Forex vs Crypto trading is one of the most asked questions among individual traders. As individual retail traders, most of them are looking for big profit potentials in both forex and crypto trading. Which one is really the best market to invest in the long run for making a huge chunk of money in your retired age? Let’s see it with step by step comparison.

FOREX

While travelling to another country, you probably would’ve exchanged your local currency notes for those of the country of your destination. This interaction would’ve made you perform forex trading without even realizing it! The term forex stands for foreign exchange. In simple terms, forex trading refers to the exchange of one currency for another.

The main aim for forex trading is to predict if the value of one currency will increase or decrease compared to the other. You will make these predictions by looking at a number of external and internal factors. You will then buy and sell these currencies according to your predictions in hopes of making a profit.

CRYPTO

Like the name suggests, cryptocurrency is a form of digital money. This is a type of currency which does not have any physical form and is only available for use through digital means. Cryptocurrency is becoming a widely popular method of payment in recent years and has proved to be very beneficial due to its high value in the market place which is consistently increasing.

Unlike forex pairs which all act as a regular mode of payment, certain cryptocurrencies are created for specific purposes instead of being used to buy anything. We’ll dive into more detail on their purposes below.

ASSETS AND THEIR PURPOSES

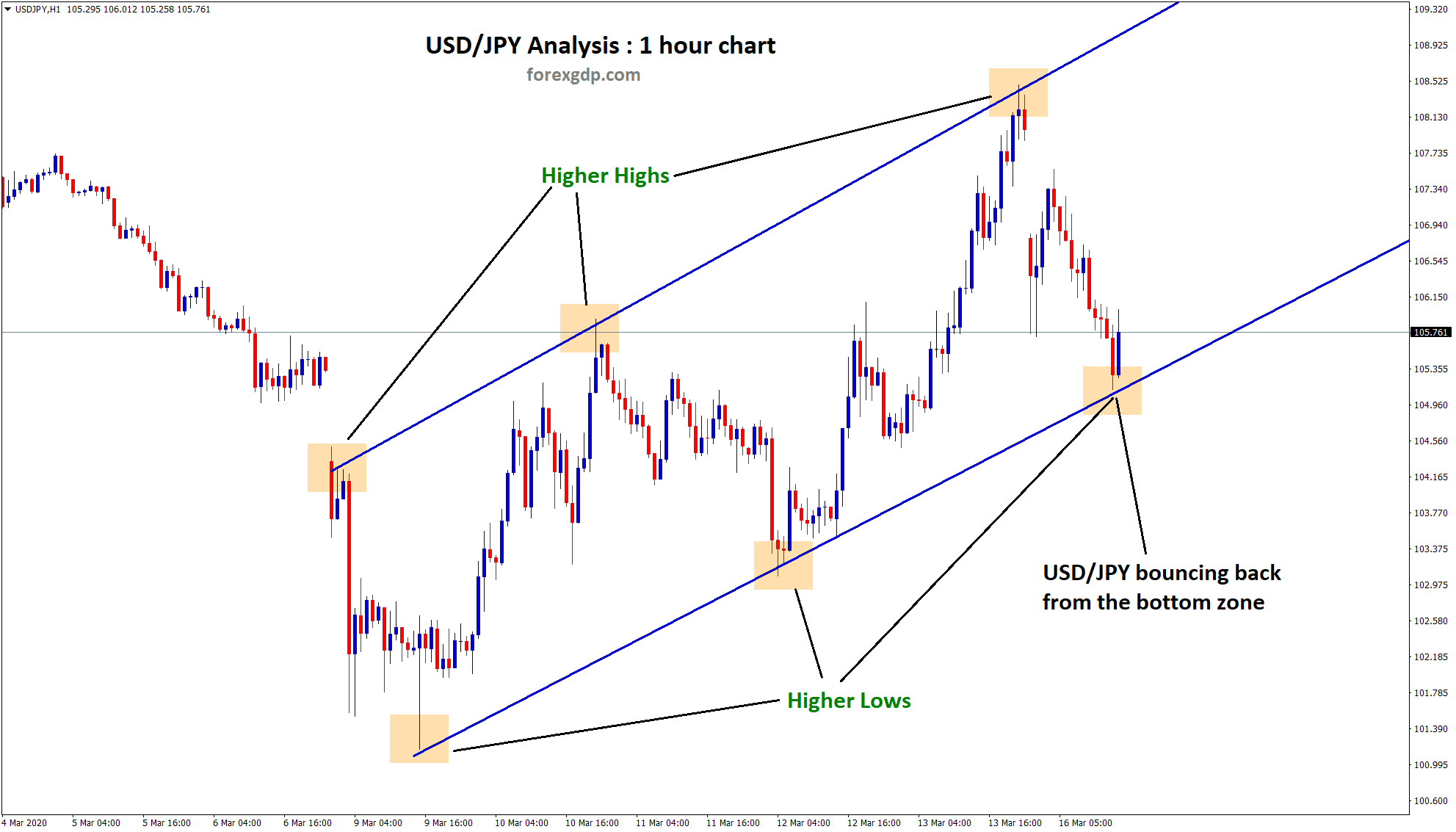

A forex investor can trade in generally any currency in the world. However, not all currencies are available with most brokers. The most commonly traded currency pairs include EURUSD, GBPUSD, USDJPY, EURGBP, USDCAD, USDCHF, NZDUSD, AUDUSD.

A recurring theme we can notice with these popular forex assets is that almost all of them have USD as their base currency. This is because USD is the biggest currency in the world, both online and in reality. This is also because it’s movement is one of the most easily trackable with generally any news on it being documented immediately.

Forex currency pairs are generally a method of payment which can be used to purchase anything from a Starbucks drink to the payment to buy a house.

A crypto trader has access to over 14,000 cryptocurrencies that are up for trading. Some of the most popular cryptocurrencies include Bitcoin, Ethereum, Litecoin, XRP, and Dogecoin. Although there are generally a lot more cryptocurrencies than forex currencies that are currently on the market, most of the trades occur in Bitcoin. Most cryptocurrencies gain no recognition and end up foreclosed.

Different cryptocurrencies have different purposes. Bitcoin works in general as a method to be able to pay for anything anywhere. Ethereum on the hand only works for its own benefit. This means that people who buy Ethereum can only use it for tasks that it currently provides online and in reality.

MARKET SIZE

The forex market is the largest financial market in the world. It reaches daily trading volumes of $6.6 trillion. The forex currency pairs are all generally equally popular among traders and there is no certain pair that is dominating the forex market.

Despite being the largest financial industry in the world, the forex market only offers a small amount of currency pairs for trading if we compare it to the thousands offered by cryptocurrencies and other financial assets. This places them at a slight disadvantage as clients of the financial industry would be more willing to invest in something which provides more asset options. This can however also be seen as an advantage as having less assets provides a clean portfolio and makes it easier for the clients to choose from the assets already available.

The crypto industry reaches daily trading volumes of about $2.5 billion. The crypto industry offers over 14,000 assets for trading. These assets are not equal in popularity. Bitcoin dominates the crypto industry with 70% of the trading volume being dedicated to Bitcoin.

Aside from this, there are quite a lot of cryptocurrencies that have been traded so minimally that they’re almost non-existent. Overall, the forex industry is huge but only offers a small amount of currency pairs for trading. Meanwhile, the crypto market is small compared to forex but it offers a wide variety of cryptocurrencies for trading. This places them at an advantage as clients have more variety to choose from, though they’d usually go for Bitcoin.

LIQUIDITY

The forex market reaches daily trading volumes of $6.6 trillion. This is spread across a large variety of investors and good amount of assets. Due to this reason, forex trading is extremely liquid. You will always at some point find someone to trade your currency with at your desired price.

Regardless of your lot size, you will always be able to get out of a trade in a good deal as long as you wait for the right moment. This moment usually doesn’t take long considering the large number of traders on the market on a daily basis. It is often just a short waiting game to get a deal at your desired market price.

The crypto market reaches daily trading volumes of $2.5 billion. This is spread across a good variety of investors and a large amount of assets. It is important to note however that Bitcoin accounts for 70% of the trading volume. Taking this information into consideration, the rest of the cryptocurrencies would therefore not be liquid.

What this means is that the rest of the cryptocurrencies aside from Bitcoin have a very low trading volume. Due to this, if you have a position in any of those cryptocurrencies, it is unlikely you will be able to find a good deal for the position due to less people trading that cryptocurrency.

PROFITABILITY

Although both forex traders and crypto traders have a great advantage of earning a ton of profit by being among some top financial industries, forex traders have a slight advantage as they’re able to use leverage in order to maximize on their profits.

It is important to note that the higher leverage you use, the more risk you place your positions at for losing money. This is one of those things that comes as a flip of a coin. You can either make a ton of profit or lose a ton at a loss. Choosing your trades carefully is the best way to maximize profitability.

Profitability for crypto traders becomes slightly complicated. Due to Bitcoin dominating the market, it has great potential for movement in the market which in turn gives people the chance to make good profits. But for other cryptocurrencies, due to low trading volume they often don’t experience movement at all which makes it extremely difficult to make a good profit.

Often times cryptocurrencies that were made for certain projects would have their market price fall to zero if the project is unsuccessful. This would make traders of this cryptocurrency unable to trade anymore or make any profits.

TRADING HOURS

The forex market is open 24 hours a day but only 5 days a week. It does not operate on weekends. This is because it is controlled by institutions which follow strict patterns that need to be maintained carefully. It switches between different institutions at certain periods throughout the day who maintain this strict schedule.

This gives forex traders the advantage of being able to rest during the weekend and catch up with other activities which they weren’t able to do while trading forex. This does however come with a slight disadvantage as they lose the chance to earn some income on those 2 days off.

The crypto market is open 24 hours a day and 7 days a week. It operates even on weekends. This is because cryptocurrencies are usually owned by individuals or small firms who don’t follow a strict regimen as compared to the forex industry.

They are slightly more available to be able to offer trading of their cryptocurrencies even on the weekend. This gives crypto traders a slight advantage of having more opportunity to earn profit as compared to forex traders. They are however at a disadvantage of having no days off and therefore being overworked.

VOLATILITY

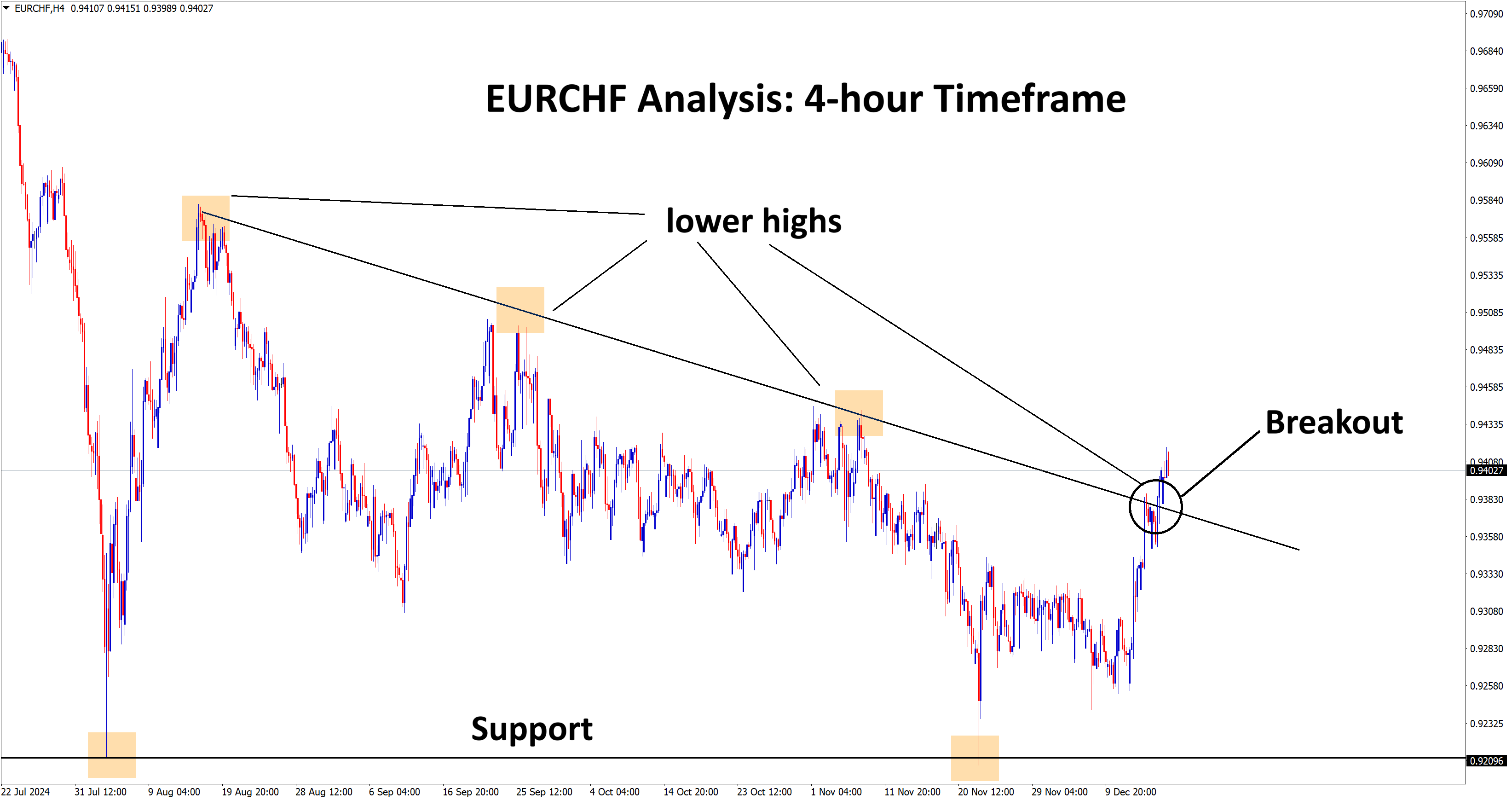

The forex market is extremely volatile. This should not be taken lightly at all. Due to their large trading volume which is equally spread across each forex pair, the forex market has the potential to become volatile at any given moment. This is even more likely to happen in exotic pairs which are very popular among traders.

The prices would constantly fluctuate therefore making it extremely risky to trade in these market conditions. It is however still nothing compared to how volatile certain cryptocurrencies can get. Your account can be wiped in a matter of seconds if not dealt with carefully.

The crypto market is extremely volatile when it comes to popular cryptocurrencies like Bitcoin. It can drop or gain market price by over $10,000 in a single day. This can therefore leave millions of traders in either bankruptcy or swimming in money.

Cryptocurrencies who don’t have a high trading volume or which isn’t popular usually aren’t volatile due to no one trading those cryptocurrencies. However, cryptocurrencies can become popular overnight as seen with some currencies like Dogecoin. So this can make it become really volatile, really quickly. It is therefore crucial to trade with extreme precaution when it comes to crypto trading as your account can be wiped in a matter of seconds, right before your eyes.

SECURITY AND REGULATIONS

The forex market has existed since people used money to pay for goods and services. It is therefore an industry that has had time to become properly regulated with rules and conditions to ensure a safe trading environment that is free from any fraud and misuse.

This market can make or break a country’s wealth and therefore governments take a keen interest in ensuring it runs smoothly as well. It is regulated by different regulatory bodies which vary by country in order to make sure traders are trading according to the rules and regulations of the country they reside in as well.

Compared to the forex market, the crypto market is not as regulated. This is mainly due to the fact that this industry is relatively new and we’re still learning the ropes around it. It hasn’t got the opportunity to become properly regulated yet by regulatory bodies as most are still distrusting of this mode of payment.

Bitcoin is one of the cryptocurrencies which has been accepted by most financial institutes and is therefore more strictly observed as compared to some other currencies. Due to being less monitored, the crypto industry has a greater chance of witnessing fraud. This industry still has a long way to go in terms of managing and deciding on regulations in order to keep the industry safe and away from fraud.

Final Thoughts

Forex trading and crypto trading are similar in many ways which include giving us the ability to make a lot of money very quickly. They are both however extremely risky modes of income and shouldn’t be used as a primary source of income unless you’re extremely certain of your trading strategies to earn you a good profit with minimum risks involved. If you’re a beginner to the trading world and are looking for a less volatile way in which you can dip your toes in the industry, we would recommend starting off with forex trading as it gives you a solid foundation in your journey.

Cryptocurrency is extremely volatile and we recommend investing small amounts of money in currencies which are relatively new with minimal trading volume as someday they could have the potential to make you millions, just like with Bitcoin. Overall, Crypto profit potential is big compared to forex market. In forex, the risk/rewards are easily controlled due to regulation and security but in crypto, the risk/rewards are not in our control due to big price fluctuations and unregulated brokers.