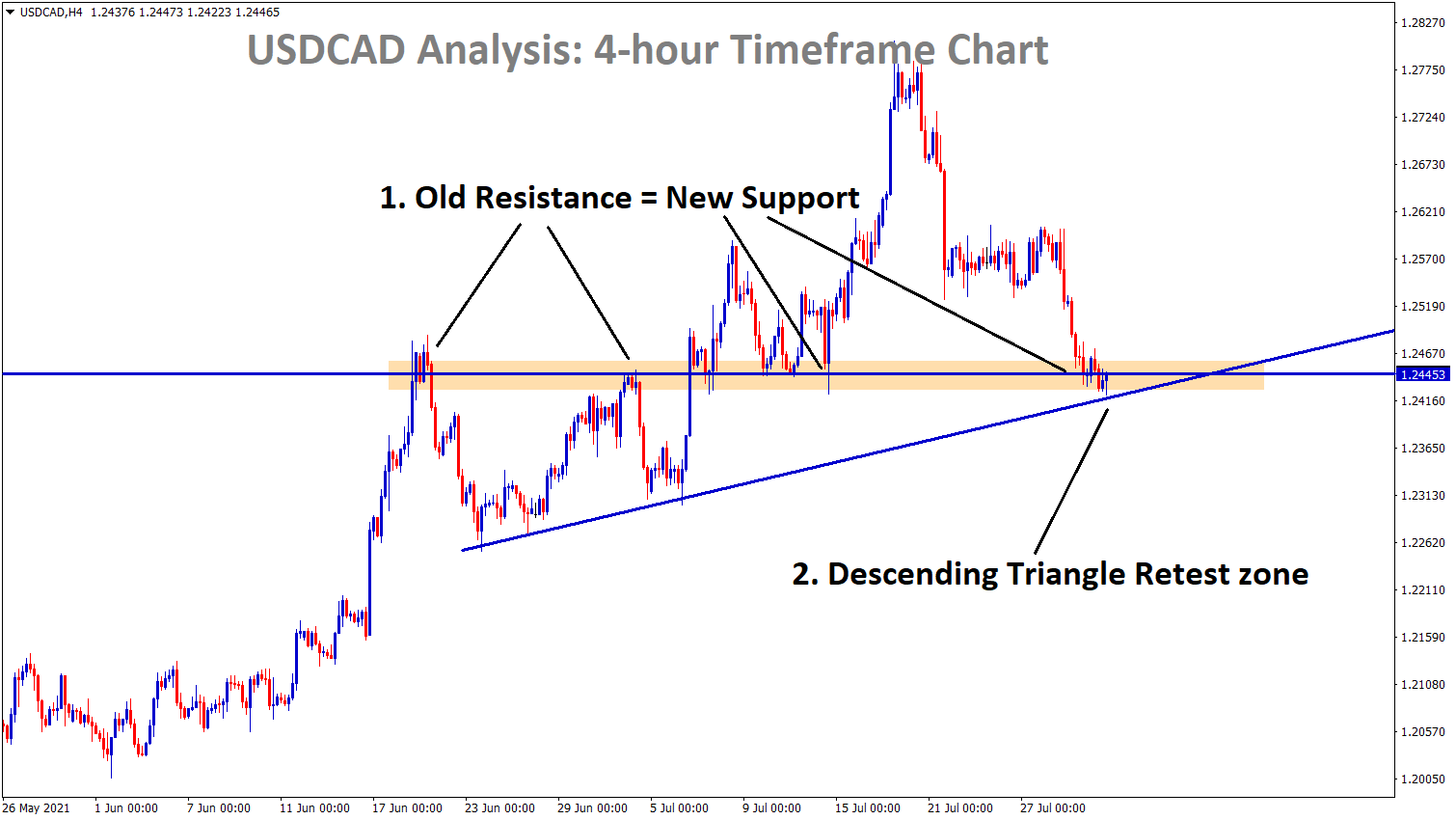

USDCAD Analysis

USDCAD is standing at the support zone and the Descending Triangle retest zone in the 4-hour Timeframe chart.

We Expected a bounce back from this zone.

After the confirmation, USDCAD Buy signal is given.

USDCAD has reached the take profit Target successfully.

US Core PCE index printed at 4% year on the year came in line with the expected 4%.

June month Core PCE index came at 3.5% from 3.4% in the previous level and missed with high expectations of 3.7%.

Lower PCE numbers made FED for Dovish stance and Favour for other currency pairs and unfavourable for US Dollar.

Personal income increased by 0.10%, and Personal spending increased by 1% in the same period.

US Dollar increases as Data missed expectations with targets.

Further decreasing numbers will help the FED for a more Dovish stance.

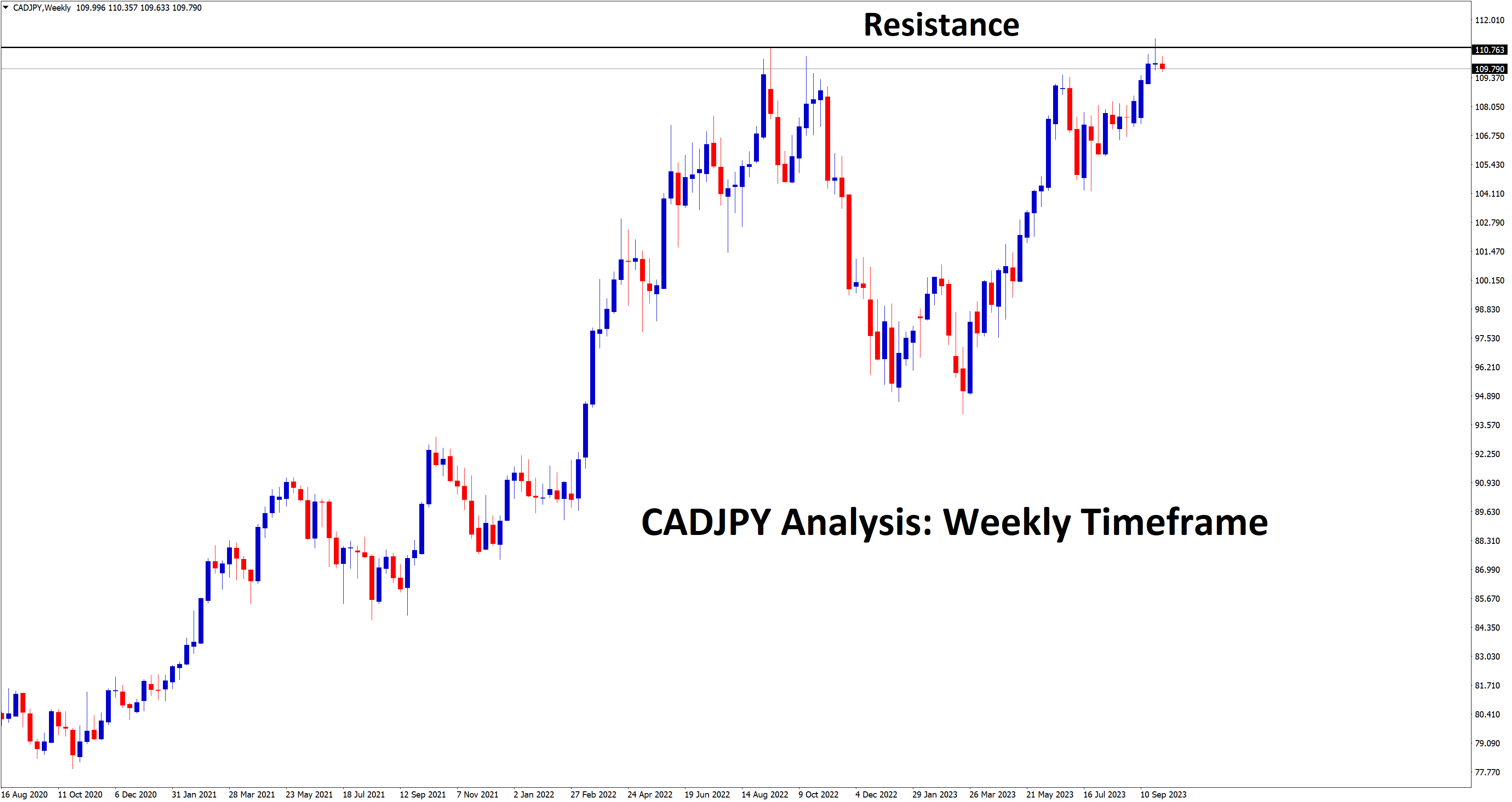

Canadian Dollar: Oil Concerns

Canadian Dollar makes higher as US Dollar gets declines after 8% increases in past 2 months.

USDCAD dropped to 1.24 level

Growing concerns of Delta cases around the Global level, Oil supply is increasing as Demand Continues, once All countries announced lockdown measures, it will impact the supply of Oil.

Due to this, Oil Prices rising in support of the Canadian Dollar.

Bank of Canada does more tapering assets in the last meeting, and further tapering will help the Canadian dollar benefit more.

Don’t Trade all the time, Trade forex only at the confirmed trade setups.

Get more confirmed Trade setups at Premium or Supreme plan here: forexgdp.com/buy