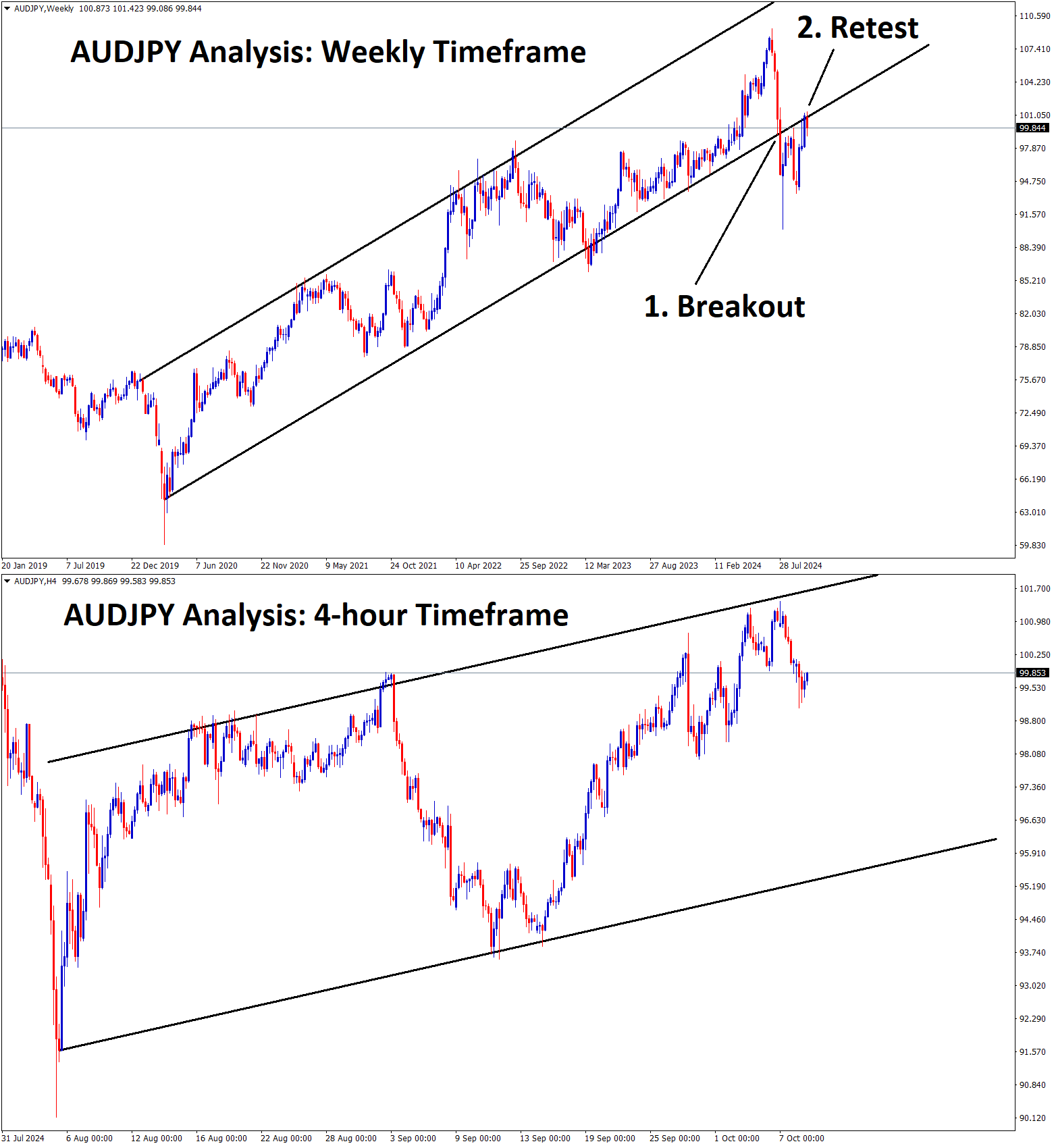

AUDJPY Analysis

AUDJPY retesting the broken ascending channel in the higher timeframe weekly chart. In the 4-hour timeframe, AUDJPY is falling from the higher high area of the channel

After the confirmation of the Downward movement, AUDJPY Sell signal was given.

AUDJPY Update

AUDJPY is Consolidate at broken the Retest area, which leads to the SL price. However, AUDJPY still have chances to fall from the retest area

Reason: Due to the release of more economic news mentioned below, the market is not making technical movements at this time.

Why AUD is Stronger

China’s Economic Influence China’s economic policies heavily influence the Australian economy due to its strong trading ties. Even though China’s recent stimulus measures underwhelmed markets, the importance of Australia’s commodity exports (iron ore, copper, etc.) to China helps support the AUD.

Commodities Market Support Despite volatility, the prices of key commodities (iron ore, copper, silver) remain at important levels, bolstering confidence in the Australian economy and its currency.

Investor Confidence The Australian stock market is benefiting from stability in industrial commodities, which signals investor confidence in the currency, even amid fluctuating global conditions.

Why JPY is Weaker

Falling Real Wages Japan’s real wages declined in August after two months of gains, signaling potential weakness in consumer purchasing power and economic recovery.

Declining Household Spending Household spending in Japan also dropped, raising doubts about domestic consumption and the strength of Japan’s economic recovery.

Uncertain Monetary Policy The new Japanese Prime Minister’s blunt stance on monetary policy, along with uncertainty over the BoJ’s rate hikes, has weakened confidence in the yen.

Reduced Safe-Haven Demand The prospect of a Hezbollah-Israel ceasefire diminished demand for safe-haven assets like the JPY, causing the currency to weaken further.

Intervention Speculation Renewed speculation that Japanese authorities may intervene to support the yen has restrained aggressive short-selling, but the overall uncertainty around intervention has kept the yen weak.

Please note In the forex market, technical works 80% of the time, and fundamental works 20% of the time. This time fundamental wins. Be patience and wait for the next good opportunity signal.

We always want you to trade safe under all market conditions.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed trade signals at premium or supreme plan here: forexgdp.com/buy/

💹 +2200% + 800% +400% +150% Growth in Live Real Trading account of our users, check here: https://www.forexgdp.com/realaccounts/