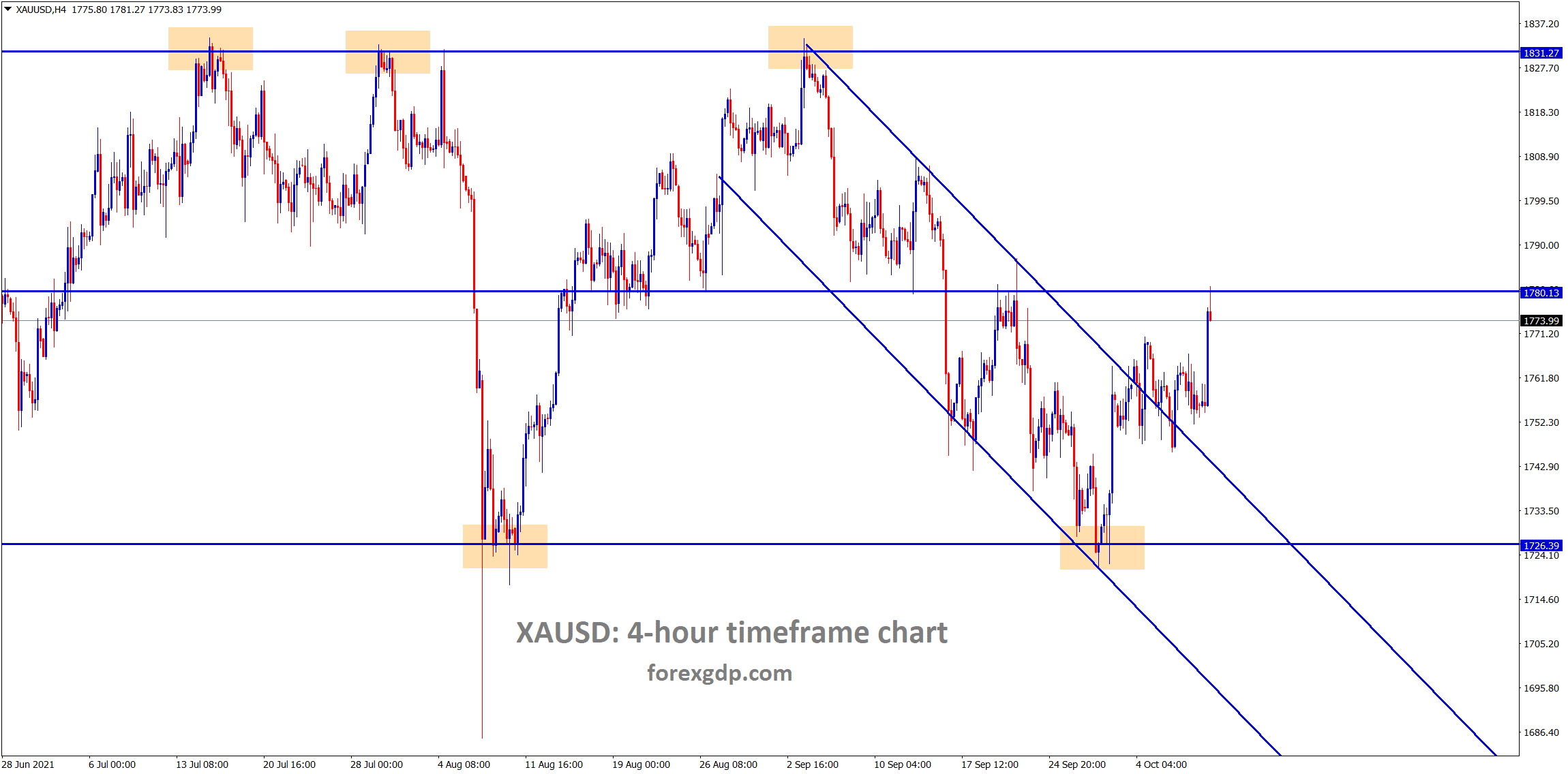

Gold: Energy crisis makes Gold prices dimmed

Gold XAUUSD has broken the top of the descending channel and the consolidation zone, now the market has reached the horizontal resistance area.

Gold prices are playing range-bound market this week as 1749 to 1770$ range due to non-Farm payrolls data displaying this week.

NFP data expected to show 5lakh jobs as a target last time only contributed 2.38K jobs make more disappointment.

And Energy supply constraints in all parts of the Globe makes commodity prices increases other than Gold.

Coal, LNG, Petrol are the primary resources of daily usage of Whole Globe, now China facing power cuts due to coal shortage.

Covid-19 is now dimming, and the Energy crisis makes shining in the market.

Due to these scenarios, Gold prices remain dull, and Demand is less in the current situation.

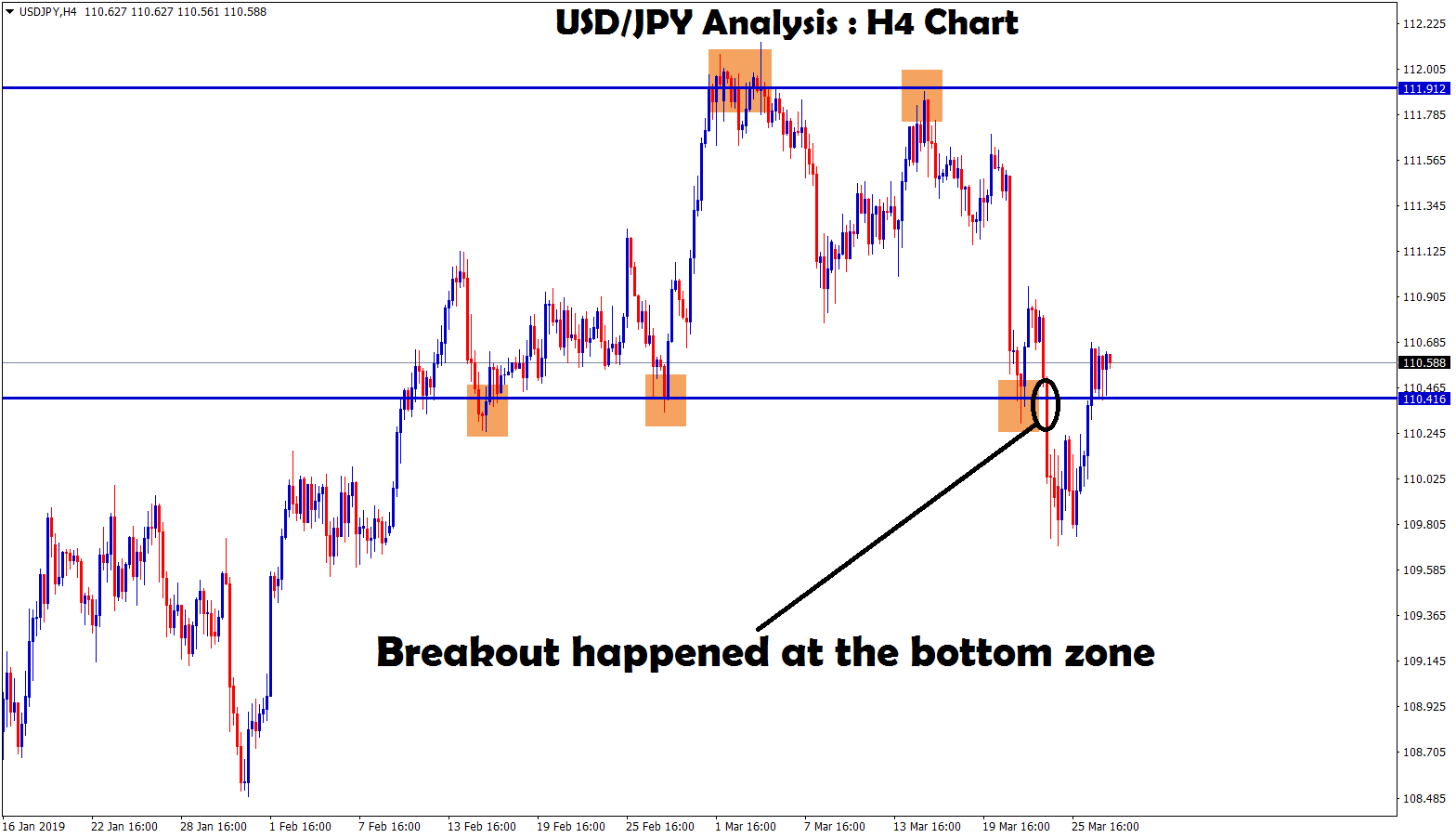

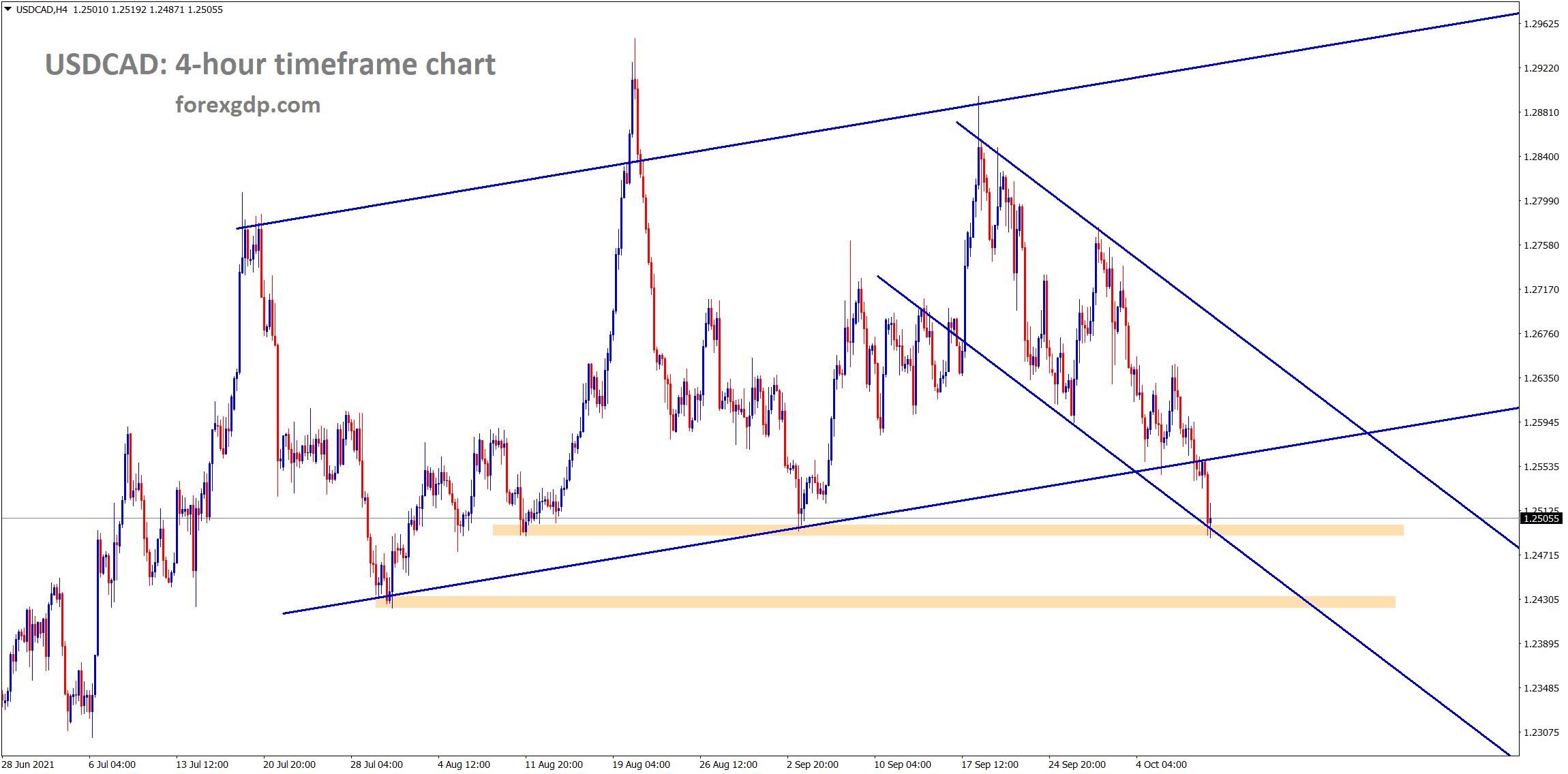

US Dollar: NFP Forecast

USDCAD has broken the higher low level of uptrend line, however the market has reached the horizontal support and the lower low area of the descending channel.

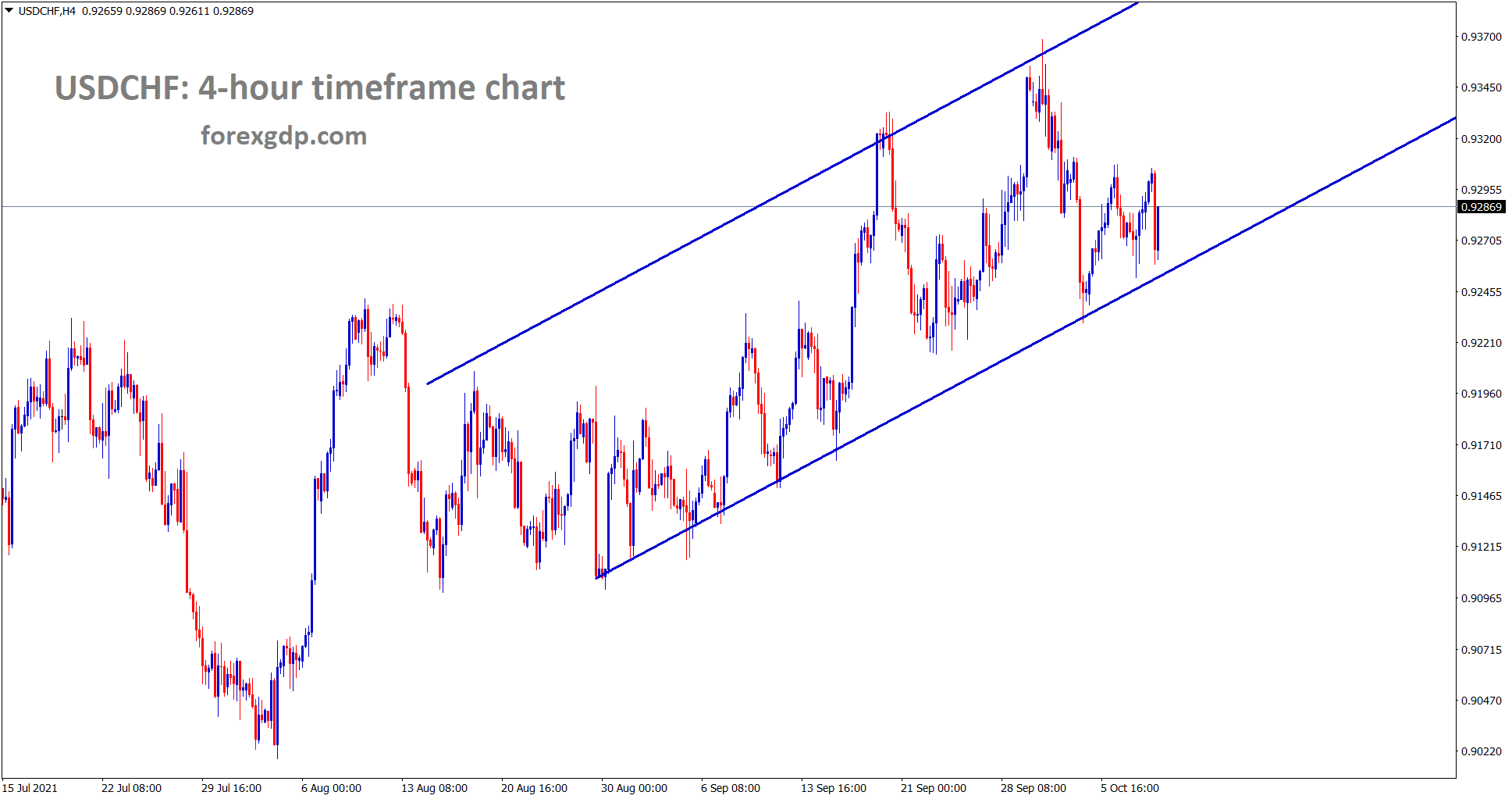

USDCHF is still moving in an ascending channel range for a long time.

US Dollar index continuous higher to 94.300 level as Strong US Domestic data support and US Debt ceiling limit is extended to December month by Opposite Party in the US.

Senate voted for 50-48 is strong approval and now passed to House of representatives before Joe Biden to sign it.

And Now, Jobs data may come in positive numbers, and FED will do tapering by year-end otherwise, delay started if Job numbers are not satisfied.

Wednesday ADP private data came at 560K versus 460k expected, shows strong Job growth in the US economy.

The same expectations of positive mood turned to non-farm payrolls today.

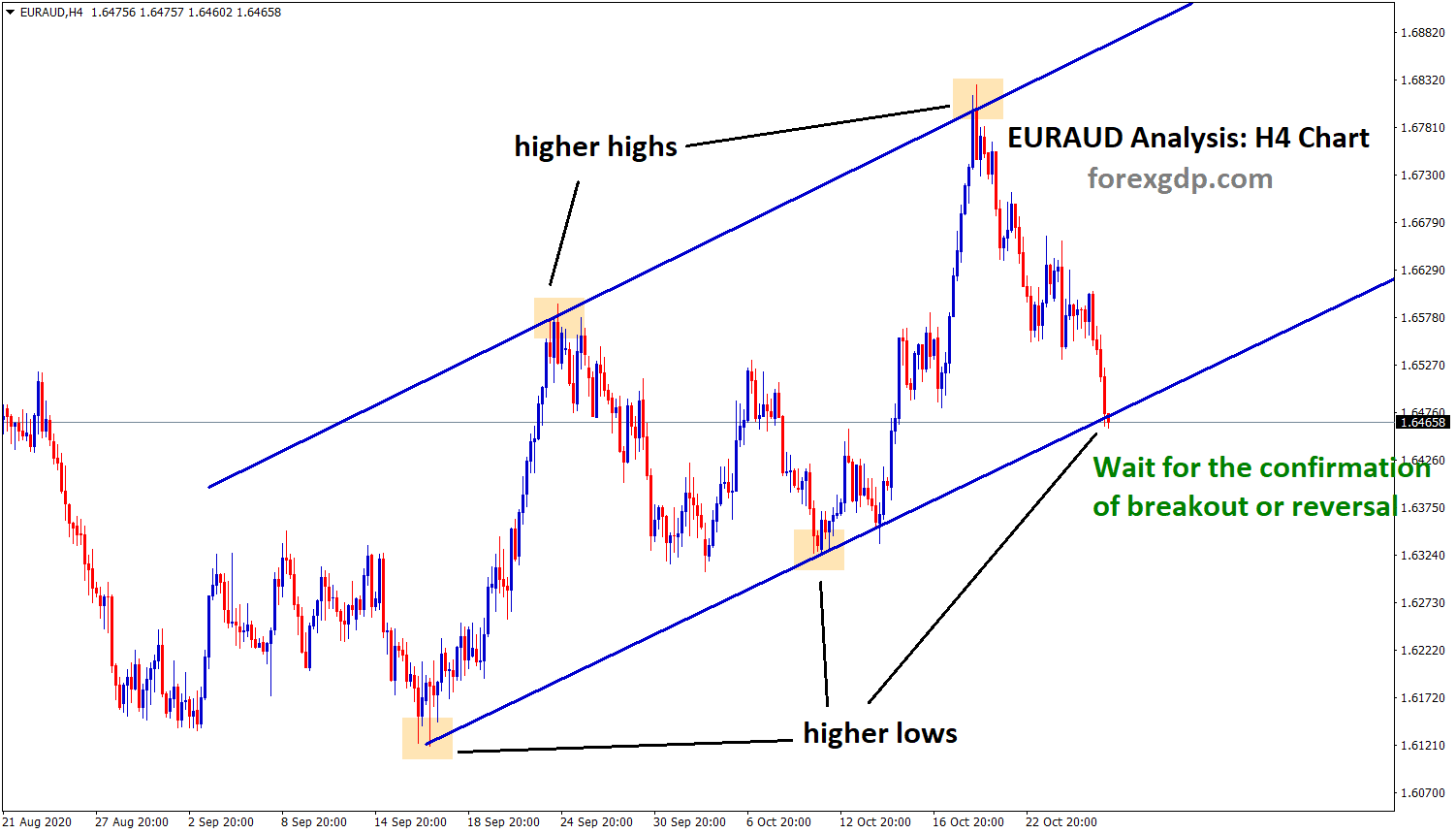

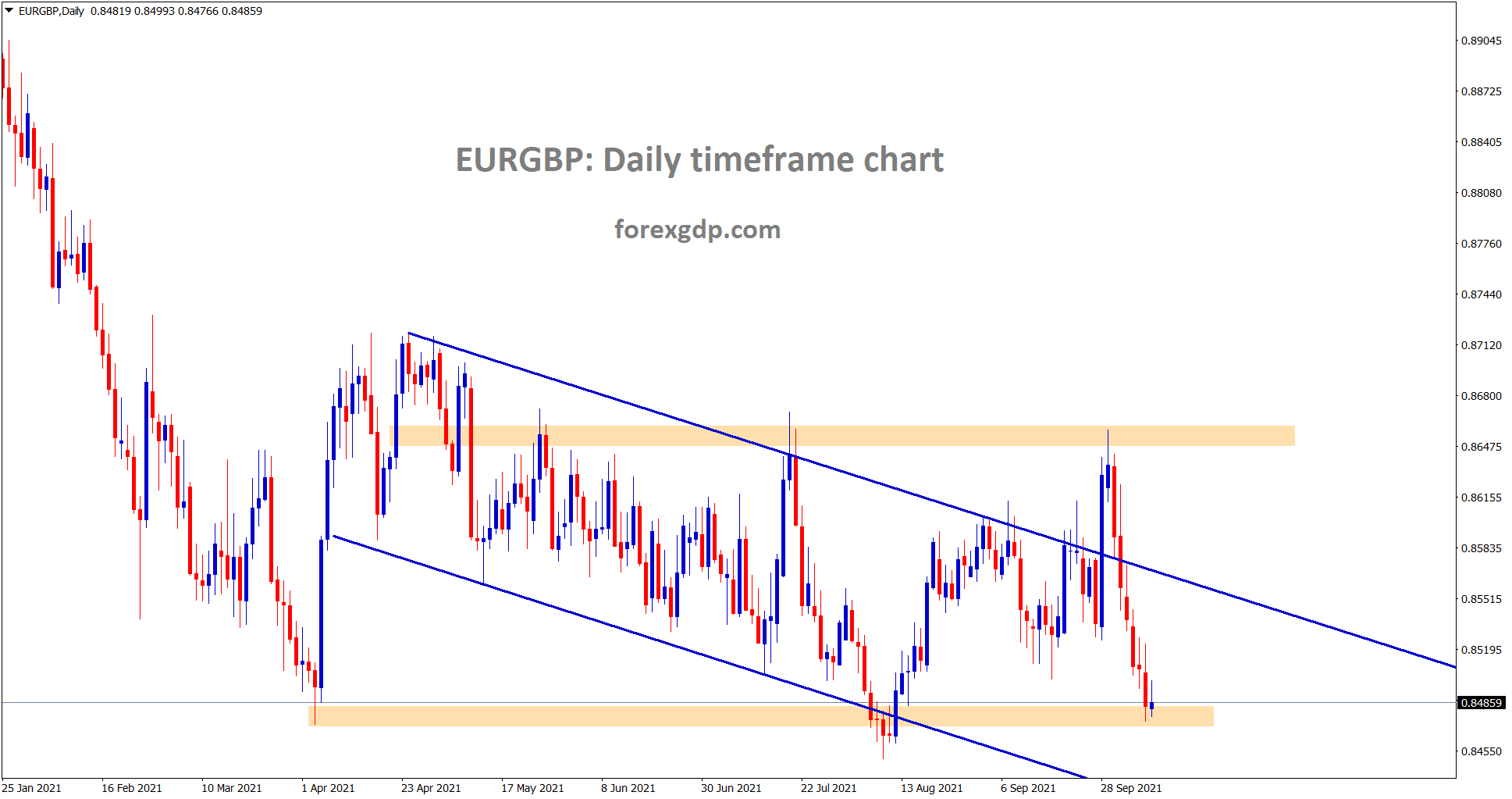

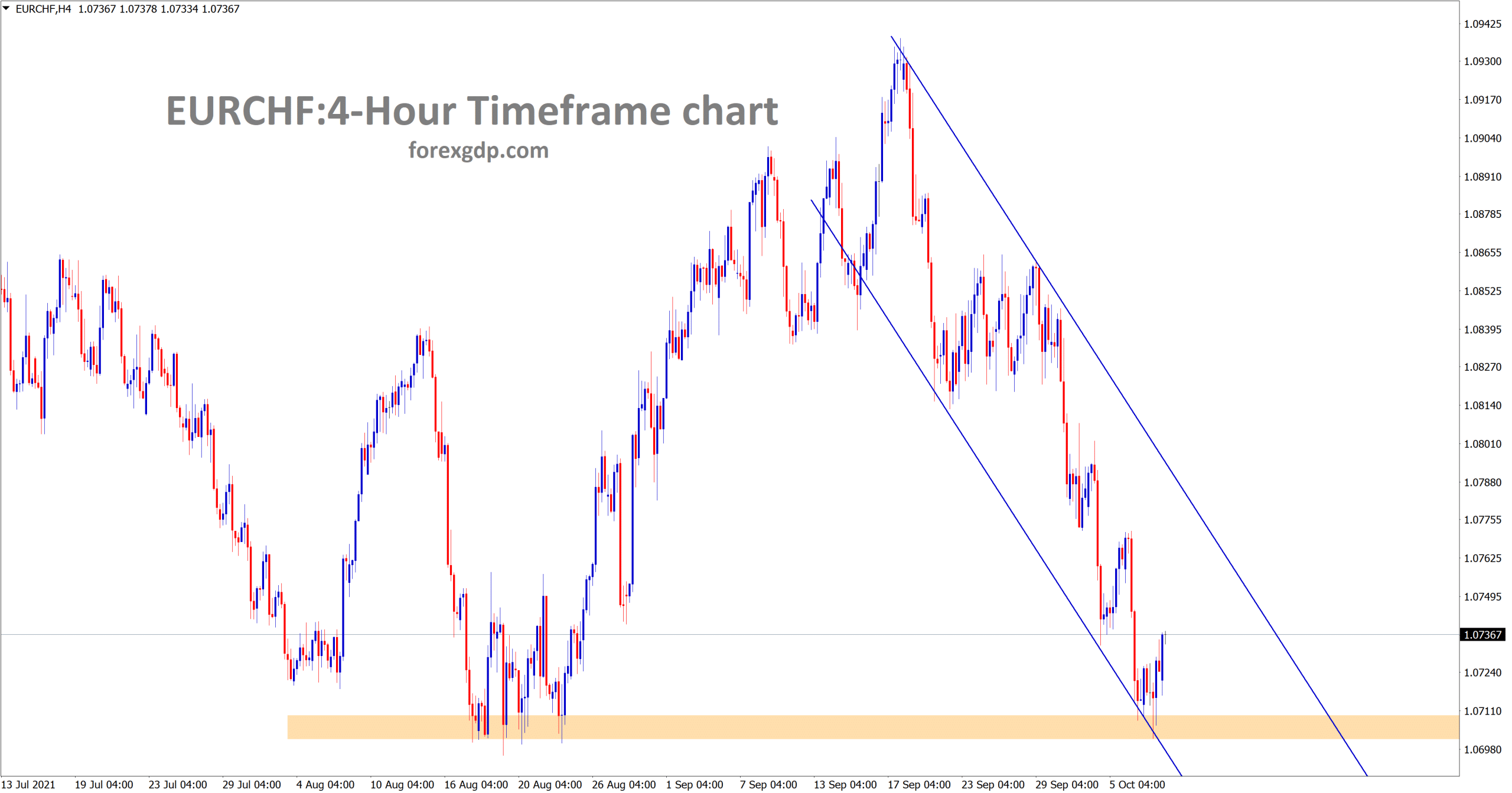

EURO: German data shows more weakness

EURGBP is at the horizontal support area.

EURCHF is making a correction and consolidation at the support area.

German economy data shows German trade surplus shrank to 13 billion Euros during August month and Current Account surplus narrowed to 11.8Billion Euros in the same period.

And German economy shows a little bit of shrink as Trade surplus weakness and EURUSD may further declines to 1.15 level soon by year-end.

US NFP jobs data shows 500k Numbers expected, and the Unemployment rate is expected to be 5.1% this week.

Positive data from the US makes the Euro fall again, and negative data makes Euro rose to a lower high.

Russian President Putin helps the energy crisis supply more gas to European nations without any delay and fast to Europe.

And natural gas prices are dipped after the Putin news.

Nord Stream pipeline is reopened for more gases to supply to Euro regions and approval seeking to Euro for reopening.

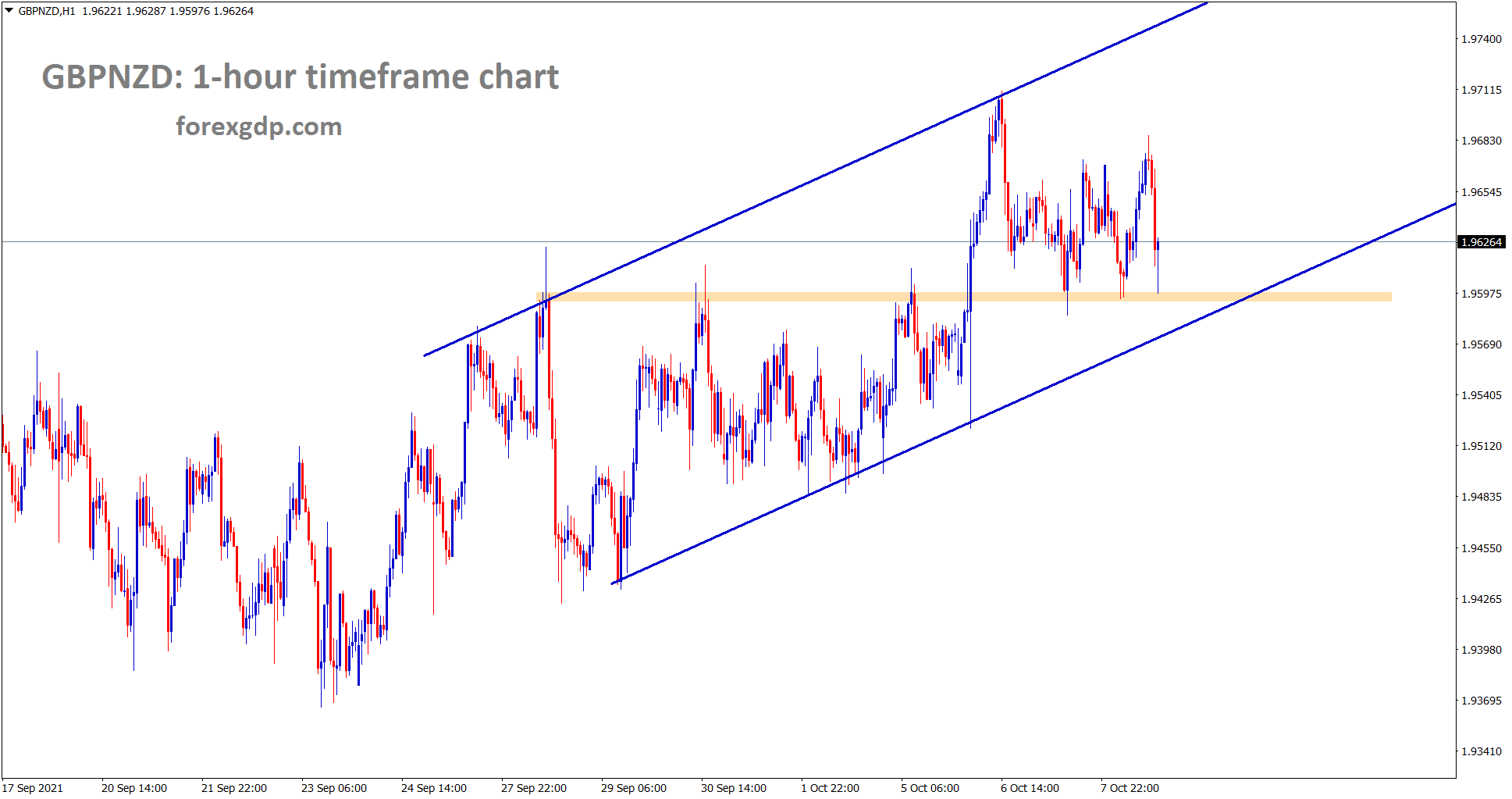

UK POUND: Gas and Petrol demand higher in the UK

GBPNZD is moving in an Ascending channel forming higher highs and higher lows.

Bank of England makes more hawkish tone in 2022, and early in 2022, we expected 15bps rate hikes in February.

Gas demand more in UK and Truck drivers are less to supply across Gas and Petrol stations.

And the UK Pound affected by Energy demand and Oil Prices is soaring to 77$ nearby.

Today NFP report is scheduled, and positive numbers will drag down the UK Pound soon.

Rising inflation prices makes the Bank of England soon rate hikes in the coming year.

Crypto assets will not affect the stability of UK Finance

Bank of England said that the financial committee shows the report of Evidence taking risks business remains higher in a number of the market as per Reuters published.

And continues to loose underwriting standards and increased risk-taking in investment banking businesses.

Financial stability to UK Finance is lower from Crypto assets.

And Financial institutions are more cautious and regulated to handle the crypto exchanges and Crypto assets.

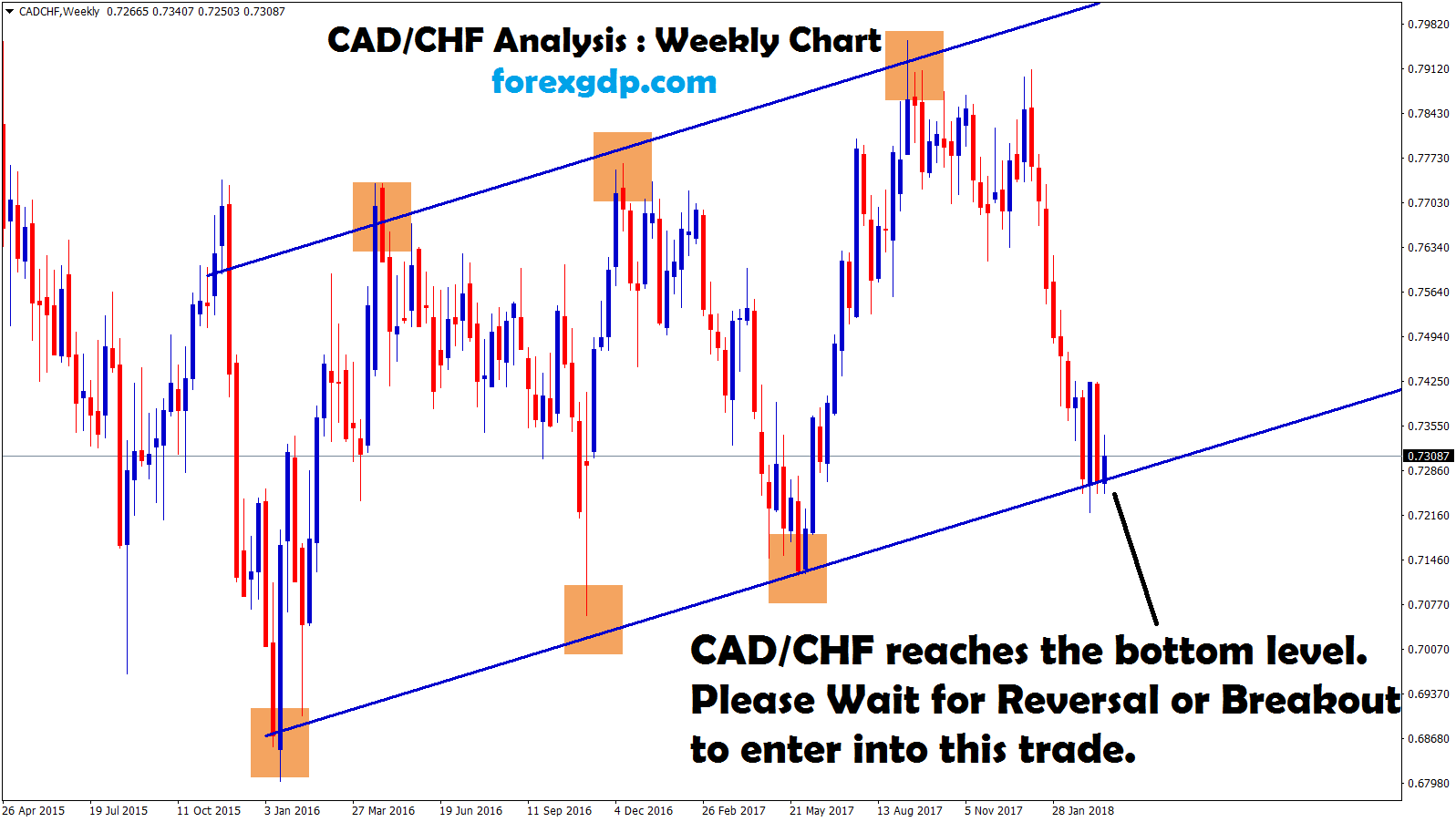

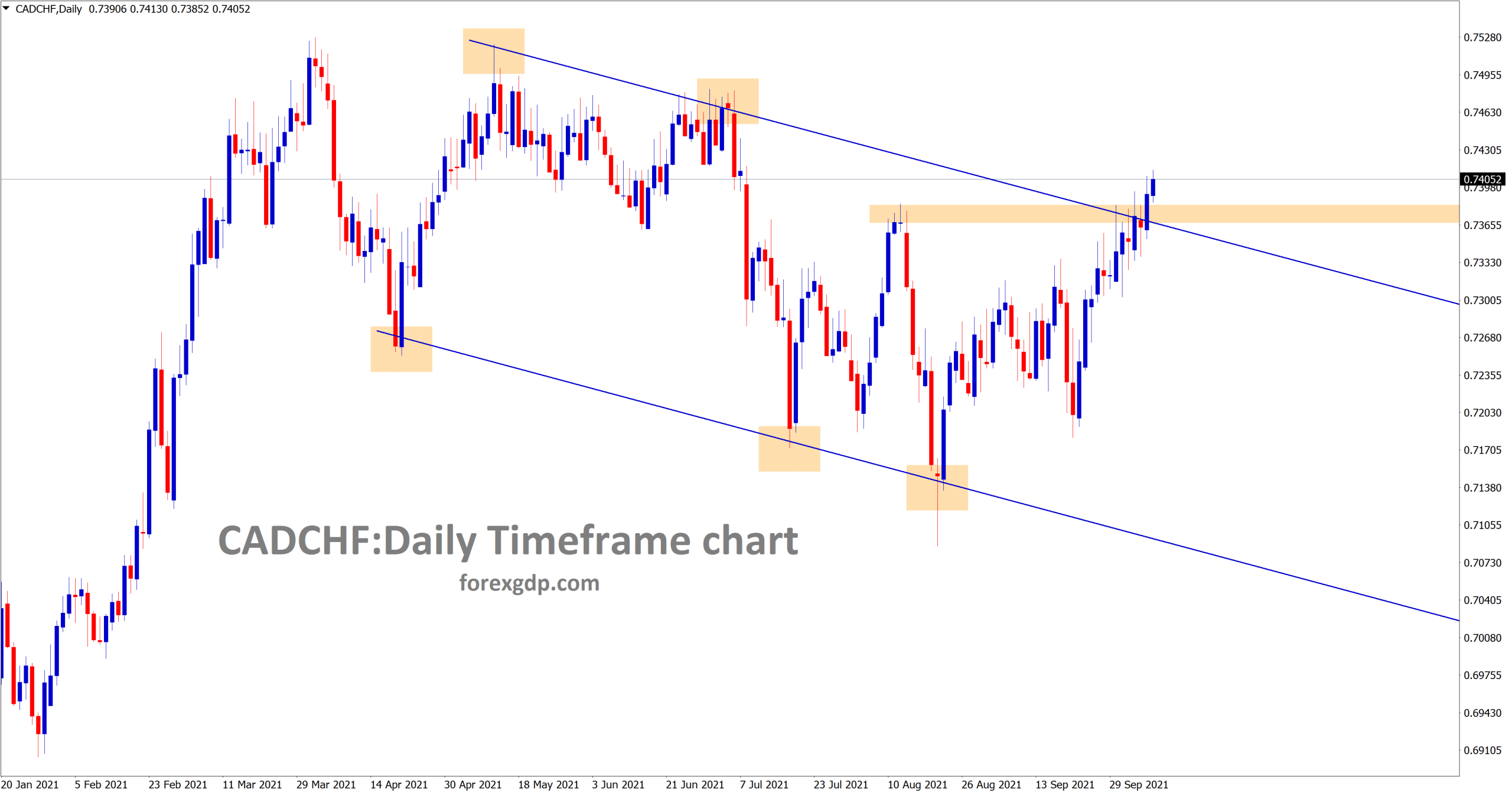

Canadian Dollar: Unemployment rate and Jobs data forecast

CADCHF is trying to break the horizontal resistance and the lower high area of the descending channel line.

Oil prices are surging day by day as the Energy crisis appears all over the market.

Canadian Employment and unemployment rate scheduled today, if it came in good numbers USDCAD will drop the support of 1.25500 level.

In the Analysyst view, the Bank of Canada might do tapering or rate hikes.

Whether US support for further Oil supplies for Global countries is a waiting approach.

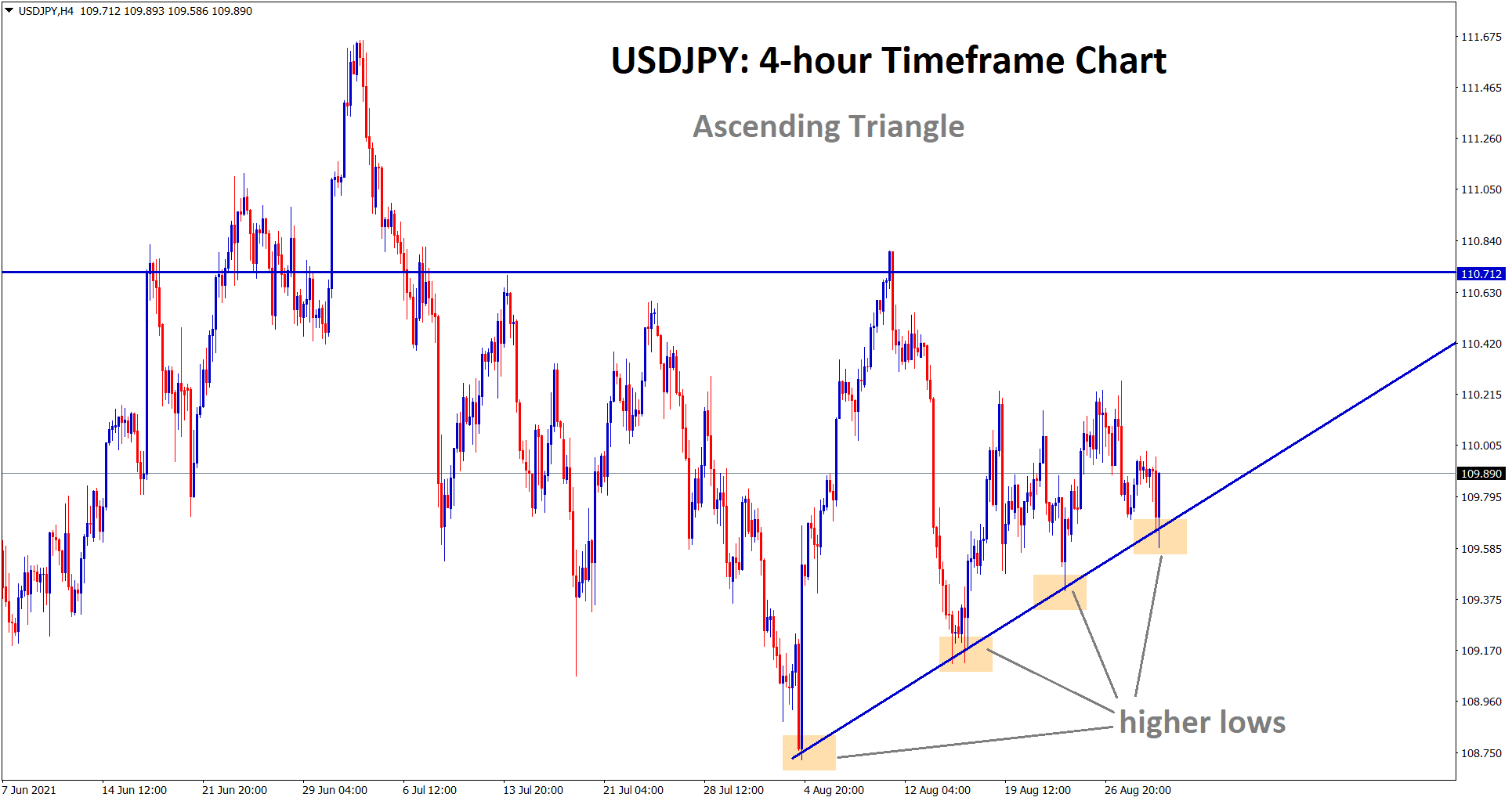

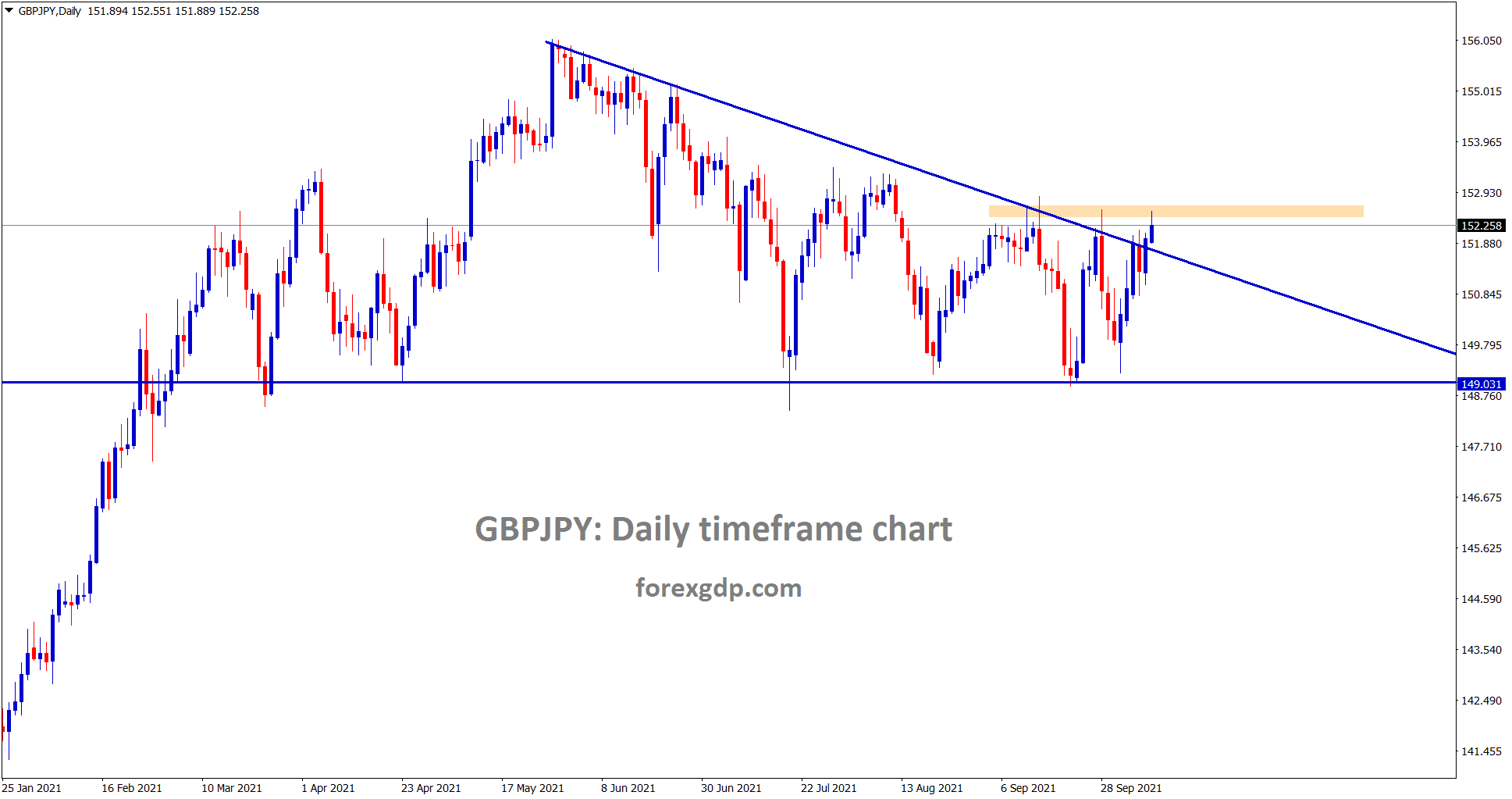

Japanese Yen: China shifted Coal imports from Japan to Australia

GBPJPY is breaking the top of the descending channel, right now the price is standing at the horizontal resistance – wait for the breakout or reversal from this resistance.

Japanese Yen remain under elevated risk as Energy concerns in all Global parts of the world. And One side Covid-19 issue still not solved, and the other side Energy crisis began.

China Caixin Services PMI came at 53.4 against 49.2 forecasts.

PBOC already makes more liquidity measures in the market and is waiting for more liquidity measures in the coming weeks and the Reserve Requirement ratio alterations.

And China has Begun imports from quality coal of Australia to compensate energy crisis and Power cuts. This produces small imports from Japan as considered.

So Japanese Yen kept weaker as export revenues were affected.

Australian Dollar: China services PMI supports AUD

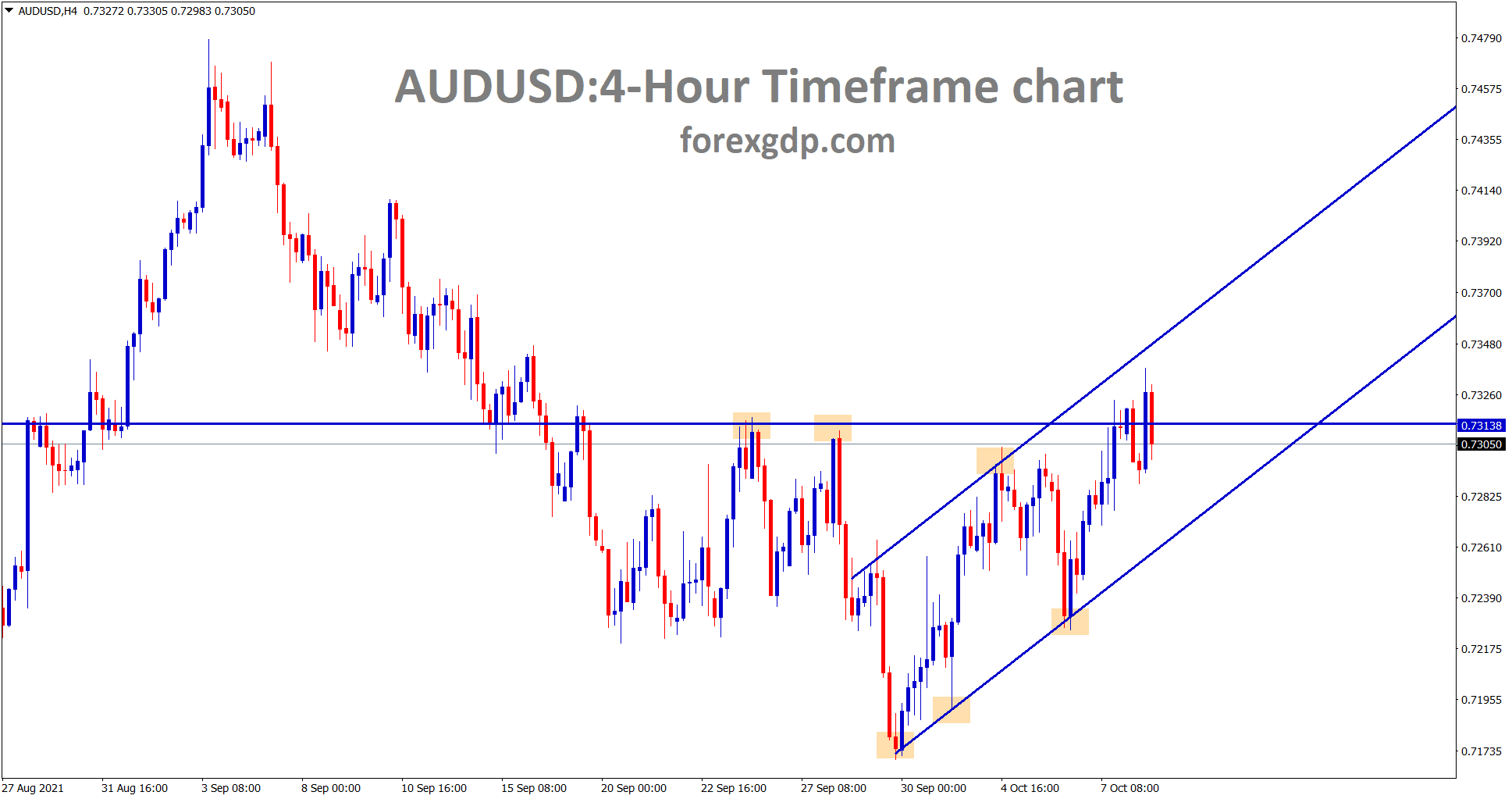

AUDUSD is consolidating at the resistance area and the higher high level of an uptrend line.

Australian Dollar benefitted from Chinese Caixin Services data as it came at positive numbers versus weak data expected.

And Russian President Putin said natural gas supplies are increased to a European nation, Nord stream pipeline will open for extra supply to European countries. Approval is waiting from the EU for Pipeline gas transmission.

The energy crisis in Europe and China causes perimeter countries to harm because All production and manufacturing come under China, Europe and the US.

Australian Dollar benefitted from China action on coal imports from Australia continues.

New Zealand Dollar: RBNZ rate hikes no momentum in NZ

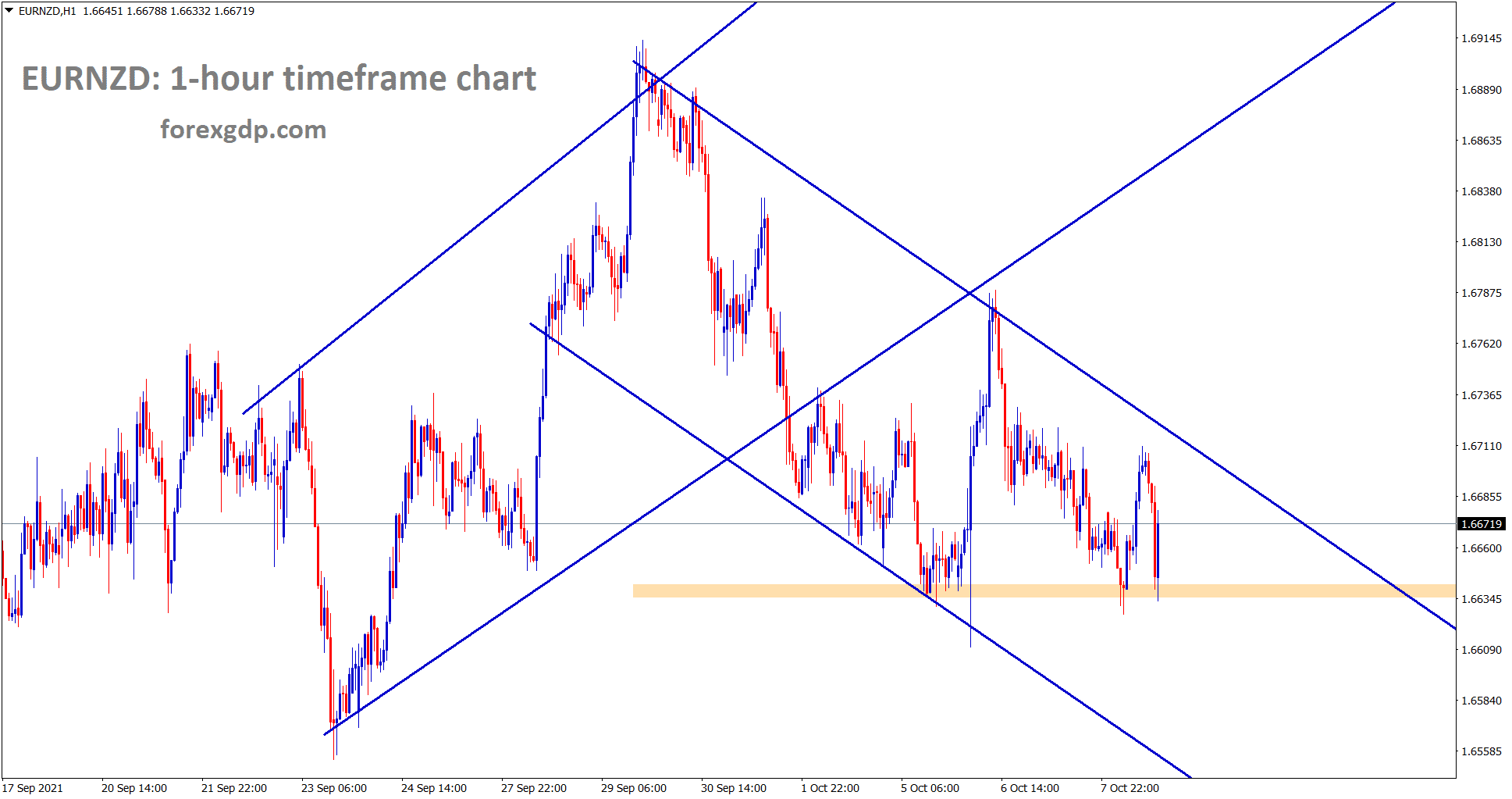

EURNZD is moving in a descending channel and ranging from the horizontal support.

New Zealand Dollar keeps lower as US Dollar is pretty stronger as the Debt ceiling limit rose by yesterday with Republican party meeting.

Reserve Bank of New Zealand rate hikes by 25Bps points this week make New Zealand Dollar booster but keeps calmer in the market against US Dollar.

And more covid-19 variants in New Zealand make the Economy recovery slow, But RBNZ did a rate hike this week.

In 2022 possible for 2 rate hikes from RBNZ is expected if the economy does well.

Swiss Franc: Debt ceiling limit bill passed for Approval to US President

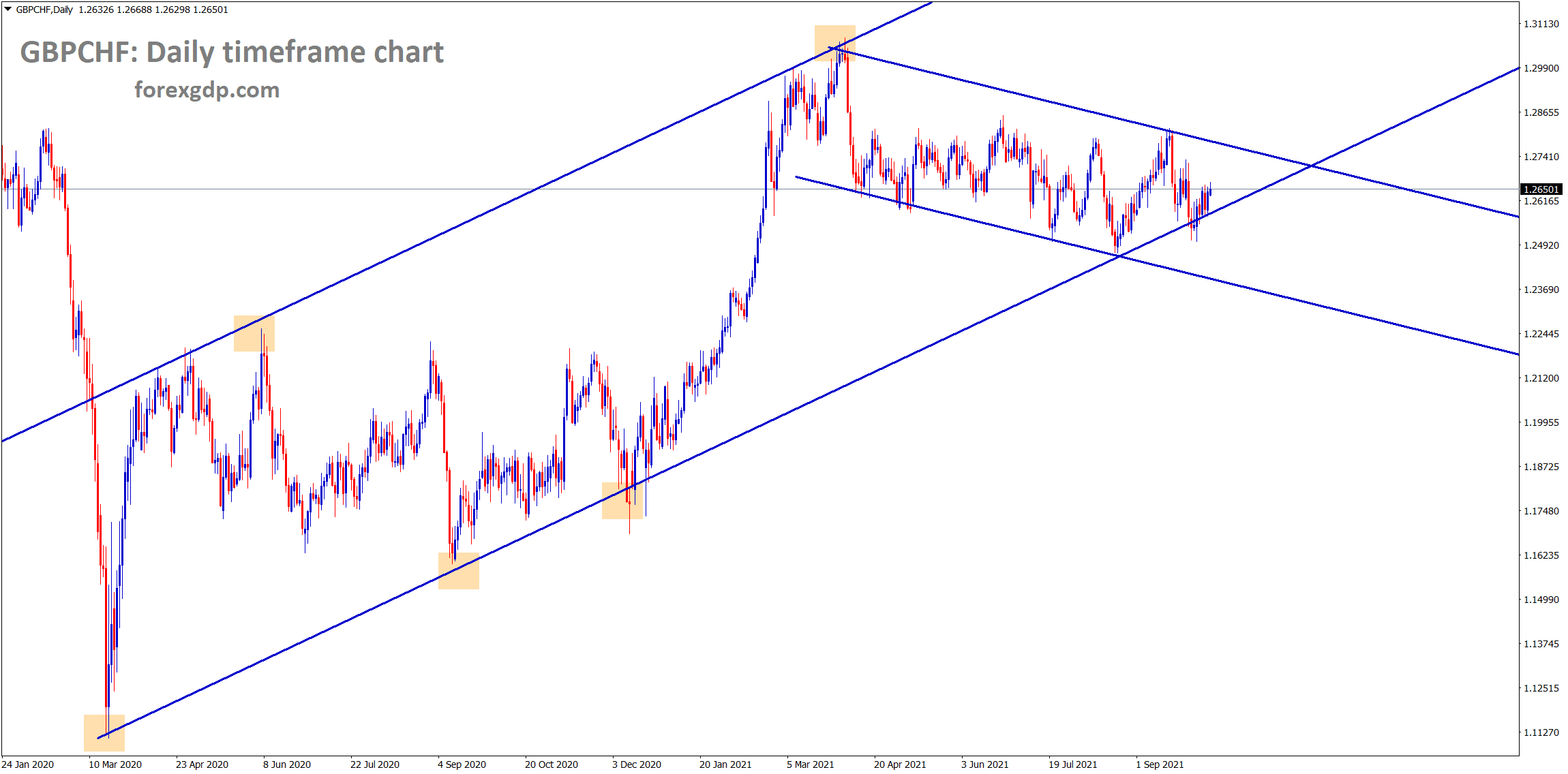

GBPCHF is moving in an Uptrend line for a long time.

Swiss Franc makes higher in the market as the energy crisis spread across China and European nations.

And China Evergrande crisis makes investors safe park funds to Swiss Franc as SNB bank.

FED Powell signalled tapering talks by the end of 2021 and rate hikes in 2022.

Today Non-Farm Payrolls data is scheduled to release positive expectations from Analysts view.

As Initial Jobless claims are lower in numbers as of October 1 report.

And US Debt ceiling limits were raised, and the bill was passed to the US House of Representatives and then table to Joe Biden to sign it.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/