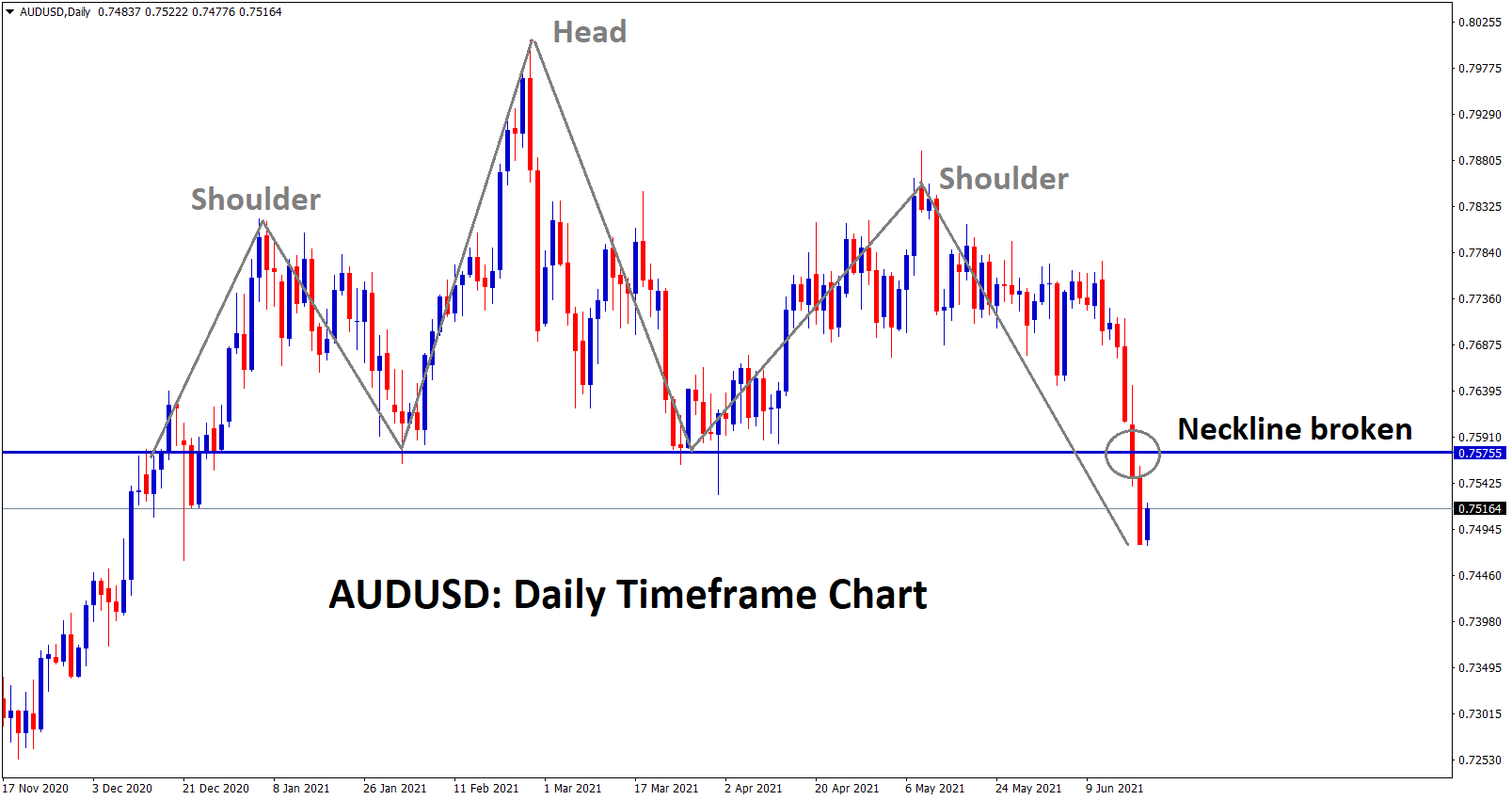

Head and Shoulder Neckline breakout happened on AUDUSD.

After the breakout confirmation, we expect some correction and given the sell signal for continuation of the trend. However, market starts to consolidate and closed at our entry price level due to the 2 days expiry as per our signal rules.

Retail sales data of Australia Crossed above numbers may stop the Bleeding of Australian Dollar Downfall.

As last week FED meeting outcome brings Australian Dollar Downfall after long sideways market to end.

Now, this week may expect some correction to 0.76-0.76500 level as Domestic data supports.

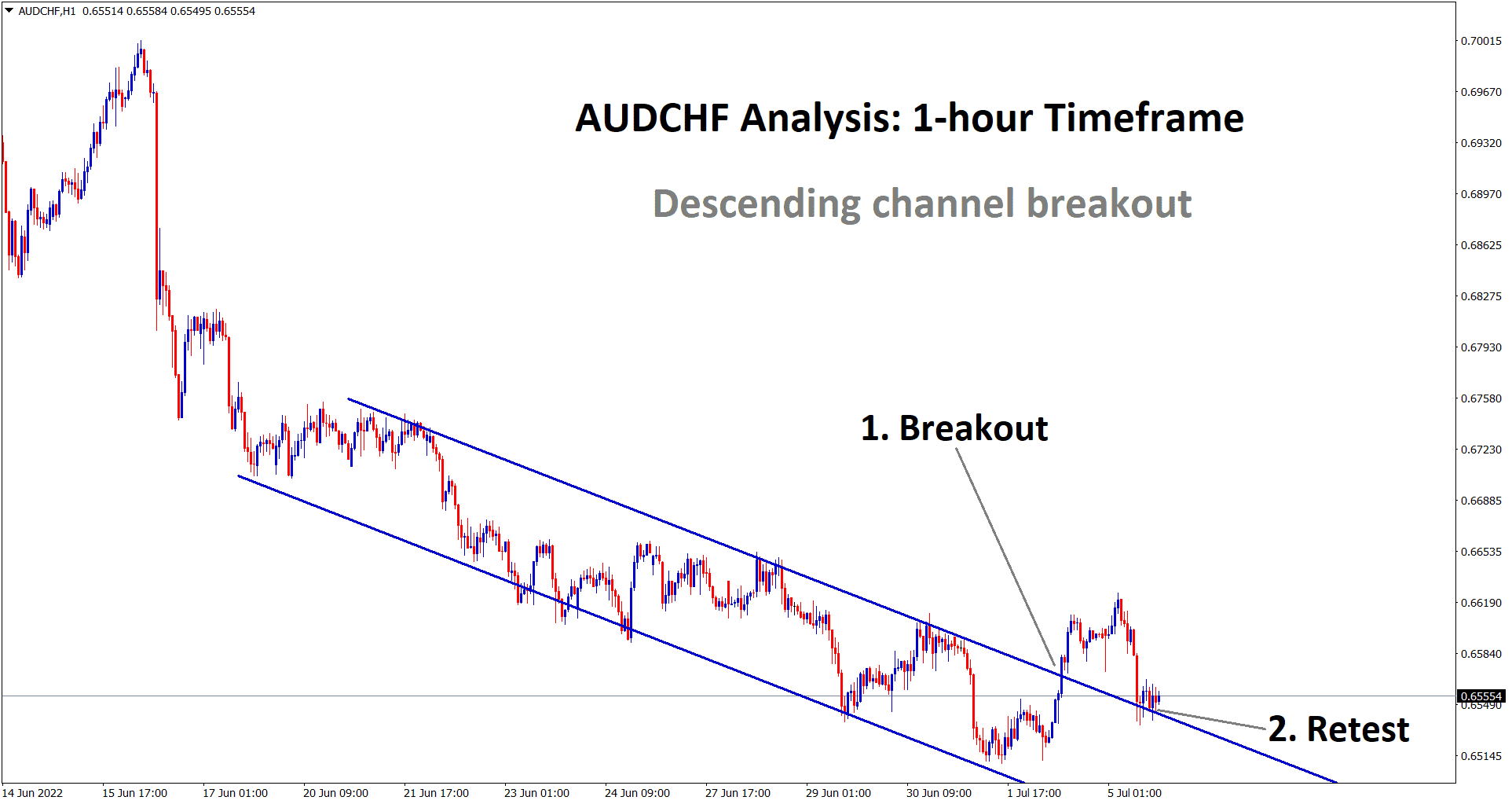

As Australian Country made significant progress against Covid-19 and circuit breaker lockdown implemented in Victoria state may impact retail growth negatively.

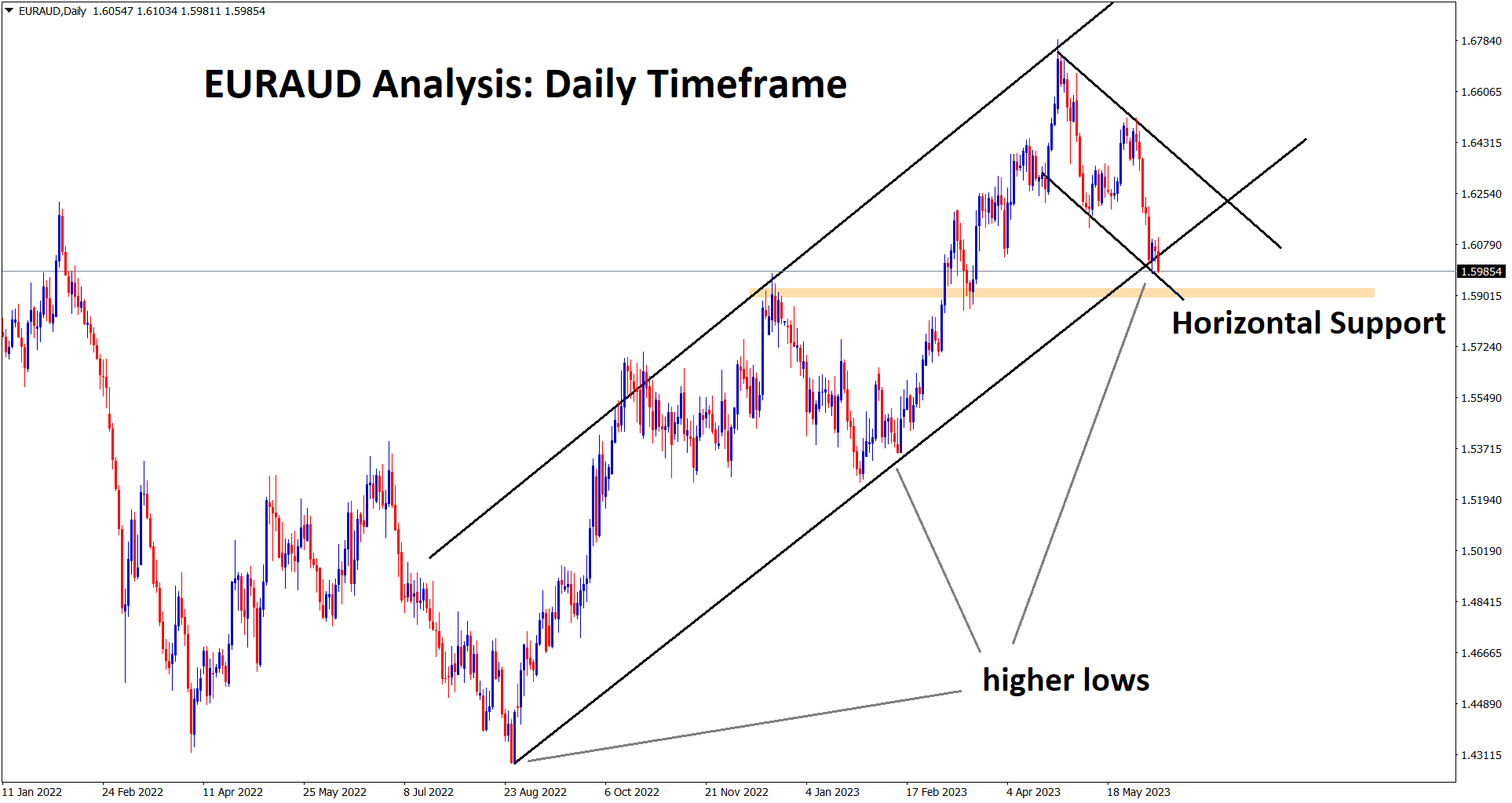

Domestic data of Australia now pullback from Weakness this week, but China tariffs on Australian Products makes Selling pressure on Australian Dollar.

China tariffs on Australian Wines

Australian Foreign minister Marise Payne said that China and Australia would go for Bilateral discussions on Wine Tariffs over 200% imposed by China on Australian Wines.

And Australia said legal statement for negotiations told over to WTO about China tariffs on Australian Wines. If it goes higher year by year, Then Businesses of exports to China will harm Australia.

Due to this, China must reconsider the tariffs on Australian Wines imposed and does tariff-free business to implement between China and Australia.

Great for your analyse

thanes