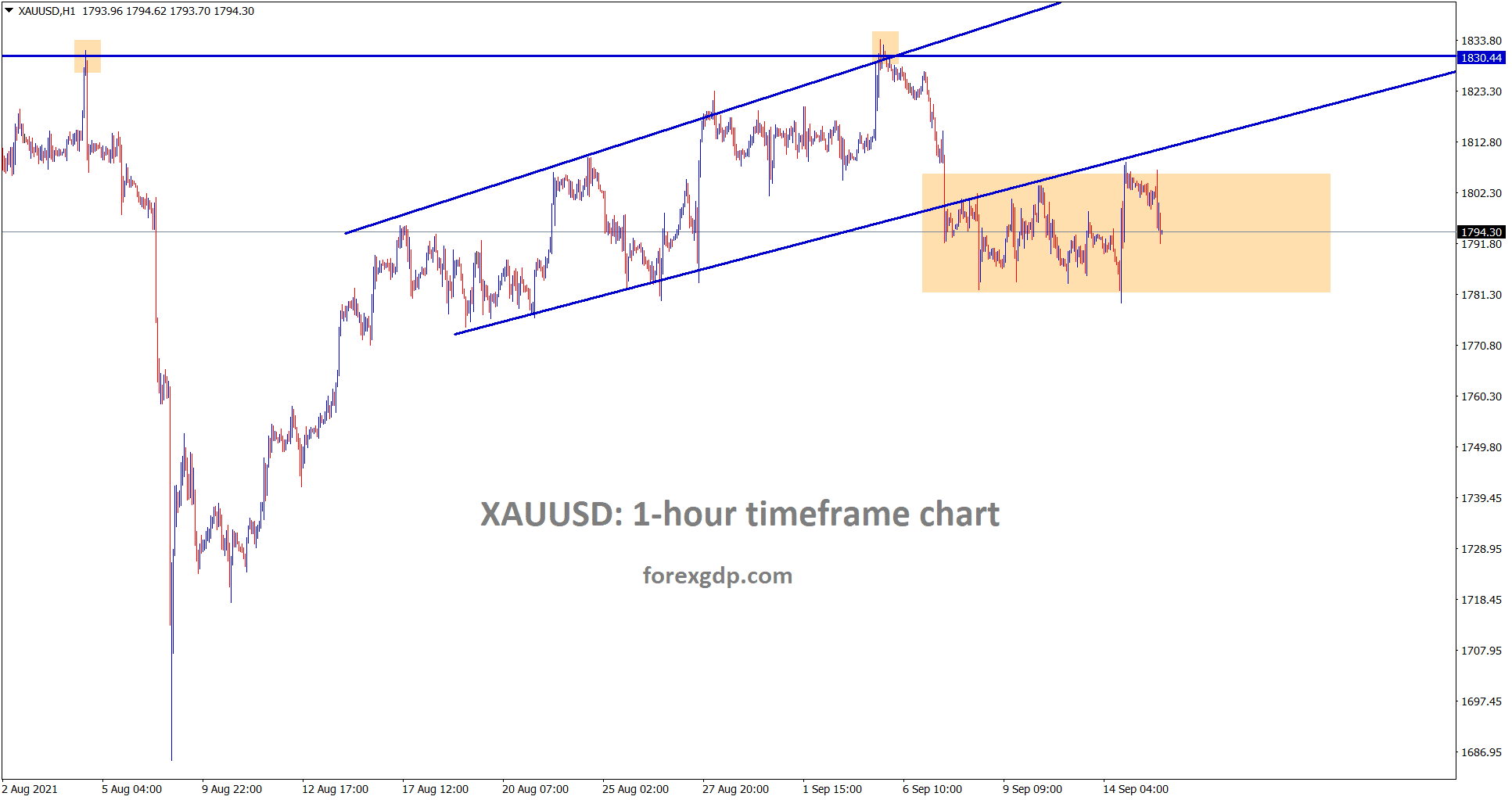

Gold: the US and China Domestic data disappointment

Gold price is still consolidating between the support resistance area.

Gold prices are moved single jump to 28$ last day after US Inflation data shows sharp lower than expected if lower inflation data is printed, then FED Cools for rates and tapering. Only when hot inflation rates survive FED may tapering, and hike rates will be expected.

Chinese Macro data shows disappointing numbers, and two big economies US and China faces tough pressure to come back from pandemic results in support for Gold.

Once Two nations recover, gold prices will befall, but in the current scenario, Gold is expected to 1833$ again this week.

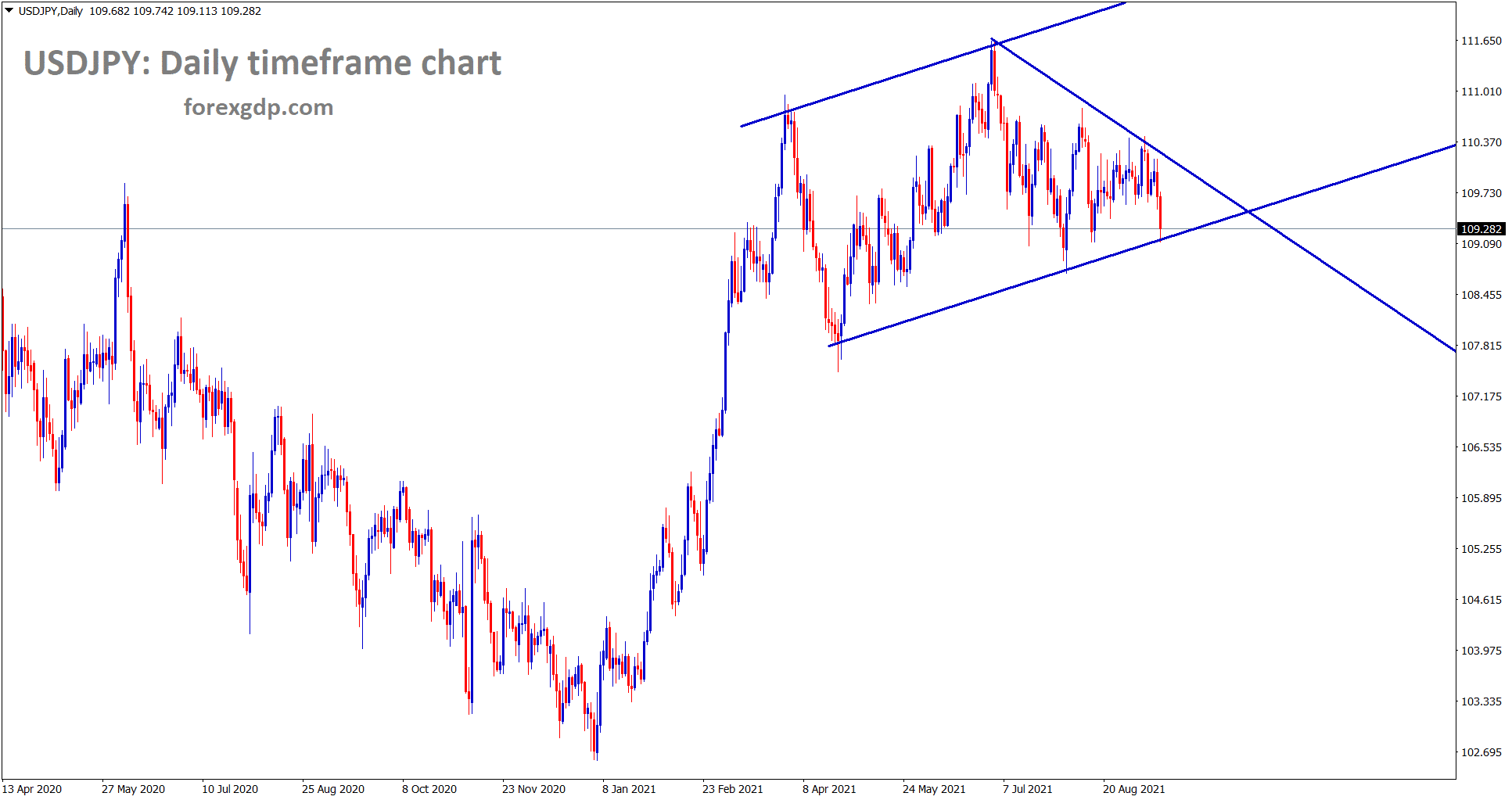

US DOLLAR: US Inflation Data

USDJPY is standing at the higher low level of a channel range.

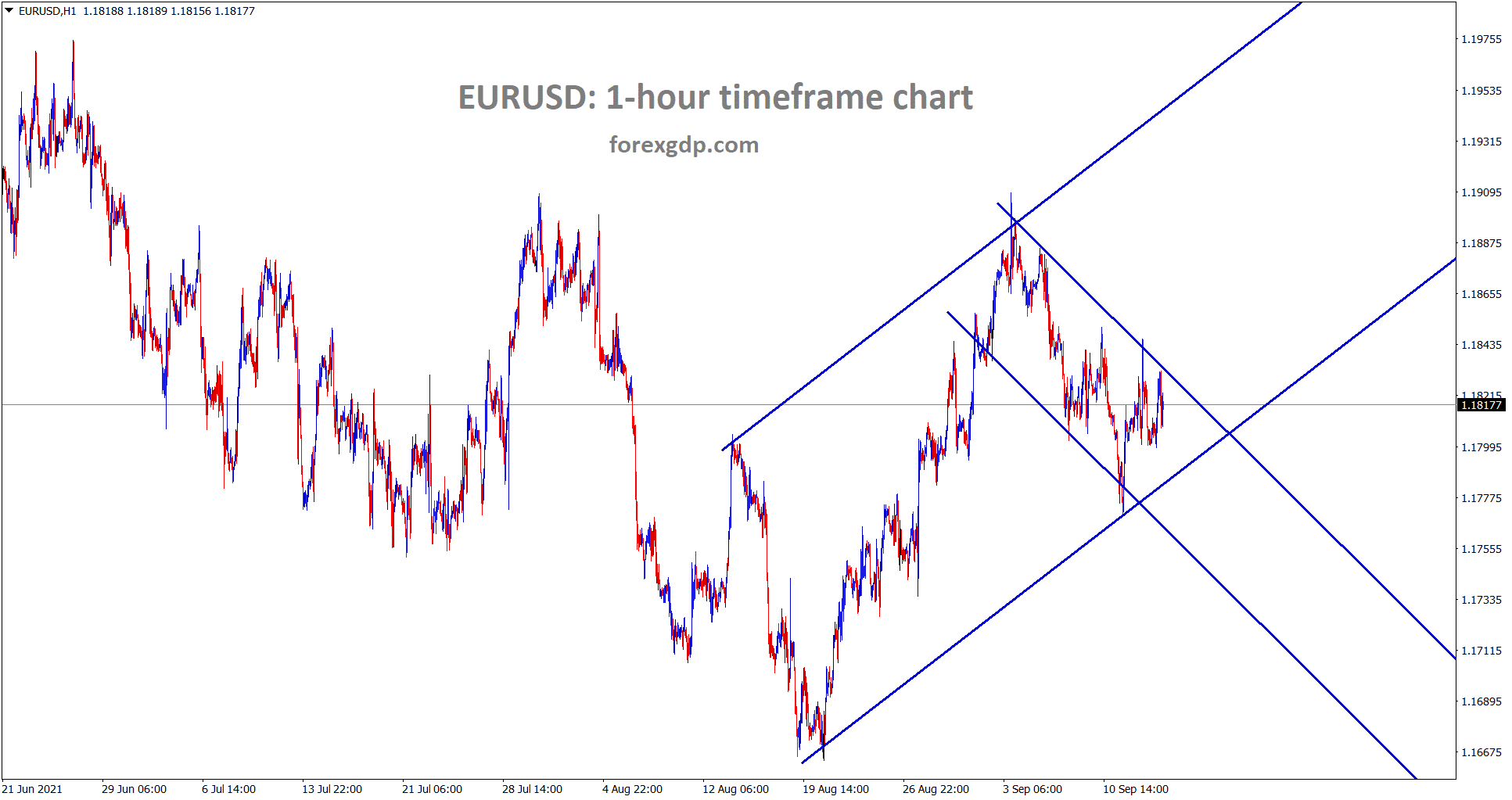

EURUSD is moving between the channel ranges.

US CPI inflation data shows 5.3% lower than 5.4% previous data, as lesser inflation prices cause FED to hike rates later and tapering securities is possible by the end of the year.

But Employment data is the main thing for FED to achieve the line goal if inflation numbers keep higher, but the outlook is temporary.

And inflation numbers will be adjusted at the start of 2022, but tapering will be done by the end of 2021 as FED members keep confident.

EURO: Euro Industrial production data

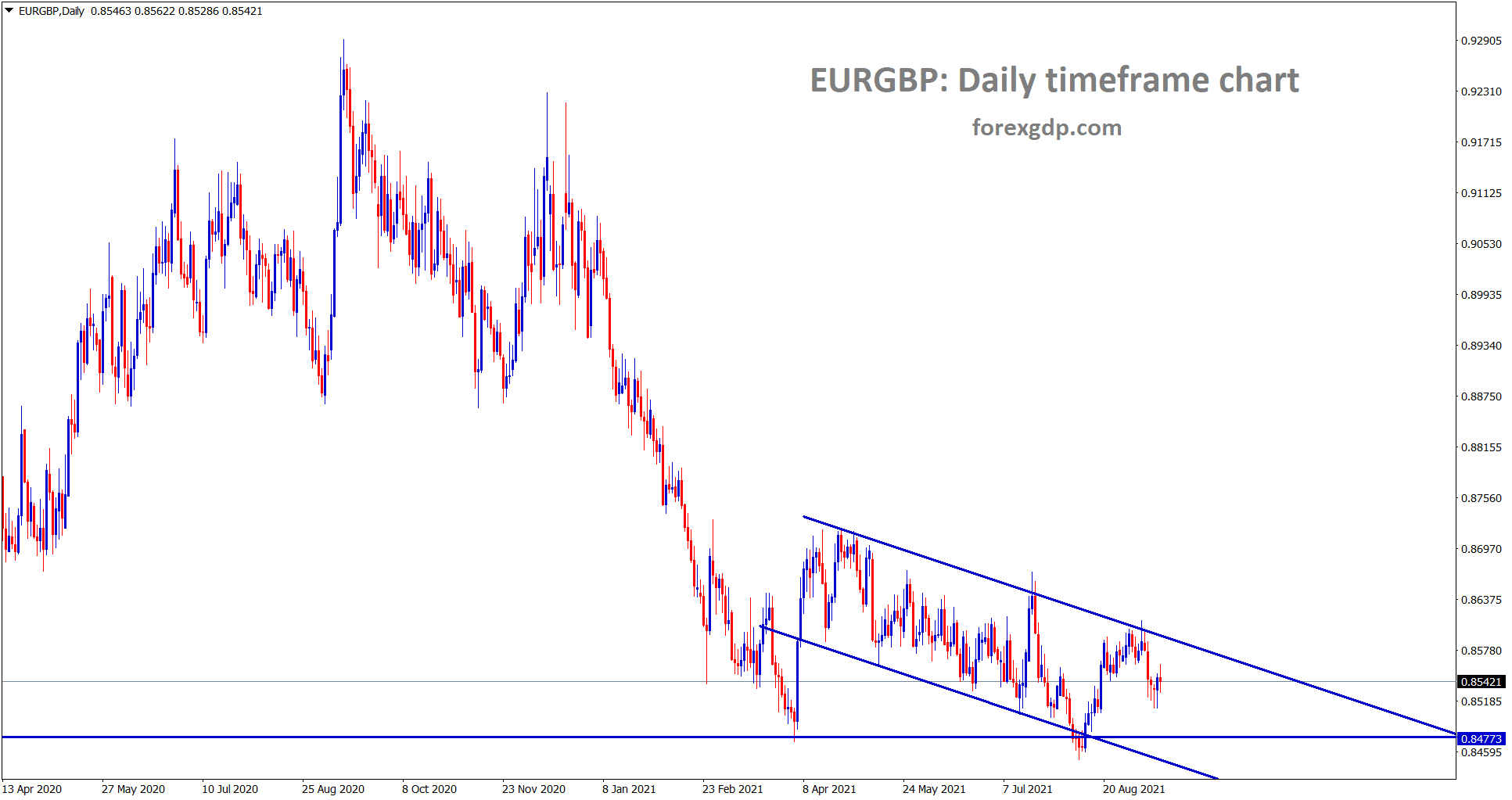

EURGBP is moving between the channel range.

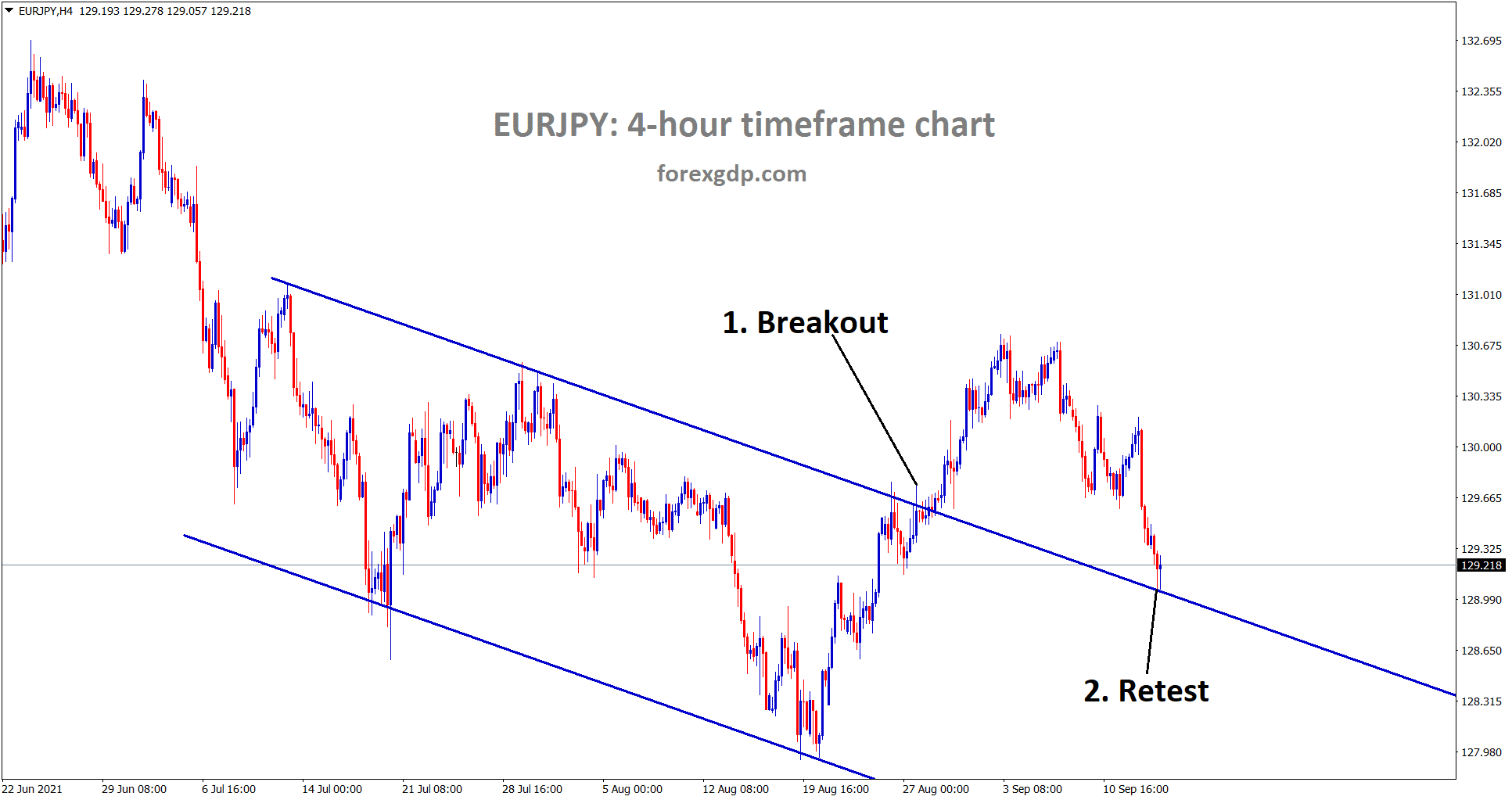

EURJPY is standing at the retest area of the broken descending channel.

Eurozone Industrial production printed at higher numbers like 1.5% versus 0.60% anticipated.

On an Annualized basis, industrial productions rose to 7.7%, surpassing expected readings and the previous month’s revised reading of 10.1%.

As the Eurozone lockdown decreased much more and opened more business, due to this scenario, people consumed more products; as a result of industrial production increased.

And US CPI Data cool numbers show FED Hopes of tapering in Doubtful, only when Hot inflation data posted, then FED will quickly do tapering and hikes rates to cool.

Anyhow EURUSD moved higher as 0.20% after CPI data was printed.

ECB Member Speech

European central bank Governing Council member Pablo Hernandez De cos commented that Current inflation in Eurozone was temporary and soon gets cool off if Economy growth is steadied.

And ECB is Closely monitoring the inflation rates and don’t see the second round of inflation rate higher.

If a Continuous rise in inflation persists then, ECB will Do proper tools to handle inflation.

The speech gives hopes for Euro investors a little bit, and EURUSD rose by 0.20%.

And Eurozone now recovers slowly from Industrial production and all other areas.

By considering the above scenario Wait and See approach is following by ECB.

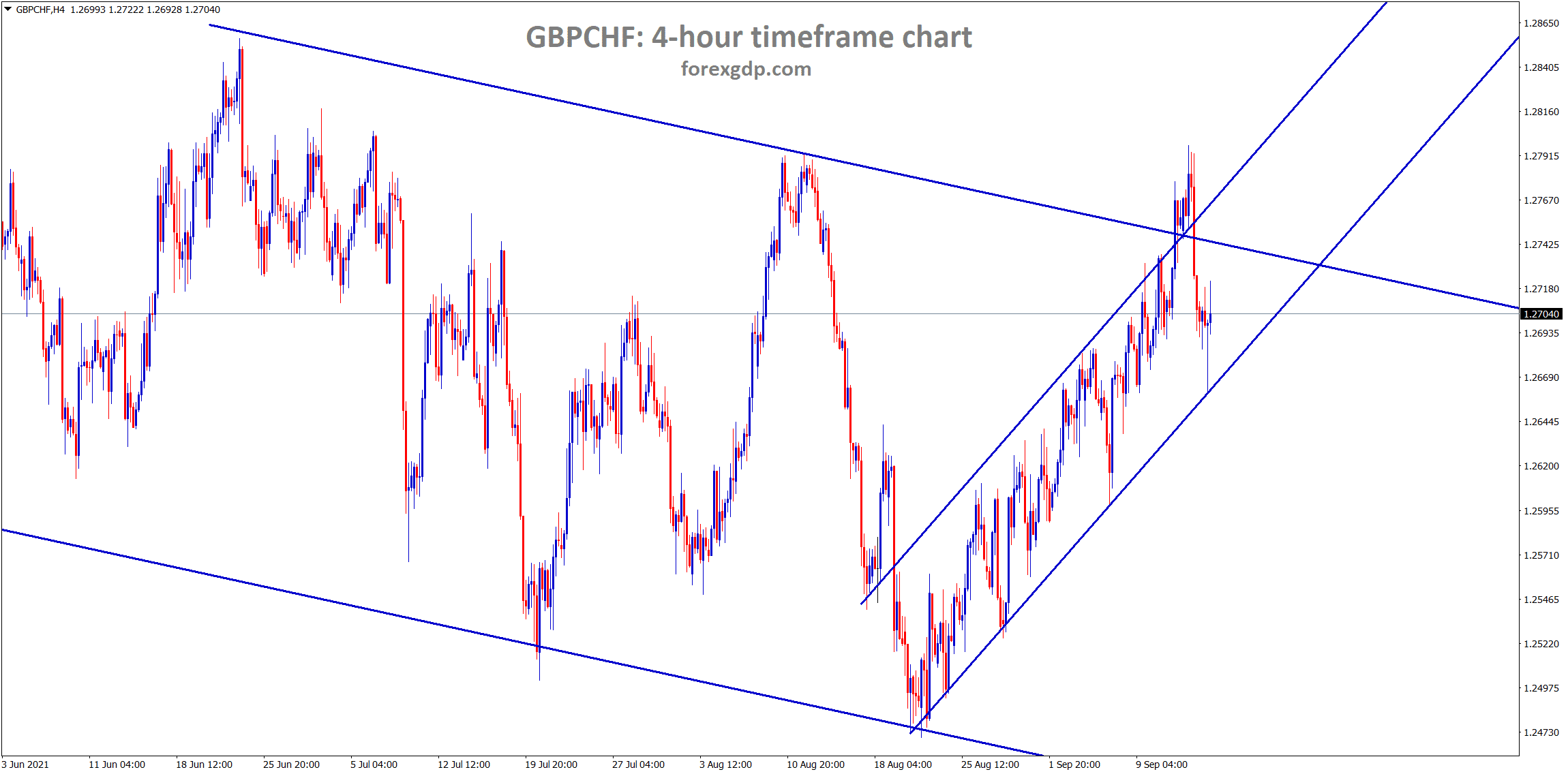

UK Pound: UK Inflation data

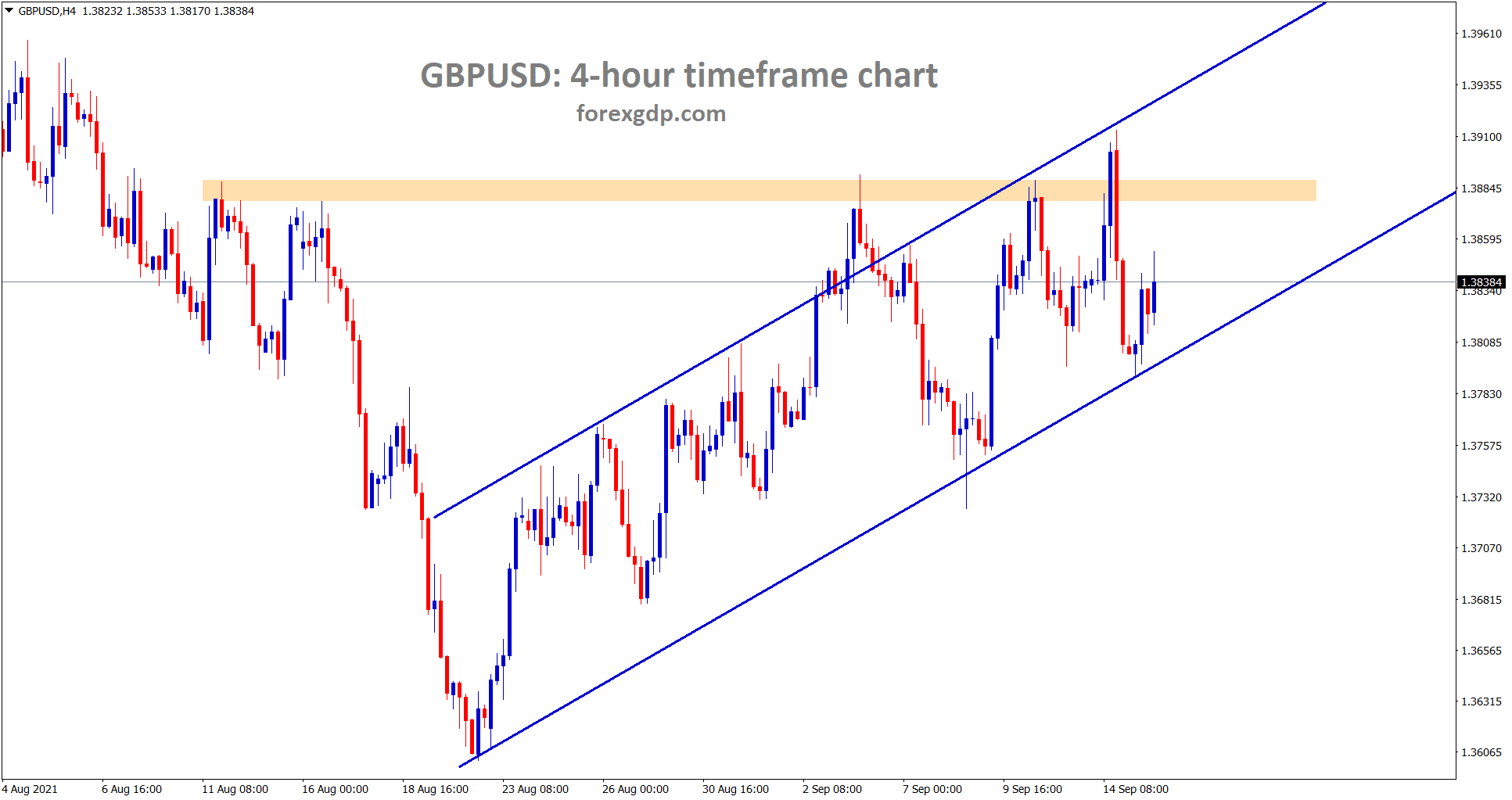

GBPUSD is moving in an Ascending channel range.

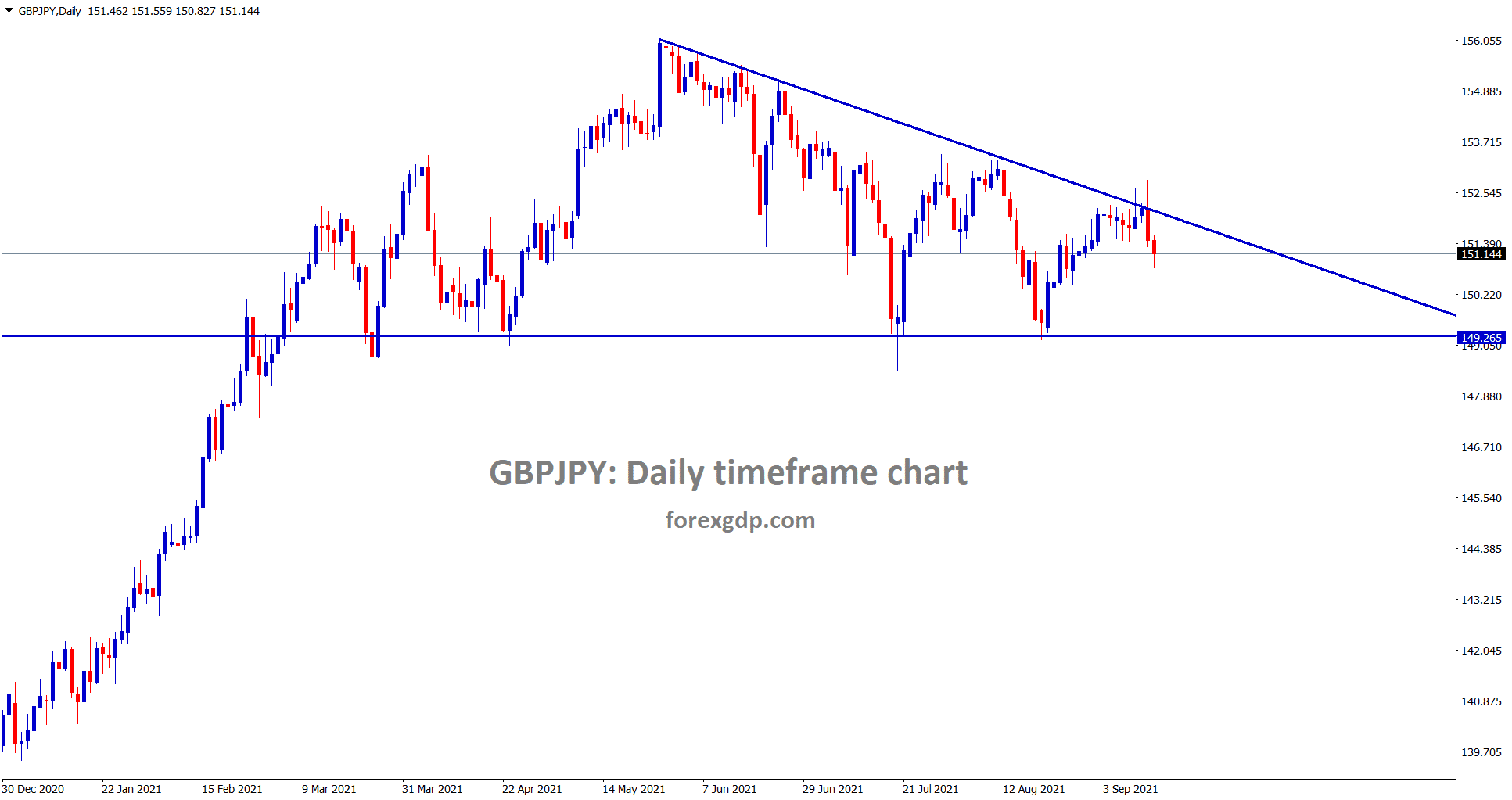

GBPJPY is falling from the top = looks like Descending Triangle pattern.

GBPUSD makes higher as Inflation data shows higher reading printed at 3.2% year on Year basis versus 2.9% expected and higher than 2% Previous reading.

And This week, Employment numbers showed 183K, and the Inflation rate also posted higher. Both numbers are seen to reach the Goals of the Bank of England.

By considering these, we can expect the Bank of England may strike for tapering and Hike rates in the upcoming meeting.

And waiting for Friday retail sales data to print at 2.7% increase year /Year August is expected.

Now Overall picture shows England Domestic data weighted numbers will help BoE to step up for Hike rates.

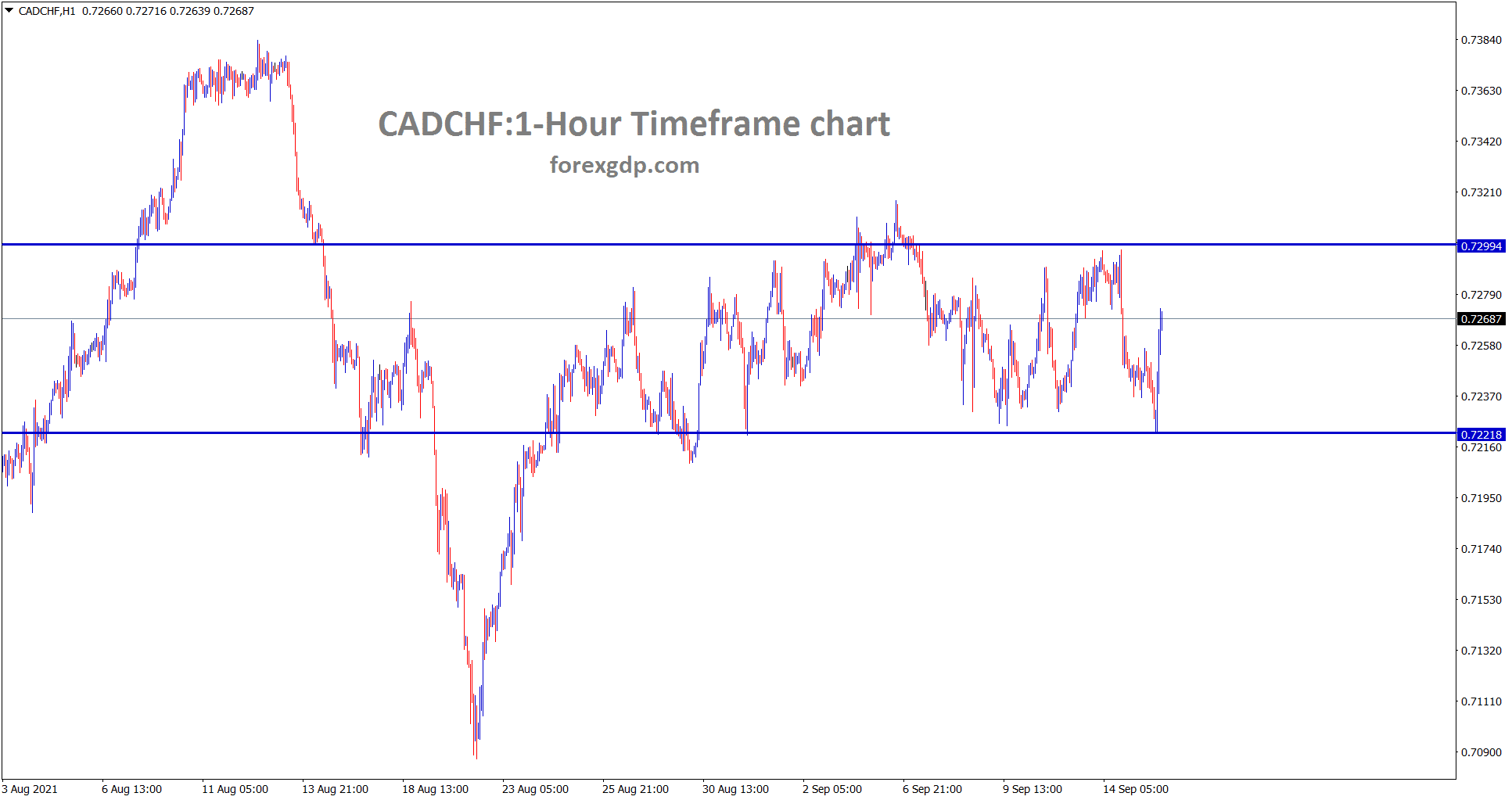

Canadian Dollar: Oil Prices higher

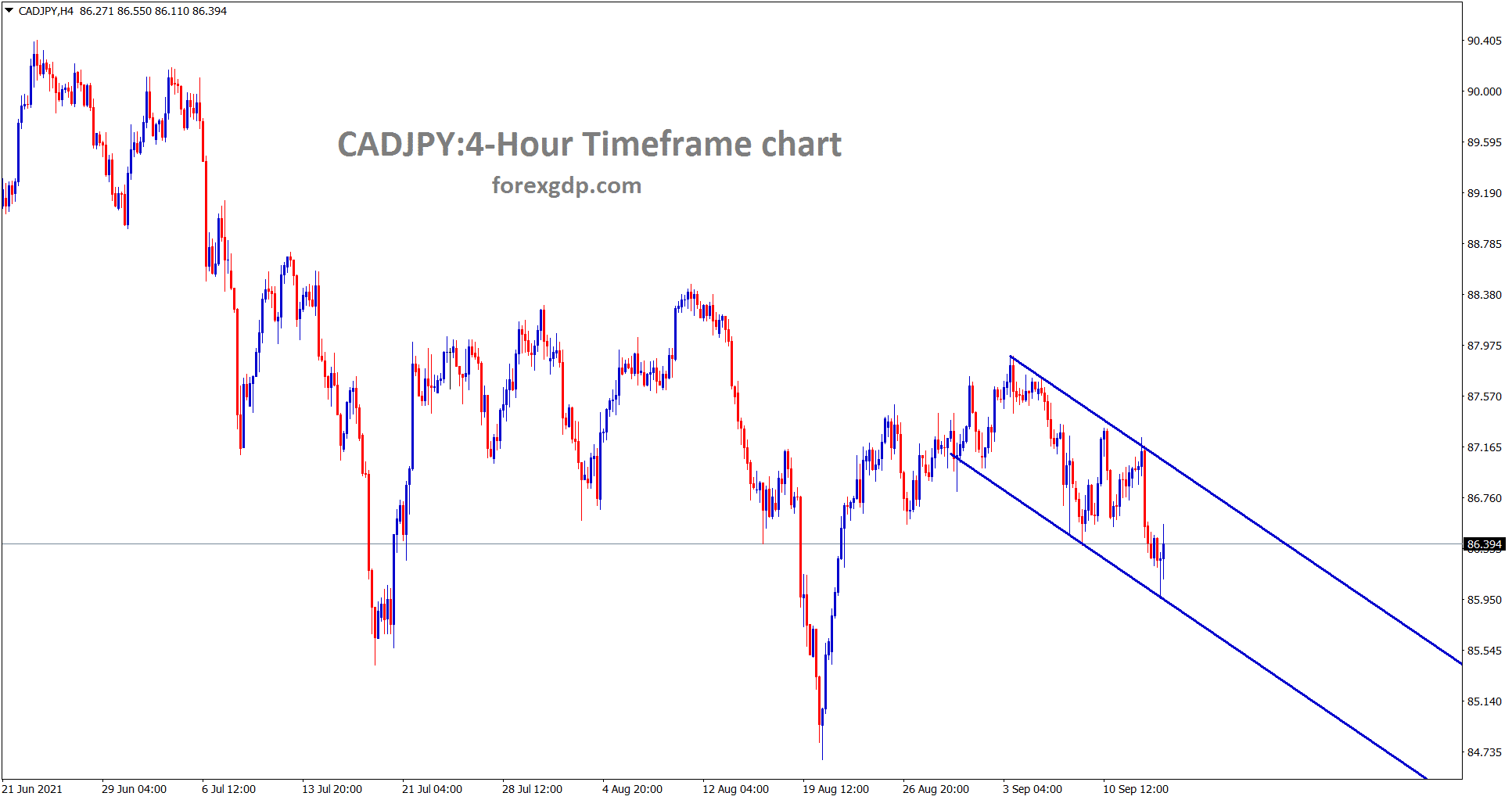

CADJPY bouncing back from the lower low level of a descending channel.

CADCHF is ranging between the support resistance area.

Canadian Dollar shows a weaker outlook in the market as Canadian Elections ahead of September 20th.

And Oil prices are slightly higher from lower as Demand increases from slower growth.

But the global level of Developed countries completed the First dose nearly 30-40%, which will help the Oil prices further this month.

And No tapering in the current meeting disappointed the Canadian Dollar to support.

Due to this, USDCAD rose higher, and CADJPY Fell lower by 0.20% after US CPI data came at lower numbers.

And Oil-producing nations are agreed to increase the output of Oil Production makes the Canadian Dollar a weaker phase.

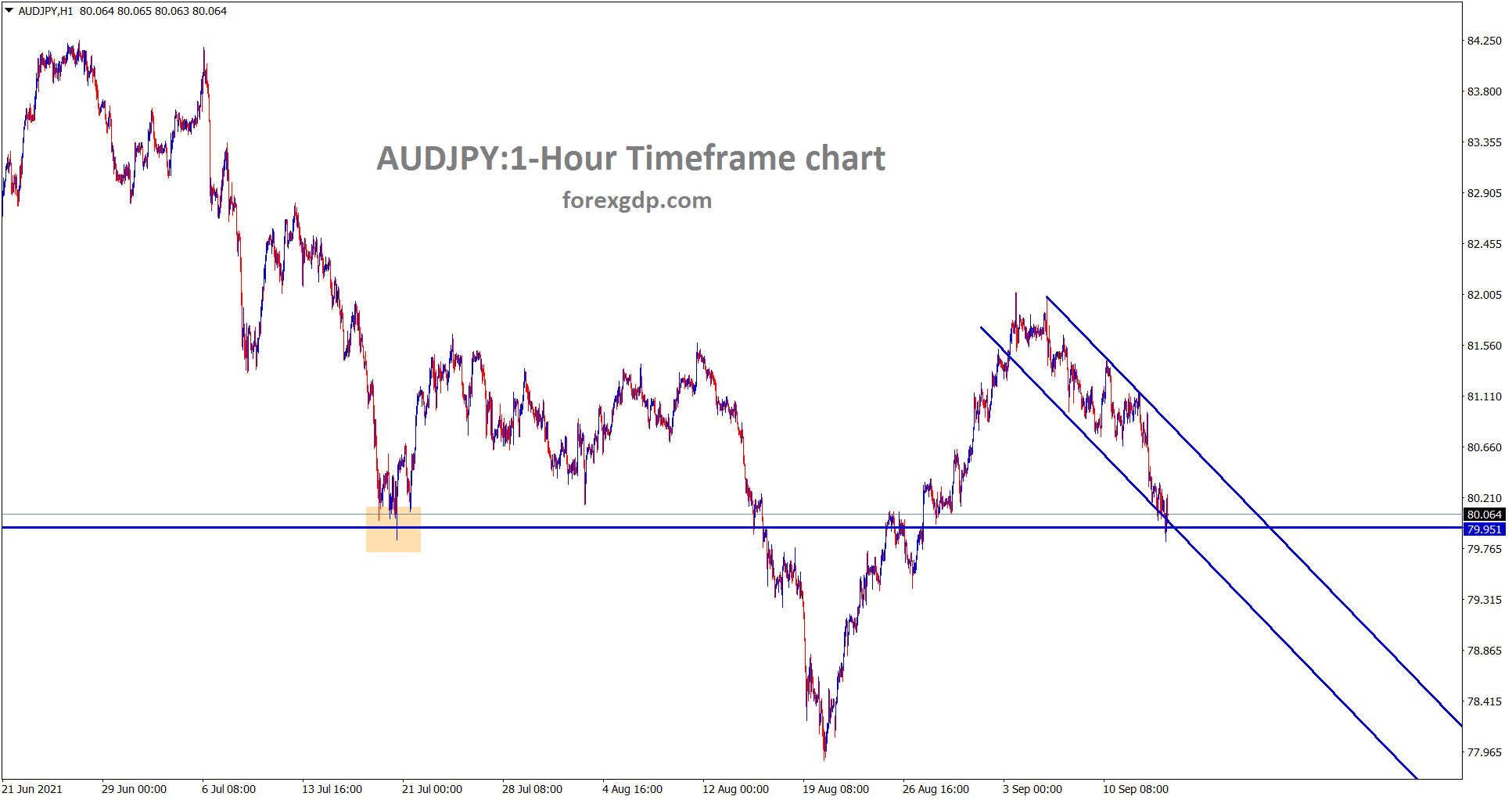

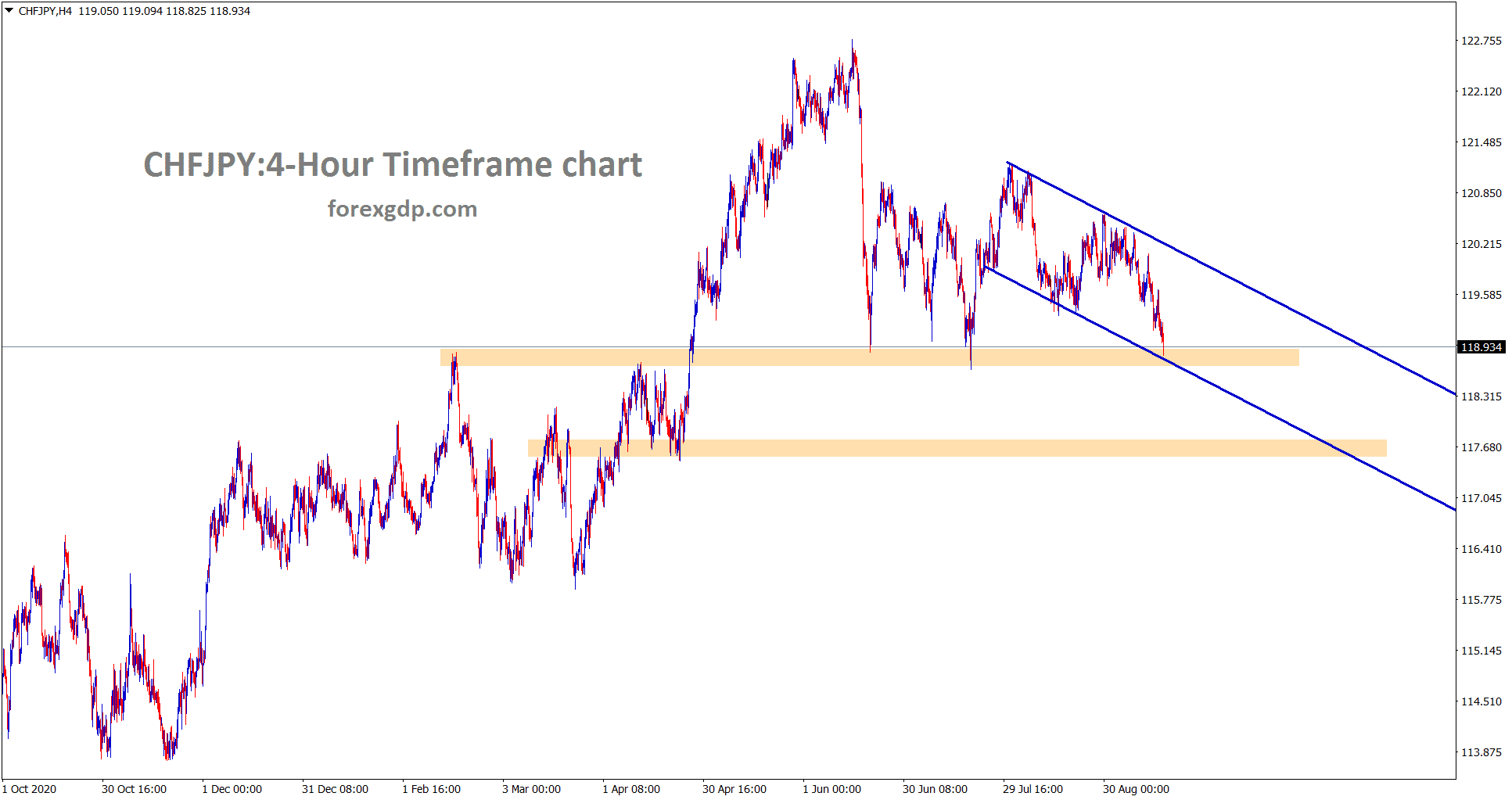

Japanese Yen: Yen Stronger role as US Domestic data slows

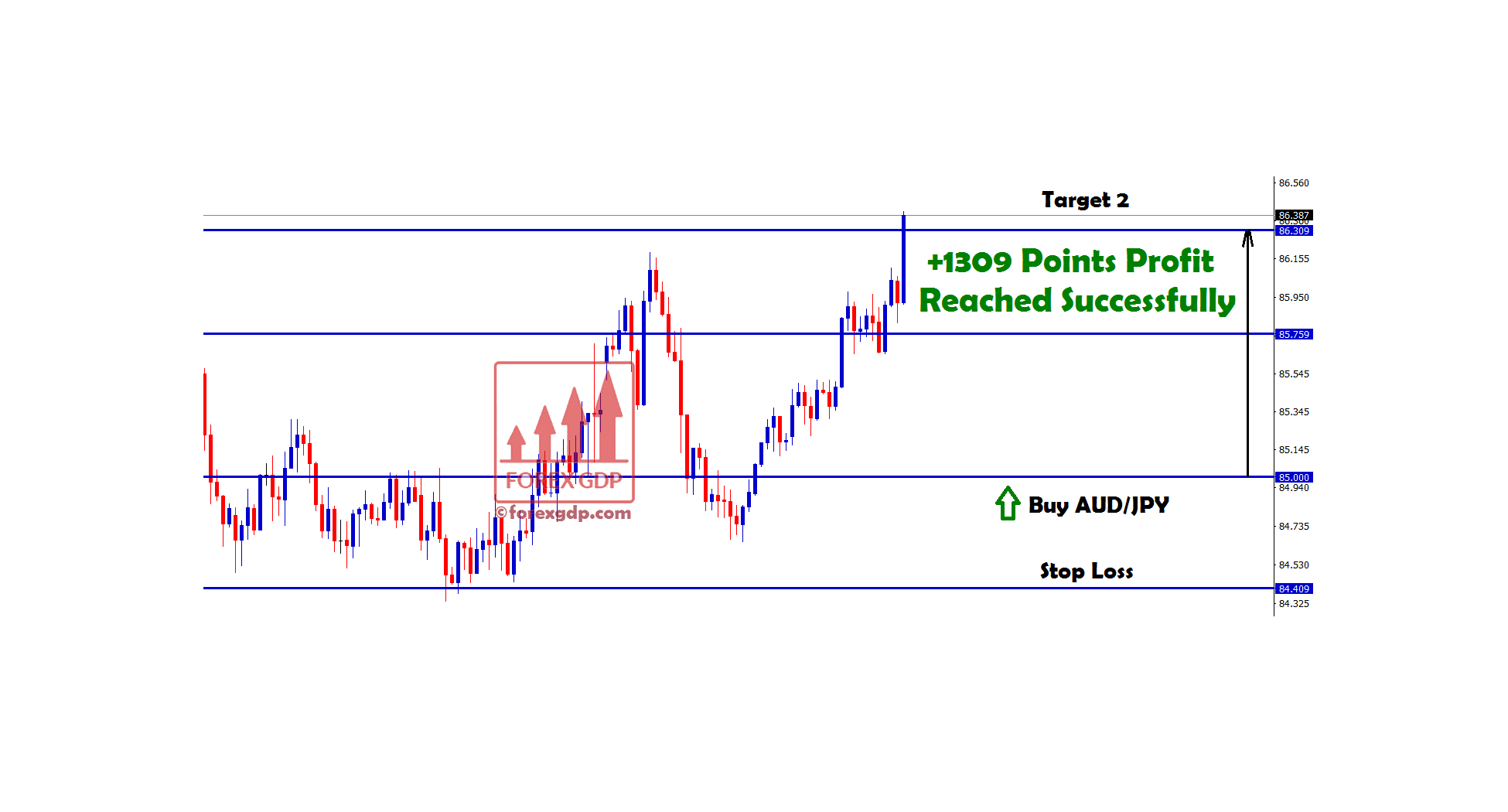

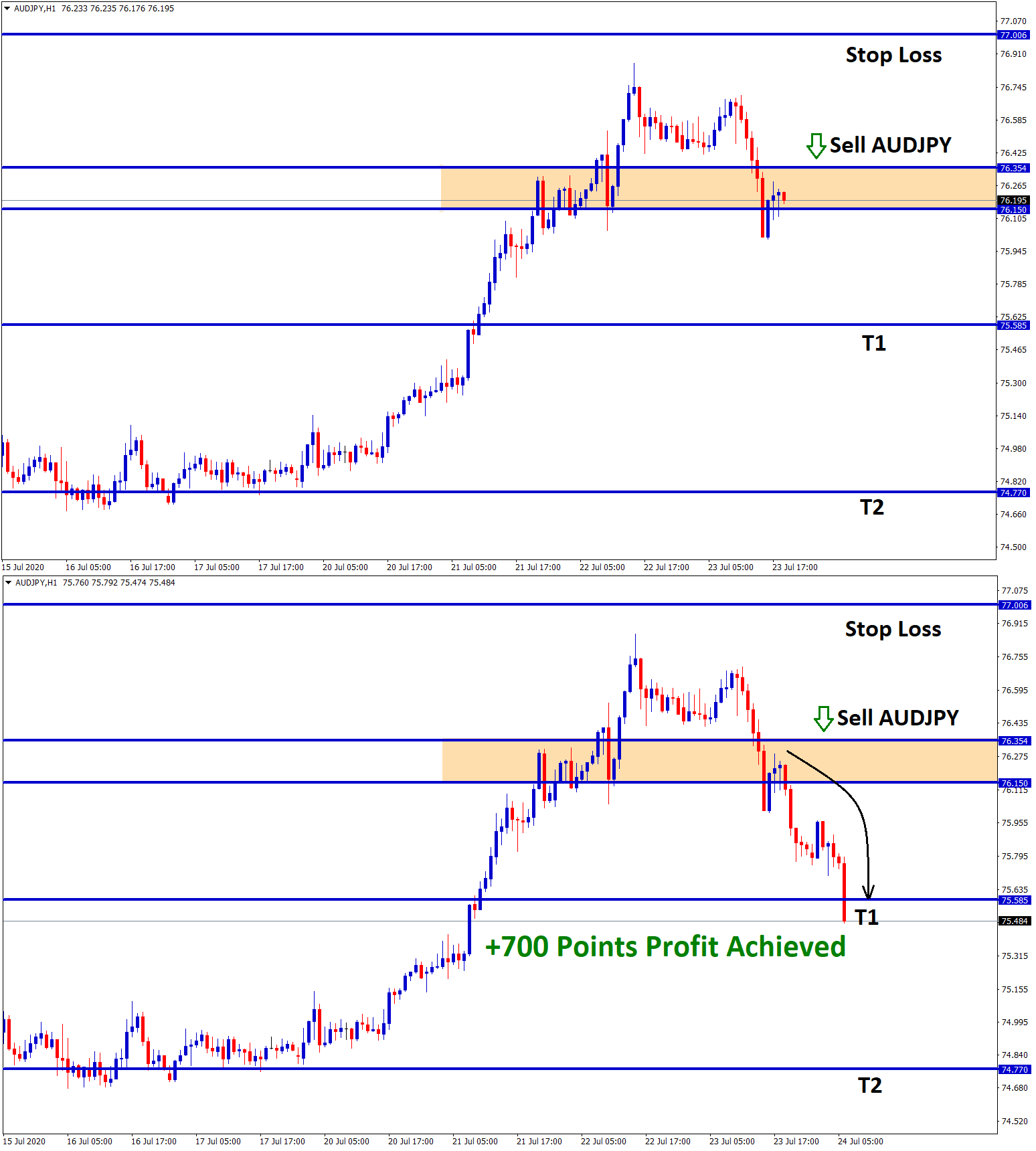

AUDJPY hits the minor support and the descending channel lower low level.

CHFJPY is standing at the lower low of the channel and the major support area.

Japanese Yen got higher yesterday versus all major pairs since more stimulus hopes if a new leader comes to the seat.

And Earthquake hits in Japan without Tsunami warning, make an additional burden to the economy from a pandemic of Covid-19.

As Japan is struggling to handle Covid-19, now Earthquake causes another Burden for Japanese people.

US CPI data shows a softer tone makes support for Japanese Yen because any time FED will do tapering and hike rates.

And Rising prices of YEN will be compensated by FED Hike rates.

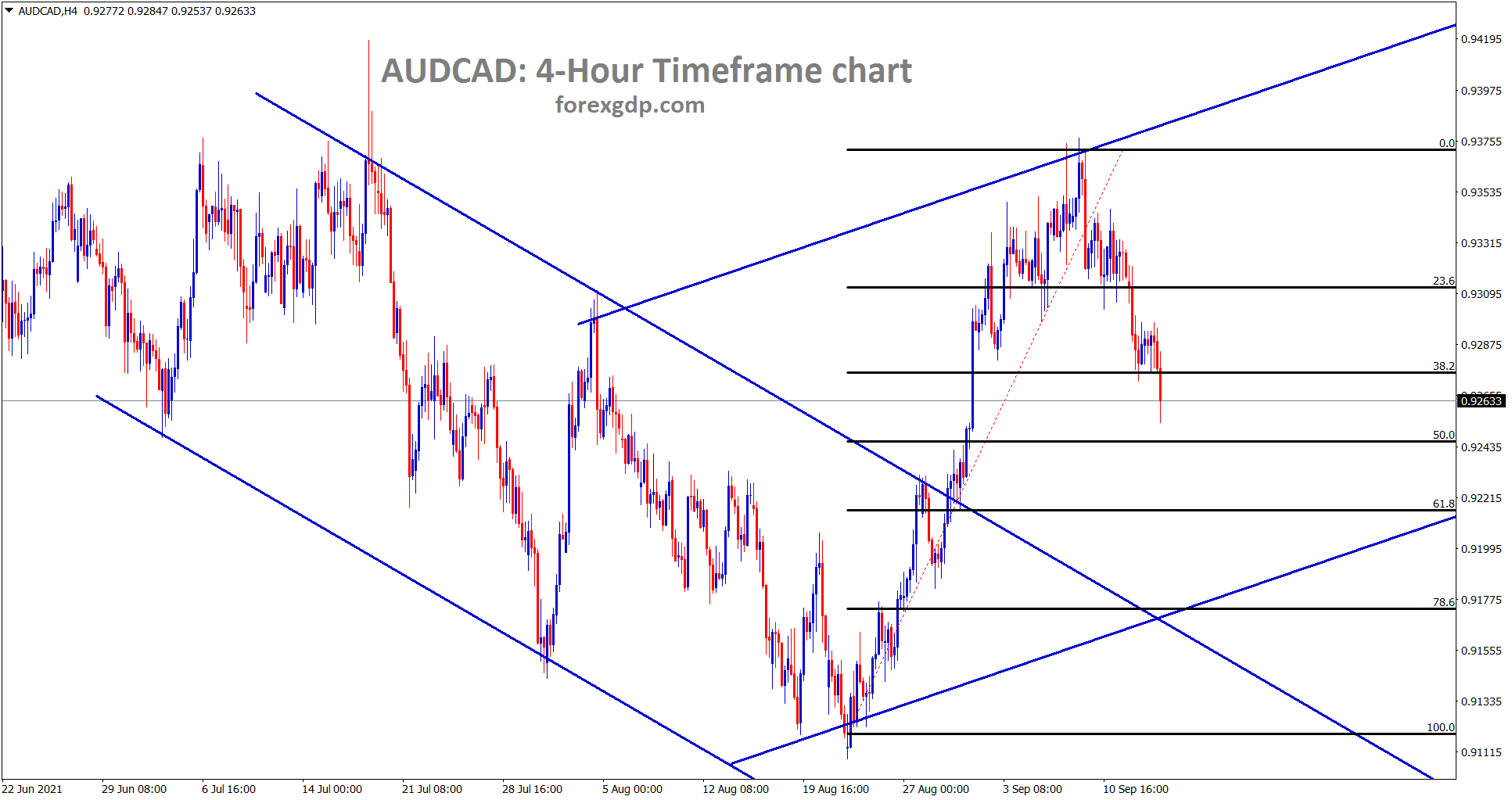

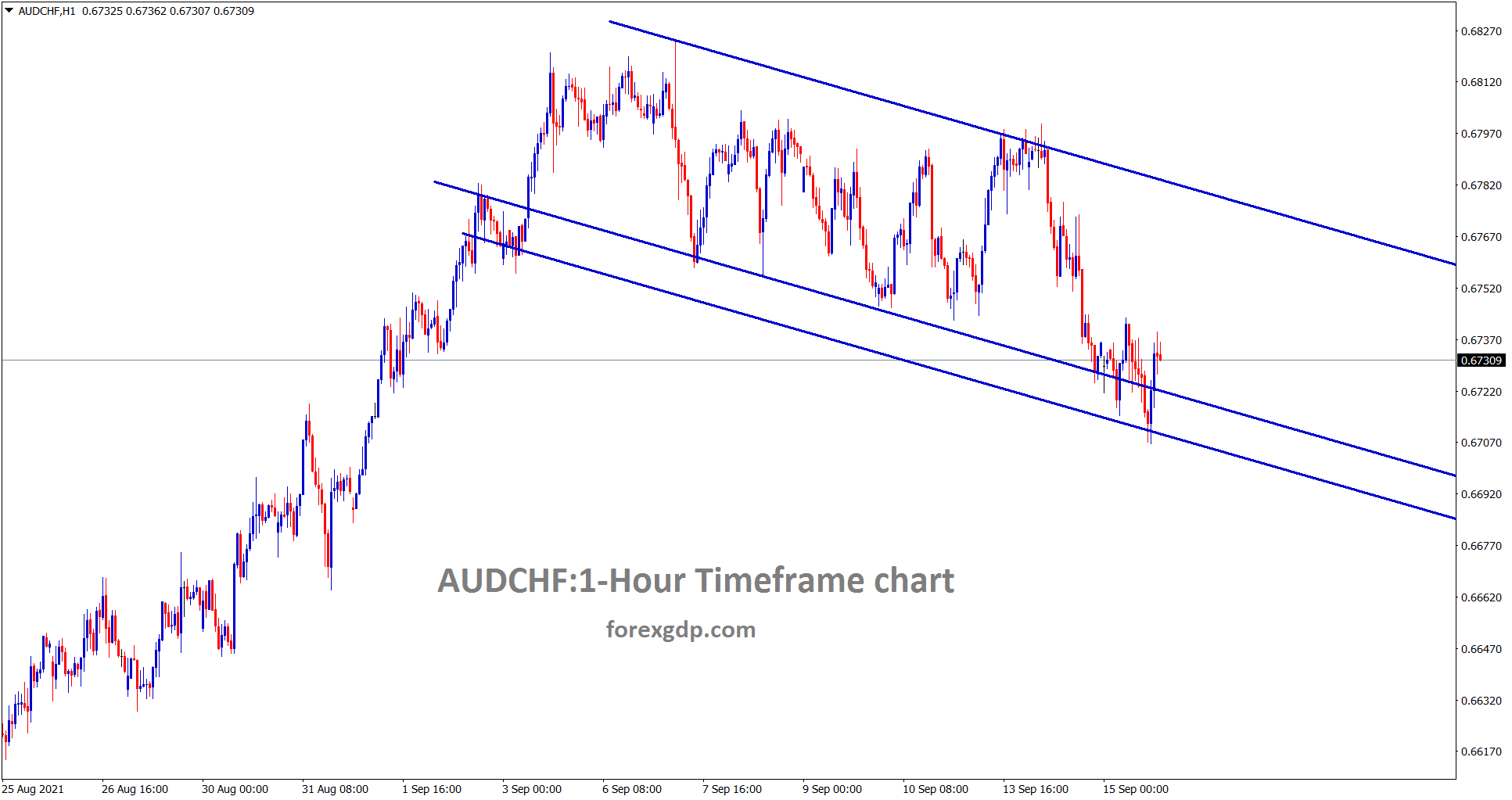

Australian Dollar: Chinese Disappointment Data

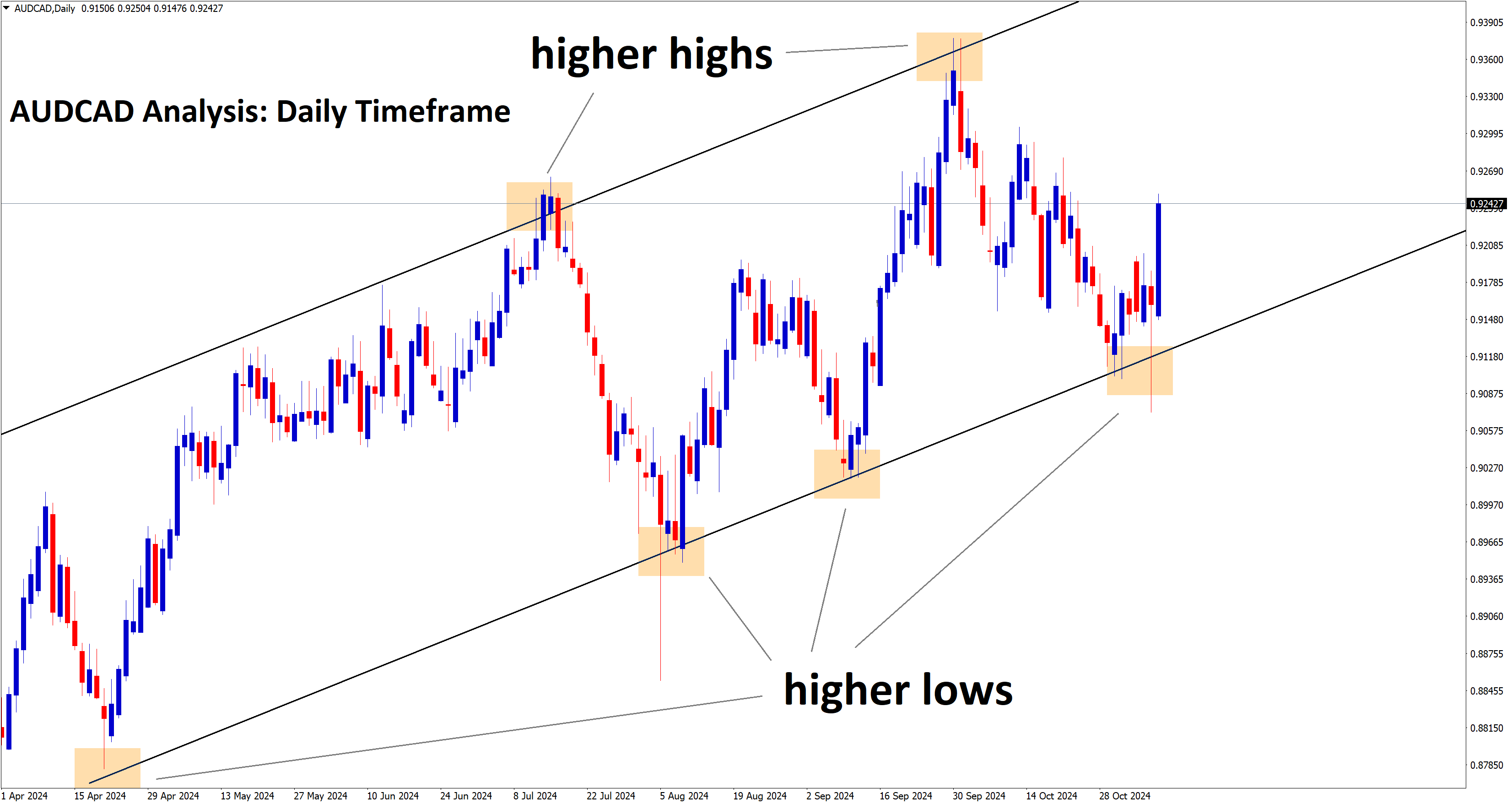

AUDCAD is making a correction from the major resistance, now it has retraced nearly 40%.

AUDCHF is moving in a descending channel range.

China retail sales data shows disappointment numbers as 2.5% versus 7.0%. Forecasted, Industrial production shows 5.3% lower than the expected value of 5.8%.

As Both readings of China domestic data show a weaker outlook, and the Chinese communist party takes more stimulus to compensate backlogs of pandemic time.

And also, the Chinese government makes regulations to Gaming software and tightens security.

Iron ore prices show sluggish mode after China demand slower in Iron ore imports.

So Australian Dollar shows lower after Chinese Domestic data got weaker this month.

New Zealand Dollar: Q2 GDP Forecast

New Zealand Dollar shows range-bound market as much waiting for tomorrow release of GDP Data of Q2, expected reading is 16.2% versus 2.4% previous reading, which shows much higher than anticipated.

But reverses numbers will thumbs down for New Zealand Dollar; if came with expectations, New Zealand Dollar sees mostly breakout in market structures.

And also, New Zealand PM released a lockdown in more cities and excepted Auckland to imposed a Lockdown at the 4th level.

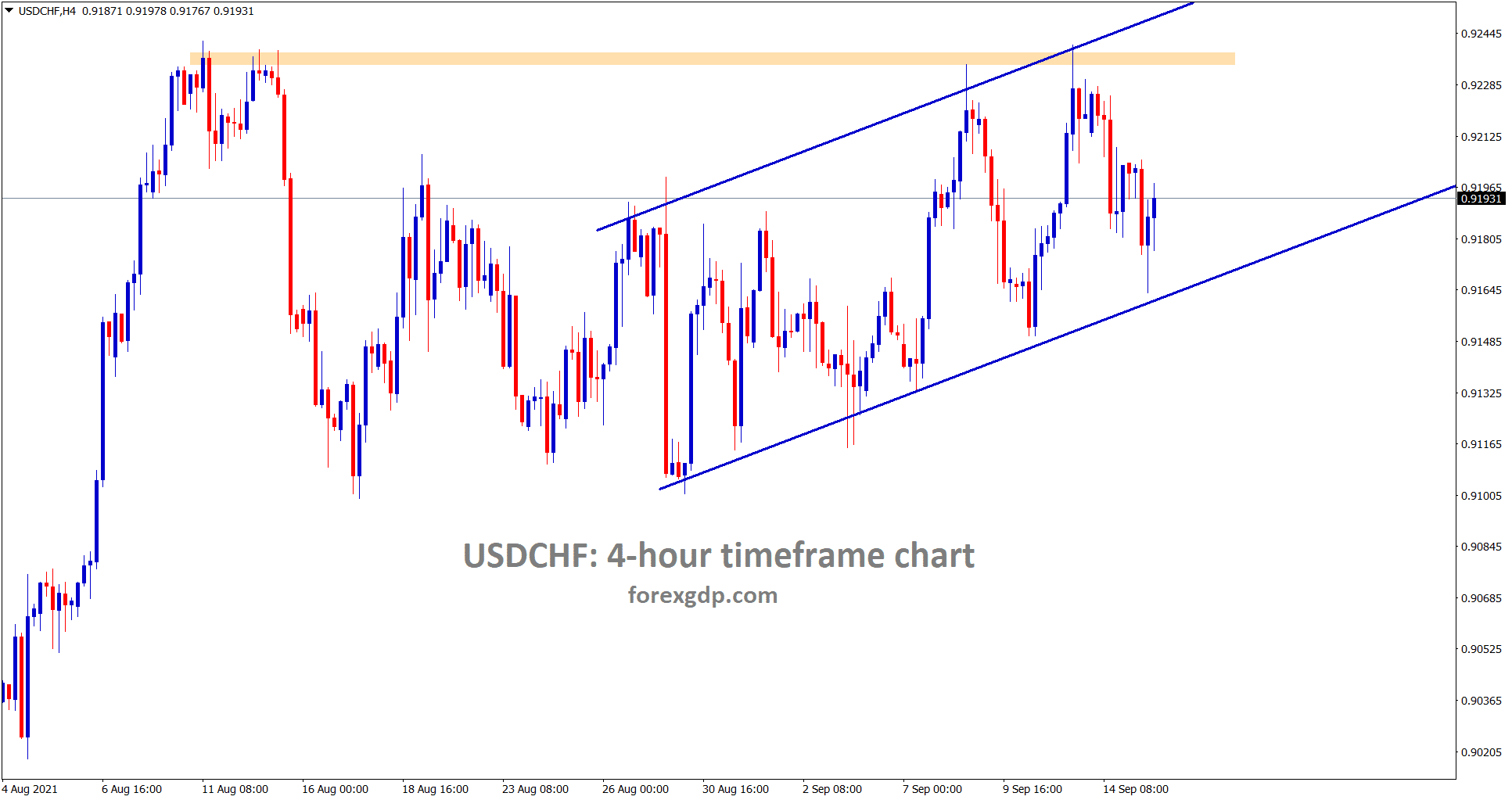

Swiss Franc: Swiss Domestic data higher than expected

USDCHF is moving in an Ascending channel range.

GBPCHF is still moving in an Ascending channel for a long time.

Covid-19 hampered the Swiss Zone more and impacted the Economic recovery of Switzerland.

Swiss Producer and import prices jumped 4.4% in August month a YoY basis.

The unemployment rate fell to 18 monthly low of 2.7% in August versus 2.8% expected.

And Swiss Franc is quite lower after Swiss Domestic data temporary higher this month and long drive still more vaccinations to cool the pandemic.

USDCHF made lower to 0.20% after US CPI Data got disappointed.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/