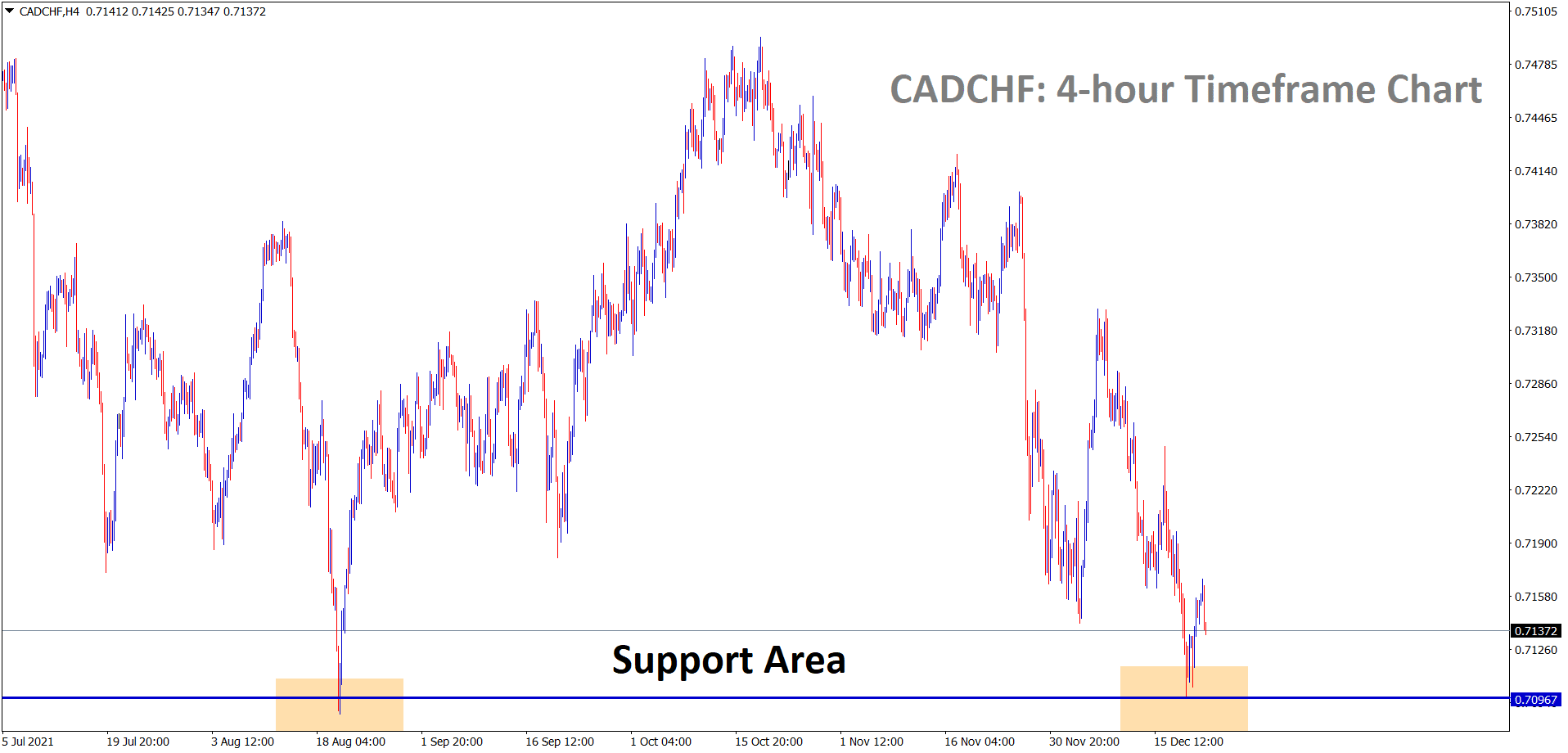

CADCHF Analysis

CADCHF is rebounding from the support zone in the 4-hour timeframe chart.

After the confirmation of upward movement, CADCHF buy signal given.

CADCHF reached the take profit target successfully.

Canadian Dollar: Bank of Canada do rate hikes in next year

Canada is also facing 4000 cases daily of Covid-19; this brings the economy to pull back from the stronger side.

Canadian Dollar shows weakness in the market due to Omicron variant spread across Globe and Oil prices declining every day.

Oil nations are increasing supply due to Demand higher in last quarter now demand sliding due to new strain of Virus.

And US Dollar shows stronger than counter pairs due to FED support of faster tapering and quick recovery from the Omicron variant by a Booster dose.

Bank of Canada will hike interest rates in Feb 2022 is expected.

Swiss Franc: US FDA approved the Pfizer pill

Swiss economy shows most Omicron variant cases and tight measures to control, and Booster Dose will be provided for public soon in next year onwards.

The Swiss economy shows the worst inflation numbers in 30-year history, and SNB is planning for selling Swiss Francs to control the value of the Swiss Franc.

US Food and Drug Administration approved the Booster dose of Pfizer and Merck Covid-19 pills this week. This news helped the US Dollar to improve more further.

And USDCHF opened higher today after the US FDA’s Omicron Pills approval started this week.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/