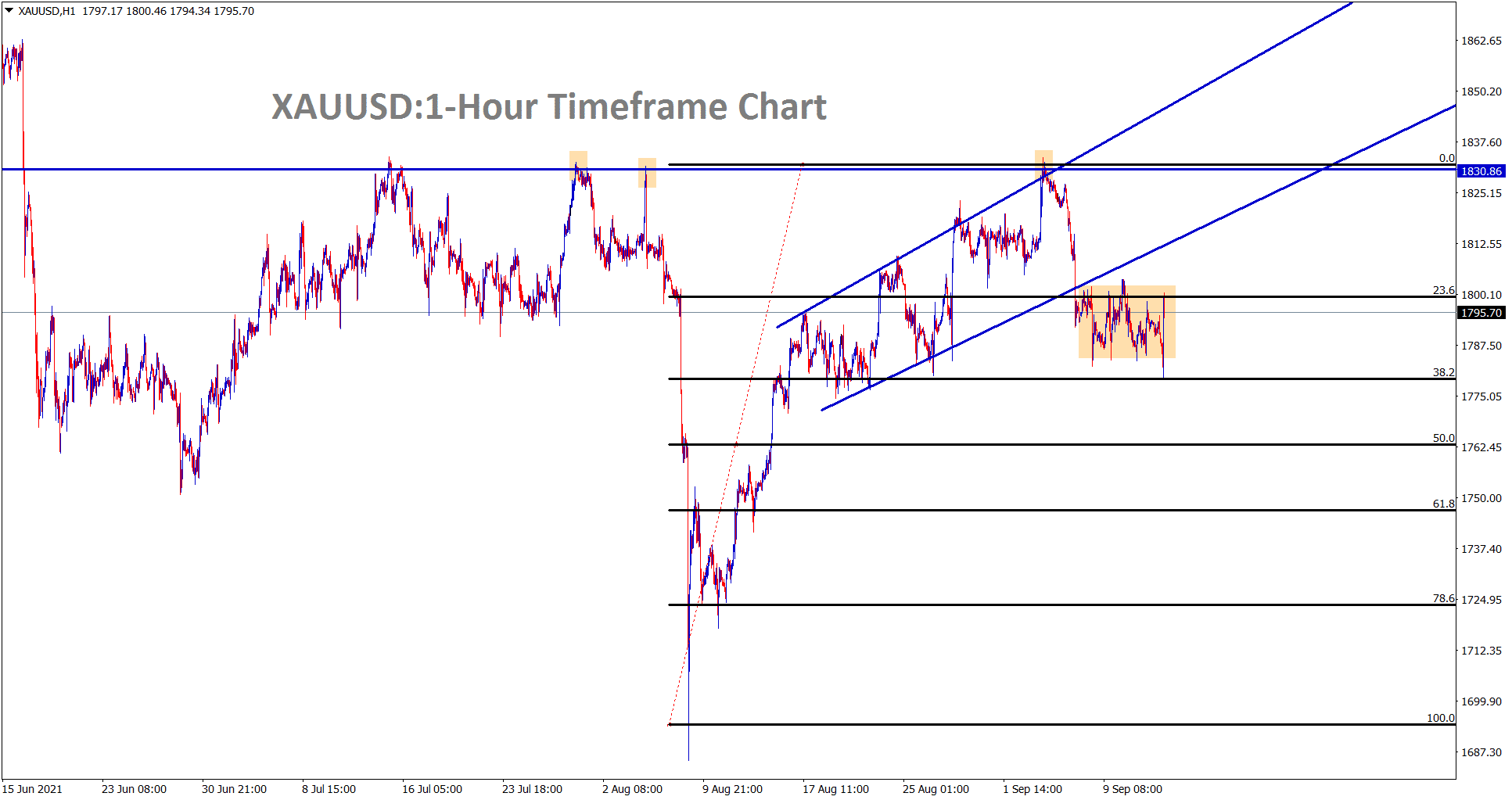

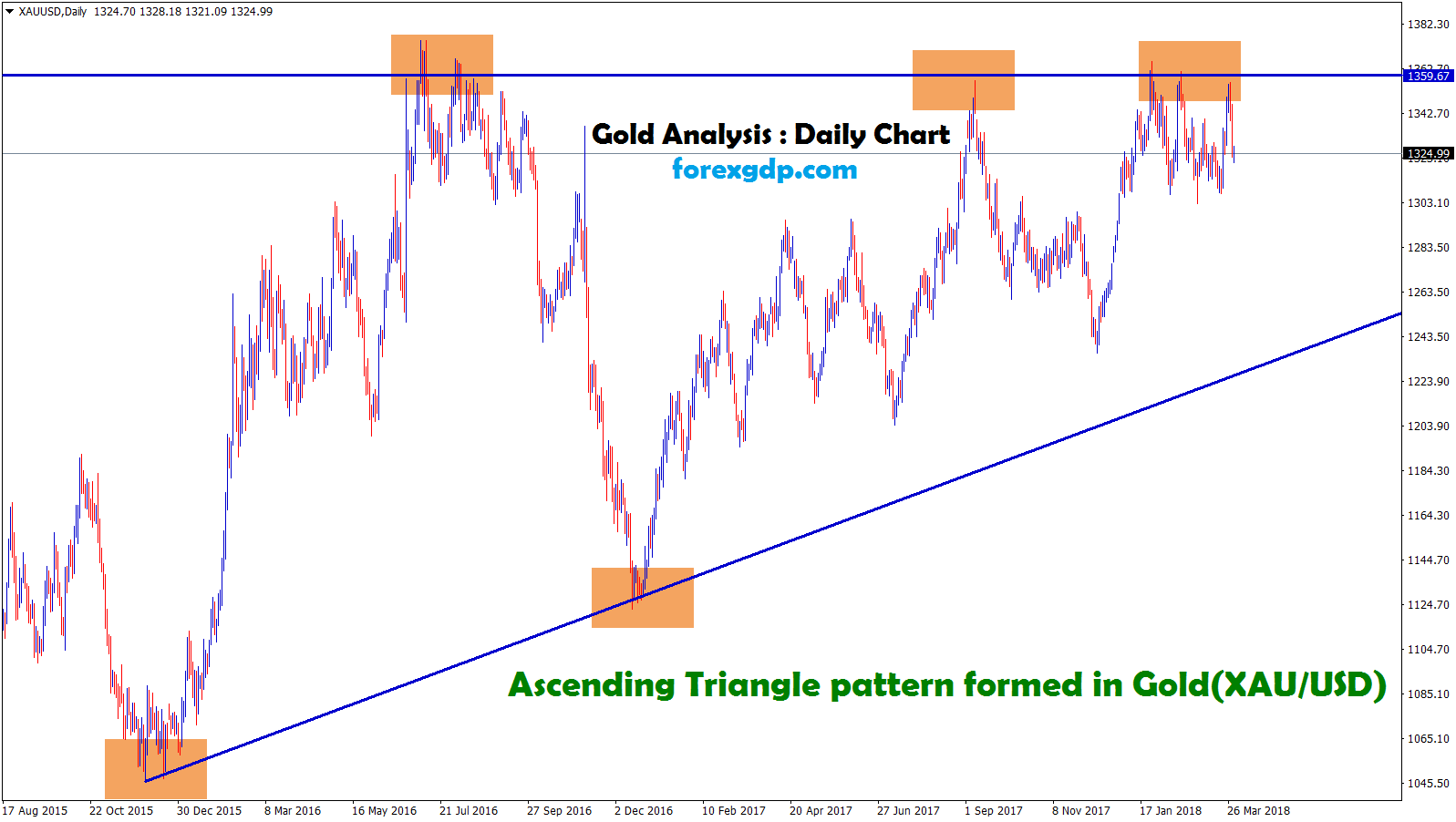

Gold: US Inflation data forecast

Gold is still consolidating between the support and resistance area in the hourly timeframe

Gold prices moved inside the range-bound market as 1800-1780$ as waiting for US CPI data published this week.

And US Inflation data today is expected to hit 4.2% for the second time this month.

More CPI data will create a hot on consumer spending, and FED must control the inflation rates.

And FED Voting members have continuously reported to the media that, FED is preparing for tapering and Announcements will come soon once completed.

Now, Gold prices now waiting for Next week US FOMC meeting outcome.

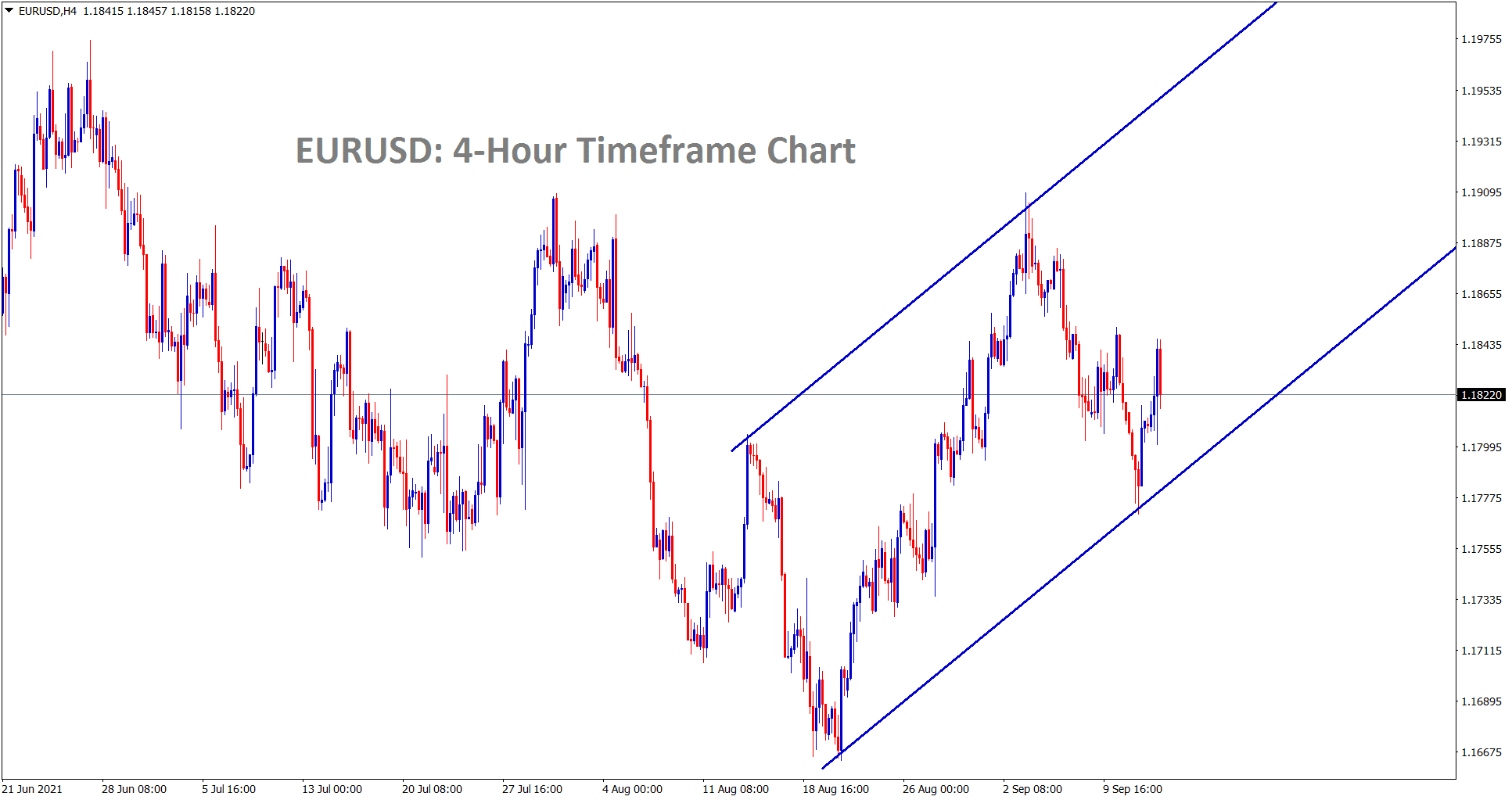

US DOLLAR: US Budget trade Deficit

EURUSD is moving in an Ascending channel range

US Dollar trade deficit widens by 170.6 billion in August from 310 Billion in July. Year on Year basis Deficit narrowed by 14.7%. Significant spending on Pandemic stress will create more debt on US Government.

And Deadline near to end for control the Debt ceiling as action taken by the Janet Yellen team.

US Government revenues totalled $3.39 trillion over the first 11 months as the economy reopened and Americans went for Work.

And Janet Yellen explained extraordinary measures must take to prevent the Government from Hitting its borrowing limit, as it will expire very soon.

But Republican party continue against the spending of $3.5 trillion stimuli for the infrastructure package by Biden proposal.

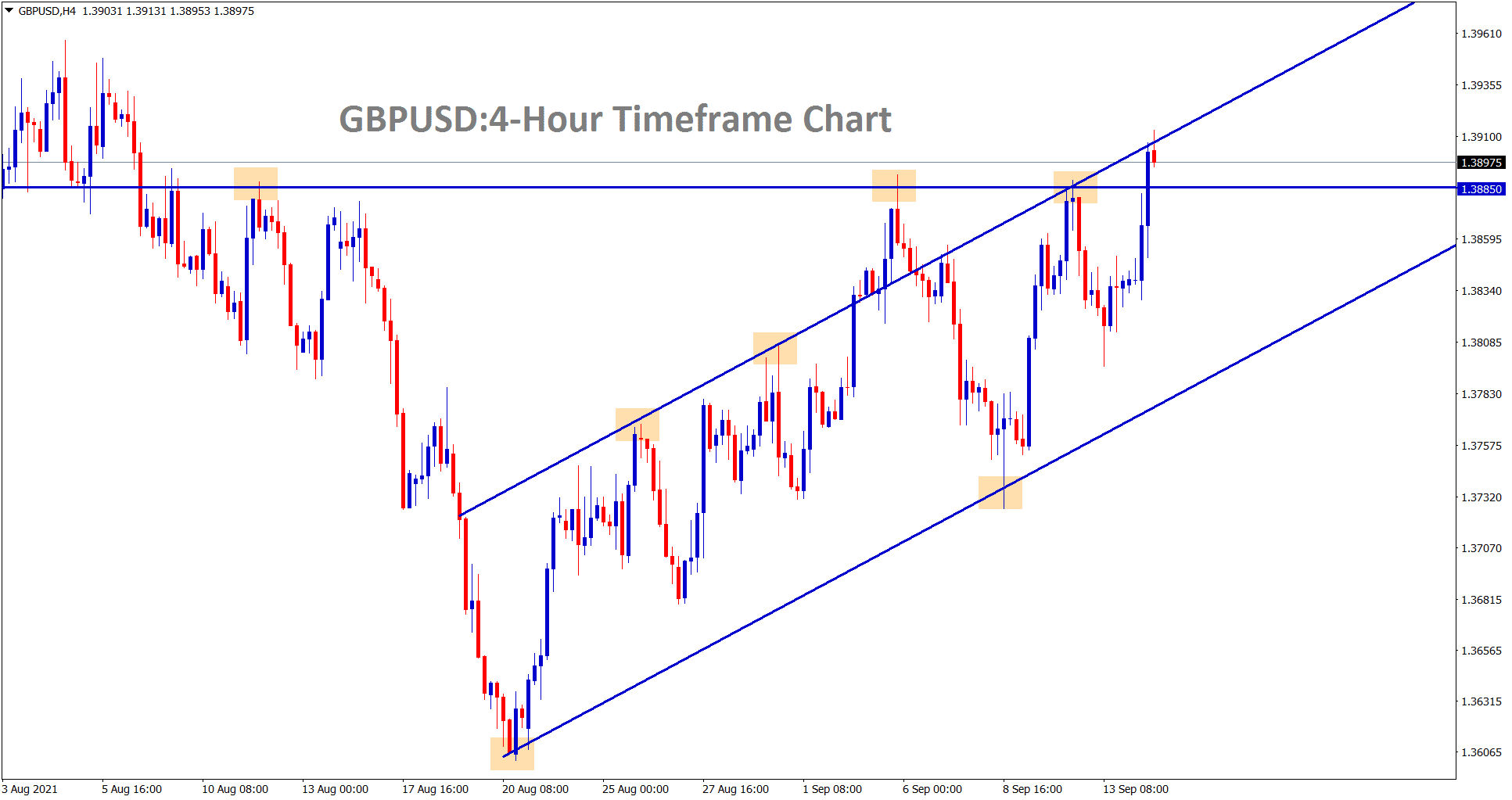

GBPUSD hits the higher high level of the ascending channel line

EURO: ECB Member Speech

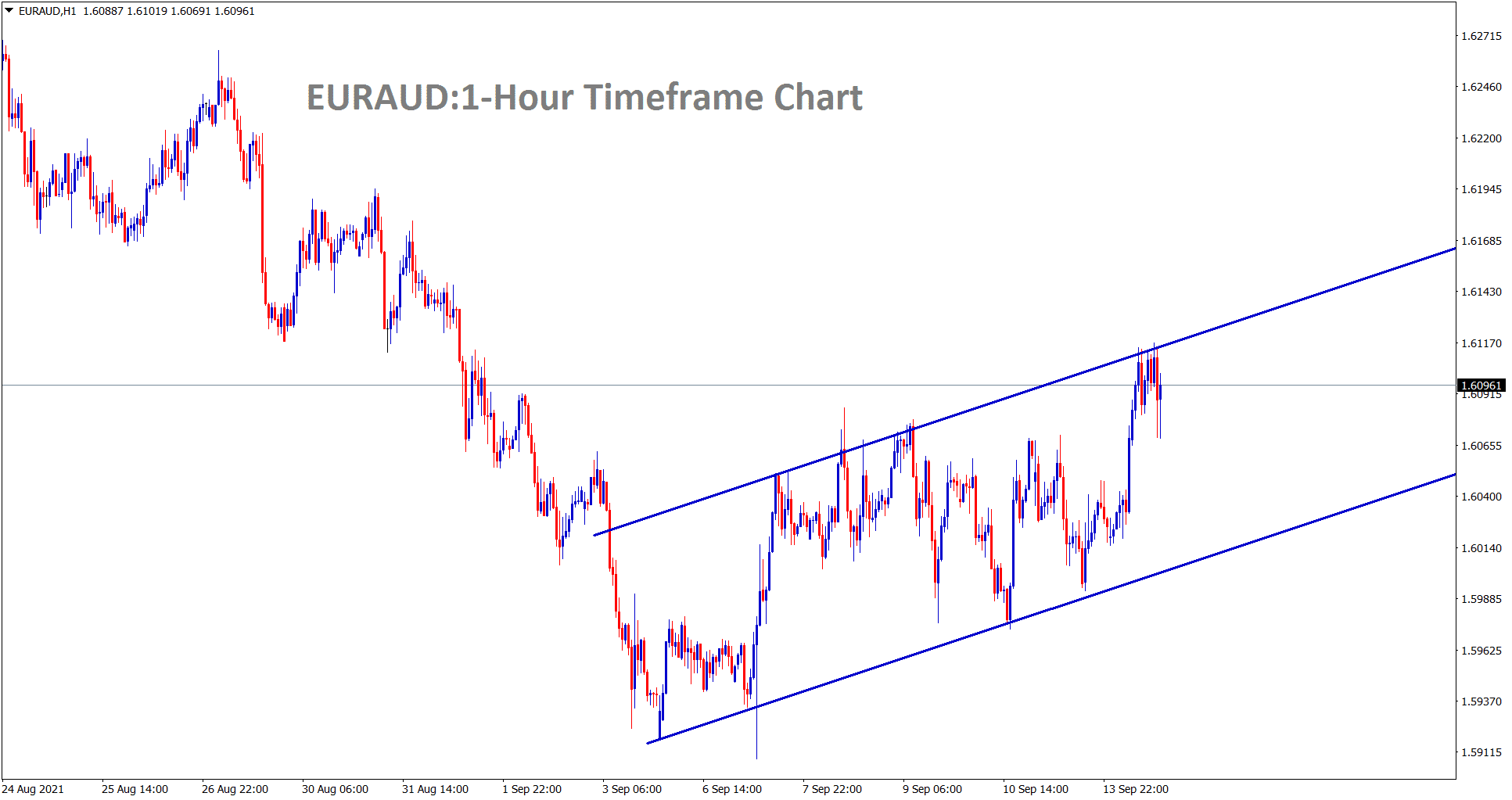

EURAUD is moving in an Ascending channel range

ECB Executive Board member Isabel Schnabel said on Tuesday that rising inflation rates are temporary and Soon may recover to normal.

But China’s positive attitude with Global countries for Vaccination optimism will help cool the Global pandemic time.

Once US Left Afghanistan European Union rushed towards the Indo-pacific relationships.

Now All eyes waiting for US CPI data to come, and it will drive further directions for EURUSD.

And Philadelphia FED President Patrick Harker also said Soon done tapering by FED and making readiness for Tapering by FED Side.

UK POUND: Jobs numbers outstanding performance for UK Economy

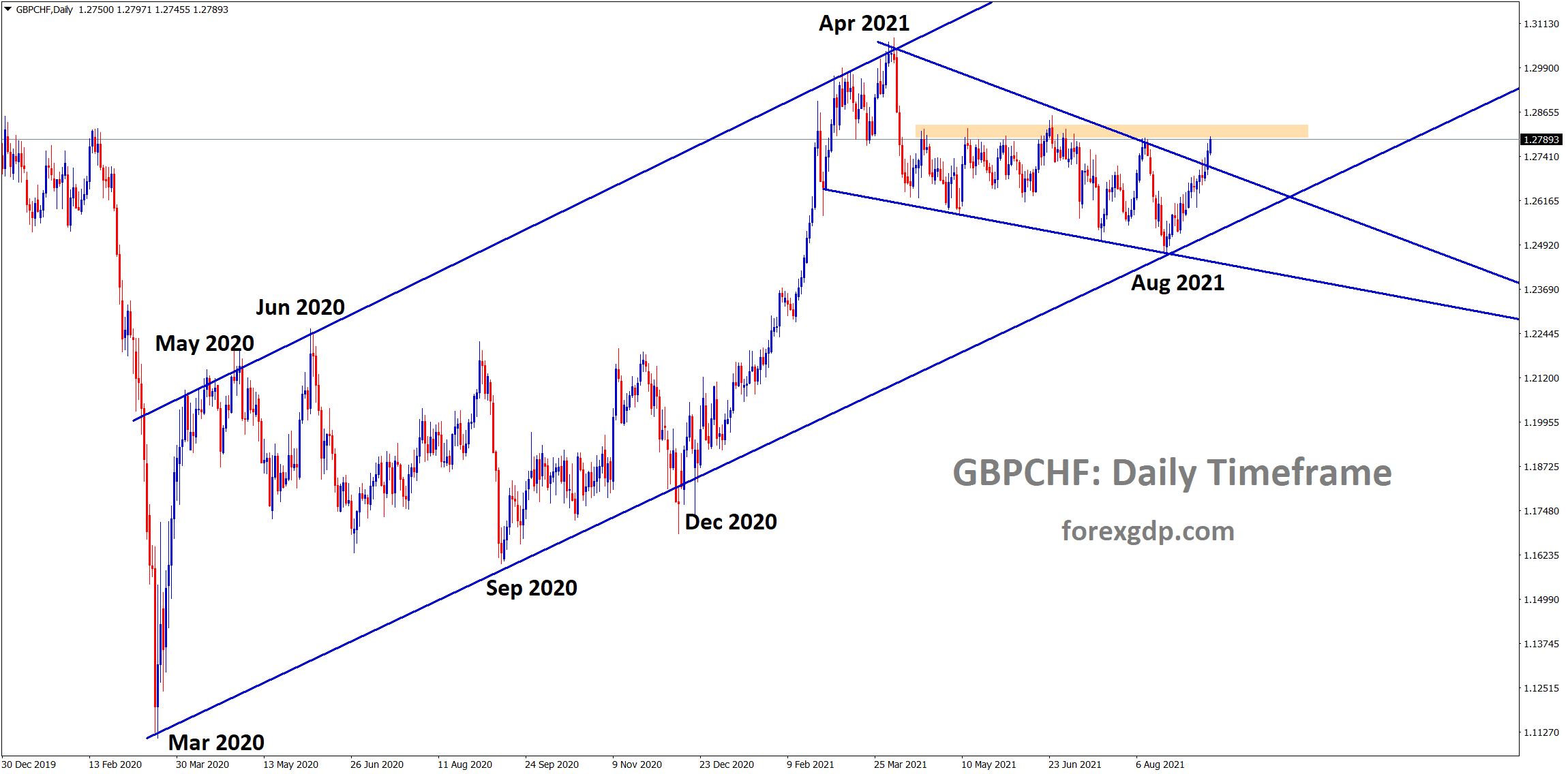

GBPCHF has broken the top level of the falling wedge and standing now at the horizontal resistance area

UK Jobs data shows today outstanding performance since pandemic 2020.

UK Job numbers reached 1 million jobs the first time as 183K came versus 178K expected and doubled to a previous number of 95K.

More people come to the office for work without hesitations of COvid-19 spread after 1st dose was done for 85% of people.

And in Upcoming weeks we can see more employment numbers will come and the unemployment rate will come at target numbers of Bank of England.

By considering the situation, the Bank of England may soon do Rate hikes before March 2022 and More tapering seen by the end of December.

Canadian Dollar: Oil prices are surging

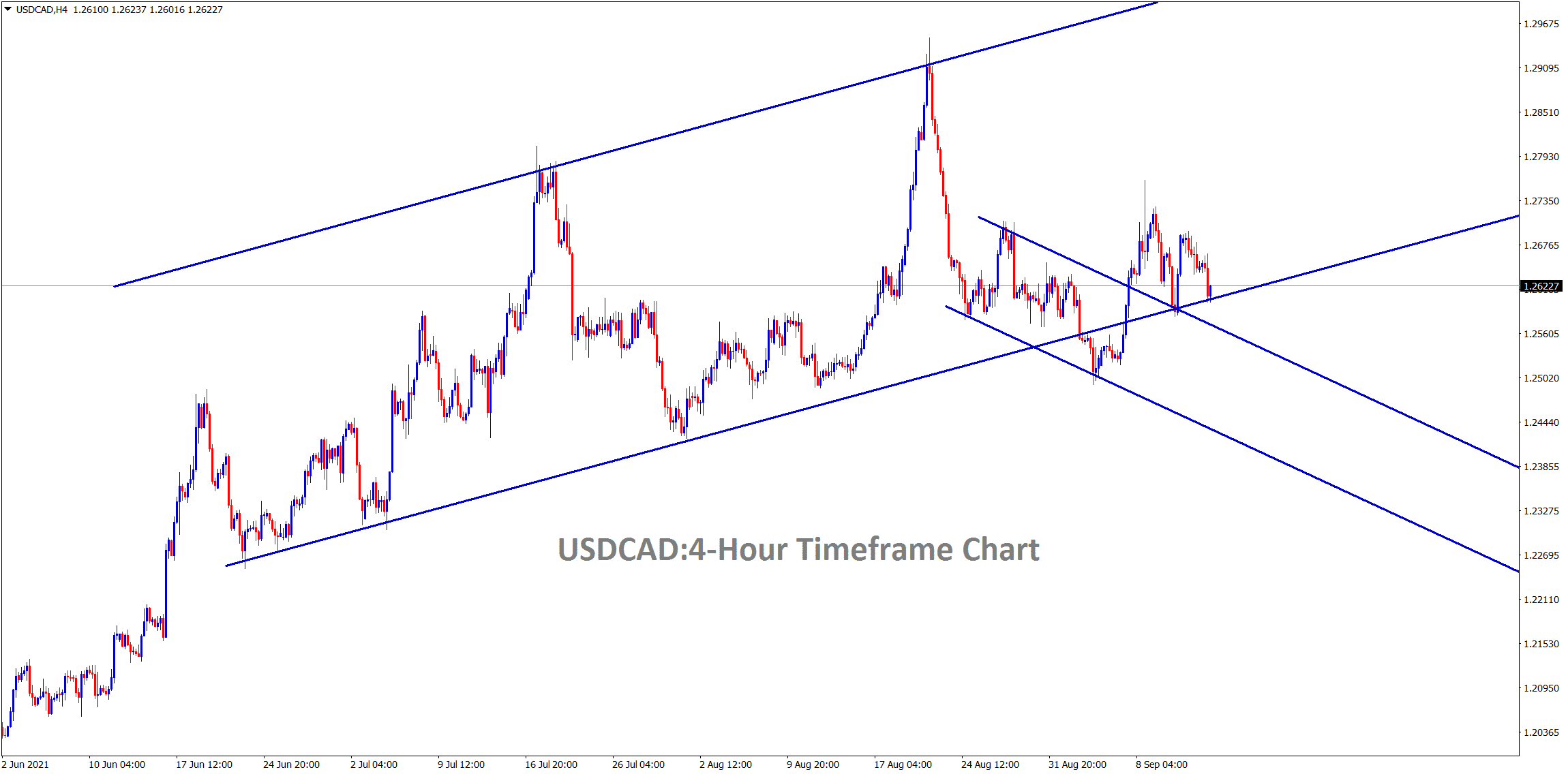

USDCAD hits the higher low level of the major uptrend line again

Canadian Dollar drifted higher as Oil Prices climbed higher from 70$ level today.

And continues to rise higher as demand increasing slightly as Vaccination rates are higher in developed countries.

Canadian elections are scheduled next week, September 20, the more or less current party will win in election is expected.

US PPI posted higher numbers since November 2010, and US CPI data is likely to be matched with higher numbers this week.

And US Inflation rising is temporary as FED statement, tapering or rising rates compensate inflation rates, but FED waiting for patients to achieve the target.

Japanese Yen: Earth Quake hits in Japan

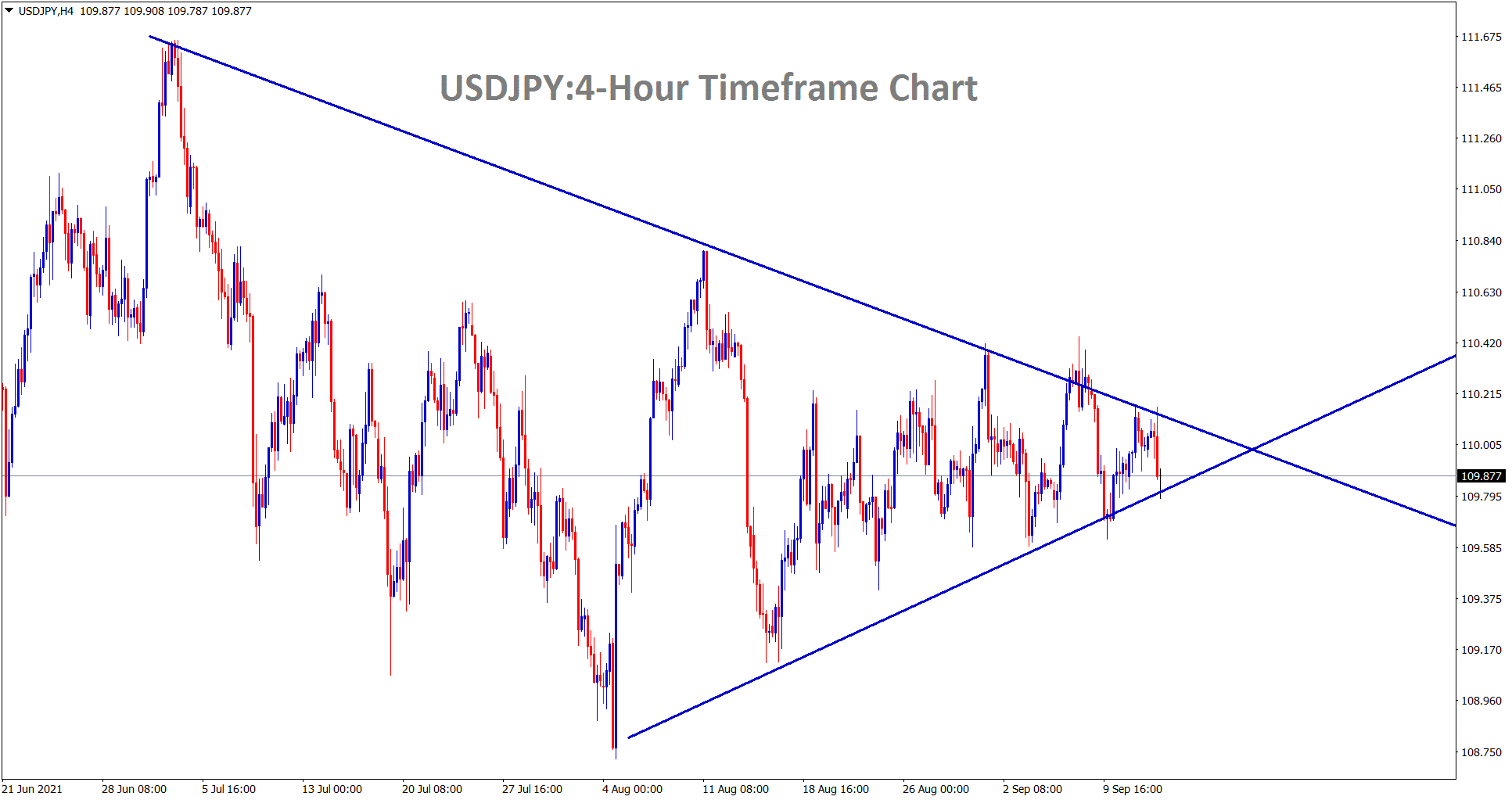

USDJPY is going to break this symmetrical triangle pattern soon

Earth Quake hits 6.1 magnitudes in Japan with no Tsunami Warnings.

Vaccination and stimulus rates are slower than expected in Japan.

And US Dollar strengthens shows the Japanese Yen weakness in the market.

USDJPY try to break the 110.500 level this week is expected, and the Japanese Government moderately handled the Covid-19 situation from pandemic 2020, and Elections commenced in November.

Australian Dollar: RBA Governor Lowe Speech

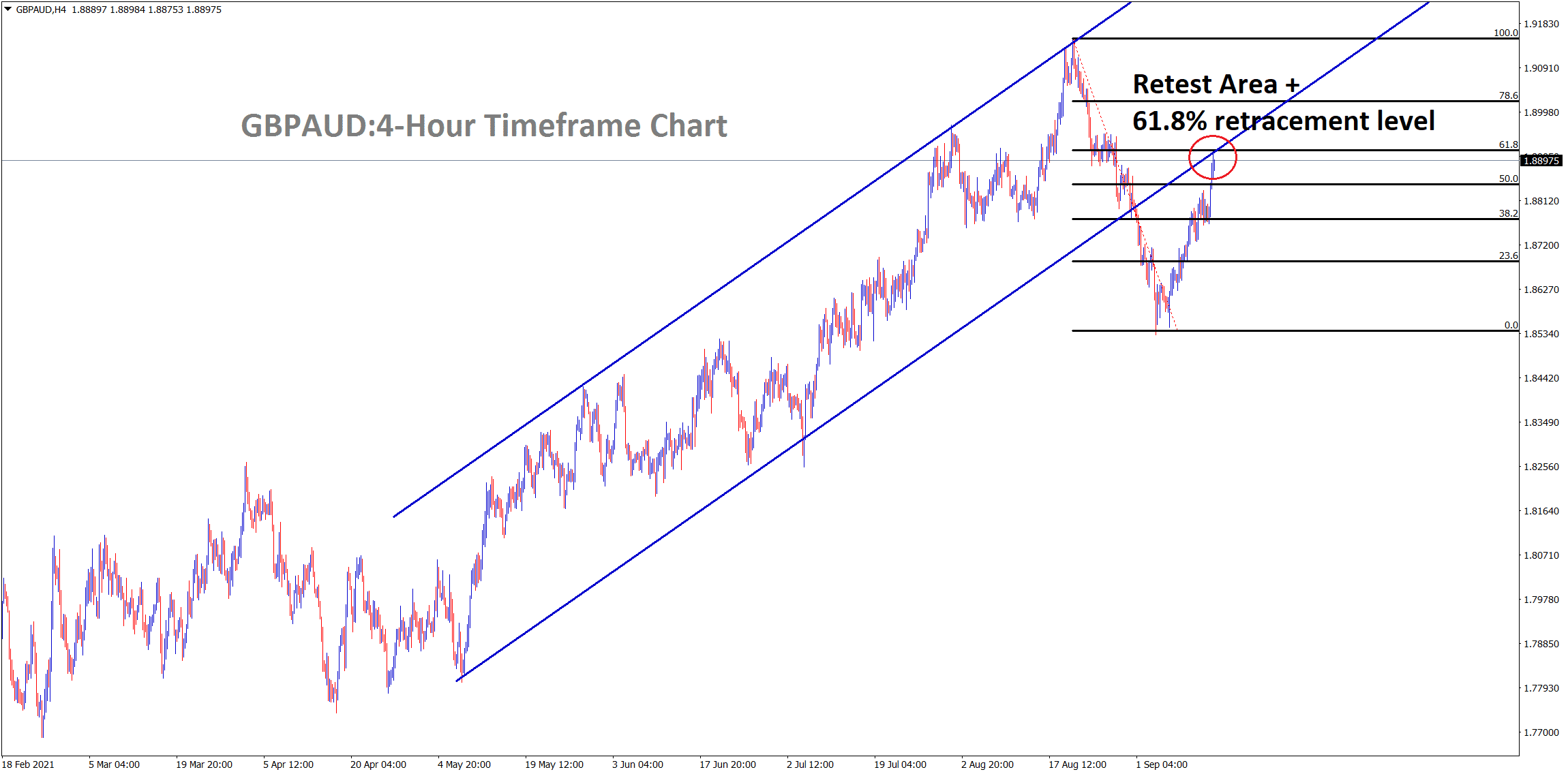

GBPAUD is standing at the retest area of the broken Ascending channel and 61.8% retracement made

Australian Dollar moved lower after RBA Governor Philip Lowe speech on Tuesday.

And He commented there is no rate hike before 2024, and Wages are increasing in Job growth and achieving our goals.

Sell off in Iron ore prices are disappointed in Export revenues, as China made more tariffs on Australian products.

And Soon may discuss the relationship to maintain consistent deals, it will help both countries business relationships.

RBA speech disappointed Aussie to underperform in the market.

And US Dollar, on another side, continuous outperformance in the market will drag Aussie to move Down.

RBA Policies divergence from RBNZ

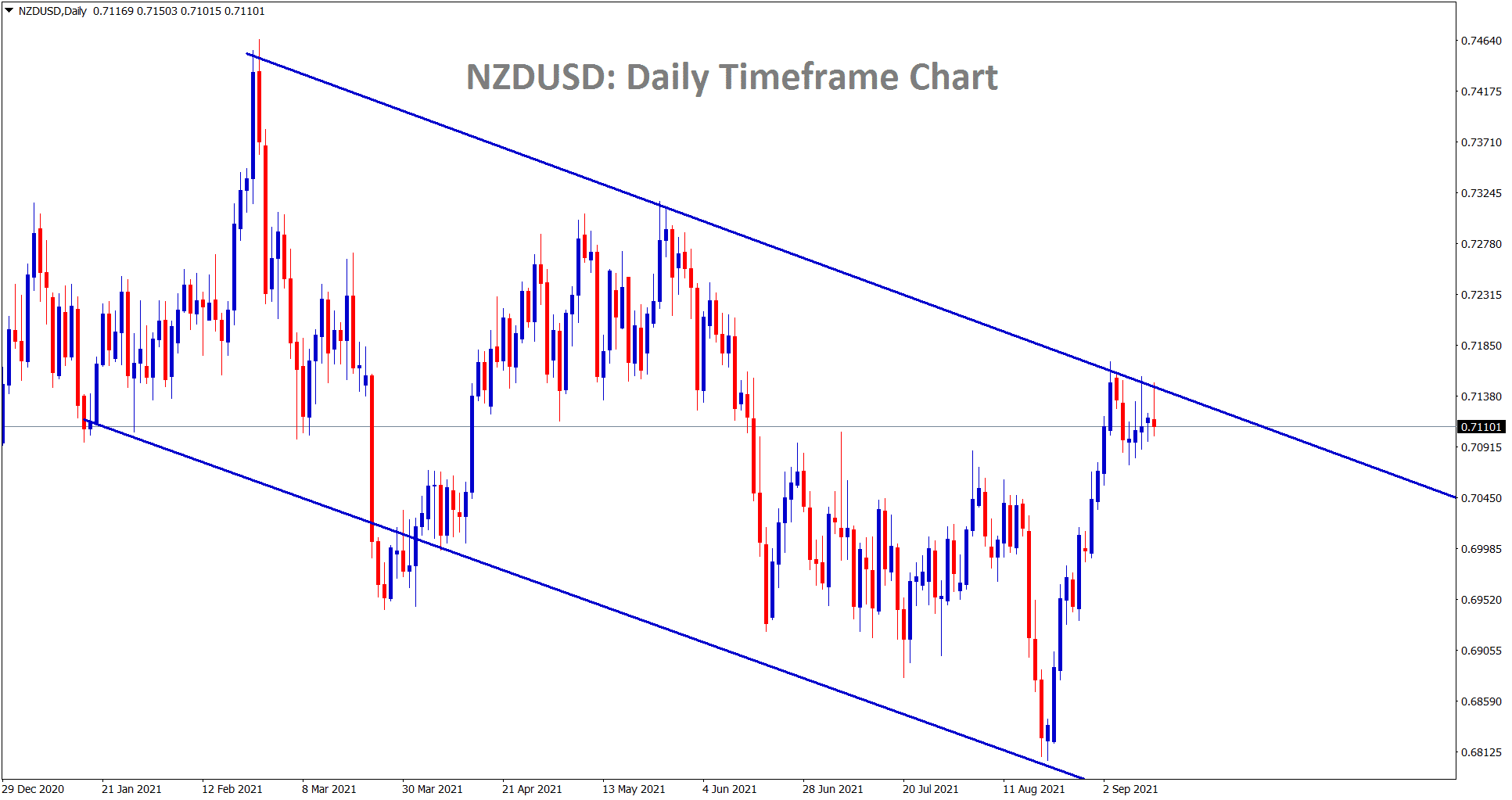

NZDUSD is consolidating at the lower high area of the descending channel line

RBA Governor Lowe clearly stated that more lockdowns in Australia made the economy slower in Q3. More job losses will expect in the Q3 stage.

There is no further tapering until February 2022, and there will be no raising interest rates until 2024.

Iron ore prices sell-off made Export revenues lower.

But Reserve Bank of New Zealand gets ready for hikes rates in October month as analysts expected.

Inflation, Job numbers, and Covid-19 handling are perfect in New Zealand Government; by considering these, RBNZ is ready to do tapering and Hike rates soon this year.

This comparison of the economy shows more Divergence from New Zealand Found in Australian Government policies.

New Zealand Dollar: Expected Q2 Numbers in Positive this week

According to Bloomberg Survey, New Zealand Q2 GDP is scheduled this week Thursday and expected 16.2% rise over year-on-year.

If GDP came in higher numbers, then New Zealand flashed for Bull trend again in the market.

And also, New Zealand PM Jacinda Ardern announced lockdown would decrease to 2nd level from 4th level in all areas except Auckland.

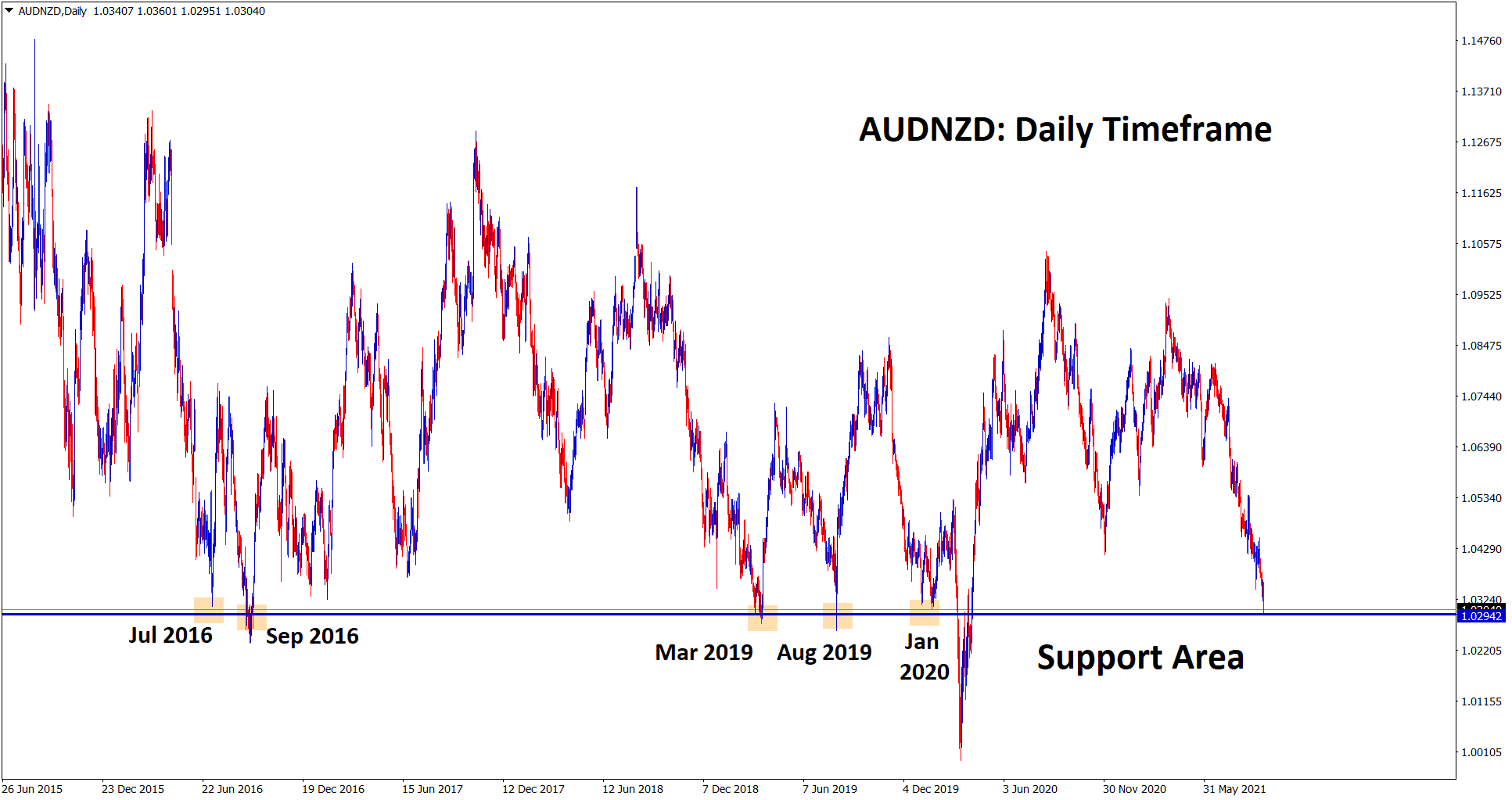

AUDNZD is standing at the strong support area in the daily timeframe

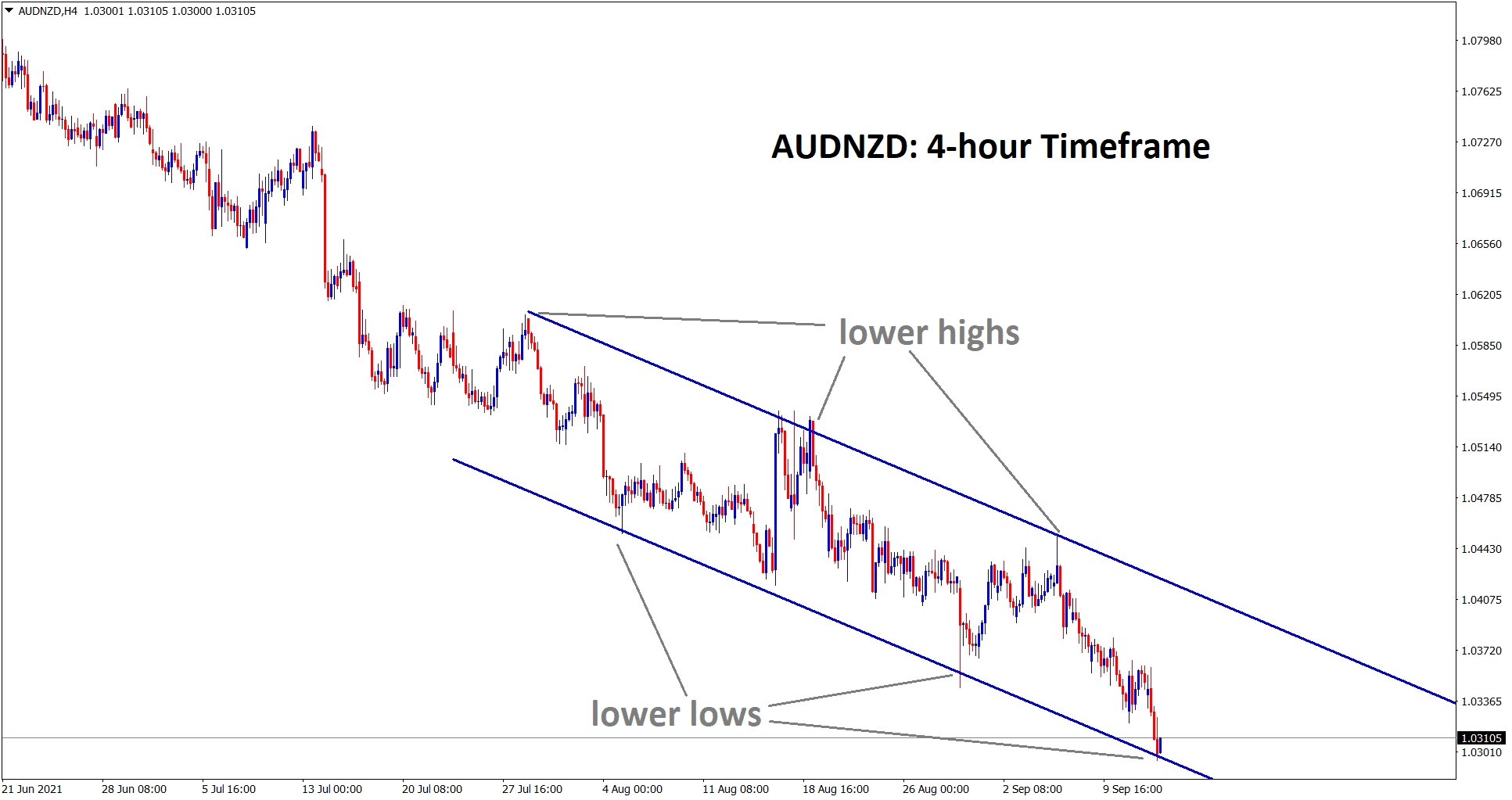

In the 4-hour timeframe, AUDNZD is bouncing back from the lower low of the descending channel

Auckland extended for 4th level lockdown for another one week.

Bank of New Zealand may raise the rate of 25Bps on October month policy meeting is expected, when Q2 GDP numbers will reach the expectations.

Swiss Franc: Slower Domestic data of Swiss Zone

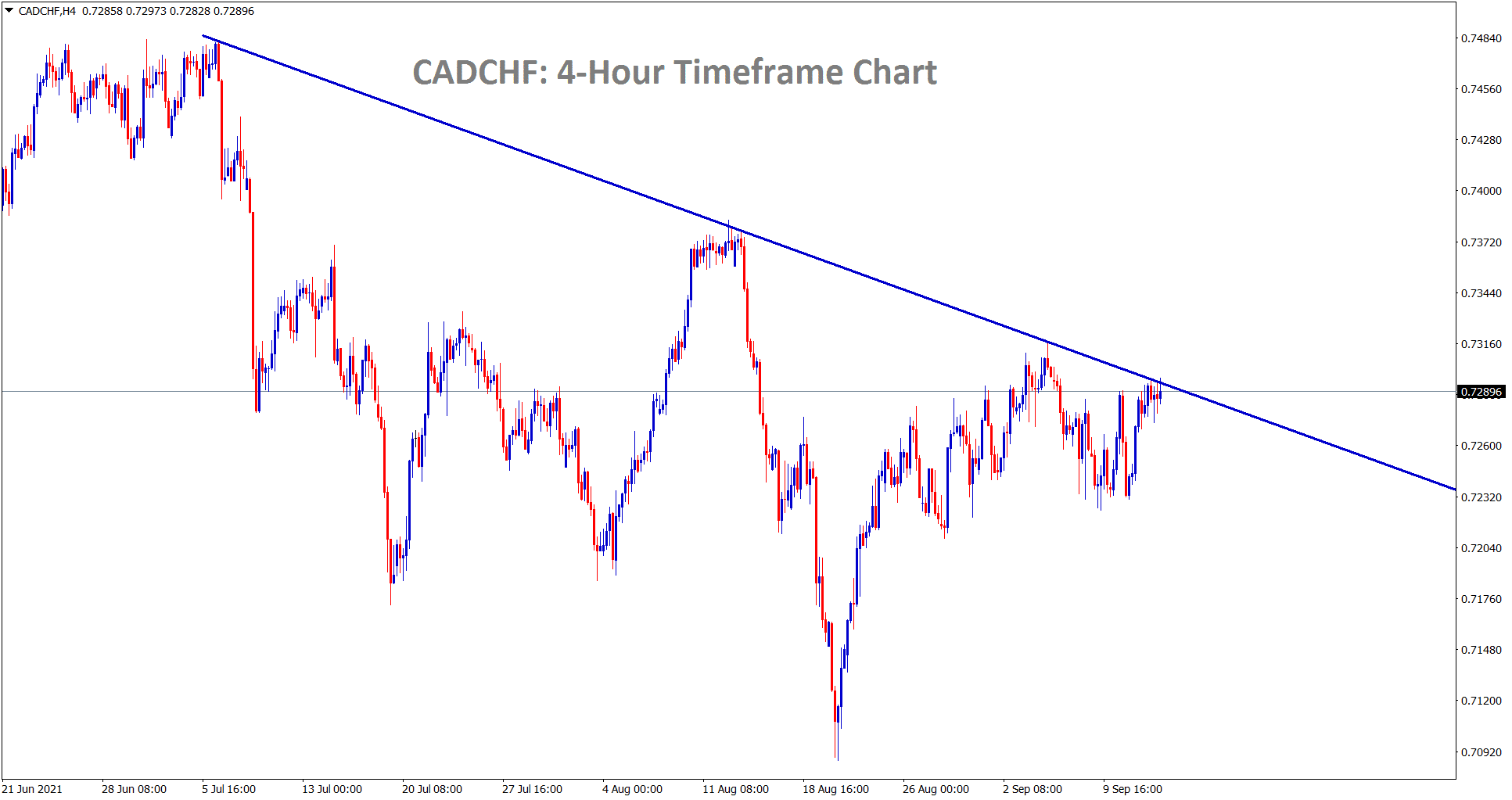

CADCHF is still consolidating at the lower high area of the downtrend line

Swiss Franc continuous to lower as Vaccination rates are slower, Economy recovery is slower than usual, since more fears among people to get started to work.

And Employment data is more behind the Government Goals, and Inflation rates are under 2% in the Swiss zone.

US CPI data is yet to flash today evening; once higher numbers cause US Dollar to strengthens and Reverses Swiss Franc will stronger.

USDCHF waiting for the 92.500 level to breakout, and all waiting for next week FOMC meeting outcome.

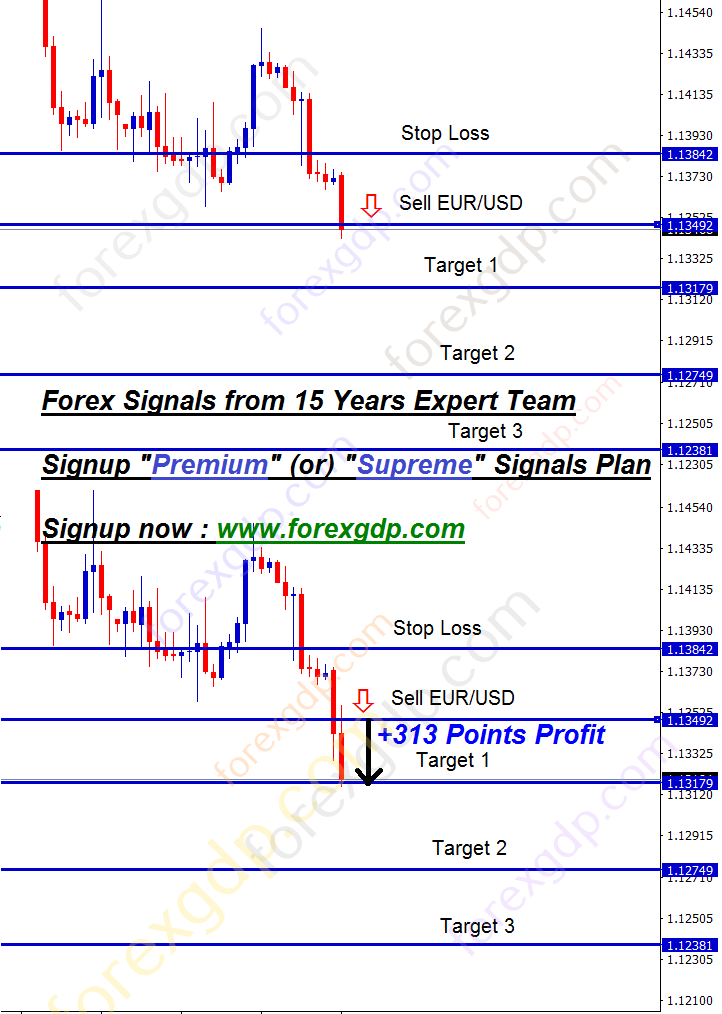

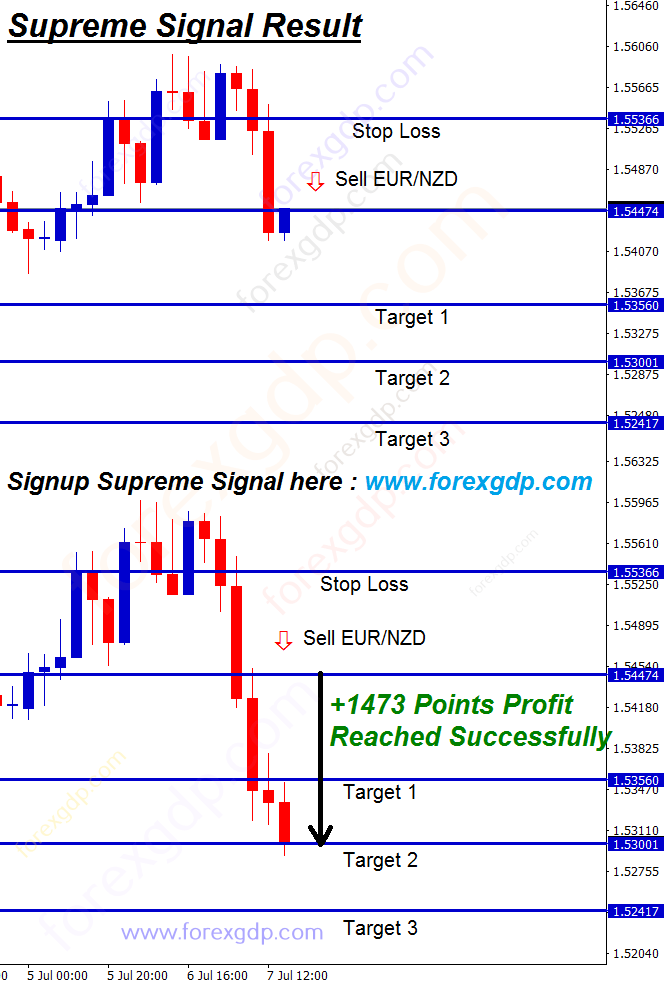

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/