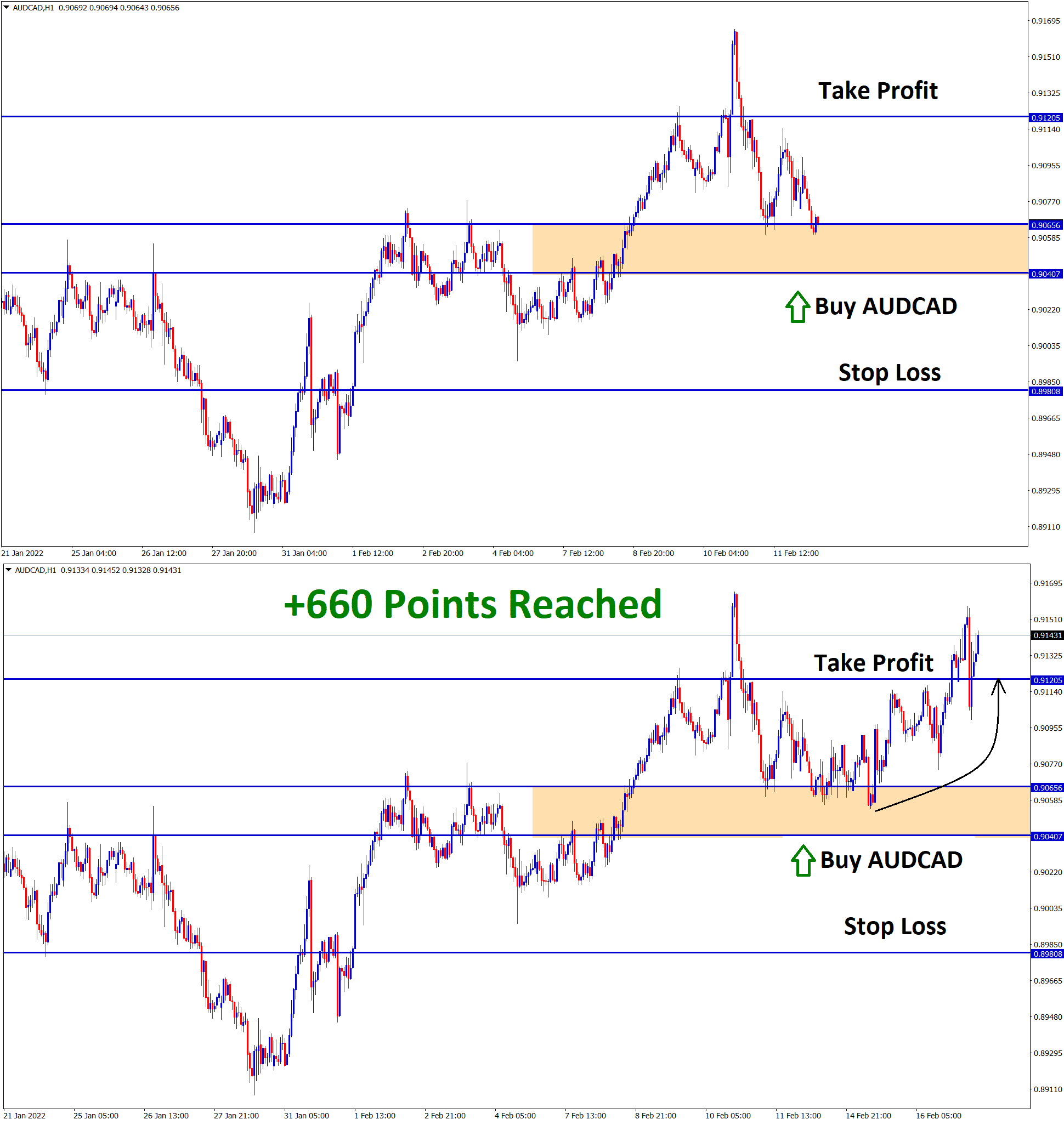

AUDCAD Analysis:

AUDCAD is moving in an ascending channel by forming higher highs and higher lows. Now the market has reached the higher low area and the old resistance which act as a new support in the 4-hour timeframe chart.

After the confirmation of upward movement AUDCAD buy signal given.

AUDCAD reached the take profit target successfully.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade setups at Premium or Supreme plan here: https://signal.forexgdp.com/buy/

Australian Dollar: Chinese PPI and CPI came below expectations

Australian Dollar regained the momentum as Russian Troops has stepped back from the Ukraine Borders.

And Russian President has no confidence in Ukraine withdrawal of NATO interest on conversations with US President Joe Biden, so still War fear is not over as per Biden commented.

And Chinese inflation data came at 0.90% below the 1.0% forecast, and the PPI index came at 9.1% versus the 9.7% forecast.

People Bank of China has breathing room for further easing Monetary policy conditions due to printed lower inflation data.

And Iron ore prices are declining and have not affected the Australian Dollar in the near term.

Canadian Dollar: Russian Troops Stepped Back from the Ukraine Borders

Canadian Dollar shows some strength against US Dollar due to Russian troops have stepped back from Ukraine Borders last day.

And Chinese inflation numbers came below forecast numbers. Chinese CPI reading came at 0.90% versus 1.0% expected, and PPI reading came at 9.1% versus 9.5% expected.

This will give PBOC some breathing room for easing; liquidity was added yesterday to help the economy support the pandemic.

And the Iron ore prices are declining to 3.0% due to the Chinese Dalian Commodity exchange crackdown by Chinese Authorities.

And also, the Tensions calm down on Ukraine Borders makes Australian 10-year Government Bonds rise to 2.22%.