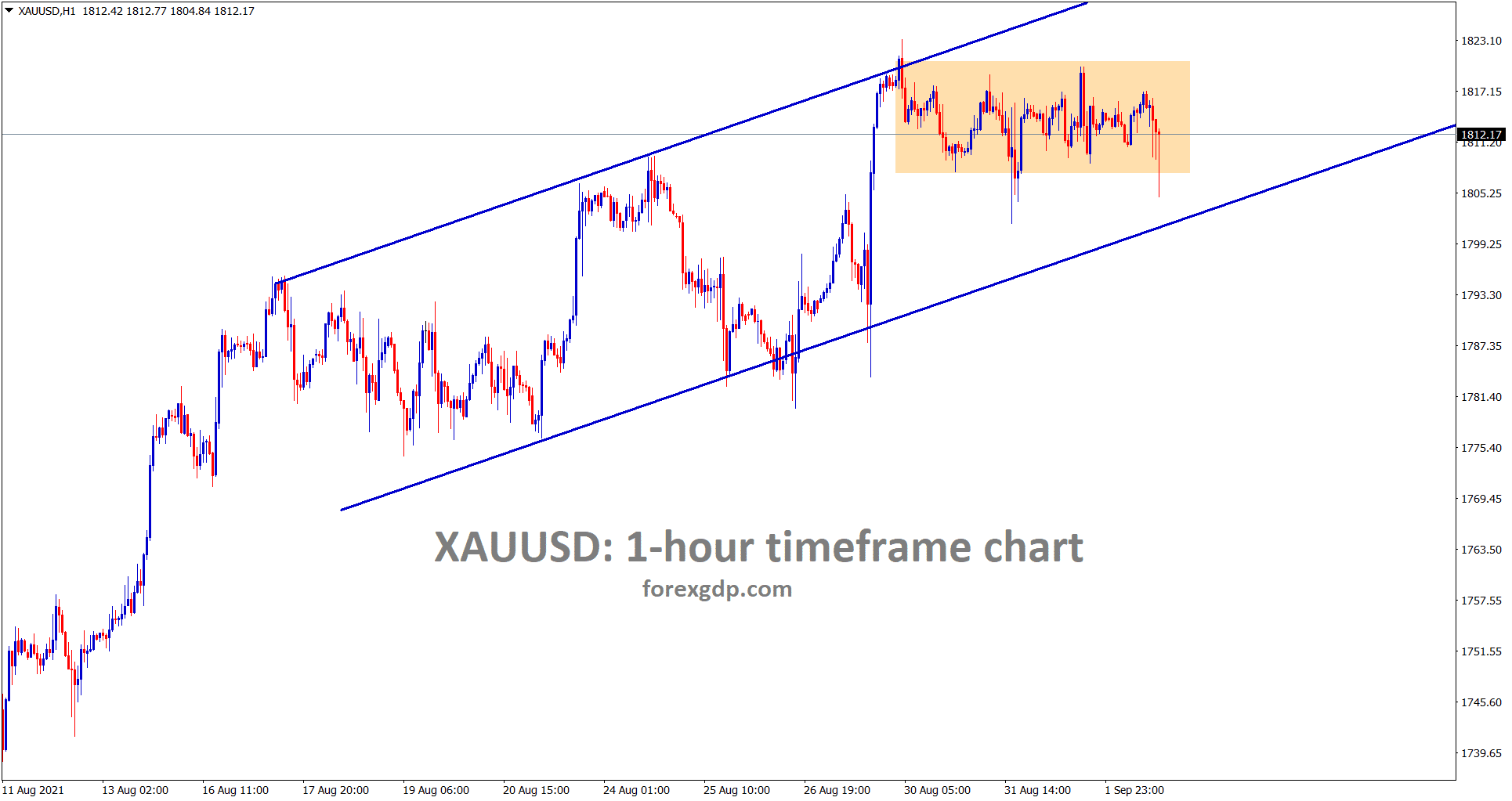

Gold: US ADP data

Gold is consolidating strongly in a minor ascending channel range – wait for this channel breakout.

Gold prices are moved in the ranging market as 1800-1820$ as US Dollar keeps weakness in the market.

And ADP data shows 375k Jobs added in the Private sector, so this time NFP data is expected to be 725K as economist view.

Now inflation target is above the target goal of FED and focuses on labour data to tapering or rate hikes soon in the market.

And also, Hot inflation running in the economy made inflation and makes hedging with gold prices by investors.

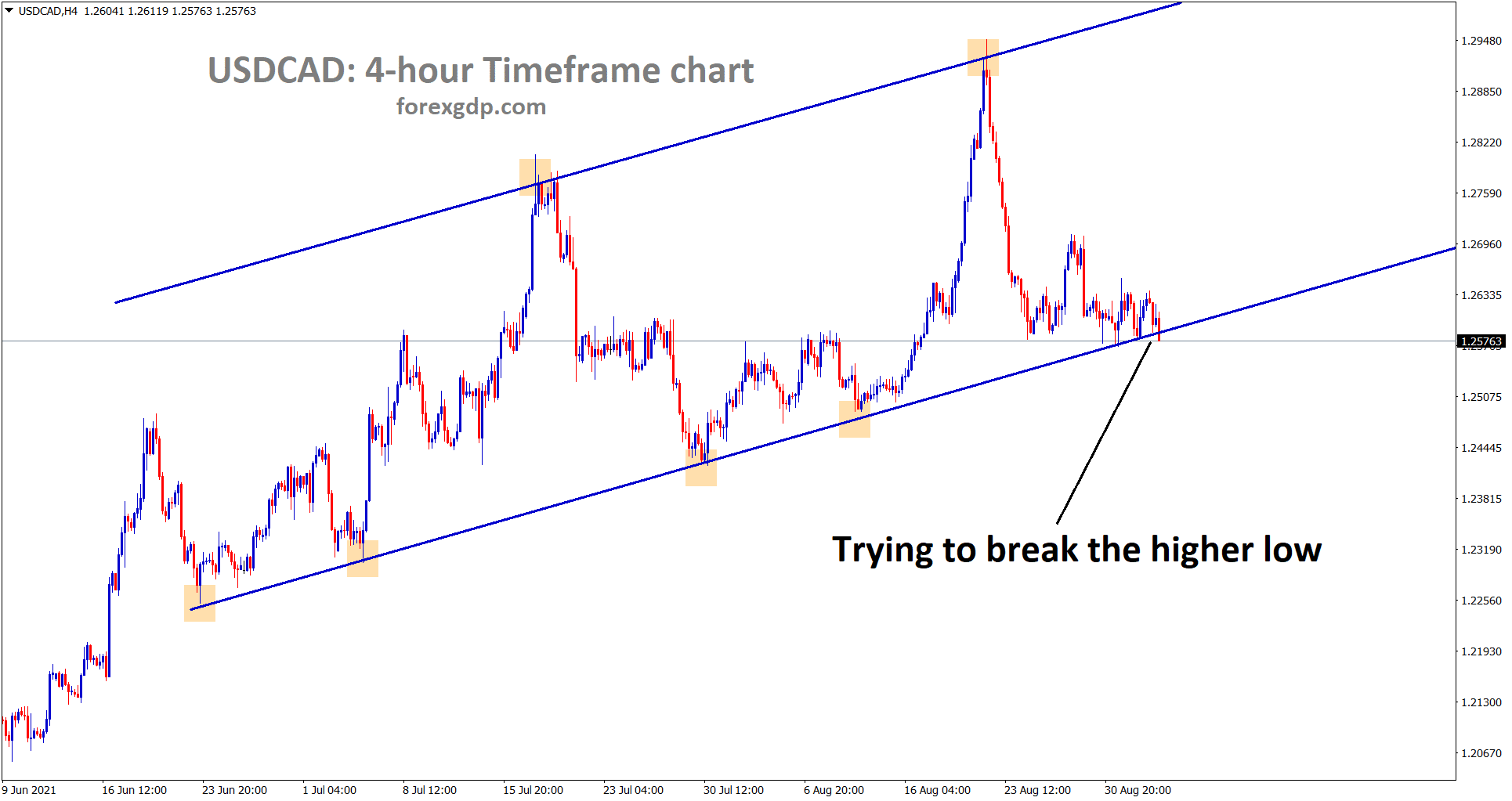

US Dollar: NFP data forecast

USDCAD is trying to break the higher low area – wait for the confirmation of breakout or reversal.

EURUSD has broken the top of the descending channel range and it’s going to reach the horizontal resistance area.

US Dollar index made lower after Wednesday ADP data showed Lower numbers than expected.

And Domestic data showing lower numbers make doubts raising on FED whether do tapering or not in the near term, During Hot inflation running economy.

Once inflation makes higher, Commodity prices make higher, USD gets down, so the Friday Labor market report of NFP is the main view for investors’ minds.

Any changes in the labour market will see changes in the FED meeting this month.

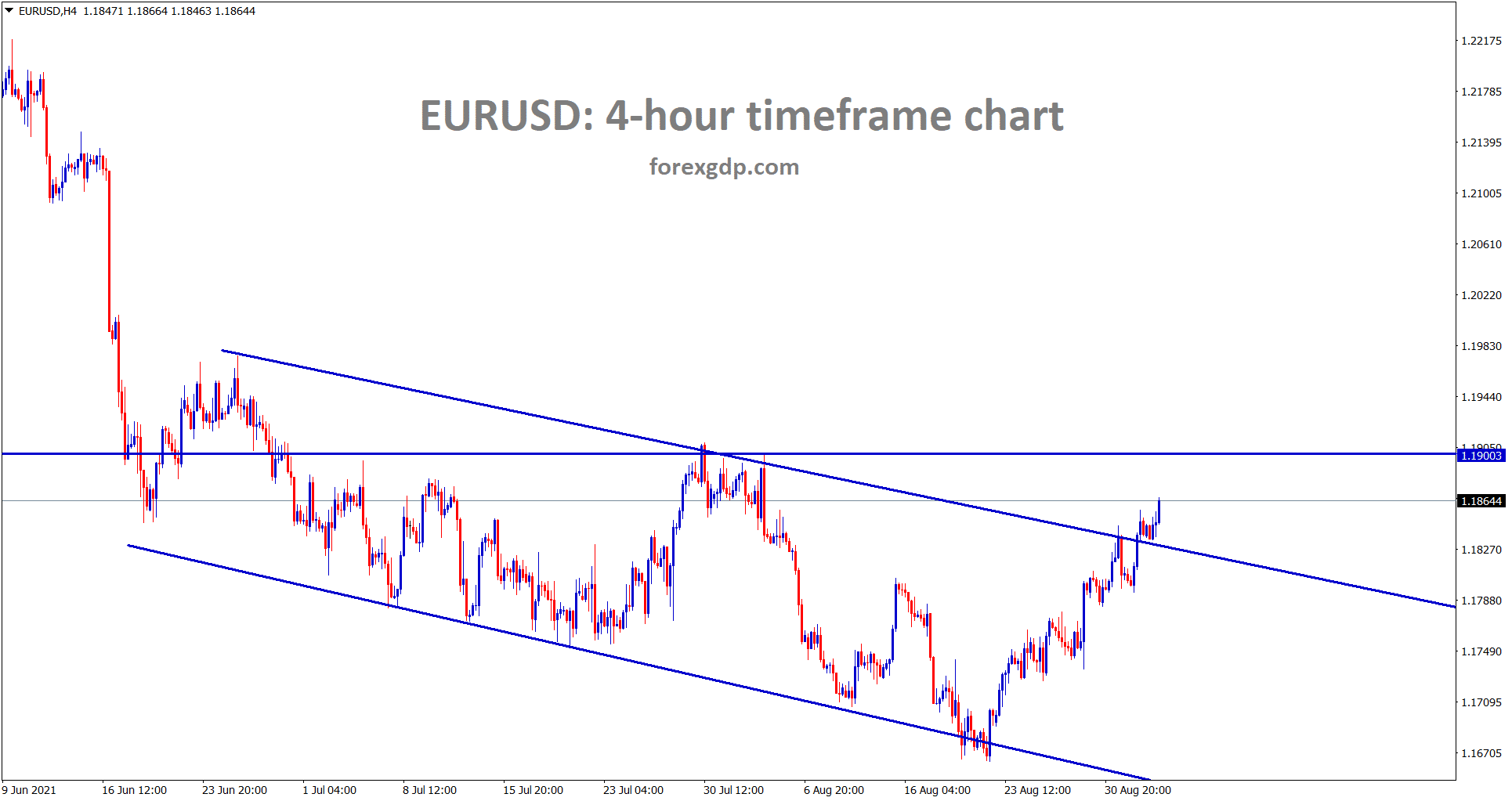

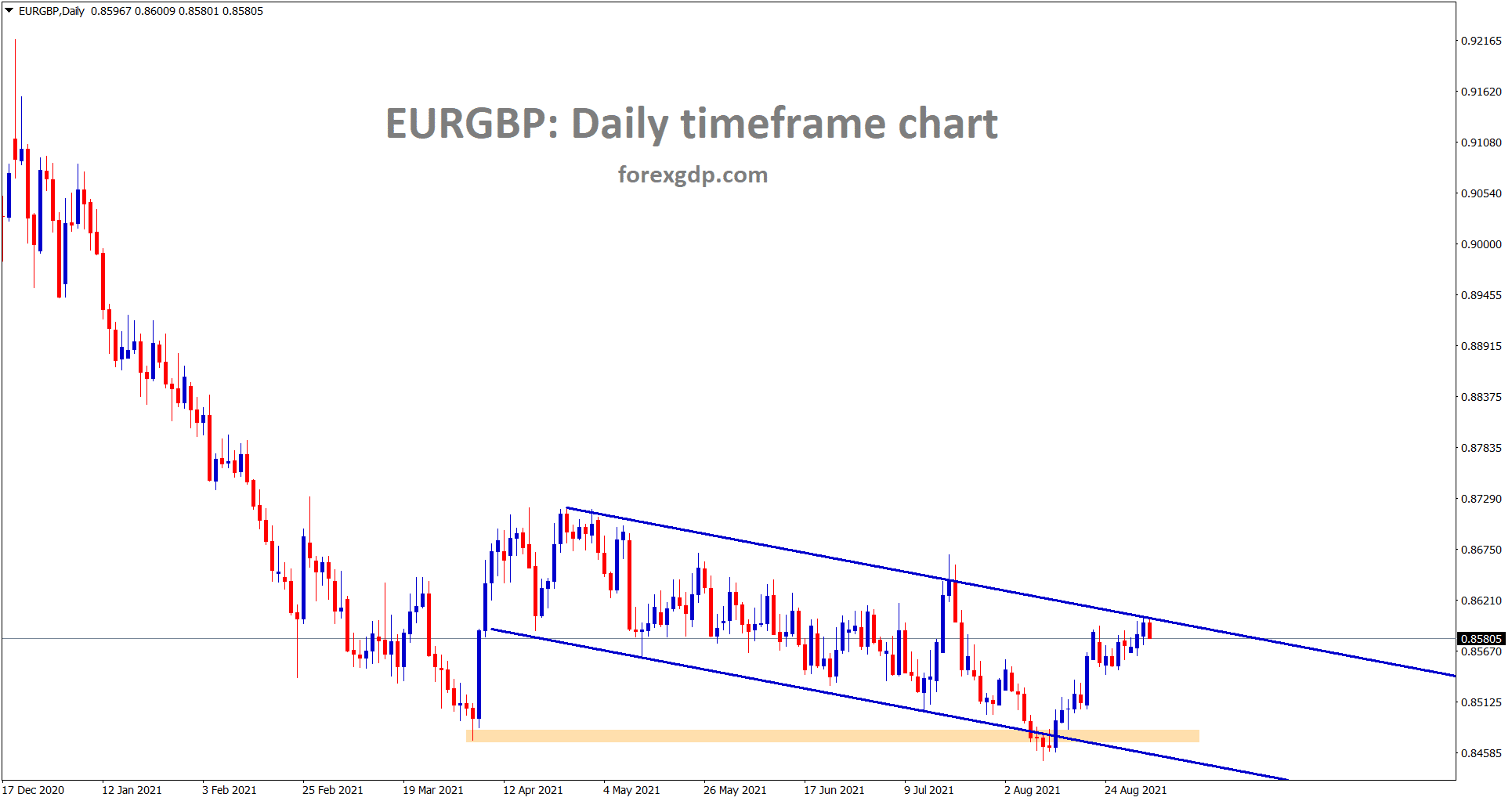

EURO: Reducing PEPP assets in October month

EURGBP reached the lower high of the major descending channel.

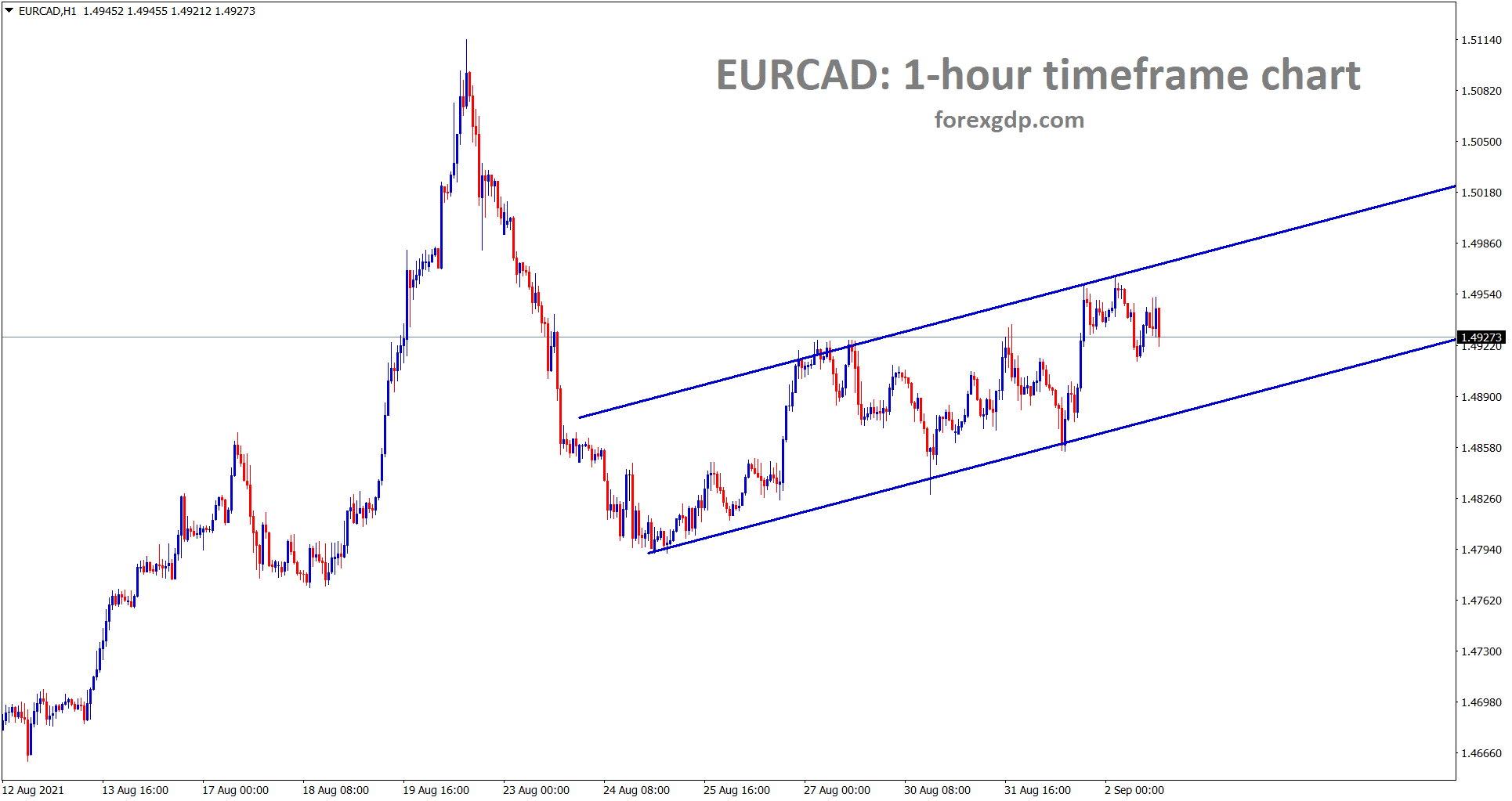

EURCAD is moving in a minor ascending channel.

EURUSD to retest 1.20-1.21 in the near term as Lower highs progress in the market.

And CPI data are lesser and approximately closer to the expected level, So ECB plans to reduce PEPP funds in August.

And Bond buying may be stopped in the Fourth Quarter onwards, and Reducing PEPP bond-buying program will increase the rate of EURO against USD.

CPI shows 1.5%, which is below the 2% target of Euro, so that EURUSD will move higher in the upcoming week.

UK POUND: Delta cases are Higher in the UK

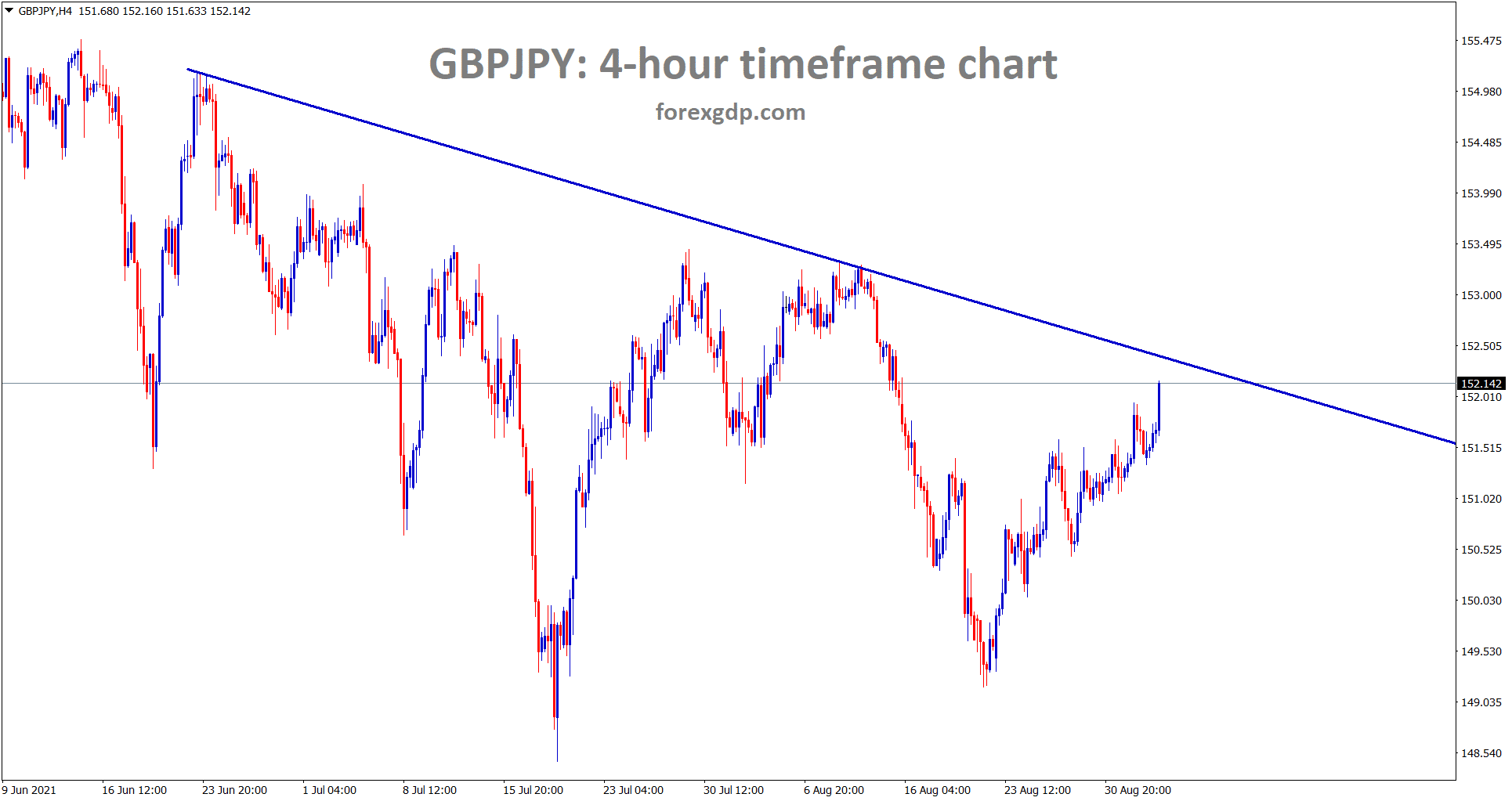

GBPJPY is going to reach the lower high area of the downtrend line.

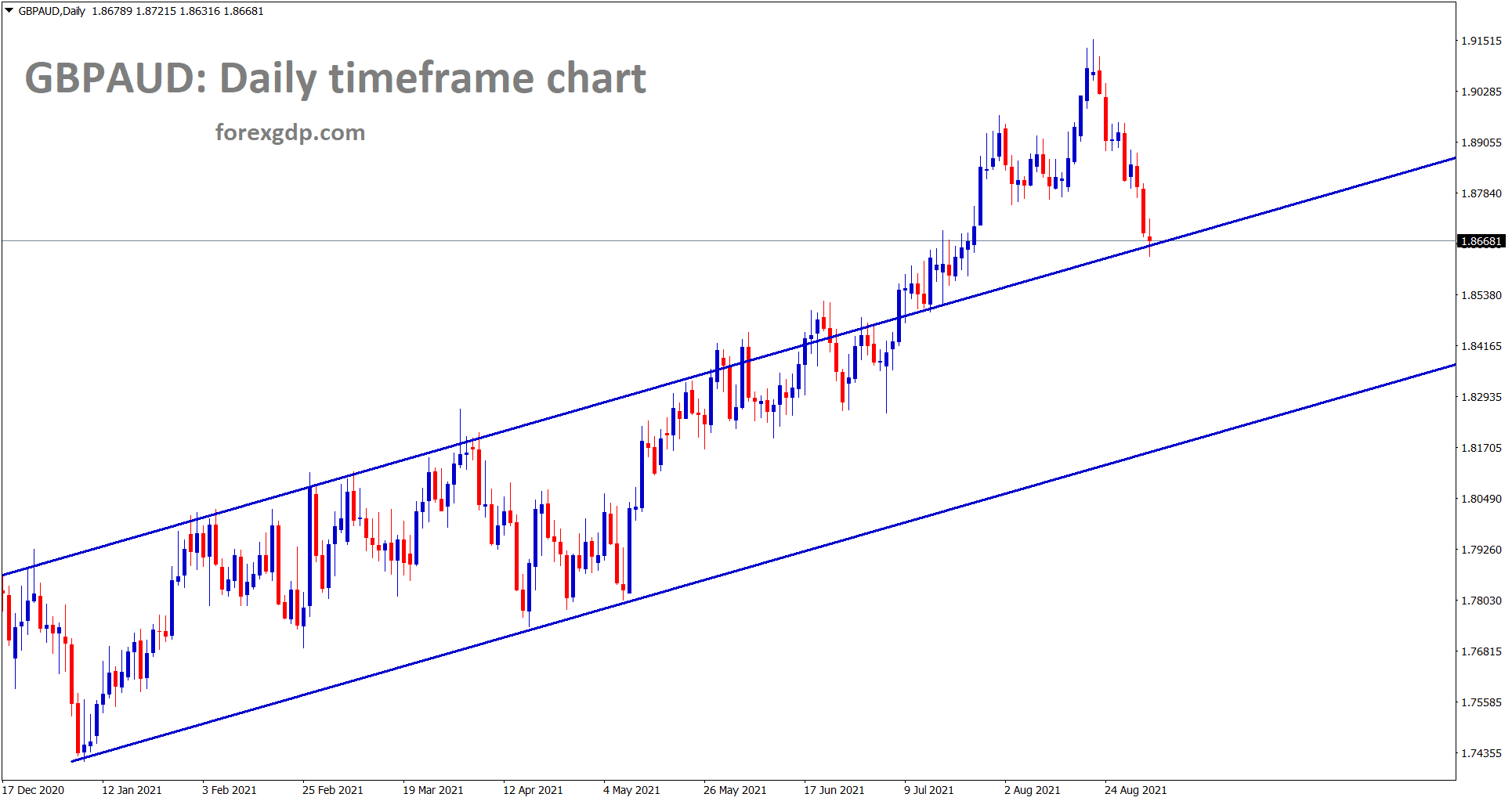

GBPAUD has reached the retest area of the previous broken resistance level.

UK Pound made higher as US Dollar found weak in the market.

UK and EU make worries on Northern Ireland Protocol, the deadline fixed at Sep 30 this month.

And Delta variant cases are made higher in the UK, and Furlough schemed will expire by Q3 of 2021, and Jobless data shows fewer numbers with no jobs.

This week NFP numbers made the Right direction for Both the UK pound and US Dollar in the market.

Canadian Dollar: OPEC+ nations agreed to extended Supply

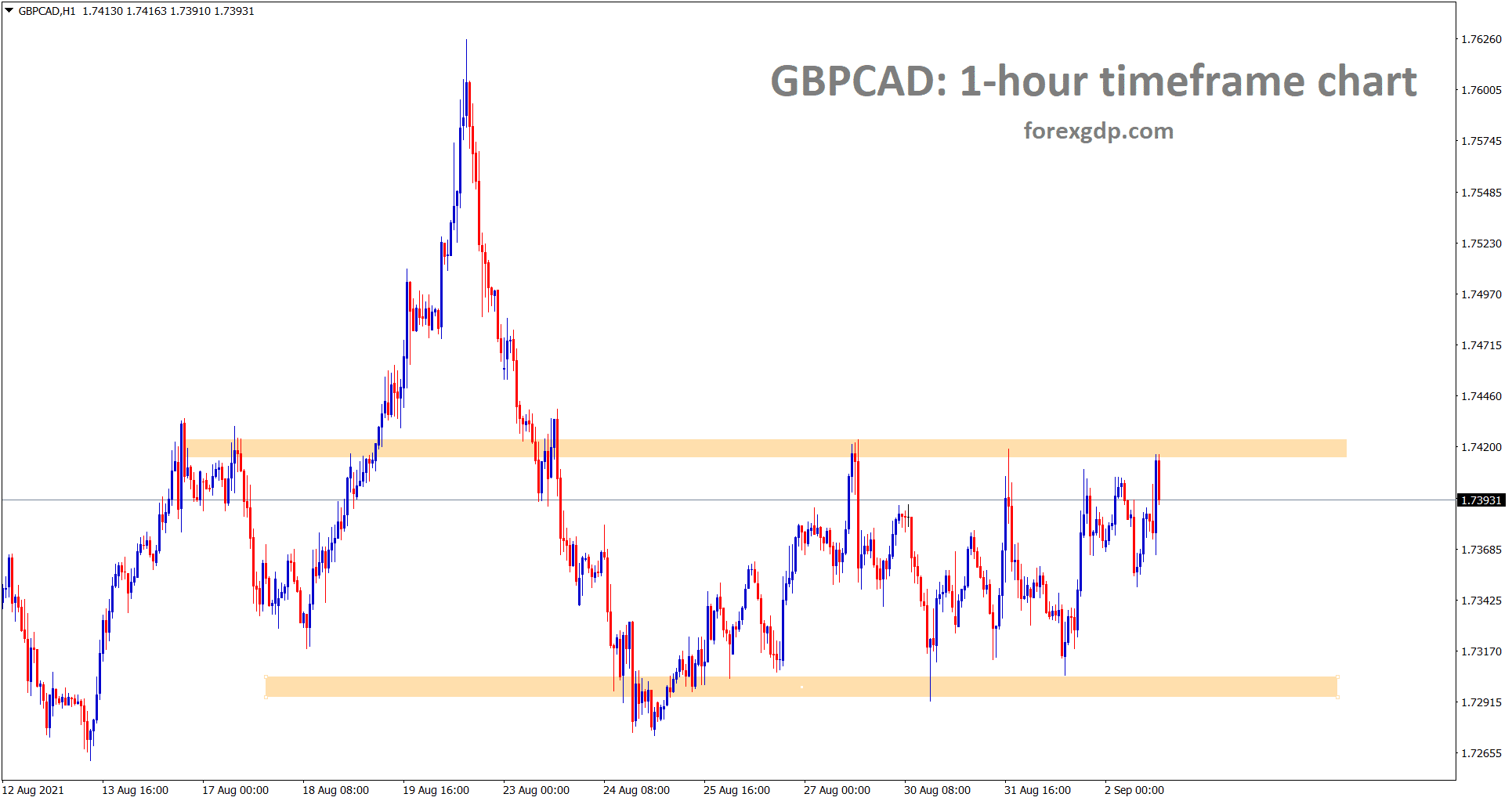

GBPCAD is standing now at the resistance area range.

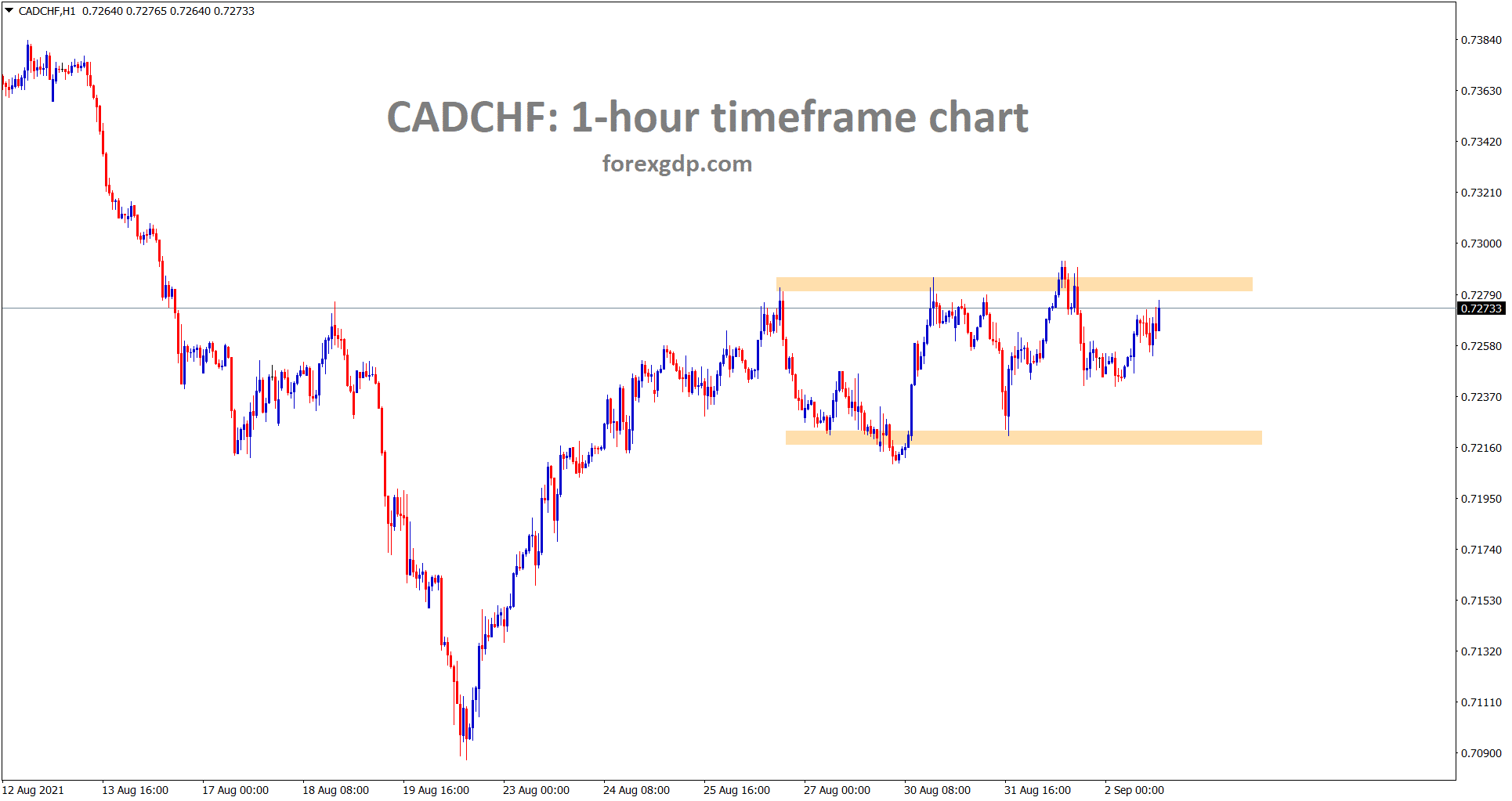

CADCHF is moving up and down between the support and resistance areas in the one hour timeframe.

USDCAD remains in the range market as 1.25700-1.26700 level as No confirmation news from Economy came this week. Tomorrow NFP data is keen news to drag or make up for USDCAD pair.

OPEC+ agreed to Supply 400k barrels per day, which is less than 1% of global supply.

And Jerome Powell said the economy remains in the pandemic state still has not fully recovered, so the Tapering of assets is incorrect at this time.

This outcome made investors pull out money from US Treasuries to Riskier currencies like EUR, GBP, AUD and NZD.

And Hedge against inflation purpose Investors diverted the money to Gold.

Canadian Dollar stood up higher after OPEC+ nation extended supply in the market.

Japanese Yen: Japan Crossed 20k Delta cases

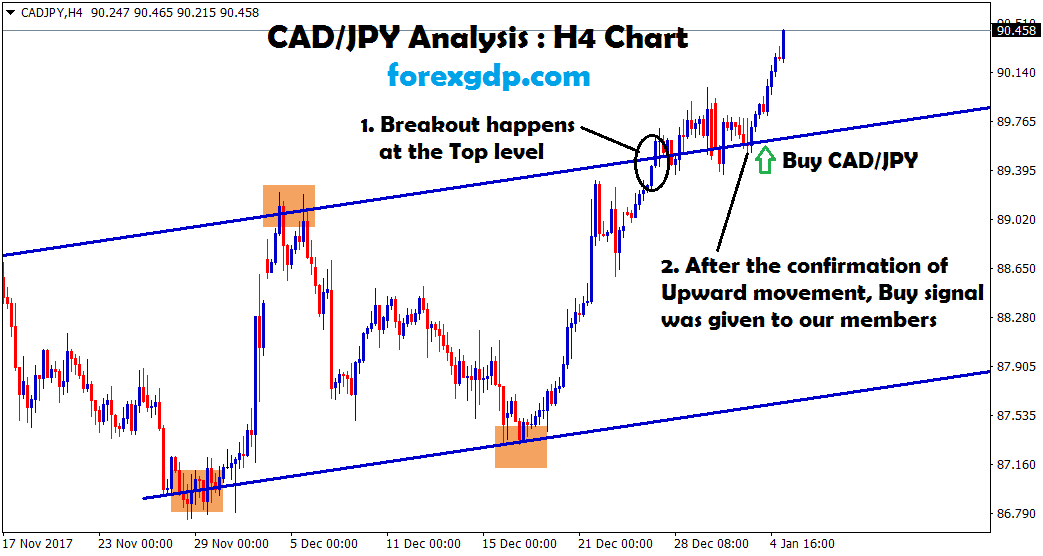

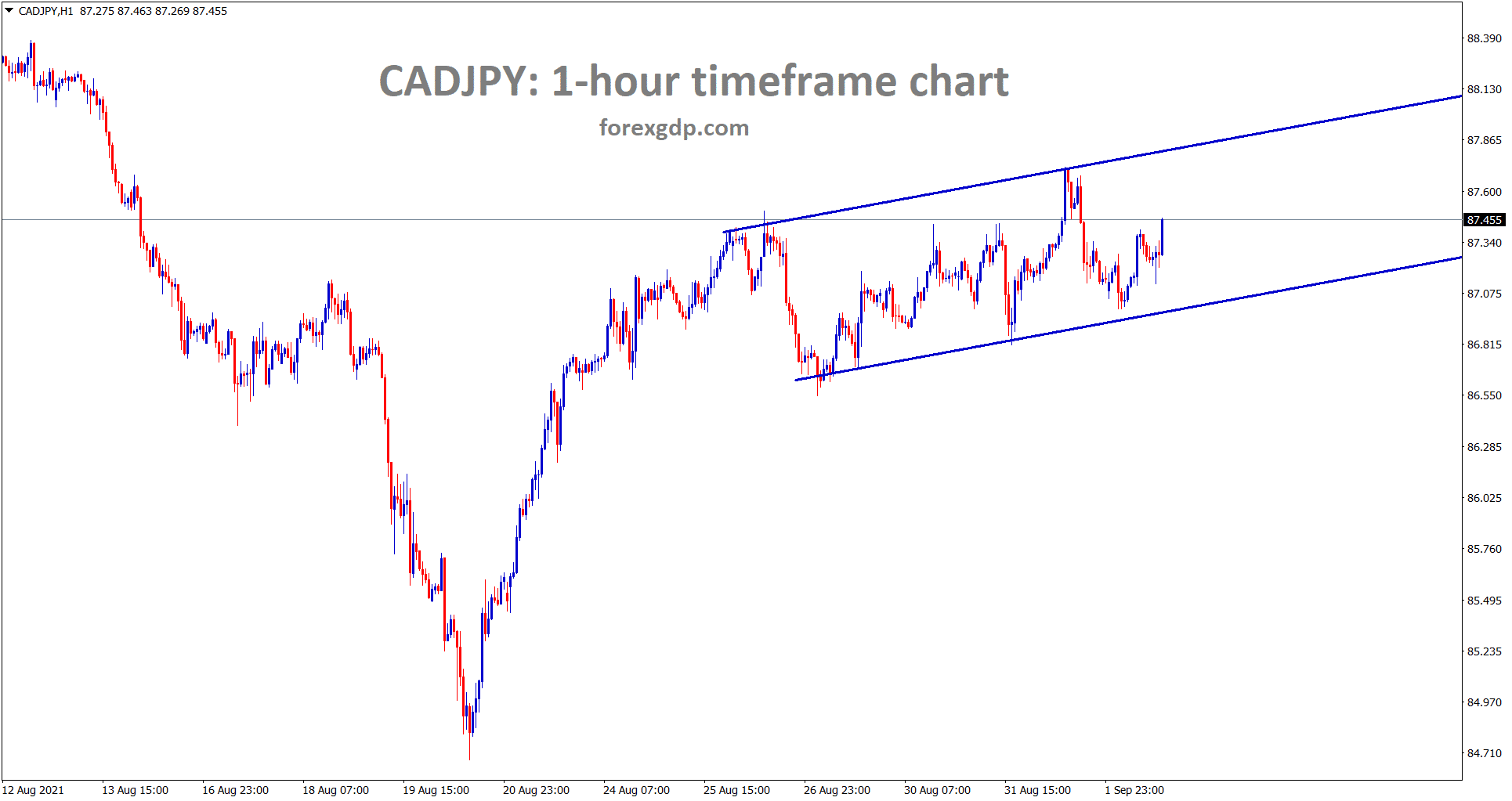

CADJPY is moving in a minor ascending channel range.

Japanese Yen made lower against all pairs as Covid-19 cases stood higher in the economy, 20k cases surpassed as on Wednesday reported.

And Bank of Japan Board member Gaushi Kataoka said the Coronavirus pandemic would impact the Japanese economy longer than expected.

Factory activity rose for seven straight months in Japan.

Abd UK has delayed the Rules for moving goods from Northern Ireland to the UK.

Japanese Ruling Chief Kishida speech

Japan’s Ruling Liberal Democratic Party policy chief Fumio Kishida said Tens of trillions of Yen is needed for pandemic Japan for recovery this time.

Bank of Japan must buy more JGB and Insert more stimulus into the economy; since 2020, more lockdowns are imposed in Japan, many businesses and Employment are more disturbed in the economy.

Due to this more stimulus for the economy only solution to solve recovery of Japan, our country must show to the world, and we are also recovering from pandemic likewise not only lockdown but also more vaccinations and more stimulus.

Australian Dollar: Australian Trade surplus and GDP data

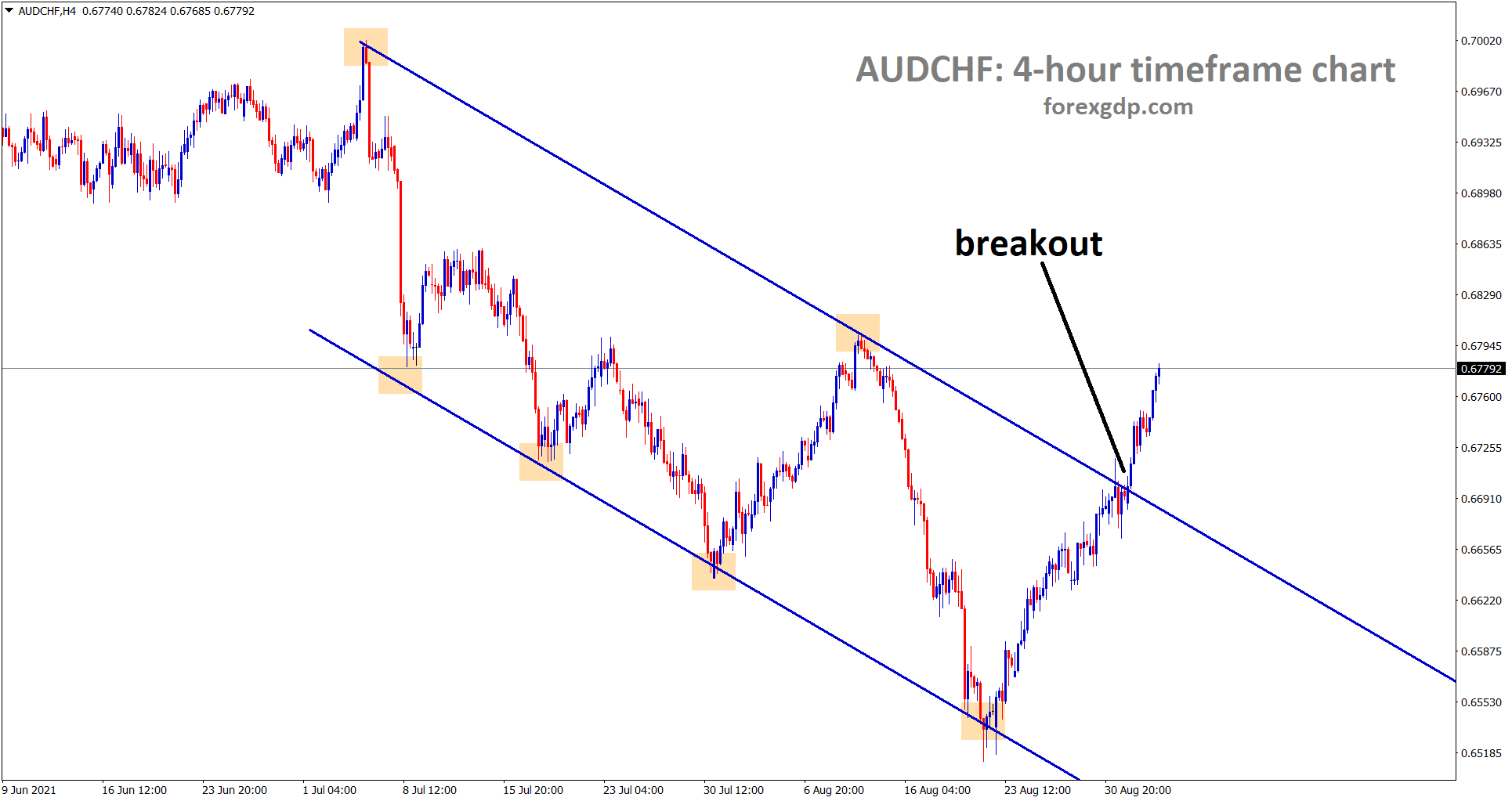

AUDCHF has broken the top of the descending channel and it’s going to reach the nearest resistance area.

AUDUSD makes higher as Australian GDP Printed higher than expected reading. But Iron ore Prices hits lower reading Today.

And Australian Trade surplus widens to 12.1 billion against AUD 10 billion. China accounts for 26.6 billion of Goods bought in July month.

The largest exports of Australia are

- Iron ore-AUD 17.1 billion

- Coal-AUD 4.7 billion

- Natural Gas-AUD 4.3 billion

- Gold-AUD 1.9 billion.

And Australian Monetary policy happening in next week, but no surprise to tapering in policy settings.

Australian Economy still suffered from more lockdowns as the Delta variant spread more.

New Zealand Dollar: Delta cases reduced in New Zealand

New Zealand Dollar keens higher moving after Delta variant decreasing day by day across all regions.

So now Lockdowns may release in next week based on Lower numbers according to ranges.

And Reserve Bank of New Zealand might do the rate hike in October, and tapering is also done in the same month.

US Dollar keeps weaker as Domestic data underperformance shown in the report.

New Zealand GDP data may rebound in Q4 after Q3 Fall.

Samples of Delta variant decreased is happy news for New Zealand Government to push vaccinations more in New Zealand Ares as 24% of the population vaccinated with the first dose.

FED chair Powell stated that no tapering near term and wait & see approach in the economy would be followed.

Swiss Franc: Slower Vaccination in Swiss Zone

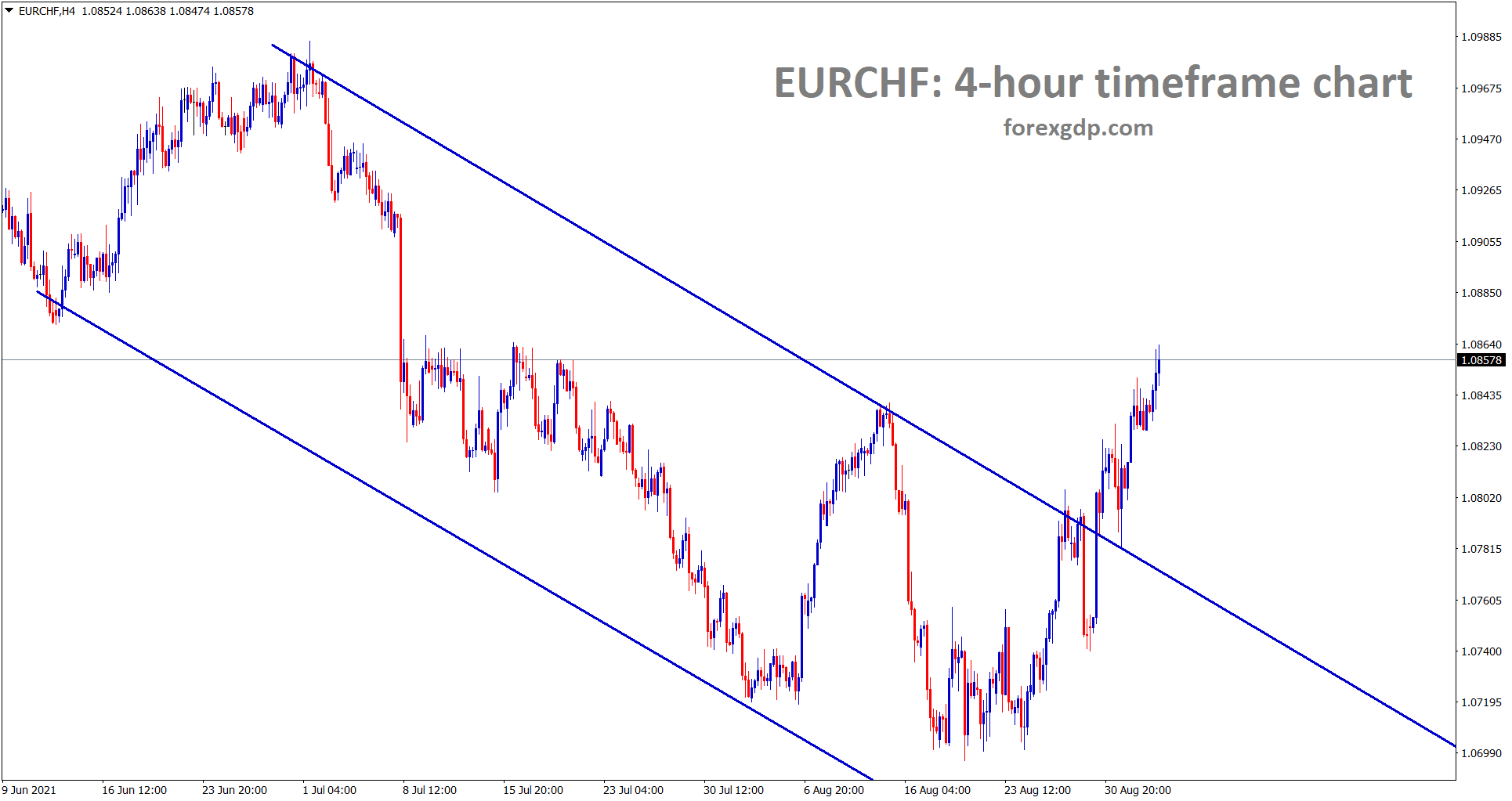

EURCHF has broken the top of the descending channel and rising up strongly.

Swiss Franc shows modest gains in the market as US Dollar shows weakness in the market.

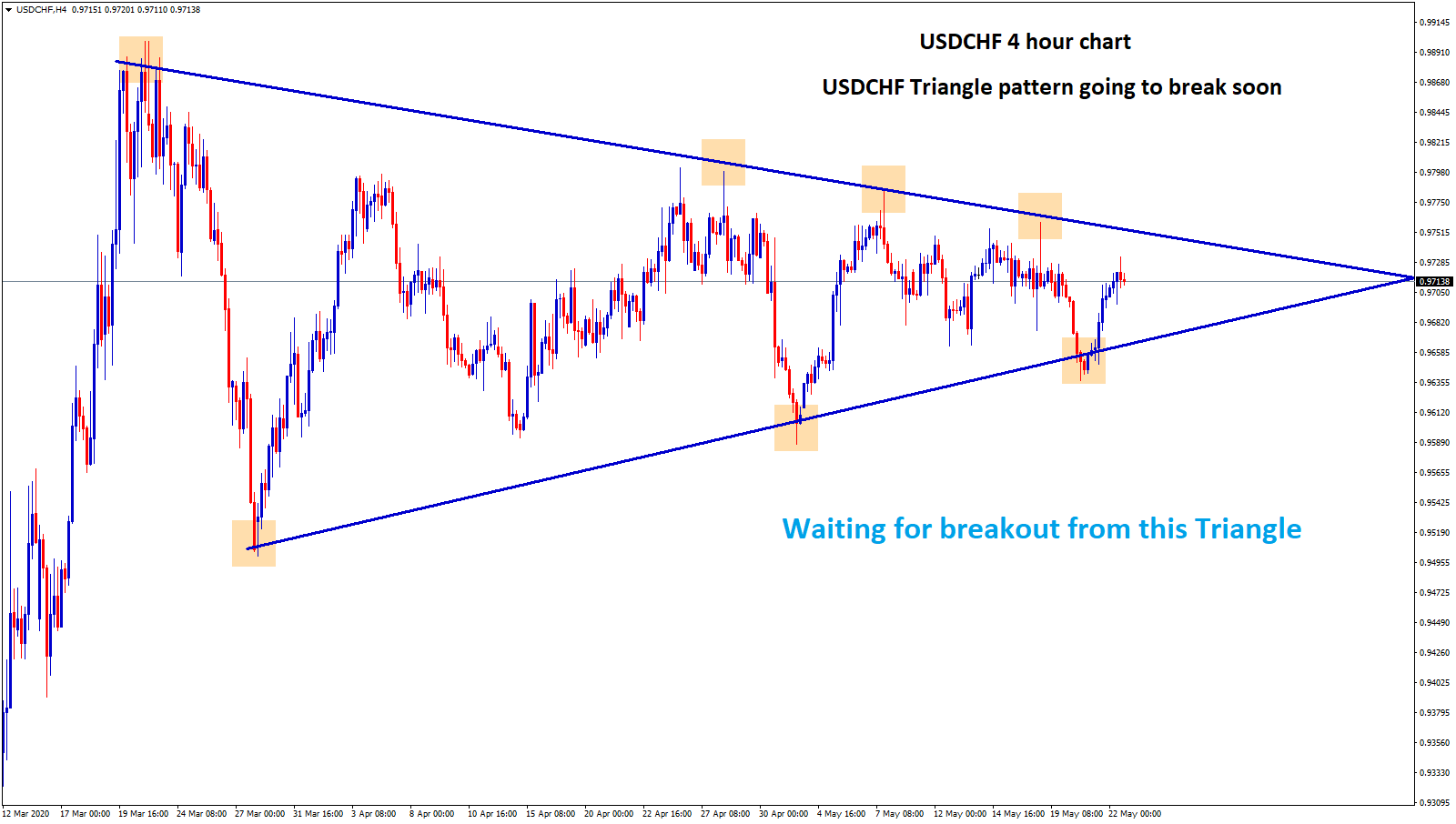

USDCHF running midway through the market at 0.91-0.92 level for the past month.

And Wednesday, ADP Non-farm data shows weakness in numbers and US Dollar got weaker by Jobless numbers.

Vaccinations are progressing slowly, and Domestic data showed poor performance in Swiss.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/