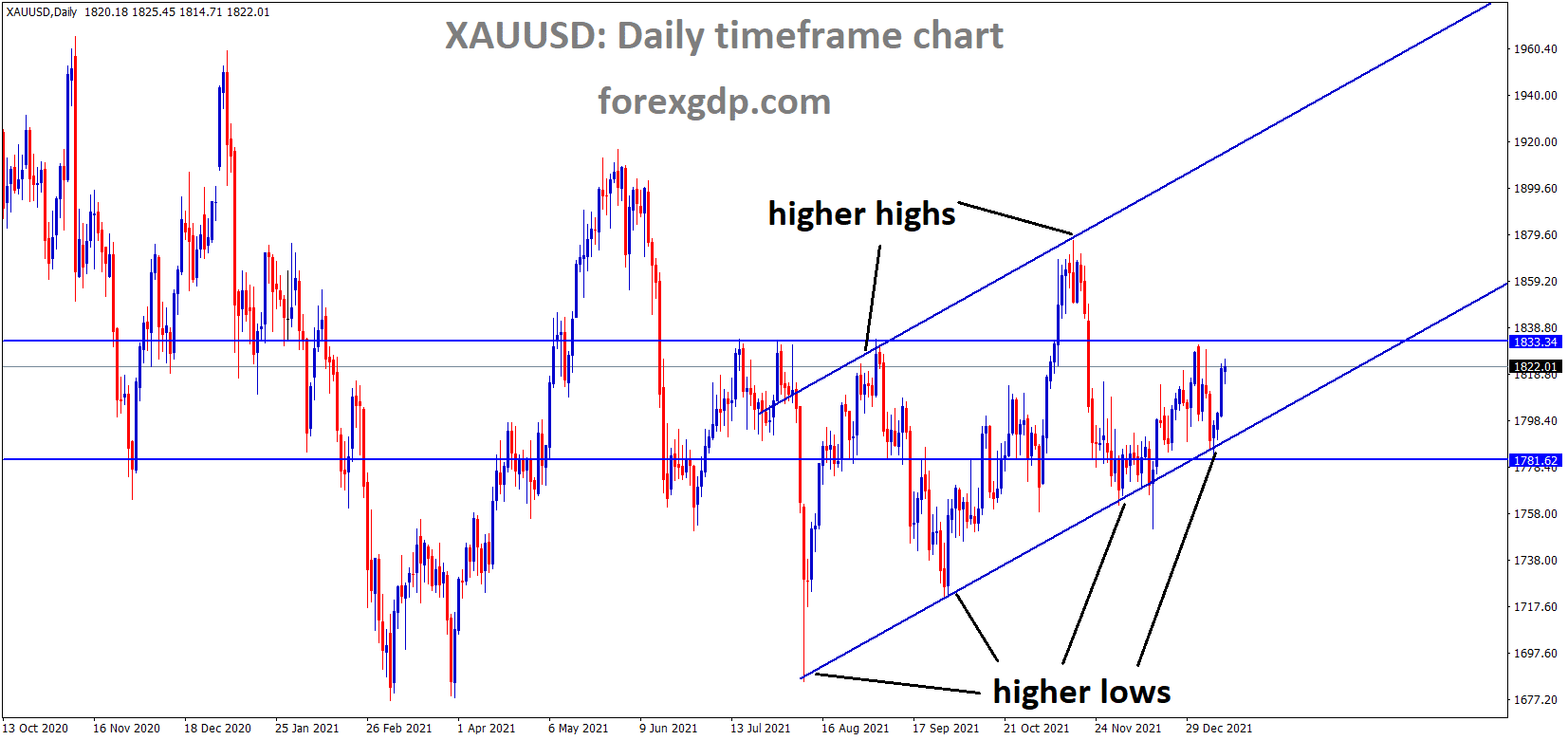

Gold: Global inflation numbers cause rising prices of Gold

Gold prices are rising over US Dollar after Yesterday Data of US inflation number came at 7.0%, which is higher since 1982.

XAUUSD Gold price is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

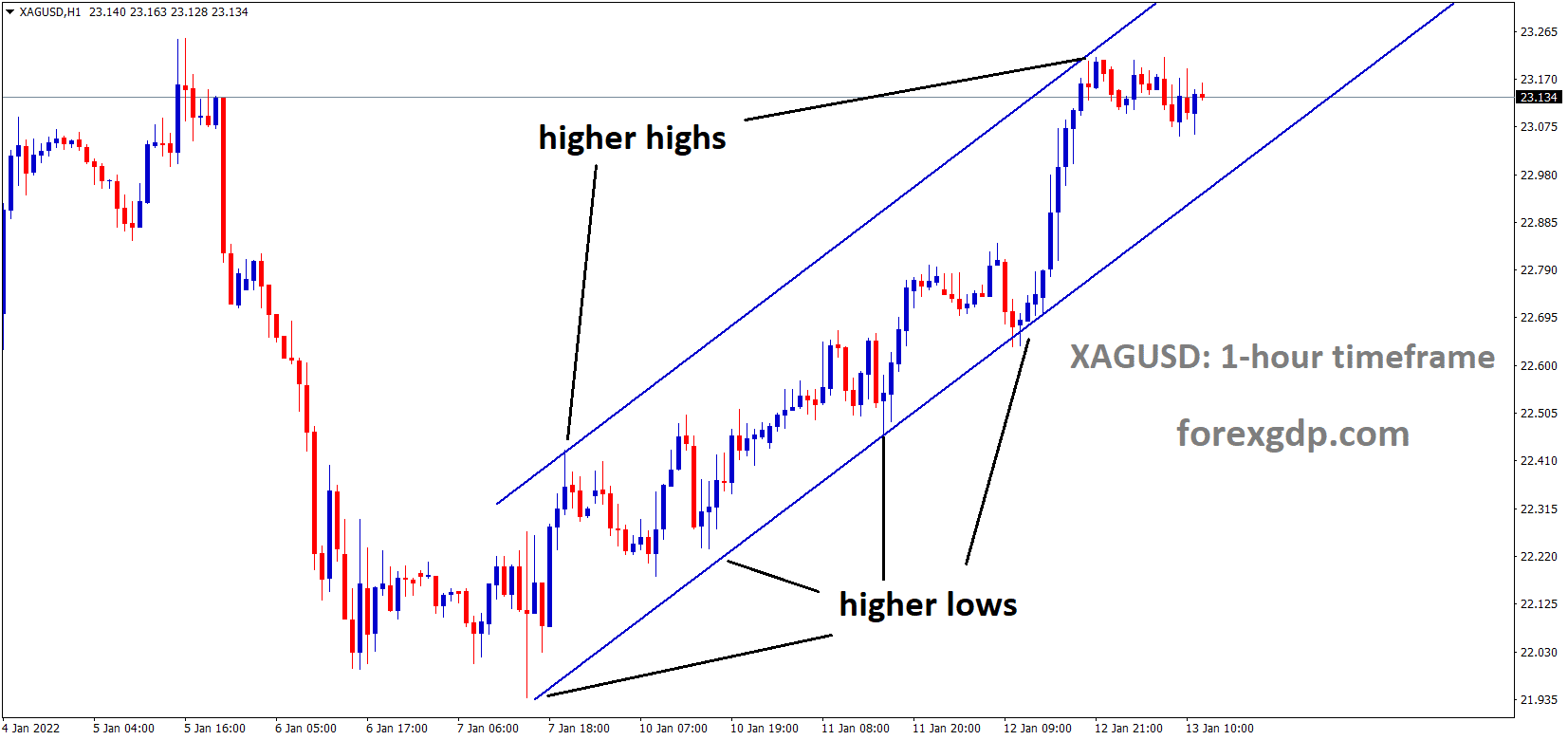

XAGUSD Silver Price is moving in an Ascending channel and the market has fallen from the higher high area of the channel.

More consumer prices will hurt the US economy more to spend; then, US Dollar prices will be valued less when compared to other countries.

So, FED must act according to the situation that will prove the dominant US Dollar to be stronger than the weaker.

Gold is the perfect hedge for inflation numbers, So FED activity on US Economy only makes it soft for US Government to run efficiently.

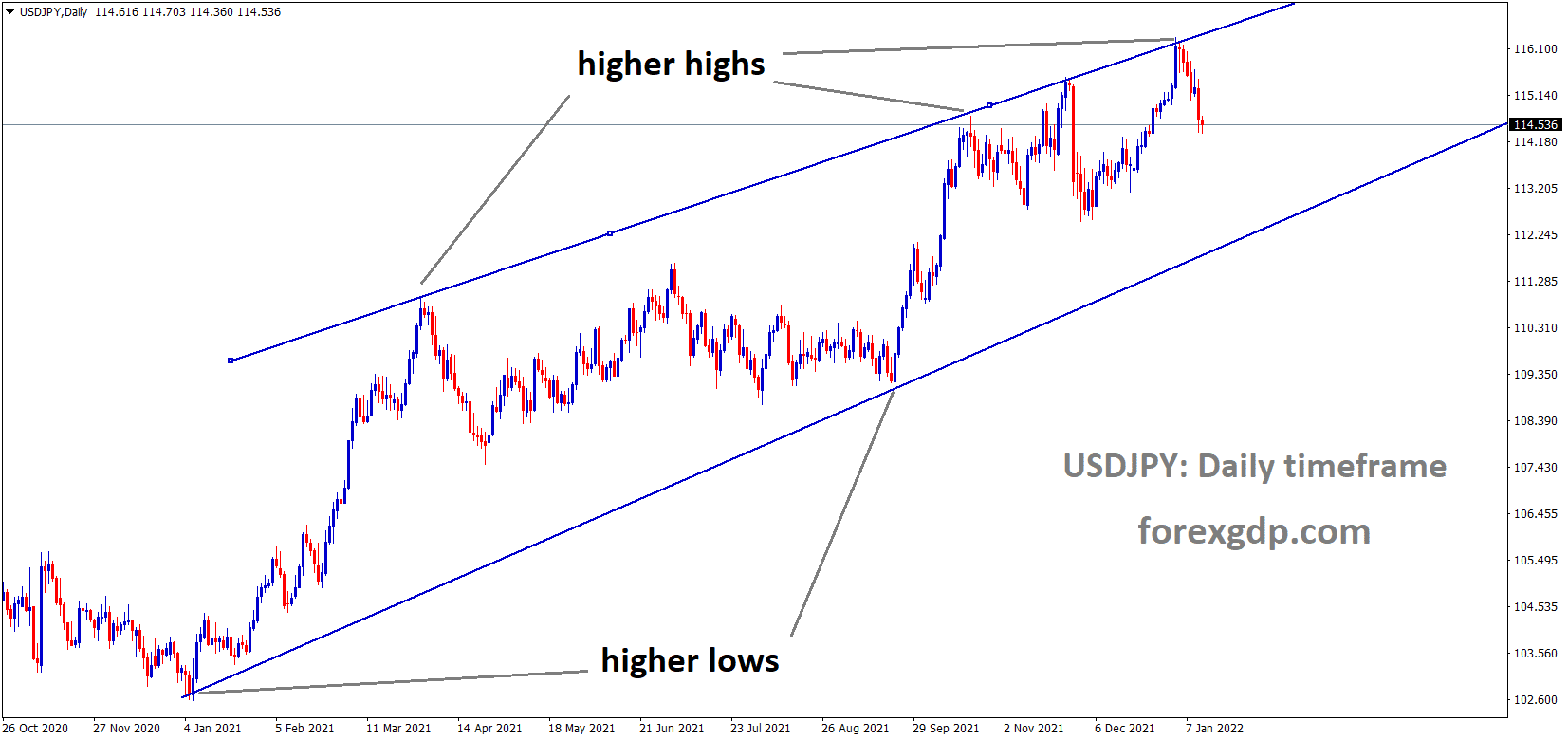

US Dollar: US inflation data came at a higher

USDJPY is moving in an ascending channel and the market has fallen from the higher high area of the channel.

US Dollar index reached 94.90 area from 96.00 area after US inflation data hits 7.0% since 1982.

FED may do rate hikes sooner than expected and only choose to control the inflation numbers.

And Tapering of asset purchases is done faster as planned in the December meeting.

This week US PPI data and retail sales are going to publish, and Further US Dollar correction will see in the chart

US sanctions against North Korea

Continuous Six missile tests by North Korea threaten the Global world once again.

Due to this, the US has proposed additional sanctions to North Korea on the UN Security Council resolution violation.

This threat happening since September month last, so further sanctions against North Korea have been implemented now, as US ambassador Linda Thomas Green Field tweeted today.

And today, sanctions against North Korea will create more disappointing relations with the US-North Korea tie-up.

We urge all nations to put sanctions against North Korea under UNSC Resolutions.

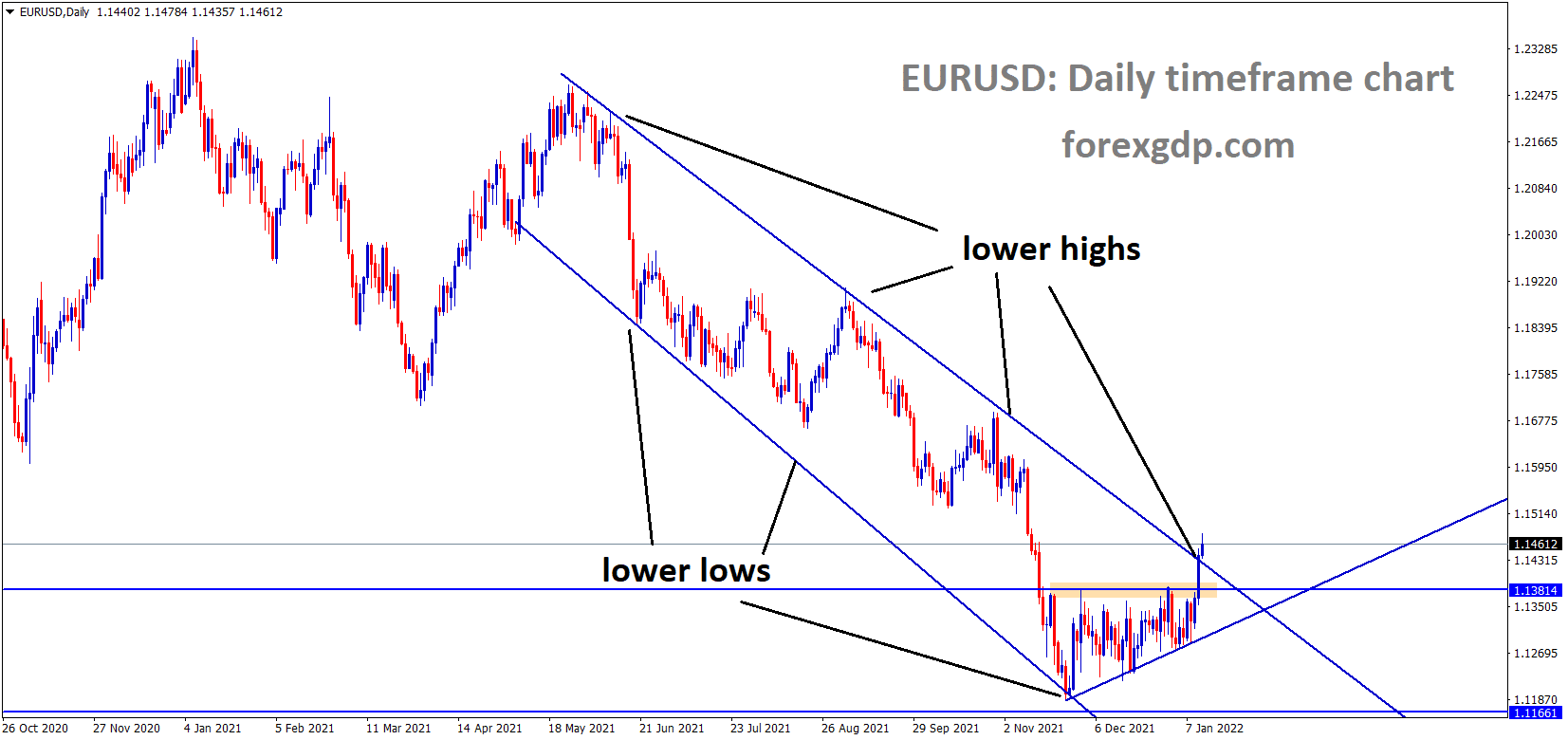

EURO: ECB will change its path in coming meetings

EURUSD is moving in the Descending channel and the market has reached the lower high area of the channel.

EURUSD Rising against US Dollar last night after US CPI inflation data crossed 7.0%, a significantly higher number since 1982.

On the other hand, ECB is expected to tighten the monetary policies if Economic Goal is achieved.

German 10-year Bund yields are going higher from Negative, and Greek 10-year yield riskier assets also moved higher by Selling pressures.

So, the Euro area is improving and not fast as US Economy, but we hope for recovery in the Eurozone in 2022.

This year, ECB will change its tone from negative to Positive rate hikes and taperings according to inflation rates.

UK Pound: Chances for UK PM Johnson resignation soon within his party

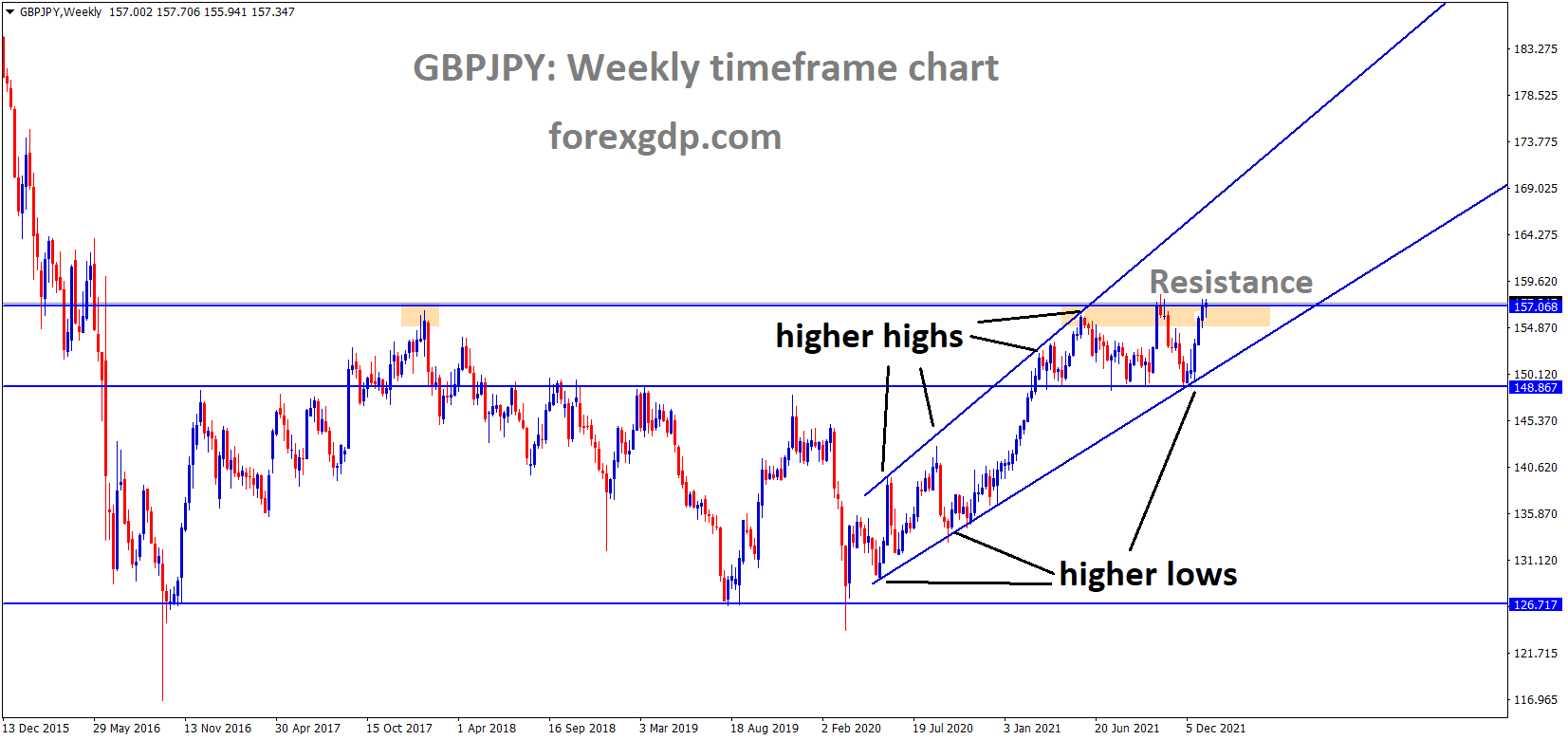

GBPJPY is moving in an Ascending channel and the market has reached the horizontal resistance area of the channel.

Brexit talks have not yet been over, and Any output is possible between EU and UK Talks,

The Main fear for investors is whether Article 16 would trigger or not by the UK is questionable.

UK PM waited for EU Proposal and Talks around Northern Ireland Protocol is progressing.

During the lockdown period UK PM has participated in Gatherings, and he was accepted before conservative parties.

So, there is a chance of UK PM To resign from his seat if the party does a Favour for UK PM Johnson

So, GBP Pound has risen over the Resistance area of 1.3700 level today.

Smooth Brexit talks will Favour GBP Pound in the near term, and UK PM Johnson resigning will be positive for GBP in the near term.

Canadian Dollar: US Concerned about Canada’s Digital tax

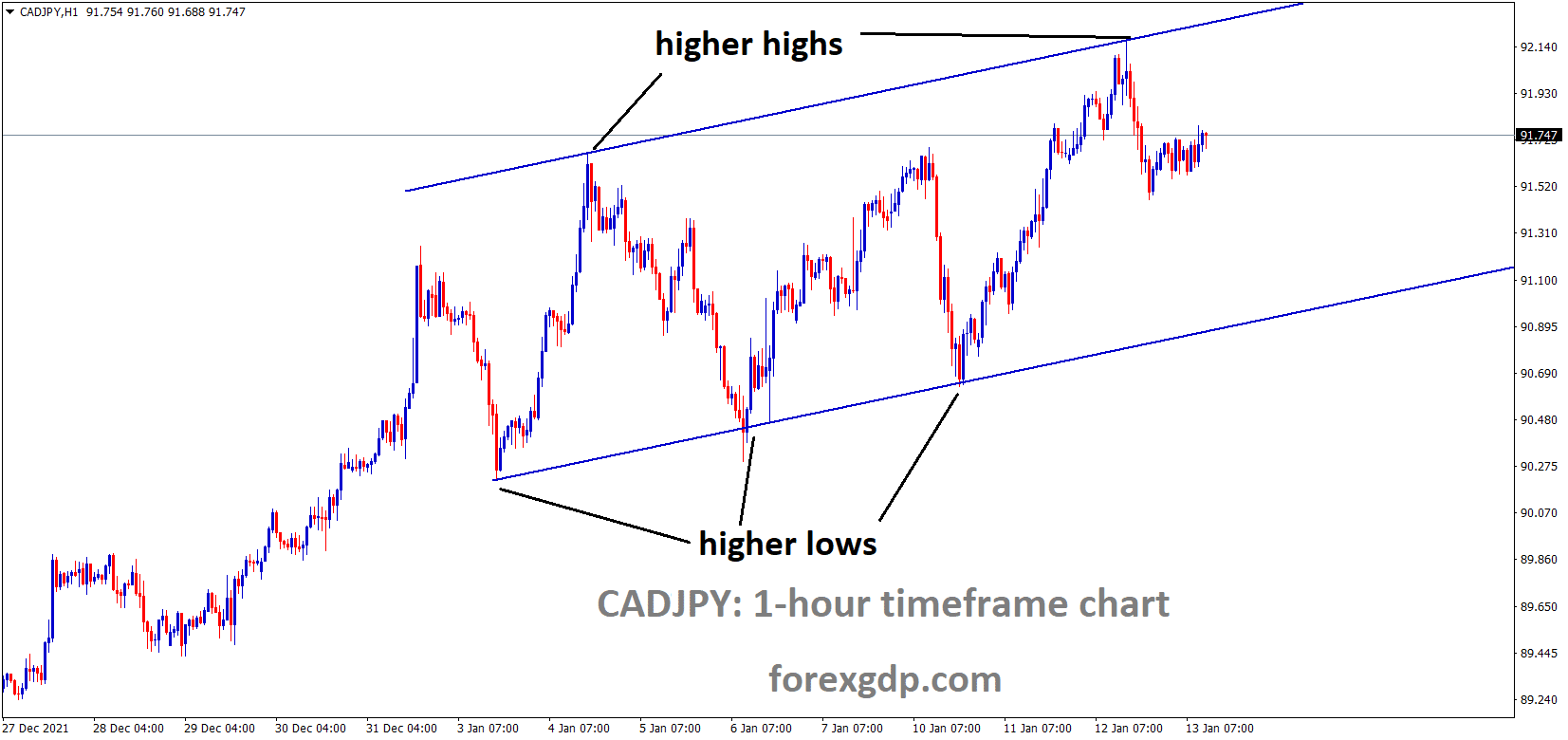

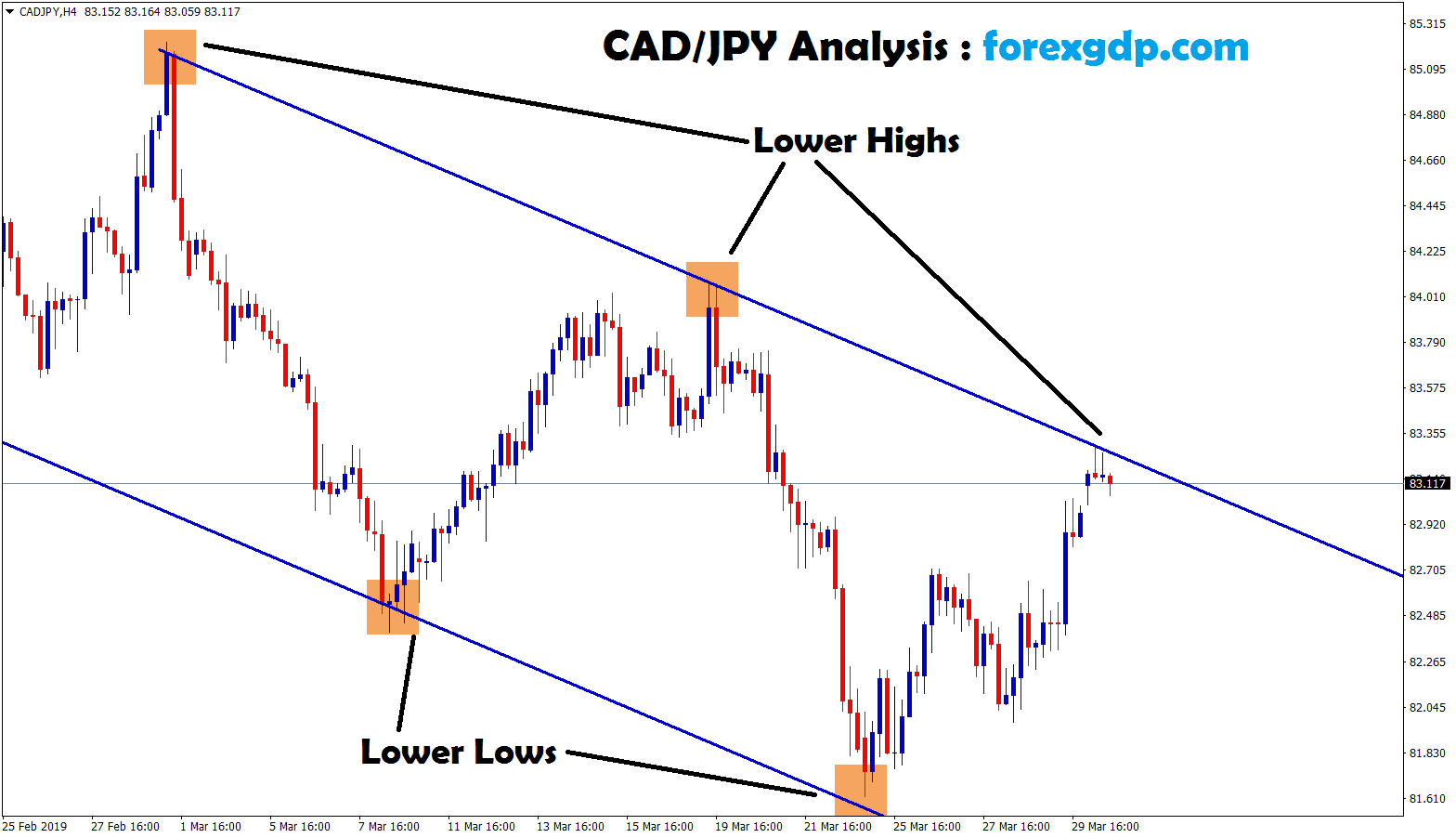

CADJPY is moving in an Ascending channel and the market has fallen from the higher high area of the Channel.

Canadian Dollar makes higher against US Dollar last day after US inflation numbers hit 7.0%,

Due to this scenario, the FED members area signaled early rate hikes this year.

And Bank of Canada also might do a rate hike this month as Employment data came in positive numbers this week.

Deputy US Trade representative Jayme White expressed Washington’s concern about Canada’s proposed Digital services tax in talks with Canada’s trade deputy trade minister.

This week US PPI and US initial jobless claims heads-on.

Japanese Yen: Base metals surged as China came back from crisis

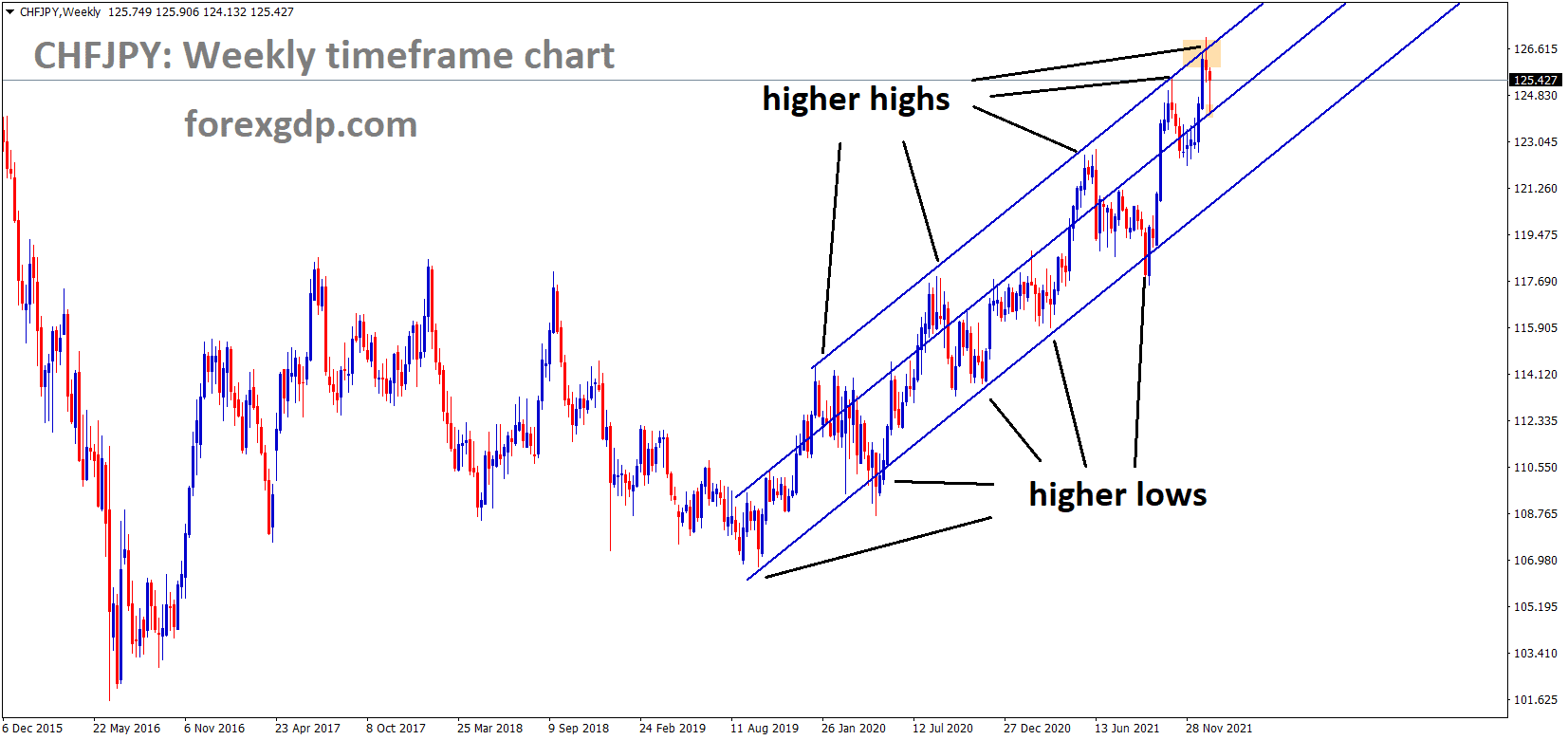

CHFJPY is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

And Japanese Yen shows a stronger outcome against US Dollar, as USDJPY fallen over 2% from highs 116.50 and now came to 114.50 area. The main reason behind this is US Inflation data came at higher last day.

And Base metals surged yesterday as China came back from Covid-19 and the Real-estate crisis.

Japanese Government shows an excellent economic outlook for 2021-2022 as Businesses are expanding more, easing lockdown restrictions.

Australian Dollar: Australian PM speech

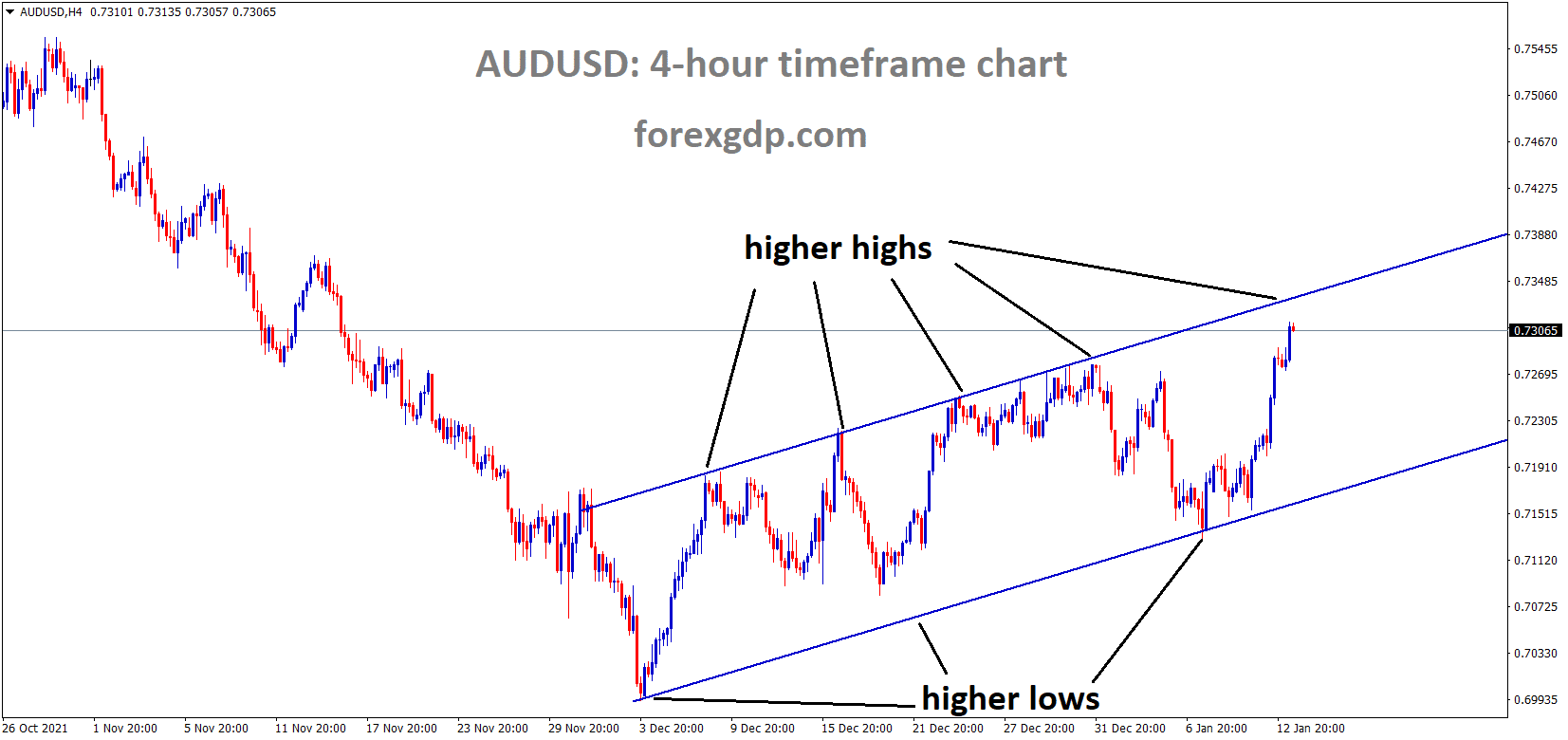

AUDUSD is moving in an ascending channel and the market has reached the higher high area of the channel.

Australian PM Scott Morrison Addressed the nation and said easing on close contacts with Covid-19 has been introduced.

All of them must ensure to do with Booster dose to avoid Omicron variant.

And have reported infections rates and Supply Chain constraints highly.

And FED Policymakers have the work to control inflation numbers due to high inflation numbers printed last day.

US PPI and initial jobless claims data are going to publish this week.

New Zealand Dollar: New Zealand Building permits higher numbers

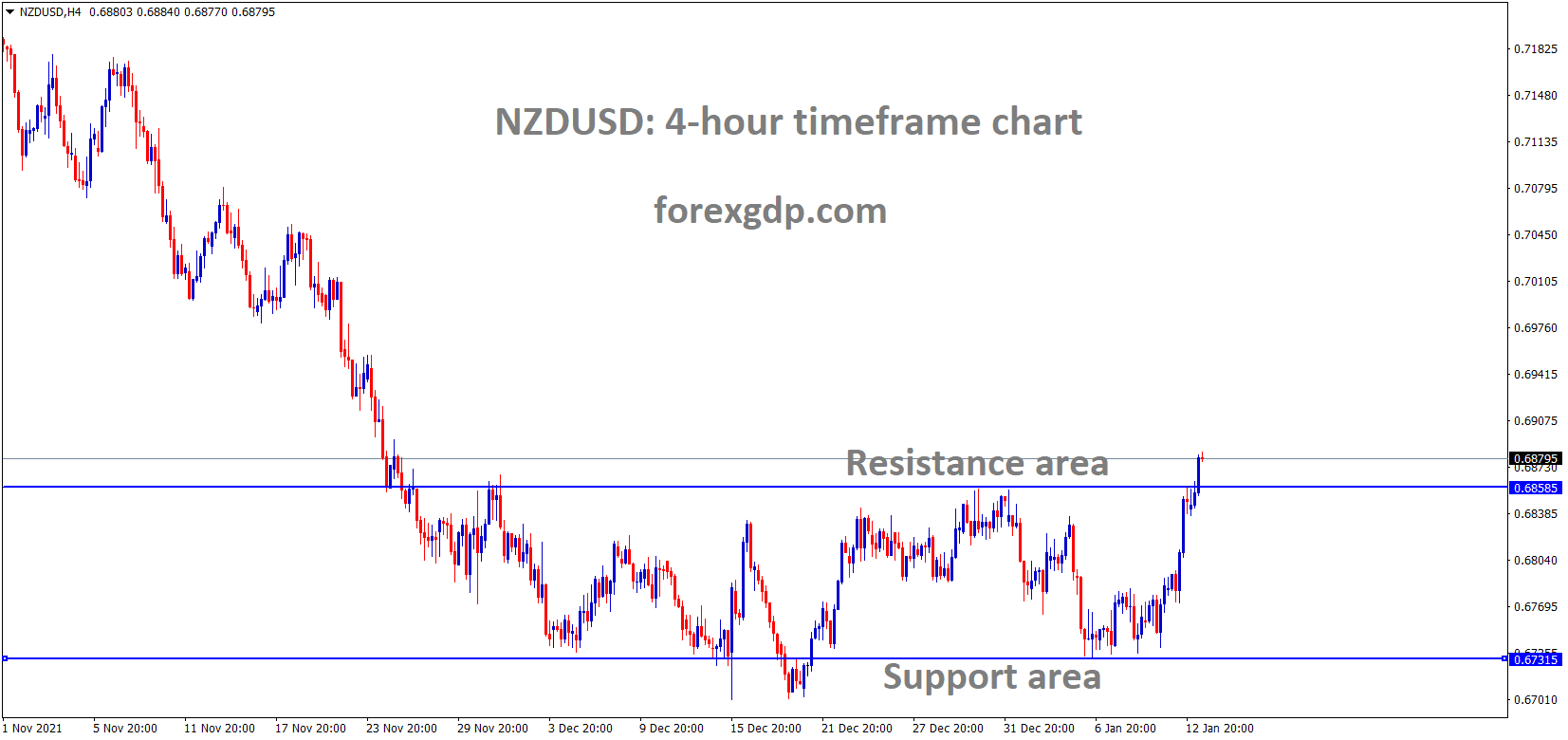

NZDUSD is moving in the Box Pattern and the market has reached the resistance area of the Box Pattern.

New Zealand nations effectively controlled the Covid-19 cases, and only 28 new community cases and 65 cases in Border only happened.

New Zealand Building permits for November up from October’s -2.1% figure to 0.6% month on month.

China makes more easing monetary policy measures to expand export revenues by currency value decreasing in Yuan.

And Gold man Sachs downgraded the outlook for China in 2022, and Bank has shaved 0.9% in 2022.

China strategy makes Success for New Zealand Exports to clear, and Domestic data developed is support for New Zealand Exports to China.

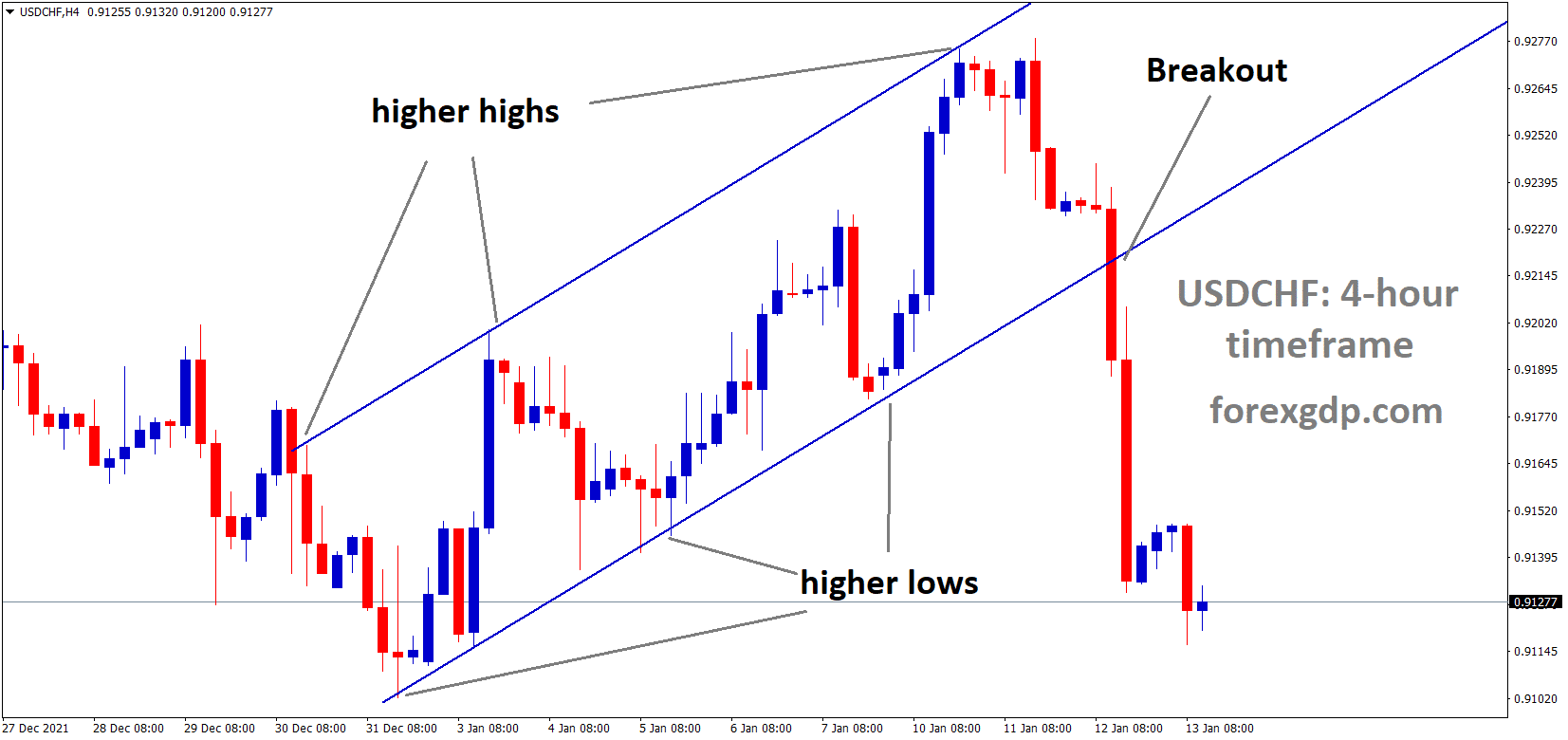

Swiss Franc: Japan’s business rising the costs of sales

USDCHF has broken the Ascending channel.

Swiss Violin Bows imported by Japanese companies rose prices by over 24% due to the Swiss Franc’s appreciations in international markets.

And SNB has the right to control the Swiss Franc, and All remedies are done backstage as portfolio investments in foreign assets.

In Japan, from papers to the Foods industry and all commercial related companies raised the product prices from 5% to 50% on Telescopes materials due to rising wages on manufacturers side and wages for employees.

More companies in Japan have suffered losses for rising raw material costs over the sales

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/