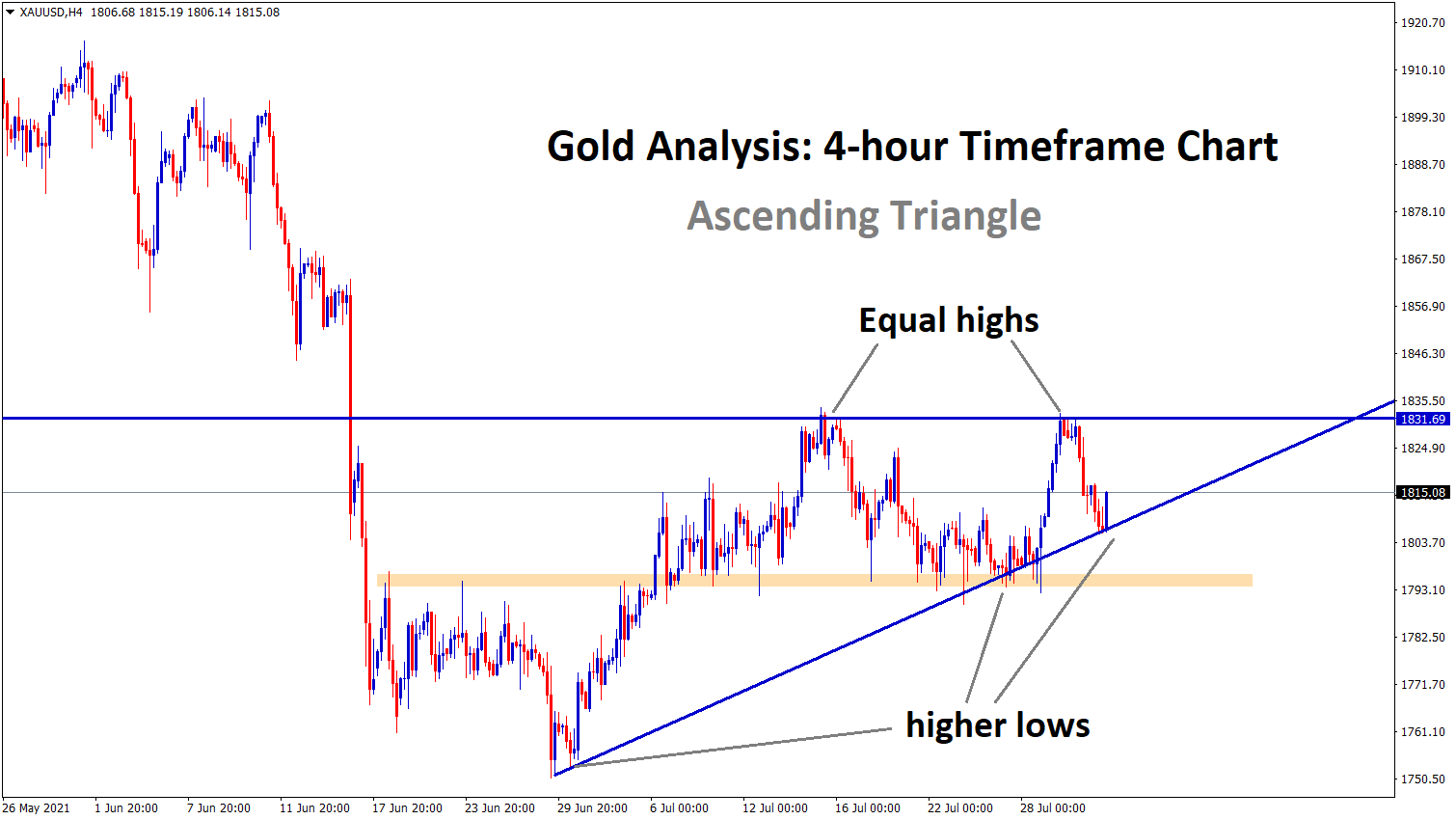

Gold: US Domestic data

Gold bounces back exactly from the higher low of an Ascending Triangle pattern.

Gold prices dropped to correction of support to 1800$ after US PCE data came in line with expectations.

And Michigan consumer sentiment came at 81.2 versus 80.8 is expected and 85.5 in the previous level.

Delta variant makes worry for Resurgence in Globally and spread is very fast than expected. If Delta variant post-high cases, the Lockdown will be reverted in the US and UK.

This Friday, Non-Farm payroll is expected to be 900k, and missing numbers will favour FED Dovish stance and Unfavor for US Dollar.

Gold prices remain higher if NFP data came with negative numbers.

Now all domestic data came in line with expectations, but the Resurgence of the Delta variant makes little worry for US Dollar.

Gold prices are supported by the FED Dovish stance and tapering stimulus bets. Scaling back stimulus packages is doubtful for the US in the coming year.

US Dollar: Economy Growth

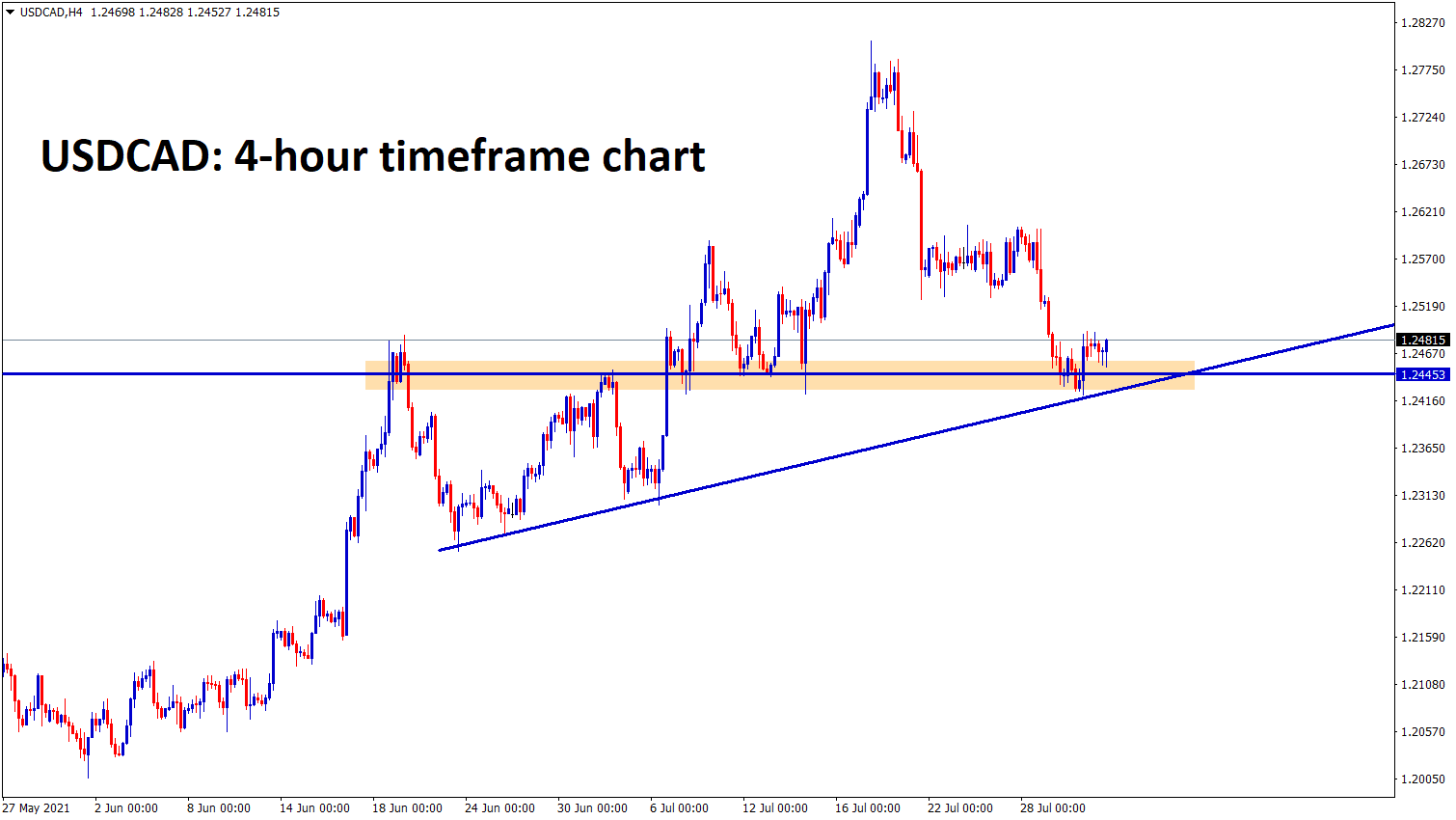

USDCAD is standing at the support area and the retest zone of the Ascending Triangle.

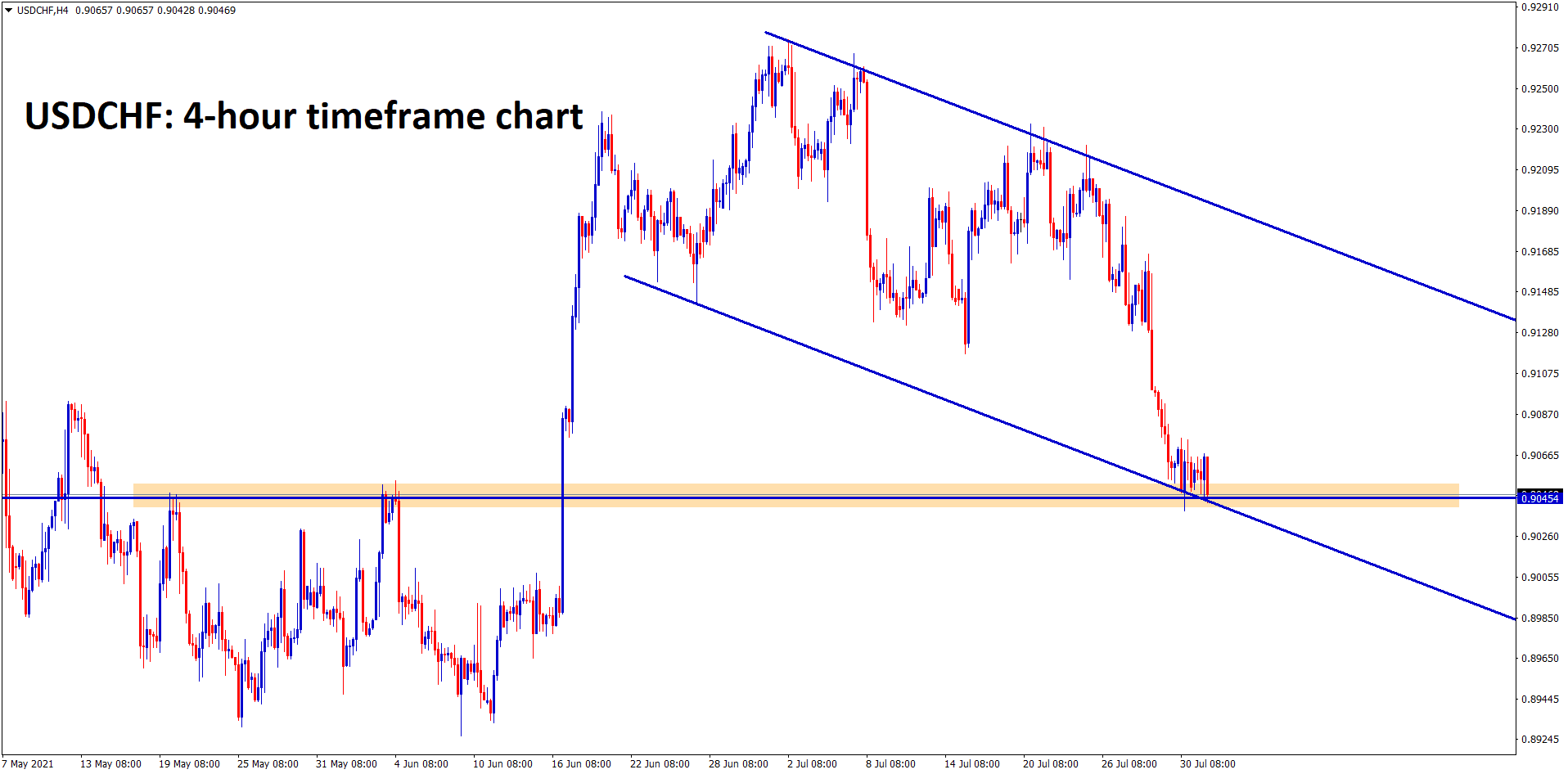

USDCHF is standing at the support area and lower low of the descending channel.

US Core PCE index printed at 4% year on the year came in line with the expected 4%.

June month Core PCE index came at 3.5% from 3.4% in the previous level and missed with high expectations of 3.7%.

Lower PCE numbers made FED for Dovish stance and Favour for other currency pairs and unfavourable for US Dollar.

Personal income increased by 0.10%, and Personal spending increased by 1% in the same period.

US Dollar increases as Data missed expectations with targets.

Further decreasing numbers will help the FED for a more Dovish stance.

UK POUND: Bank of England Meeting Forecast

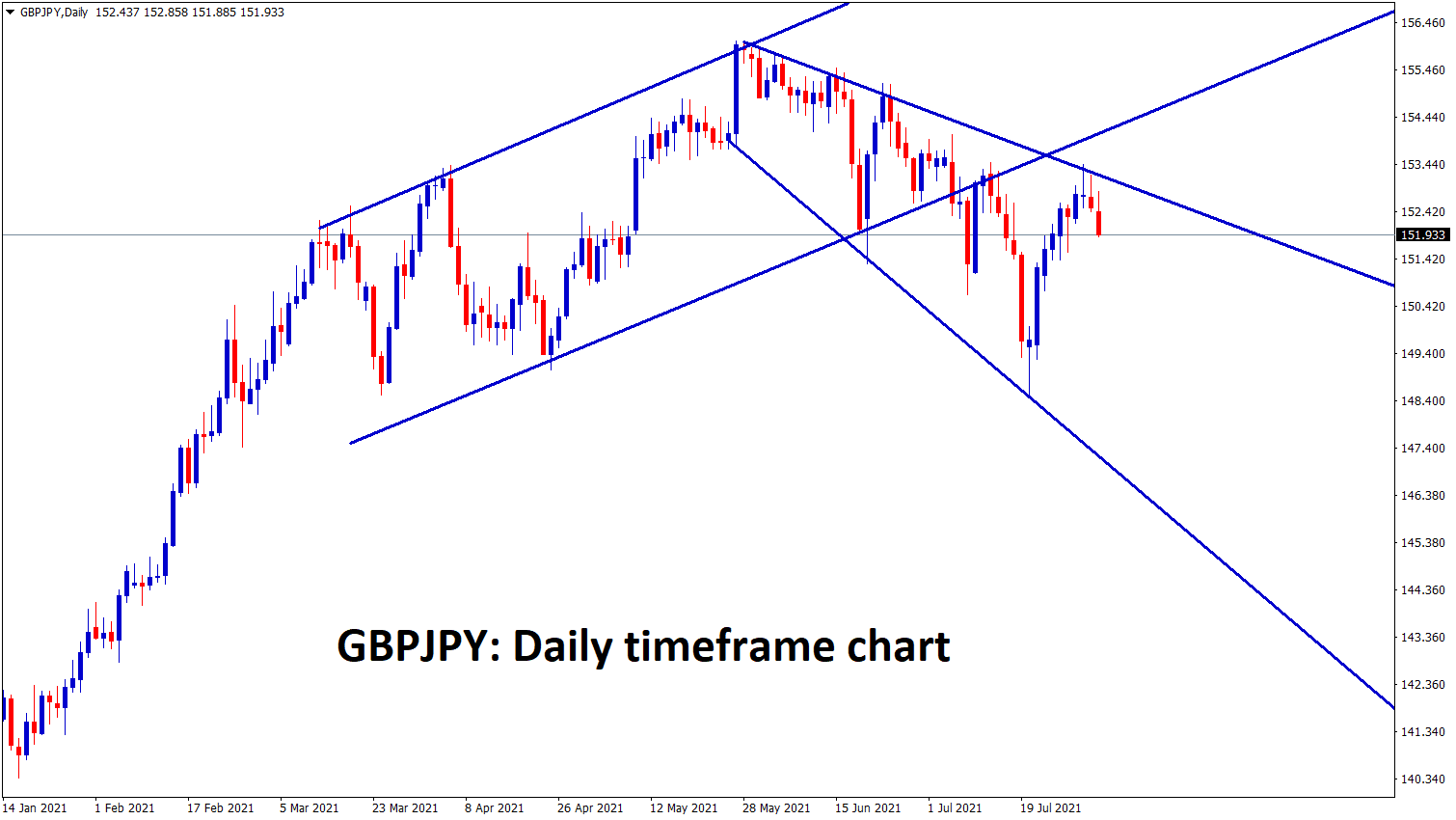

GBPJPY has formed an Expanding Triangle after breaking the bottom of the Ascending channel.

Bank of England Monetary policy meeting happening this week, More Hawkish tone and Tapering assets classes is expected from Meeting.

GBPUSD up by 4% from Last 2 weeks as 1.39800 level we seen in the past market.

GBPUSD Has reached the past week 1.39800 level and Rebounds to support level of 1.38 previous past price if any breakout at resistance or Support level we see new levels after Outcome of Bank of England Monetary policy meeting.

Economic data of England shows Stagnation of Growth, Retail sales and consumer inflation coming in weaker than expected in June, PMI data shows a loss of confidence from Industry Professionals.

Covid cases resurgence in UK and EU zones makes resistance for Growing domestic data, and the Highest vaccination rate in the UK is Notable.

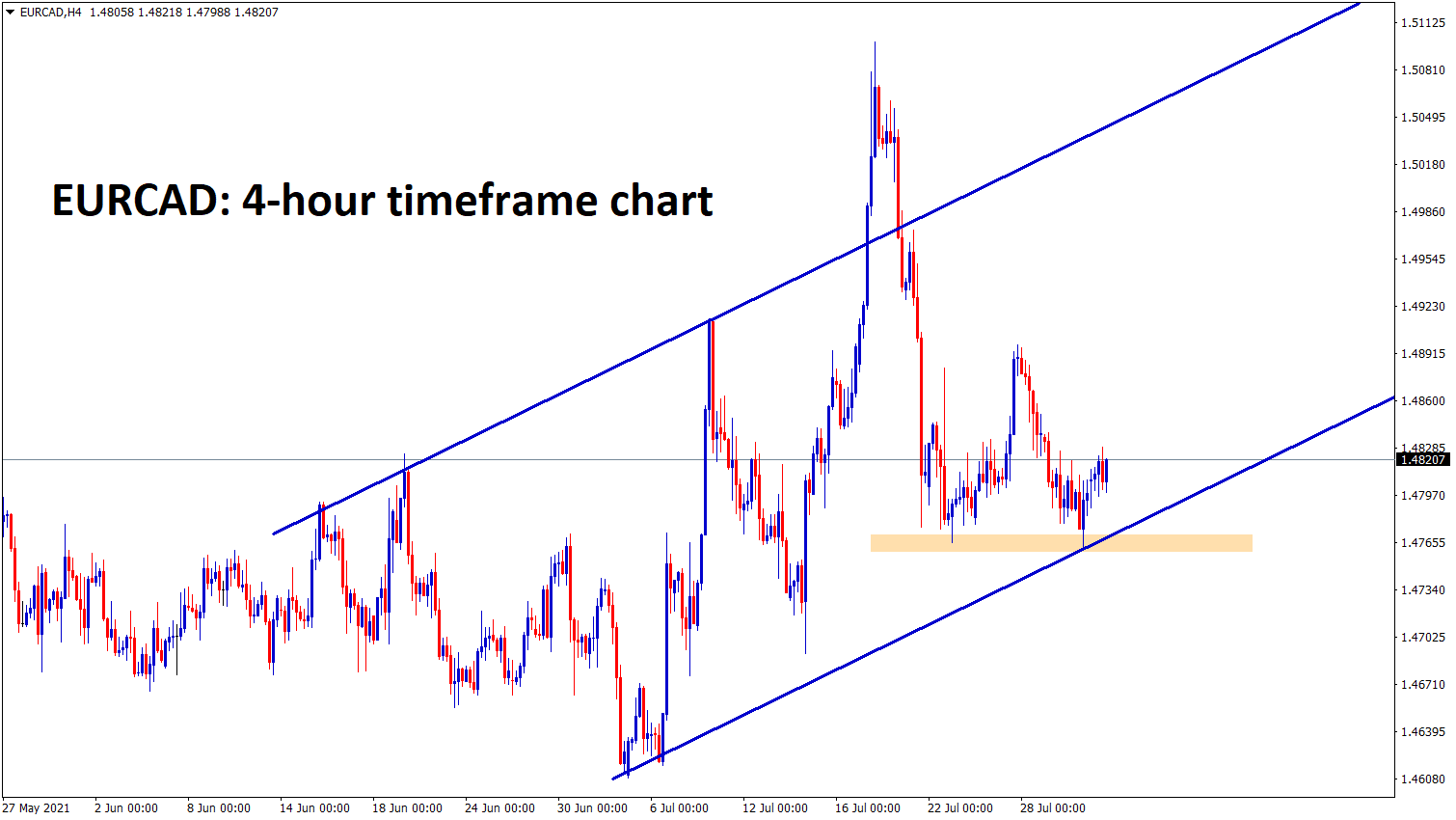

EURO: Domestic data

EURCAD bounces back from the recent support and higher low level of an uptrend line.

EURUSD has risen further as US Dollar declines day by day after missing expectations of the PCE index. This week Non-farm Payrolls will drive the directions of the US Dollar.

Last Week Eurozone GDP and Inflation data came in bright numbers helped Euro to climb higher further. Eurozone GDP is expected to be 5% by year-end.

If growing Domestic data is stable every month, then tapering and scaling back assets from ECB is possible.

Now ECB supports more stimulus to recover the economy, putting pressure on the Euro currency against US Dollar.

German Retail sales data

German Retail sales came at 4% as Month-on-month reports versus 2% expected. Year on year basis 6.2% printed versus -2.4% expected.

This news triggered EURUSD to move upside this week.

Germany released more lockdown after 3rd phase of covid-19. So manufacturing industries make backlog slower, but this time retail sales boosted in Favour of more production to come.

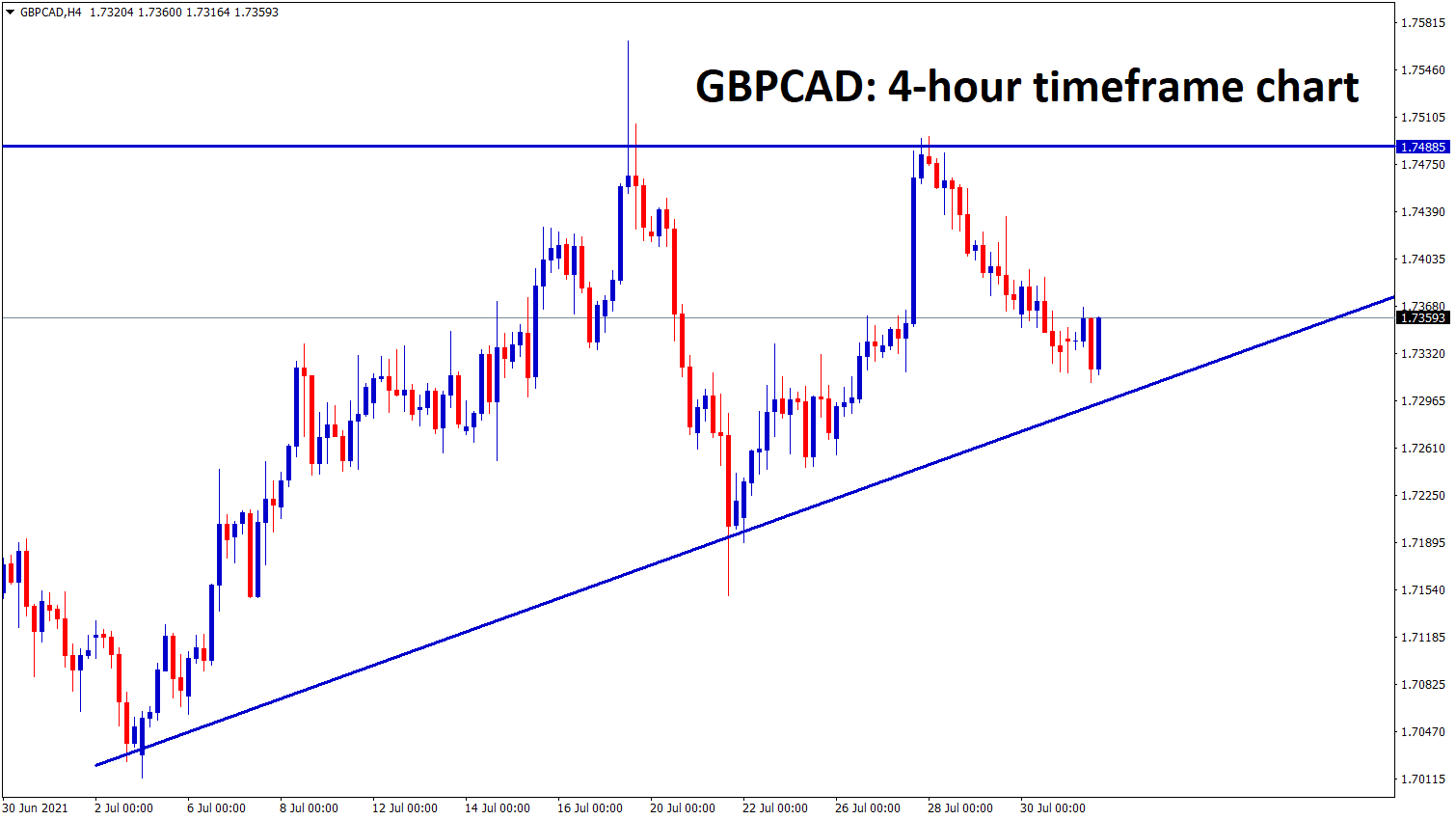

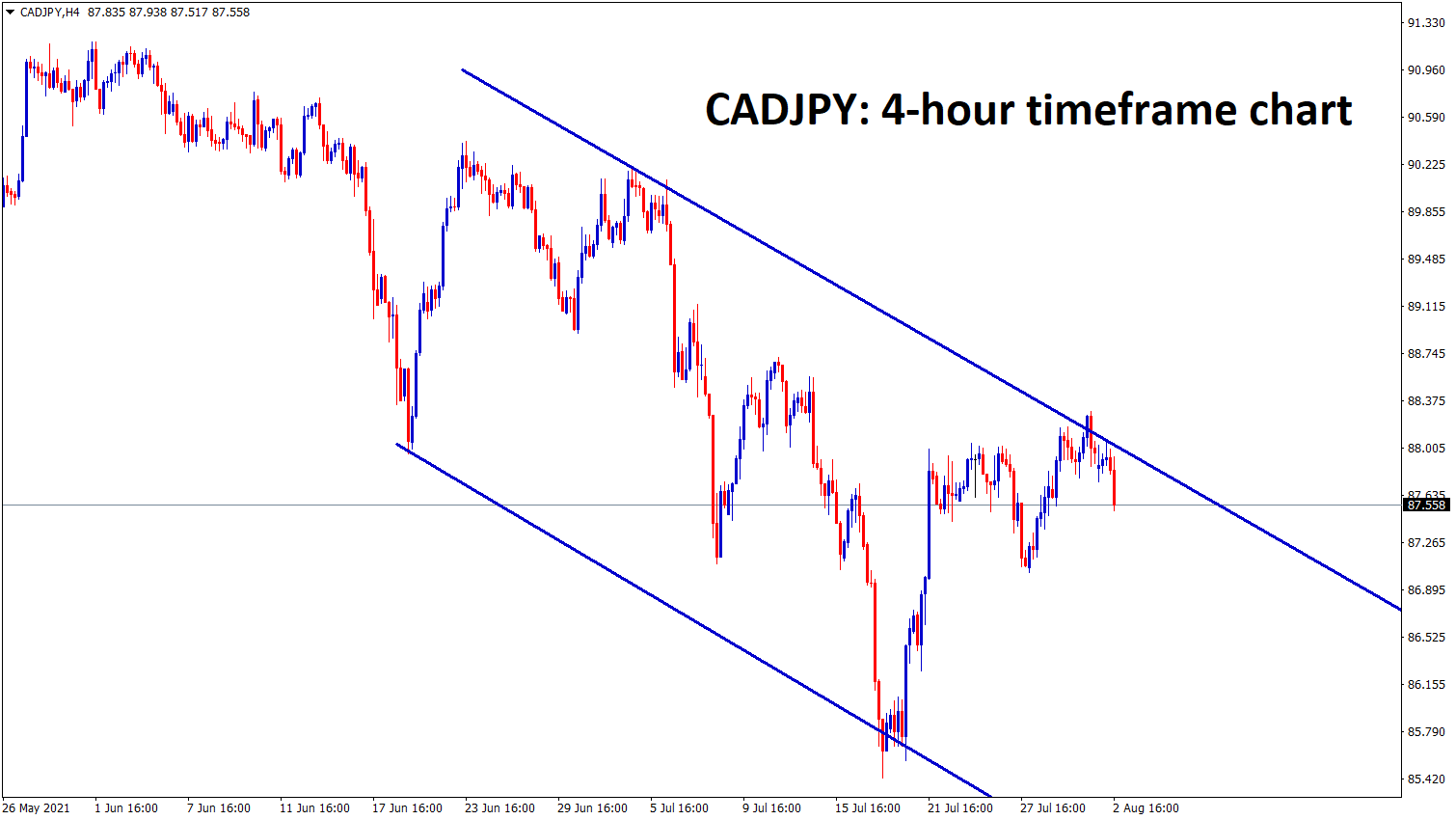

Canadian Dollar: Oil Supply concerns

GBPCAD has formed an Ascending Triangle pattern in the h4.

CADJPY is falling from the lower high zone of the descending channel range.

Canadian Dollar makes higher as US Dollar gets declines after 8% increases in past 2 months.

USDCAD dropped to 1.24 level

Growing concerns of Delta cases around the Global level, Oil supply is increasing as Demand Continues, once All countries announced lockdown measures, it will impact the supply of Oil.

Due to this, Oil Prices rising in support of the Canadian Dollar.

Bank of Canada does more tapering assets in the last meeting, and further tapering will help the Canadian dollar benefit more.

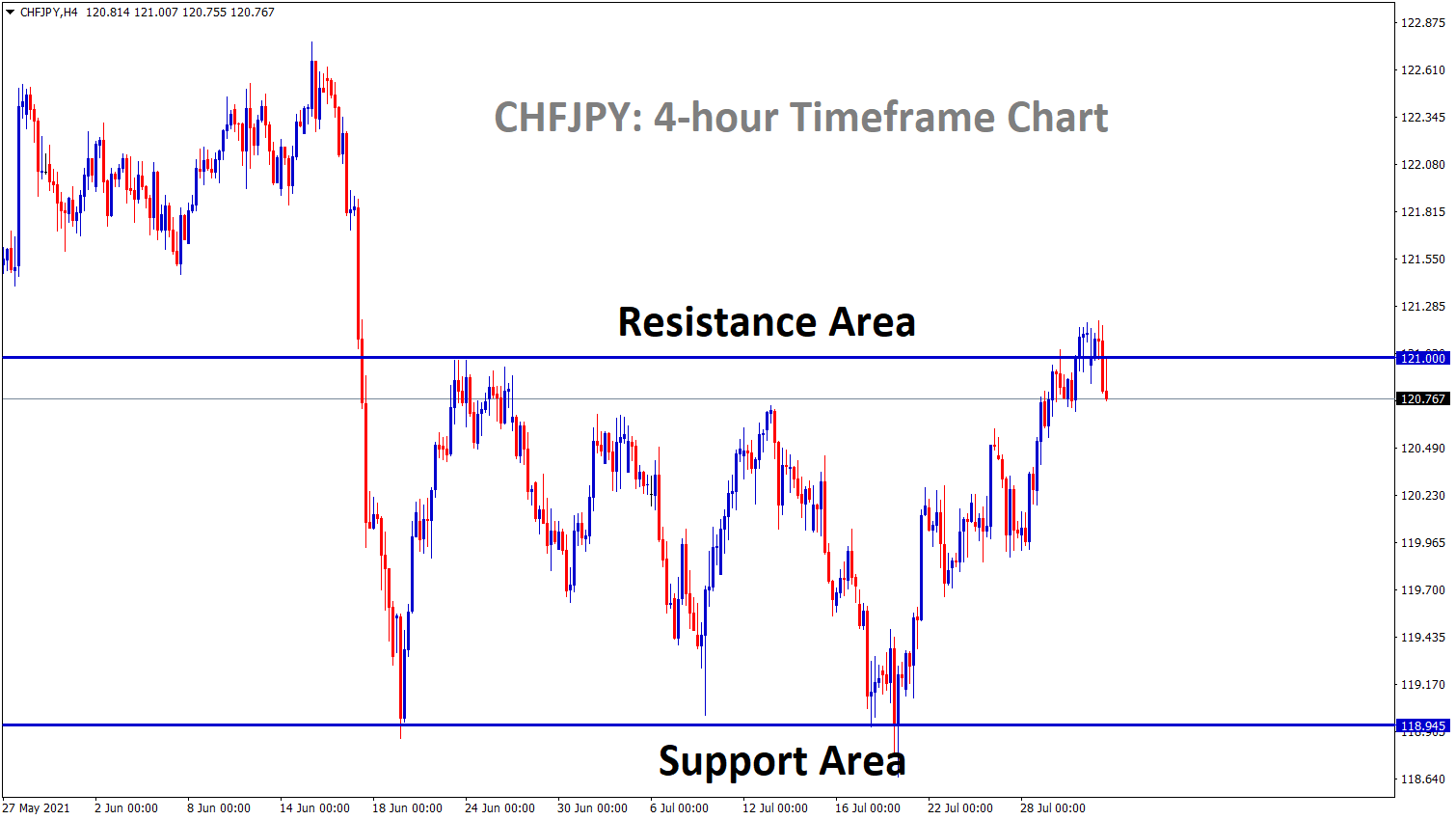

Japanese Yen: Japanese PM Speech

CHFJPY is standing now at the resistance area – it is ranging between SR levels for a long time.

Japanese Yen is kept weakening after Japanese PM Yoshihide Suga warned the nation from affecting Covid-19 last Friday.

This will worry further weakness showing in Yen currency against other Pairs.

Japan’s unemployment data shows 2.9% versus 3% and Expansion in Industrial productions by 6.2% compared to 5%.

USDJPY hinted lower to 109.600 in support zone last Friday as Japanese Domestic data is picked up, but spreading Virus is not controlled by the Japanese Government in an Effective Manner.

Australian Dollar: Australia – China relationship

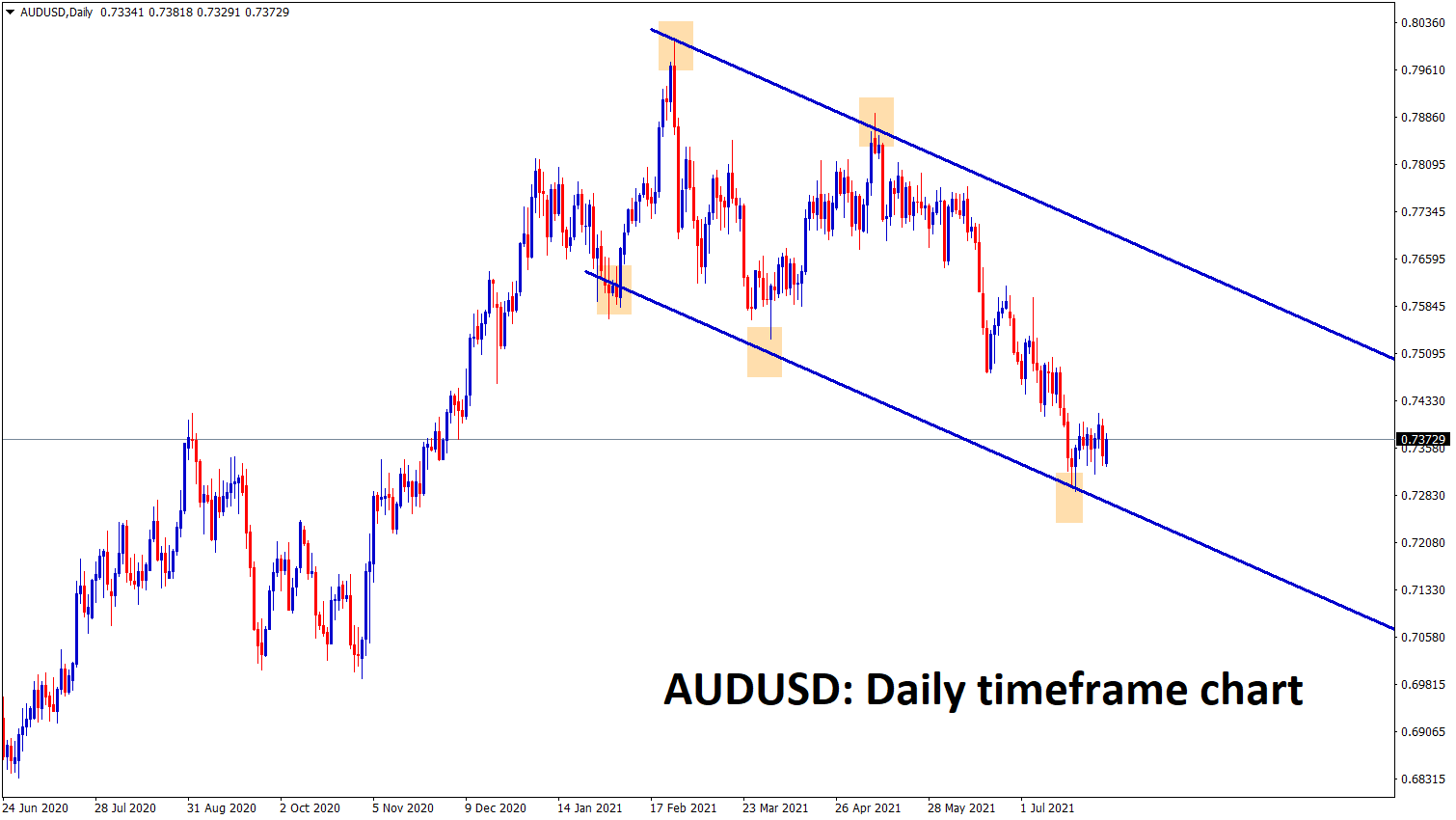

AUDUSD is consolidating at the lower low level of the descending channel.

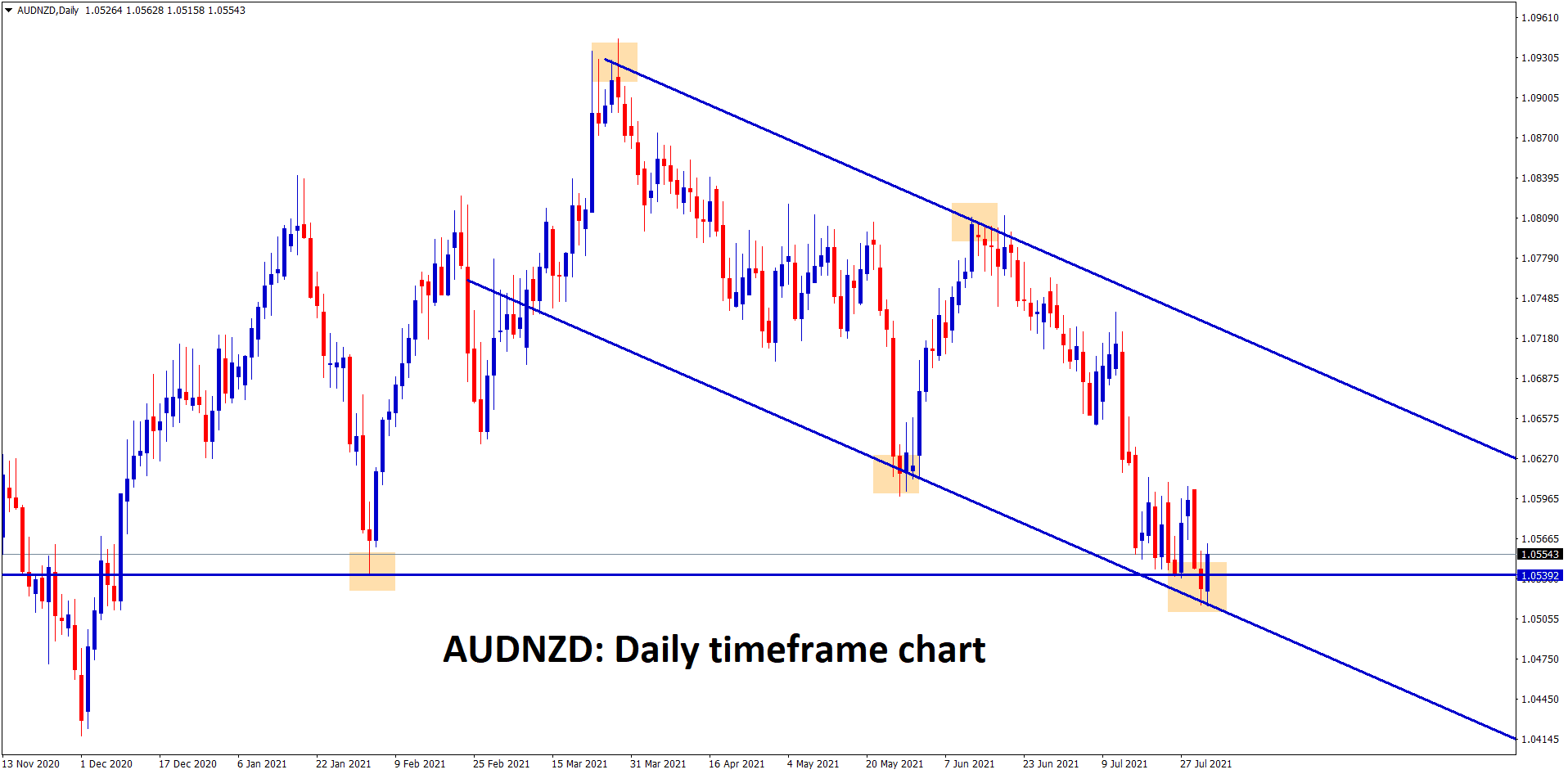

AUDNZD is standing at the support zone and the lower low level of the descending channel.

Australian Dollar suffered more losses as Delta variant spread more in Sydney, New South Wales and Victoria.

Australian PM Scott Morrison has claimed that investigations for Origin of Covid-19 will hurt Chinese Business with Australia; Australian telecom giant acquired six pacific channels and gave push back to Chinese telecom giant Huawei.

Most tourism revenues from China has been rewarded for Australian revenues in GDP.

And now worries of the relationship between Australia and China will affect the Arrivals of Chinese to Australia for Education and Visiting purposes.

Chinese Rains and Flooding affect slower Growth

China comes front to support Domestic expansion for Recovering the economy from Covid-19 and Floods that happened last week.

Due to this more impacted SME sector will get benefits from the Chinese Government.

And July PMI slower numbers after China faced abnormal rains and Floods in recent days.

China now boasts the Drive the expansion of domestic demand and Boost consumption in the second half.

New Zealand Dollar: China and Australian PMI

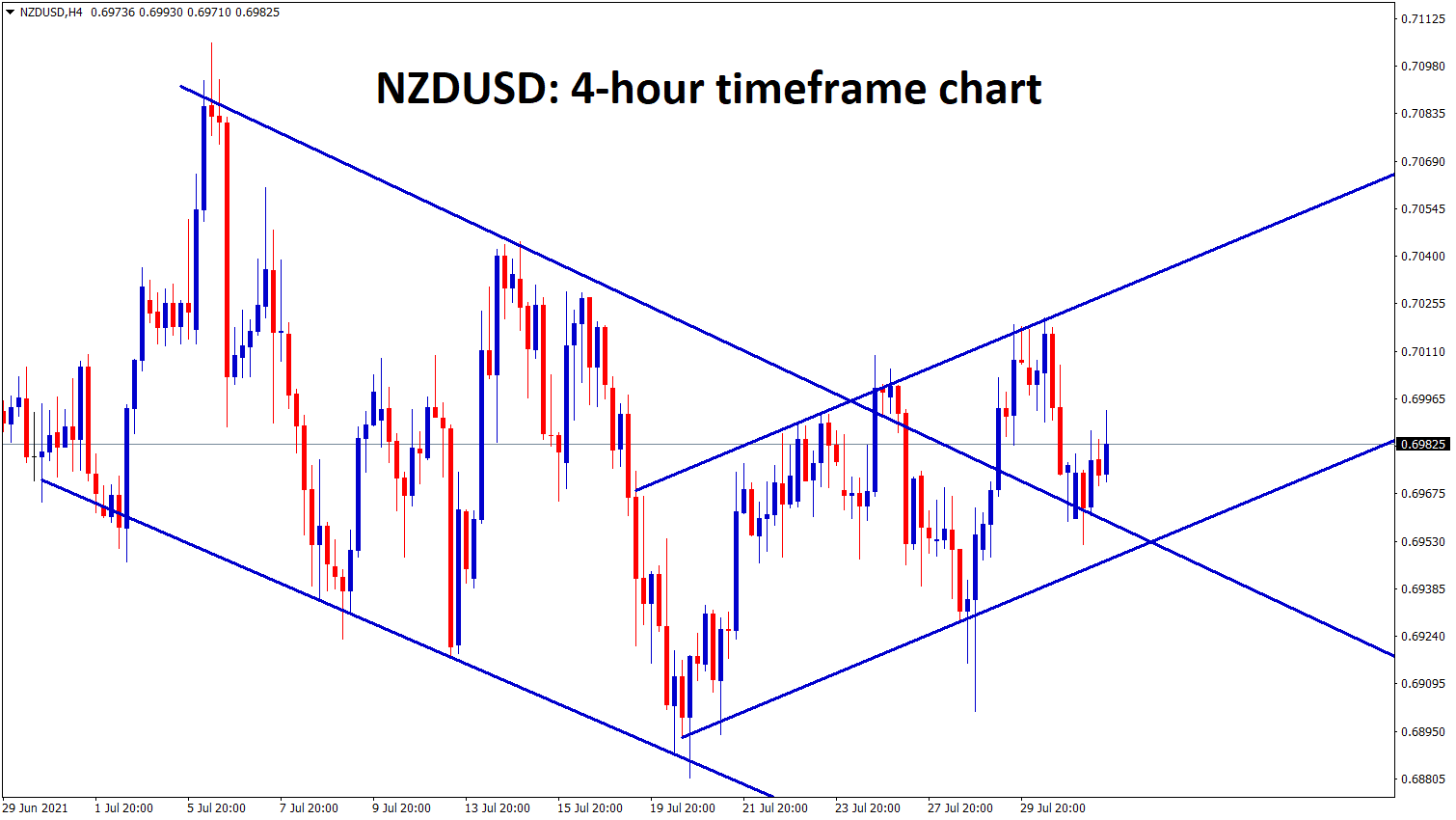

NZDUSD is moving up and down between the channel ranges.

New Zealand Dollar moved inside range Bound market for the last 2 months.

As New Zealand Government has put lockdowns across Borders and Makes safety measures from the Delta variant.

But Domestic data is Favouring New Zealand Dollar, and the Reserve Bank of New Zealand is now waiting to hike rates at the end of this year.

China made poor PMI numbers after raining and Flooding in recent days.

US Dollar posted last Friday as Line numbers with expectations printed supports for New Zealand Dollar.