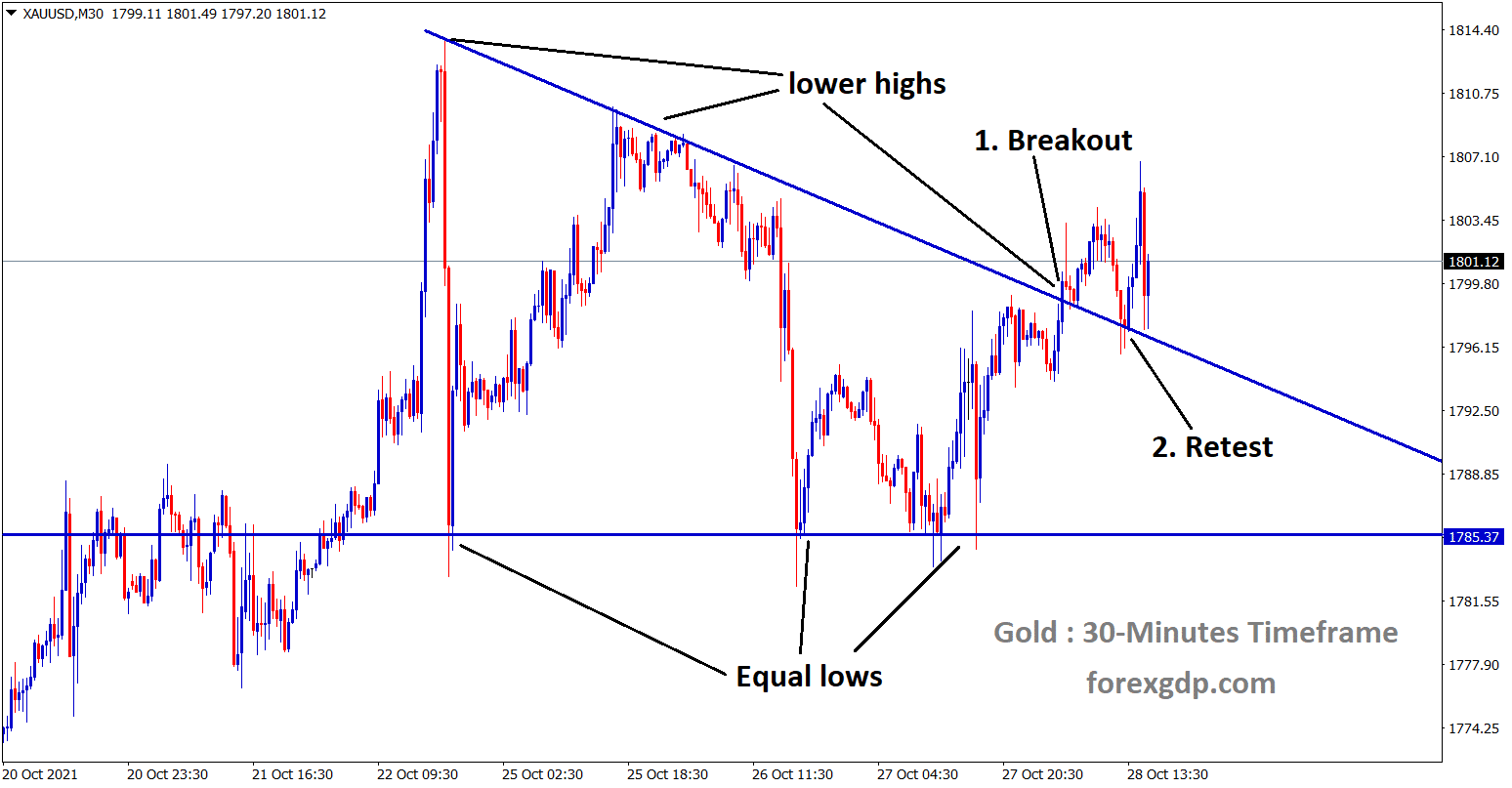

Gold: US GDP Prices forecast

XAUUSD Gold price has broken the top – lower high of the descending triangle pattern and now market has retested the broken level.

Gold prices remain lower as US Domestic data performed well, and FED Powell plans to taper at the end of 2021.

Gold prices remain lower as US Domestic data performed well, and FED Powell plans to taper at the end of 2021.

And Annualized economic growth is expected to down as 2.6%from 6.7% in the previous quarter.

Today US GDP data makes the Direction of US Dollar and Gold as all expected.

China Crisis of real estate, Covid-19 and Energy makes Less demand on Gold.

And US Dollar makes a more robust move as US Domestic data shows healthier numbers this week.

Rising inflation reading is transitory as FED Forecasts and Mostly down in late 2022 or starting of 2023.

US Dollar: FED planned for tapering in November meeting

USDCAD has reached the 61.8% retracement area – Recently market rebounded twice after hitting the 61% retracement level.

US Q3 GDP data scheduled today, US and China fear on Taiwan pending issue, and talks are progressing.

And US Trade balance set to lower than expected, and US Durable Goods dropped lesser than expected.

And now US Dollar waiting for US GDP data and FED Meeting next month on November 3rd.

The spending bill of $1.5 trillion likes to pass in this week as all hopes.

And Bank of Canada announced the end of tapering, and the UK cut its bond issuance, so this time the US is ready to cut its bond purchases.

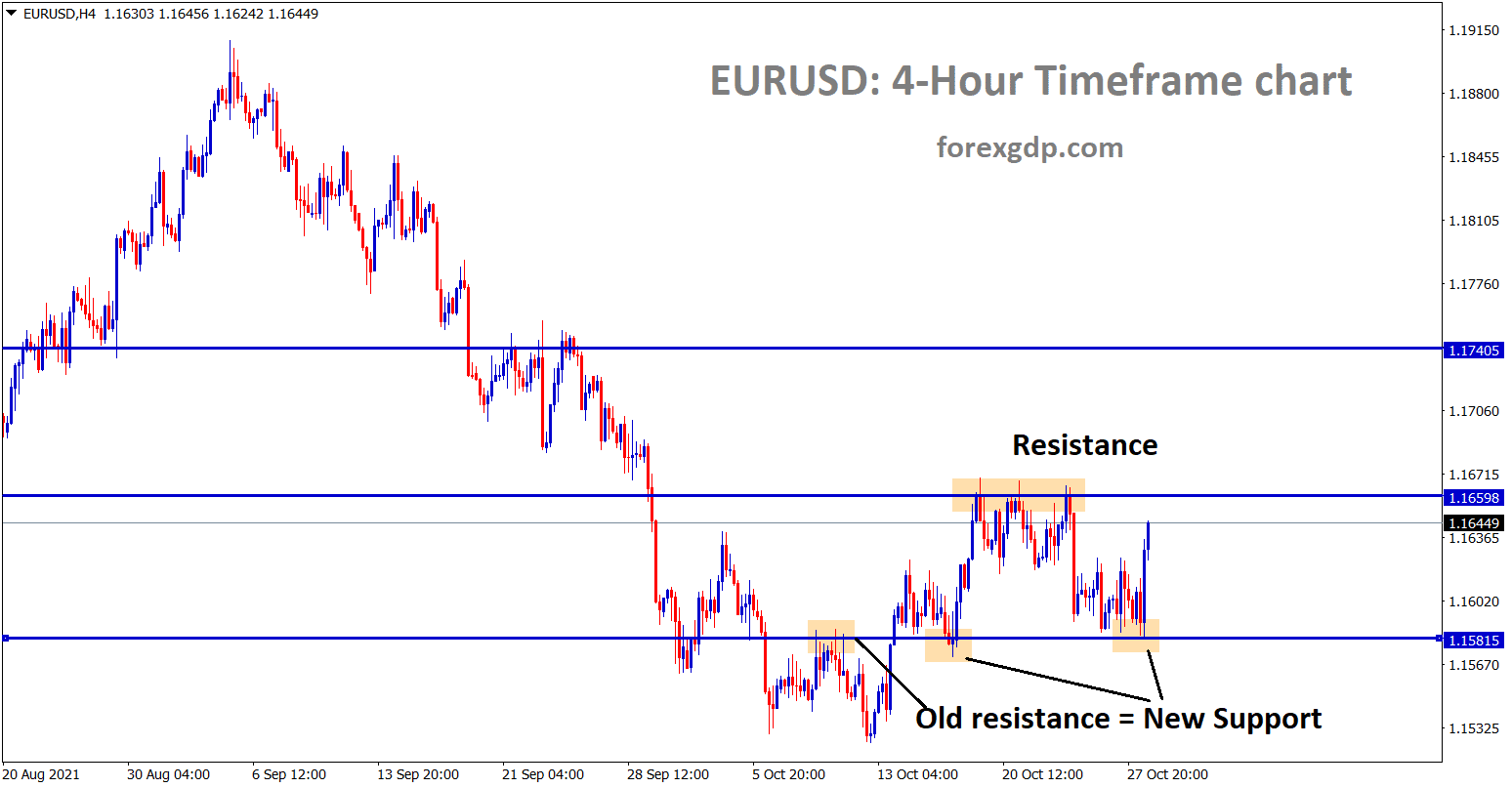

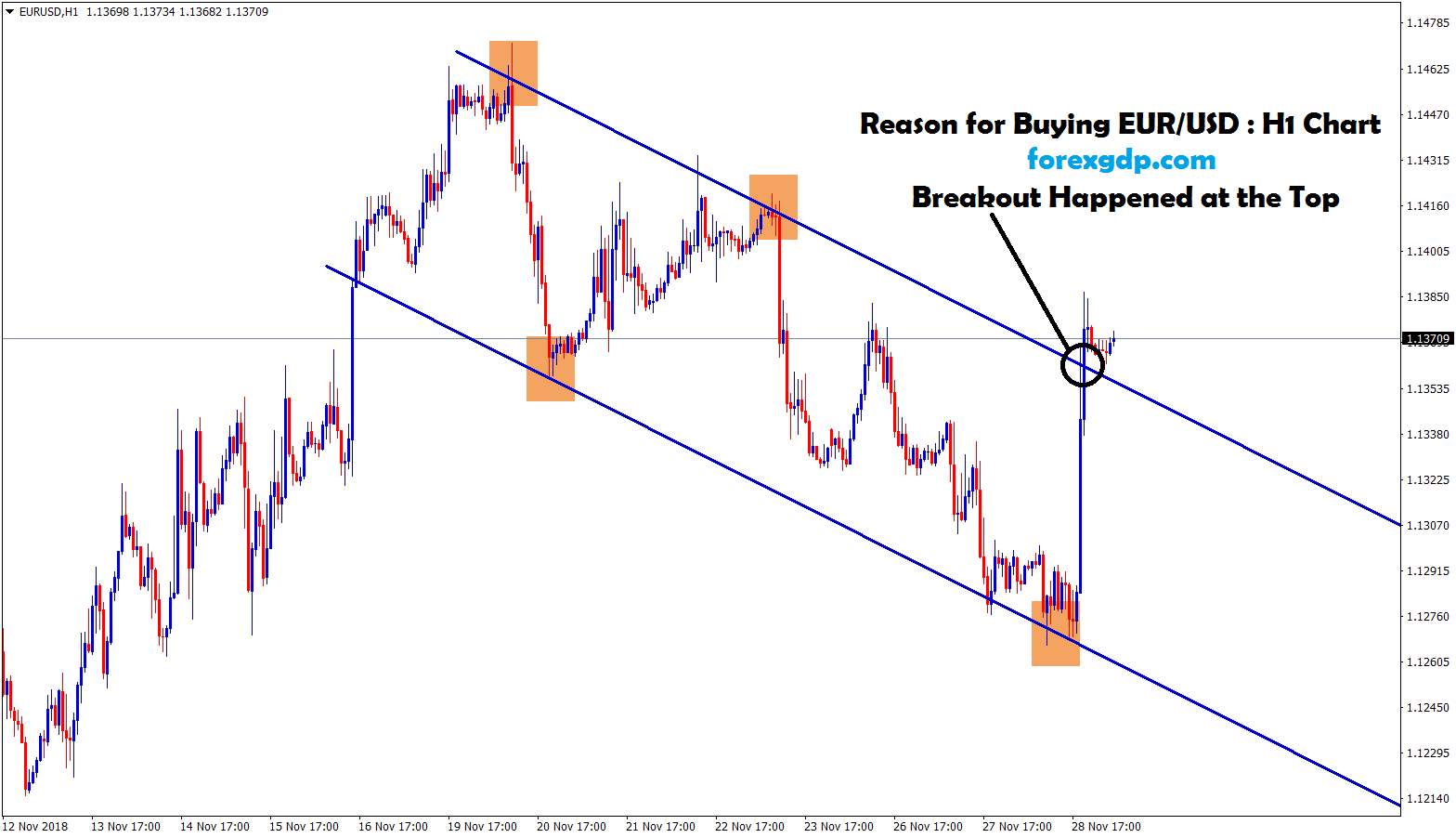

Euro: ECB meeting forecast

EURUSD is moving in a consolidation mode and the price is moving between the resistance and support area.

Eurozone Q3 is moderate, and coming Q4 may see the same type of modulations from ECB actions on inflation looks transitory only not to panic.

And ECB Forecasts of inflation reading came down to 1.7% in 2022 and 1.5% in 2023, which is below the 2% target level.

Today ECB meeting involves no more changes are expected still as no outlooks are determined.

Once FED and Other central banks go for tapering, then ECB will do tapering in the Eurozone.

![]()

In Eurozone Germany faced more industrial down pressure due to semiconductor shortages.

But in the Eurozone, Inflation keeps 3.4% above 2% Goal, and ECB makes more patience handling inflation.

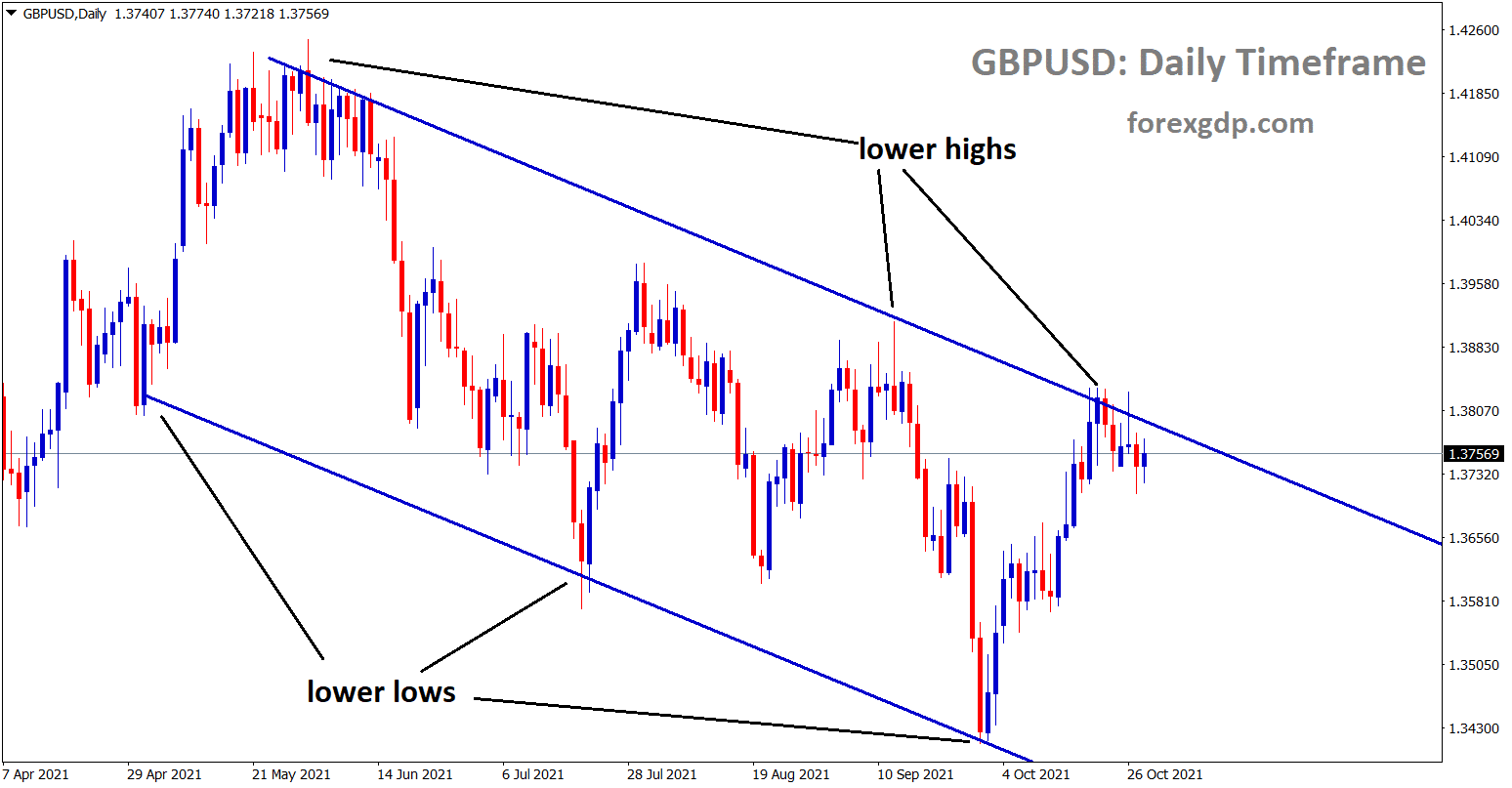

UK Pound: UK Budget makes no sounds to market

GBPUSD is moving in a descending channel – market is standing at the lower high area of the channel.

Yesterday UK Budget made no sound to markets, and Chancellor Rishi sunak presented a Budget that benefitted some alcohol companies of tax benefits.

After this news released UK Pound made no moves against US Dollar.

And today ECB meeting is scheduled, inflation is 3.4% in the Eurozone above the 2% target of the Eurozone Goal.

So EURGBP makes further weakness in the market if ECB does not do any tapering plan or rate hike in today meeting.

And Post-Brexit deal in Northern Ireland Protocol is more severe than we thought, UK steady as its rights on NI protocol.

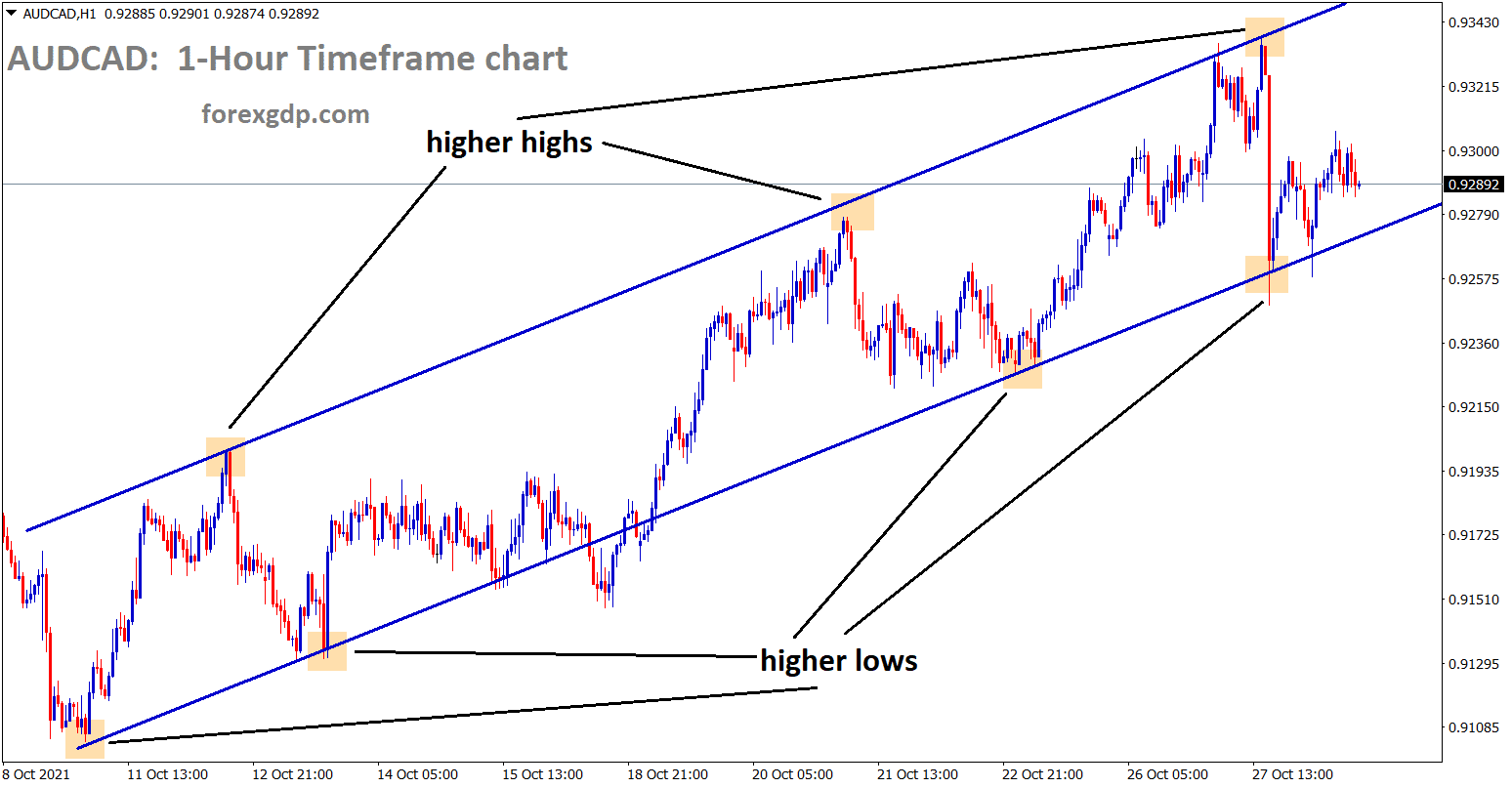

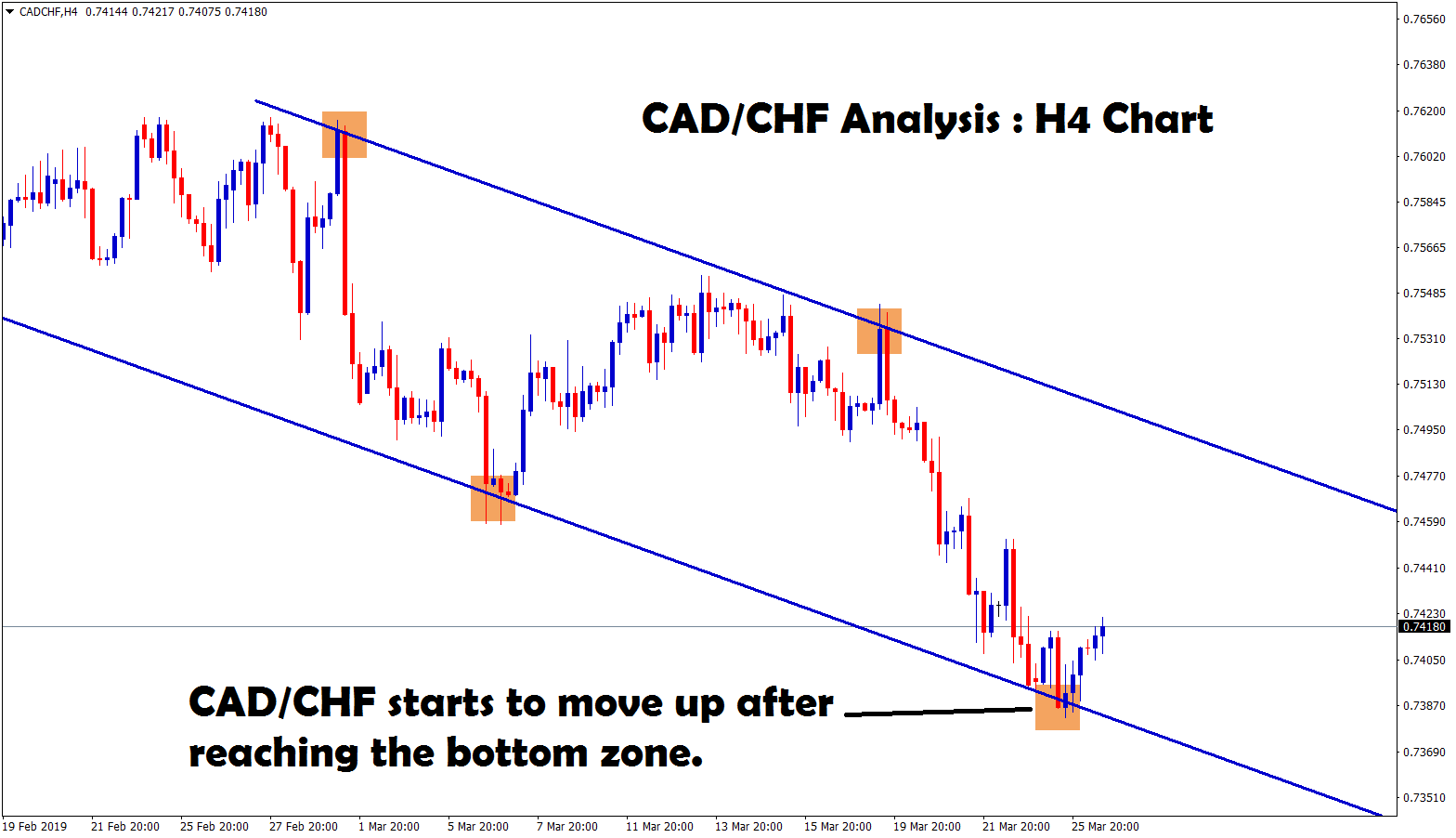

Canadian Dollar: Bank of Canada left interest rates unchanged

AUDCAD is moving in an Ascending channel for a long time. Now the price is rebounding from the higher low area of the ascending channel line.

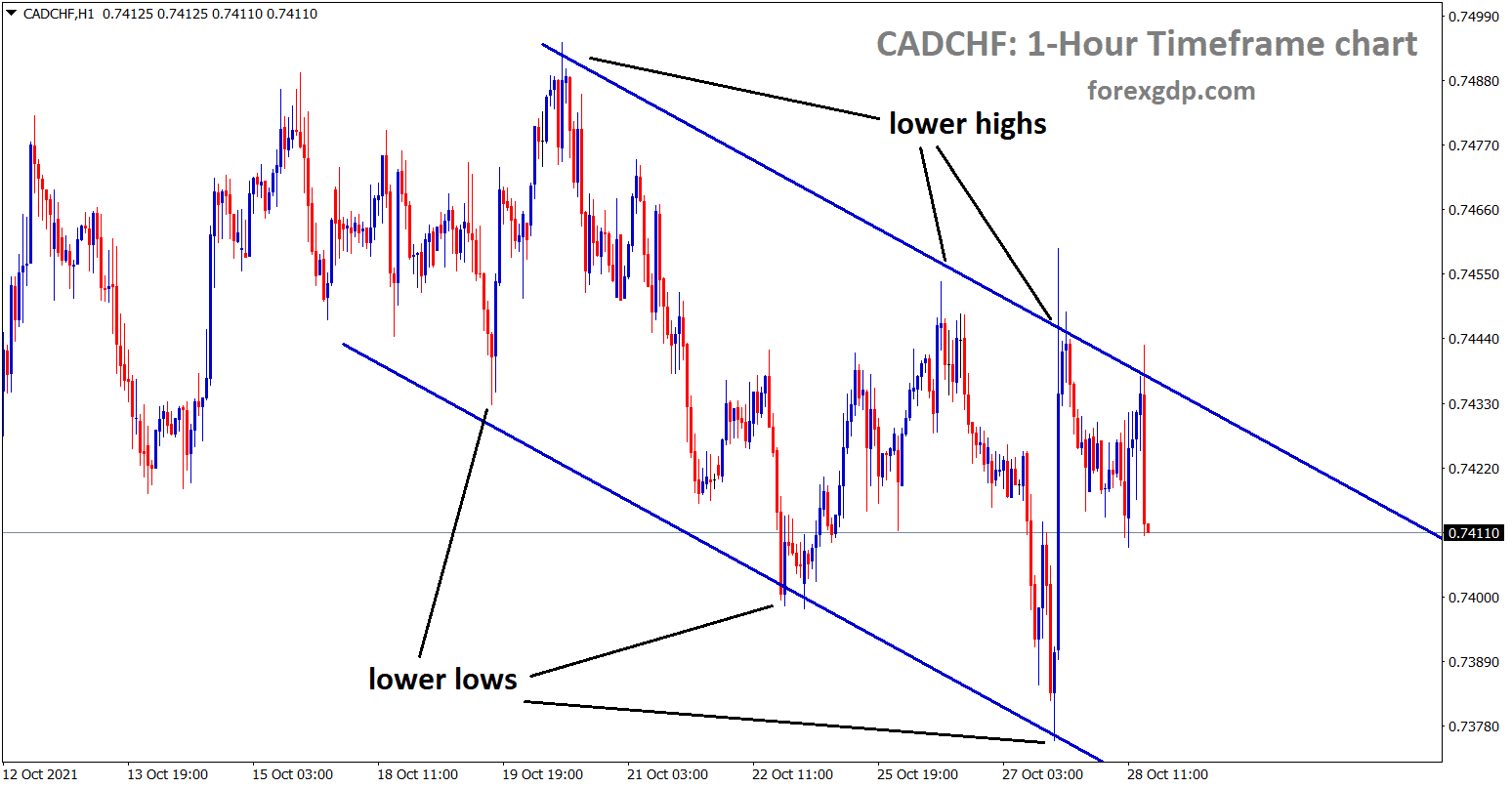

CADCHF is moving in a descending channel and falling now from the lower high area of the descending channel line.

Crude oil prices slipped lower as yesterday more supplies readings from WTI in US Oil market.

EU and Iran planned for Oil transactions in the next month due to more Oil demand in Eurozone.

And the US Have to remove sanctions from Iran, which were imposed in Trump’s period; now, Biden maybe supports for Global demand to release Iran sanctions.

If approved by the US, then Oil market once again meets in the normal range from a higher high level.

And Yesterday, the Bank of Canada left interest rates unchanged, and no tapering was done.

Canadian Dollar met a higher high before the news was released, but it stayed calm in the market after the announcement.

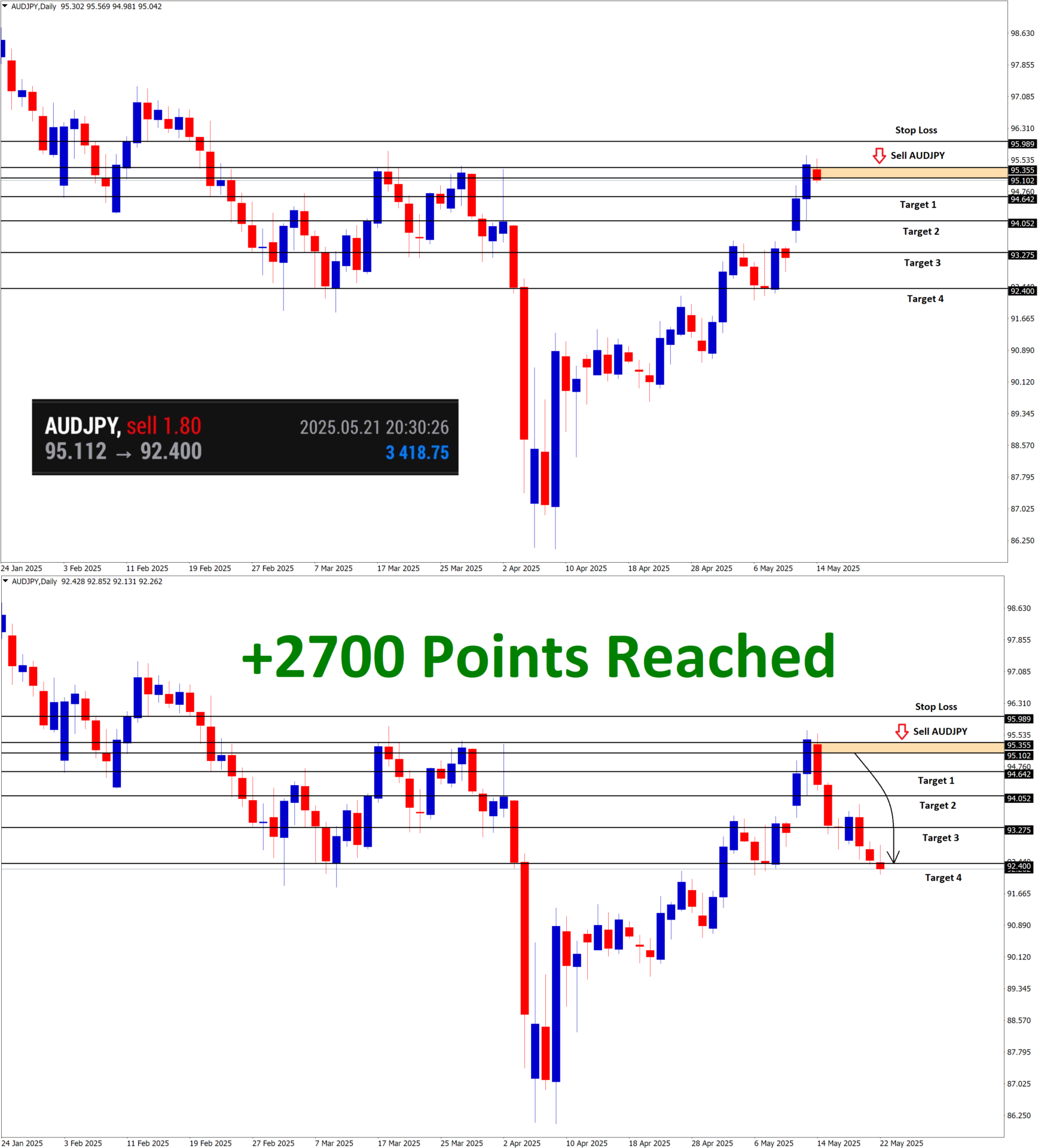

Japanese Yen: Bank of Japan left rates unchanged

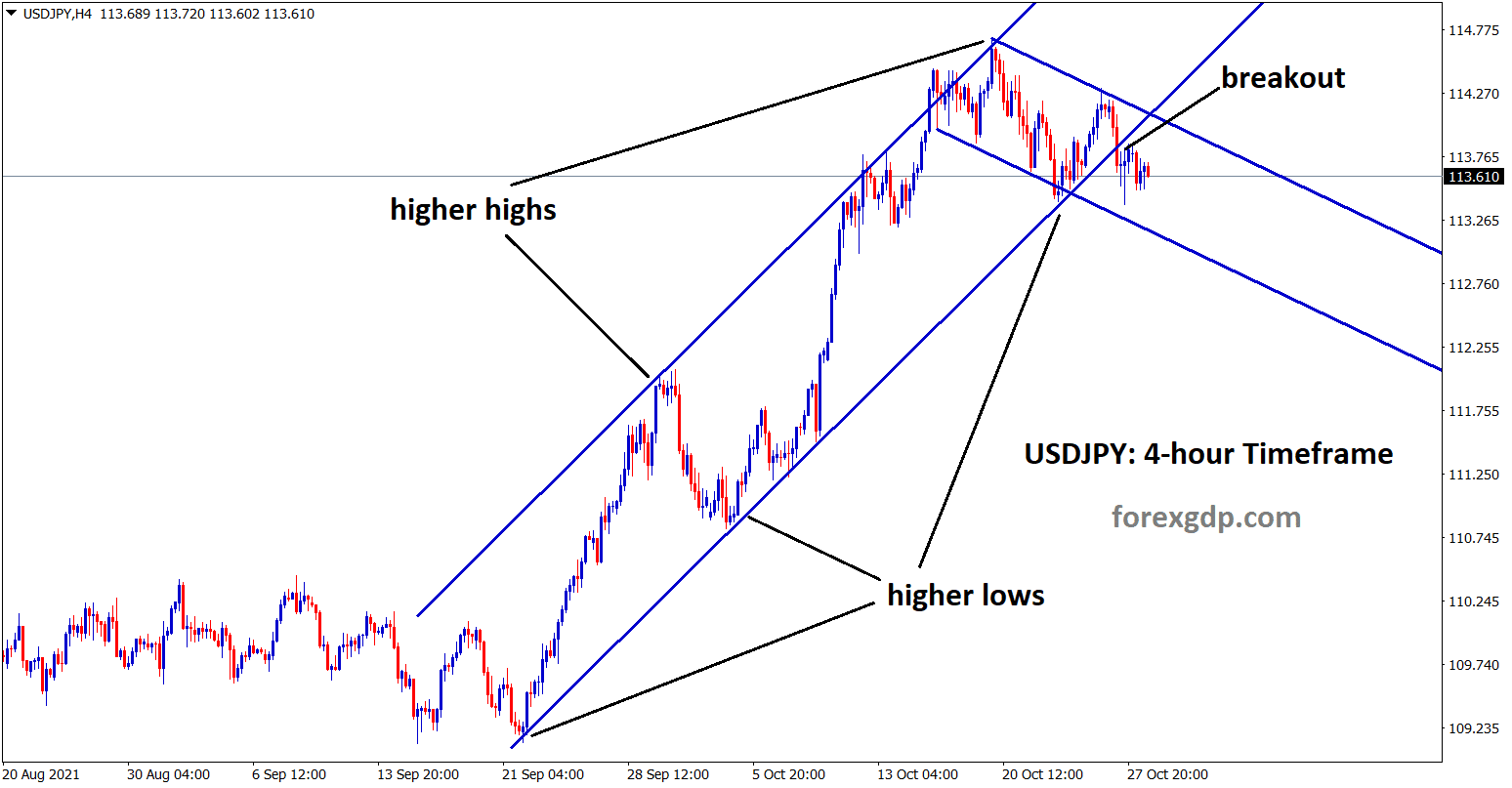

USDJPY has broken the bottom – higher low area of the major ascending channel and now the market is moving in a minor descending channel

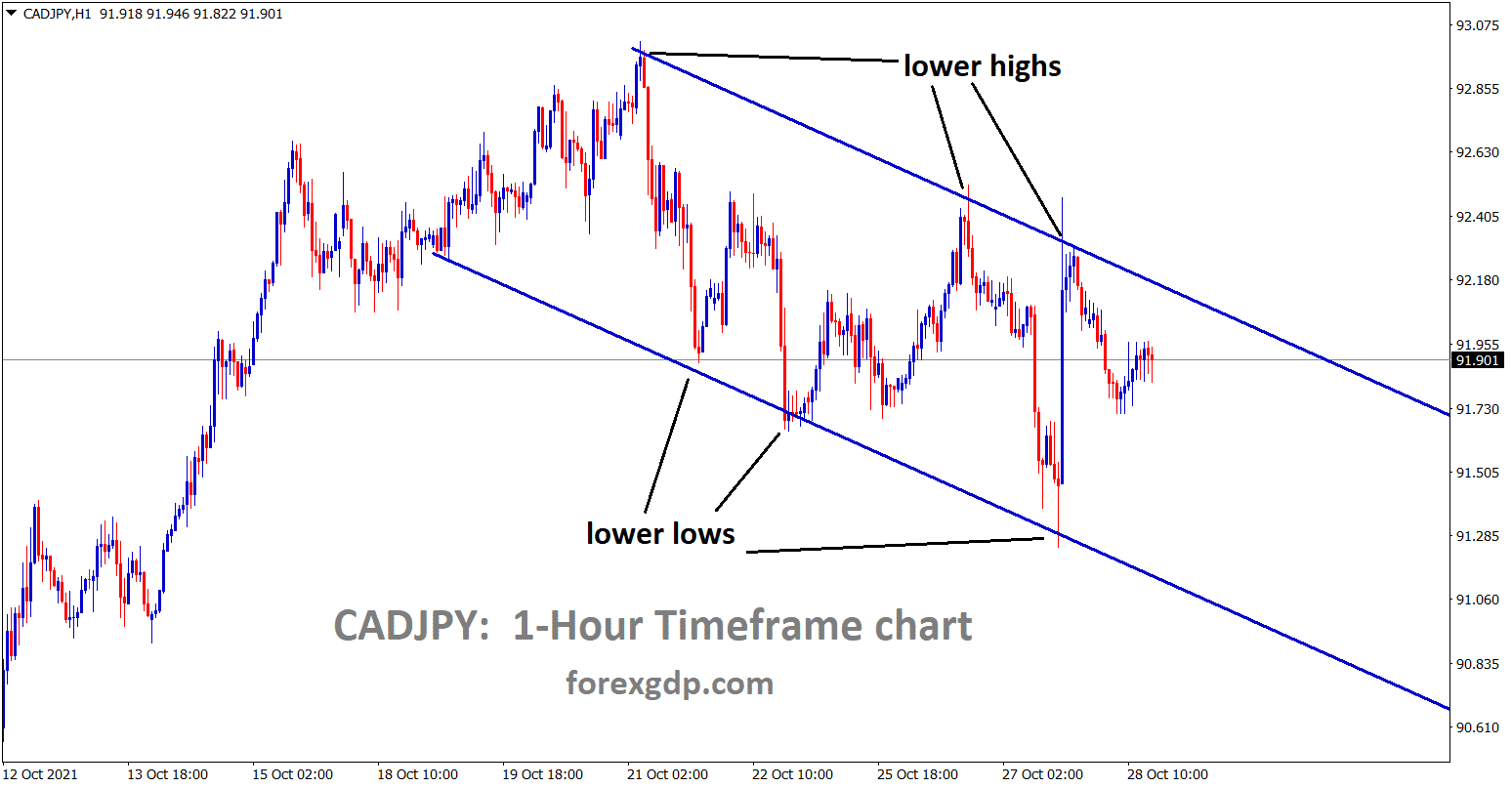

CADJPY is moving in a descending channel and falling from the lower high area of the channel

Bank of Japan left rates unchanged at -0.10% and kept the 10-year JGB Bond rate at 0% as Japanese members voted 8-1 today.

And Japanese Core CPI shows 0.0% versus 0.6% forecasted, and the Japanese GDP arrived at 3.4% from 3.8% expected.

More lockdowns and lower stimulus approaches formed GDP to lower, and the Manufacturing sector was affected with Chips shortages for Automobile spares.

And in the Coming quarters, we can see the Japanese economy recover by Japanse Government Stimulus.

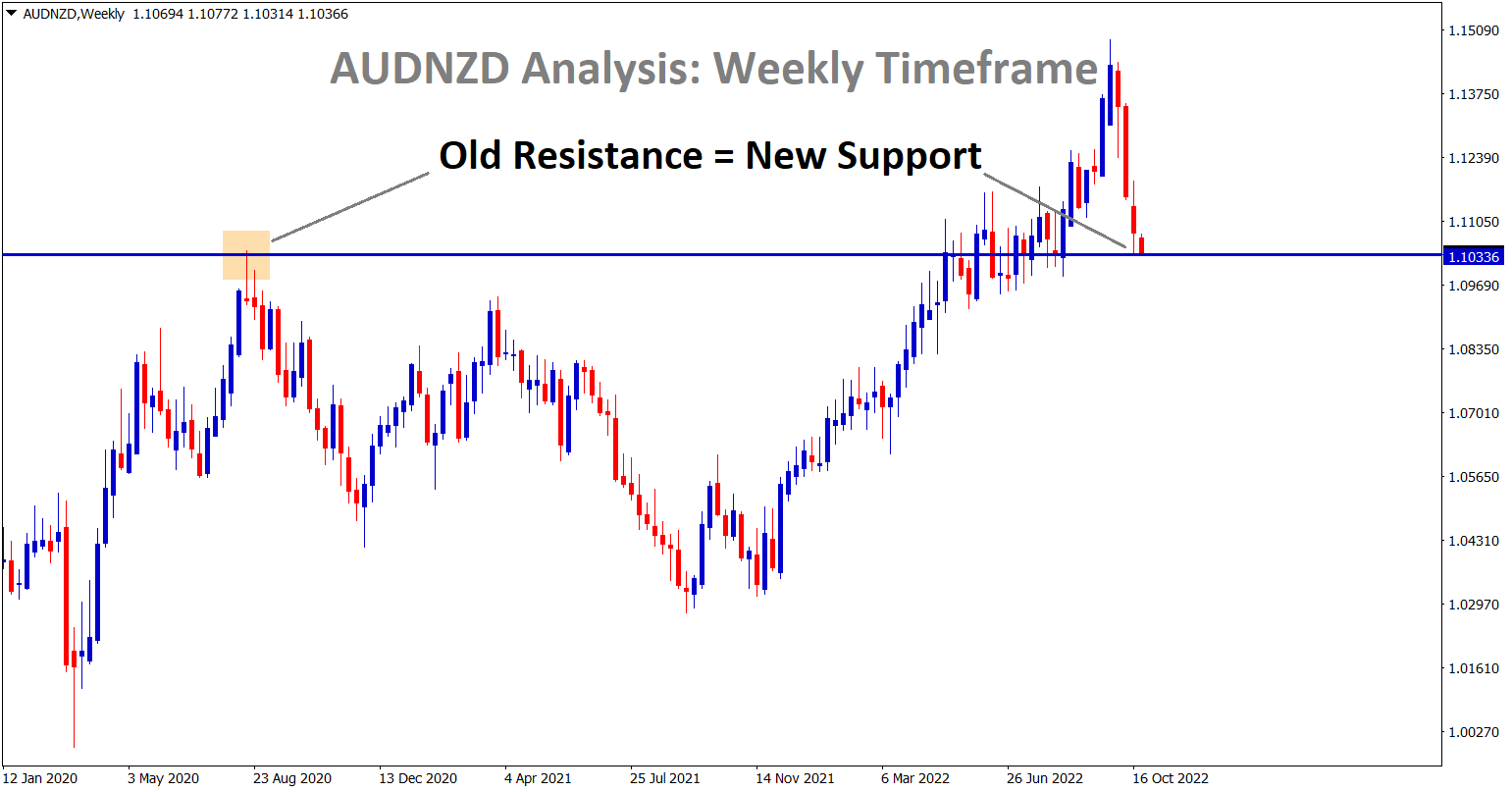

Australian Dollar: 10yr Australian Bonds spread widens

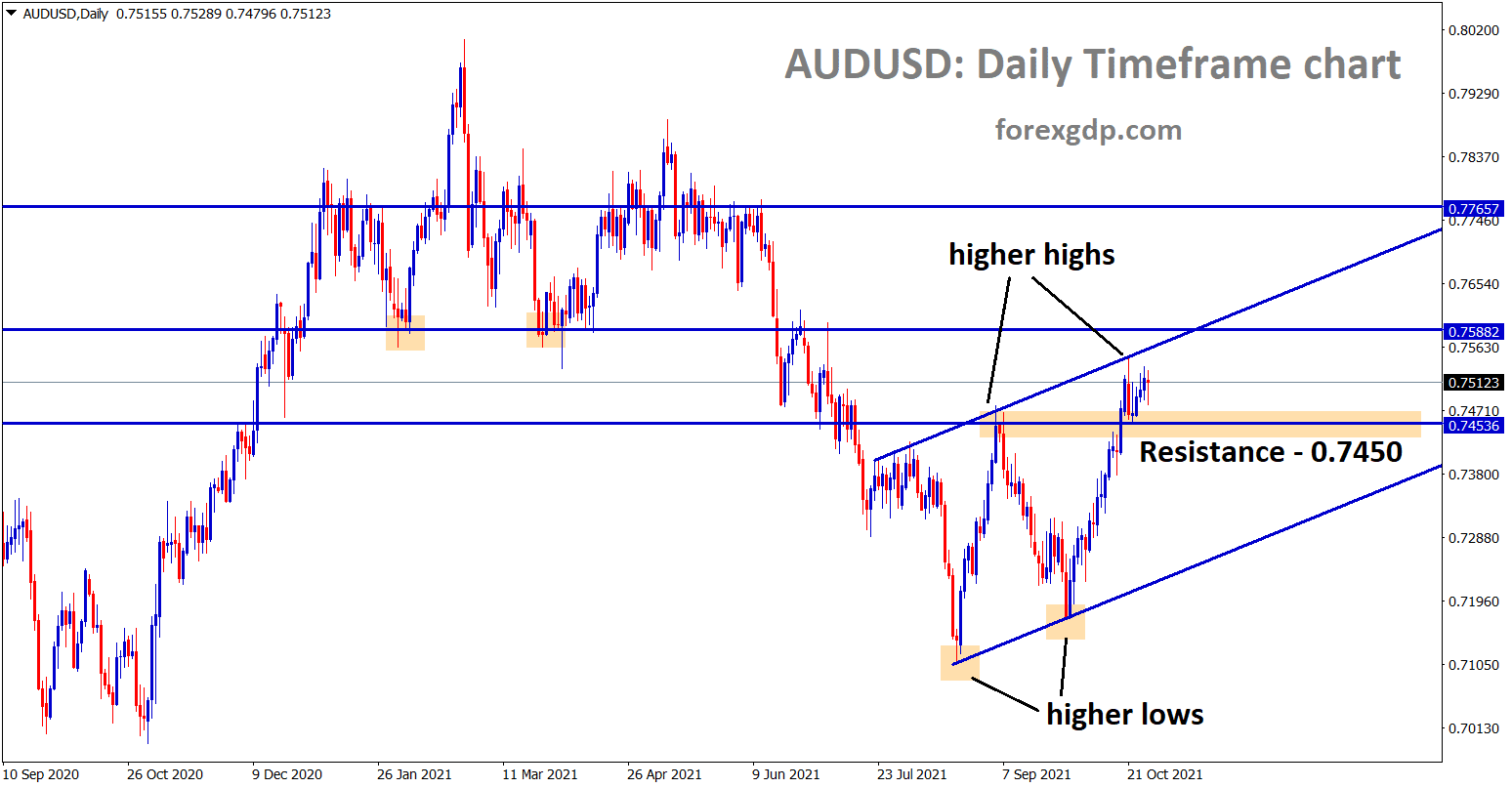

AUDUSD has broken the recent resistance 0.7450 and standing now at the higher high area of the ascending channel

Australian Dollar gains as Australian 10-year bond yields rise over 1.9% and Government bond spread widened to 30 basis points Favours for Australian Dollar.

And Russian President Putin said more gas supplies to Europe until demand satisfied.

RBA monetary policy setting is scheduled for next week; if any tapering happens, the Australian Dollar will pressure upward.

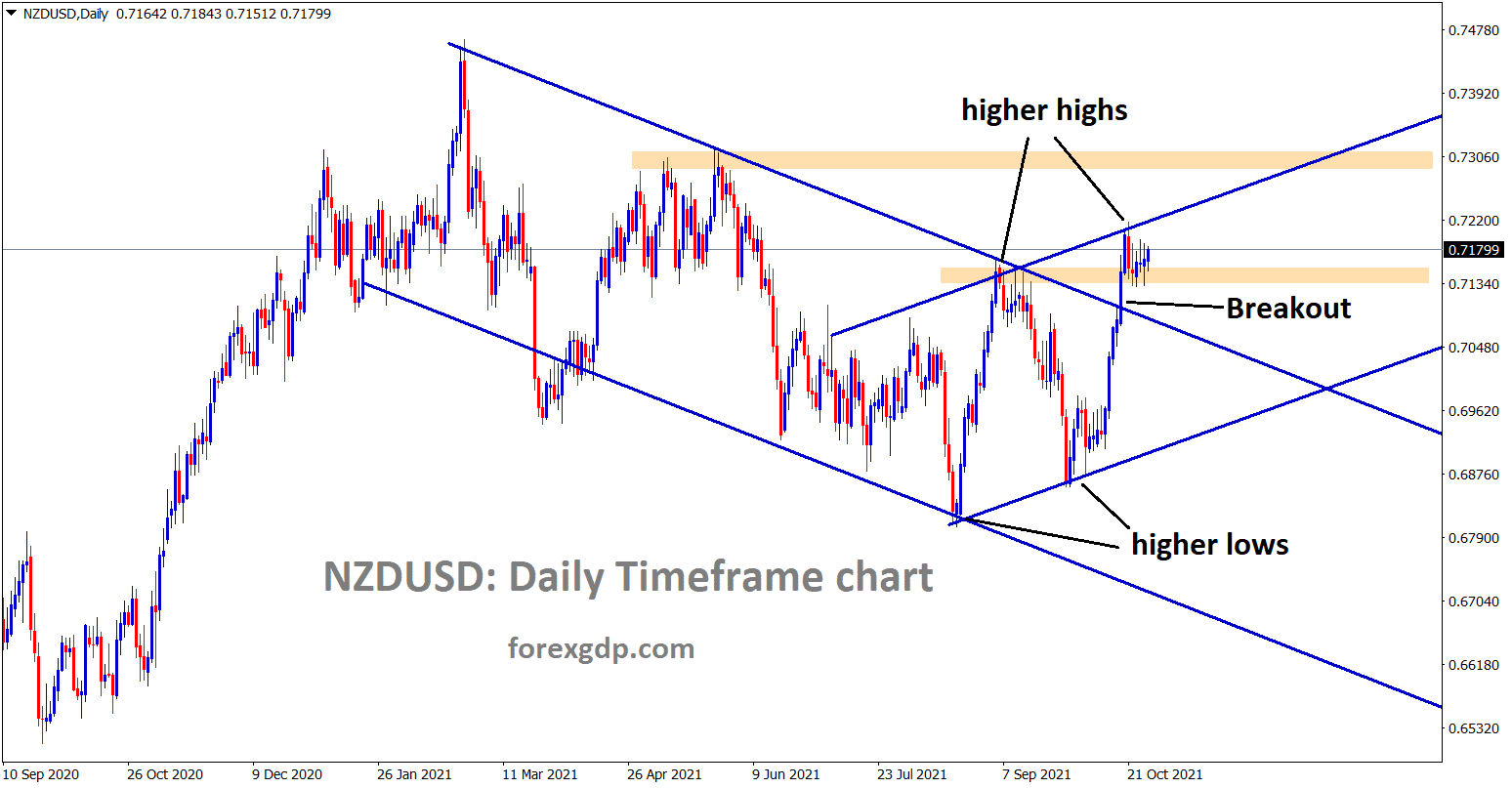

New Zealand Dollar: Inflation expectations higher in New Zealand

NZDUSD has broken the major descending channel and now the price is standing at the higher high area of the minor ascending channel.

New Zealand yield spread ratio widens, and US FED is supported for Hawkish direction in the upcoming months.

The Rising inflation expectations in New Zealand makes compromised due to the Rates hike done by the Reserve Bank of New Zealand.

And another rate hike is expected in the next meeting to compensate inflation becomes higher next year.

Today US GDP data is set to be released, and if any positive numbers, it will reflect in New Zealand Dollar against US Dollar.

Tourists are allowed in next month

New Zealand Covid-19 minister Chris Hipkins said that fully vaccinated travellers are approved to visit New Zealand from next month.

And the quarantine period for tourists was decreased to 7 days from 14 days period.

And also stated that We should be more cautious about allowing abroad travellers to New Zealand since vaccination has low numbers.

Delta variant is now decreased in New Zealand as restrictions tightened in the last 3 months.

So now, more precautions have been taken to allow travellers to New Zealand under a quarantine period of 7 days.

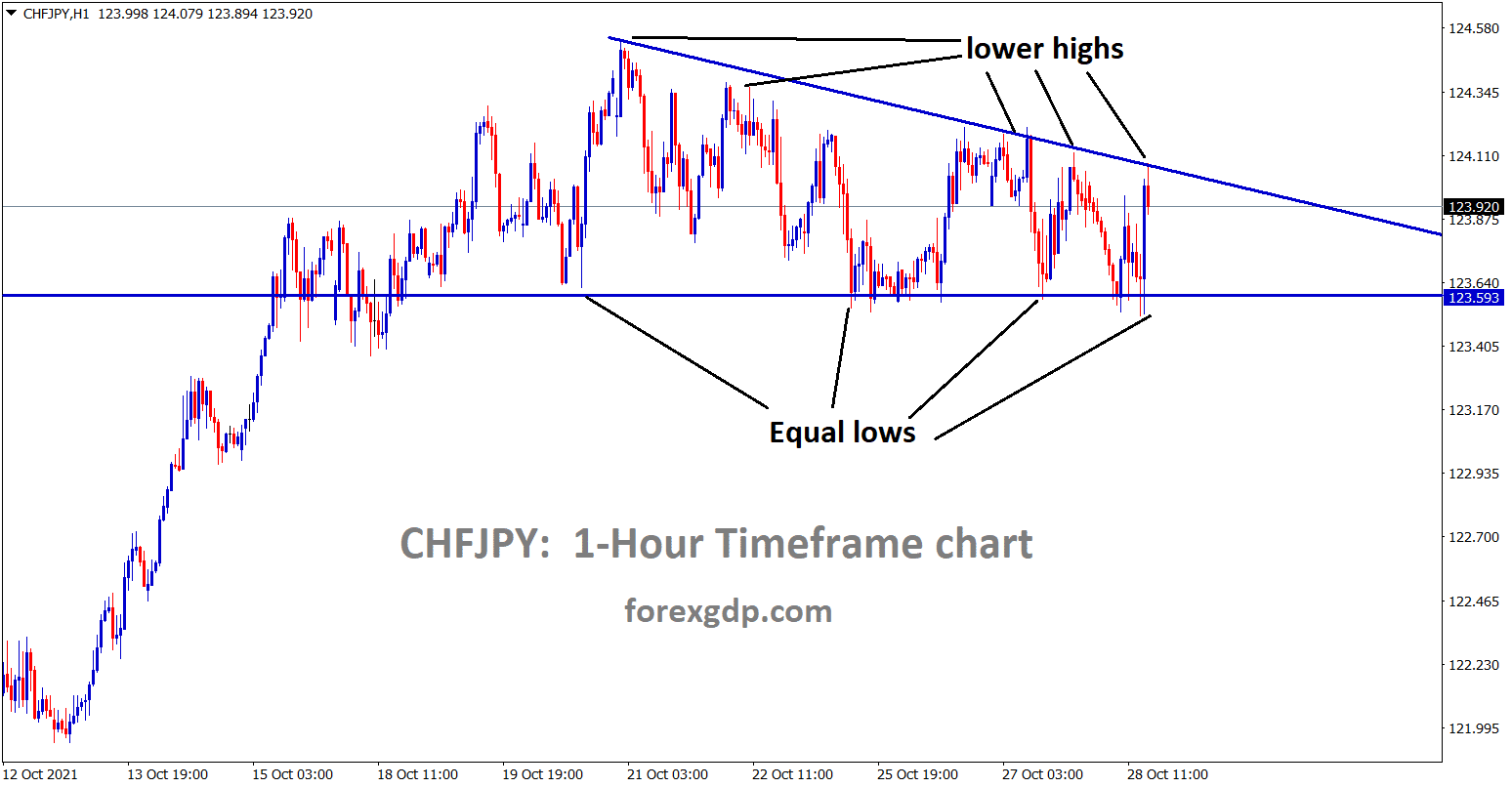

Swiss Franc: SNB member speech

CHFJPY is moving in a descending triangle triangle pattern.

SNB member Andrea Machler said pile of Swiss Francs to invest in more stocks involved in indexes rather than Coal mining companies.

And Many environmentalists said SNB to invest in the green energy sector, but SNB is not making a goal of World greener.

We have to plan for slowing the appreciation of the Swiss Franc by FX interventions and slowing the Swiss Franc purchases.

To maintain monetary policy settings, Swiss France must be stable.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/

I enjoy your signals and anylises. They help me understand more about FX