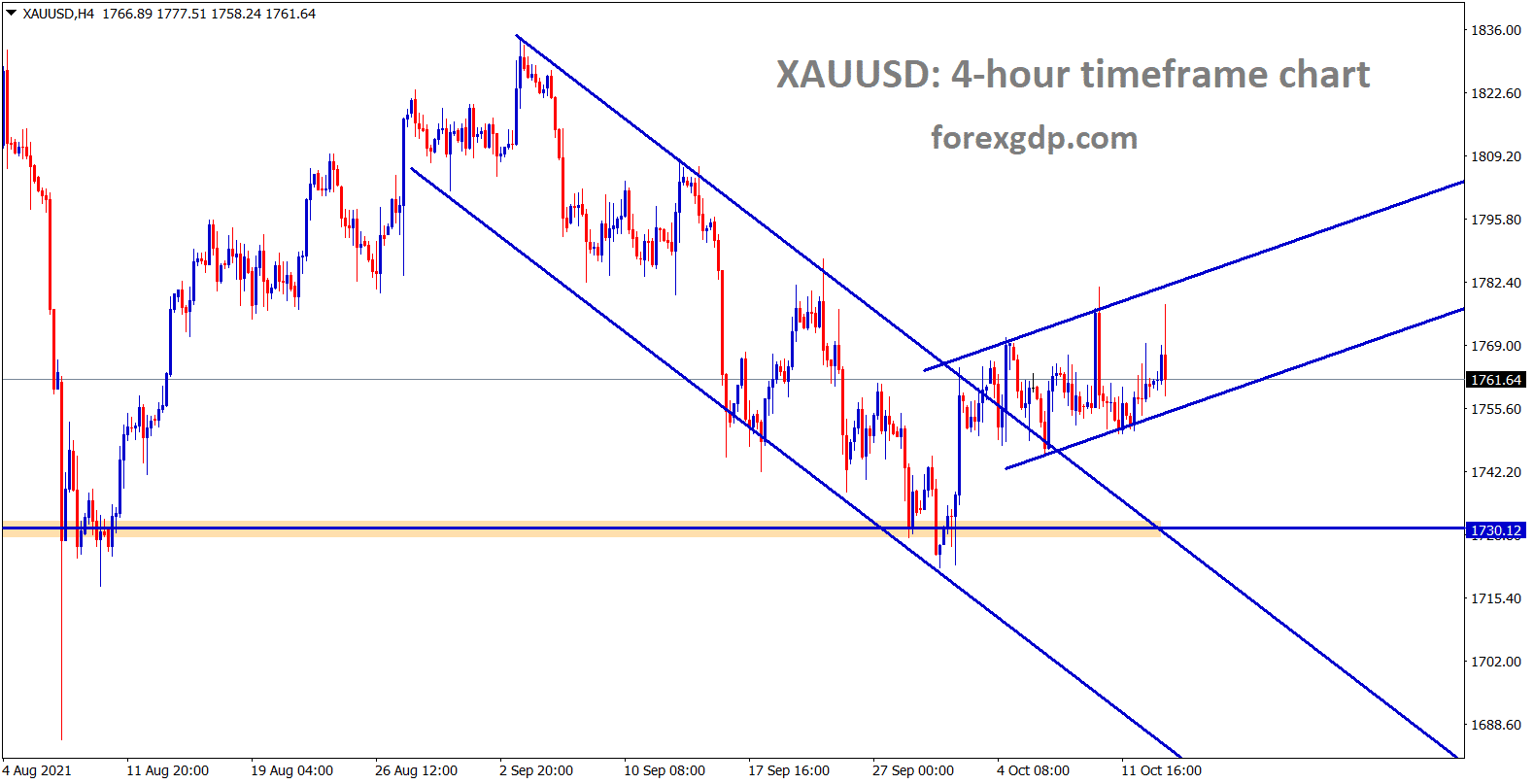

Gold: IMF Downgraded World Economic Growth in 2021

Gold XAUUSD price is still consolidating between the minor ascending channel range – wait for the breakout.

International monetary funds forecasted World economic growth seems downgraded by 0.10% to 5.9% from 6.0% after Goldman Sachs downgraded US Growth this year.

Anyhow, Gold seems like an Inflation hedge currency tool in people minds.

In 2008-2013 Gold surged to a high rally because More currencies got printed by the US to compensate Lehman brothers collapse.

Now this time is different from financial crisis to Virus crisis.

So Impact will be less severe than 2008, So Gold prices will remain under 2000$ not skyrocketed above 2000$.

And FED may announce tapering measures from the November meeting, and Rate hikes for June 2022 polls suggestion increased to 25%.

So, tapering of US FED decision makes Gold phenomenal low to 1600$ by the end of 2022, if Rate hikes consecutive done in 2022 by FED.

And also China Evergrande Crisis makes the People bank of China print more Yuan to compensate for Money demand in China. So, Gold continuously sells off by the Chinese Government to print more money.

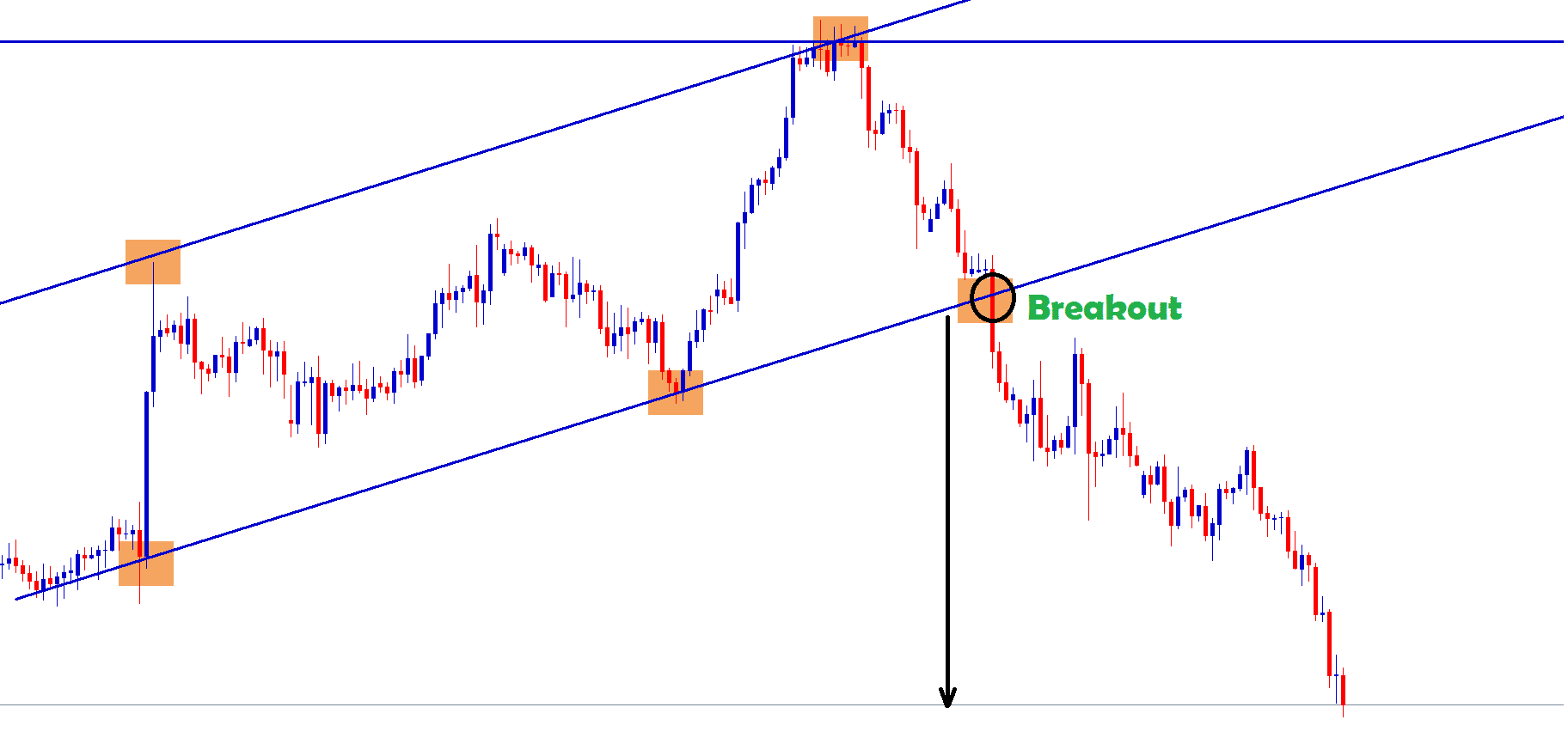

US Dollar: US FOMC meeting minutes Forecast

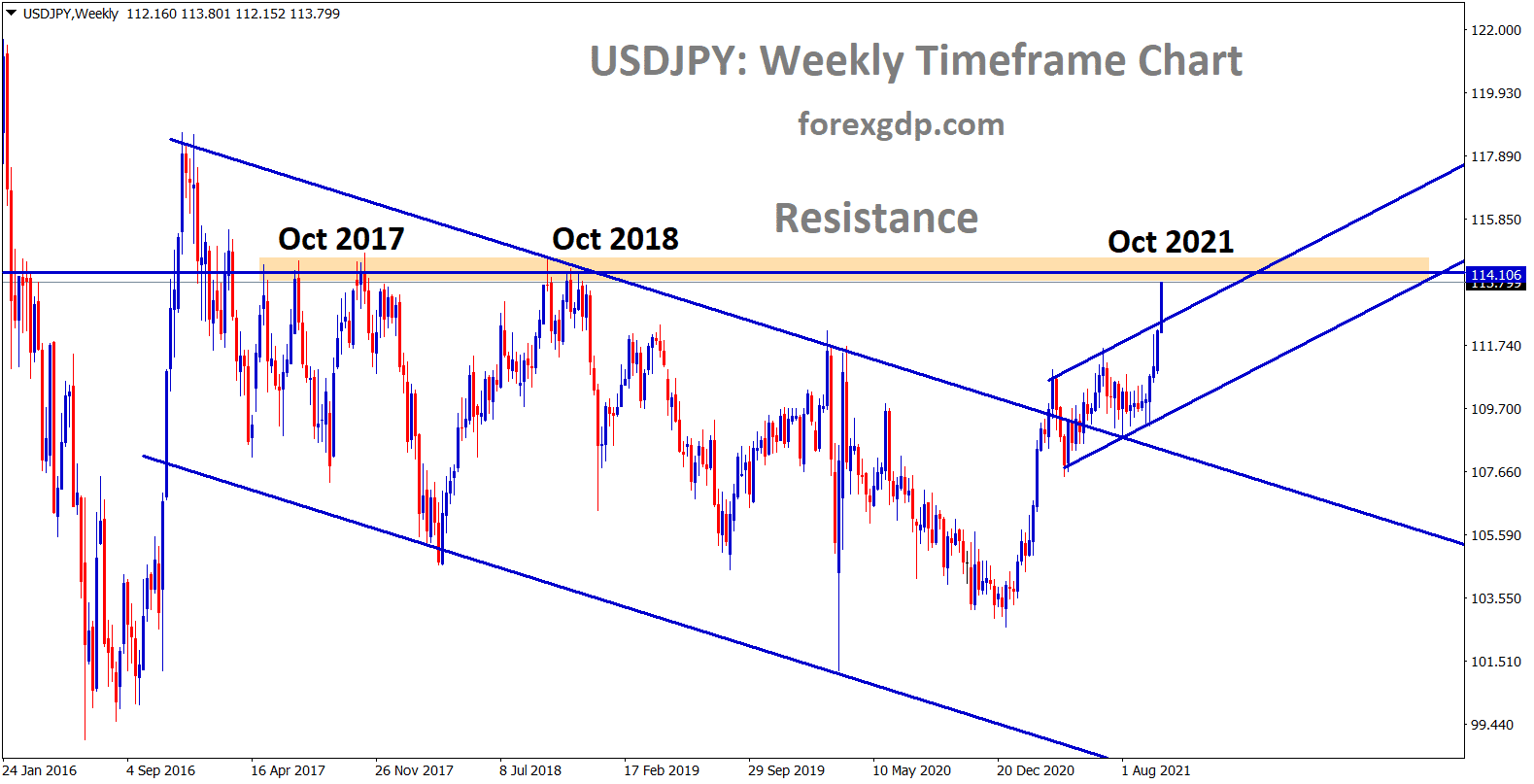

USDJPY going to reach the major resistance area – wait for reversal or breakout.

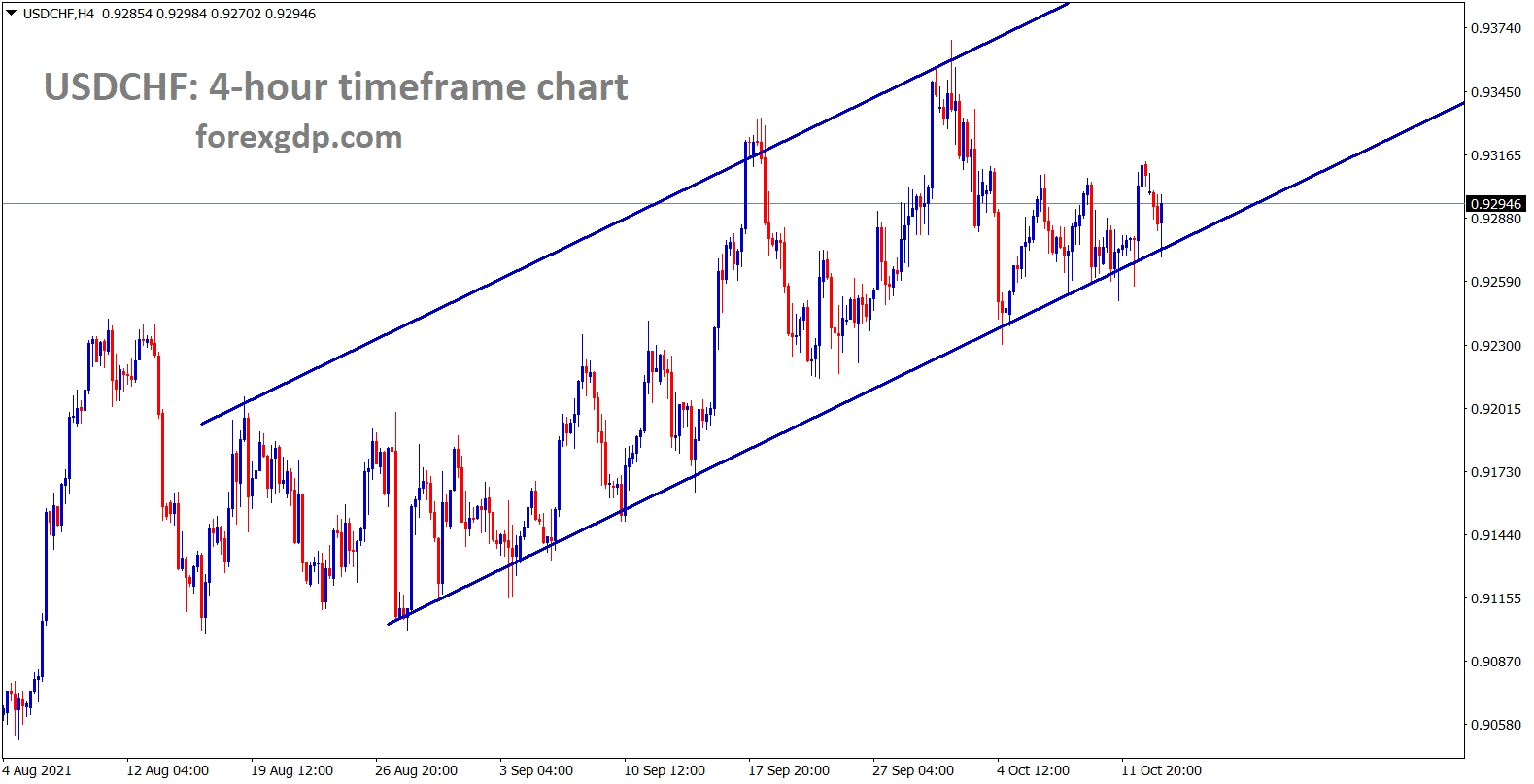

USDCHF is moving in an uptrend line respecting the higher lows.

US FOMC Meeting minutes scheduled today and November Month tapering announcement might happen in this meeting.

And US Debt ceiling extended to December month, and US CPI data is yet to be published this week.

Based on Domestic data US FED will decide the Tapering level of Bonds to adjust according to the level of Economy.

US Dollar performed well compared to other counter currencies since the Energy crisis started in China, the EU and UK.

Now, Covid-19 issue cooldown and Energy prices come’s hot in the headline of All nations.

And Petrol, Gases and Coal buying in terms of US Dollar, so demand automatically increasing for US Dollar.

Euro: Euro Domestic data more weaker than US Economy

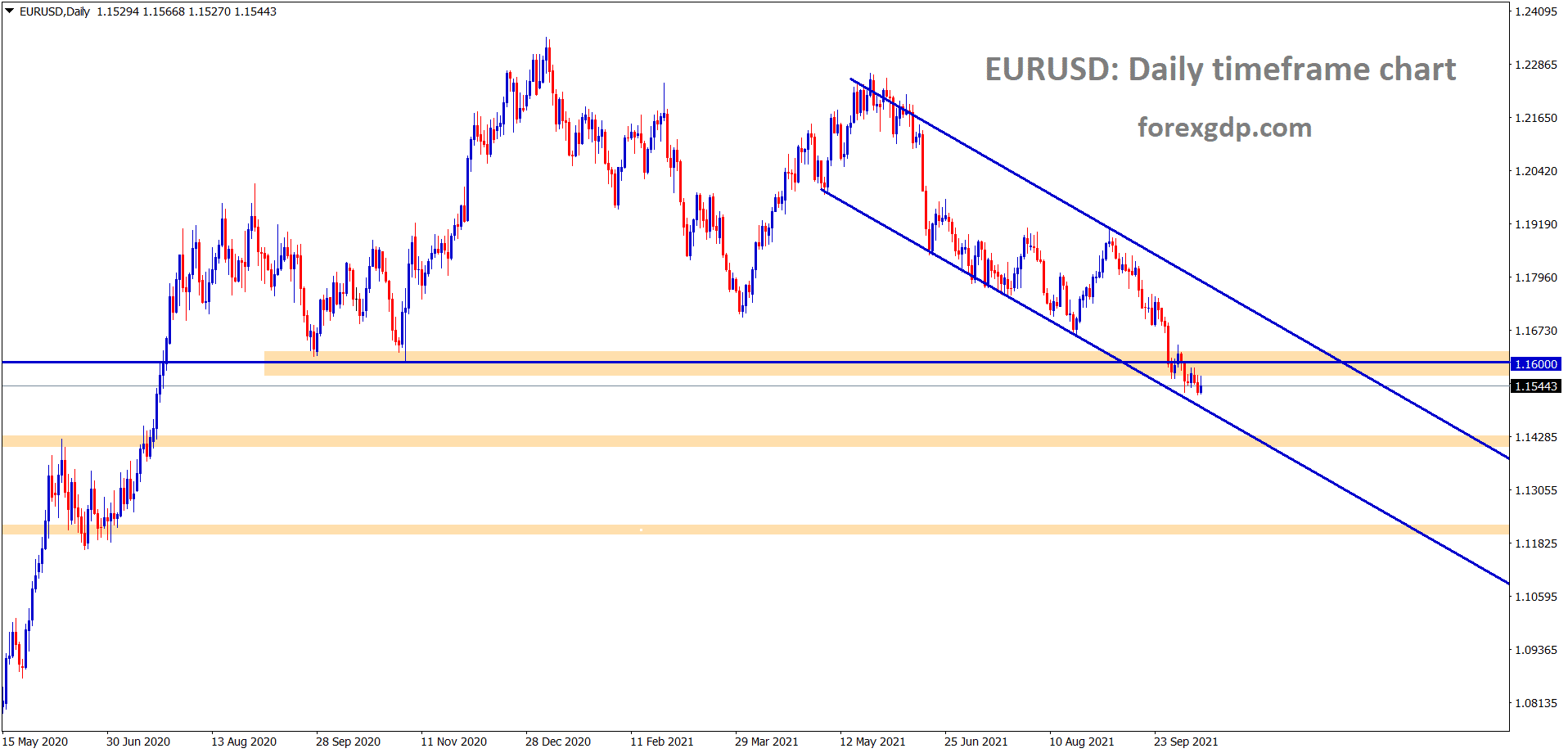

EURUSD is consolidating at the support and the lower low level of the descending channel for a long time.

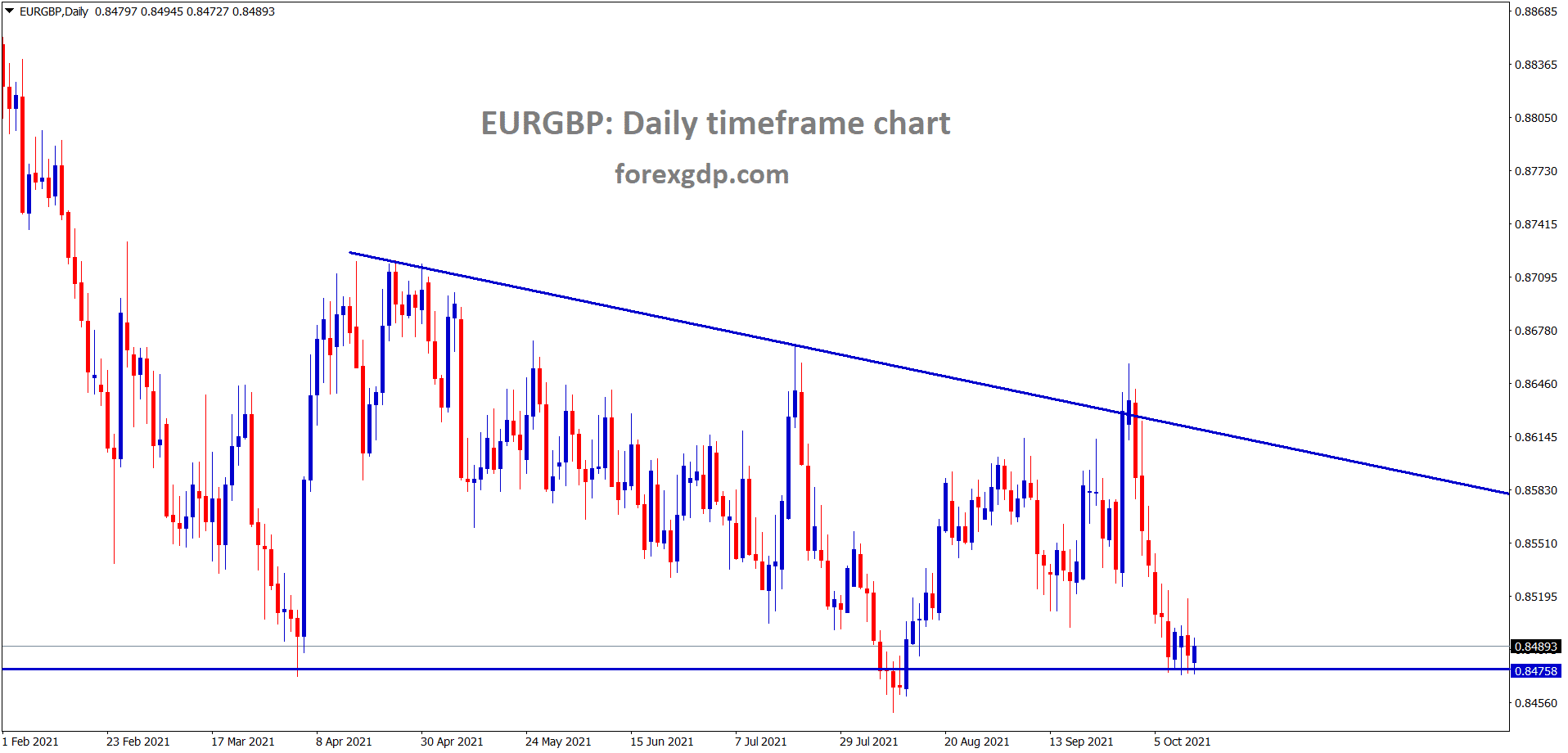

EURGBP is standing at the low level of the descending triangle pattern – wait for breakout from this triangle.

US Economy is improving faster day by day when compared to the Eurozone.

The Last Euro ZEW sentiment missed expectations indicates a weak Eurozone scenario.

European nations are in an energy crisis to resolve this. Russia lend a helping hand by providing Sufficient Energy supplies to the Europe zone, as the Russian President told Earlier.

And FED announced tapering by the end of December 2021, then US Dollar keeps a higher pace, and Euro will slip to 1.13 level against US Dollar by mid-2022.

US FED plotted rate hikes map for 2022 and 2023 gives a clear hint for Investors for buying more bonds in US Treasuries.

And 10 Year Bonds rates difference is higher between the US and Europe because the Economy expansion more in the US than in Europe.

UK POUND: UK GDP came at higher Reading

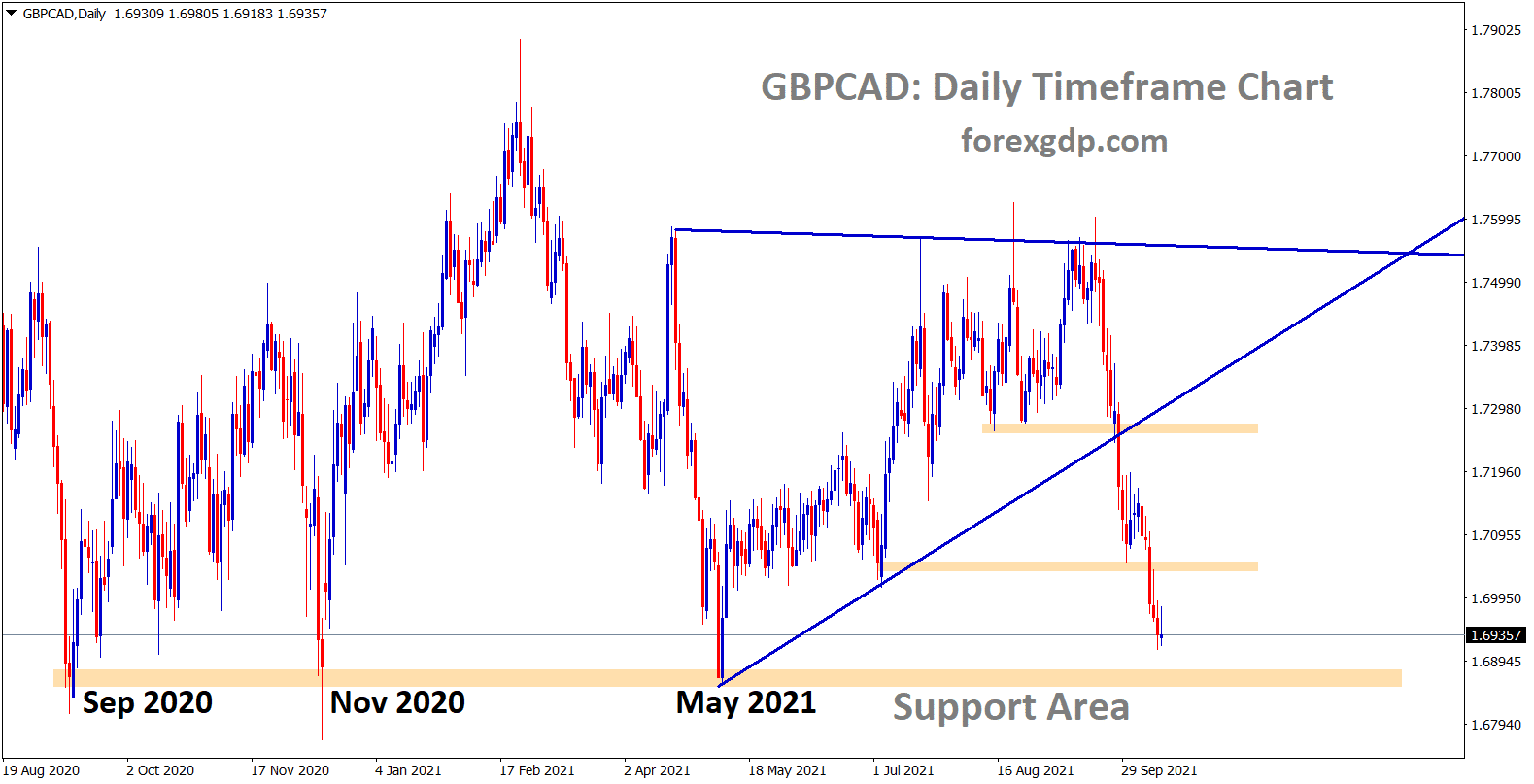

GBPCAD is going to reach the major support area.

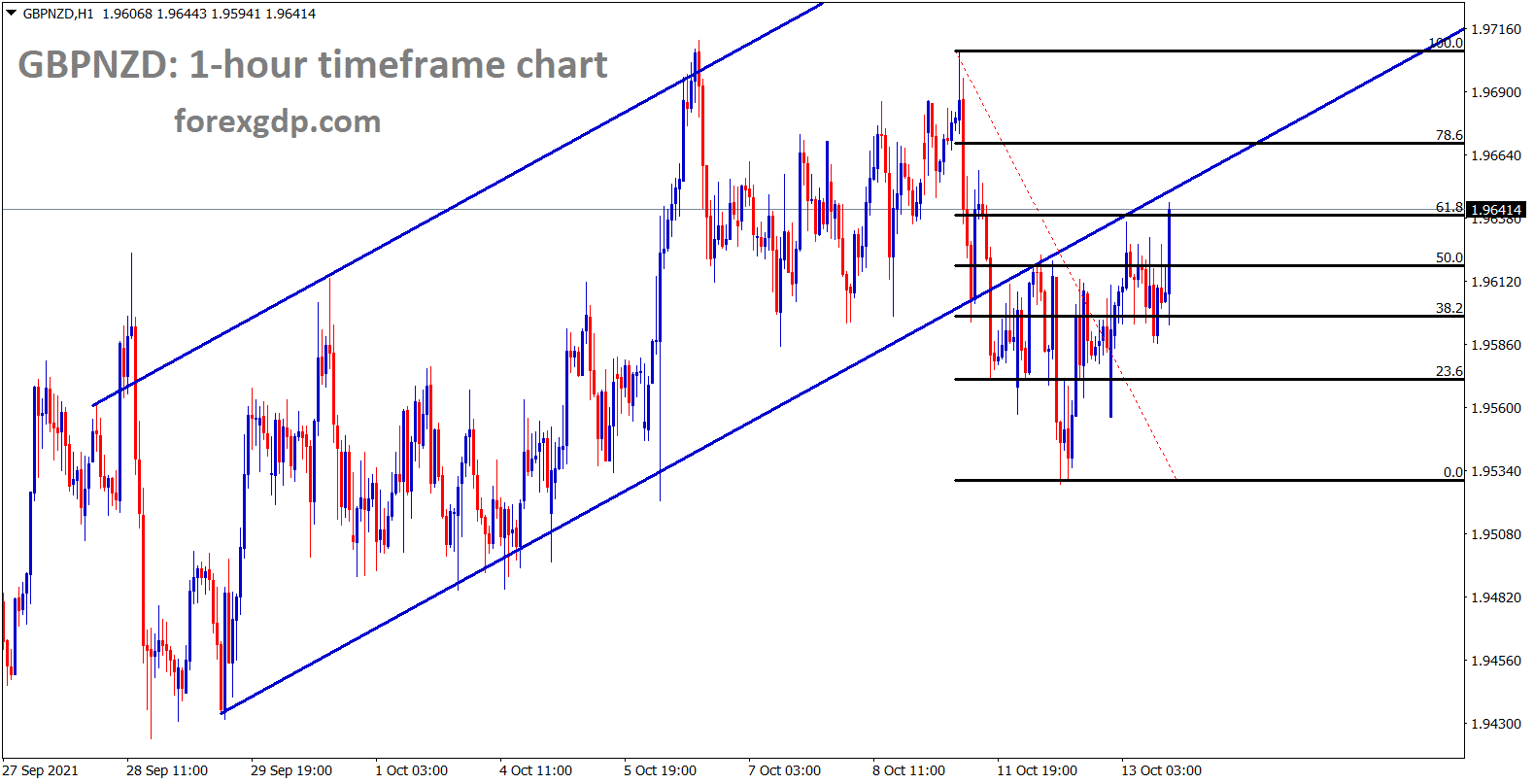

GBPNZD is consolidating at the retest area of the ascending channel range and it has retraced 61% from the previous high.

UK GDP data released as higher as 6.9% versus 6.7% forecasted and just below July month rate of 8.8%.

Now UK Picture of GDP hinted the Expansion of Economy in a Good Way.

And International Monetary Fund’s said UK would achieve fast economic expansion in the G7 nation list.

However, Inflation rates are soaring high in the UK due to Energy prices soaring and Demand for Commodities like Petrol, Gas and Coal.

GDP outlook of UK shows Bank of England will raise interest rates by 0.25% from 0.10% by the end of this year.

UK Budget forecast

UK Government does not compromise with EU for Northern Ireland Protocol till day.

And UK Economy expansion in a faster manner when compared to European nations.

The energy crisis makes inflation higher in UK and EU, and rate hikes are more expected in the UK by the end of 2021 when compared to Europe.

Bank of England Governor Andrew Bailey stated that rate hikes are possible by the end of 2021 if the inflation rate fires more.

In October month Budget, the UK may add the Hike taxes for Businesses and Employees is possible and compensate tax revenues backlogs that occurred in the 2019-2021 Covid-19 crisis period.

Canadian Dollar: the US is ready to open the borders for Canada in November month

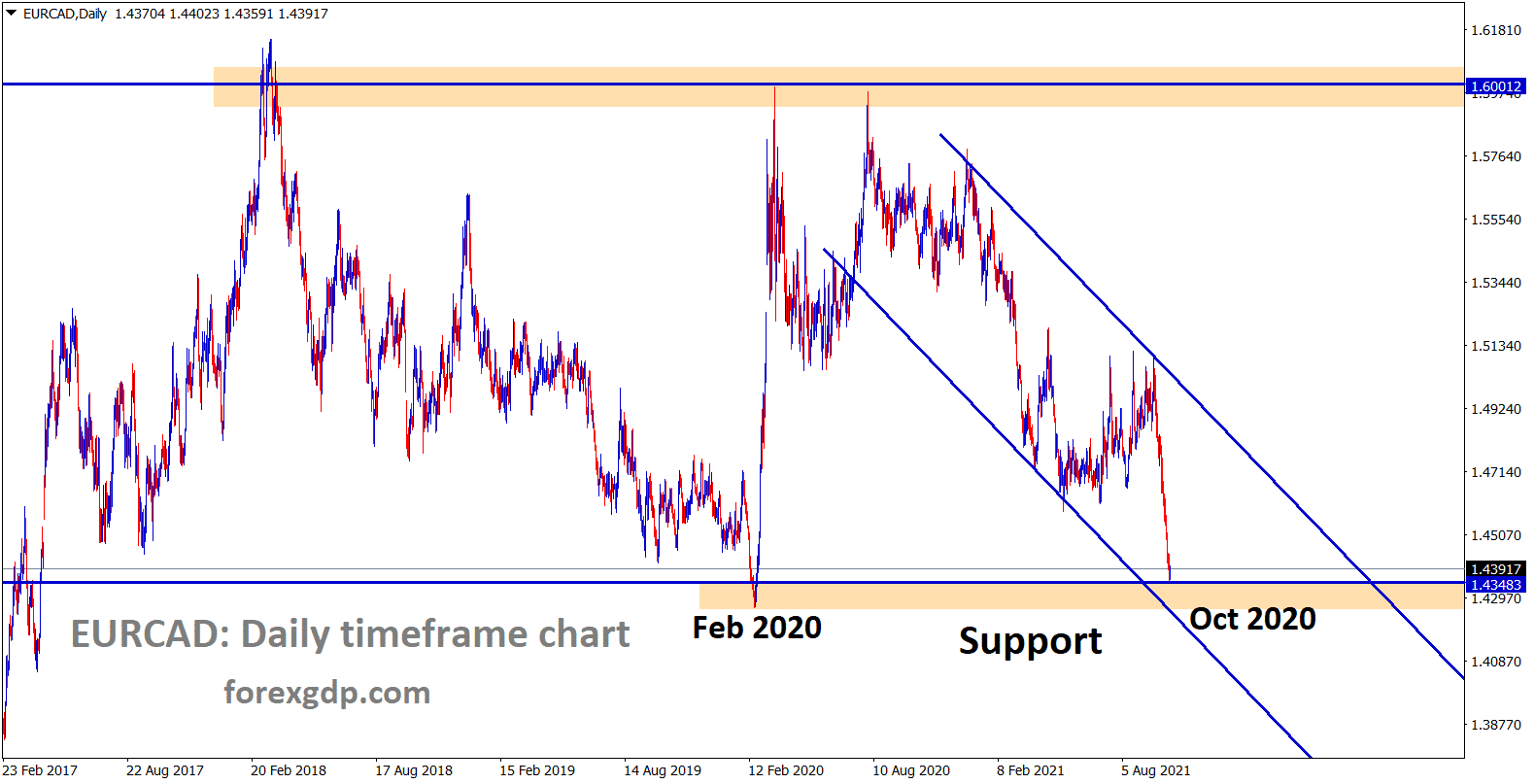

EURCAD is near to the major support area after a long time – wait for reversal or breakout.

US Senate Democratic leader Chuck Schumer’s office reported that the US Plans to open US-Canadian Borders for non-essential vaccinated travellers by early November as per Buffalo news report.

Followed by opening the US-Canadian border, another announcement from US Democratic senator Gillibrand’s office said -Mexico border to open for Only Fully vaccinated Mexicans.

After news announcements, US Dollar was impressed as More tourist revenues will be added to US Governments as perks.

Japanese Yen: Stimulus will be passed after the Japanese Election in November

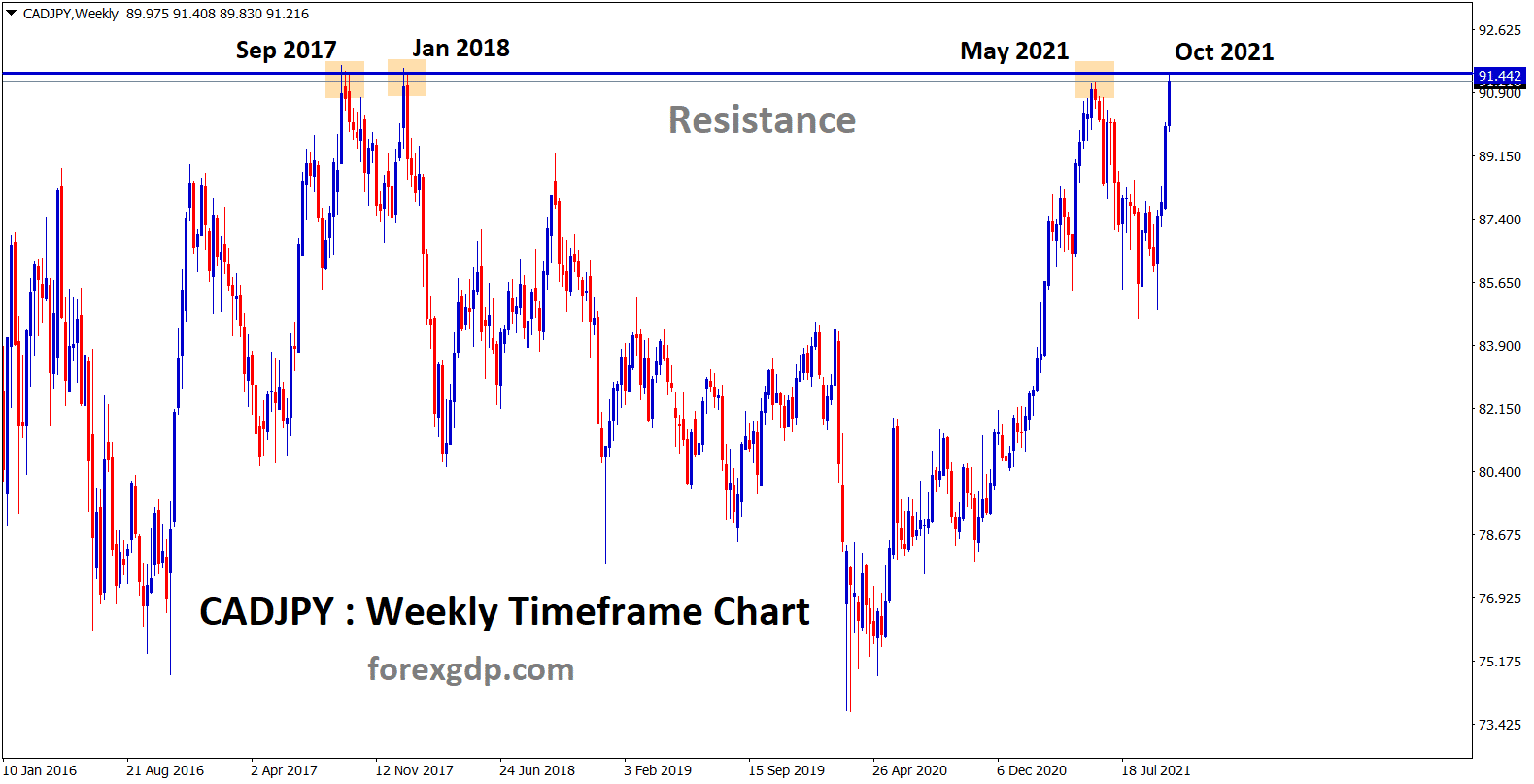

CADJPY hits the major resistance area again – wait for reversal or breakout.

Japanese Yen keeps weaker against US Dollar from last month due to change of PM in Japan and Energy crisis followed by Covid-19 crisis.

And also, Vaccination is progressing slowly, and imposed lockdown is still not lifted by Japan.

Much more production and Manufacturing are stopped due to chips shortage once side and other side is Covid-19 spread lockdown.

New PM Kishida said Government would do more stimulus to recover from the pandemic and Japan whole Economy will recover seen in 2022 and 2023.

After the election in November only makes full stimulus to release by New Form Government.

US FED announce the tapering plan by today in FOMC minutes as all eyes waiting.

FED will do rate hikes in 2022 mid-level and wider spread between JGB and US Treasury bond yields.

10-year US Treasury yields are strong correlation with the Japanese Yen

Australian Dollar: Uranium recognized as green energy for Approval

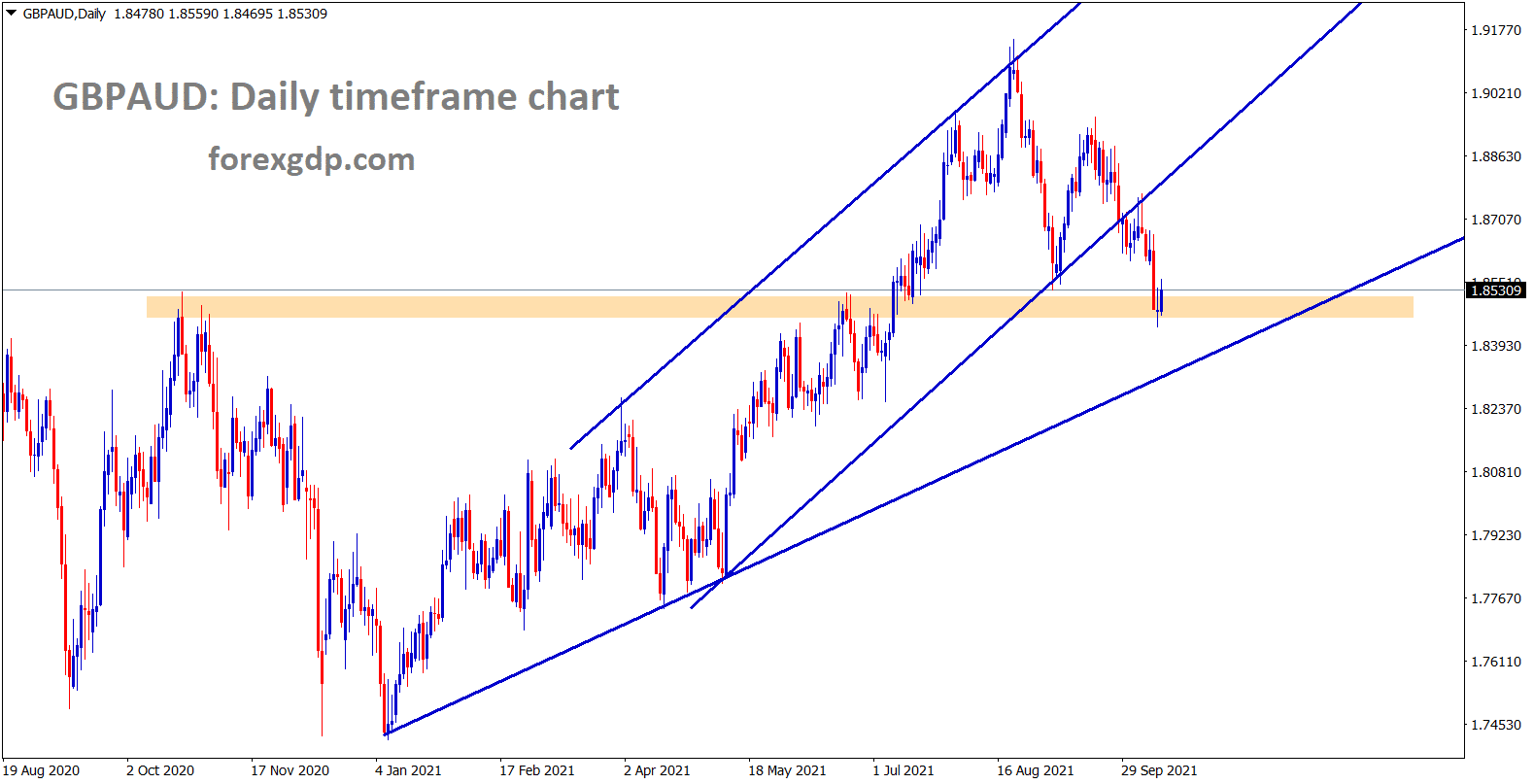

GBPAUD has reached the previous horizontal resistance area and trying to make a correction.

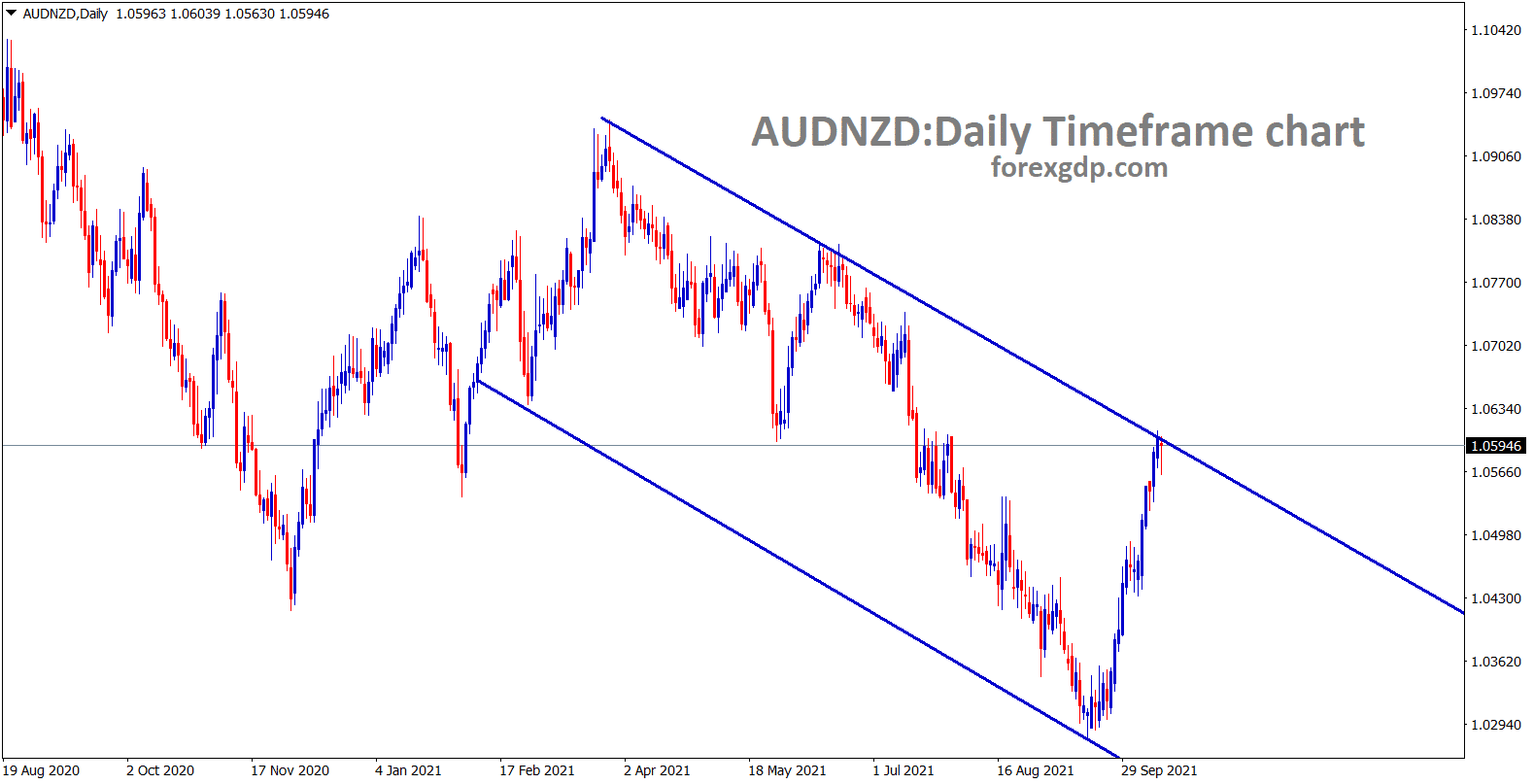

AUDNZD hits the lower high area of the descending channel line.

Australian Dollar keeps steady as 0.73500 to 0.72500 level after China imports coal from Australia due to energy crisis in China.

And Uranium prices rose higher overnight due to Ten European countries sent letters to the European Council to recognize as a source of green energy as Uranium.

Uranium is a radioactive material to create nuclear creators.

Due to Chip shortage, Apple cut its manufacturing production for a month.

And China’s trade balance is likely to slow in the September month report as $46.8 billion will be down from %58.34 billion in August.

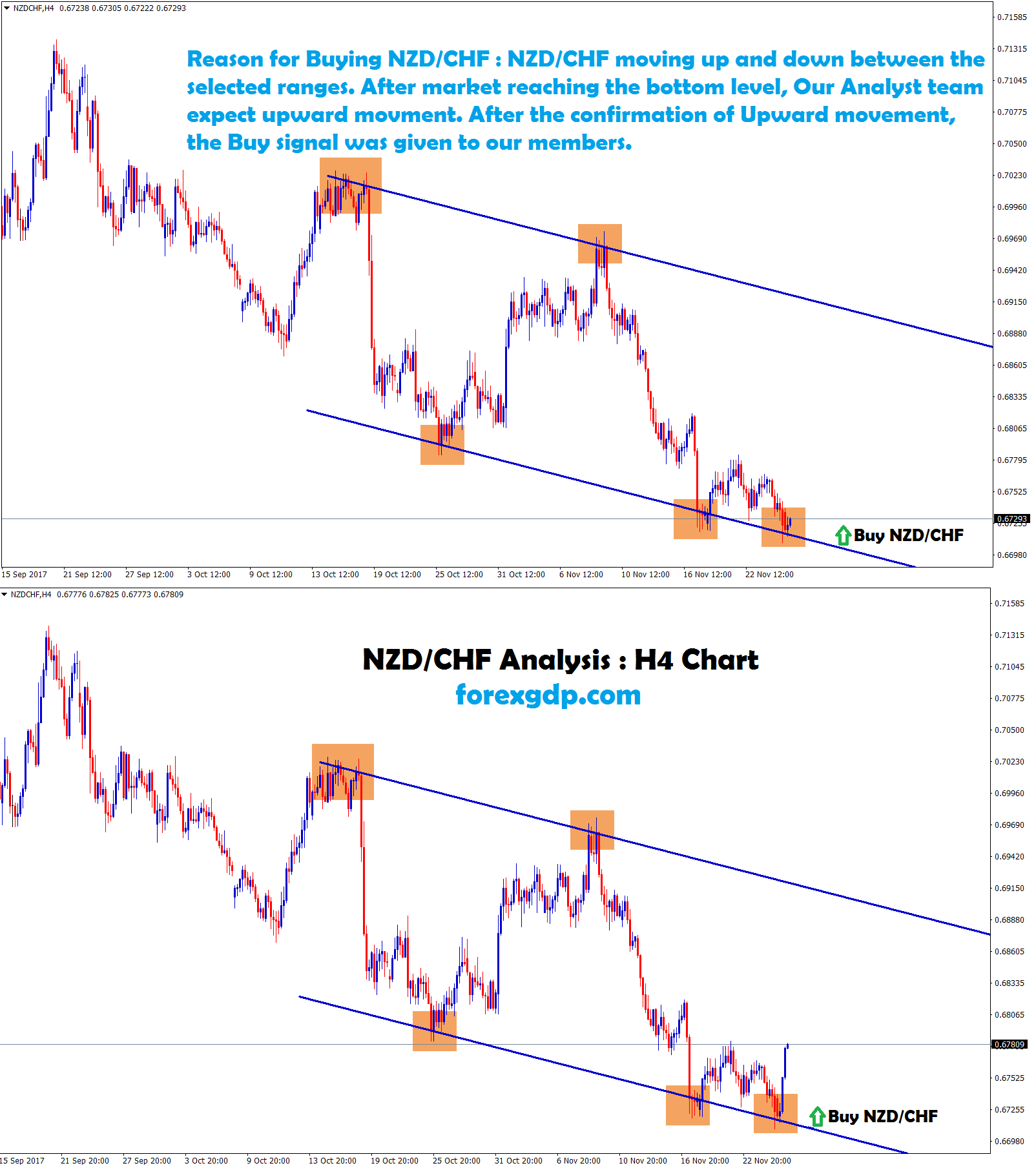

New Zealand Dollar: Travel restrictions not lifted

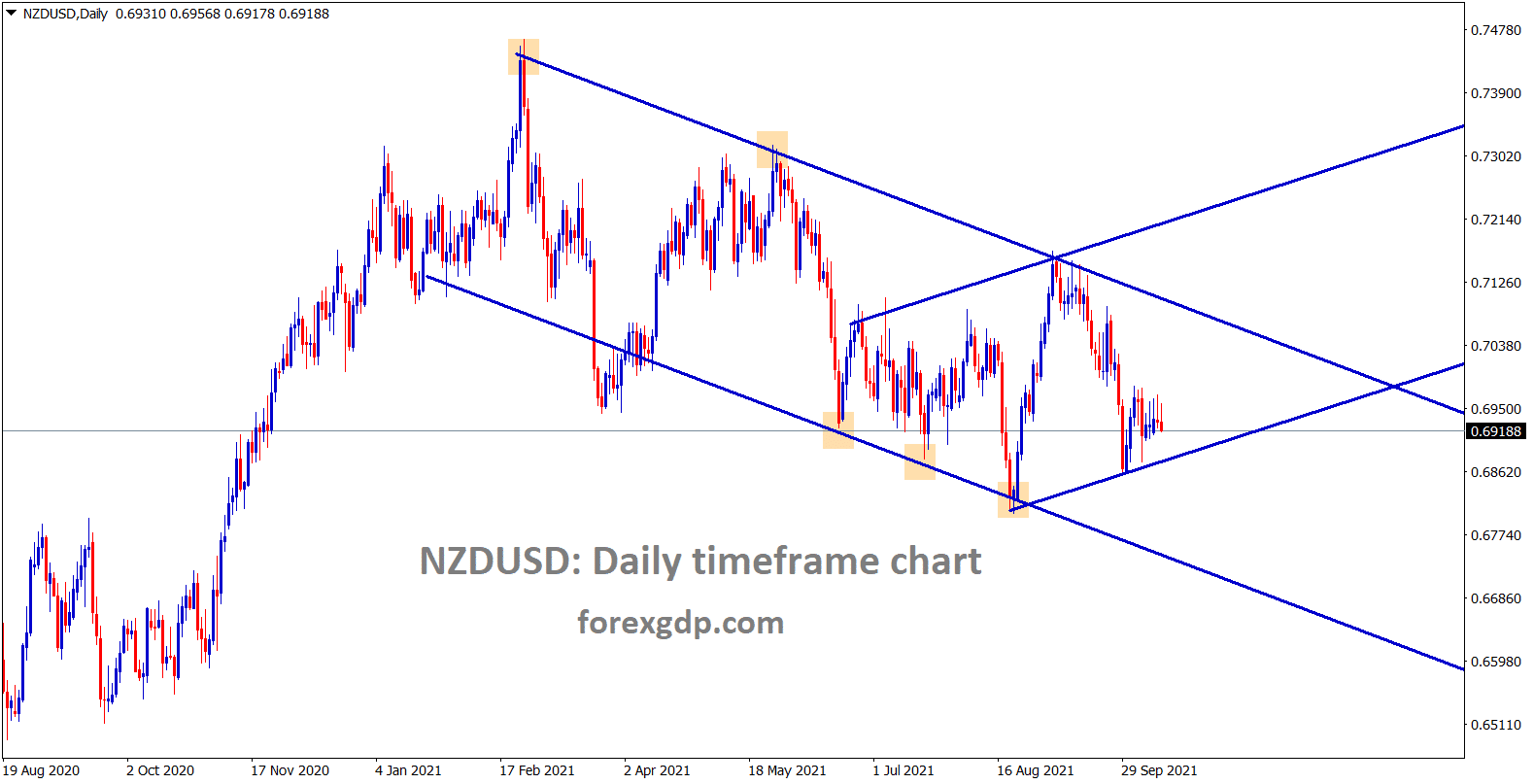

NZDUSD is consolidating at the smaller price range.

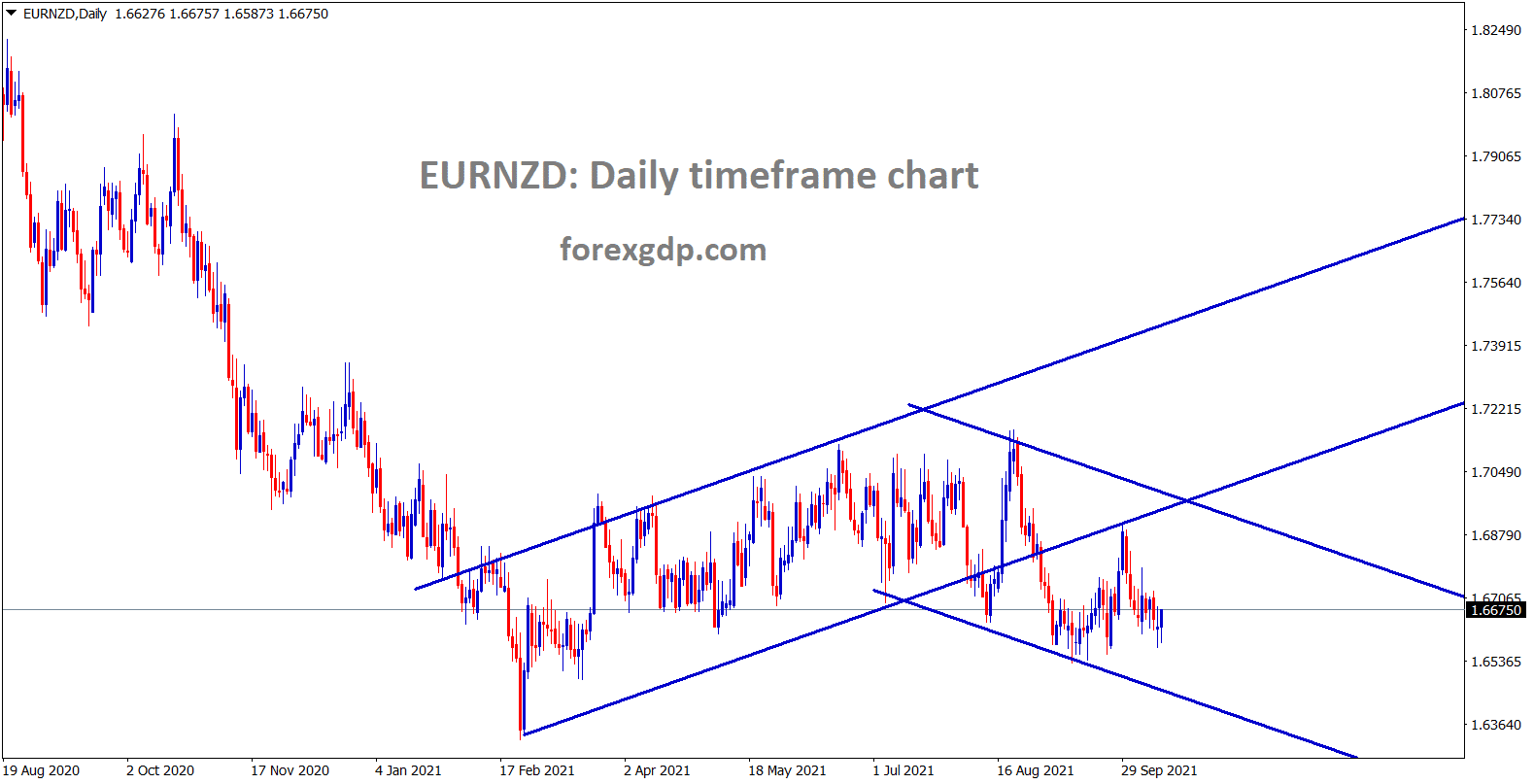

EURNZD is moving in a channel ranges.

New Zealand Dollar keeps higher as New Zealand PM Jacinda Ardern announced one more month lockdown extension for Auckland Main population city.

And Travel bans are still not been removed from New Zealand Government, and There will be one more rate hike in the next meeting by the end of 2021.

New Zealand Tourist Visits revenue slowdown by the lockdown of travel ban and restrictions from Outstations.

Australia allowed neighbouring nations to travel and outstation people to visit if Two doses of Vaccination were completed.

Now Covid-19 crisis slowdown and Surging Energy crisis in Global level.

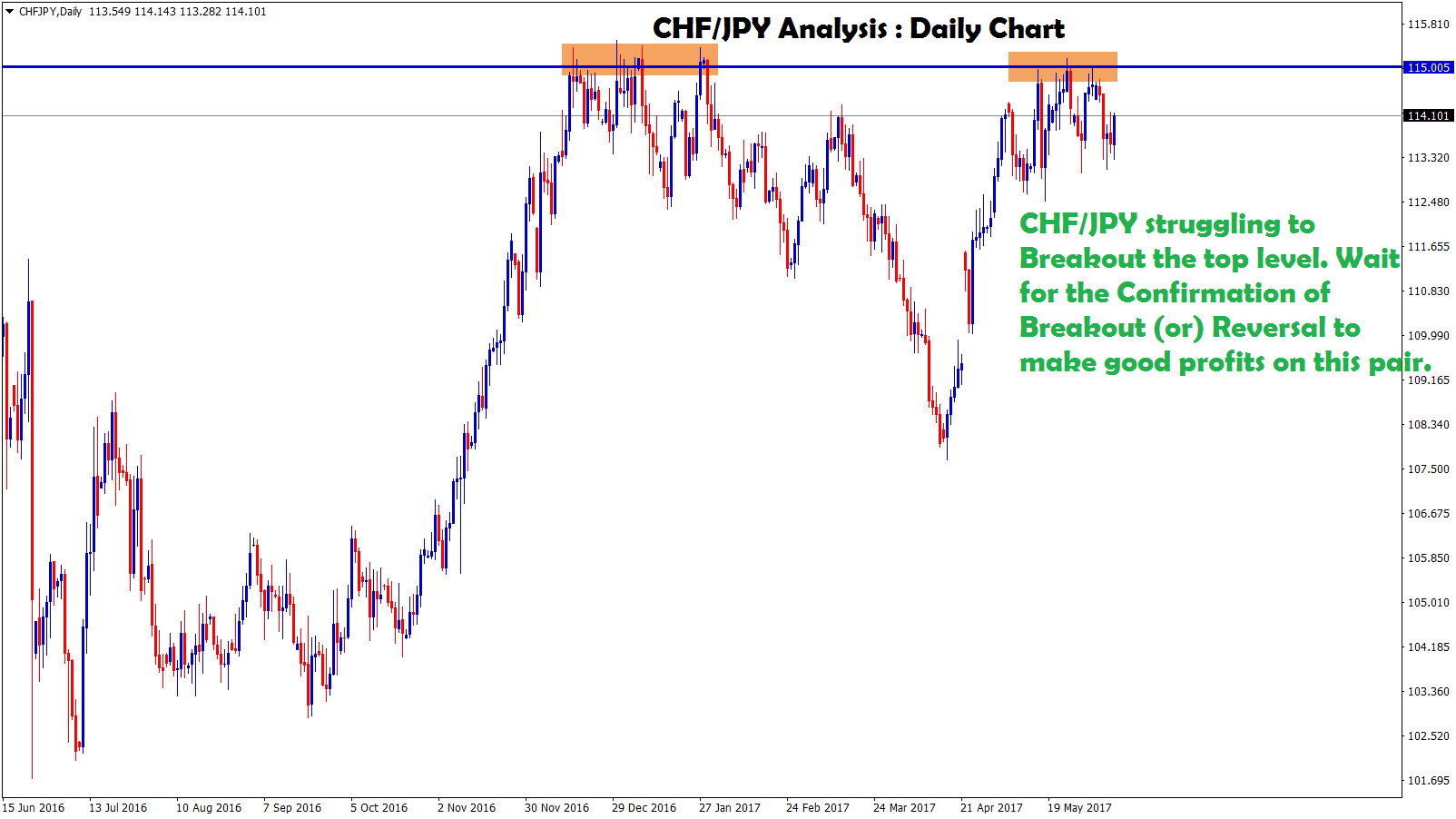

Swiss Franc: Swiss made higher after Japan economy slowdown

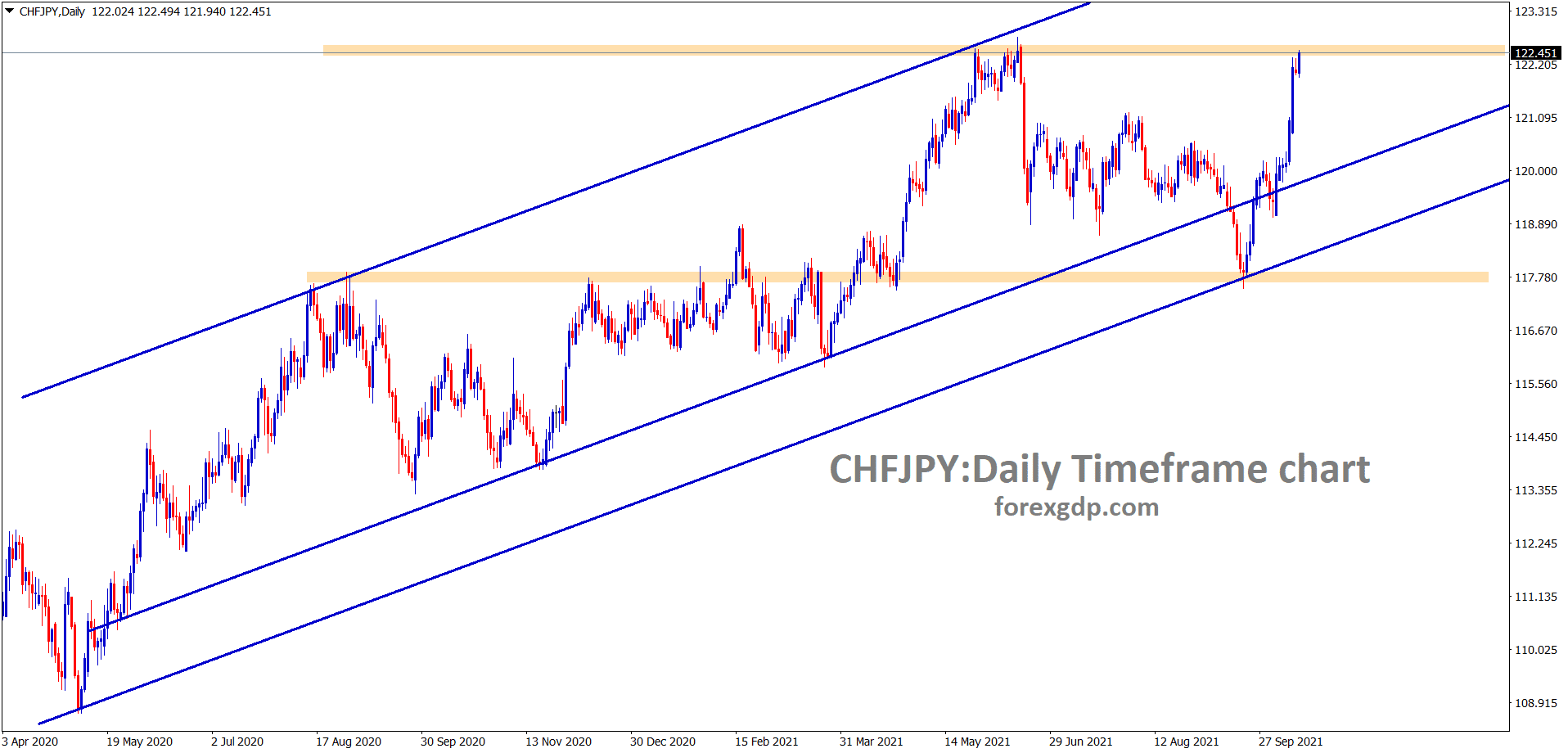

CHFJPY hits the resistance area again – wait for breakout or reversal.

Swiss Franc played high as 5% increased from September mid-level to today.

CHF had a massive surge against the Japanese Yen after Japan’s political improvement, Energy crisis and the Covid-19 vaccination slower rate.

And US Dollar keeps higher against the Swiss Franc as US Domestic data performing well in the last six months.

US Employment data shows mixed bag in last week, But Today FOMC meeting minutes make sense of Tapering outlook in upcoming next meeting.

And SNB makes any Forex intervention if Swiss Franc makes higher day by day to control.

China Evergrande crisis makes investors protect money to safer currencies like CHF, So Swiss Franc makes higher against Japanese Yen.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/