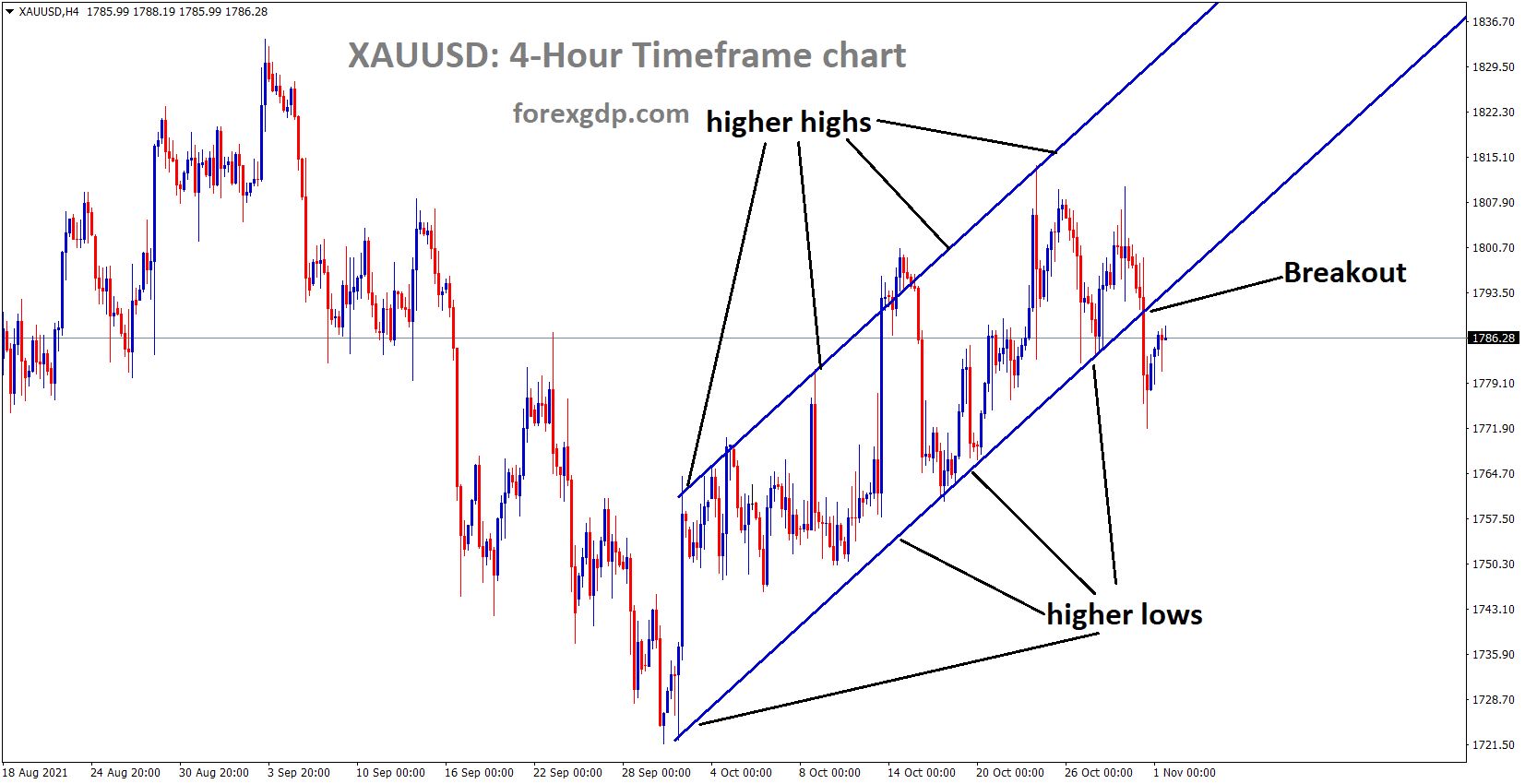

Gold: US PCE Index shows line with expectations

XAUUSD has broken the Ascending channel pattern.

Gold shows sinking pressure ahead of the FOMC meeting scheduled this week.

And Last week US PCE Index came at 4.4%. It was the highest reading since January 1991, as the data shows.

Lower US GDP data shows some worries in US Dollar, but tapering of US FED is positive for US Dollar.

And tapering of $20 billion per month is a more favourable plan for FED as analysts expected; if the tapering is done per month as expected, the process will be completed by June 2022 tapering process.

This week October month ISM manufacturing data is scheduled, waiting for positive numbers from Domestic data

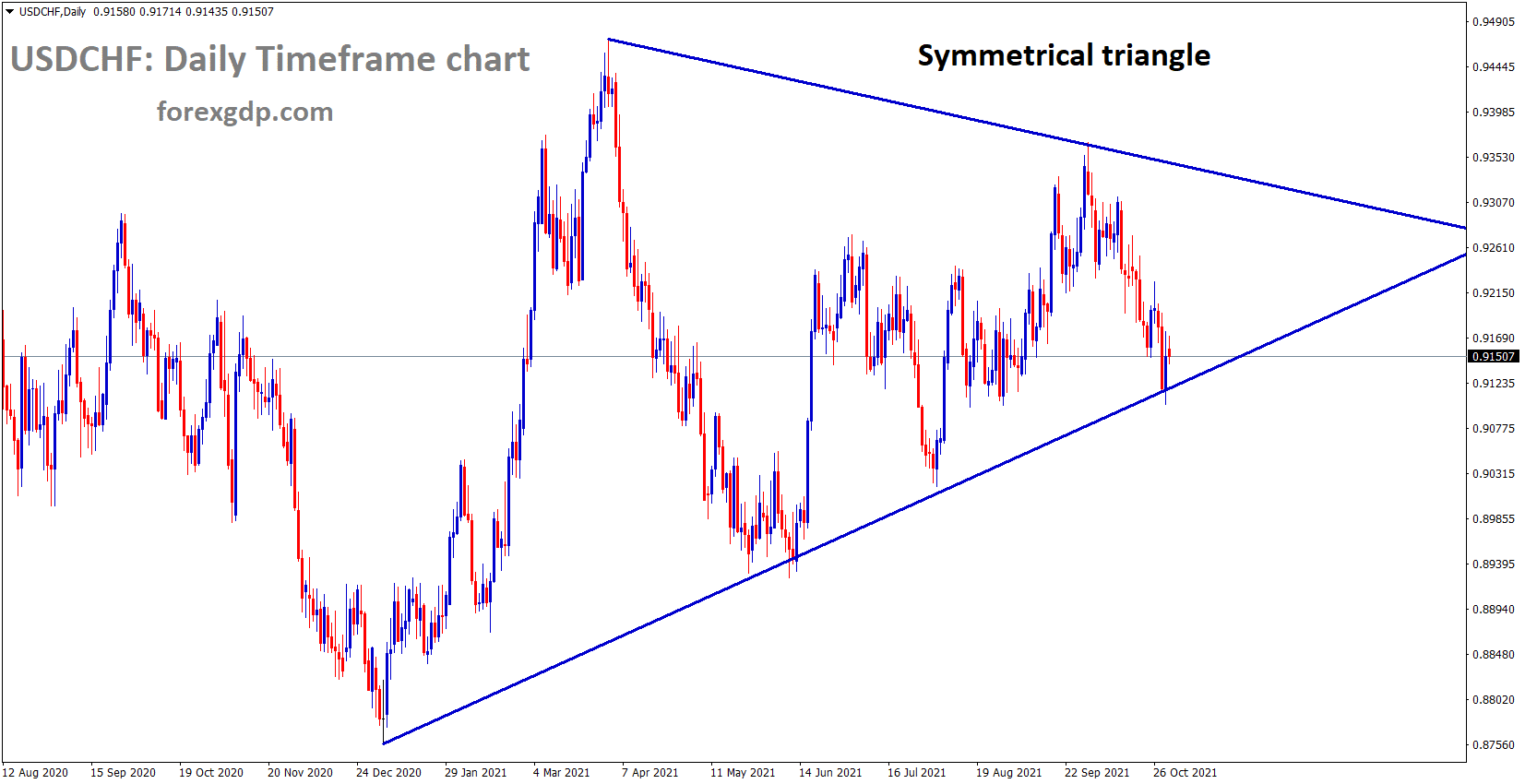

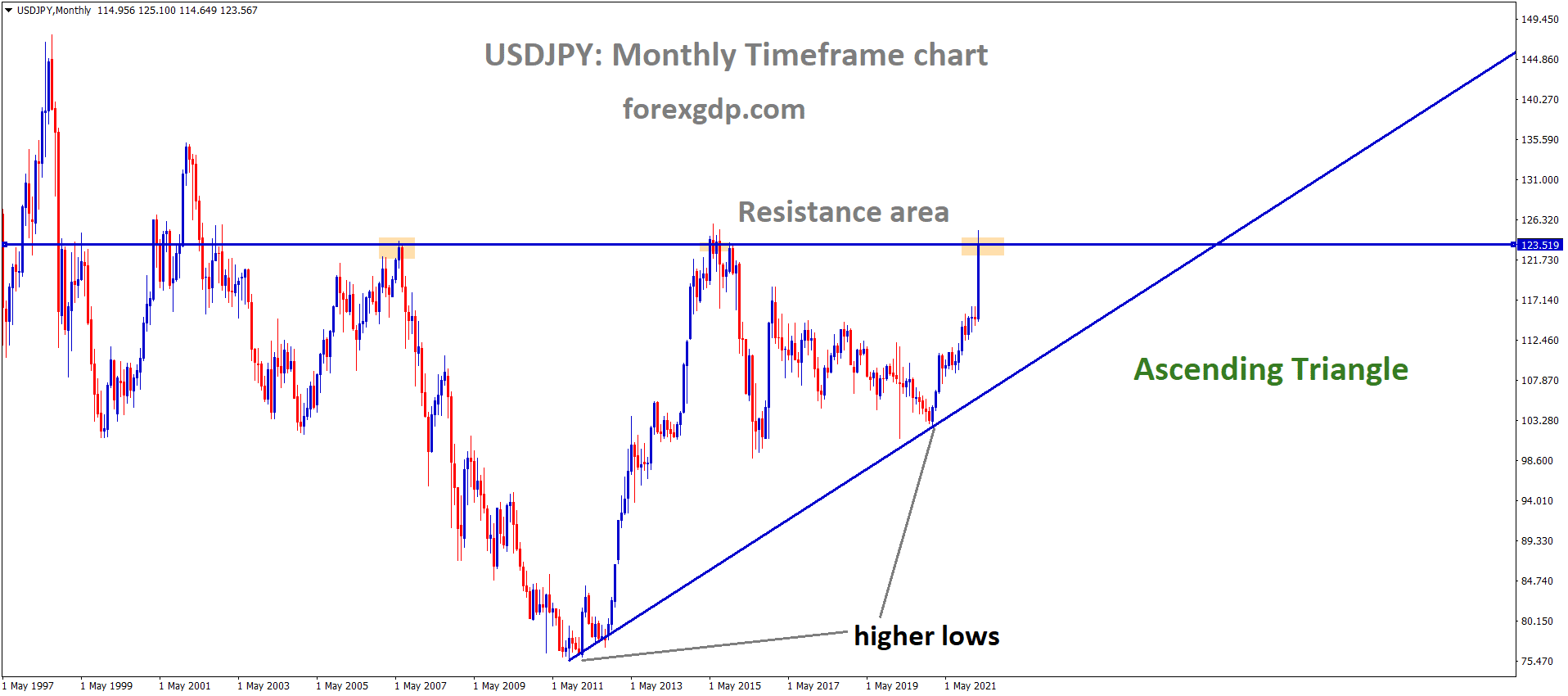

US Dollar: US secretary Yellen speech

USDCHF is moving in the Symmetrical triangle pattern.

US Treasury secretary Janet Yellen said China would soon be committed to the Trade deal agreement as hoped.

If China makes ok with lower tariffs, then Inflation prices will come down, more supply will be created.

As of now, Supply decreases and inflation makes higher is the cause of the Global issue.

And Supply chain Bottlenecks will solve soon if the Trade deal is ok with China signed quickly.

FOMC and NFP data Forecast

US Dollar makes higher ahead of the US FOMC meeting which scheduled this week.

And 520K job gains are expected in non-Farm payrolls data this week.

FED Powell will explain the tapering assets this week, and the plan to reduce inflation pressure will be shown this week.

And Analysts expected a $20 billion per month reduction in tapering would be done, and it extended to June month for a close of $120 billion purchases now.

Last week PCE index came in in line with expectations, and Michigan consumer sentiment came at higher than expected.

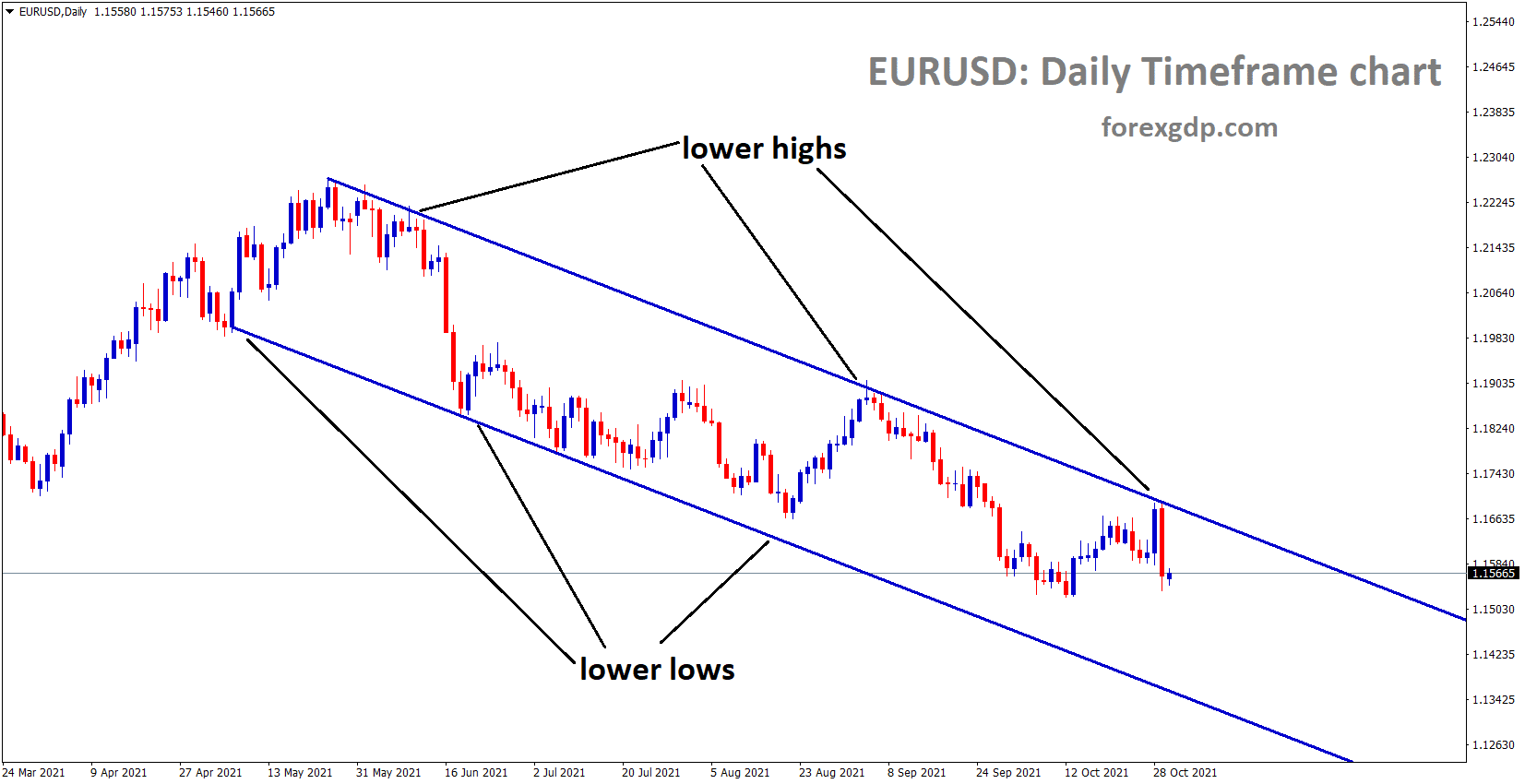

EURO: ECB meeting shows positive for EURO

EURUSD is moving in the Descending channel and fell from the lowerhigh area.

ECB meeting shows less Dovish comments on last week, ECB President Lagarde said next year-end of 2022 rate hike would be processed, then inflation reading will slow step by step to regular numbers.

Now ECB view is on tapering soon as FED sends a clear tapering message this month is primarily expected.

And EURUSD dropped 0.50% since last week as Friday US Domestic data shows positive numbers.

This week German retail sales, US ISM Manufacturing data, and FOMC meeting are in the table.

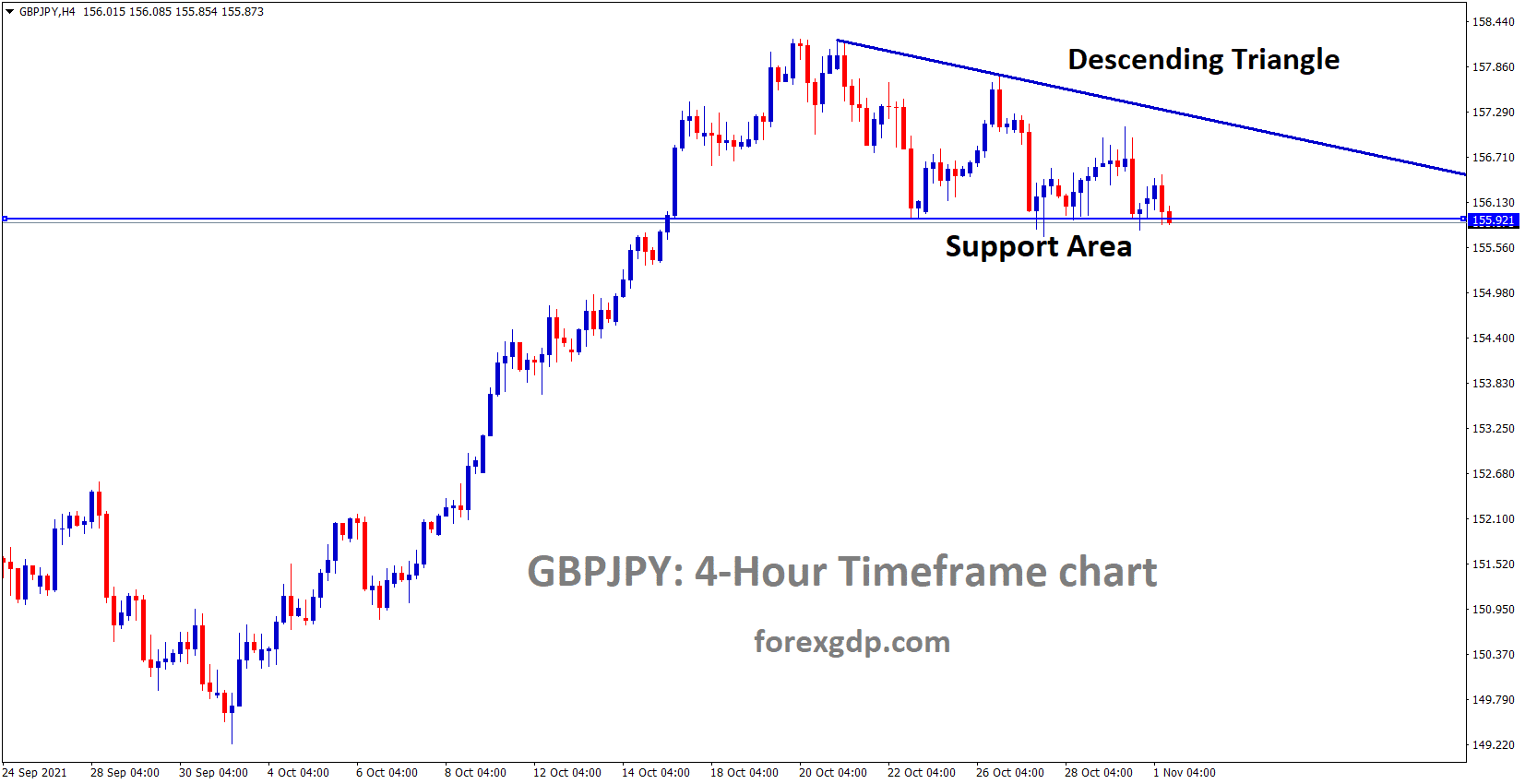

UK Pound: France set talks with the UK

GBPJPY is moving in the Descending Triangle pattern and market standing at the minor recent support level of Triangle pattern.

UK Pound seems some downward pressure because UK Post Brexit deal concerns increased.

And France seized UK boats last week, making more tensions between UK and France sides.

UK PM Johnson gives warning for France if this instance continues.

And On Sunday Prime minister of Both countries, the Uk and France, set to talks for easing the issues of Fishing rights on French water.

Due to this, UK Pound makes selling pressure as the upcoming issue will come on Northern Ireland protocol.

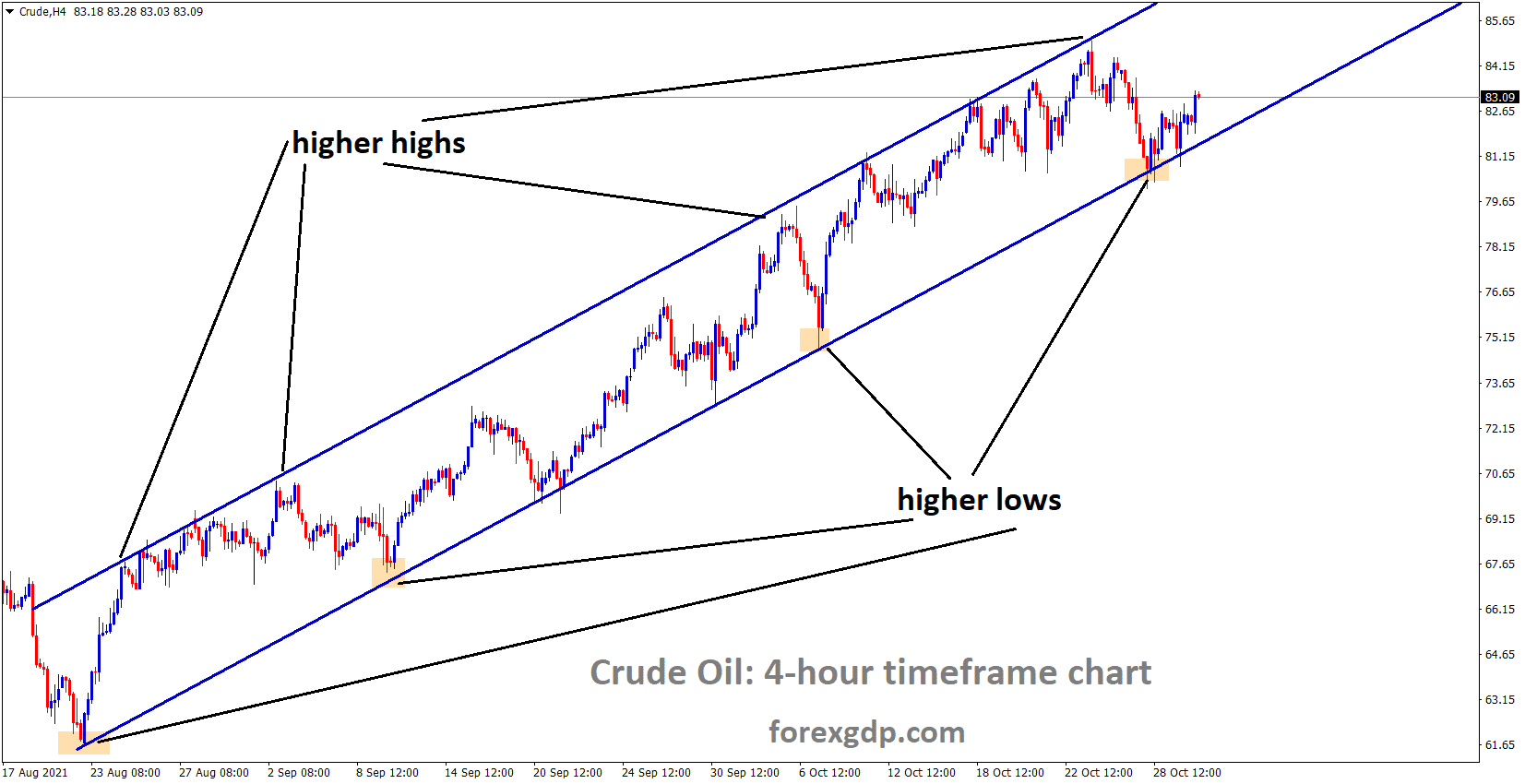

Canadian Dollar: OPEC+ meeting forecast

Crude oil prices are moving in an Ascending channel and rebounded from a Higher low area.

OPEC+ nations meeting happening on November 4th of this week, and Global energy head Regina Mayor said OPEC+ Nations maybe consider to increase the output from 600000 Barrels per day to 1 million barrels per day.

As more governments suffer from crisis and energy demand, OPEC+ nations will support demand concerns.

So in the upcoming meeting creates hopes for increasing the supply of oil-by-Oil countries.

Canadian Dollar will be short down if increased the supply this week.

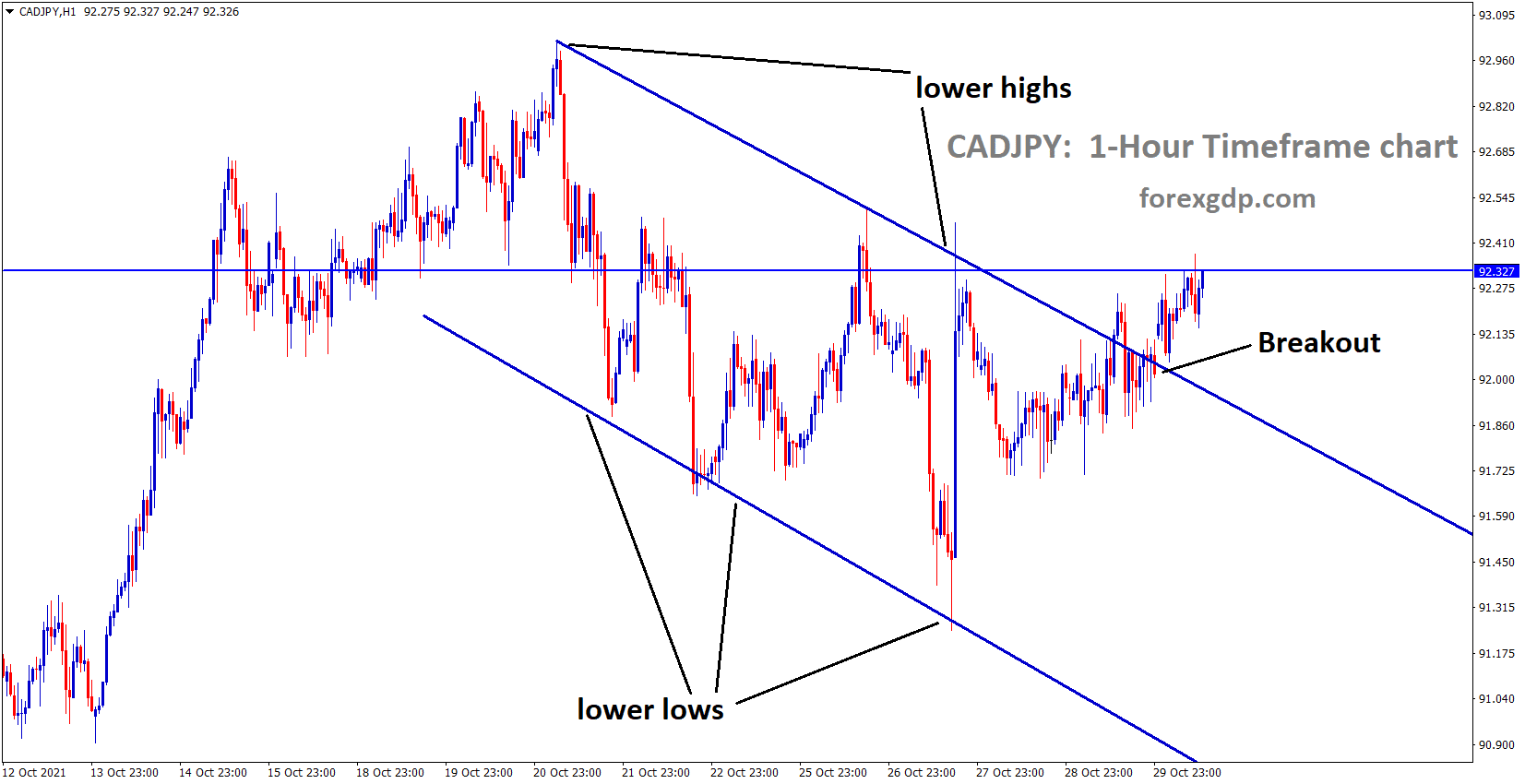

Japanese Yen: Ruling party makes less majority

CADJPY has broken the Ascending channel and market prices are moving near to the resistance area.

Japanese election shows less clarity of Majority places taken by the Current LDP party.

And the Prime minister Kishida party wins with less majority of Votes and purse will be stringing for the Spending stimulus package.

So, the Recovery of the Japanese Economy will be narrower as Less spending in the minds of Investors due to less majority of the ruling party.

And US Dollar posted recovery from the bottom as a FED meeting scheduled this week.

Due to this, USDJPY Keeps bullish as Japanese Yen weakness shows in the Market.

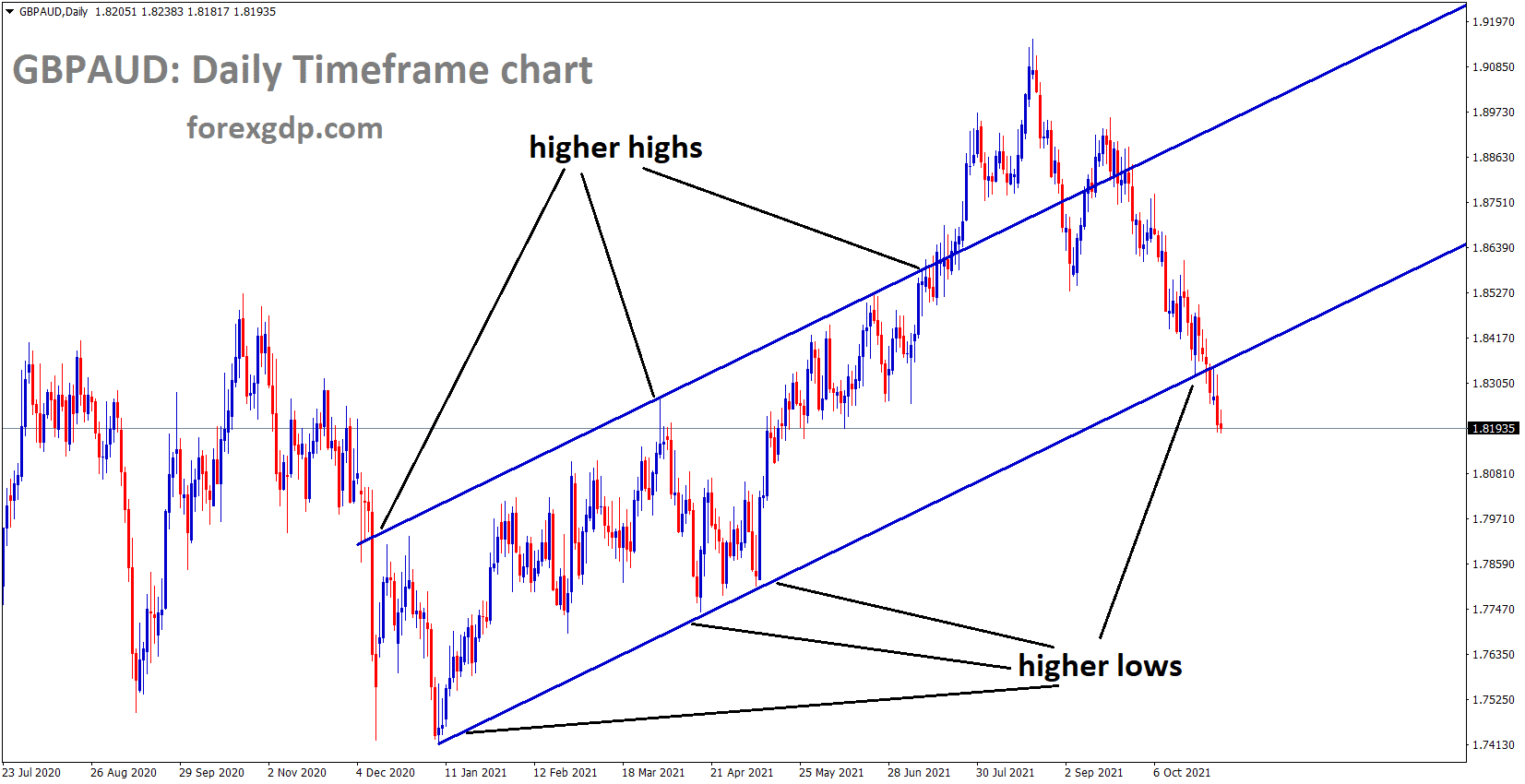

Australian Dollar: Easing lockdown restrictions on International Border

GBPAUD has broken the Ascending channel.

Australian Commonwealth Bank Manufacturing PMI came at 58.2 versus 57.3 forecasted. ANZ Job advertisements increased to 6.2% versus -2.8% previous.

And September Housing figures came at negative numbers and favoured sellers.

Australia set to ease international border restrictions for the first time this week, in 18 months. The Shutdown was restricted for arriving and exiting from Australia.

And the Chinese manufacturing data set to lower causes the Australian Dollar to be weak, but strong commodities exports from Australia to China support the Australian Dollar.

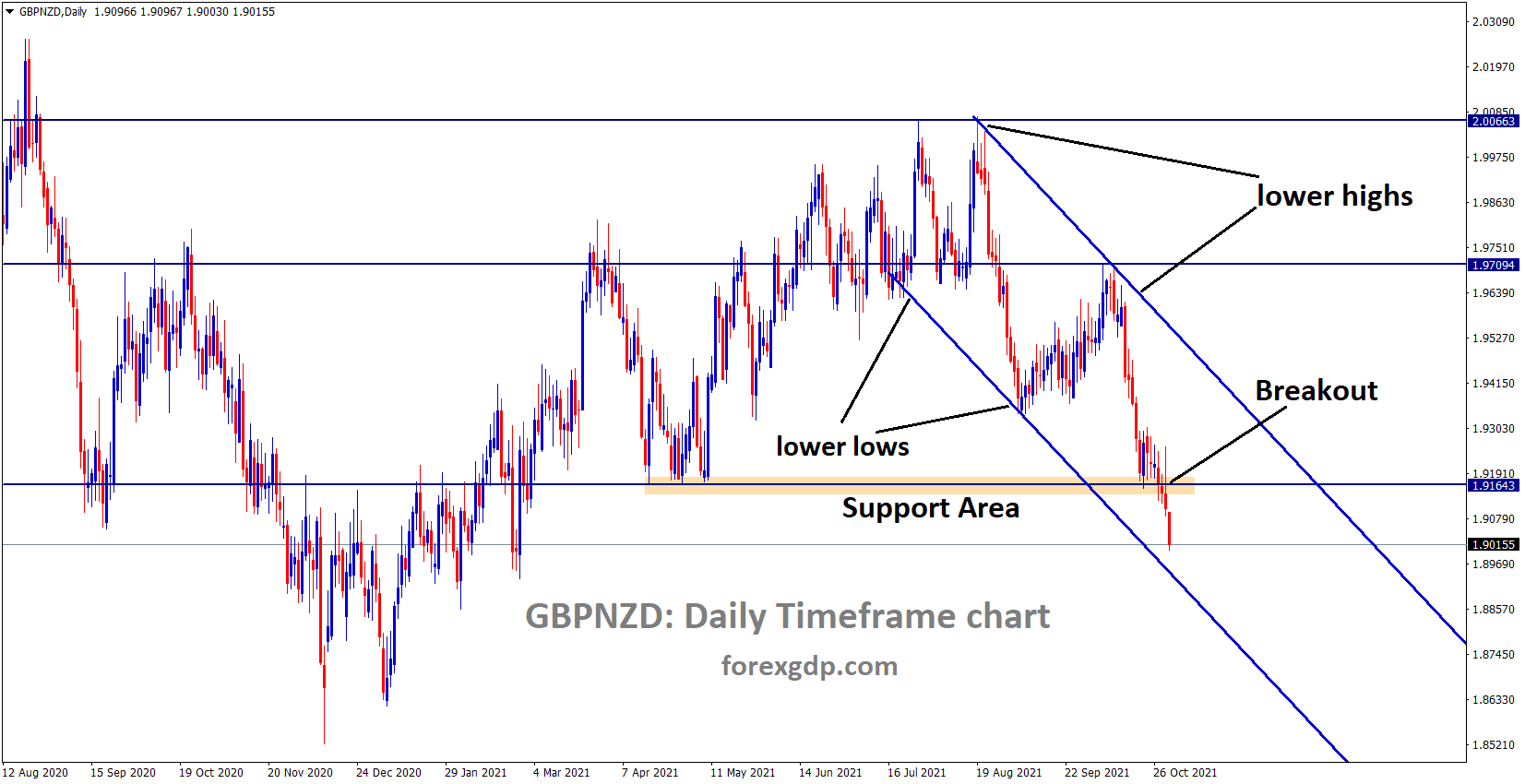

New Zealand Dollar: Auckland seems an extension of Lockdown

GBPNZD is moving in the Descending channel pattern and fell from the lower high area and broke out the recent support area inside the channel.

New Zealand PM Jacinda Ardern to increase the Level 3 restrictions in the major city Auckland.

But next, we can expect to ease some restrictions in Auckland, as Jacinda commented.

And New 162 delta cases reported today and a total of 3500 cases as of now reported.

Among new infections, 156 were in Auckland reported.

New Zealand Dollar seeks upside pressure as US Dollar has made a weakness in the last week.

And FOMC meeting this week will decide the Directions of the US Dollar against the New Zealand Dollar.

And China Crisis of Delta, Real estate and Electricity issue cause more impact on Exports of New Zealand.

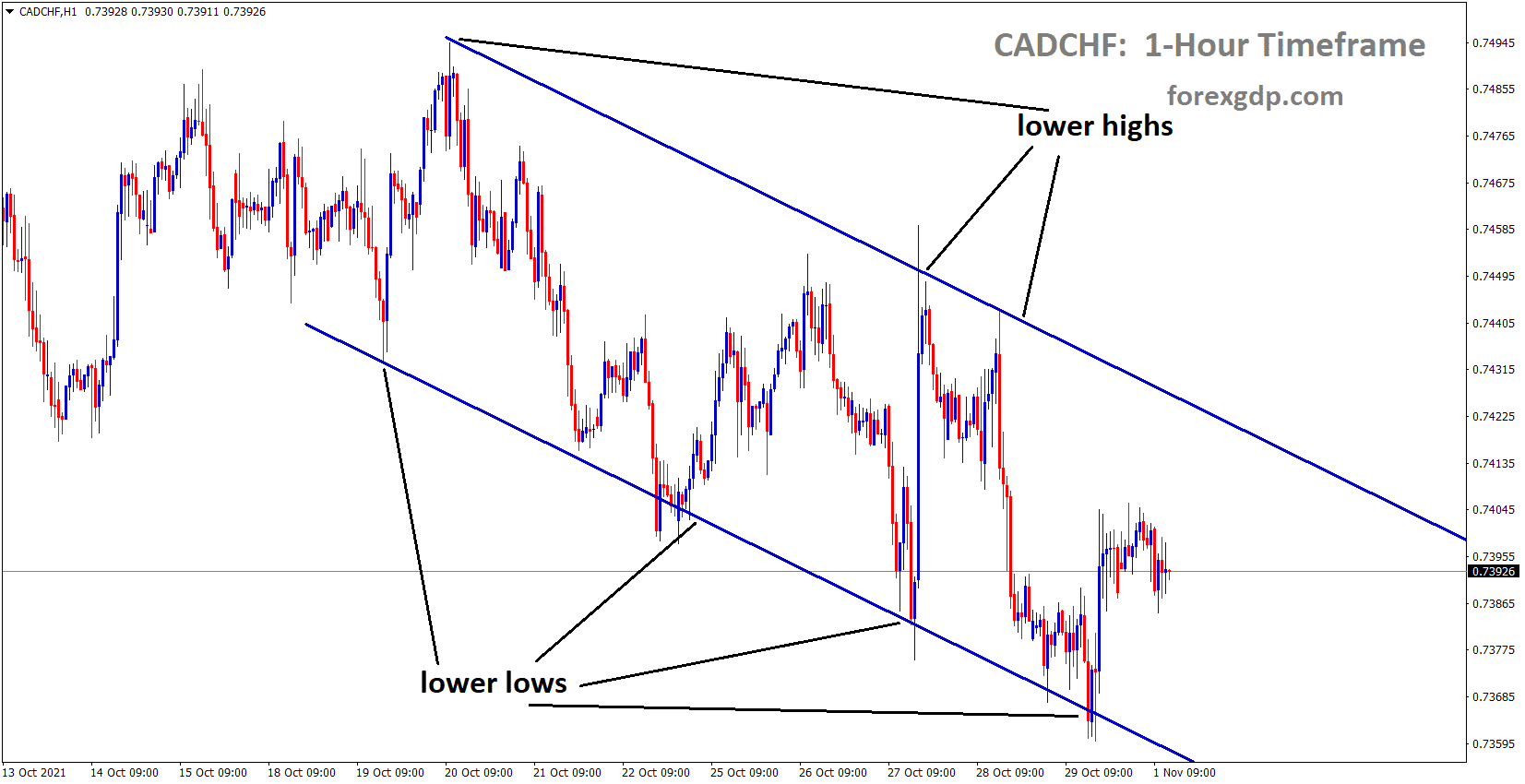

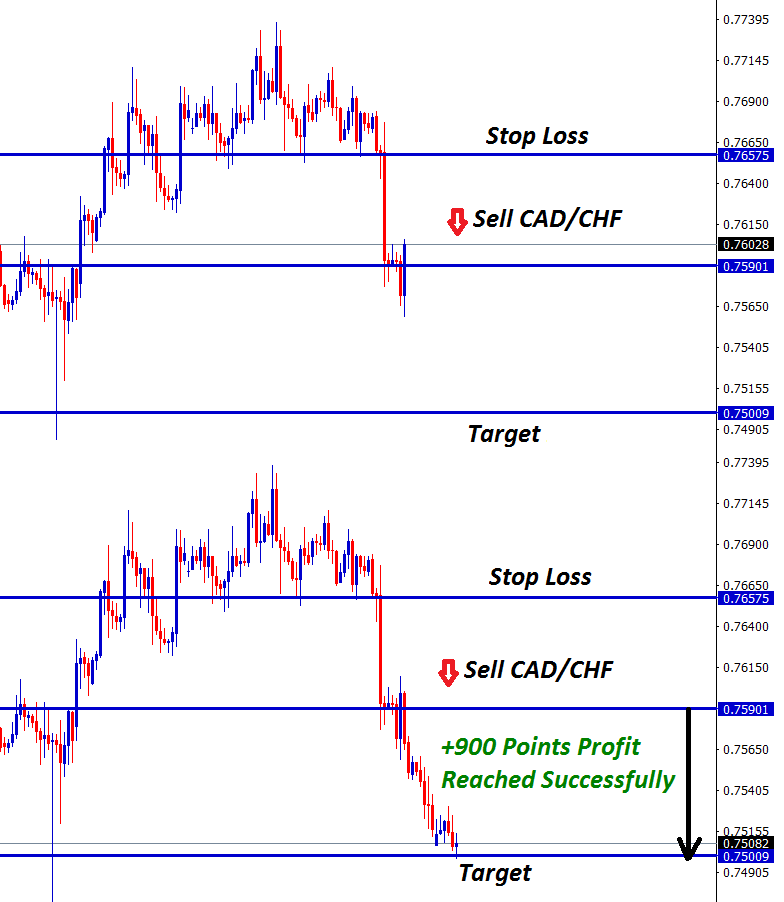

Swiss Franc: SNB reported a loss of 2 billion Francs

CADCHF is moving in the Descending channel and rebounded from the Lower Low area.

Swiss National Bank reported a loss of 2.075 billion francs during the third quarter due to losses from equity markets, and It failed to cover losses by Bond markets and negative interest rates.

But SNB made 109.10 million francs gained from gold holdings and 250 million francs from Negative interest rates as investors parked money overnight.

And MSCI world prices index fell by 1.7% due to supply chain bottlenecks, energy demand and Delta virus concerns.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/