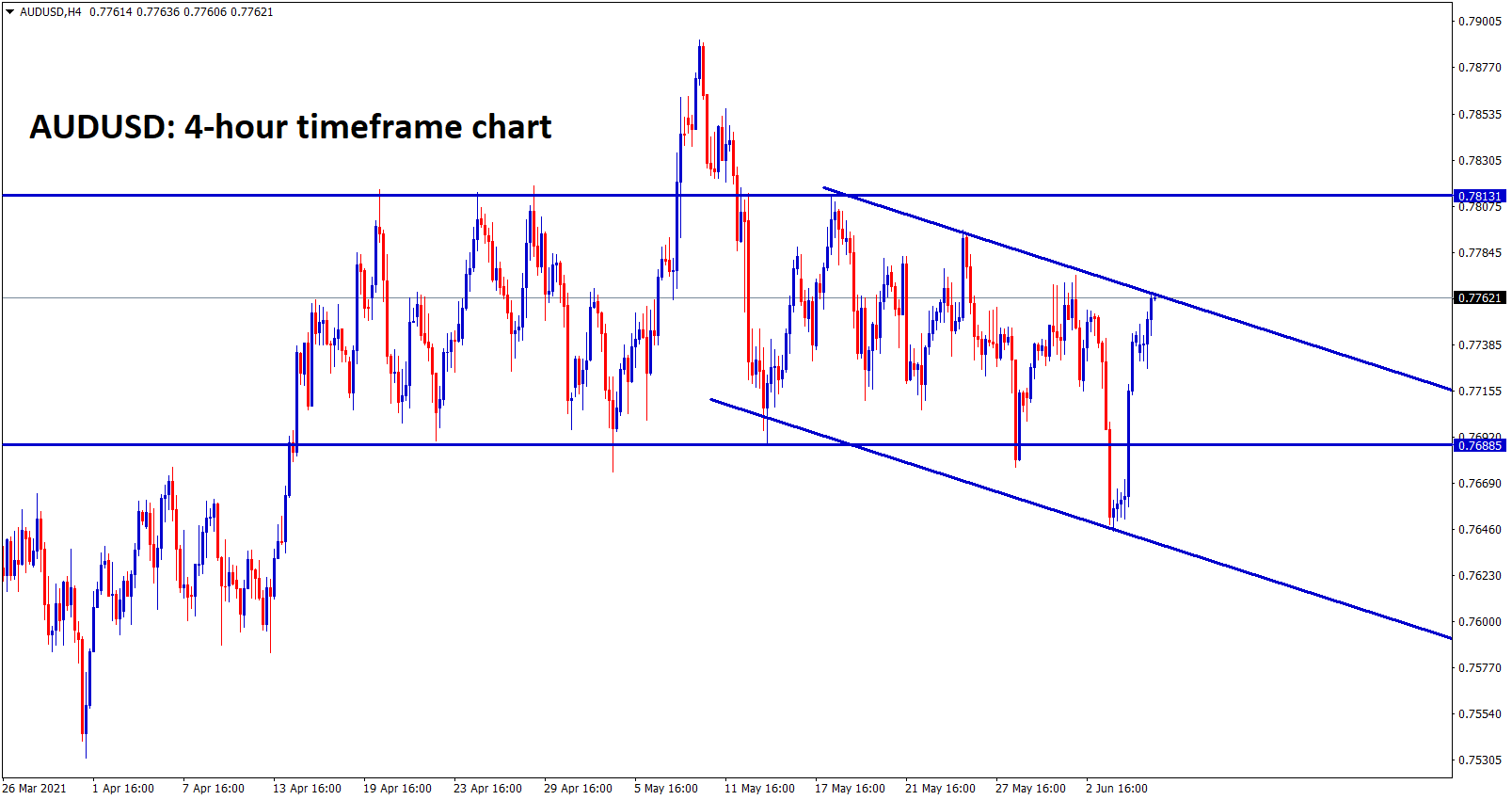

AUDUSD is moving between the specific price range for a long time.

US Dollar index fell to 0.50% on Friday after 0.80% in Thursday ADP report; Because Non-farm Payrolls reports were missed expectations, as Wage growth increased to 2% from 1.8% and the Unemployment rate fell to 5.8% from 6.1%. So mixed Bag of Data makes US Dollar tilted to Downside as correction phase.

And US FED waits in patience for Inflation to reach higher at least to stable as the higher range for 6 months average.

This month Fed meeting expectations are tapering speech and Hike rates decision.

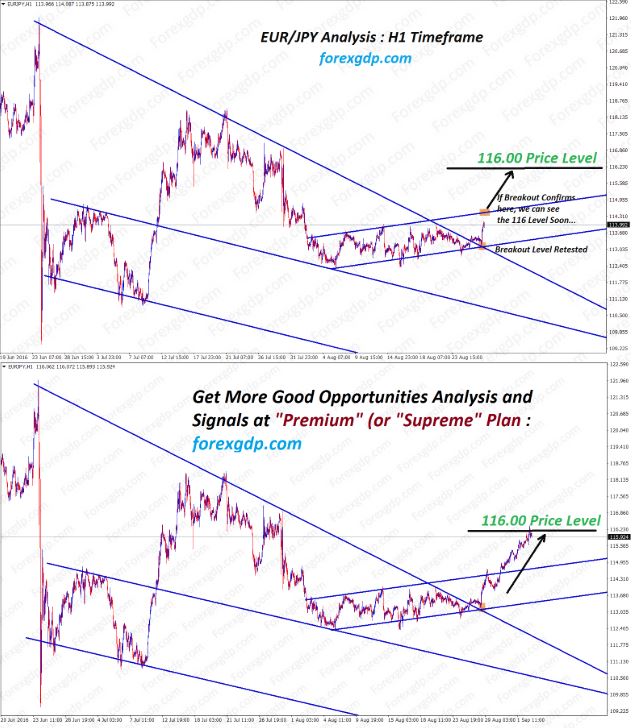

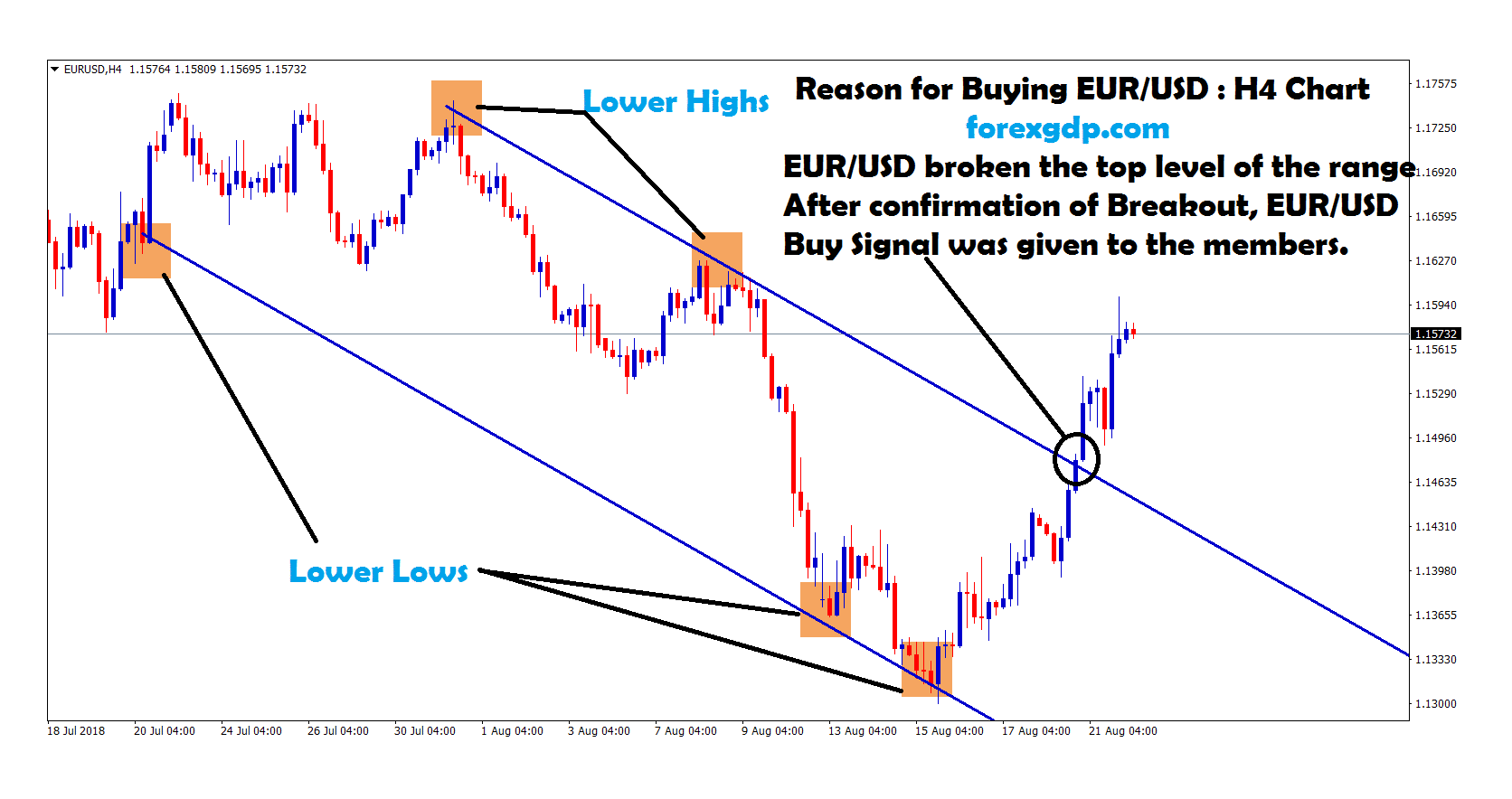

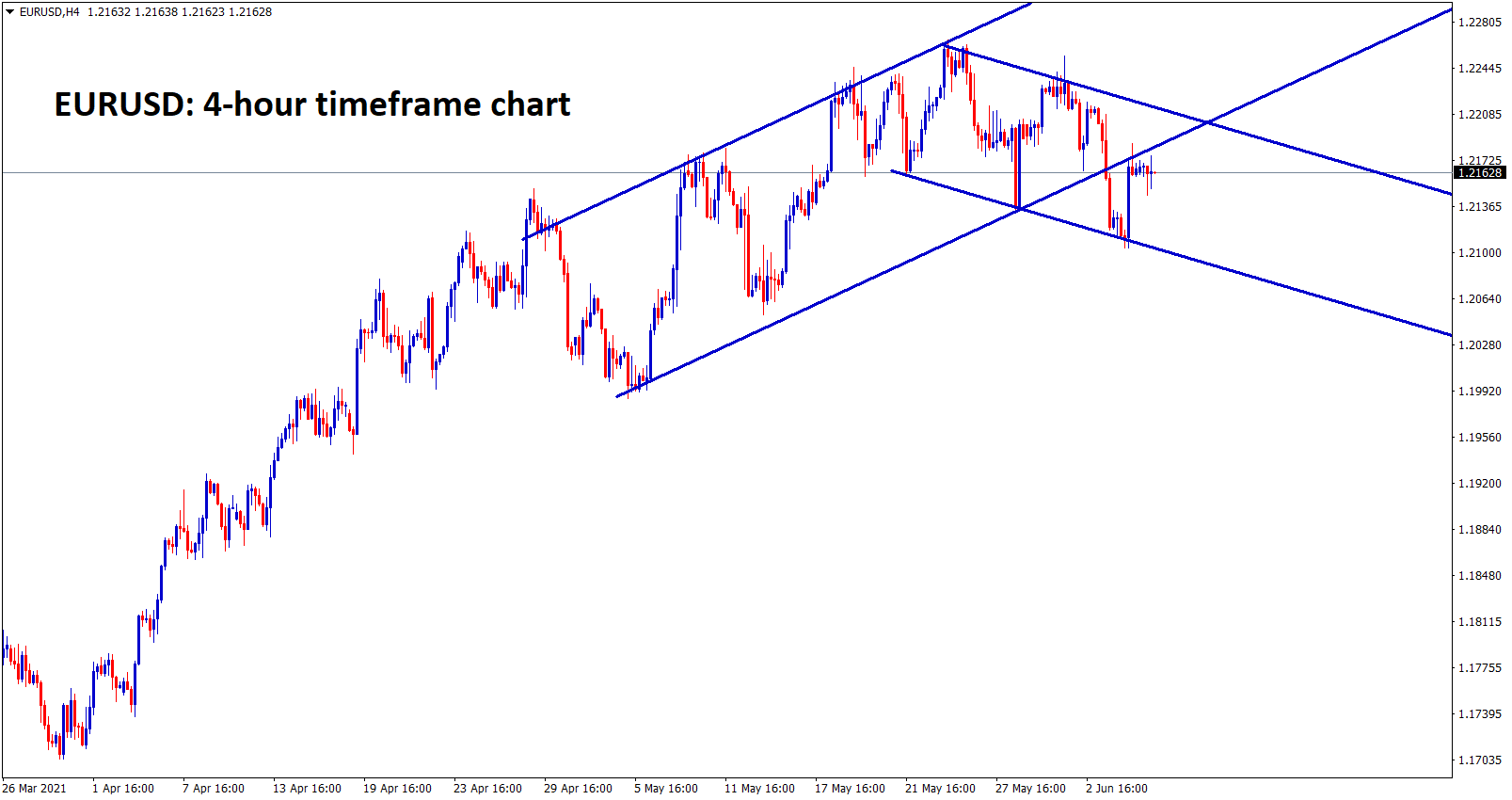

EUR

EURUSD is moving between the ascending and descending channels.

In this week’s ECB meeting, there may be No changes in PEPP purchases and increasing purchases.

The inflation reading is higher in Eurozone; Germany’s Finance minister Isabel Schnabel said inflation in Germany might rise above 3% this year, but this is temporary fluctuations, and ECB monetary policy strategy will be designed according to the situation.

Due to this, EURUSD will see another Dip to 1.20 level this month as No changes will be expected from ECB, and Additional purchases will lead to a Correction in Euro Currency.

Germany factory orders are High.

Germany factory orders missed the expectations of 1% reading versus -0.2% is printed as MoM in April.

But Germany factory orders reached 78.9% yearly as a higher record on an overall basis.

But EURUSD fell by 0.10% as Germany missed the expectations of readings and Deutsche Bunds bank released the Inventories, Shipments and Factory orders completed and incomplete will be published.

The Increasing Factory orders indicated the German inflation picked up higher and Sales will be in robust Growth.

GBP

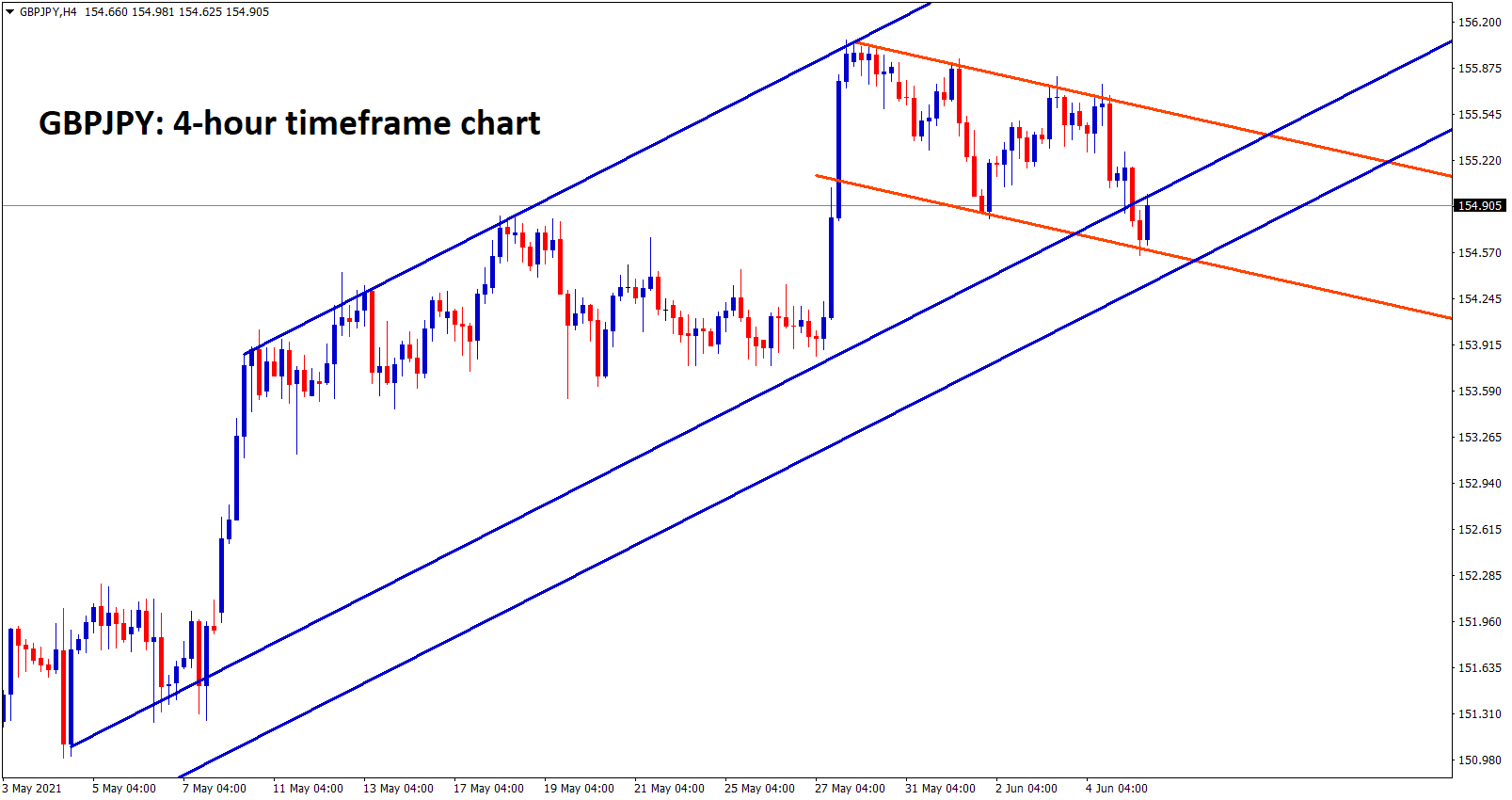

GBPJPY forming a flag pattern in an uptrend.

UK Scientists said Delta Variant of Covid-19 spread estimated to 40% of the population to be affected.

And due to this UK Government is keeping thinking to delay the June 21st lockdown ends. 2 weeks likely to delay and will open from July 2nd week as expected.

But UK Pound tough to breaks the multi-year resistance of 1.42500, and We can expect some Major fundamental news to Break up the Price levels.

And US Dollar, on the other side getting stronger as Biden plan of Stimulus spending for 2021-2022.

But in the long-term, UK Pound is in Bullish view but short term as Consolidation view- 1.41-1.42 level.

CAD

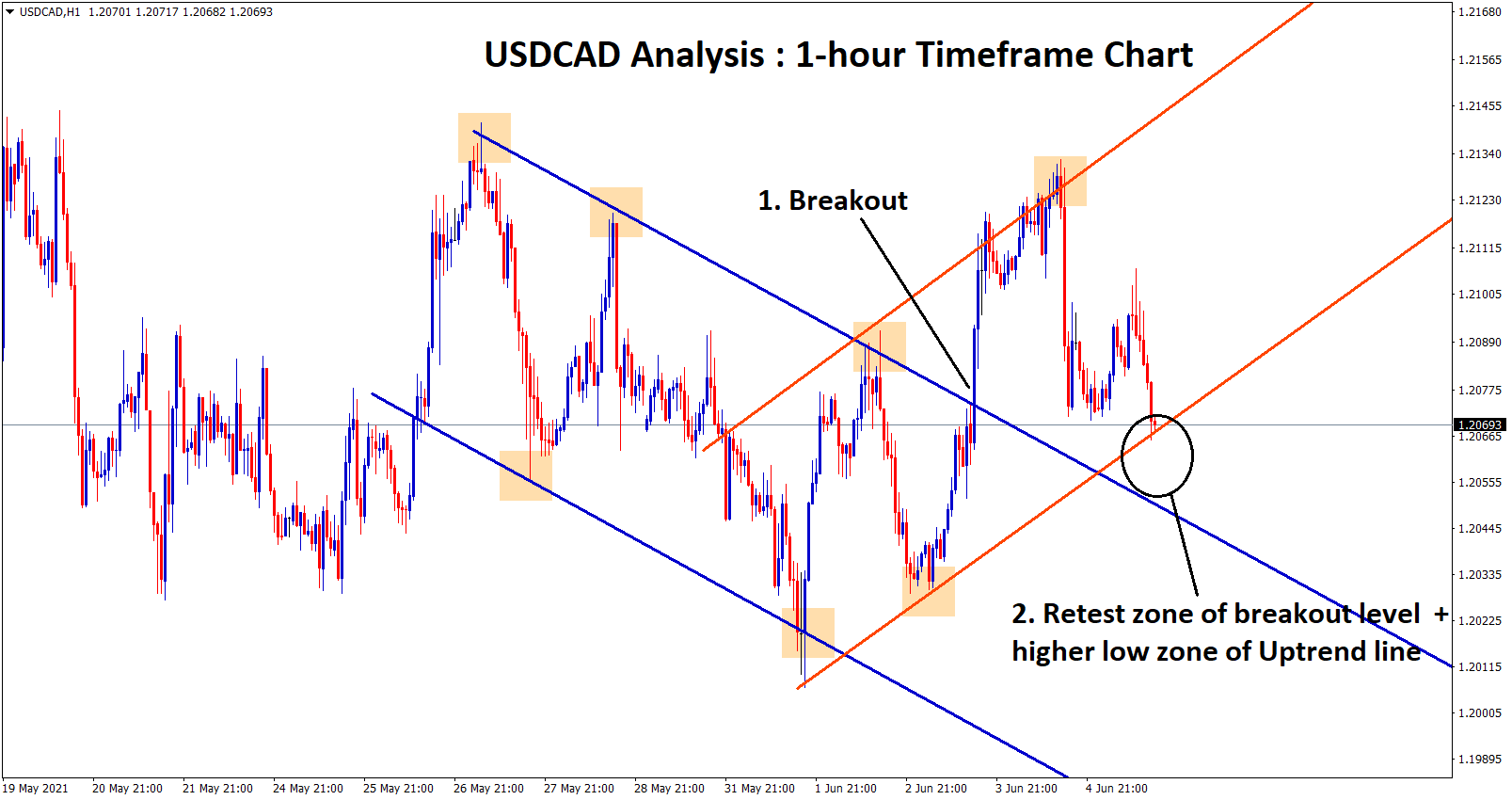

USDCAD hit the Retest zone of the broken downtrend line and higher low zone of the current uptrend line.

Canadian Dollar brings down as the Unemployment rate stood at 6.2% and Employment numbers came at missed expectations.

This will be reflected in the upcoming policy meeting; concern for Tapering purchases and the Canadian Dollar fell about 0.50% after Friday missed results.

And US Dollar soared to 1.21 level as the Canadian Dollar weakness, but it is in the Consolidation level from 1.20-1.21, the Cyclical Double Top neckline point market stands on.

By Considering this scenario, we can expect the Canadian Dollar will make another Dip or Jump based on Oil prices and Domestic Data.

JPY

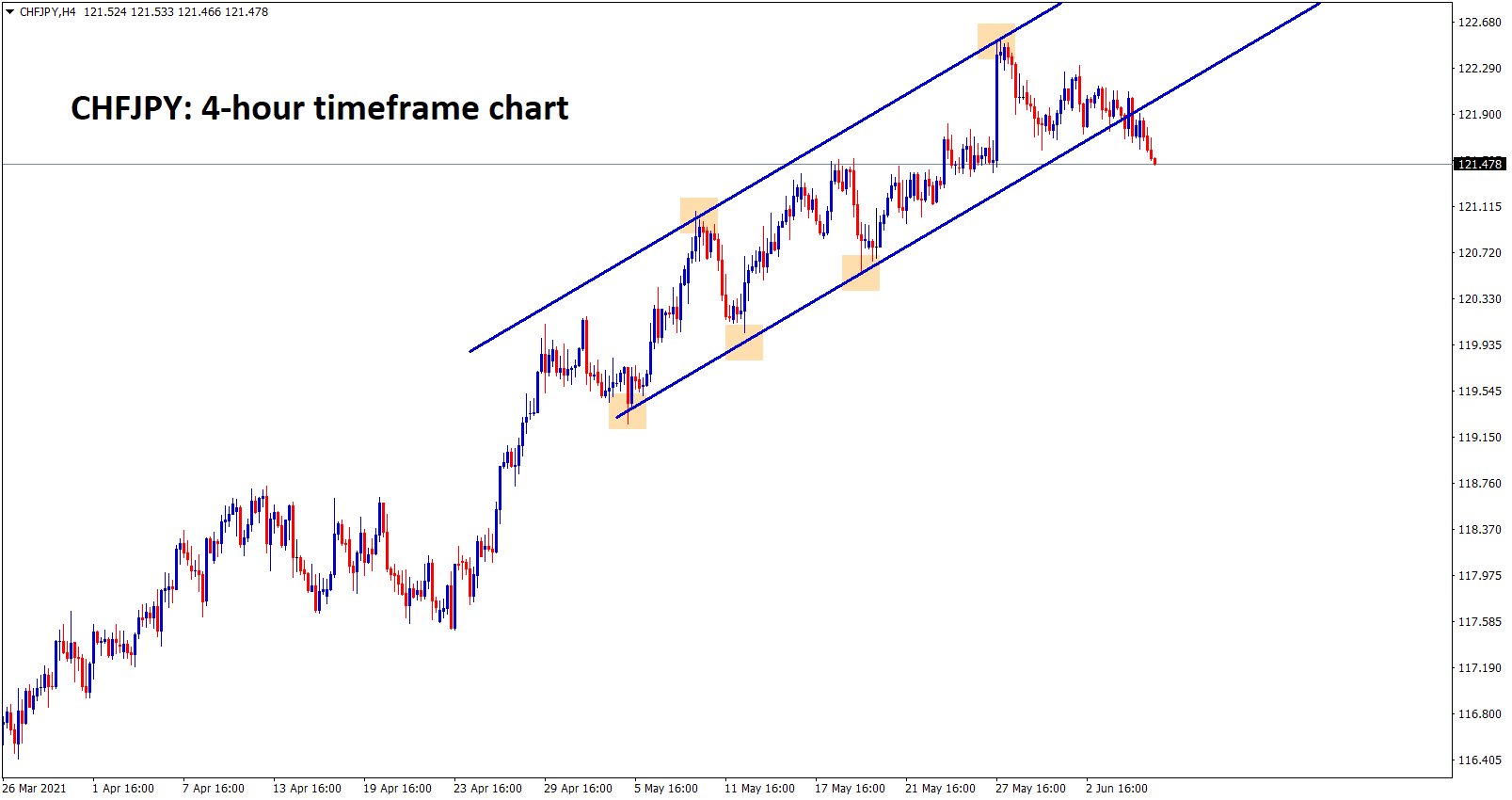

CHFJPY break the higher low of the Uptrend line.

Japan’s Government tries to reform fiscal spending and take a flexible economic policy to support Businesses and People to recover from Normal life from the pandemic.

And they hope to achieve the target 2% inflation by proper rules followed and Vaccination rollouts.

The economy will come back to a normal level only after the Government implement policies to push employment and Business growth higher.

And Japanese Government Promote Green, Digital investments from Private demands.

AUD

EURAUD reached the retest zone (broken level) of the Ascending Triangle.

Australian Dollar remains in the rangebound market since April month 2021. This is because of China and Australian Trade barriers taxation of Australian exports.

And the Chinese economy remains well progress as Capital inflows, services sector higher, and Manufacturing kicked off higher.

The Ai Group services index for May forecasted the Services sector of Australia might come at 59.0 versus 61.0, and This mark was highest since 2003.

Global Vaccinations improved, and Demand is heavily created in China; this will be good support for Australian Exports.

Australian Dollar moved to 1% after NFP data disappointment release on Friday.

NZD

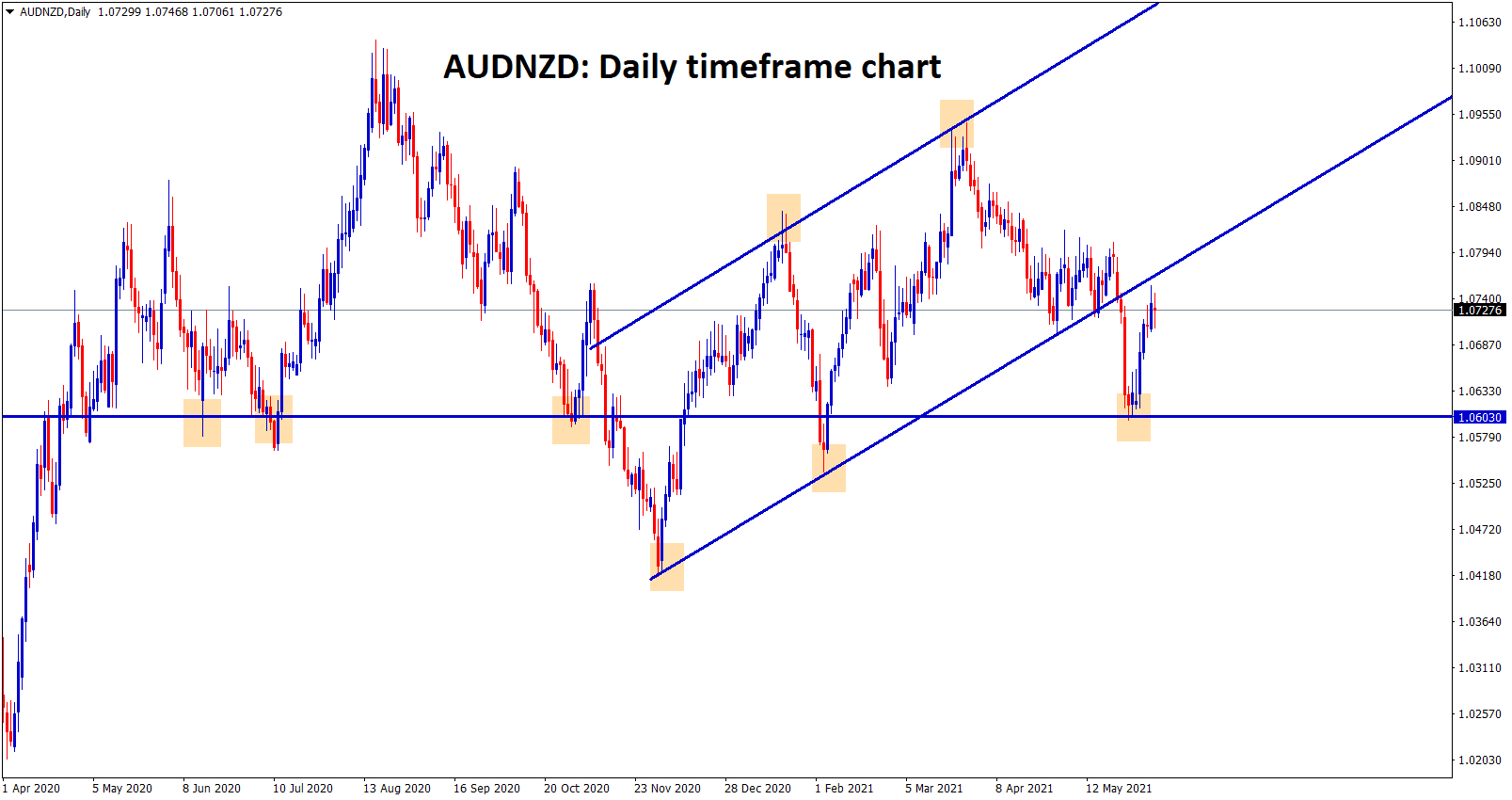

AUDNZD bounced back from the support and reached the retest zone of the broken uptrend line.

New Zealand Dollar quite formed in Range bound market as No more special news this week.

China Trade balance surplus came at $50.5 billion versus $42.85 billion previous reading.

This will boost the Surplus of Exports and Imports of New Zealand and US Dollar weakness sustained on Friday after missed numbers of NFP Data.

And NZDUSD traded around 0.71-0.73 for the last 1.5 months, and no more exciting news breaks the Upside potential.

Normal views of markets progress, and This month FED meeting will create another trending market in All USD Counterparty pairs.

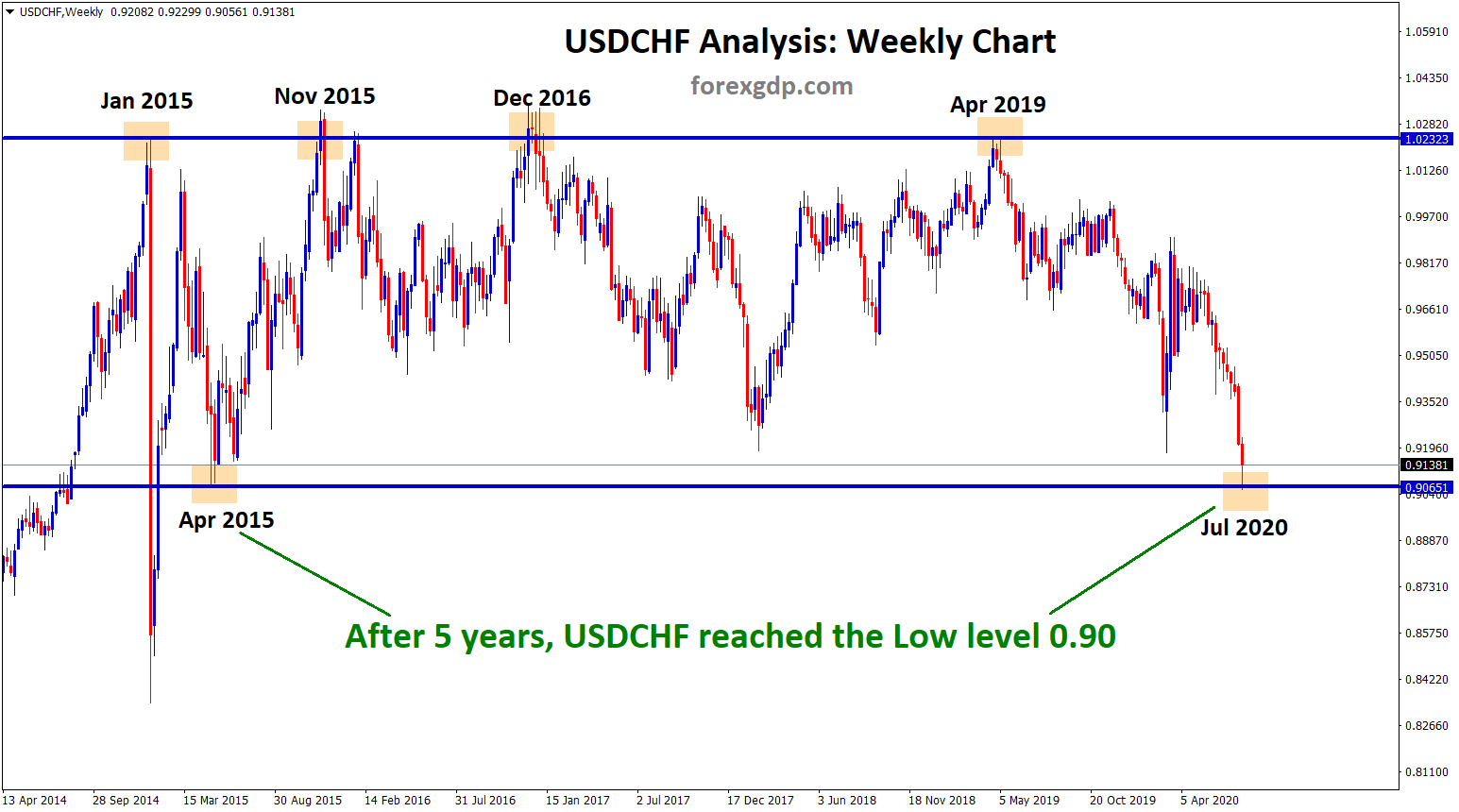

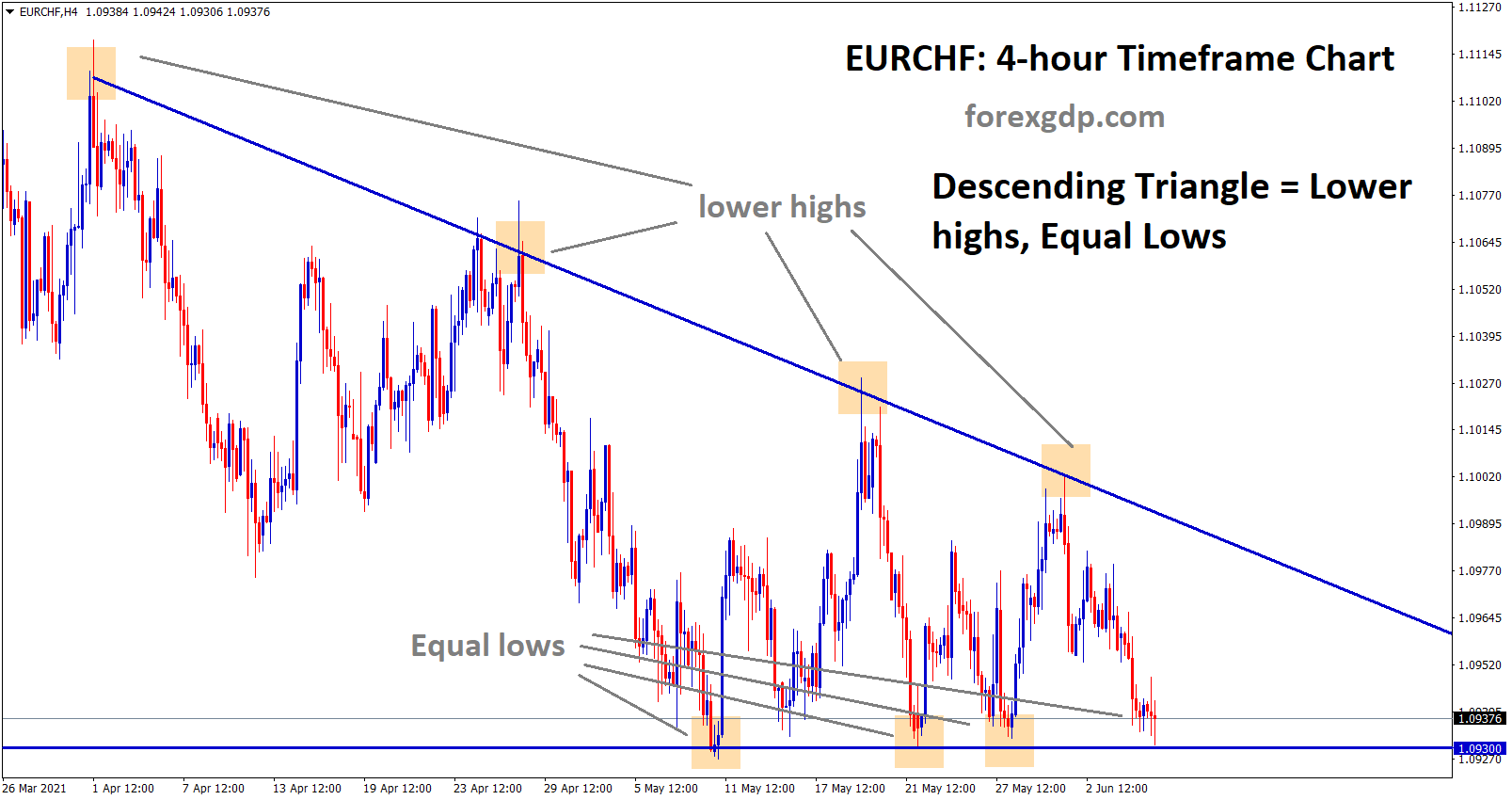

CHF

EURCHF at the support level of the descending triangle, wait for a breakout from this Triangle pattern.

Switzerland Finance minister said on Monday, and Swiss country will support for G7 nations deal of a minimum corporate tax rate of 15% to implementation.

Government policies change Adaptive to Businesses as corporate tax changed to a minimum slab of 15%.

And It will take necessary measure for Business to remains an attractive location to startups.

Swiss CPI rose to 0.6% on YoY in May month Versus 0.3% in April.