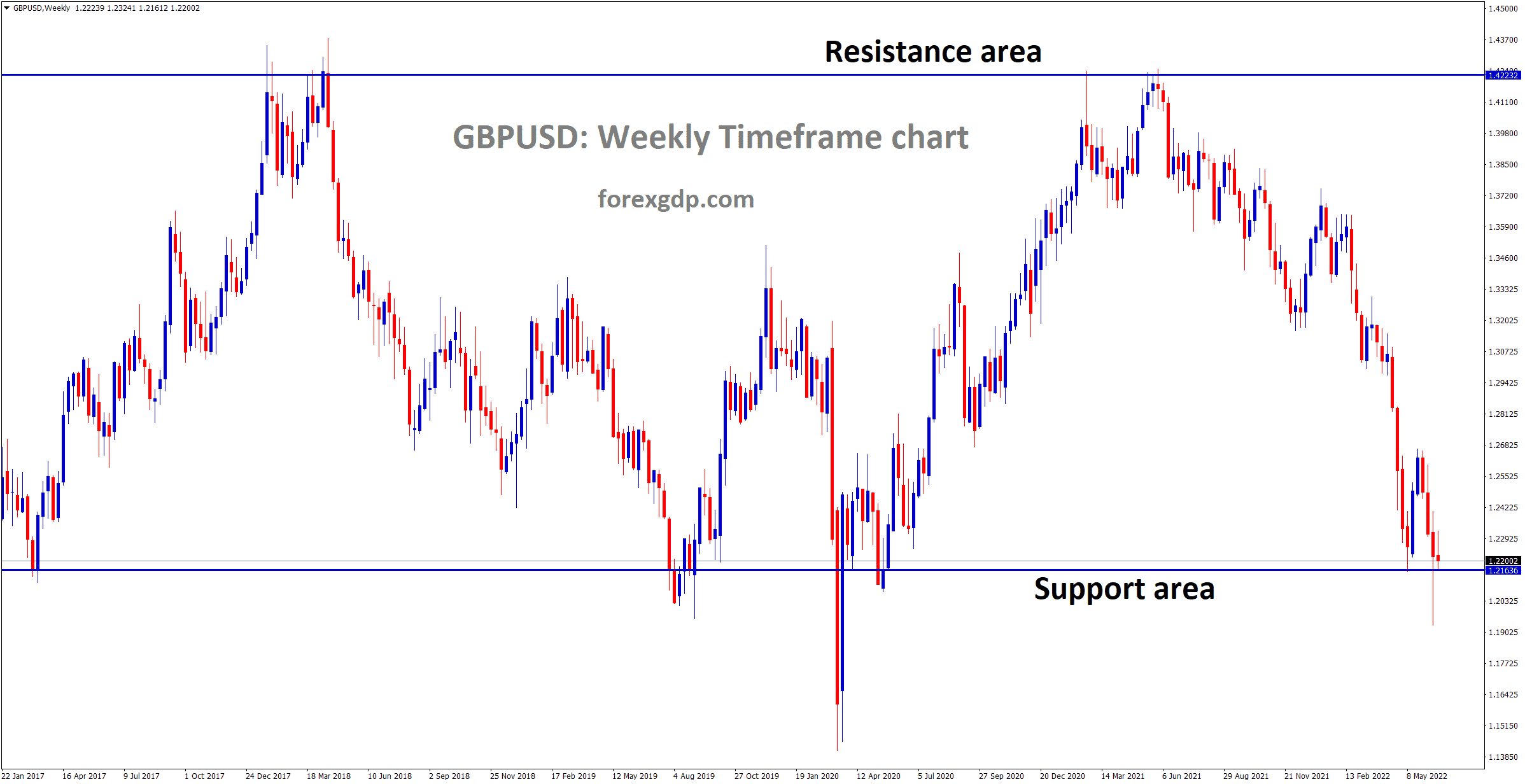

GBPUSD is moving in a box pattern and the market has reached the support area of the pattern.

Where Is GBPUSD Today

The GBPUSD currency pair is falling today as a result of the release of the CPI data. As a result of this decision, the GBPUSD pair faced an increase in its market value and is now teasing at around the 1.219 region.

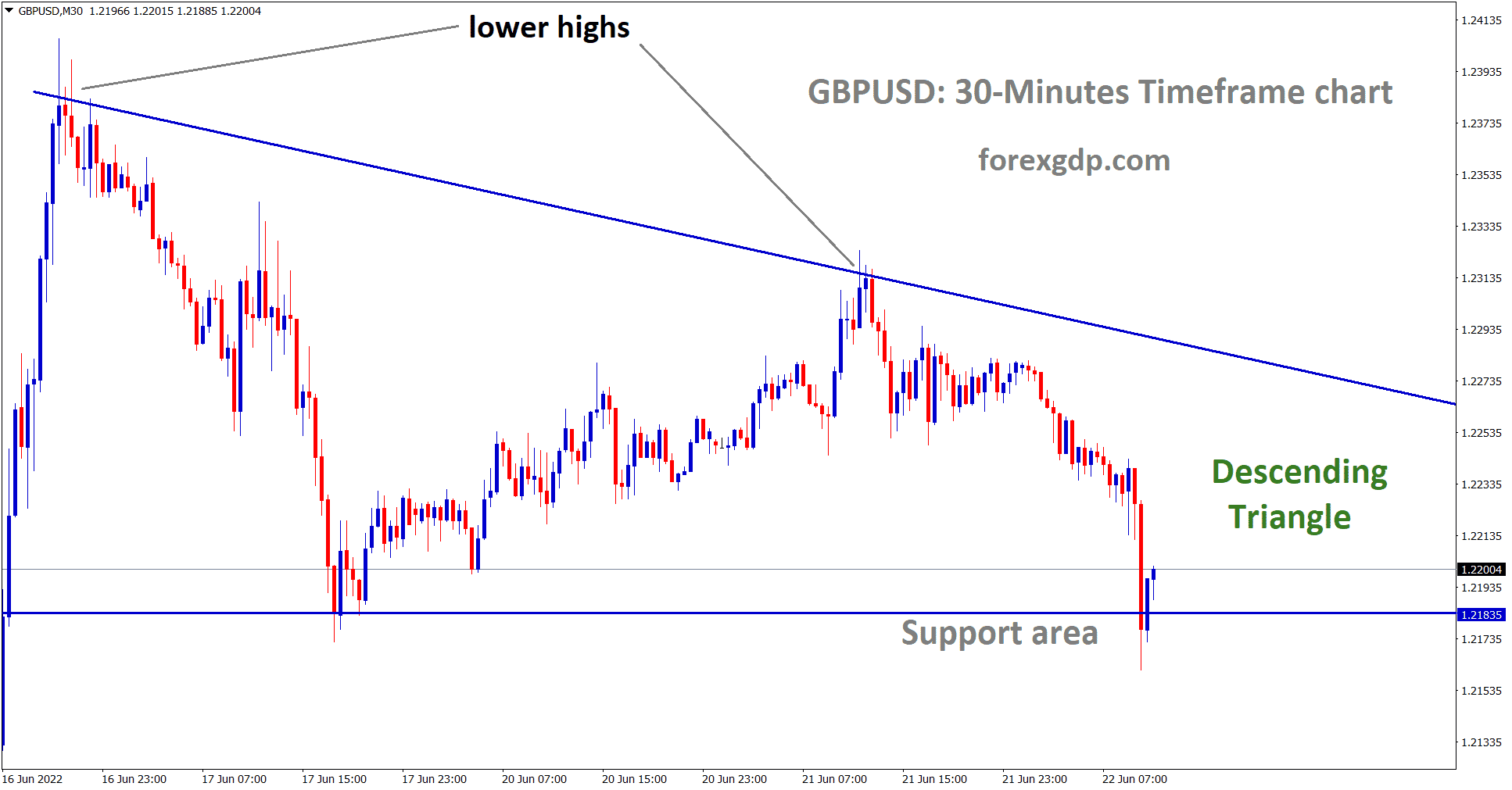

GBPUSD is moving in the descending triangle pattern and the market reached the support area of the pattern.

The GBPUSD chart is showing some bearish market conditions. We may continue to see this pair decrease in value throughout the day.

The UK Inflation Record

Early on Wednesday, it was revealed that the UK is now facing the highest inflation it has seen in over 40 years. This comes after the recent release of the CPI data which shows that the CPI has increased from 9% to 9.1%. It was expected that the CPI would remain unchanged however, it rose by 0.1% which shows a new inflation record despite this rise being not that significant. We also found out that the consumer prices rose to 0.7%. This is also slightly above the 0.6% that we expected it to rise by. This recent data release shows that the interest rate hikes that have been occurring by the Bank of England has so far had no impact on the inflation rates in the country. The BOE needs to rethink their interest rates and come up with a solution.

Economists at the CNBC reveal, “U.K. inflation hit 9.1% year-on-year in May as soaring food and energy prices continue to deepen the country’s cost-of-living crisis. The 9.1% rise in the consumer price index, released Wednesday, was in line with expectations from economists in a Reuters poll and slightly higher than the 9% increase recorded in April. Consumer prices rose by 0.7% month-on-month in May, slightly above expectations for a 0.6% rise but well short of the 2.5% monthly increase in April, indicating that inflation is slowing somewhat. The largest upward contributions to the inflation rate came from housing and household services, primarily electricity, gas and other fuels, along with transport (mostly motor fuel and second-hand cars). The Consumer Prices Index including owner occupiers’ housing costs (CPIH) came in at 7.9% in the 12 months to May, up from 7.8% in April.”

BOE Mann Speech

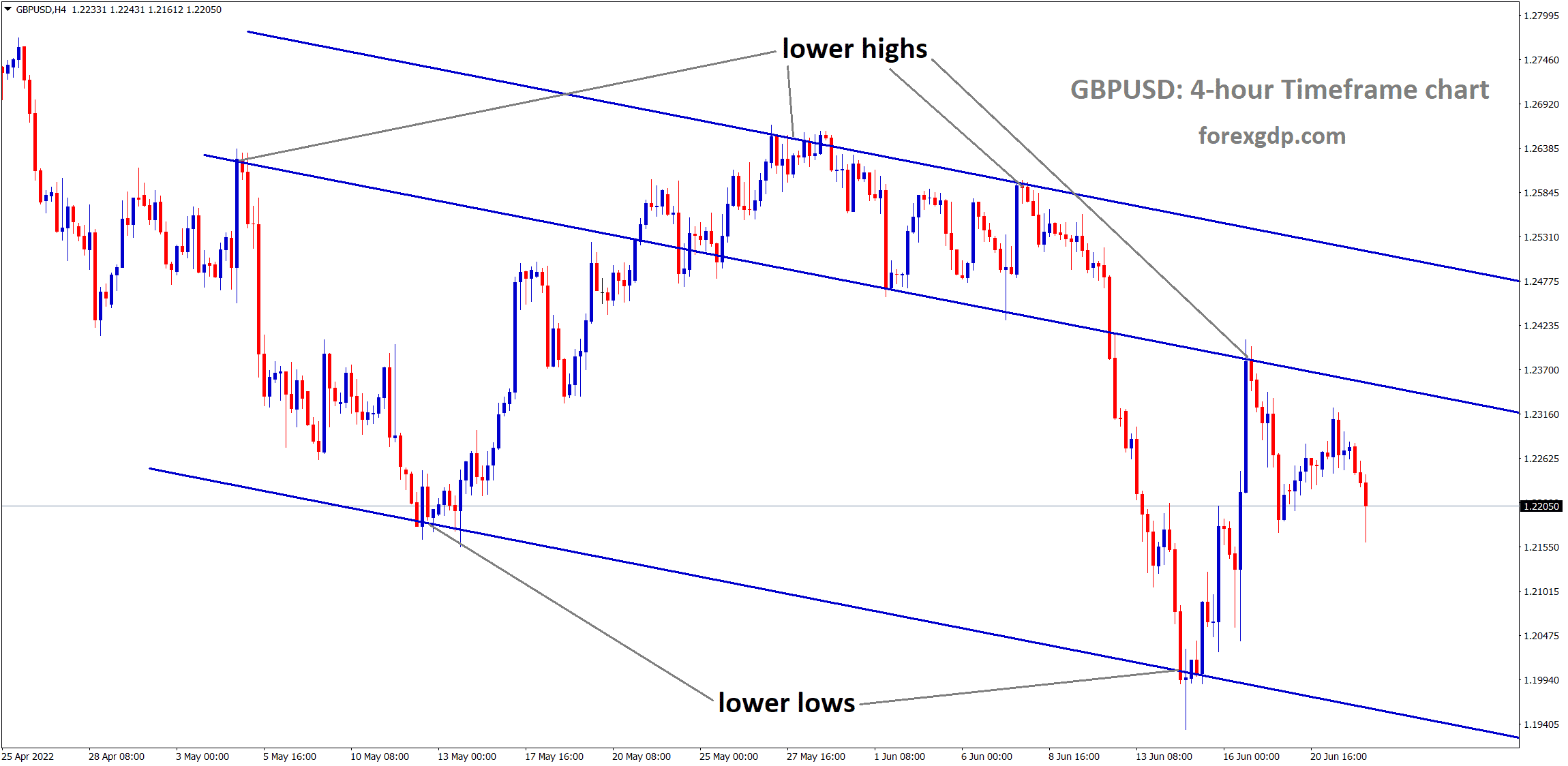

GBPUSD moving in descending channel and the market has fell from the lower high area of the channel.

Catherine L. Mann, Member of the Monetary Policy Committee at the Bank of England, recently held a speech at the Market News International Connect event where she discusses the changes in interest rates in the US and how they can affect the UK economy. And also she explains how that has influenced her thinking on what should happen to interest rates in the UK. She states, “While the domestic effects of monetary tightening are (relatively) well-established, the net effect on economies abroad is a priori ambiguous. On the one hand, via slowing US domestic demand, US monetary tightening will reduce demand for goods and services produced abroad. The global demand channel causes a slowdown in activity and disinflation. On the other hand, all other things being equal, a monetary policy tightening in the US ought to appreciate the Dollar vis-à-vis foreign currencies as compensation for holding Dollar-denominated assets rise and capital flows to the US increase.”

She further reveals, “For the foreign economy, this means capital outflows and a depreciating currency. As imported goods become more expensive in terms of foreign currency, this global financial channel will tend to have an inflationary effect on the non-US economy. To the extent that the depreciation makes exports from this country more attractive on the world market there may be a boost to exports that offset the global demand slowdown. Inflationary pressures from US tightening have been documented especially for emerging market economies and have been found to be large and significant but the relative price effect on export volumes apparently is mitigated by a number of factors including dollar invoicing and being part of a multinational supply chain. In sum, the global demand channel should induce the same signs in output and inflation at home and abroad while the global financial channel would induce the opposite sign in the foreign economy. Therefore, the net effect for the non-US economy is not determined a priori. Additionally, all other things are not usually equal in the real world. Instead, which way activity and inflation break in the foreign economy depends critically on the reaction of monetary policy in that economy.”

BOE FPC Response

The Bank of England recently released a response with the Financial Policy Committee which reveals, “Following this consultation, the FPC has decided to withdraw the affordability test Recommendation with effect from 1 August. The withdrawal of the FPC affordability test Recommendation does not place any requirement on lenders to take action, as existing affordability assessment practices are subject to the FCA’s MCOB framework and will remain so. It will be up to individual lenders as to whether they wish to make any changes to their own lending practices and to determine the timing of any such changes after this date. The FPC judges that a notice period of six weeks appropriately balances the desirability of giving lenders notice ahead of the change in policy and the desirability of minimizing the risk of borrowers delaying purchases due to uncertainty about how reversion rates and the stress rate might move in future.”

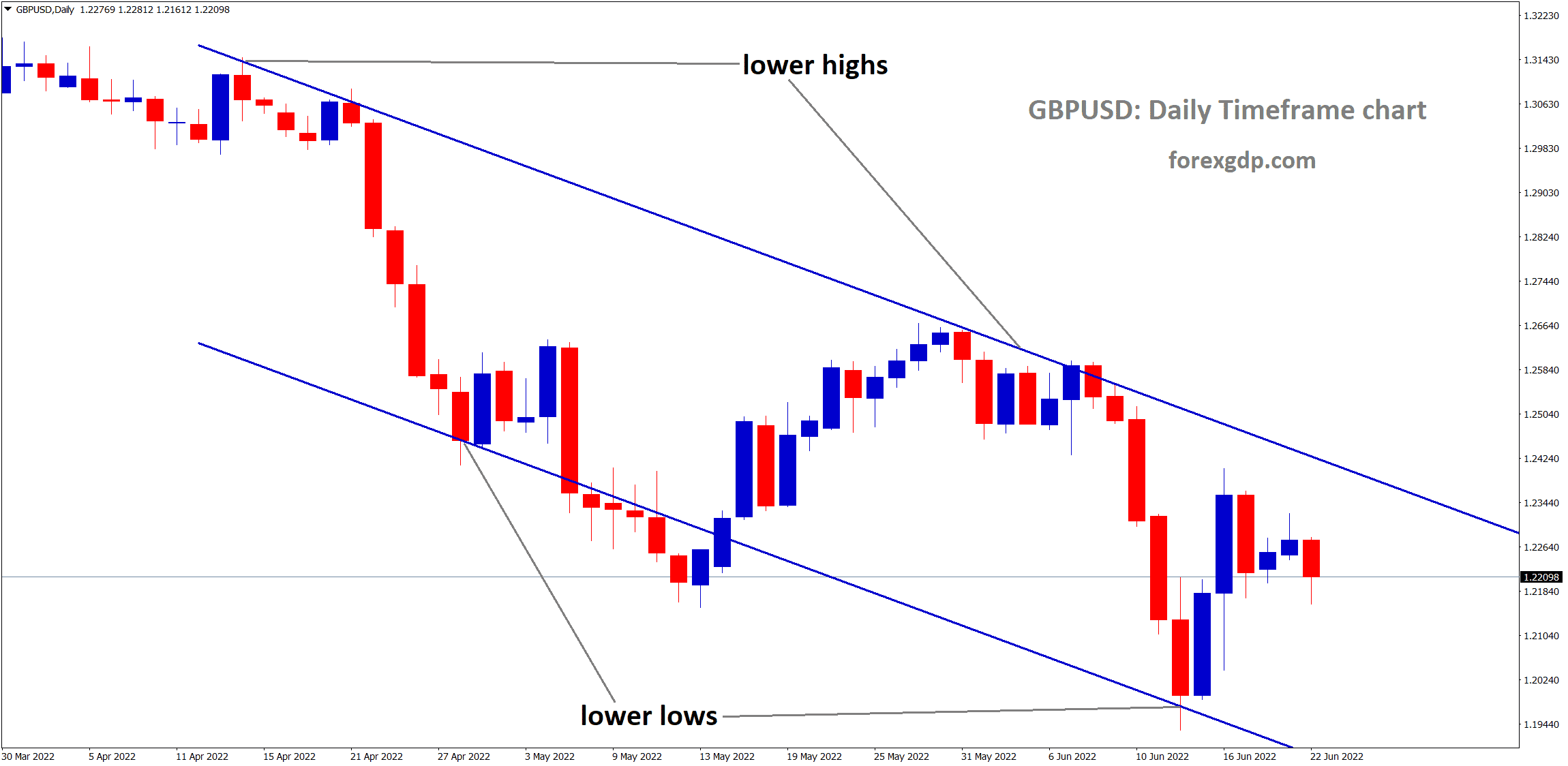

GBPUSD moving in descending channel and the market has reached the lower high area of the channel.

The response further adds, “At its September 2017 meeting the FPC confirmed that the affordability test Recommendation did not apply to any remortgaging where there is no increase in the amount of borrowing, whether done by the same or different lender. The rationale behind these Recommendations is to guard against a loosening in mortgage underwriting standards that could lead to a rapid increase in aggregate household debt and the number of highly indebted households. An excessive build-up and rapid growth in mortgage debt, often associated with rapid increases in house prices, has historically been a significant source of risk to the UK financial system and to the economy. In addition, by moderating aggregate household indebtedness, household credit growth and the share of highly indebted households, the Recommendations can also help to reduce the proportion of borrowers who face repayment difficulties on their mortgages during stress.”