Gold: US Michigan and Retail sales are lower than Expected

Gold prices are actively steady above 1800$ against US Dollar, and this is due to US retail sales coming with -1.9% versus 0.0.% and the previous 0.20% and yield rates are raising

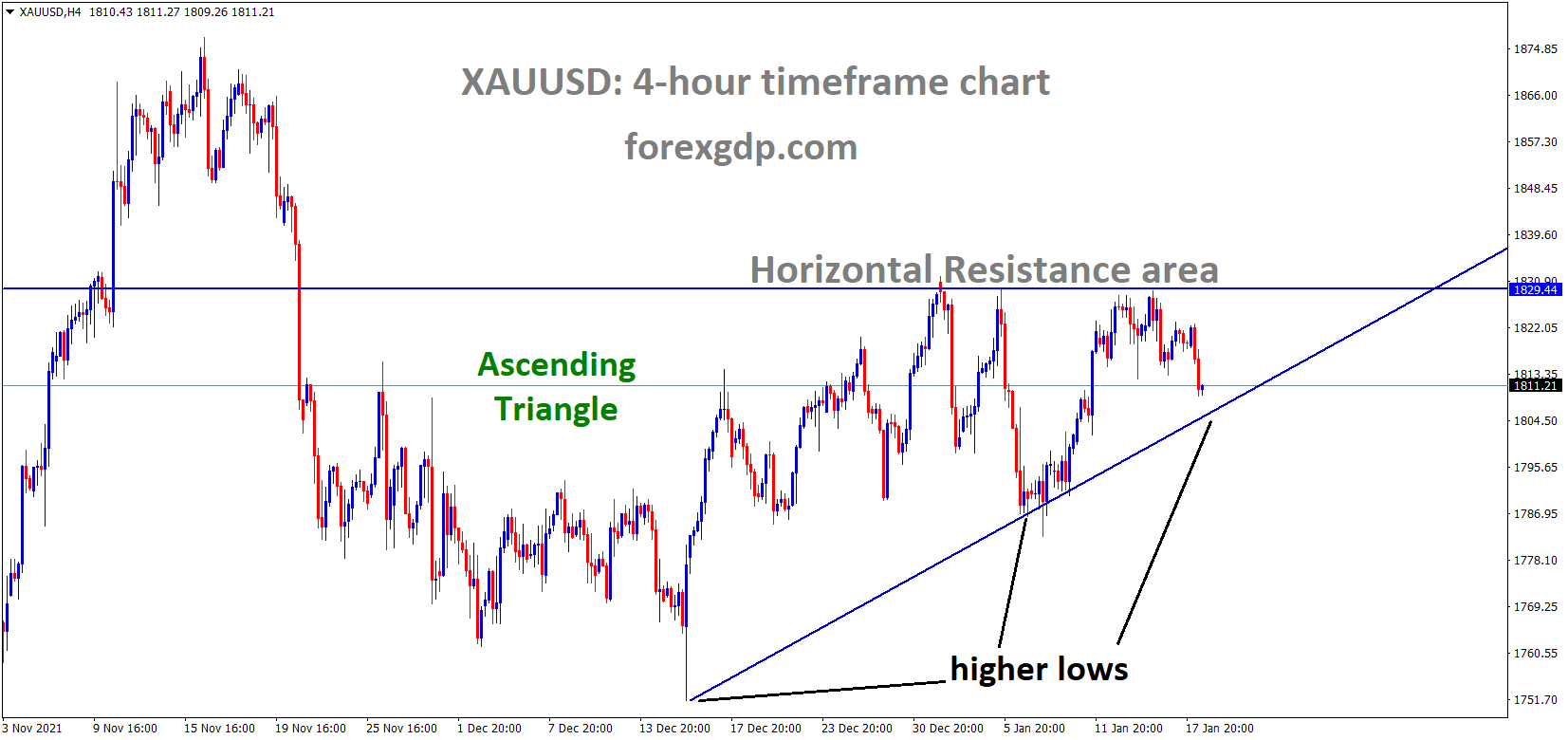

XAUUSD Gold price is moving in an ascending triangle pattern and the market has fallen from the Horizontal resistance area and yield rates are

And Michigan Consumer sentiment came at 68.8 versus 70.0 expected, making the US Dollar relatively low against its Counterparts.

US inflation data last week printed at 7.0% makes it Happy for Gold investors to hedge against inflation rates and pour more money for buying interests in Gold.

FED maybe Do active rate hikes like 3 to 4 in 2022, and 3 more hikes in 2023 are Goldman Sachs predictions.

And their actions for inflation rates will calm down the gold prices to a stable level.

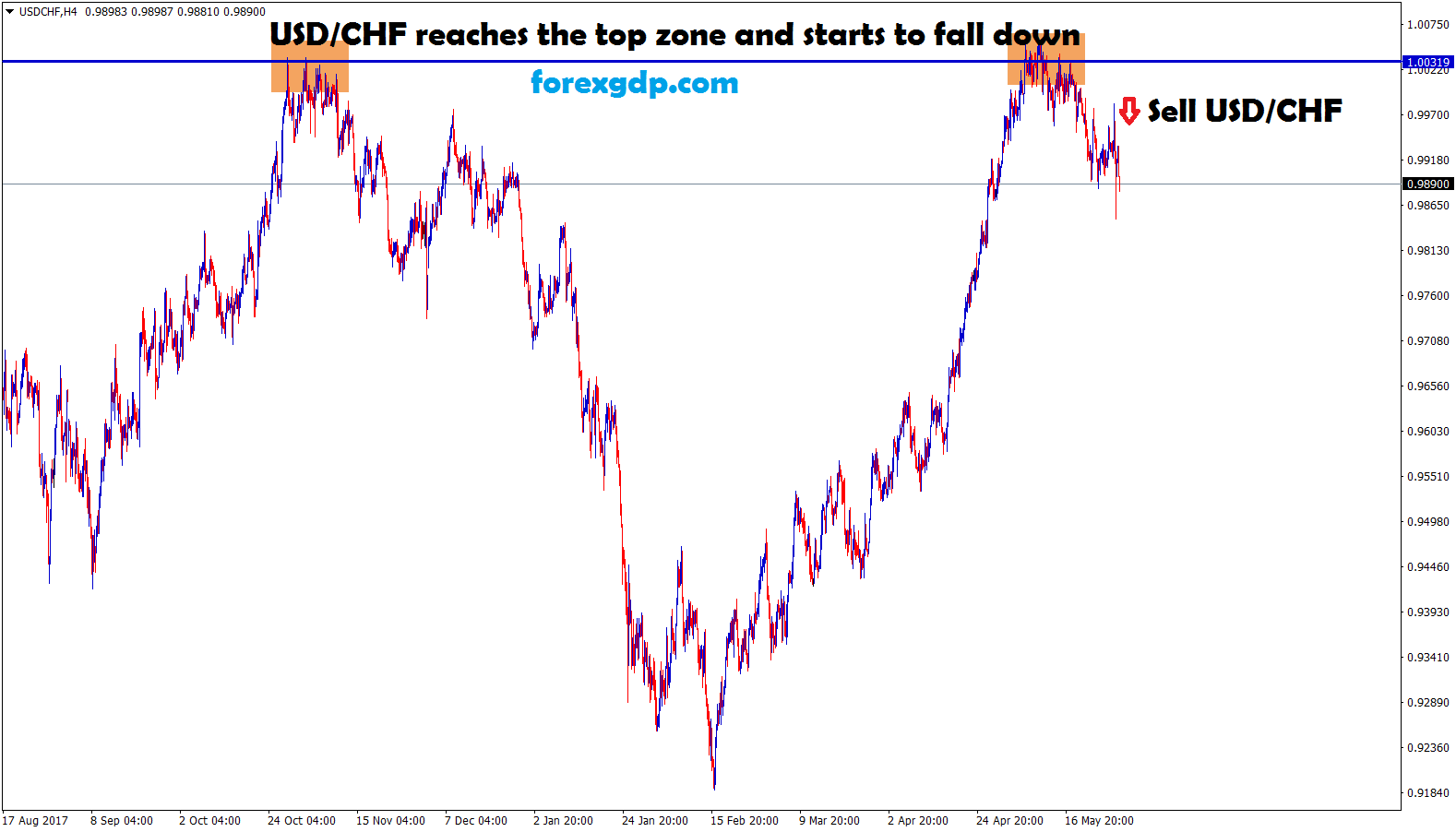

US Dollar: US 10Yr yield rates rose to higher

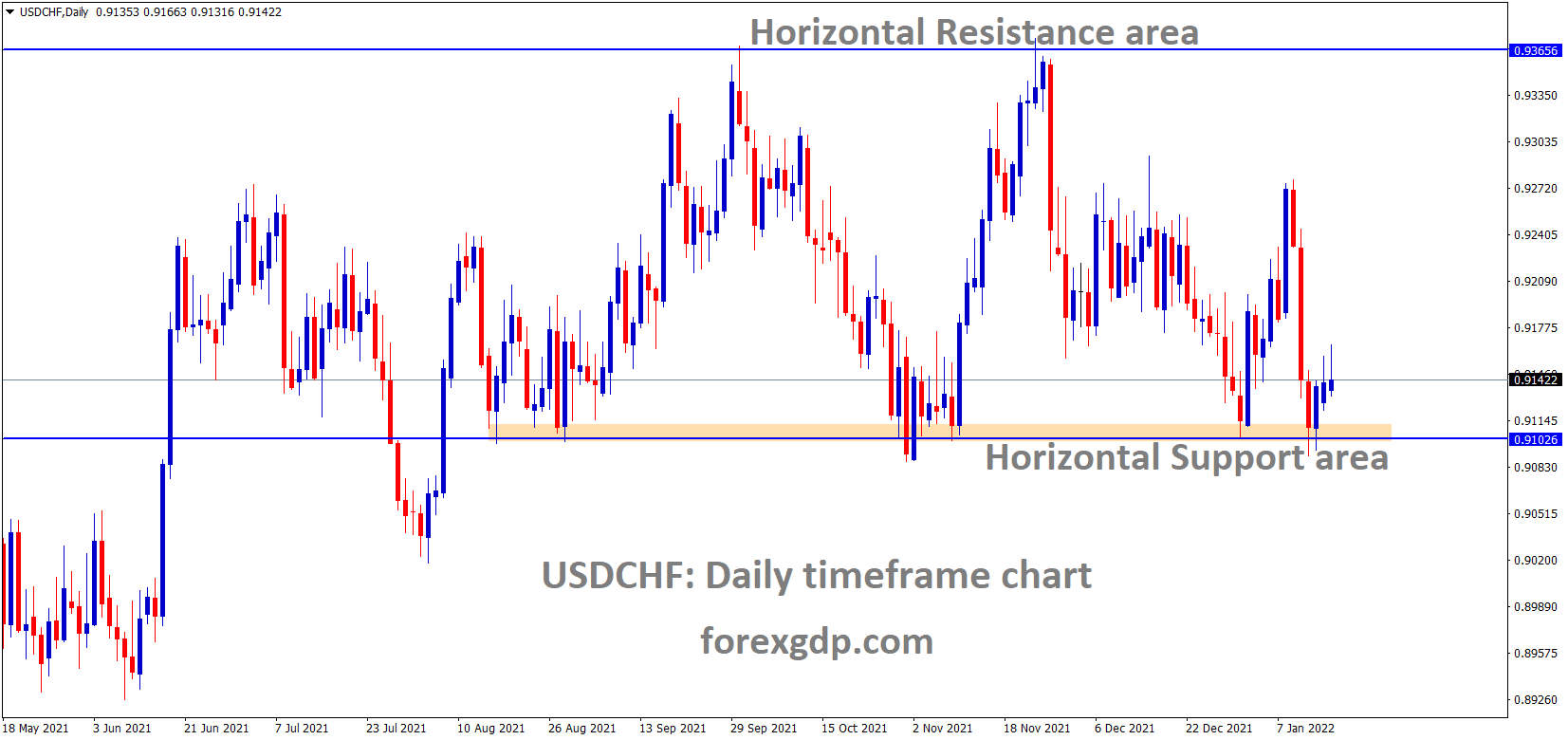

USDCHF is moving in the Box Pattern and the market has rebounded from the Horizontal support area of the pattern.

US Dollar index shows gains from the corrections that happened last week.

And Last Day US Market holiday makes little gains in 2-year note and 10-year note.

And Yields rates are also increasing due to Bonds sellers broad happened in the market as FED will tighten the interest rates in March 2022.

FED planned for three more rate hikes in 2022, So Bond yields are rising further as Bonds Sellers sell Bonds and return their funds quickly.

This week US initial Jobless claims data scheduled, better than expected data will make stronger US Dollar.

EURO: ECB Forecast of inflation rates in 2022

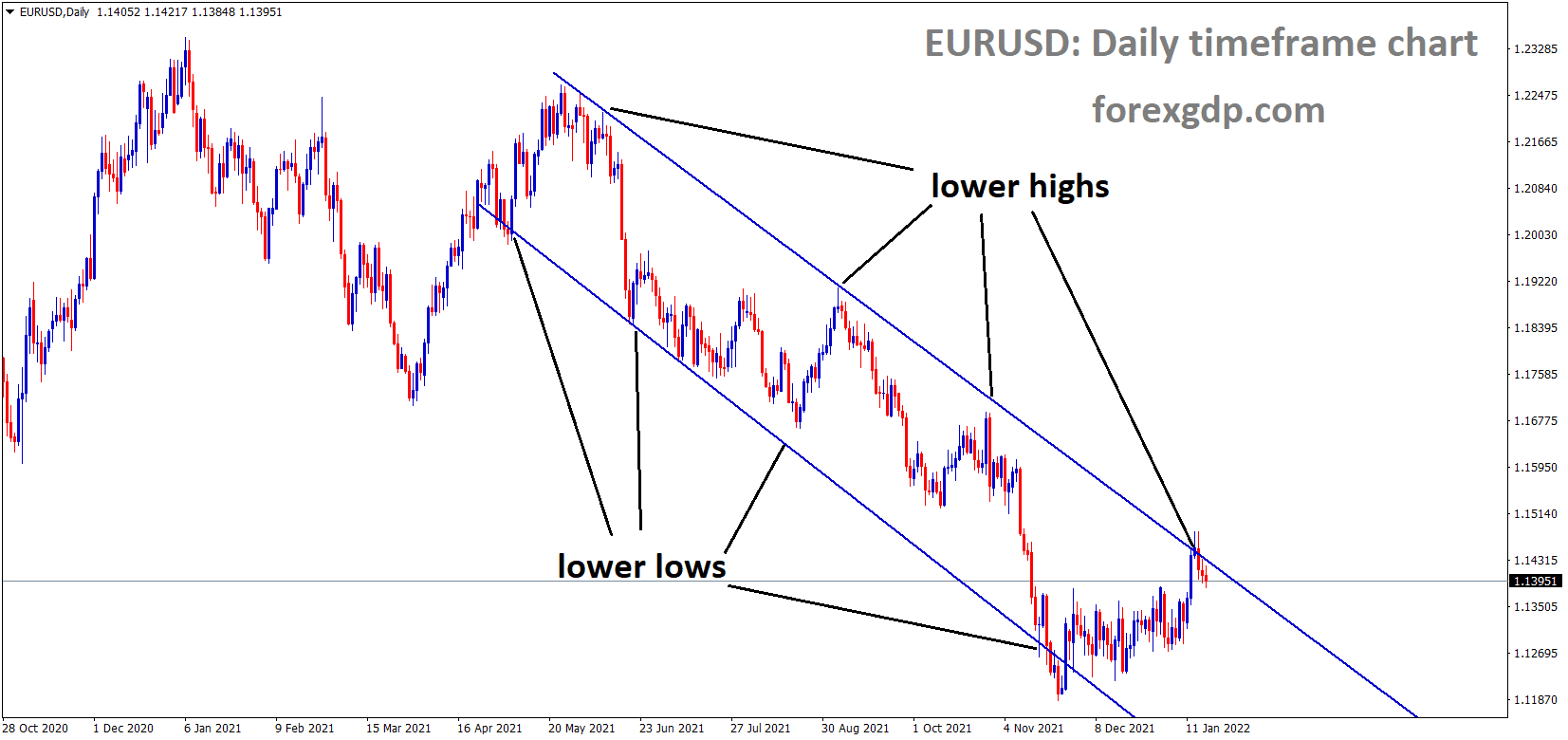

EURUSD is moving in the Descending channel and the market has fallen from the Lower high area of the channel.

Euro makes lower after ECB President Lagarde speech looks less hawkish than counterpart FED signals of More hawkish tone.

And Inflation keeps temporary higher and does not look for a permanent, and It will be higher in 2022 end and down in 2023 as per ECB Forecasted.

Today Eurozone German ZEW reading is going to publish; Positive reading may strengthen the Euro against US Dollar.

And US San Francisco & Newyork FED Presidents Support for Rates to hike in March 2022 for FED Powell approach for rate hikes.

UK POUND: UK Unemployment rate printed at a higher rate

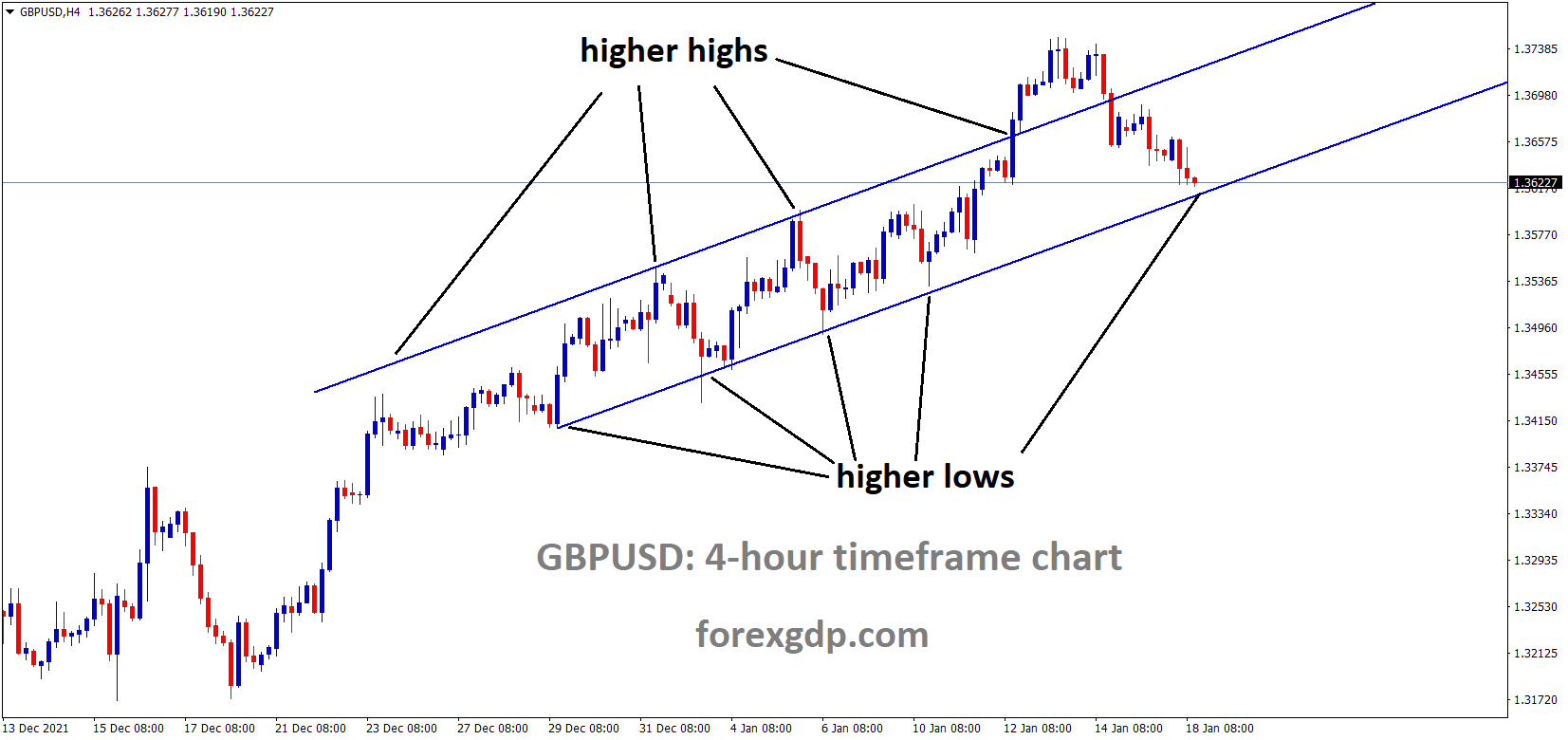

GBPUSD is moving in an Ascending channel and the market has reached the higher low area of the channel.

UK labour markets show resilient data on the Unemployment rate published at 4.1% in November.

And the wage growth of the UK has decreased but not more than 4.2%.

Furlough scheme has ended in UK and UK proved tightening labour market conditions from the unemployment rates printed.

And Bank of England has decided to four rate hikes in 2022 as the unemployment and inflation rates are correspondingly at reasonable rates.

This year May 2022 UK Election will give a Stronger move for UK Pounds at all sides expected.

And UK PM Johnson is planning for fewer restrictions for the UK due to less severe caused by the Omicron variant.

Canadian Dollar: Yemen’s Drone Attack on UAE

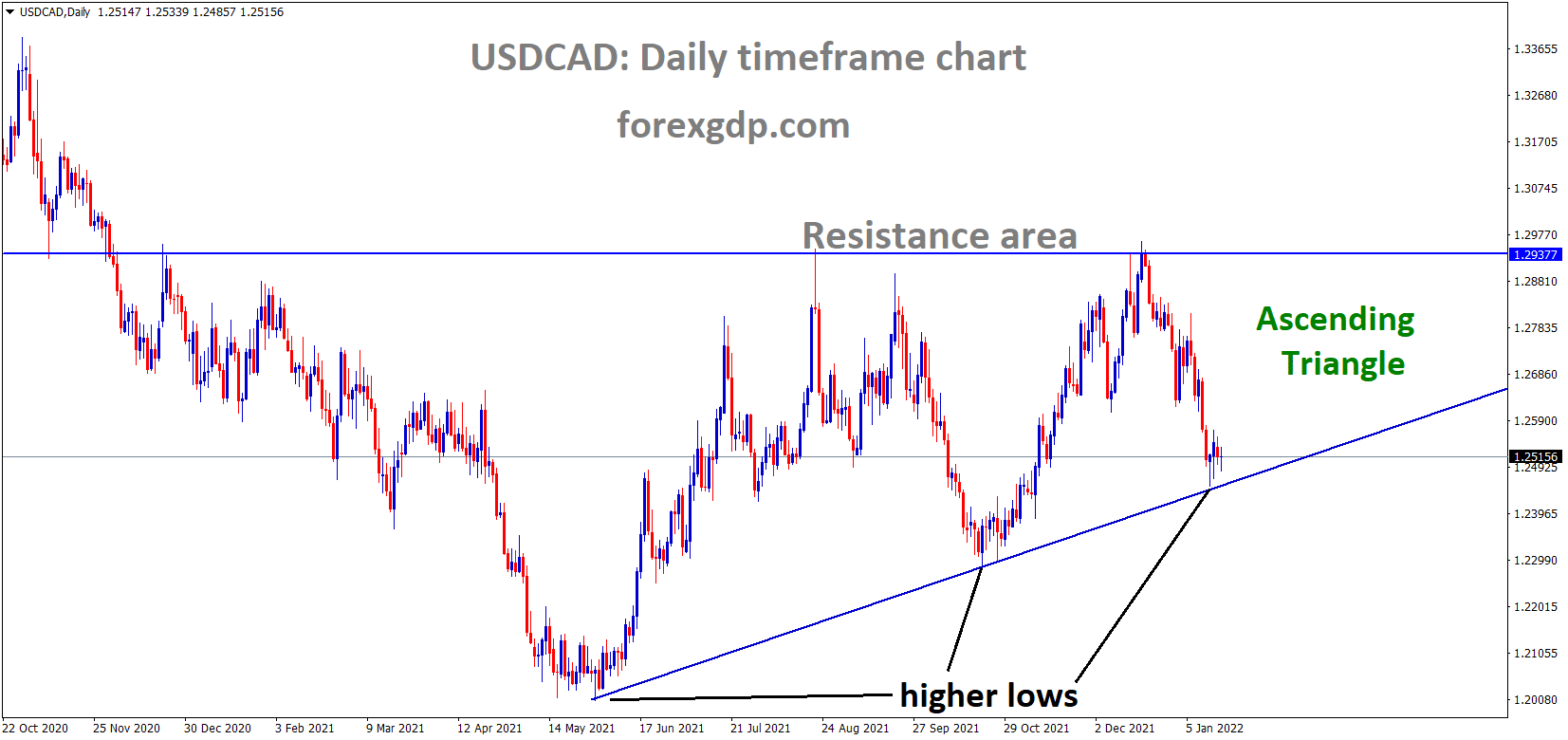

USDCAD is moving in an ascending triangle pattern and the market is consolidated at the higher low area of the pattern.

Yemen’s Houthi Group claimed the Drone attack happened in the UAE capital city of Abu Dhabi, and Three people were killed.

And this leads to the Third largest OPEC Producer maybe giving Supply disruptions to Global countries, But USD pays stronger due to FED activities to raise interest rates in March 2022.

USDCAD withstanding above 1.2500 area but Oil prices rally daily and stand on seven years high.

The US have sufficient inventories on Oil measures, and Any revenge attack from UAE causes some disruptions on Oil Supplies.

Japanese Yen: Bank of Japan Leaves interest rates unchanged

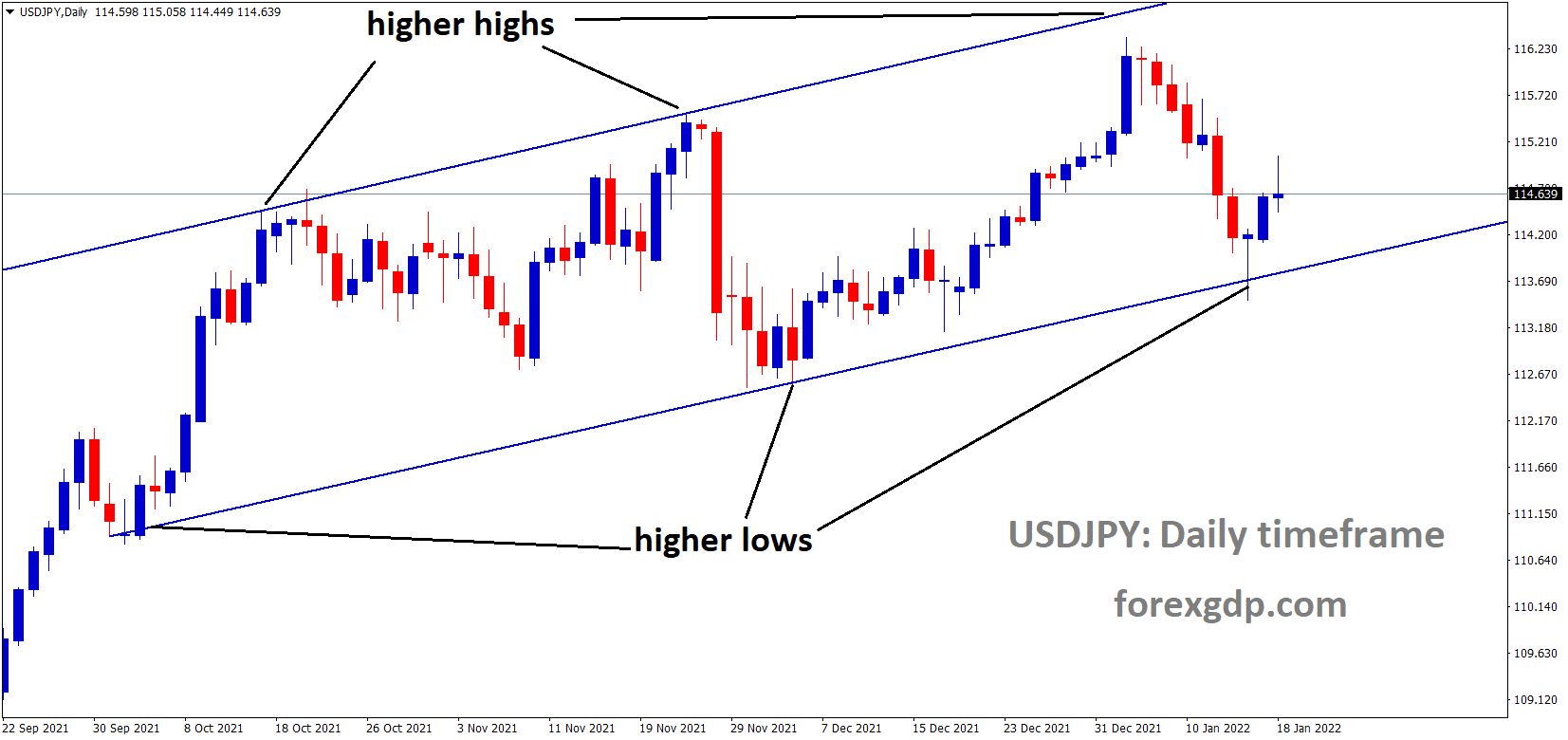

USDJPY is moving in an Ascending channel and the market has rebounded from the higher low area of the pattern.

Bank of Japan left monetary policy unchanged and kept the interest rate unchanged at -0.10% or near zero maintained.

And lift the inflation rates expected of one year to 1.1% from 0.90% and 2years from 1.0% to 1.1%.

The Growth forecasts of Current GDP Dropped to 2.8% from 3.4%, One-year outlook up to 3.8% from 2.9%, and 2-year outlook dropped to 1.1% from 1.3%.

And they maintain the Yield curve control, and 10-year JGB yields fell to 0.135% from 0.175% last week.

Bank of Japan made it clear ultra-loose monetary policy and Growth, unemployment rate to develop this year.

Australian Dollar: Omicron variant spreads higher in Australia

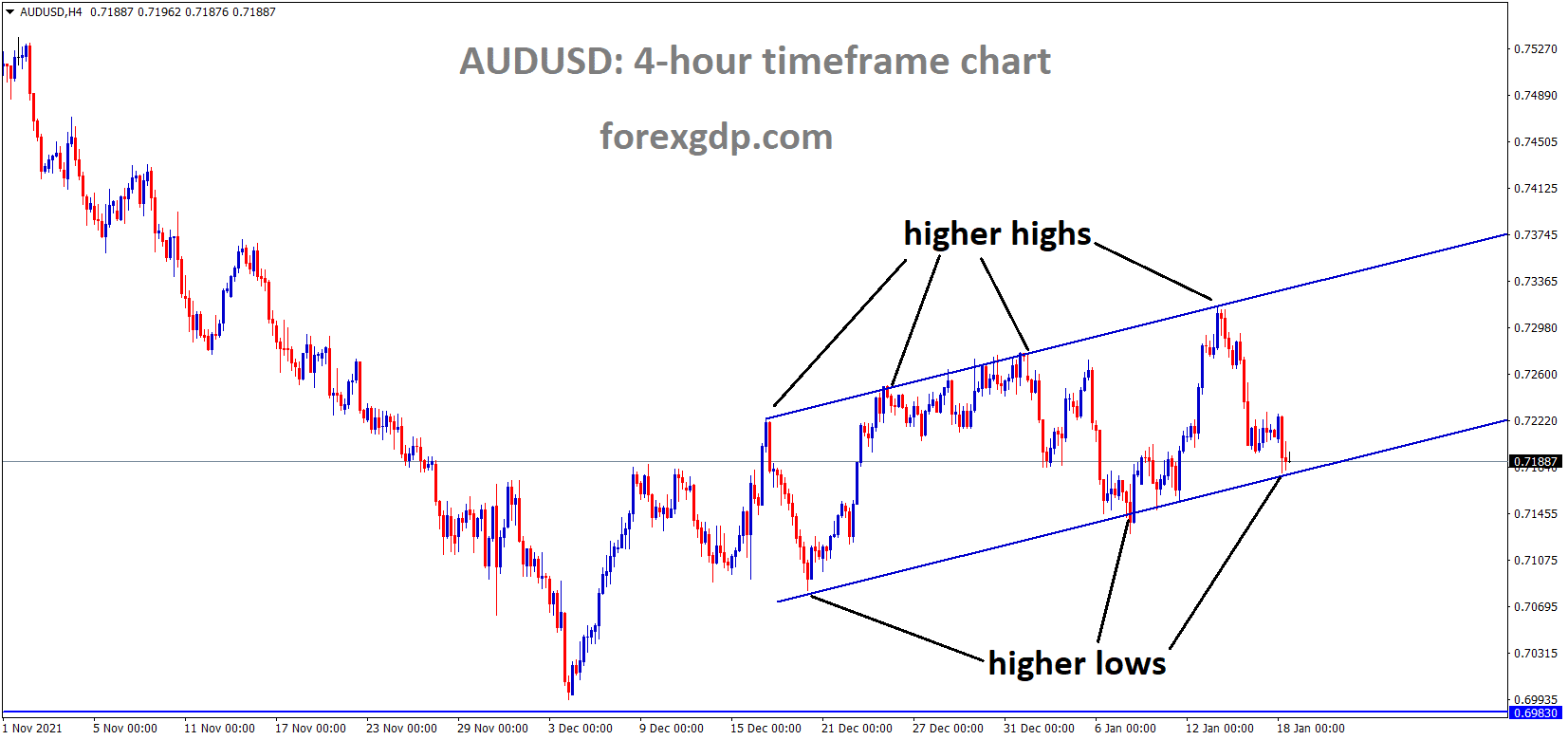

AUDUSD is moving in an Ascending channel and the market has reached the higher low area of the Ascending channel.

Omicron cases are higher in Australia and Japan; maybe a quasi emergency plan will be executed if situations go abnormal.

China GDP Growth steadied in the Fourth quarter makes Good for Business conditions with Australia.

Commodity prices like Iron Ore, Aluminum are higher as China regained its place in the industrial production ramp-up.

So, the Australian Dollar is now Going to reverse with the Bull trend if China matters and Omicron matters are solved.

People Bank of China makes ultra-loose monetary policies

China opened the door for easing ultra-loose monetary policy, and China cut two key policy interest rates ahead.

One year tenor already dropped by Five basis points last month, so the Five-year rate will decline to allow for cheaper mortgages.

As TD Securities analysts said, we expected the 10bp easing in LPR this quarter and another 50bp cut in RRR.

Lu Tung, Chief China Economist at Nomura Holdings Inc, said Space for further rates cuts this year is relatively small. We expected another 10 basis points before mid-2022.

And Appreciations in Yuan makes discomfort for Exports in China, So easing monetary policy measures and interest rates cuts make Support for Export revenues and Yuan depreciation.

New Zealand Dollar: China GDP data performed well in the fourth quarter

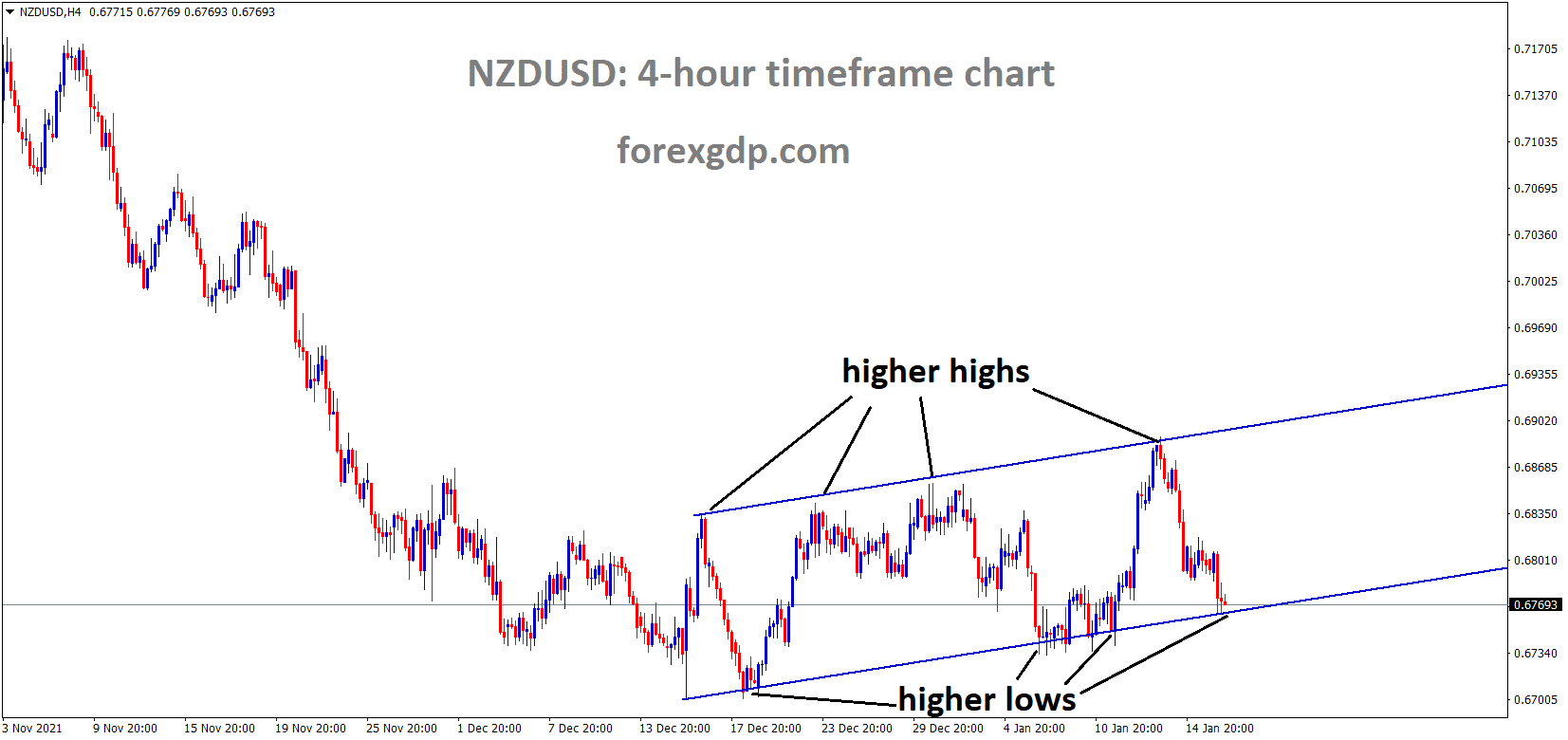

NZDUSD is moving in an Ascending channel and the market has reached the higher low area of the channel.

New Zealand Dollar keeps lower against US Dollar as US Domestic data performed higher when compared to New Zealand Dollar.

Yesterday New Zealand PM Jacinda Ardern said the Public must remain cautious on the Omicron variant and maybe looks for an orange or green signal this time from New Zealand Government.

And China GDP data and Industrial production data show higher than previous months.

Still, China faces lots of risks in real estate payments and loose monetary policy as much as possible, Cutting the Reserve requirement ratio for local banks to lend more money to Loans.

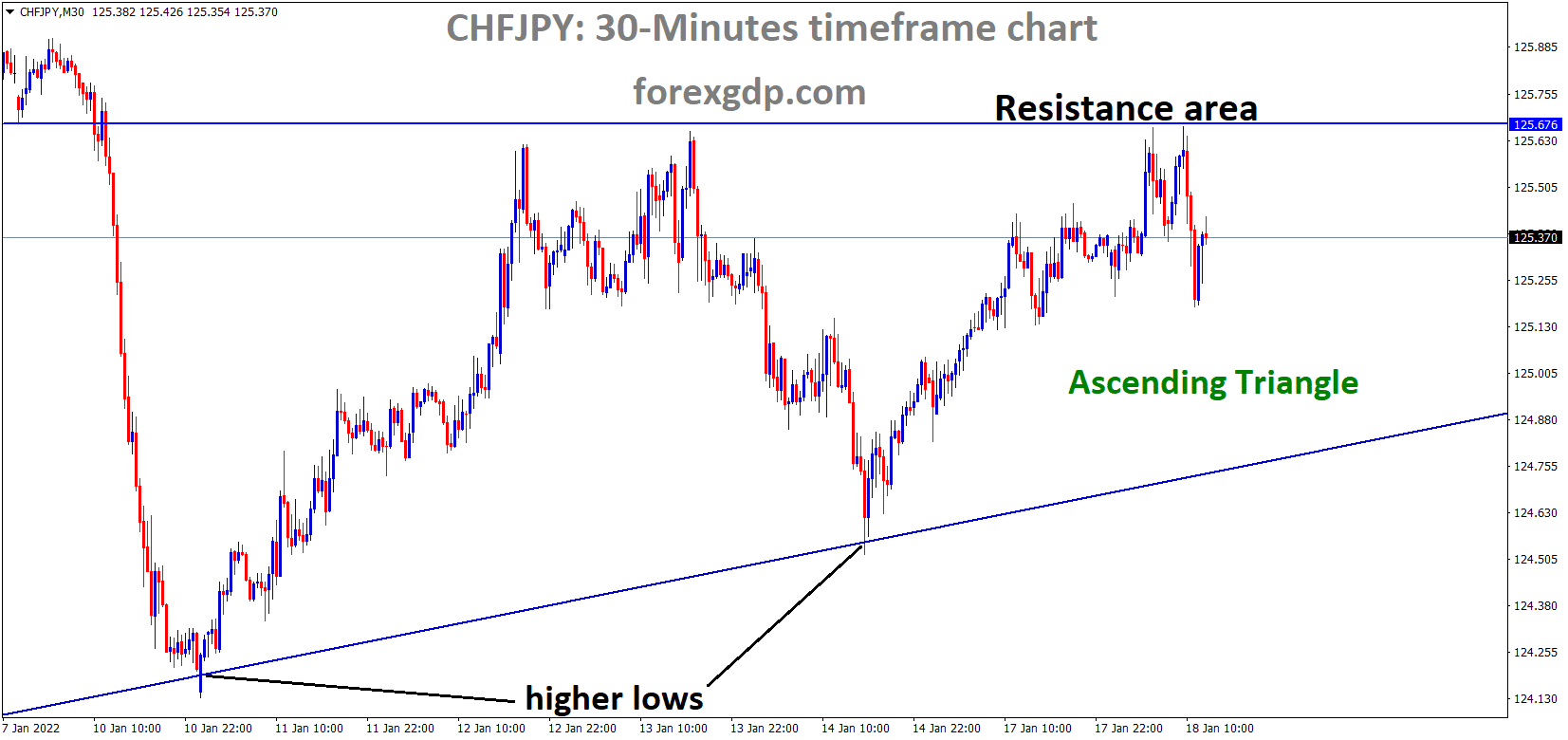

Swiss Franc: SNB shows higher Sight Deposits in January month

CHFJPY is moving in an ascending triangle pattern and the market has fallen from the Horizontal resistance area of the pattern.

SNB shows the deposits rose more than CHF 655.103 billion as of January 14; this data shows How active SNB acted in FX markets to down the CHF Strengths Globally.

According to SNB, Swiss Francs seem overvalued, making Exports revenues difficult and import revenues are costlier.

So SNB involved more actively to compensate the Swiss Franc strengthened by Selling Swiss francs in global markets.

USDCHF made lower last week after US Domestic data failed to impress the US Dollar.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/