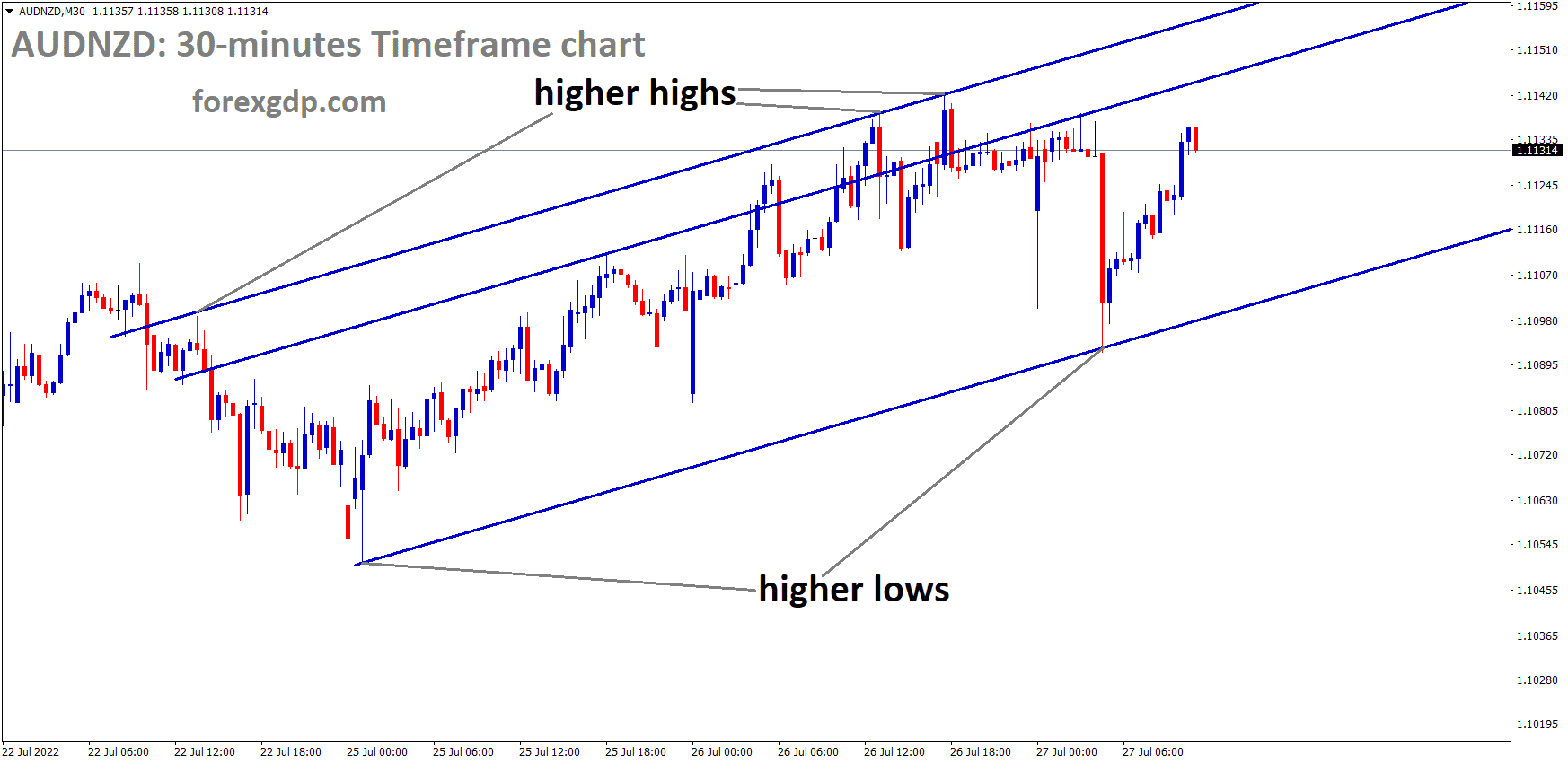

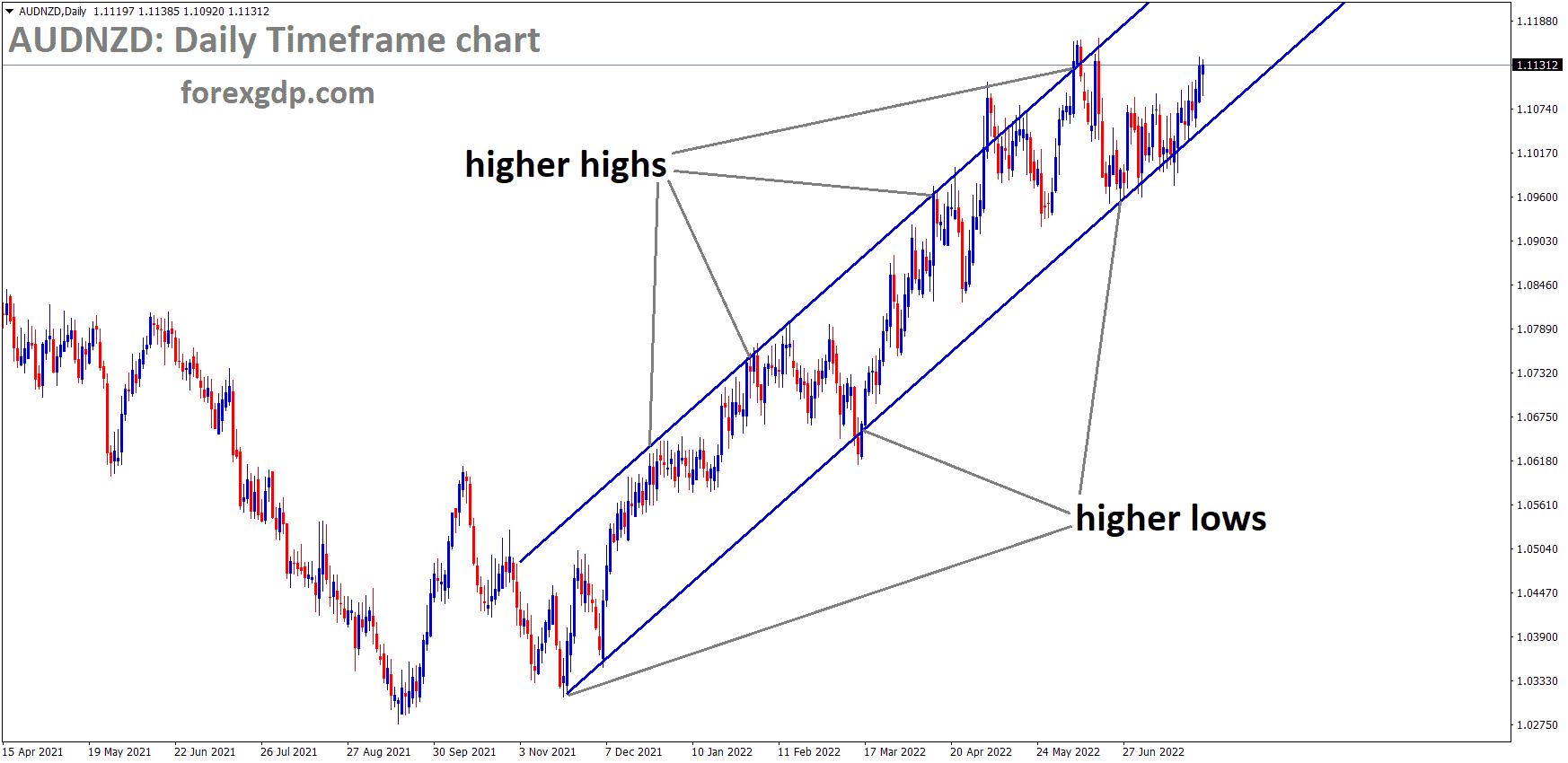

AUDNZD is moving in an Ascending channel and the Market has rebounded from the higher low area of the channel.

Where Is AUDNZD Today

The AUDNZD charts are quite unstable today as a result of the speeches by the RBA and RBNA which reveal monetary policy queries and concerns.

AUDNZD is moving in an Ascending channel and the Market has rebounded from the higher low area of the channel.

We also witness the pandemic causing a lockdown in New Zealand once again. As a result of these releases, the AUDNZD pair faced a high instability in its value and is now teasing around the 1.11 region. We may continue to see this pair be volatile throughout the day.

RBA Monetary Speech

The Reserve Bank of Australia recently held a monetary speech that reveals, “After many years in which inflation was something that most people didn’t think too much about, it is now a topic of everyday conversation. This is understandable as higher prices are putting pressure on people’s budgets. In many countries, inflation is now running at its highest rate in decades. In the United States and most of Europe, inflation is close to 10 percent. The last time that this was the case was in the early 1980s. The policy challenge for the RBA is to return inflation to the 2–3 percent target range while, at the same time, keeping the economy on an even keel. We don’t need to return inflation to target immediately, as we have long had, for good reasons, a flexible medium-term inflation target. But we do need to chart a credible path back to 2–3 percent. We are seeking to do this in a way in which the economy continues to grow and unemployment remains low.”

They further reveal, “It is certainly possible to do this, but the path ahead is a narrow one and it is clouded in uncertainty. Global factors, including Russia’s invasion of Ukraine, are one source of this uncertainty. And domestically, the path back to 2–3 percent inflation will be shaped by how the general inflation psychology in Australia evolves and how Australians respond to higher interest rates. So, these are some of the issues we will be watching carefully over the months ahead. The second factor is Russia’s invasion of Ukraine, which has caused major disruptions to the global markets for energy and food. This has directly affected CPI inflation in all countries and there are now also second-round effects as higher energy costs feed into higher costs of transport and production. The third factor is the surprising strength of demand in many economies. Household spending, in particular, recovered more quickly from the pandemic than was expected. This reflected the success of the vaccination campaigns in advanced economies and the unprecedented support to household finances from fiscal and monetary policies. This policy support meant that, as the health situation improved, households had the confidence and the ability to spend. The result has been strong growth in aggregate demand and the emergence of tight labor markets in many countries. This has contributed to the higher inflation we are now seeing.”

New Zealand Lockdown

New Zealand is once again facing over 10,000 COVID-19 cases in a day which caused the government to make the country go into lockdown again. Economists at the ABC reveal, “Across the Tasman, New Zealanders who were once asked to lock down over a single case of COVID-19 are now being urged to wear masks as the country records a seven-day rolling average of nearly 10,000 cases a day. Authorities believe there is widespread community infection in every region of New Zealand, driven by the highly transmissible Omicron BA.5 sub-variant.”

Economists at the ABC reveal, “And for a nation of just 5.1 million people, attention is now turning to New Zealand’s daily death rate, which has been among the highest in the world according to one World Health Organization measure. Health authorities have refused to move back towards settings that would limit the size of gatherings, instead insisting that a three-pronged strategy of masks, vaccines, and isolation will get the population through winter. With its borders now open and strict lockdowns a thing of the past, New Zealand is now riding the waves of COVID-19 as they crash across the world.”

RBNZ Monetary Speech

The Reserve Bank of New Zealand recently held a monetary speech that reveals, “A report released today, How Central Bank Mistakes after 2019 led to Inflation, has been received by the Reserve Bank of New Zealand and will be considered as part of our public Monetary Policy Remit review process underway. As Governor of the Reserve Bank and Chair of the Monetary Policy Committee, I acknowledge that consumer price inflation is at 7.3 percent, above the Remit target range of 1-3 percent. I also acknowledge that the Monetary Policy Committee’s decisions over recent years have influenced this outcome. This acknowledgment is reflected in our regular Monetary Policy Statements and through our ongoing efforts to quell excess demand in the economy. Any recommendations arising from the review will be delivered to the Minister of Finance for consideration. We have encouraged public participation in the Remit review process and sought independent international expert advice. In addition to the Remit review, we are also reviewing our recent performance in conducting monetary policy, including the use of additional monetary policy tools.”

It further reveals, “This monetary policy review will assess inflation and employment outcomes relative to the targets outlined in the Remit, and the decisions taken at various times based on the information available at the time, relative to other central banks, and relative to likely alternative economic outcomes if these decisions had not been taken.

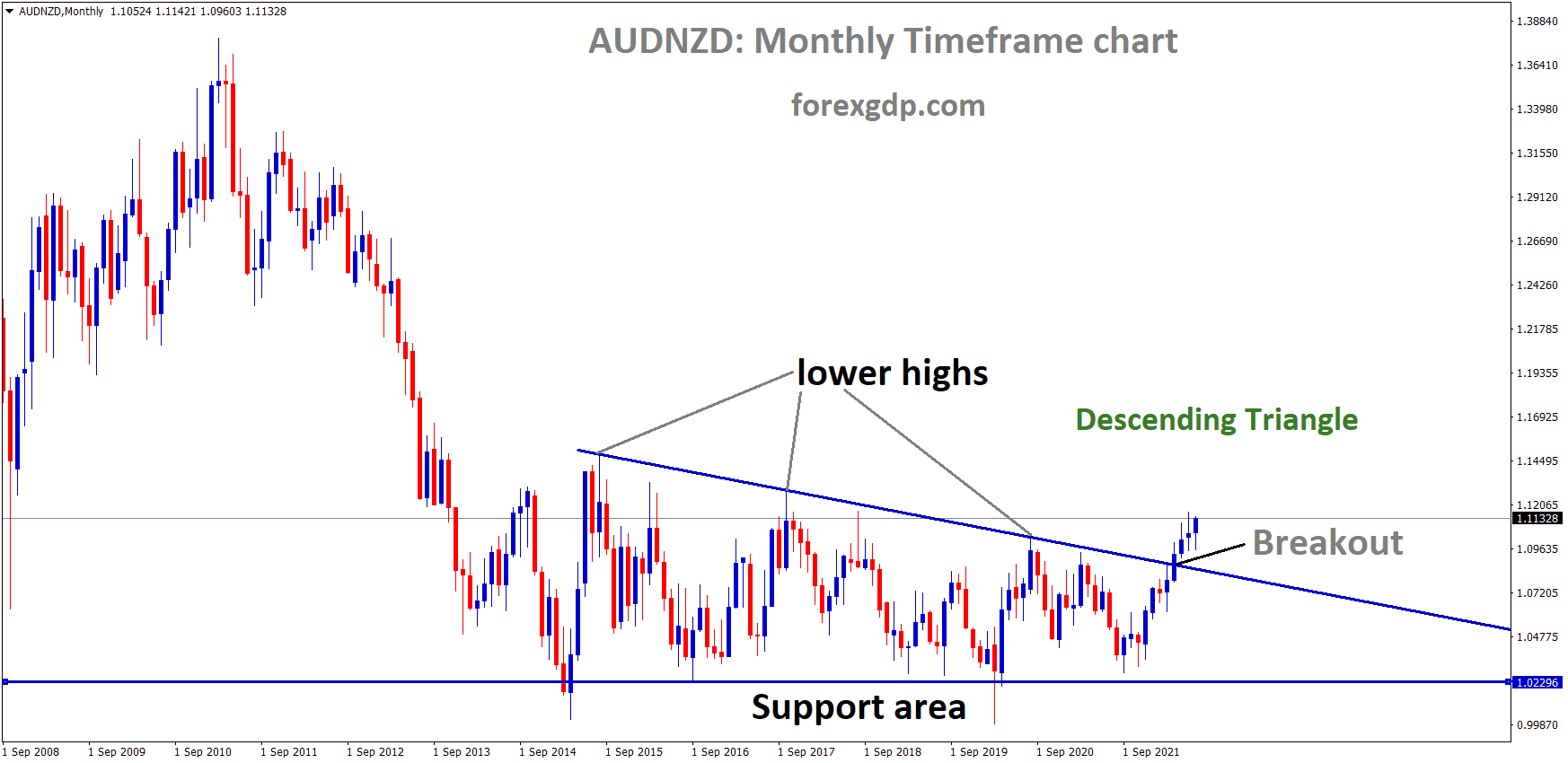

AUDNZD has broken the Descending triangle pattern in Upside.

The decisions of the Monetary Policy Committee are always made with the information at hand at the time. This information and the assumptions made at each decision point are outlined for all to view in our Monetary Policy Statements. I regret that the Committee – and society at large – has been confronted with the COVID-19 pandemic and other recent events that have caused food and energy price spikes. We are a learning institution, and through the open process of the Remit review and the monetary policy review, we will be very clear on our lessons learned as we forever seek to do a world-class job for the people of New Zealand.”