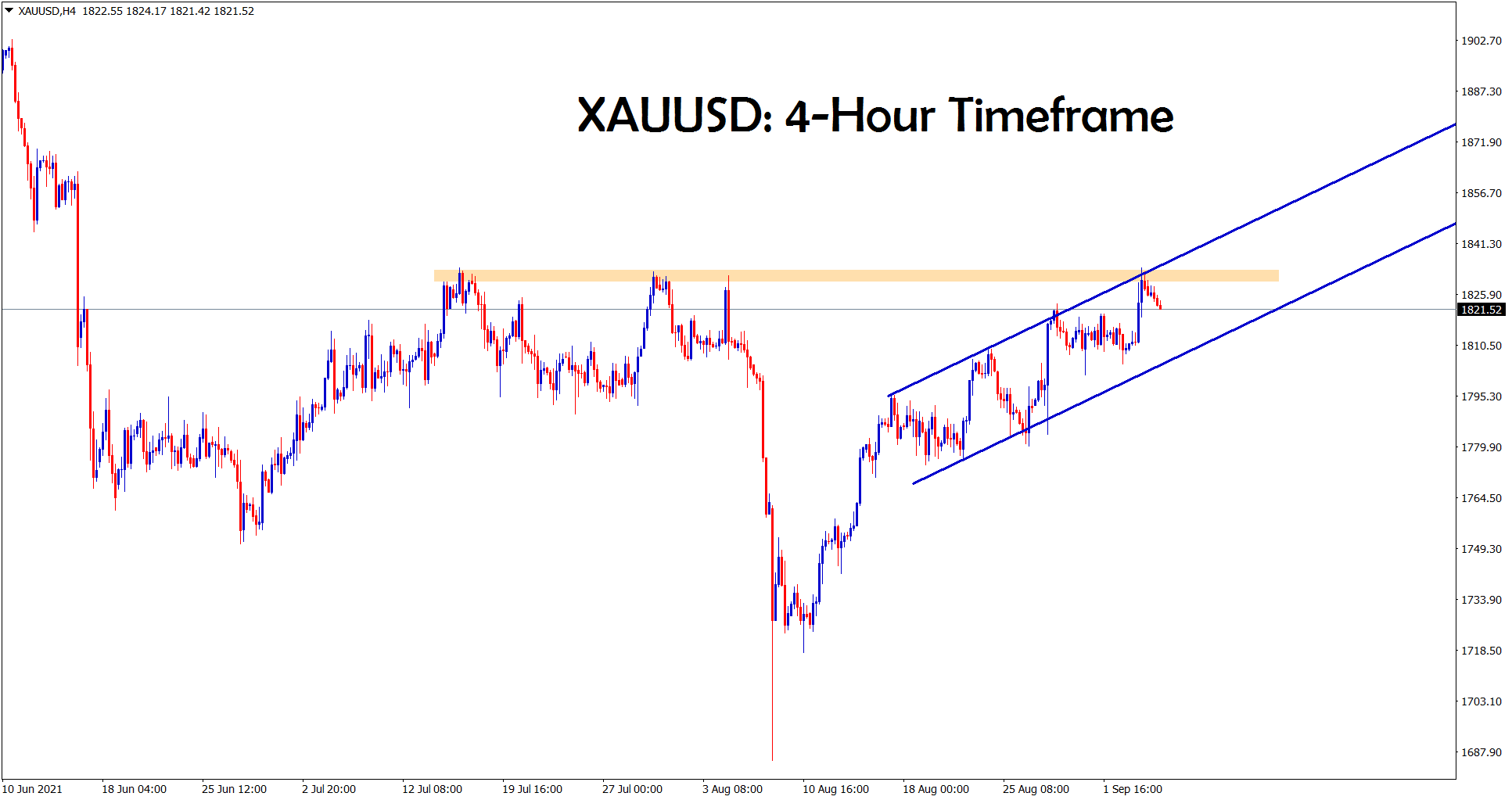

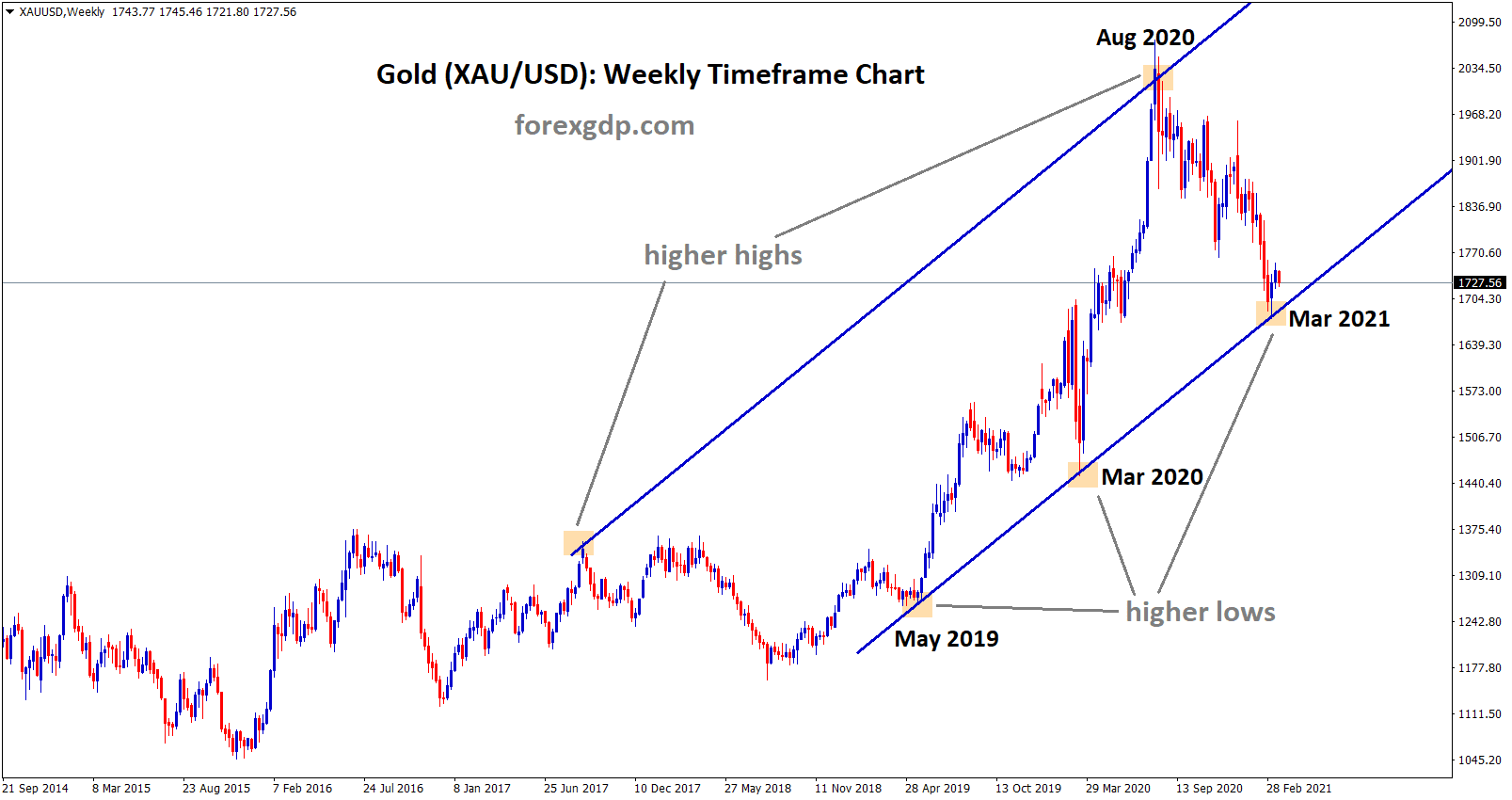

Gold: US Disappointment NFP numbers

Gold has reached the horizontal resistance area and making a correction from 1830

US NFP data showed 235K Jobs created versus 750K expected reading on Friday, But June and July month came above 900k is a consideration.

Every month we cannot expect the higher number of Job creations as viewers want; some concerns in the Job market may not help achieve the target of expectations.

And pandemic lockdowns lost more jobs, and Companies lost more skilled workers.

Reunite the whole workers to restart the routine work in the same company is not possible, and some people went to other companies for better perks, some people fear working in an office for Covid-19.

Due to this, FED may consider the Job numbers as the first goal in Agenda.

Based on August month data, FED may take an appropriate decision whether to do tapering or delay the tapering.

Gold prices were touched the previous resistance level of 1833$ last Friday. If it breaks above this week, then the next resistance level of the market is 1849-1850$.

US Dollar: Unemployment rate and US Labor day Holiday

EURUSD is moving in a narrow ascending channel and making a correction from the horizontal resistance area

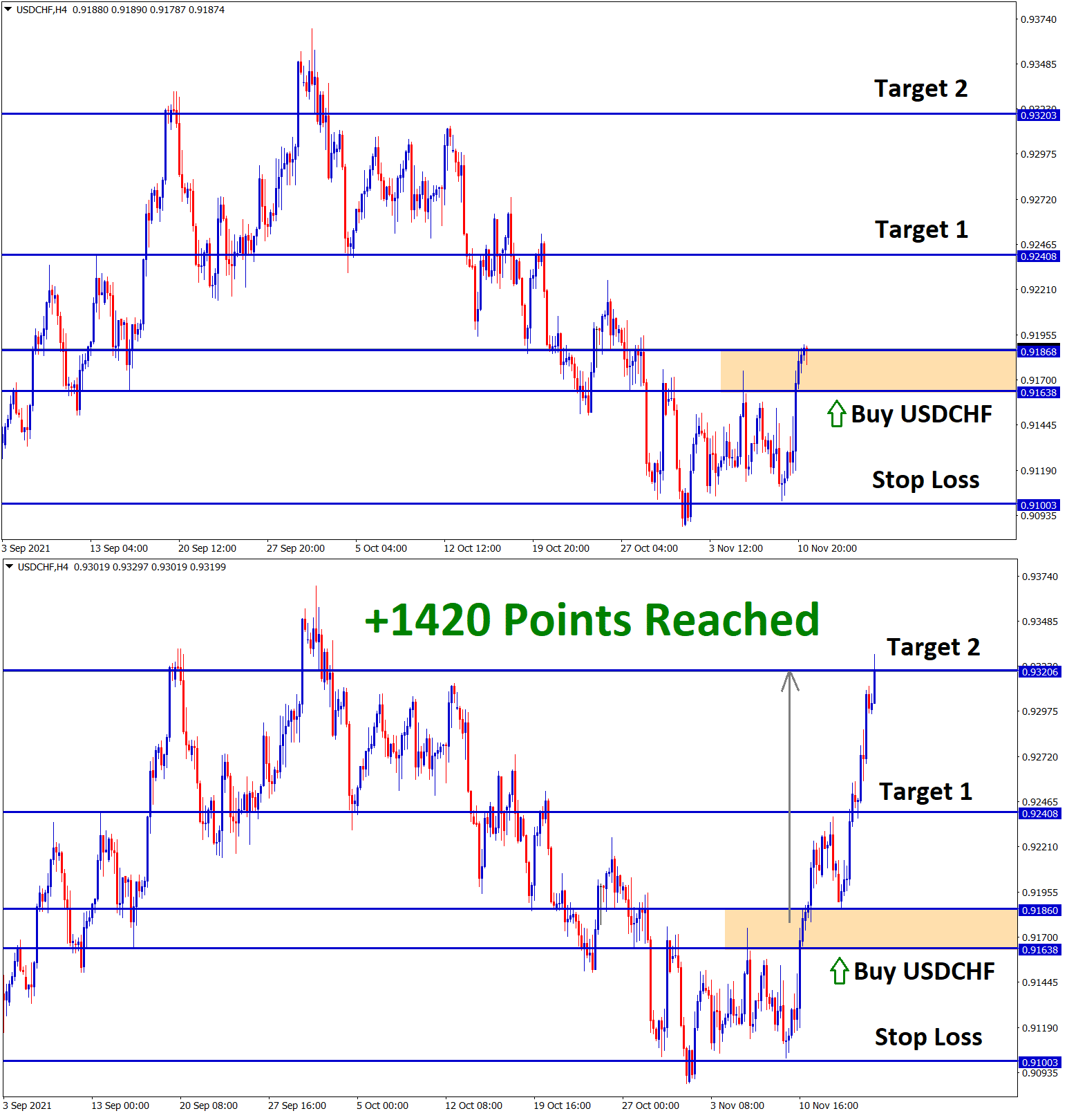

USDCHF has formed a symmetrical triangle pattern – wait for the breakout

US Dollar index made lower as NFP data shows lower numbers versus expectations.

The unemployment rate stood at the expected level of 5.2% as the estimated price.

Now all eyes wait for the September meeting of FED Policy whether any tapering assets have been done or no tapering will make. Based on the labor market report, only FED now take decisions correctly.

And Inflation rates are rising rapidly, and retail sales fell last month shows caution for FED to control inflation rates.

Today US Labor Day holiday and no major moves are expected from the US Dollar; last time, Jackson’s hole symposium speech of FED trigger the broader sell-off in the US Dollar.

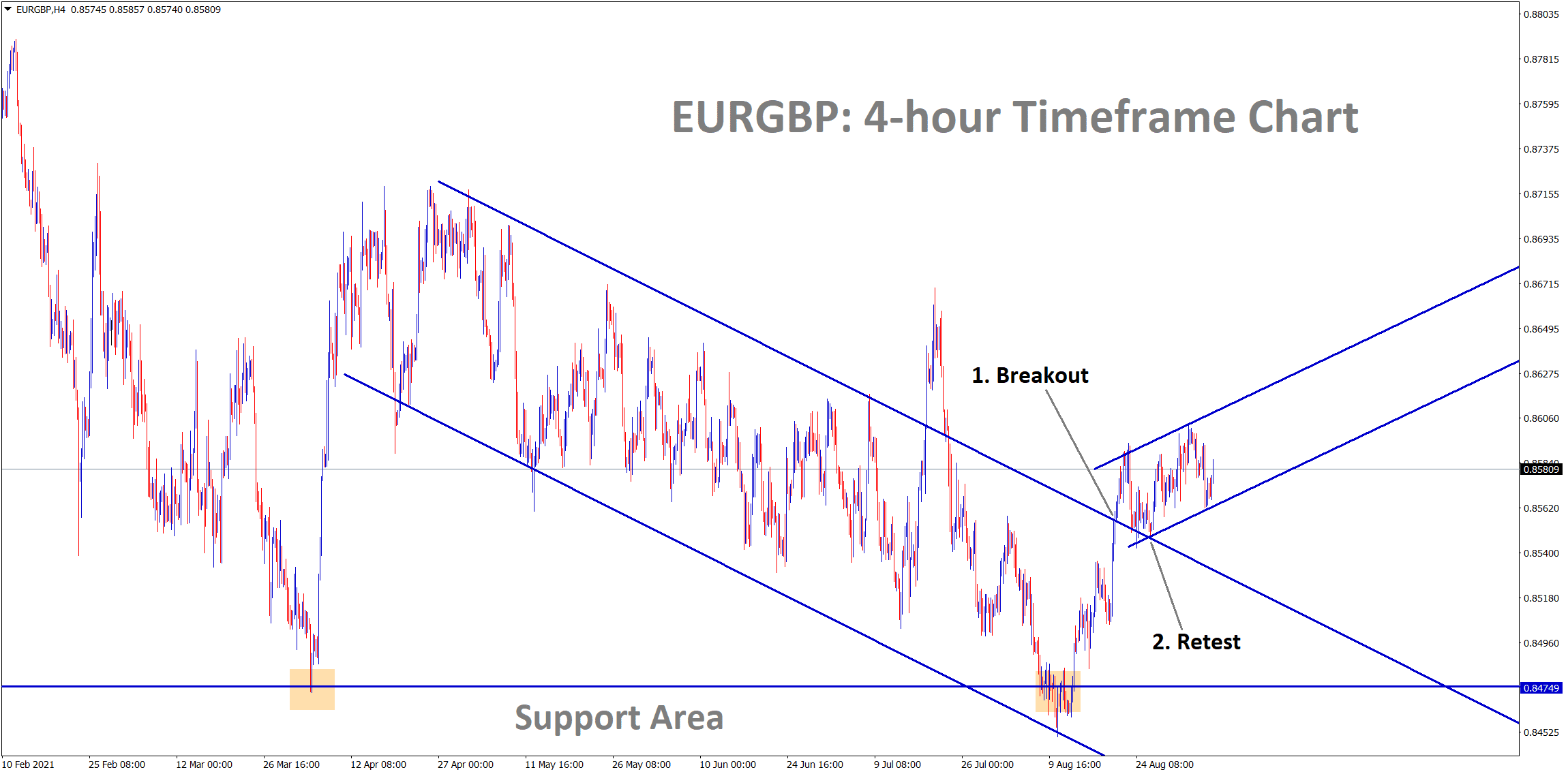

EURO: ECB no plan for tapering in the upcoming meeting

EURGBP is bouncing back after retesting the broken descending channel in the 4-hour timeframe chart.

ECB board members warning that ECB must taper its asset purchases as Inflation are reached above 3% target by this year.

But ECB President Lagarde said no with pre adjusting of asset purchases and no tapering.

And there are no rate hikes before 2024, and the Economy facing the third wave of Delta variant in the market, so wait and see approach matter will be handled in the market.

By the end of the year, ECB may have the option to move from pandemic purchases program to asset purchase programme as a Slow tapering move.

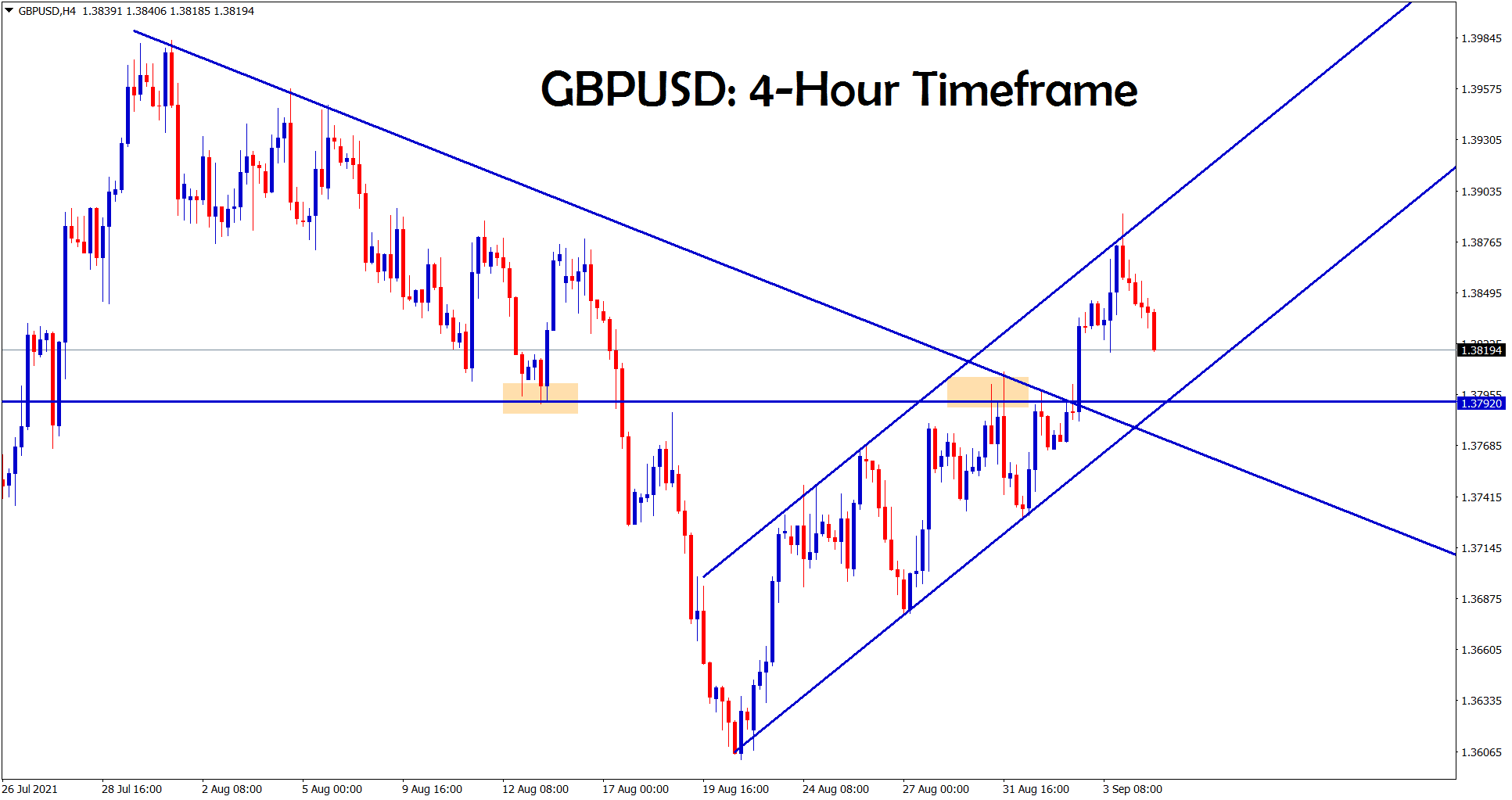

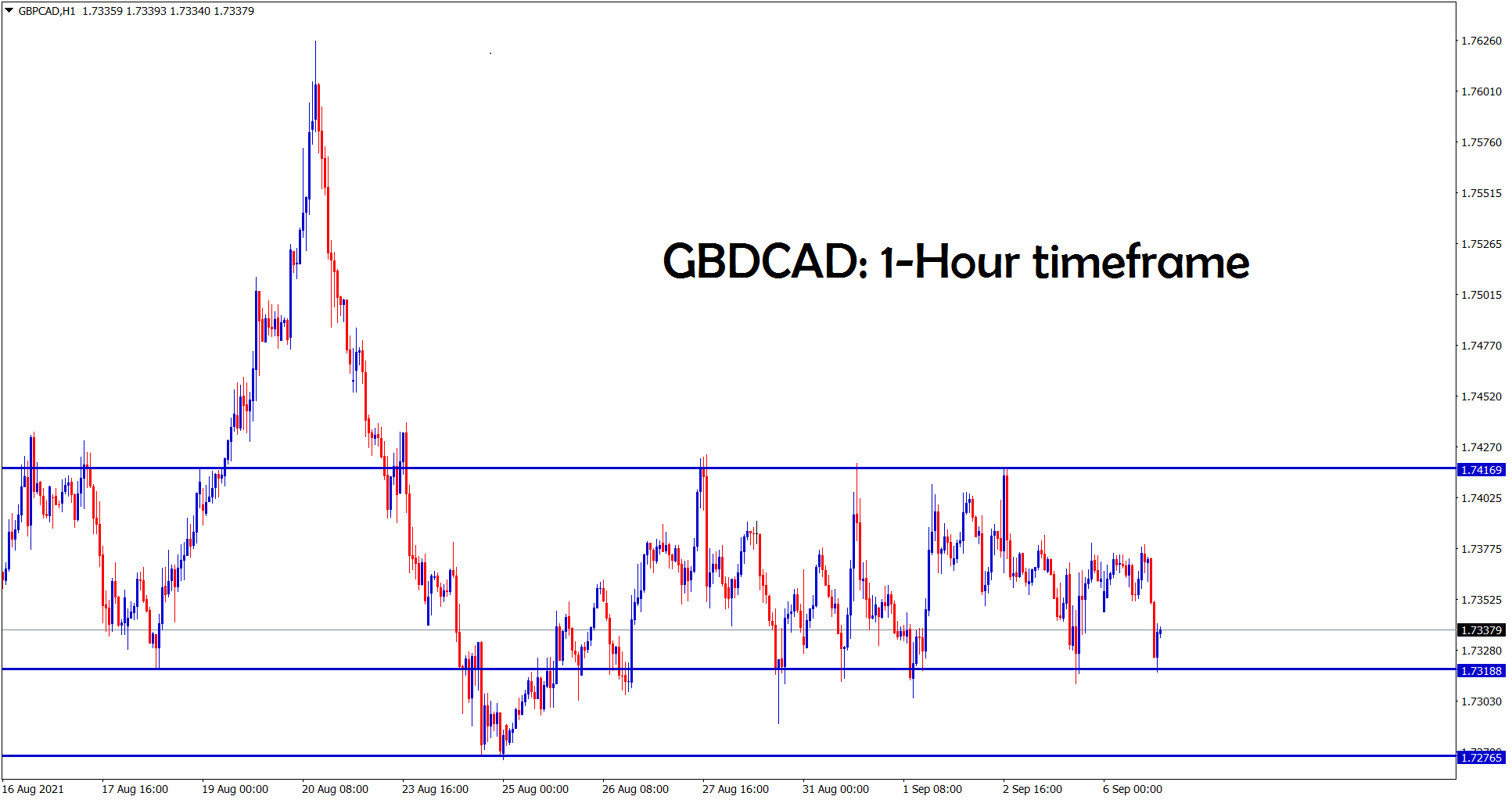

UK POUND: UK PM plans for national insurance tax implementation

GBPUSD is moving in a channel range

US Non-farm payrolls data were disappointed in the market and pushed UK Pound to a higher level.

Now, this week UK Parliament started to access from Recession period. The main view is that UK PM Boris Johnson announced to raise national insurance tax as he already said in the election manifesto before covid-19 occurred.

But the situation is different from the non-pandemic period to the pandemic period.

And UK PM said that national insurance tax would be compensated the pandemic relief funds in his point of view.

But Members of parliament will not pass this bill, and a Debate will be created against UK PM as expected.

Now only the UK economy slowly recovers from the Pandemic, and now tax burden implemented on People means how they will face the problems calmly or accept the tax politely.

So GBPUSD may be faced slight correction if heavily debate occurred in parliament.

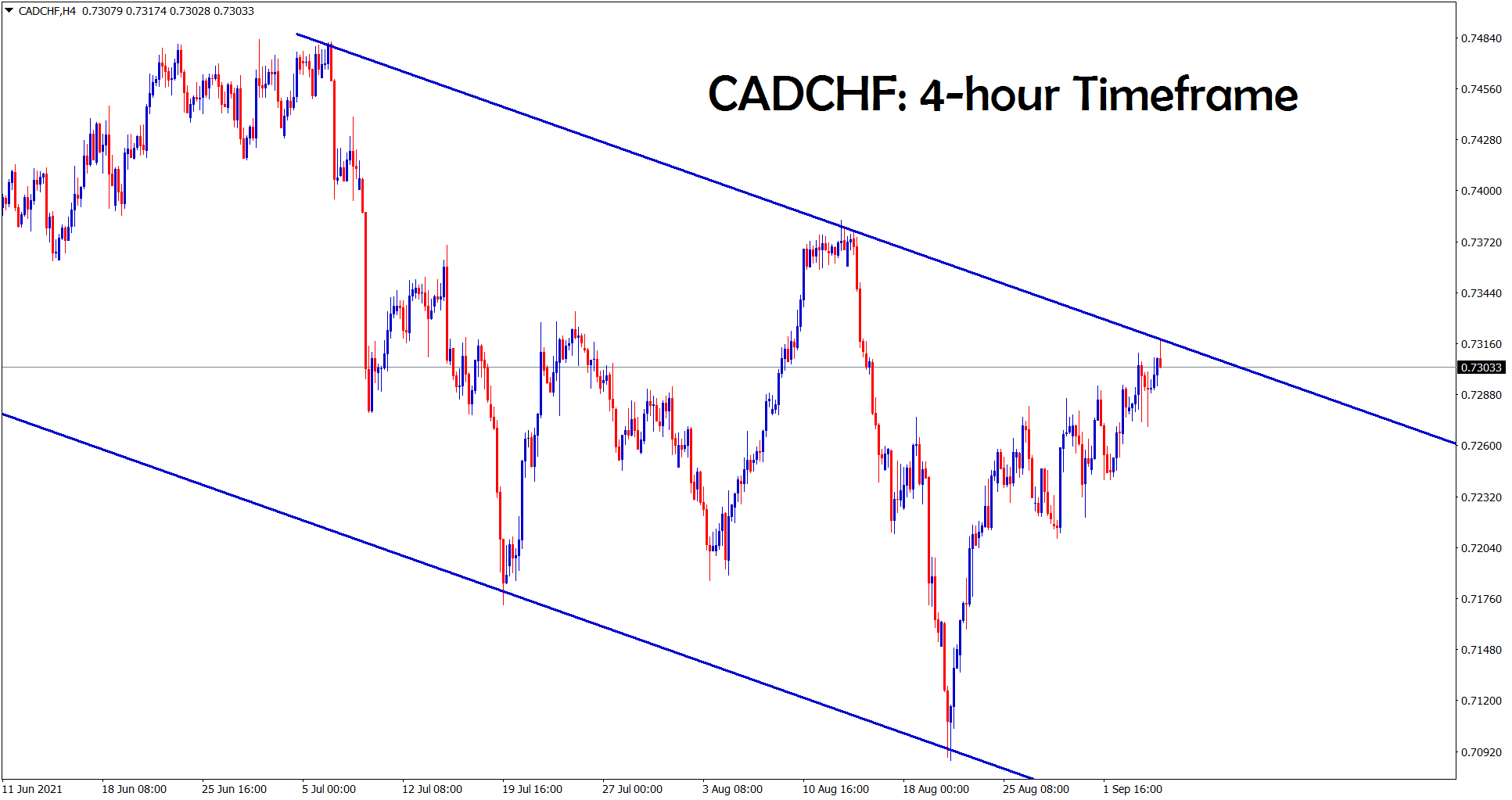

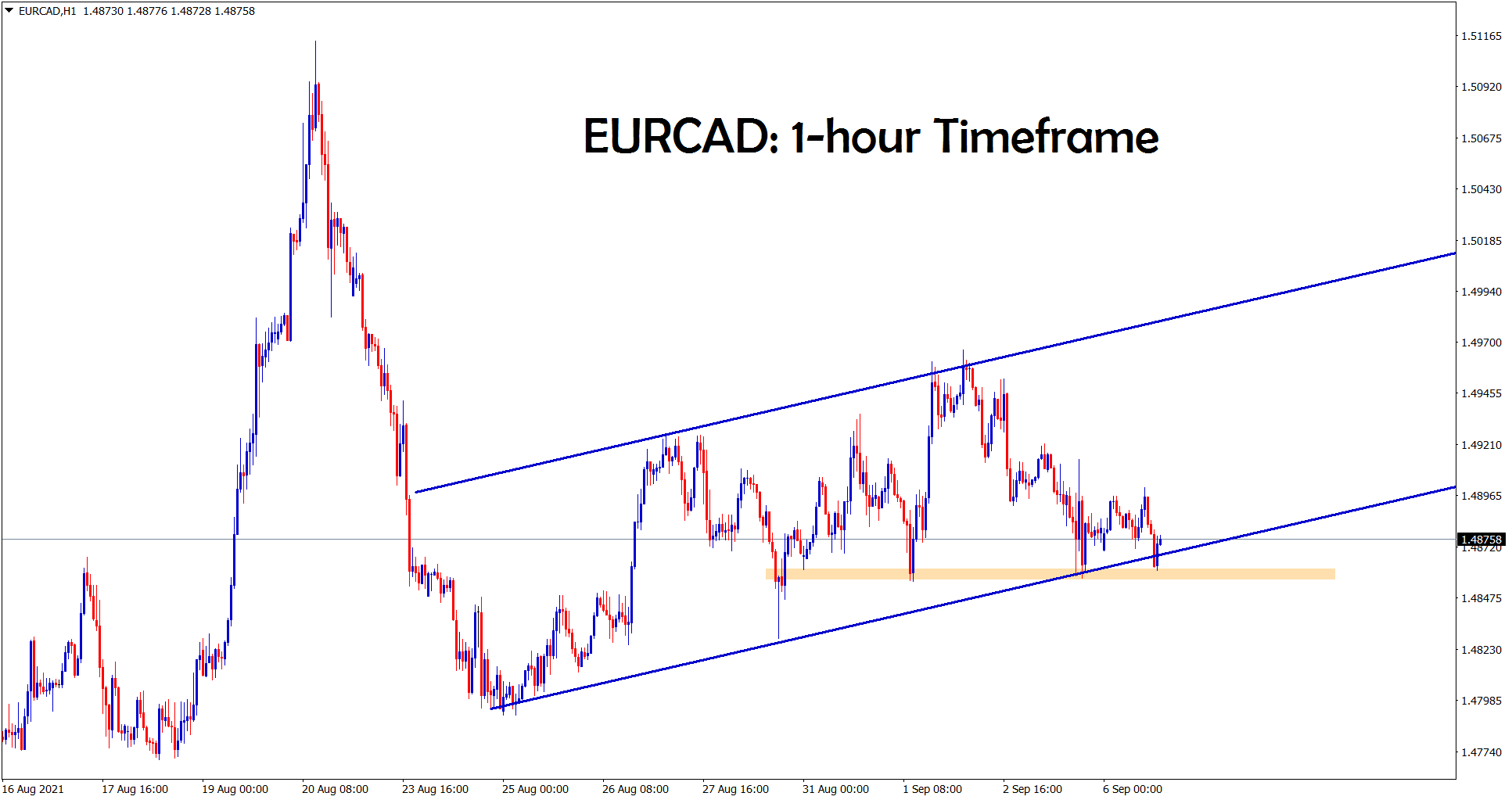

Canadian Dollar: Saudi Arabia slashed oil prices to Asian countries

CADCHF hits the lower high level of a descending channel in the 4-hour timeframe

EURCAD is moving between the SR levels and moving in a channel range

GBPCAD is ranging up and down between the SR levels

Canadian Dollar moved higher last week as US NFP data declines and missed expectations.

And now Saudi Arabia announced slashing Oil prices to Asian countries ahead of delta variant concerns around the world, and Supply will be overweighted as Fuel demand is slower in a pandemic.

By considering the situation, the Canadian Dollar may fall this week as Oil prices slashing concerns, and Oil revenue nation will fall in revenue part.

So USDCAD may rise as the Canadian Dollar falls this week.

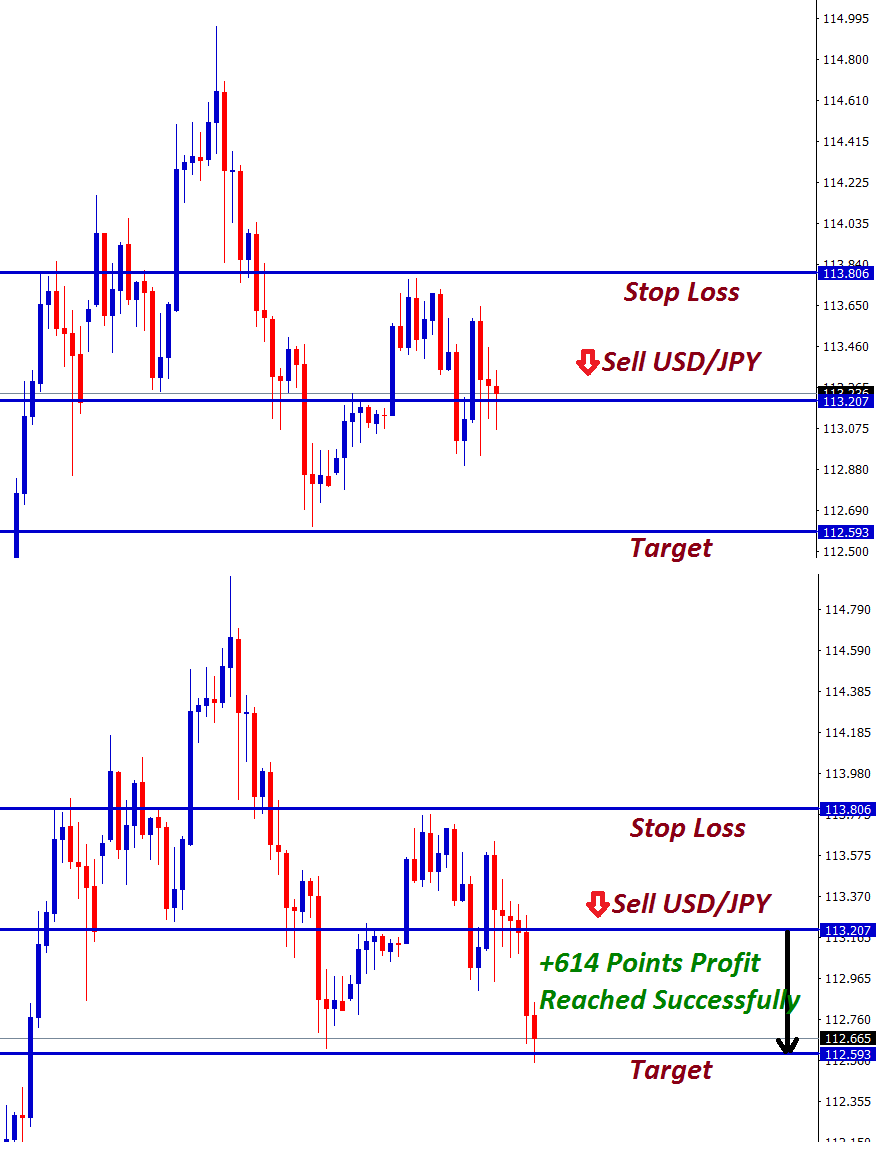

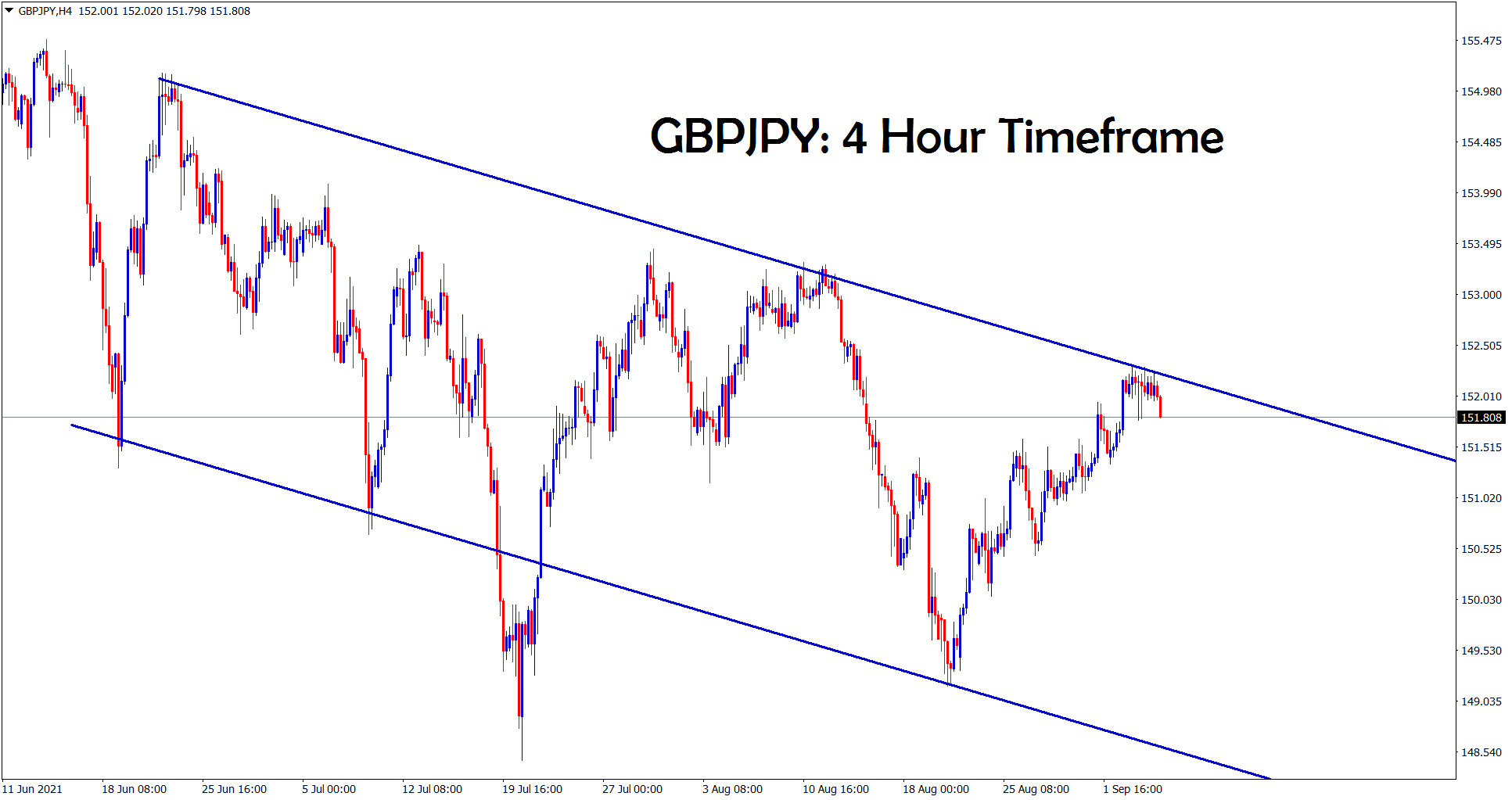

Japanese Yen: FED tapering is Good for Yen Appreciation

GBPJPY hits the lower high level of a downtrend line

As per economists view in Natixis, the Bank of Japan will rejoice if FED Do taper this year-end. This will make Yen Appreciations as Declines in Domestic nation.

Japan, now surrounded by heavy pandemic and currency were appreciation as many investors pouring money as haven assets.

If Fed Do tapering assets, then Yen Value will befall, and it will be positive for the Bank of Japan.

And Japanese Yen has already devalued currency in a normal situation, so if a pandemic occurred in World, and the Japanese Yen got appreciates from devalued, if World got stabilized, then Yen will be depreciated.

So, FED doing tapering is a worry for other banks, but the Bank of Japan takes deep breathier from FED action.

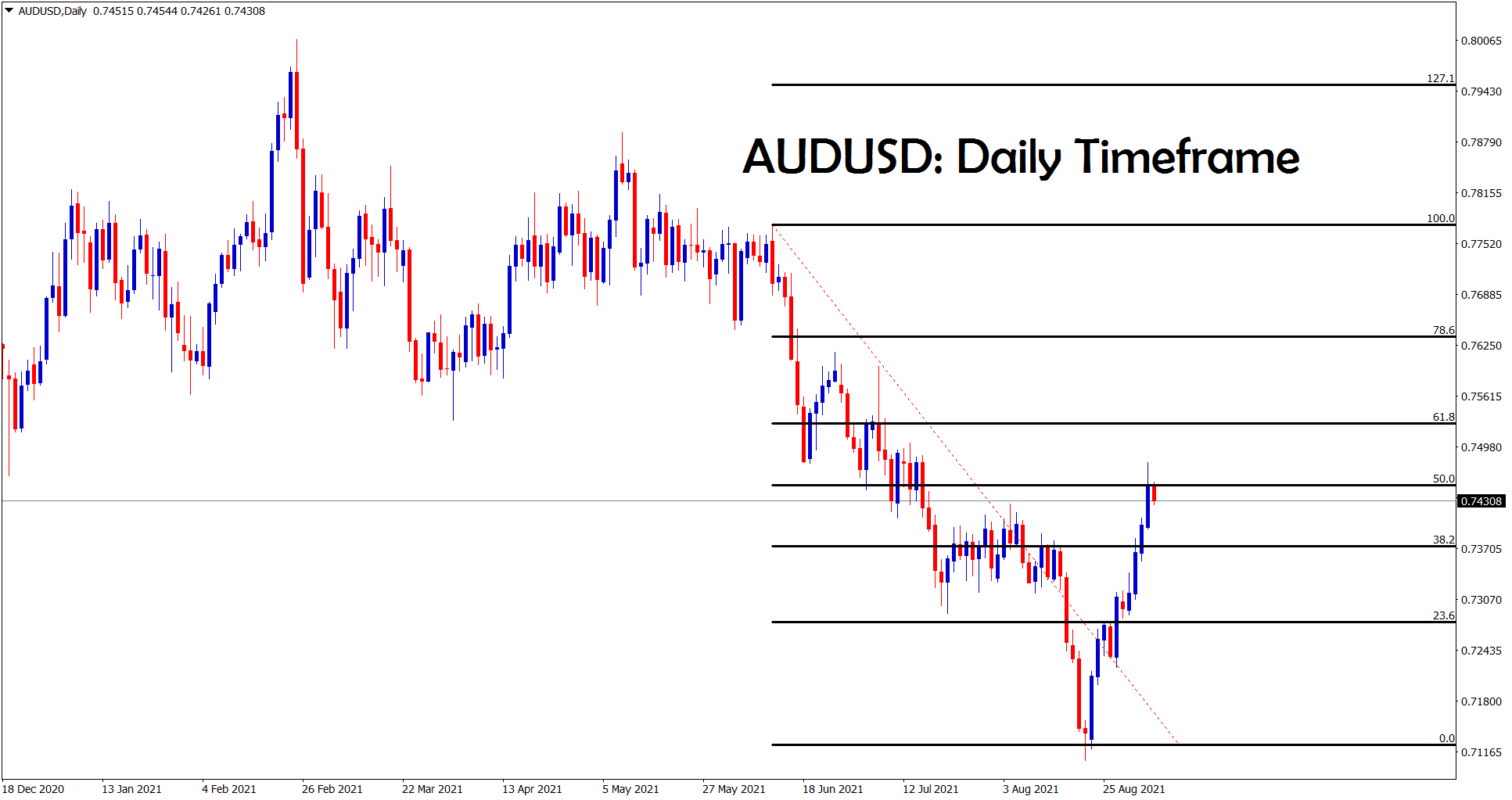

Australian Dollar: Delta cases higher in NSW and Victoria state

Australian Dollar shows strong performance in last 3 weeks as shoot up to 4% from lower levels.This move happens from US Dollar declines from higher highs.

And US Domestic data of non-farm payrolls disappointed the market on Friday. This labor data-pushed AUDUSD to move higher and the US Dollar index to move lower.

And Delta cases surpassed 1684 in Australia, and out of 1684, 1485 cases from New South Wales.

Victoria and New South Wales are major cities with the most population, faces more lockdown restrictions to avoid the earlier spread of the Third wave.

Vaccinations are injecting into people in a faster manner to achieve a 70% vaccination rate.

AUDUSD is trying to make a correction after 50% retracement

EURAUD bounces back from the horizontal support after breaking the higher low of uptrend line

RBA meeting Forecast

RBA monetary policy meeting will happen on Tuesday, and the Debate is whether tapering is good for now or that they should delay their tapering.

Now Delta cases are rising more sharply in New South Wales and Victoria state.

And these 2 states accounted for 55% of Australian GDP, but both states fully lockdown as Delta cases spread.

By Considering this situation, RBA whether tapering from A$5 billion to A$4 billion or A$3 billion per week or leave it as same previous level.

RBA decision is keen to watch this Tuesday for tapering or non-tapering assets.

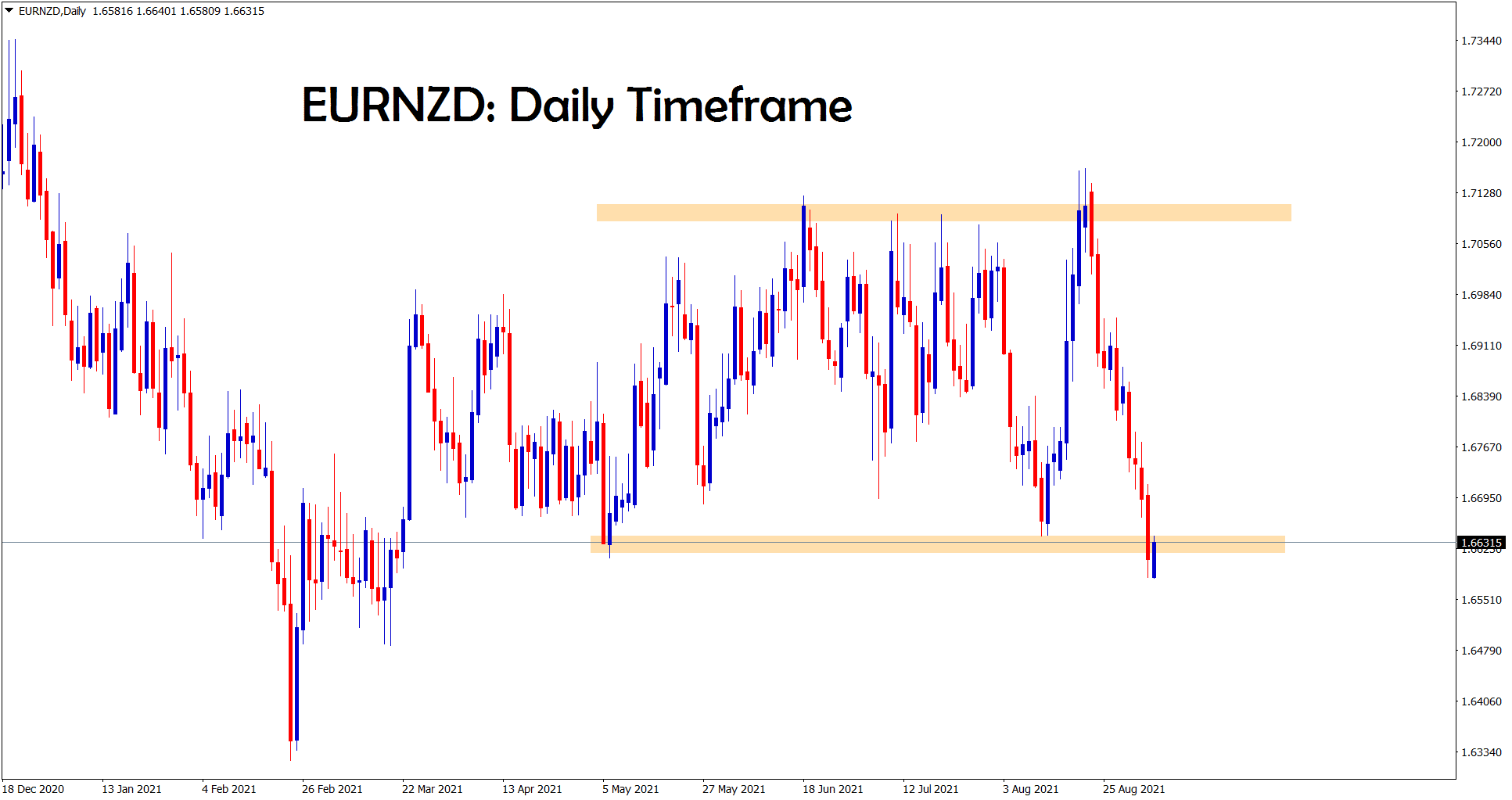

New Zealand Dollar: Delta cases lower in Auckland and Lockdown likely to be easing

NZDUSD is making a correction from the lower high of the descending channel

New Zealand Facing Delta cases were lowering from last week, and New Zealand Government is likely to scale back lockdown in many cities like the Auckland area.

And This news is positive for the Reserve Bank of New Zealand to do rate hikes in the upcoming meeting, as analysts expected.

But Delta cases are very serious fiction in New Zealand in last week now cases lower made positive for New Zealand Dollar.

And also, Last week US Dollar made declines as a disappointment to NFP data. This will help New Zealand Dollar to climb 3% up from lower levels.

EURNZD is standing at the support area – wait for breakout or reversal

Swiss Franc: Swiss Governing Board member Andrea Machler speech

CHFJPY is ranging and formed a symmetrical triangle pattern in the 4-hour timeframe

Swiss Franc made lower as Swiss retail sales data fell 2.6% on a yearly basis in July, and this seems to first decline in six months.

And the economy expanded by 1.8% every quarter in June and below the expected level of 2%.

Swiss national bank Governing Board member Andrea Machler said Covid-19 pandemic uncertainties would be prolonger for some more time until the Swiss faced some economic difficulties.

And US Dollar made lower on Friday after lowering Job numbers data, and the Swiss franc made higher as US jobs declines.

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/