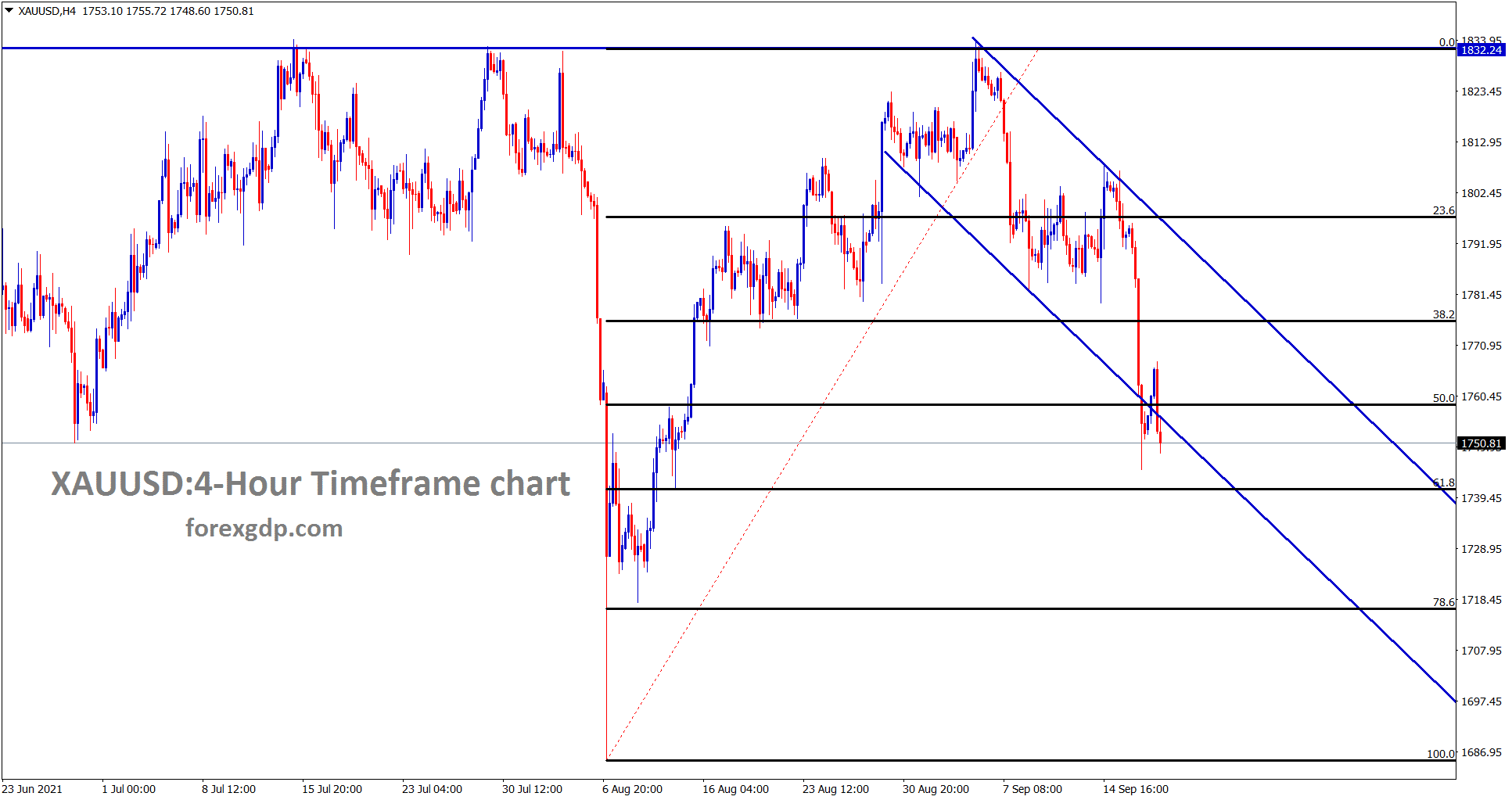

Gold: US Retail sales show Positive numbers

Gold is ranging between the 50 to 61% retracement zone.

Gold prices decline as 2.40% as 50$ in a single day from 1796$ due to US Retail sales data shows Positive numbers.

US Retail sales printed at 0.7% M/M versus -0.7% anticipated.

This data helps the FED to do tapering in upcoming meetings, and the US economy shows consumer spending is more as fear decreasing from the pandemic.

And Retail sales data shows more production in demand improves; these sales will progress US People spending more from pocket.

Once Inflation gets lower, Retail sales higher and the Employment rate lower, these three scenarios happened in US Economy, and FED has reached the Goals of the target, then they do tapering & Hikes in the market.

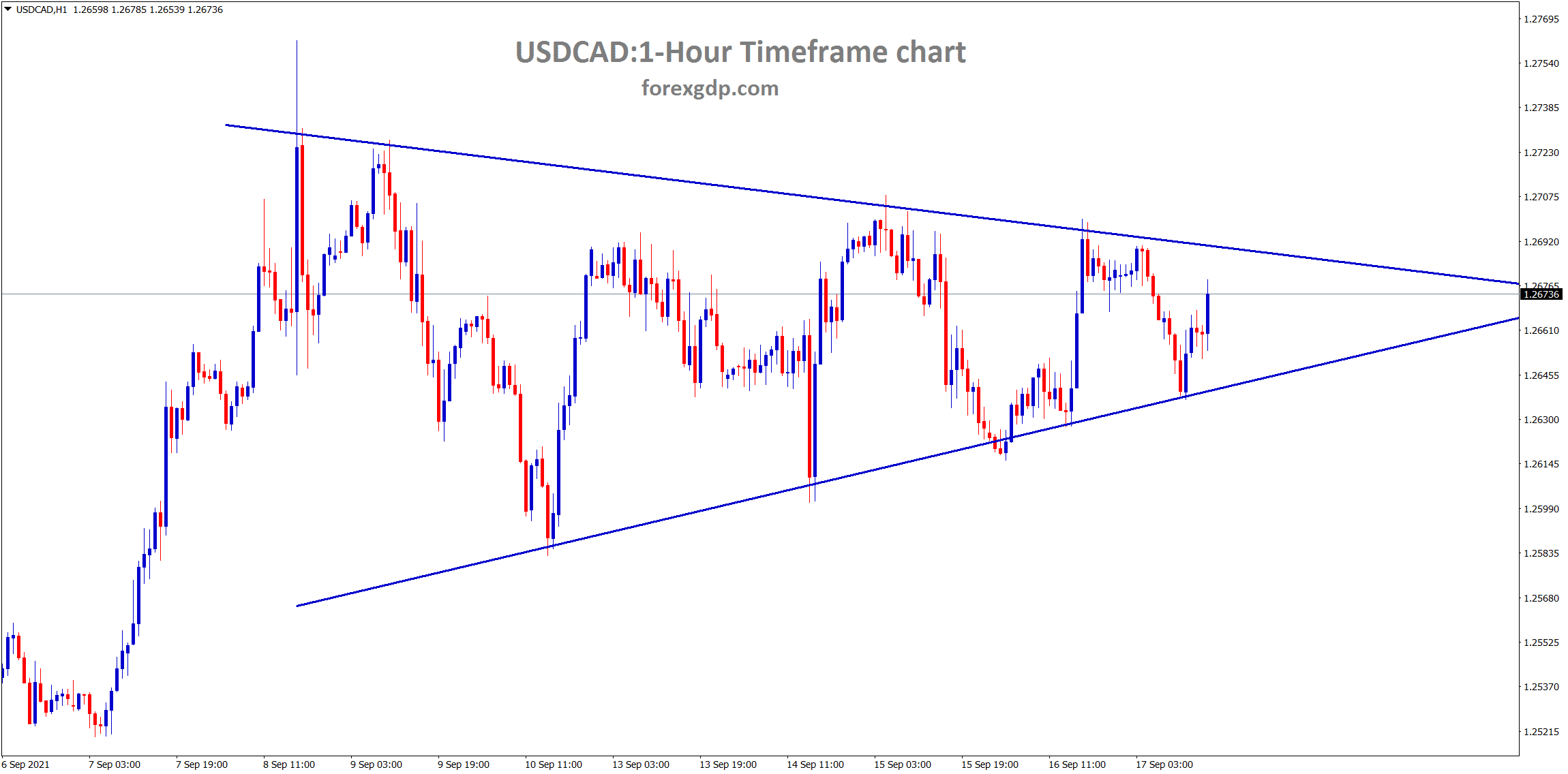

US DOLLAR: Michigan consumer sentiment forecasted

USDCAD has formed a clear symmetrical triangle pattern – wait for the breakout as the triangle getting narrower.

USDCHF is trying to break the horizontal resistance level at the top.

US Dollar boosted by healthy US Retail sales posted last day as 0.7% printed from -0.8% anticipated fall.

And Business sentiment survey by Philadelphia FED also shows significant improvement in numbers.

Economic data of the US show healthy improvement from a pandemic, and Vaccinations are properly progressing; these vaccinations result impact the US Dollar to boost higher.

And Today Michigan consumer sentiment data scheduled, if came in solid numbers then Additional boosting for US Dollar.

By Considering these scenarios, we expected some tapering speech in next week FED meeting, as retail sales data boosted.

North Korea tested missiles.

North Korea tested a new railway borne missile system to attack enemy forces significantly.

This testing was done at the static site of the enriching uranium site.

Now at least 25% of Uranium will be utilised for making a missile system on this site as planned by North Korea.

South Korea and Japan found two ballistic missiles tested by North Korea, followed by the latest testing.

The US makes no reply for North Korea testing occurrence but supports with Public as contrasts to Obama administration.

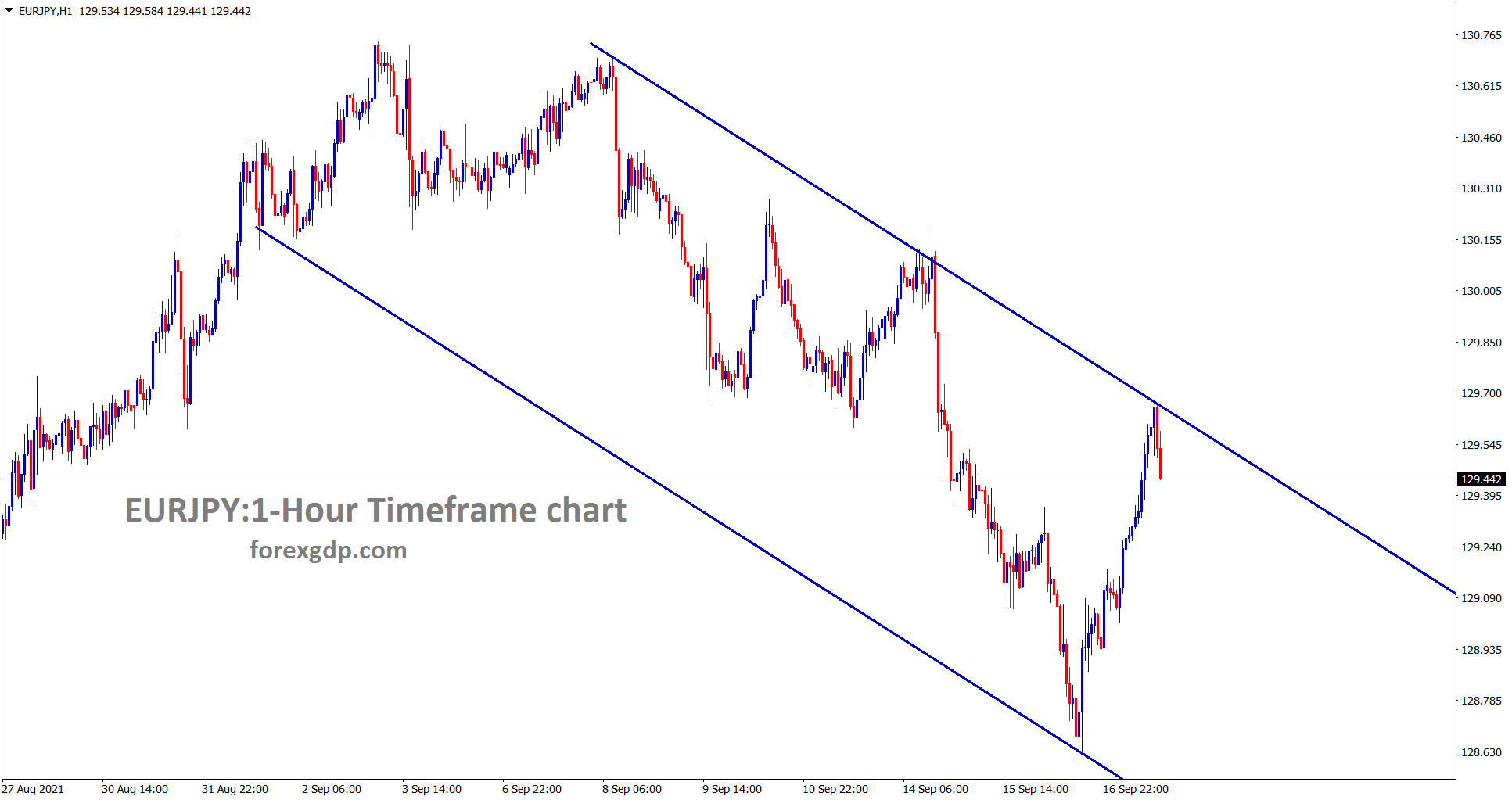

EURO: ECB Delaying Tapering concern for EURO

EURUSD is still moving between the channel ranges.

EURJPY hits the lower high area of the descending channel.

EURUSD faded lower as ECB Delaying tapering and Rate hikes.

Chinese data disappointments and FED favours for tapering made EURUSD to Dull performance in the market.

ECB Members stated that a hike in inflation is a temporary move, and it will not long last.

And ECB team is more wait and see Approach for slowing purchases of PEPP and Hike interest rates.

Yesterday US retail sales data showed positive numbers, and the US economy is in better progress.

But in the EU zone, Domestic data shows less impressive than other developed nations.

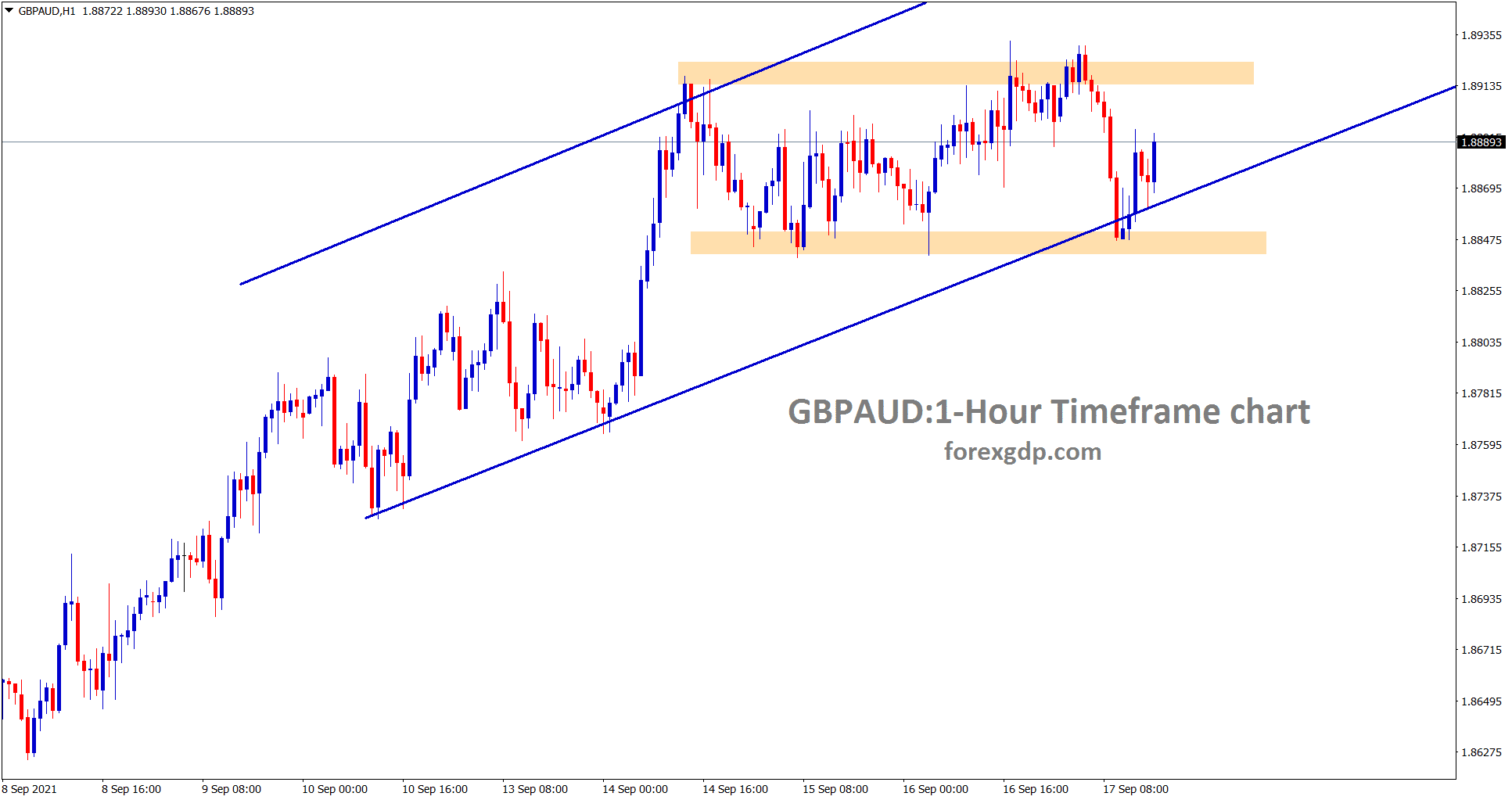

UK Pound: UK retail sales declined

GBPUSD is ranging in an uptrend line.

GBPAUD is ranging in an uptrend line.

UK Pound retail sales data came at disappointment numbers as -0.9% MoM in August versus 0.50% expected as Previous -2.5% printed.

The nation is now free of lockdown in the UK; slight fears of Delta variant impacted retail sales this month.

And Cost of Transportation of Energy is pacing higher in last 13 years.

Commodities prices are ranging higher as the Gulf of Mexico hits higher by a thunderstorm.

Today US Michigan consumer sentiment is scheduled; the last day US Retail sales came at higher than expected makes UK Pound down lower.

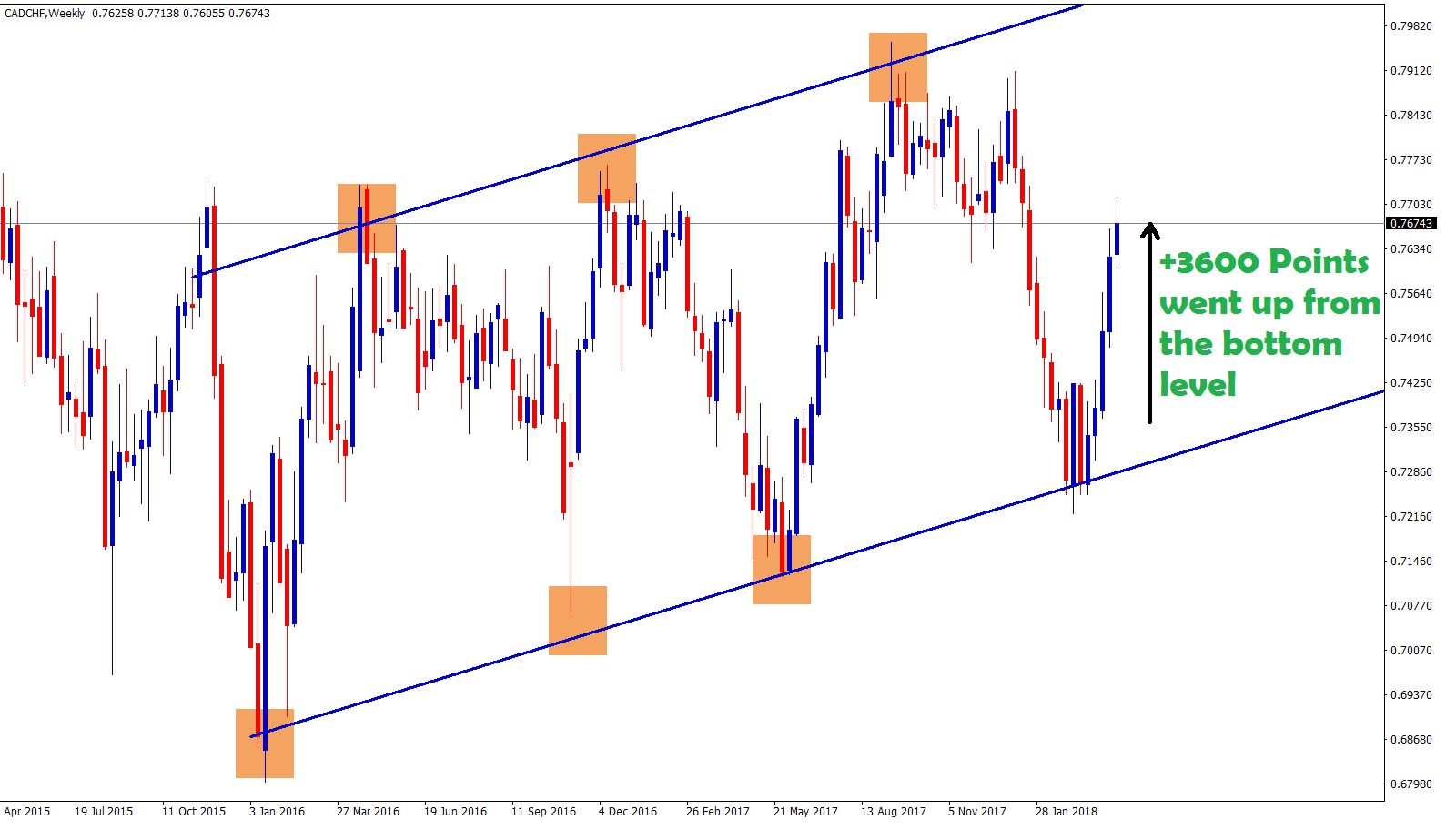

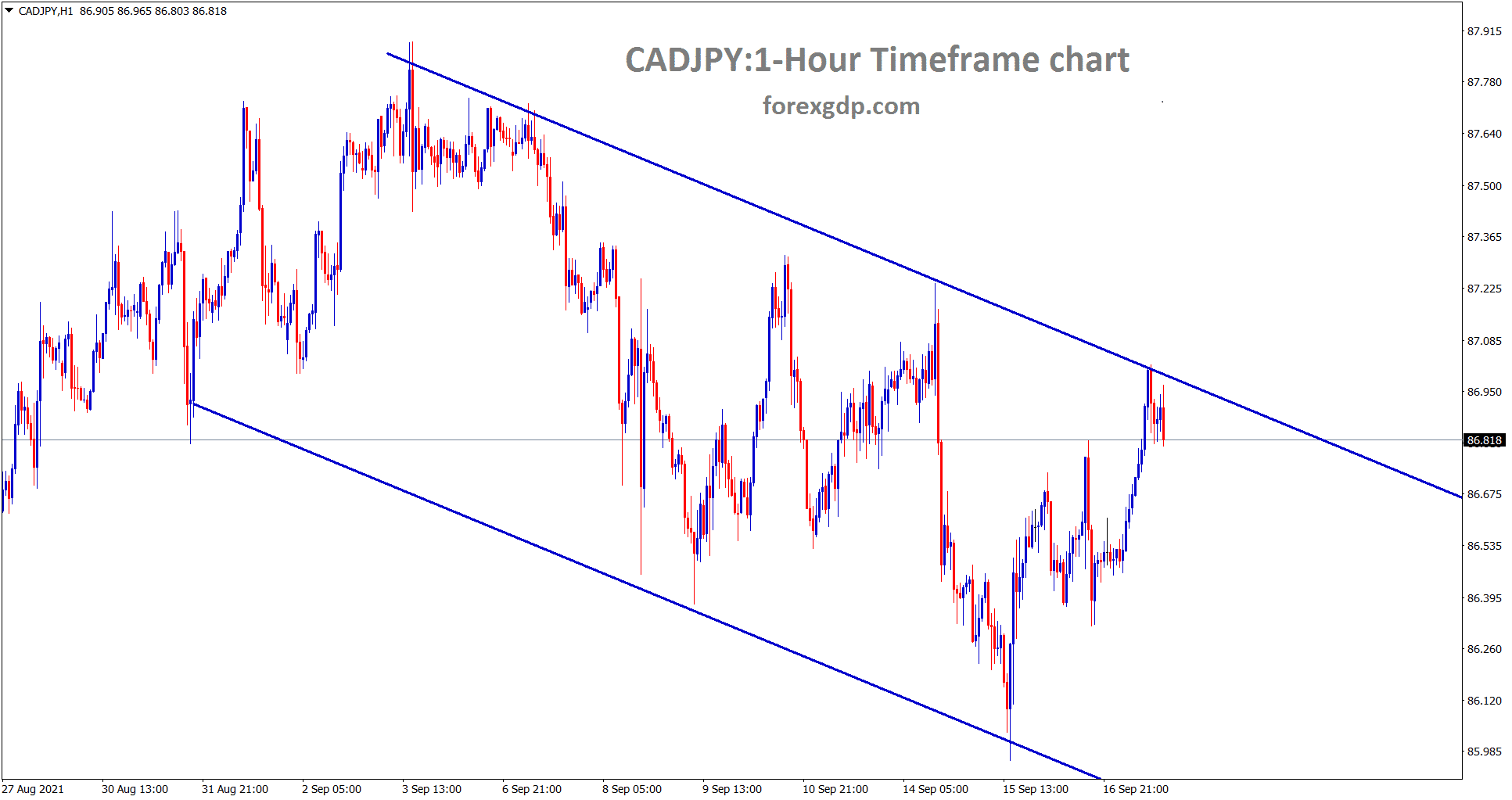

Canadian Dollar: Canadian CPI posted higher.

CADJPY hits the lower high area of the descending channel.

Canadian Dollar makes higher after US Oil prices lifted higher in market.

USDCAD posted a rangebound market after US Retail sales data posted positive numbers.

And Bank of Canada shows higher inflation numbers this week; more tapering is expected from the Bank of Canada in the October meeting.

But Oil prices are demand higher after the Gulf of Mexico is attacked by a thunderstorm.

China and the US show sluggish recovery in GDP numbers, Oil demand now growing faster after Vaccination picked up.

Japanese Yen: Japan Vaccine minister Kona speech

USDJPY has reached the lower high area of the downtrend line – wait for breakout or reversal

Japan PM contender Current Vaccination minister Kona said the 22 trillion-yen output gap must be filled as actions taken by Japan Government.

And covid-19 test kits will be manufactured at lower costs, and Government will take investments in Renewable energies.

Government must increase corporate profits will help household income.

And Japan will take the lead in upcoming quarters if proper vaccinations are done.

Australian Dollar: Jobs data concern for Australian Dollar

AUDNZD has broken the top of the descending channel in the 1-hour timeframe.

Australian Dollar declined lower after Weaker Job reports published last day.

And RBA predicted the Q3 GDP would be lower as Vaccination progress in a way, But Q4 GDP will look brighter after Vaccination completion.

And Tapering is not an idea until February 2022, and rate hikes are only expected in 2024.

Concerns remain at Australian Dollar by Domestically and Global cues like China relationship with trade deals.

And also, Iron ore prices remain lower as Consumption is lower by China imports. So Until December end, we have to wait for Vaccination to complete and Lockdown to be fully released.

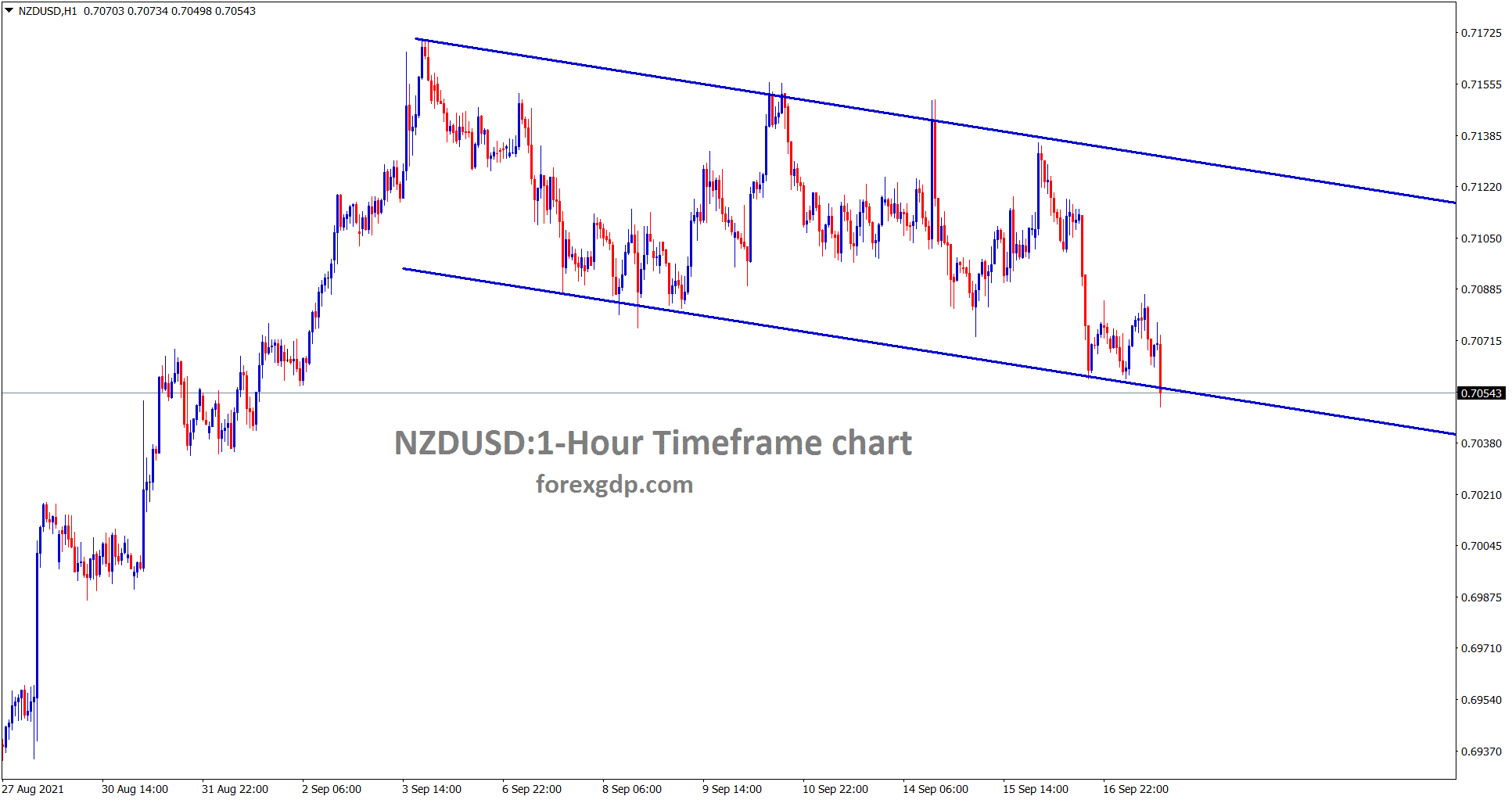

New Zealand Dollar: Business PMI Declined

NZDUUSD is consolidating between the channel line.

New Zealand Dollar shows Range bound market as New Zealand Business PMI came at lower numbers as 40.1 from 62.6 compared with the previous month.

But New Zealand GDP data showed higher numbers yesterday morning, and it benefitted from All Domestic data in line with expectations.

And Reserve Bank of New Zealand will do rate hikes in October as All Eyes expected; all data shows positive for RBNZ this time.

And yet, Auckland under Level 4 Lockdown until next week, other cities under level 2 lockdown.

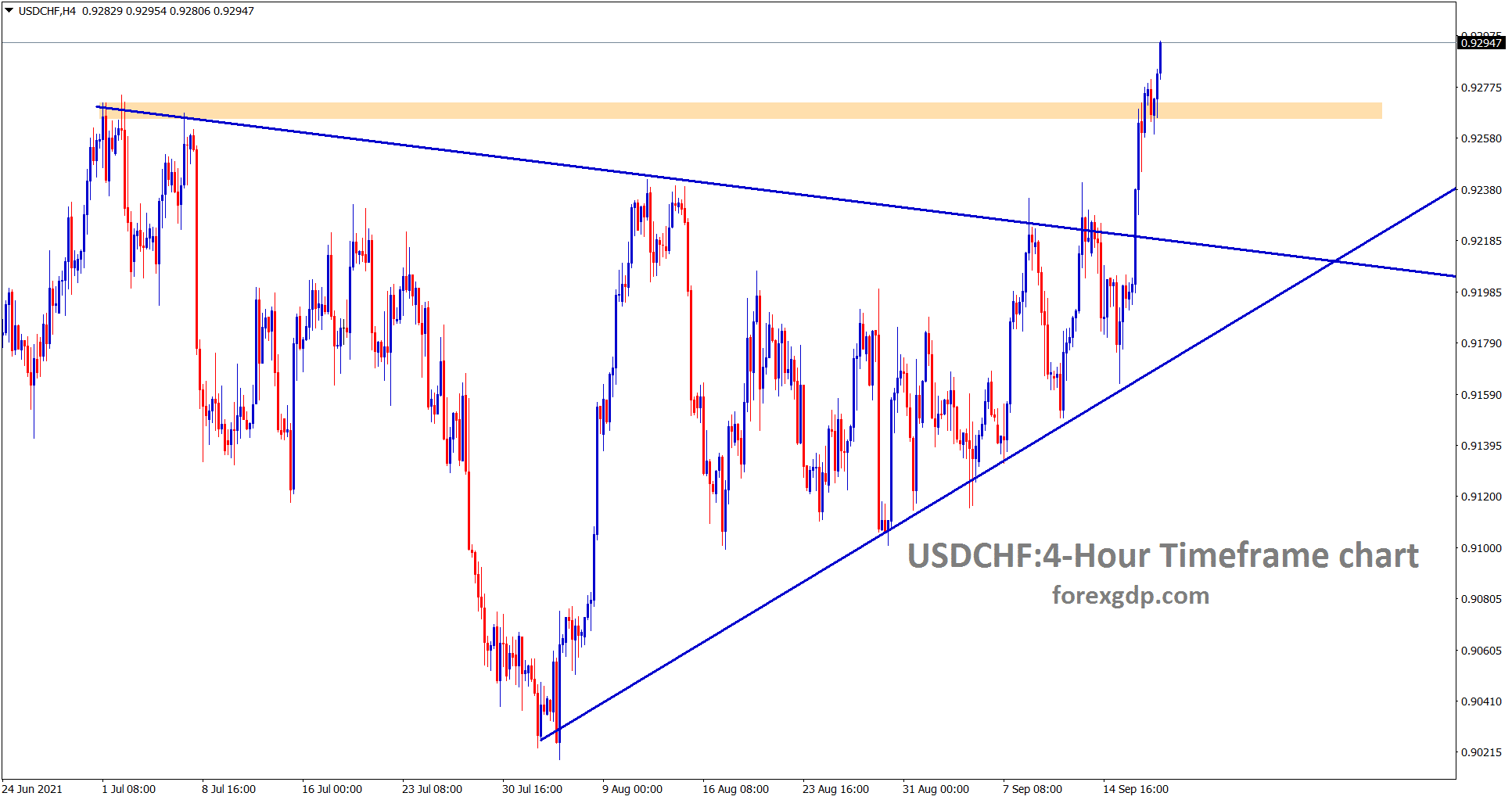

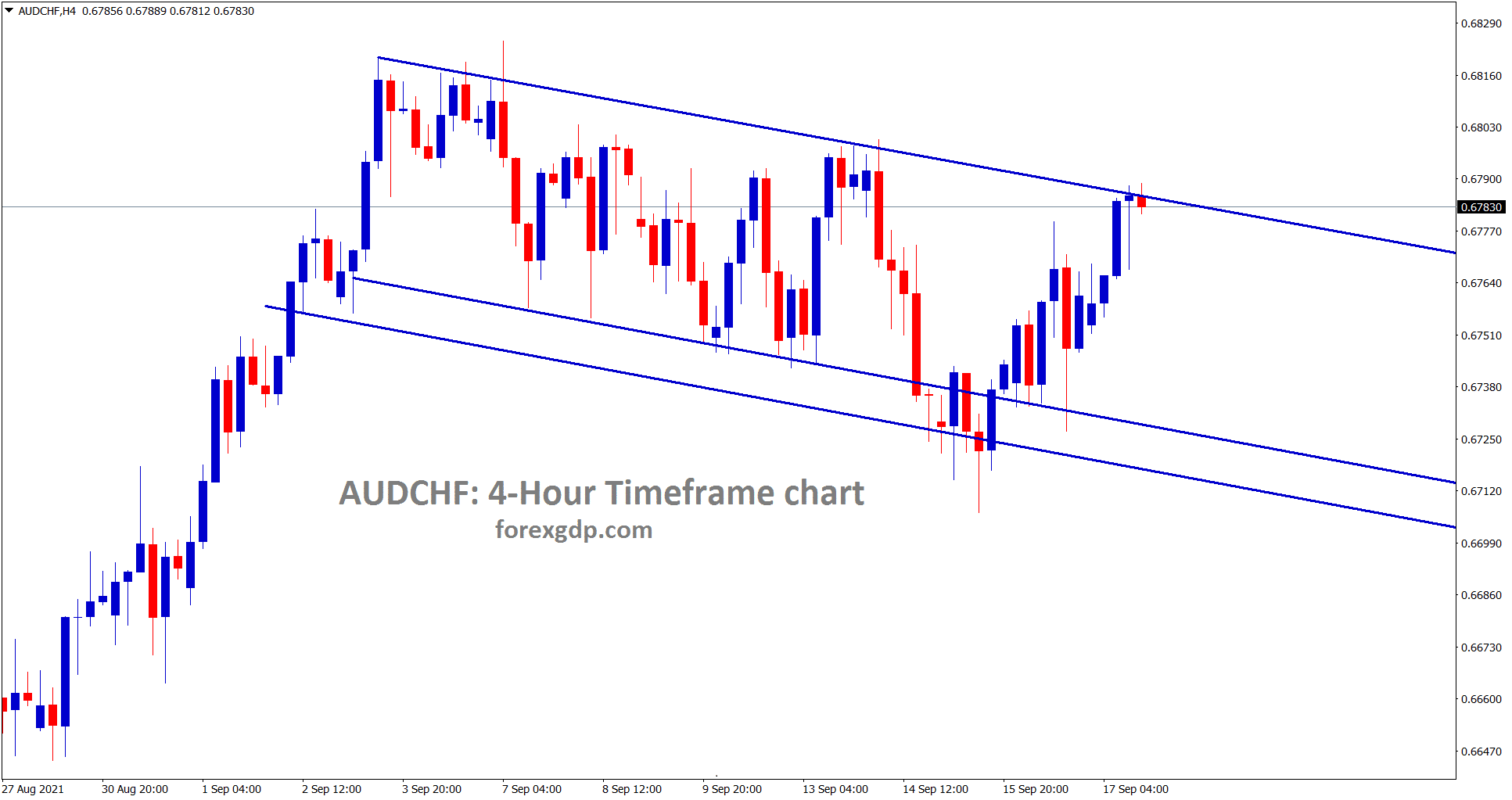

Swiss Franc: US Domestic data shows positive numbers

AUDCHF has reached the top level of the descending channel range.

Swiss Franc made lower after US Retail sales data more robust numbers printed at the table.

But Swiss economy is improved by taking more vaccinations in the Swiss Zone and takes more stimulus to improve the economy.

And FED will soon be tapering assets than SNB Applies for tapering.

Today Michigan consumer sentiment is scheduled on the table, and Positive numbers boosted USDCHF higher and reversed if negative numbers came.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/