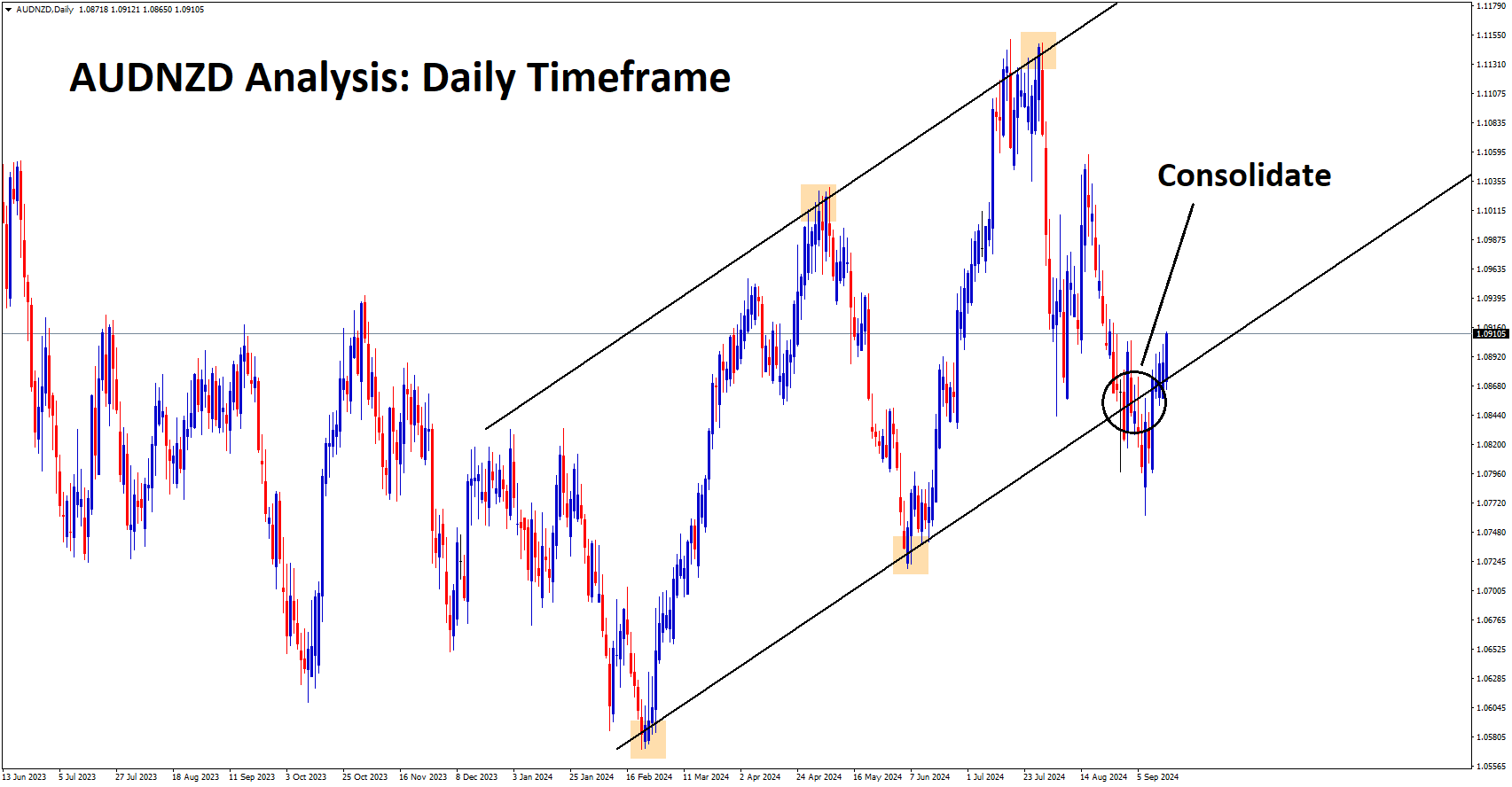

AUDNZD Analysis

AUDNZD broke the higher low area of the Ascending channel

After the confirmation of the Downward movement, AUDNZD Sell signal was given.

AUDNZD Update

AUDNZD is Consolidate and trying to re-enter towards the channel, which leads to the SL price. However, AUDNZD still have chances to fall from the breakout area and the higher low area

Reason: Due to the release of more economic news mentioned below, the market is not making technical movements at this time.

Why NZD is Weaker

Risk Aversion : NZD is considered a higher-risk currency due to its reliance on global commodity prices and trade. During times of uncertainty, investors seek safer assets, like the USD or JPY, which weakens the NZD.

Commodity Dependence : New Zealand is heavily reliant on the export of commodities like dairy, meat, and timber. Any decline in global demand or commodity prices negatively impacts NZD.

Interest Rate Differentials : Lower interest rates in New Zealand compared to other major economies make the NZD less attractive to investors, leading to currency weakness.

Economic Data : Weak domestic economic indicators, such as GDP growth, employment rates, or inflation figures, can lead to a decline in the NZD as they signal poor economic performance.

China’s Economic Health : New Zealand exports a significant portion of its goods to China. Any slowdown in the Chinese economy can reduce demand for New Zealand’s exports, weakening the NZD.

Please note In the forex market, technical works 80% of the time, and fundamental works 20% of the time. This time fundamental wins. Be patience and wait for the next good opportunity signal.

We always want you to trade safe under all market conditions.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade signals at premium or supreme plan here: forexgdp.com/buy/

💹 +2200% + 800% +400% +150% Growth in Live Real Trading account of our users, check here: https://www.forexgdp.com/realaccounts/