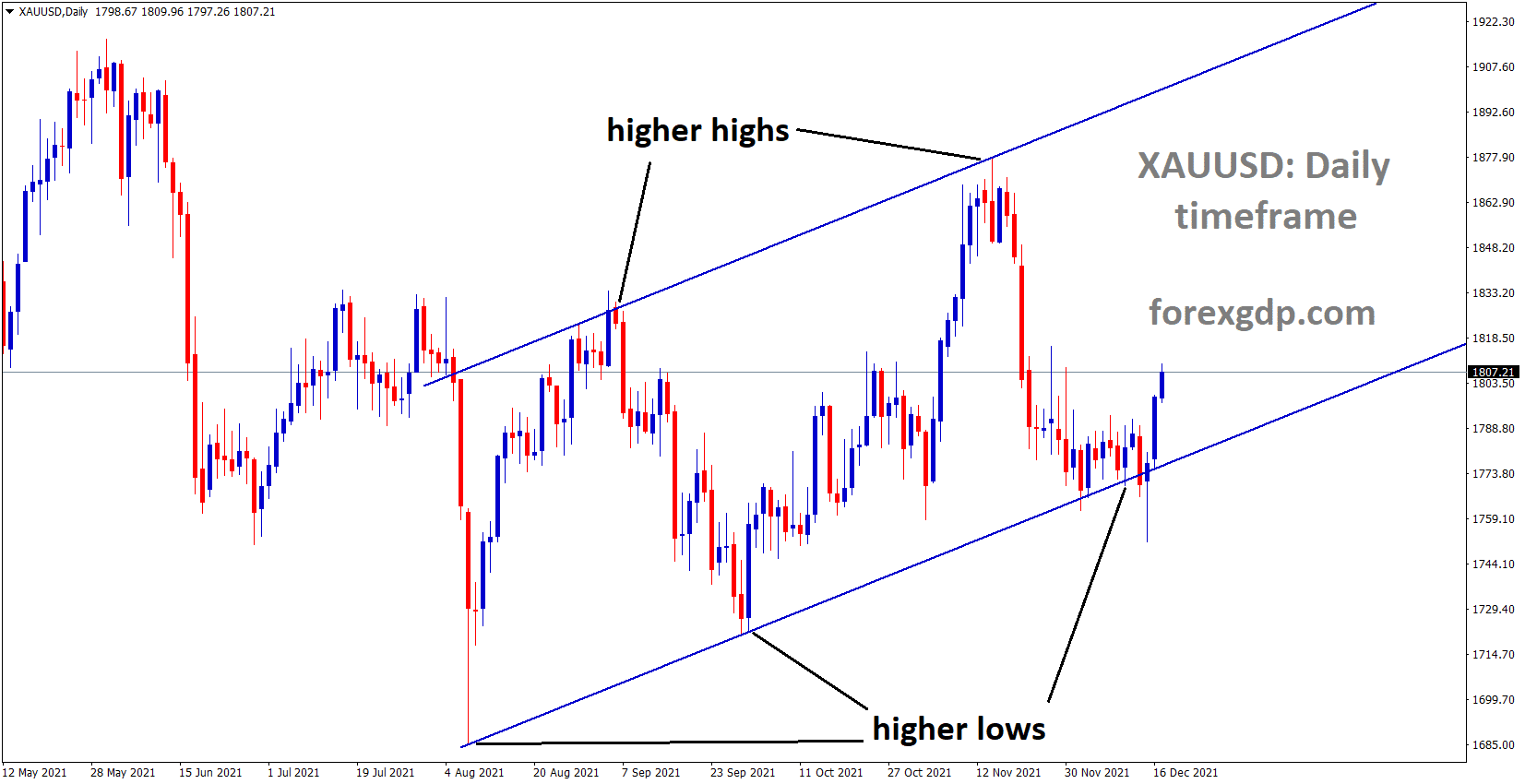

Gold: Government of India Planning for reducing import duty tax on Gold

Gold prices seem higher and have broken the previous resistance area of 1795$ yesterday due to Treasury Yields going down on the expectations of FED Rate hikes.

XAUUSD Gold price is moving in an Ascending channel and the market rebounded from the higher low area of the channel.

XAGUSD Silver price has broken the Descending channel.

And Indian Government is Going to Cut the import duty from 7.5% to 4.0% as the proposal came from Authorities, still under Scanning purpose; once the decision is taken to reduce tax, it will be supported for gold prices to rise more.

And FED has planed for three rate hikes in the 2022-2023 period if tapering is completed in March month of 2022.

US and China tussles on Xinjiang Province & US and Iran Tussles on Denuclearization activities support US Dollar Demand.

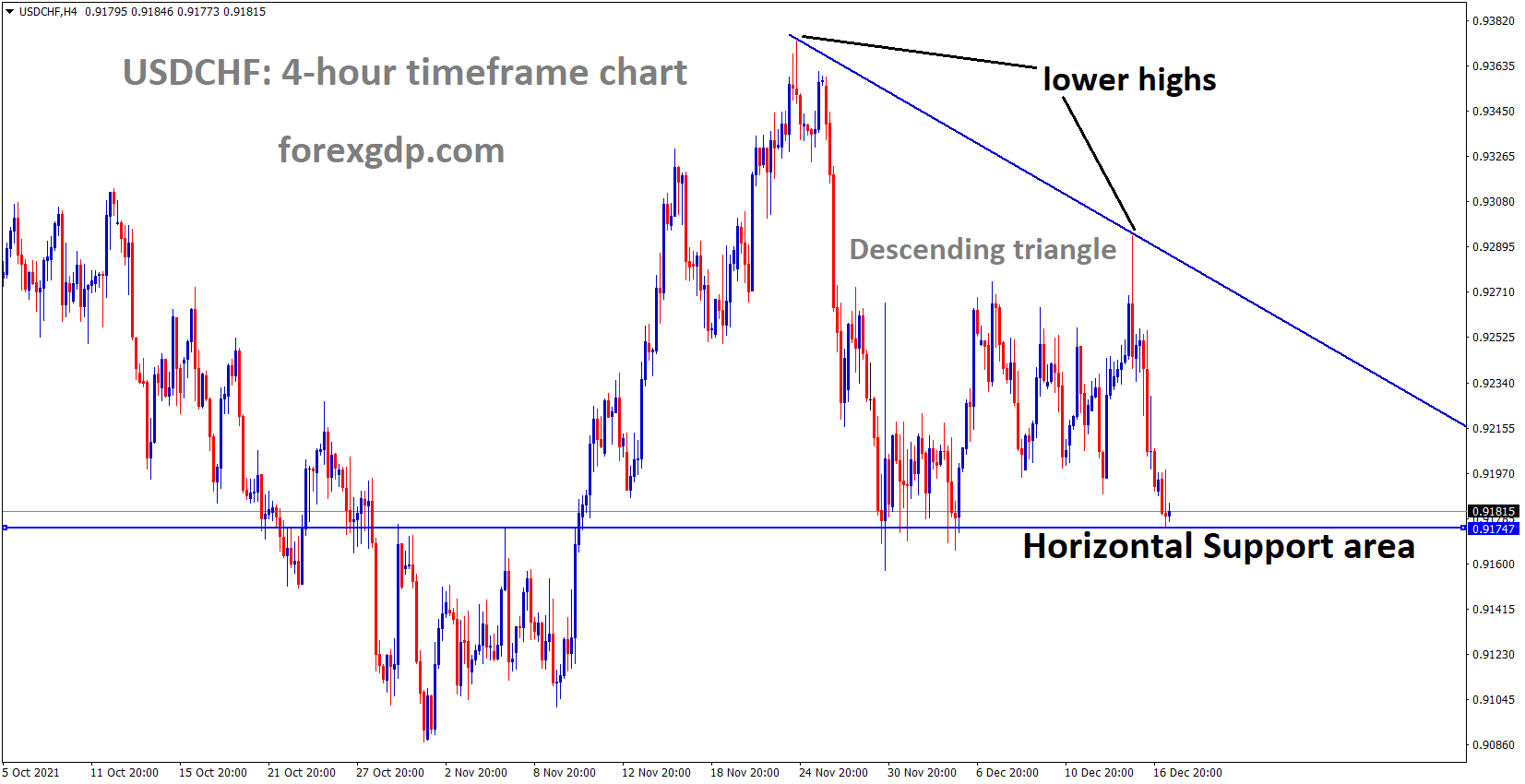

US Dollar: US President Joe Biden Speech

USDCHF is moving in the Descending triangle pattern and the market reached the Horizontal support area.

Yesterday US President Joe Biden addressed people from Roosevelt Room in the White House that the omicron Variant would spread more in the US than usual and said It’s time to add Booster Dose for those who got Two Dosages shot.

The People not vaccinated will be got severe more on the Omicron variant.

And the US Must be cautious on Mask mandatory side, and Booster Dose will help us from the Omicron variant.

And the UK already reported 88000 cases per day due to Omicron variant spread.

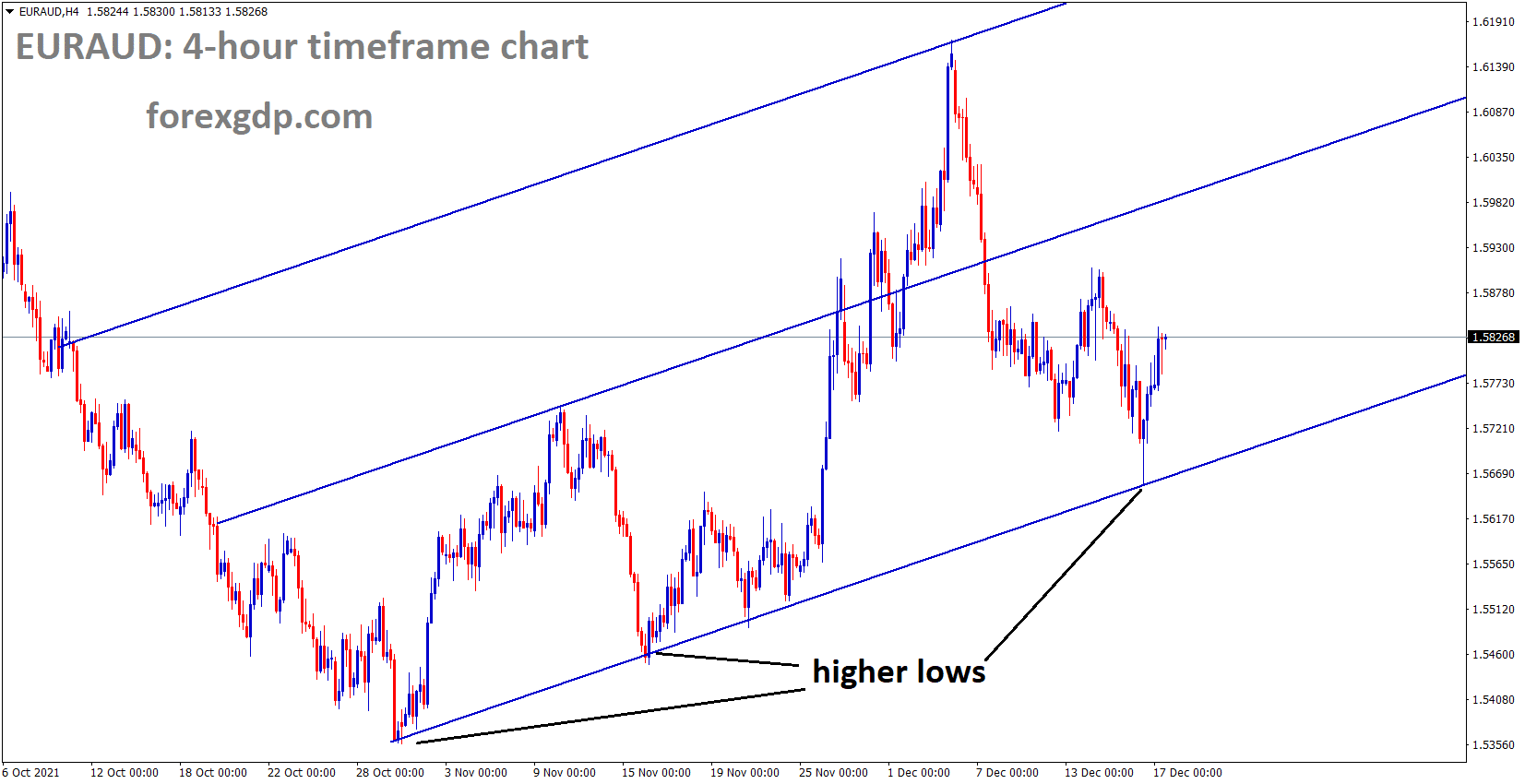

EURO: ECB left rates unchanged and a Tapering plan announced

EURAUD is moving in an Ascending channel and the market rebounded from the higher low area of the channel.

ECB made a slight hawkish signal in the monetary policy meeting that happened last day, and it would like to complete the Pandemic emergency Purchases from March 2022.

But Asset purchasing program will be Euro 40 billion Q2 of 2022 and Euro 30 billion in Q3 of 2022.

Now ECB also looks to shine on its path by reducing APP plan, and Euro will be more assertive in 2023, is all expected.

After this, EURUSD is slightly higher from Lows and pushed higher to 1.1320 level again.

The US Senate rejected the Democratic proposal and Joe Biden plan of Trillion-Dollar extension program

Germany’s Bundesbank downgraded GDP Growth in 2022

Germany’s Bundesbank said that the Economy will draw down in the Final quarter of 2021 and the First quarter of 2022. The main reason is Supply chain Bottlenecks and Pandemic restrictions across Globe.

Private consumption will increase in the Spring of 2022.

And German GDP growth will be 4.2% in 2022, and 5.2% in June.3.2% will see in 2023 versus 1.7%.

German inflation at 3.6% in 2022 vs 1.8% in June, the expected German inflation at 2.2% in 2023 and 2024, which is ECB’s target, will be achieved.

UK Pound: Bank of England did interest rate hike to 0.25% from 0.10%

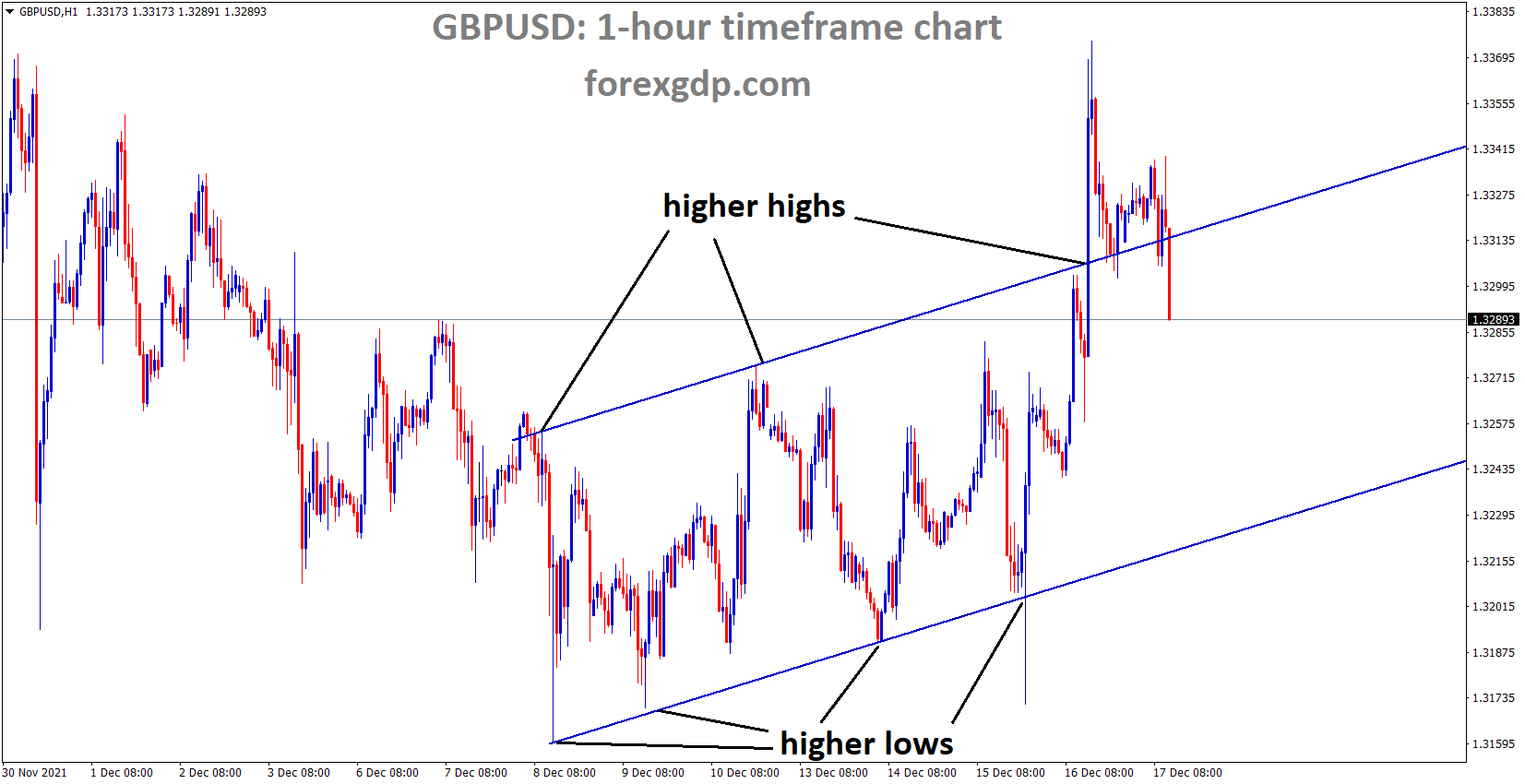

GBPUSD is moving in an Ascending channel and the market fell from the higher high area of the channel.

Bank of England raised the interest rate to 0.25% first since pandemic 2020; the previous rate was 0.10%.

And UK Retail sales show 1.4% printed versus 0.80% expected and 1.1% Previous reading.

Due to these scenarios, the UK Pound jumped sharply from 1.32-1.3370 area after the Surprise rate hike.

UK reported 80K cases per day the first time after the pandemic, and Booster Doses are like to implement those completed 2 Doses.

And People are suffering from the spread of Omicron Variant rapidly compared to the previous one, but it’s not too dangerous compared to the previous one.

UK Government follows mask measures and Lockdown restrictions keep tightened to minimize Spread of New Variant.

Canadian Dollar: Convergence in Policy of FED and BoC

Crude oil price is moving in the Descending channel and the market falling from the lower high area of the channel.

Canadian inflation numbers printed at 4.7% in November month.

And Bank of Canada Governor Tiff Macklem said it is time to change monetary policy settings due to higher inflation in the Canadian Economy, which is 30 years high in Canadian History.

And we planned for Five rate hikes in 2022 once tapering was completed in March.

The convergence of FED with BoC is related to more rate hikes in 2022, as the FED decision is a more coincidental decision.

Oil Prices keeps consolidation due to Omicron spread and Supply getting stronger, and Demand Getting weak Globally.

Japanese Yen: Bank of Japan left rates unchanged

GBPJPY is moving in the Descending channel and the market fell from the lower high area.

Bank of Japan left rates -0.10% unchanged today, and Governor Kuroda speaks that Western Countries increased rate hikes won’t affect the Japanese Yen.

And Weaker Yen is well supported for Exports and Corporate profits.

Inflation seems to be increasing in a step-by-step manner in Japan, and we will not be tapering; the easing of monetary policy more keeps Yen weaker again.

And We have reverse culture when compared to Western Countries. If a pandemic hits, the Japanese Yen gets stronger when other currencies are weaker.

At the same time, if the Economy got ok, then the Japanese Yen gets weaker and Normal currencies strengthen again.

So, Japan will recover to the Pre pandemic stage in 5 years.

Australian Dollar: UK and Australia made Free trade deal

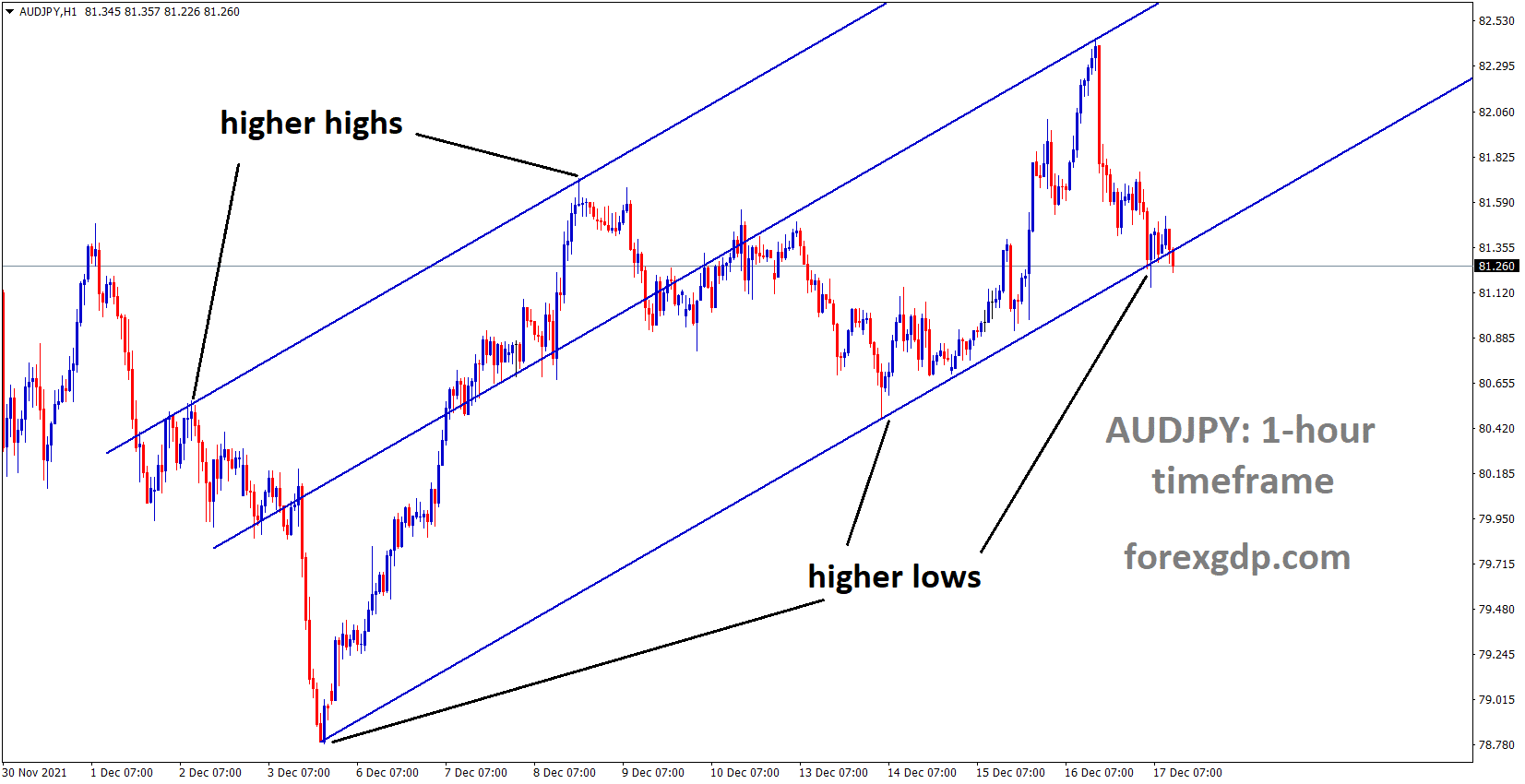

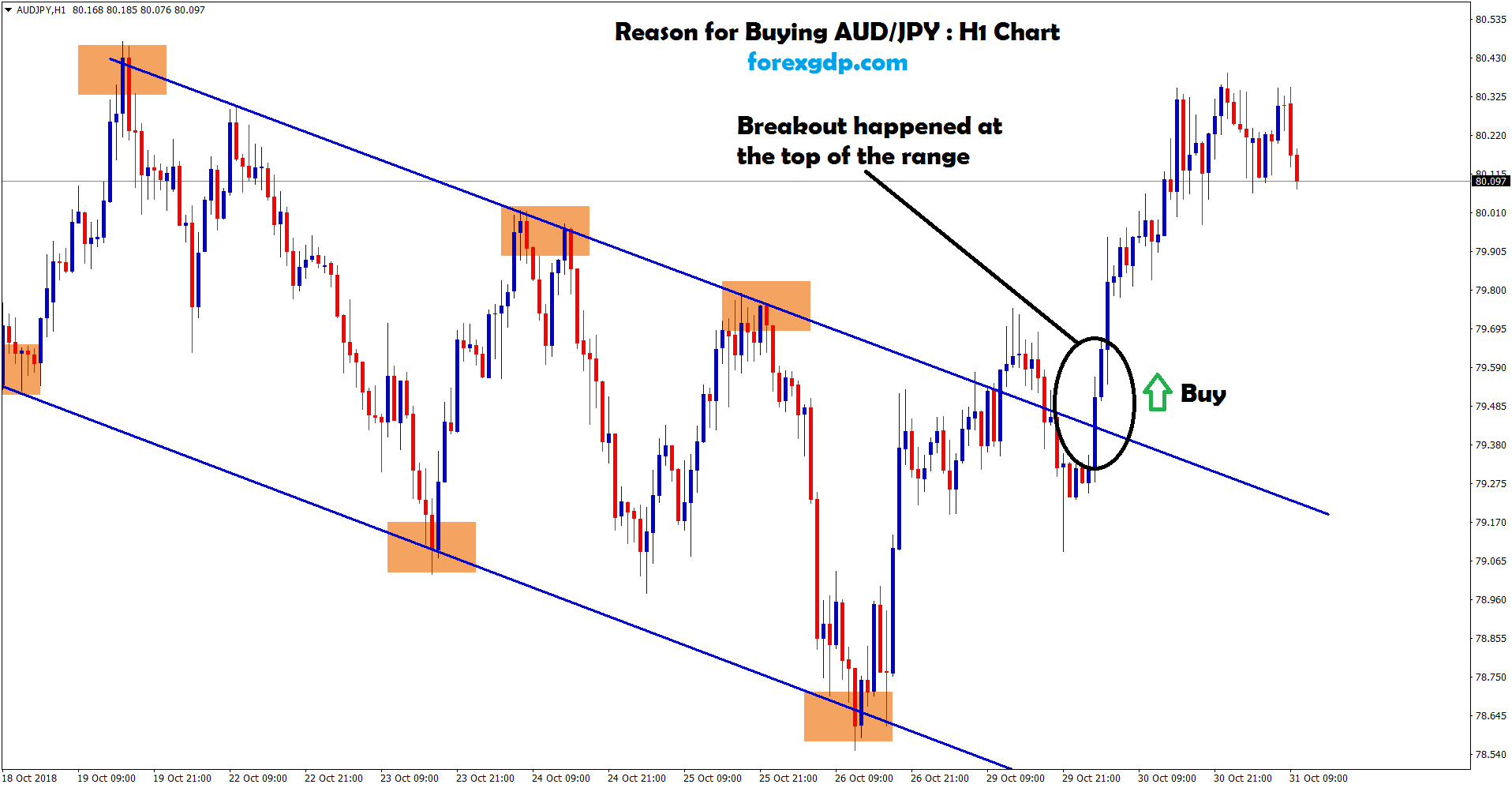

AUDJPY is moving in an Ascending channel and the market reached the higher low area of the channel.

Australia New South Wales faced 3700 cases daily, which heightened security risk restrictions due to the Omicron variant.

Britain and Australia met the Free trade deal for the first time after the post-Brexit agreement. Terms and conditions are not changed.

And Australia likes to unblock UK Pound 10.4 billion worth of additional trade while ending tariffs on the UK.

China never stops imports of Australian Iron ore, as Australian Treasurer Frydenberg said, but they must end Economic coercion and be a friendly relationship to maintain with Australia.

New Zealand Dollar: The business confidence index came lower than expected

NZDUSD is moving in the Descending channel and the market fell from the lower high area of the channel.

New Zealand Business confidence came at -23.2 in December and down from -16.4 in November, and Bank’s activity outlook reading also wakened to 11.8 from 15.0.

And New Zealand Dollar shows weakness against US Dollar due to the FED Dot plot showing more rate hikes in 2022.

The US Retail sales came down with expected numbers, and Joe Biden said Omicron Variant is more fast spread than expected.

Wearing Mask keeps mandatory, and Booster Dosage will be the primary source of cure from Omicron variant.

And New Zealand Nation is still far from Omicron cases and is more cautious on national borders restrictions.

Swiss Franc: SNB Chairman Thomas Jordan Speech

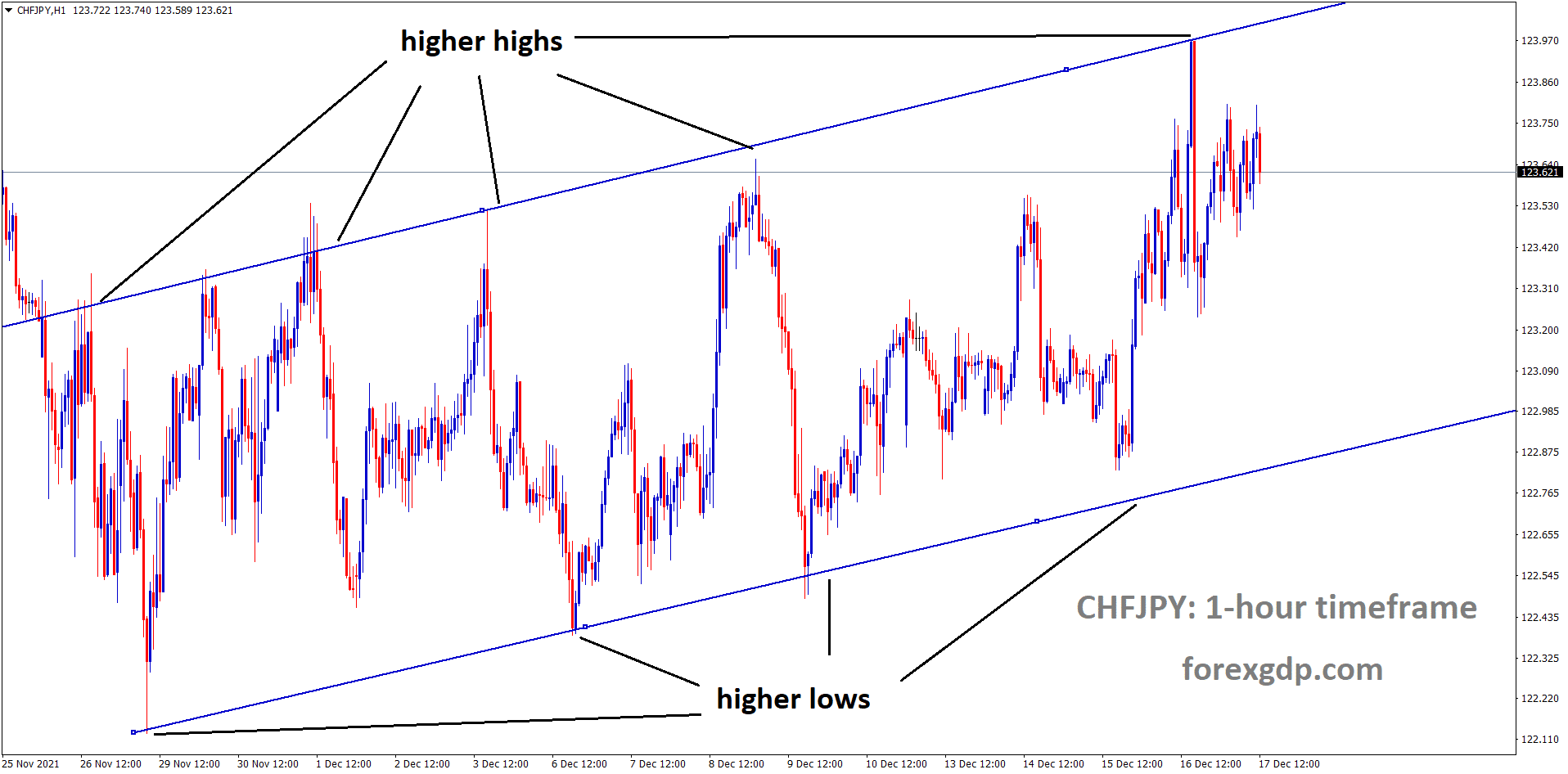

CHFJPY is moving in an Ascending channel and the market consolidated at the higher high area of the channel.

Swiss National Bank shows inflation is slightly higher in the Swiss Zone; SNB Governor Thomas Jordan said, and we like to intervene in foreign markets if the Swiss Franc Going a higher value.

ECB meeting shows more Dovish stance and ECB President Christine Lagarde said No rate hike in 2022.

But APP purchases will taper consequently as Euro 40 billion in Q1 2022 and Euro 30 billion Q2 2022 and indefinitely as back-to-back tapering seen in 2022.

As More Divergence in Policy settings between SNB and ECB, the Swiss Franc showed stronger momentum against Euro last day.

And ECB Lifted forecast inflation to 3.2% from 1.7% in 2022.

Don’t trade at your free time, instead trade the markets only when there are confirmed trade setups.

Get confirmed trade setups here: https://signal.forexgdp.com/buy/