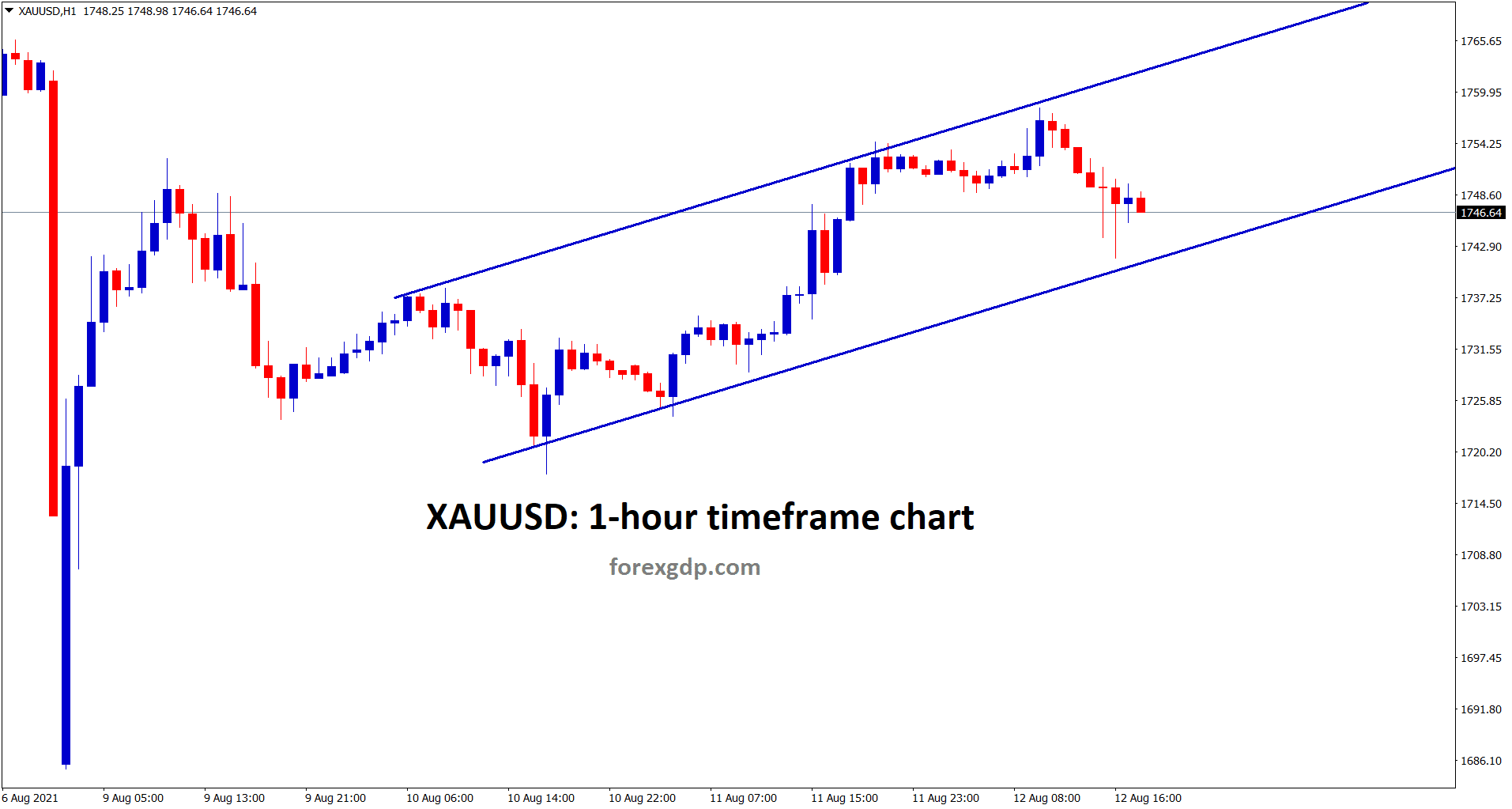

Gold: Fear of inflation around investors

Gold is moving in an uptrend range slowly and it has filled the gap down movement by full retracement.

Gold prices remain higher as Lower high progress inside the channel.

US CPI data missed expectations of higher numbers, and FED members more said on hawkish tone on Monetary policy settings.

China faced a tough situation on delta virus spread and Selling Gold more as money required to the stable back economy in China.

Now Fears of inflation makes Investors pour the funds from US Dollar to Gold.

Now Dollar index faced the profit booking after a 1% gain from the 92 levels.

Not only Gold but also USD counterparts like EUR, GBP and AUD also spiked up last day as 0.50%.

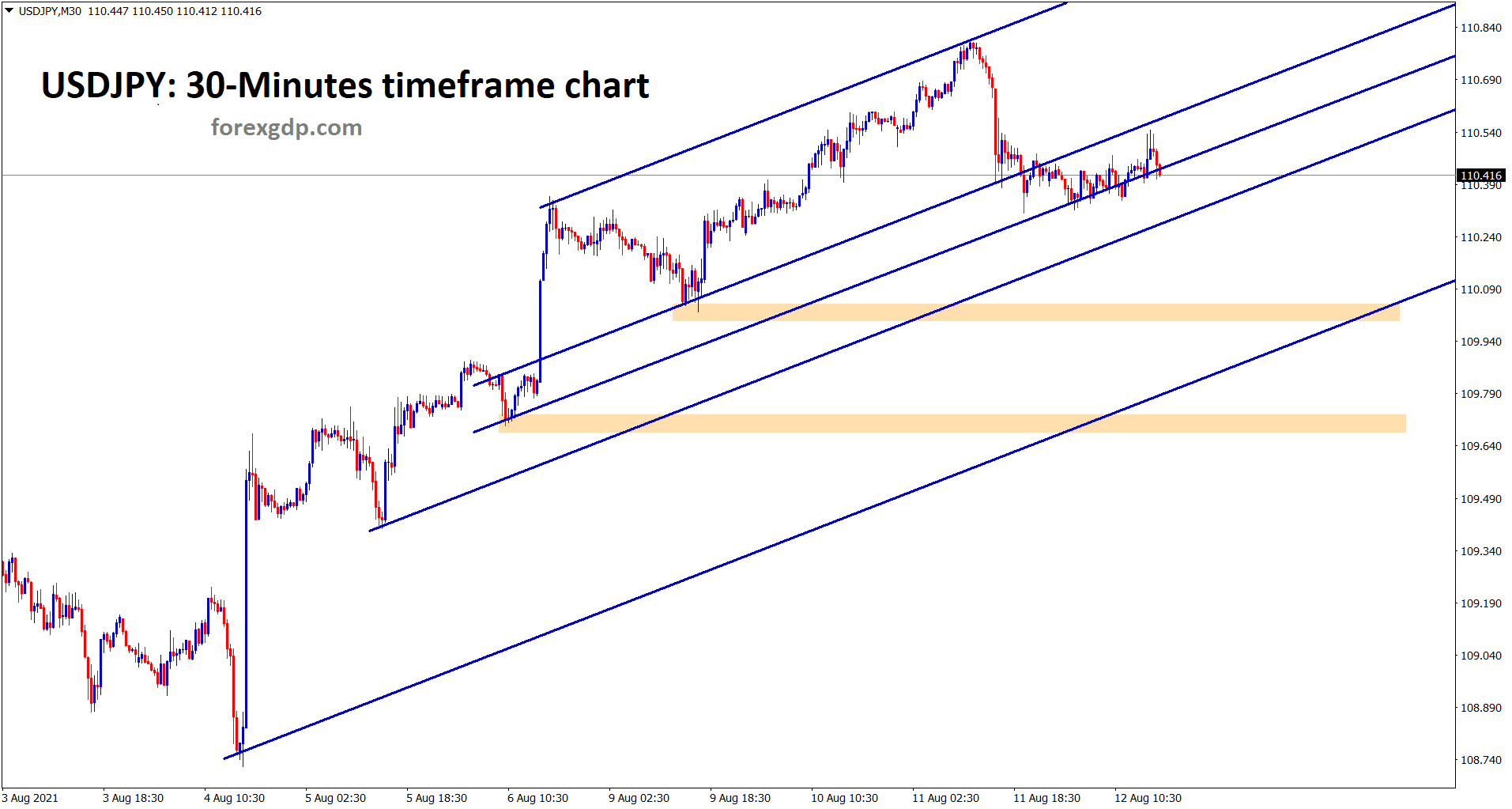

US DOLLAR: US CPI DATA

USDJPY is standing at the higher low zones of an uptrend lines – if it falls it will fall to the highlighted horizontal support areas.

US Dollar slightly lower against Counterparties as US CPI data came in line with expectations. Because of FED may wait to taper if the inflation reading is not higher. This fear makes investors to Dollar sell-off in the Market.

Higher Inflation makes investors enthusiastic as FED will increase rate hikes and Tapering asset purchases soon.

FED Board members also placed a hawkish tone on Policy settings, and Investors pour more funds on US Treasury yields.

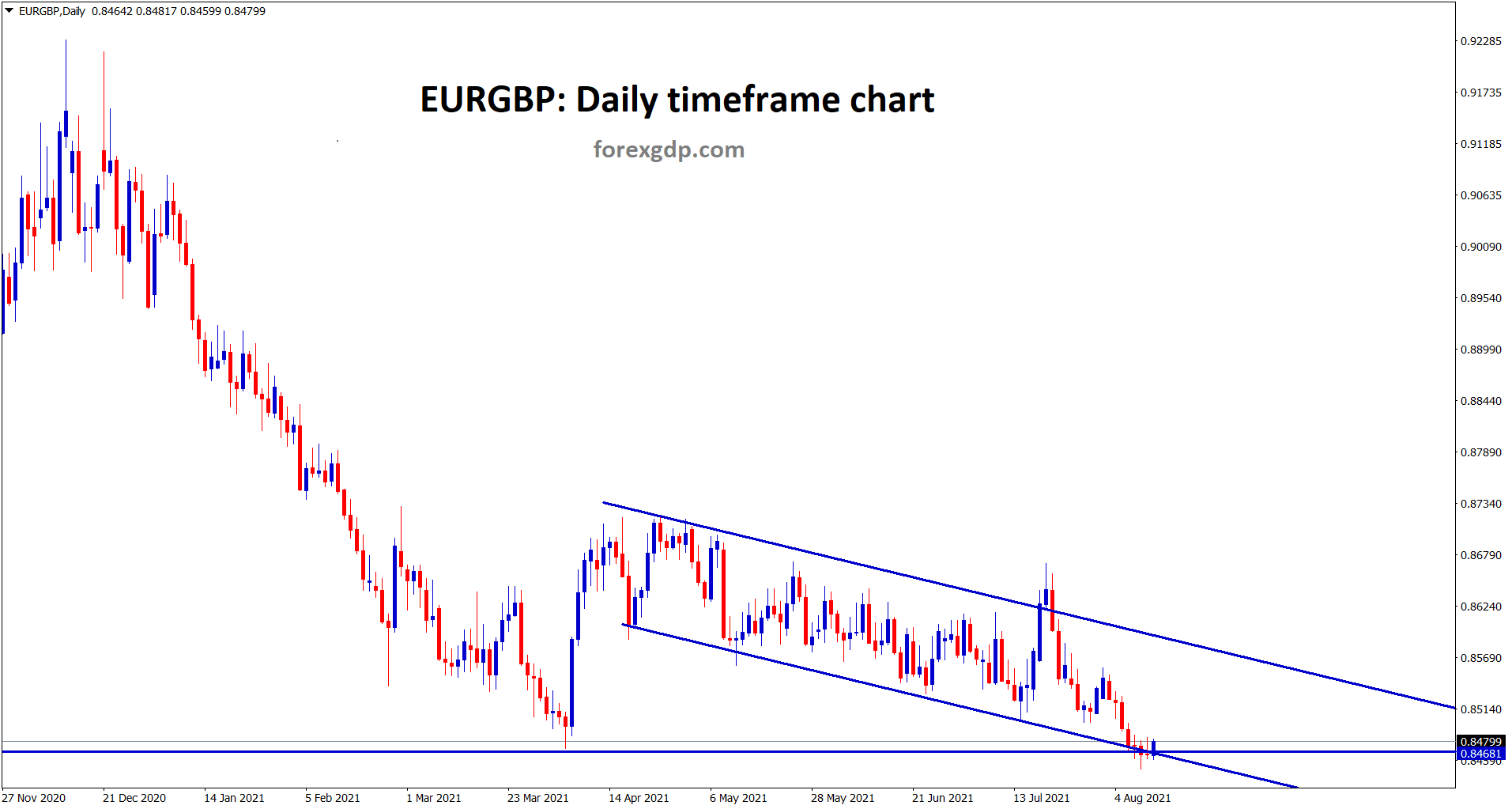

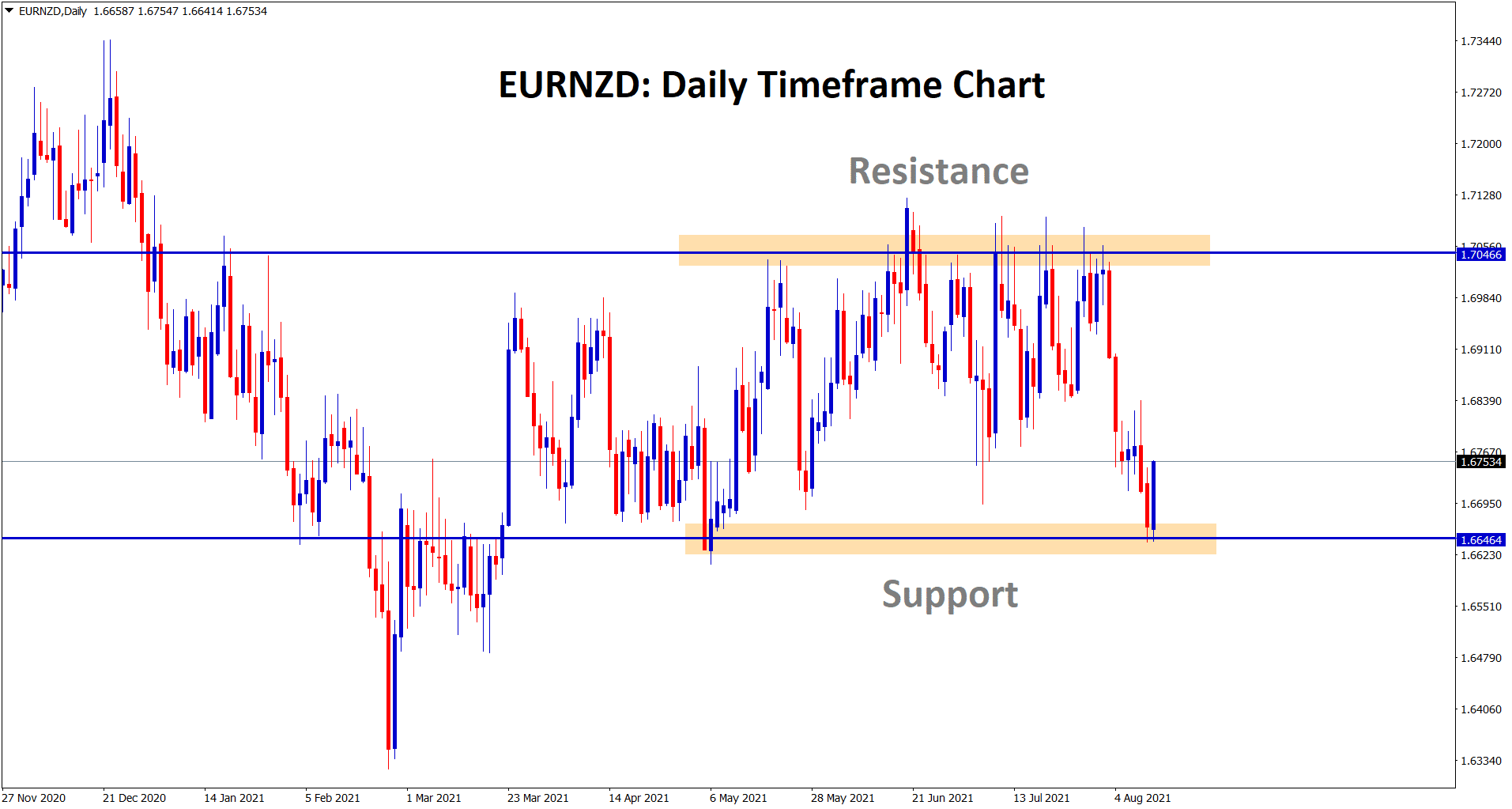

EURO: US PPI and Jobless claims data forecast

EURGBP is standing at the support and lower low level of the descending channel.

EURNZD bounces back harder from the support area today.

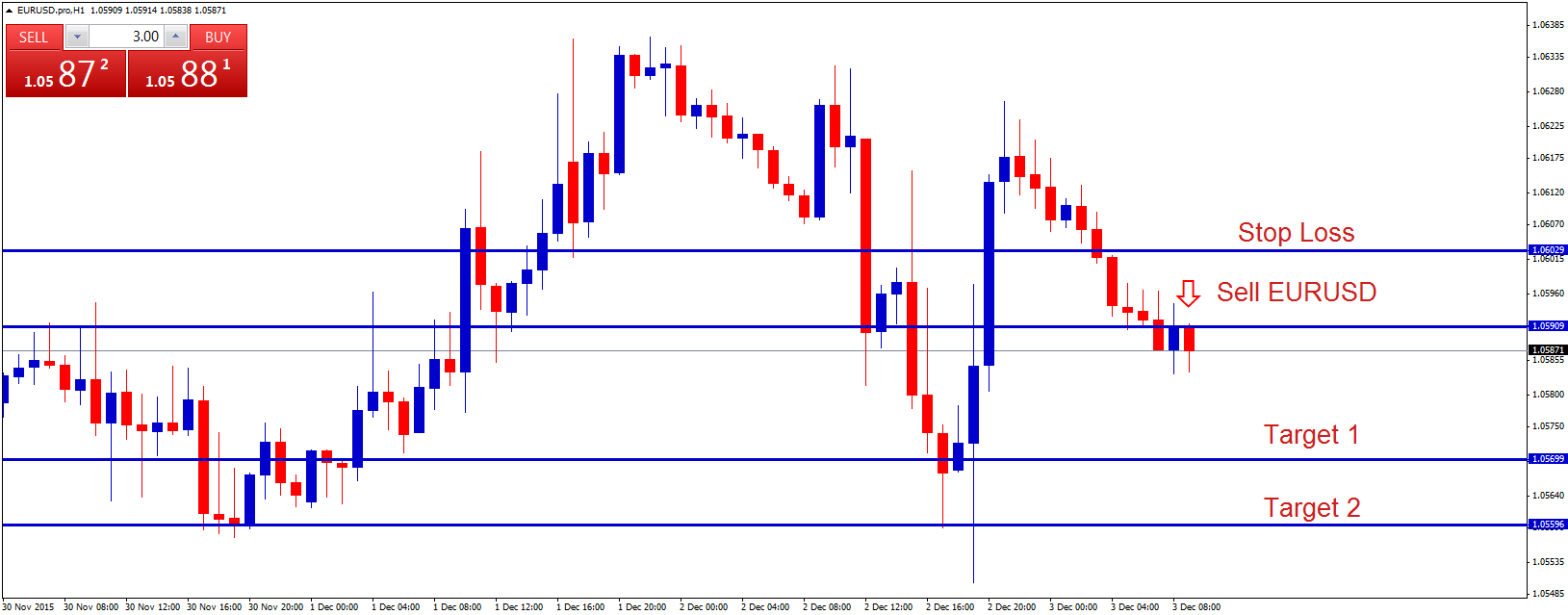

EURUSD makes dead cat bounce back from Support level from 1.17 level.

Now US Dollar shows profit booking in the market from higher to lower, and Counterparties like EURUSD jumped to lower high.

This is a temporary move only, but long-term focus EURUSD keeps lower to 1.15-1.12 level is possible as Monthly support reached previous years.

This week US PPI and jobless claims are waiting for focus, and positive numbers will be positive for US Dollar.

UK POUND: UK GDP Data

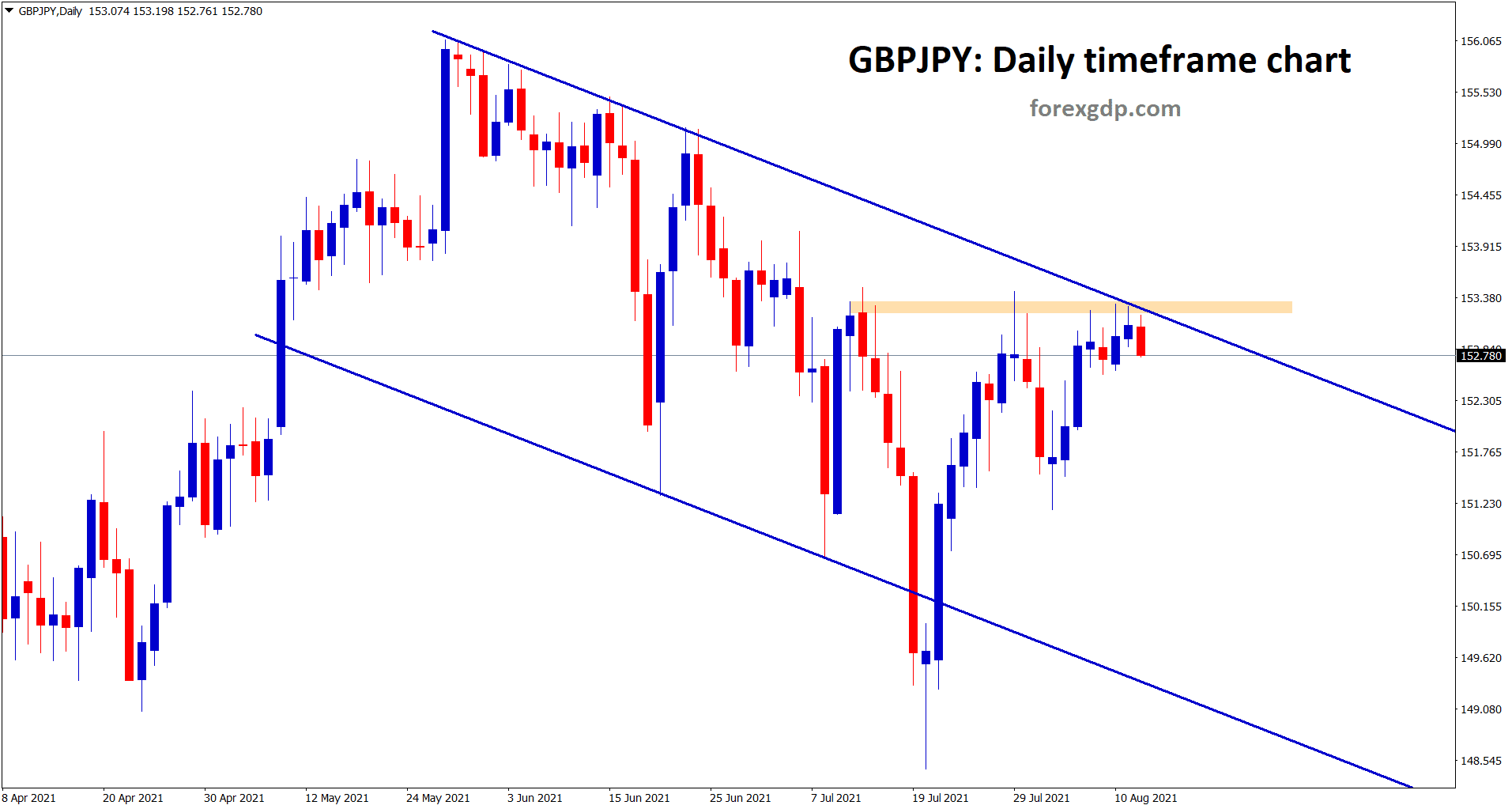

GBPJPY is falling down from the horizontal resistance and lower high zone of the descending downtrend channel in the daily timeframe.

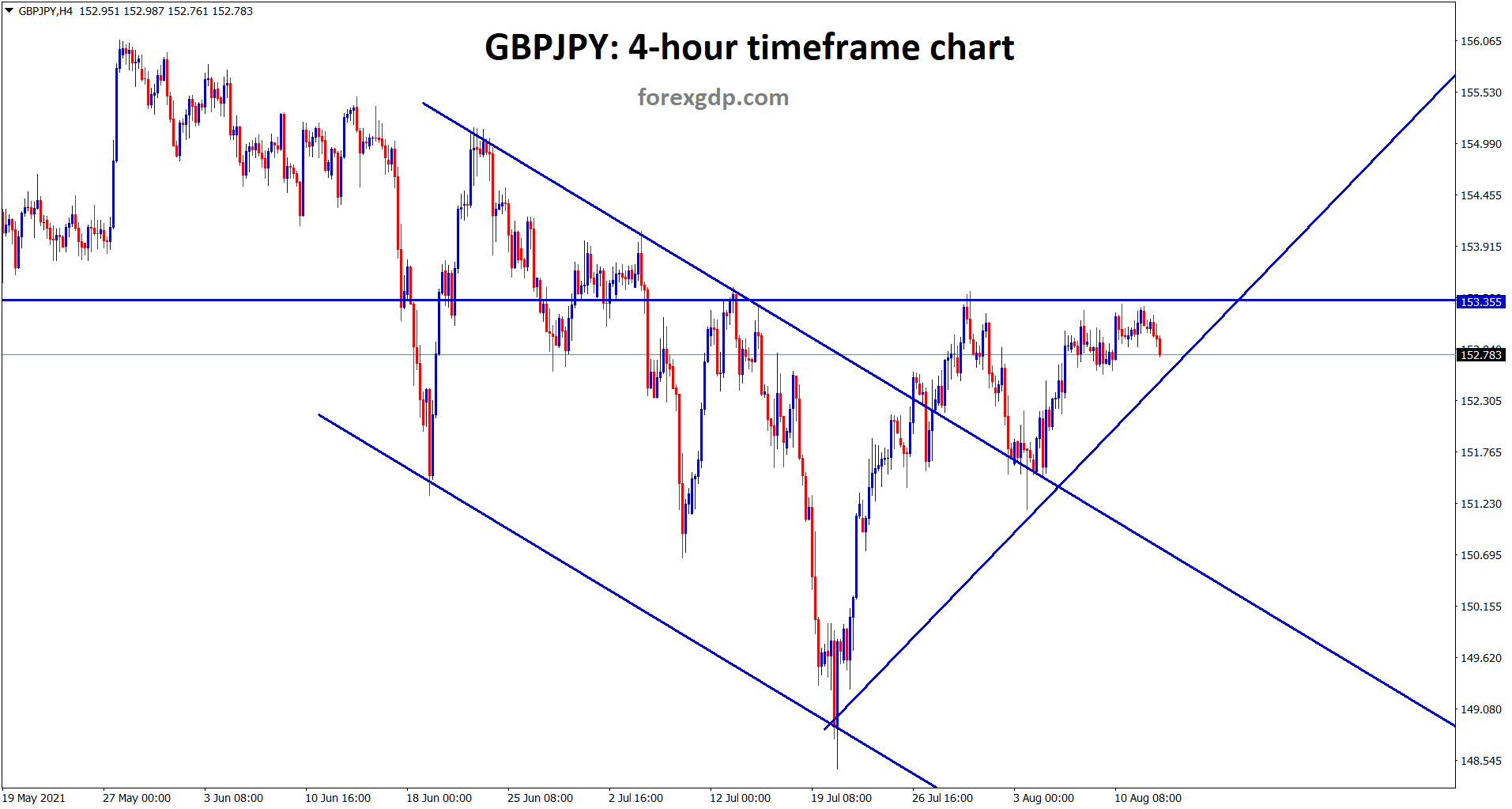

In another view 4-hour timeframe, GBPJPY has formed an ascending triangle pattern recently.

UK GDP data printed at YoY at 15.2% versus 14.9% expected, Q2 GDP data expanded at 22.2% versus -6.1% previous printed.

The UK GDP stronger data produced by Manufacturing and industrial production favoured for GBP numbers to more.

But UK Trade deficit is larger than UK Pound 11.988 billion from UK Pound 9.601 billion. Due to this UK Pound capped gains against US Dollar.

Now investors waiting for the Producer Price index and Jobless claims data of the US.

Canadian Dollar: US Janet Yellen visit to China

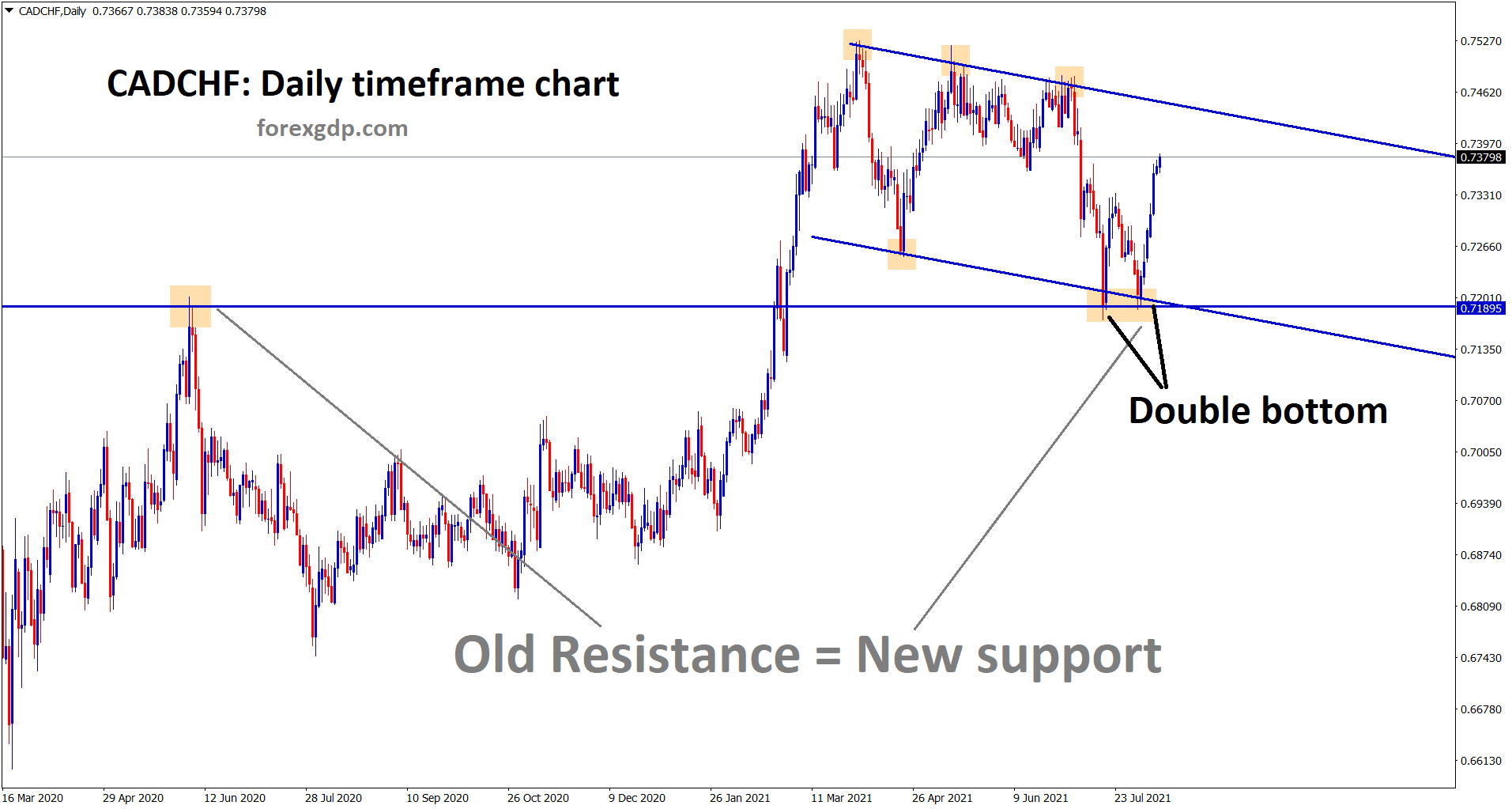

CADCHF is moving up faster after creating a double bottom and retest at the previous resistance area.

Canadian Dollar makes higher after US CPI data makes lower numbers than expected.

US Treasury Janet Yellen visited China this week, and Oil demand now cooled as China facing Delta variant more.

China formed as the Biggest Oil consumer, due to the Lockdown makes Oil demand lower.

Canadian Dollar still supported by US Dollar depreciation in last day.

Now US President Joe Biden gets the approval from Senate to Pass a $1 trillion package of infrastructure spendings.

Japanese Yen: Japan PPI data

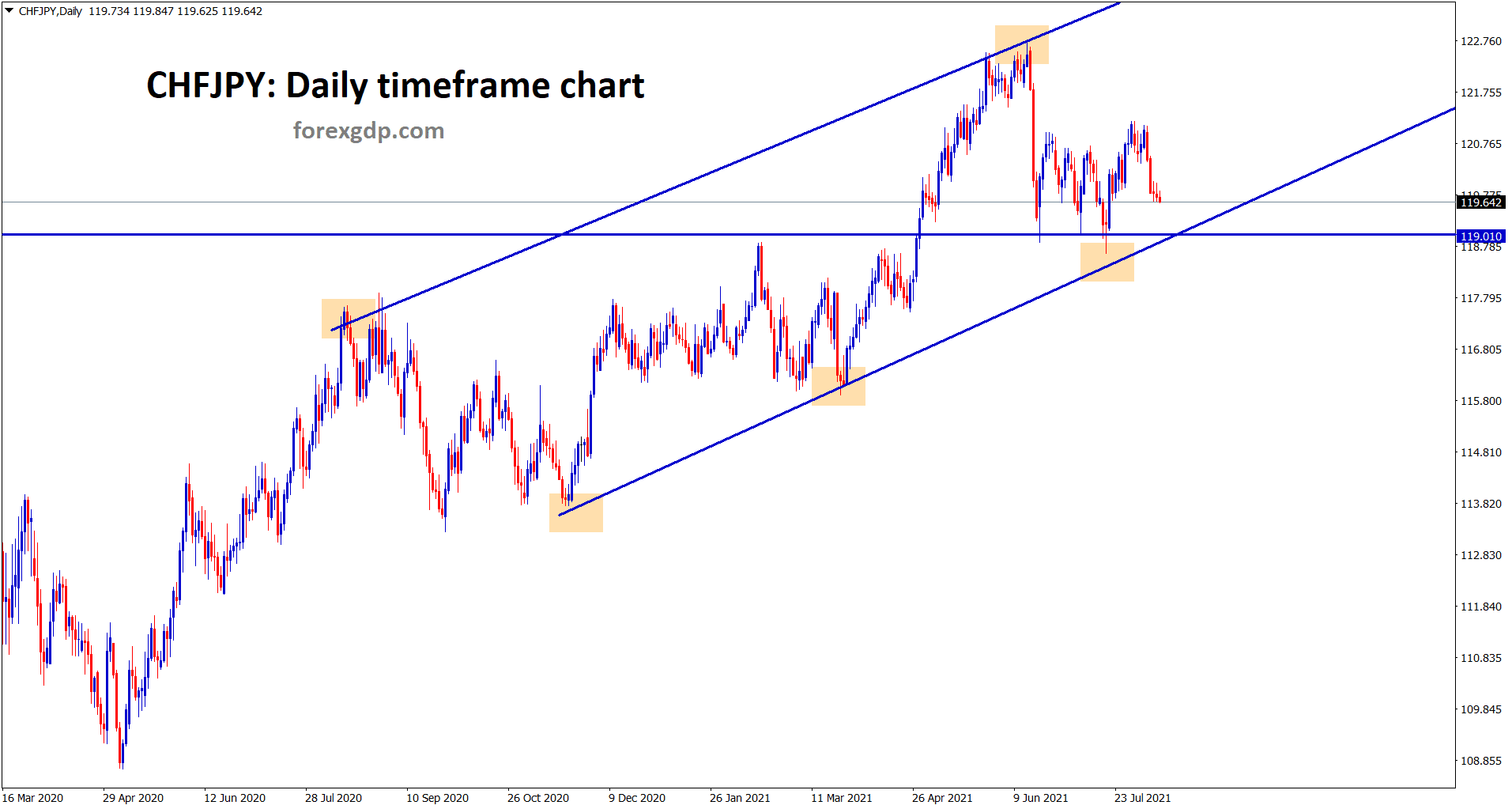

CHFJPY is moving in an ascending channel, however market is now heading to the higher low again for the fourth time.

UK Health minister Sajid Javid’s confirmation that people who vaccinated above 18’s need not self-isolate themselves.

Now US Treasuries people have visited China counterparties to discuss trade plans.

Delta variant makes slower for China GDP, and This meeting may help for better trade agreements.

The UK now faced both Delta variant, and Northern Ireland pressure for Post Brexit deal to Follow properly by Britain.

Japan’s Producer price index jumped to 1.1% on MoM and 5.5 YoY vs 0.5% and 5.0%, respectively.

This shows Raw materials cost higher due to Supply and demand Mismatch. Now inflation started to Higher in Japan if Lockdown reopens; a similar scenario happened in the US, EU and UK countries.

Australian Dollar: Westpac Consumer Confidence data

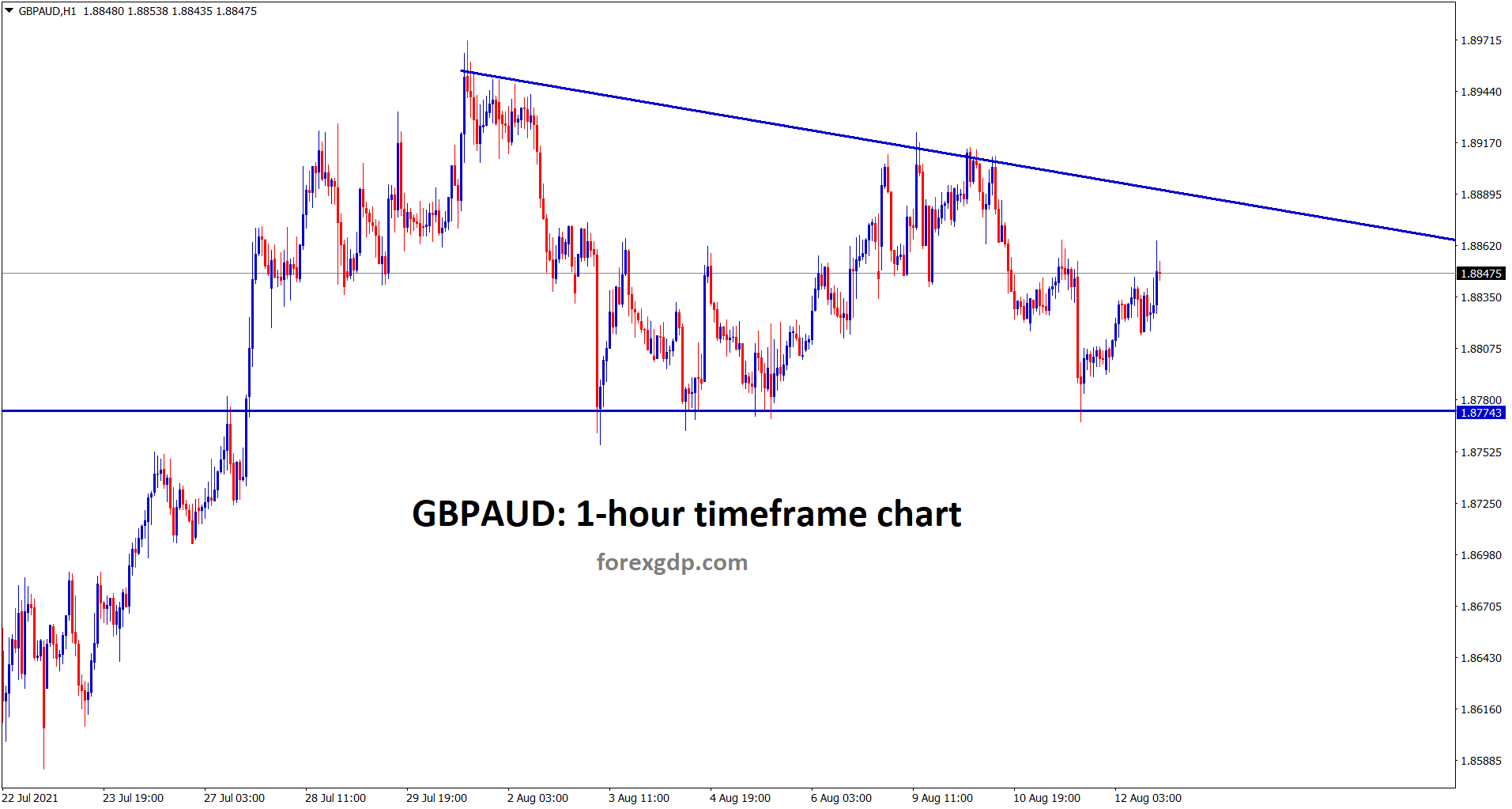

GBPAUD has formed a descending triangle pattern in the hourly chart.

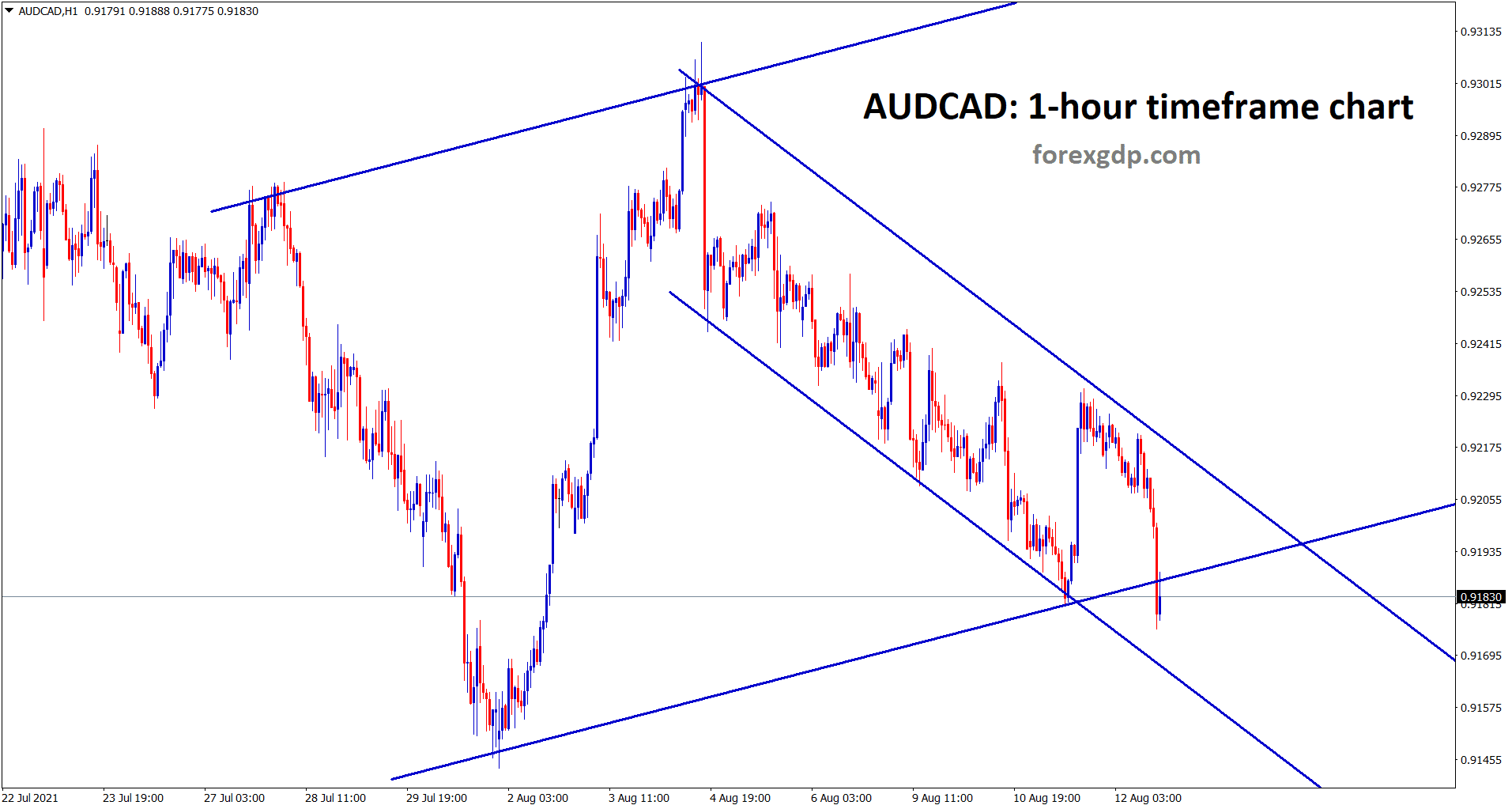

AUDCAD is falling down continously in a descending channel.

Australian Dollar keeps higher after US CPI data showed inline expectations. Australia focusing on controlling of Delta variant by putting a steady lockdown in many areas.

Now Westpac Business confidence data also did not meet expectations and came with 104.1 versus 108.1 expected.

Australia now Jobs and wages growth to focus and Gloomy outlook is expected because nation put more lockdowns in important areas.

Sell off Iron ore by China

A huge supply of Iron ore now goes for sell-off by China to reduce steel production as the economy slowing to Delta variant.

Now huge lumpsum need for China government to recover the economy in a stable mode. Due to this Goal of producing less steel this year to 495mt down to 23% YoY.

The second half of 2021 may produce less output than expected. Rising steel prices impact the many construction buildings and Pending buildings.

Due to higher raw materials, pending home sales will not be sold at the higher value at the current cost.

So Chinese Government takes action against Steel production to cut down to help the real estate business to stable.

New Zealand Dollar: US FED members speech

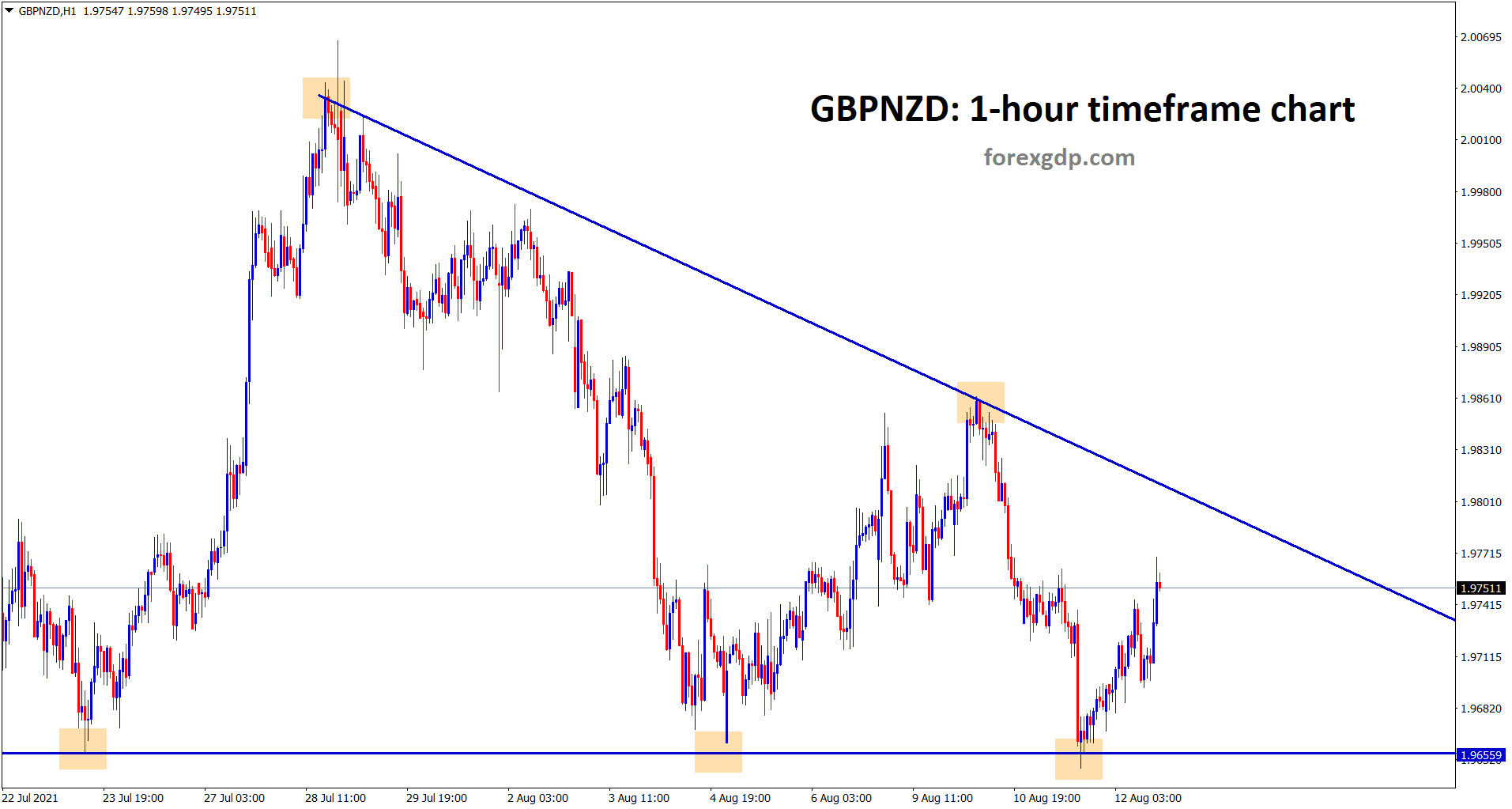

GBPNZD has formed a descending triangle pattern same as GBPAUD in the hourly chart.

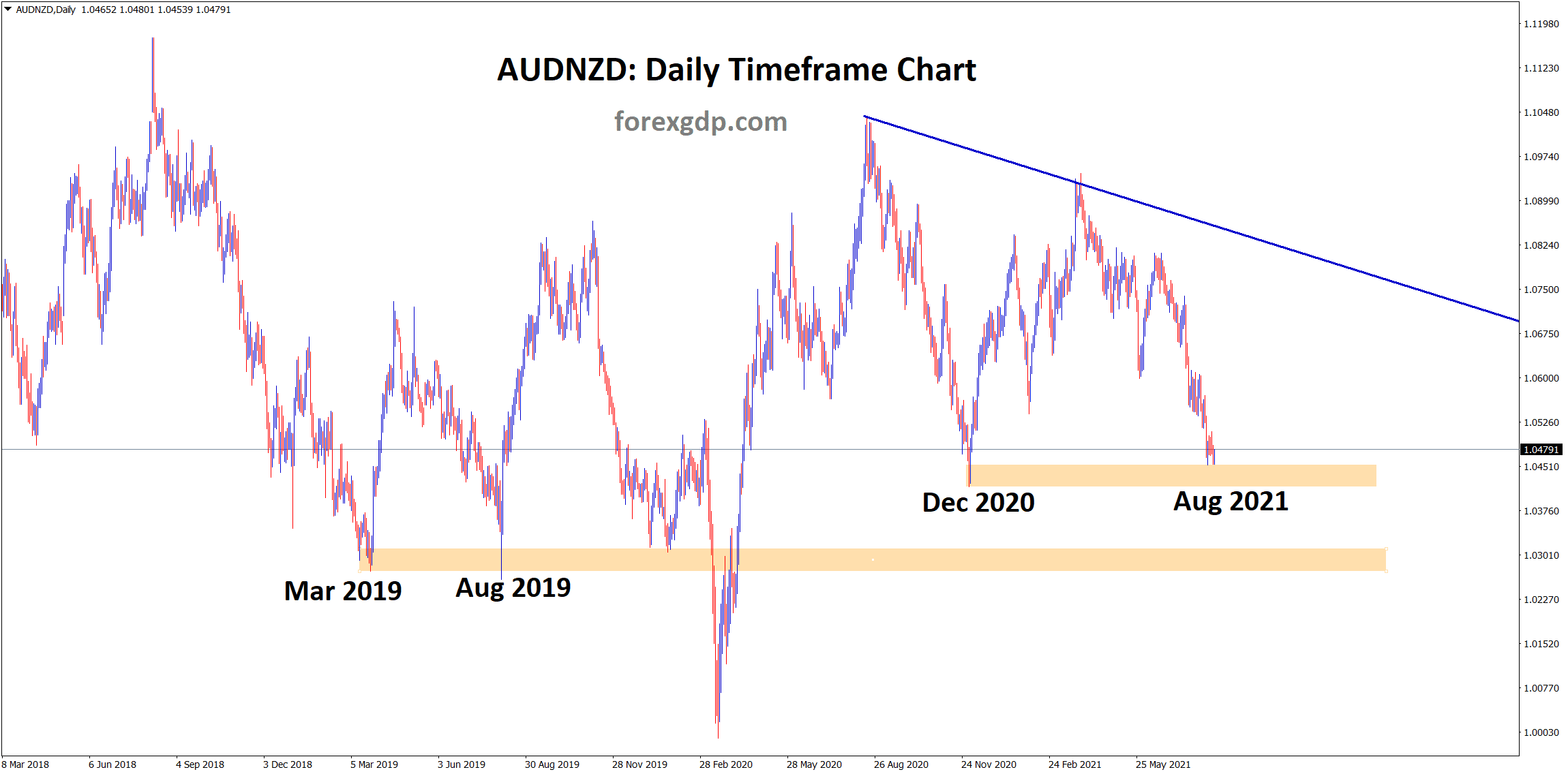

AUDNZD is standing now at the December 2020 support area.

New Zealand Dollar moved higher after US CPI data missed readings of expected numbers.

Kansas City Fed President Esther George said FED might taper the bond-buying program in the September meeting, and Dallas Fed President Tob Kaplan also said bond buying now came to an end by the next meeting of FED.

Considering this scenario, US Dollar will become stronger as FED is Confident in Tapering and Hike interest rates.

New Zealand Dollar keeps ranging market as 0.69-0.71 in the last 2 months.

PM Ardern Speech

New Zealand PM Ardern said Nation is not simply to reopen as Just, But All people should be vaccinated at phase one before September 1.

And Government is concentrating more on the Vaccination process to avoid the Delta variant.

Reopening border planned in Next year and Self-isolation pilot to be tested.

New individual risk set in three ways from Foreigners to New Zealand as Low, Medium and higher risk pathways from Q1 2022.

Trade forex market only at the confirmed trade setups.

Get Each trading signal with Chart Analysis and Reason for buying or selling the trade which helps you to Trade with confidence on your trading account.

Want to increase your profits in trading? Get the best trading signals at an accurate time. Try premium or supreme signals now: forexgdp.com/buy