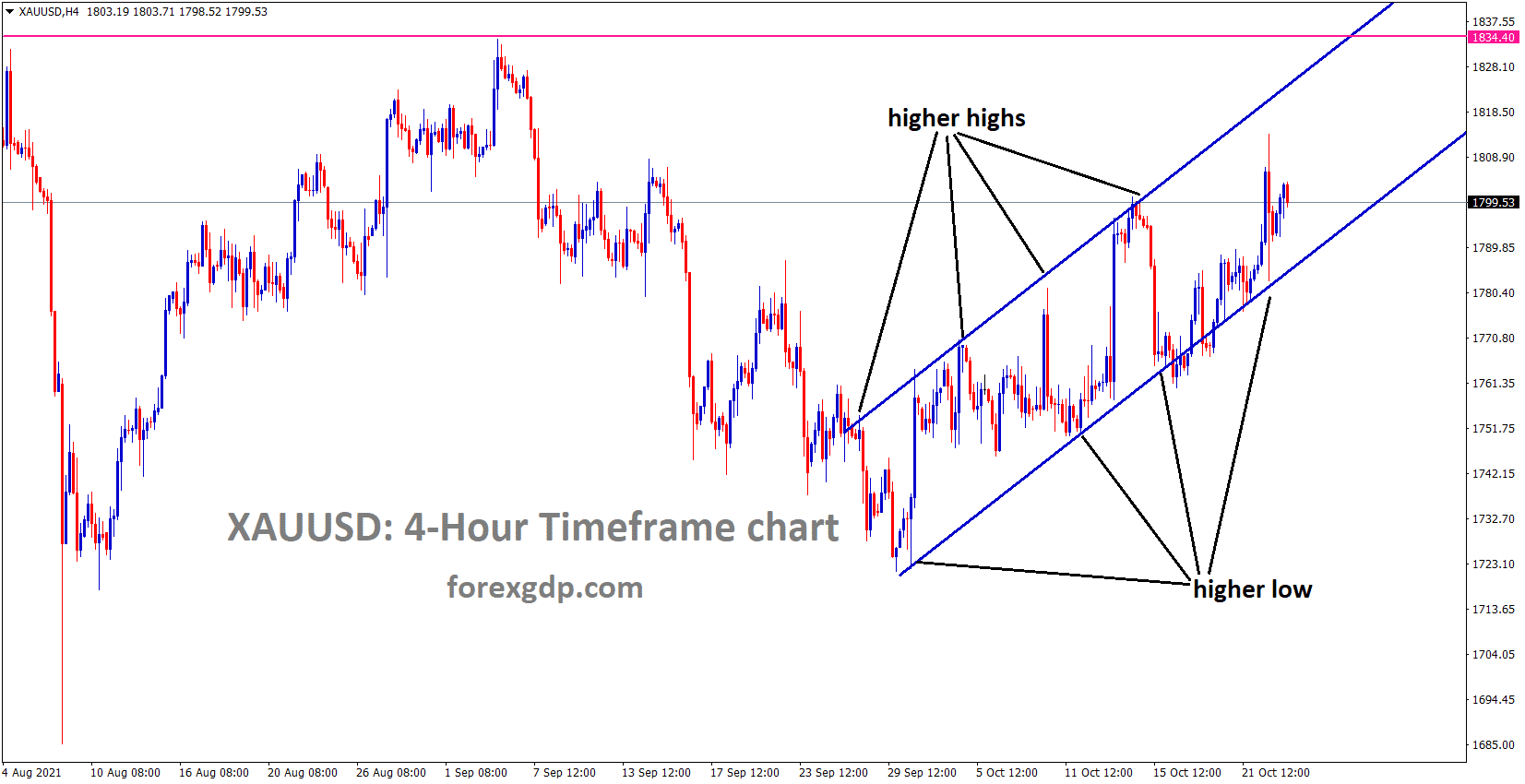

Gold: FED Decision is waiting for tapering

XAUUSD is moving in an ascending channel and higher high progressing now.

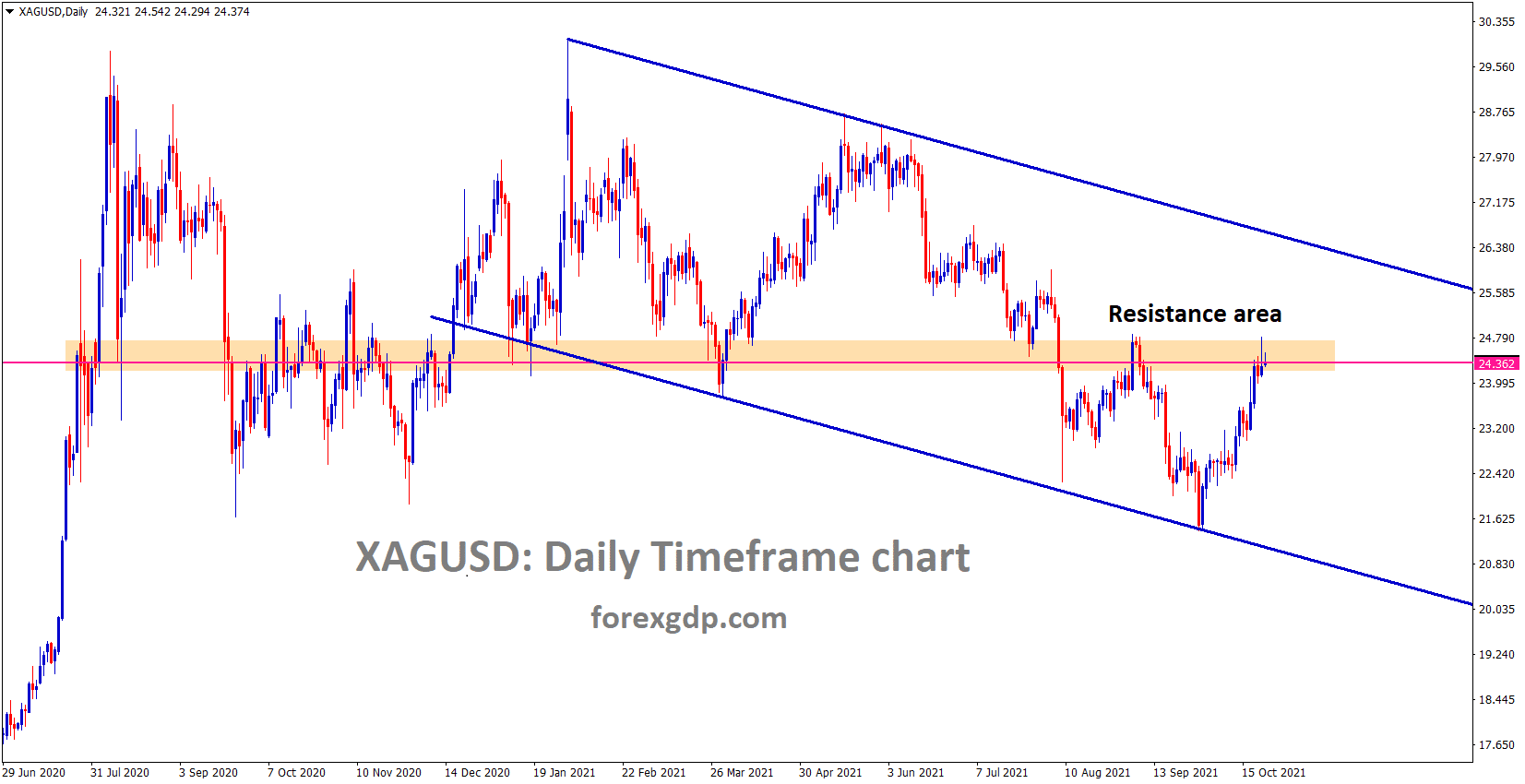

XAGUSD hits previous major resistance area and market standing on Previous high.

Gold prices are slightly higher after US Domestic data performed lower last week.

And this week, US GDP data is on the table, and the outcome of data will affect the gold prices.

China ever Grande issue makes the Chinese Government inject more stimulus of 100 million Yuan to the economy.

And US Fed Powell may taper stimulus in Next week FOMC meeting, and investors eyes are keen on this data.

Gold will be increased or decreased depending on the US FED decision next week.

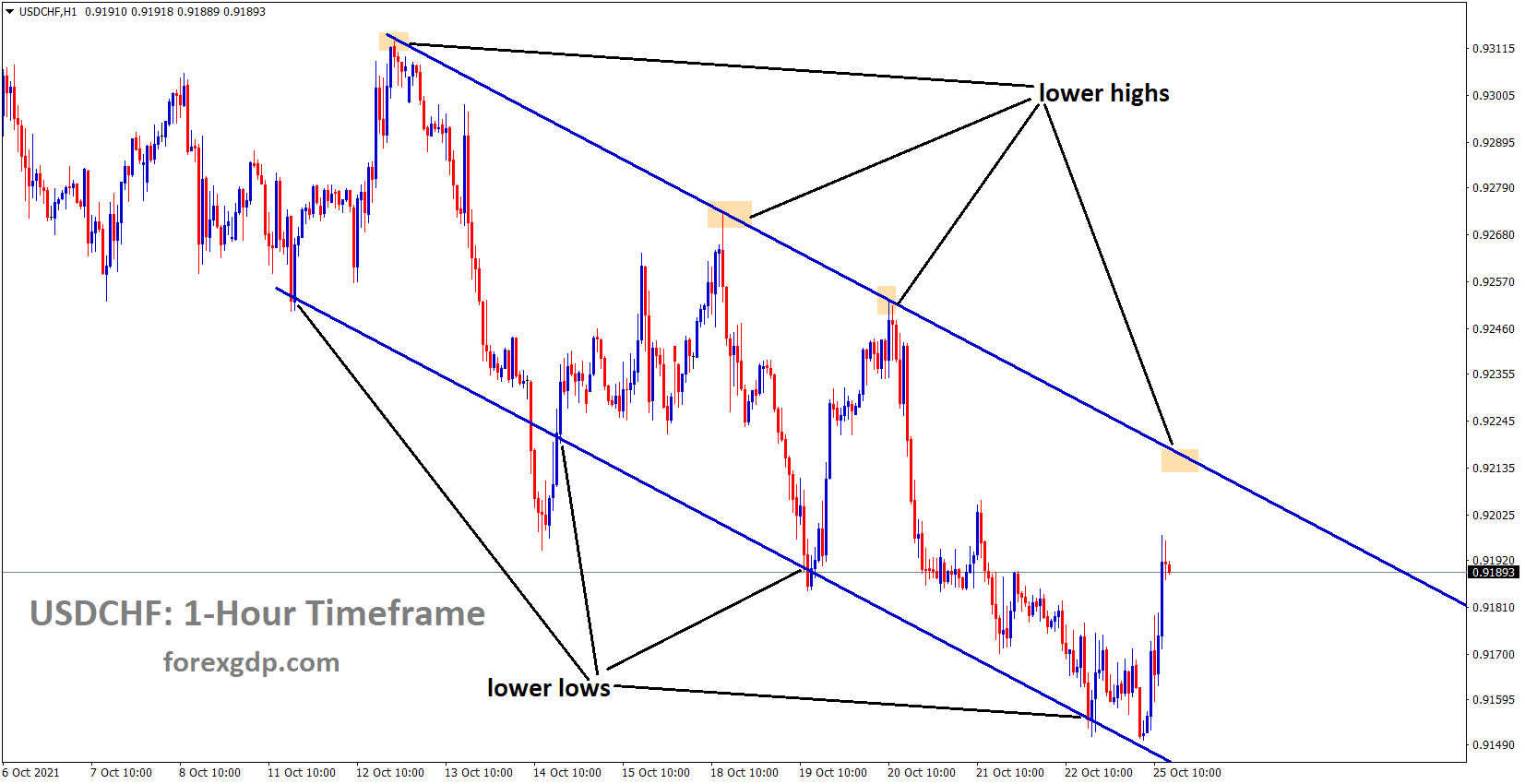

US Dollar: US GDP data forecast

USDCHF is moving in a Descending channel and it’s trying to create another lower high for the fourth time.

US Dollar makes lower as US FED doubted for tapering in next week as investor hopes as a reflection in price action charts.

This week US GDP data and Core durable Goods data are scheduled; positive numbers will pushups the prices of the US Dollar index.

And FED Powell planning for tapering next week and rate hikes at end of 2022 or starting of 2023.

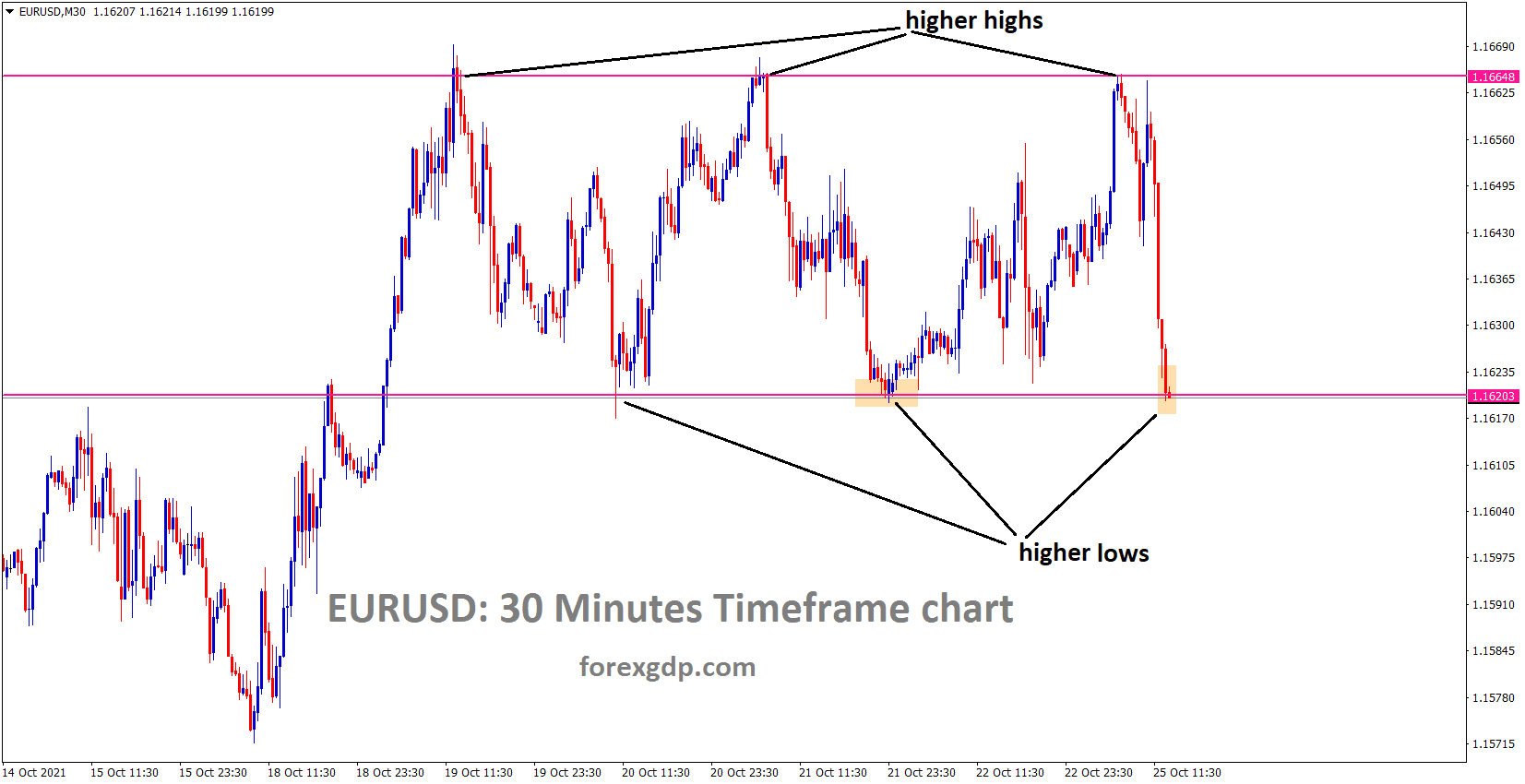

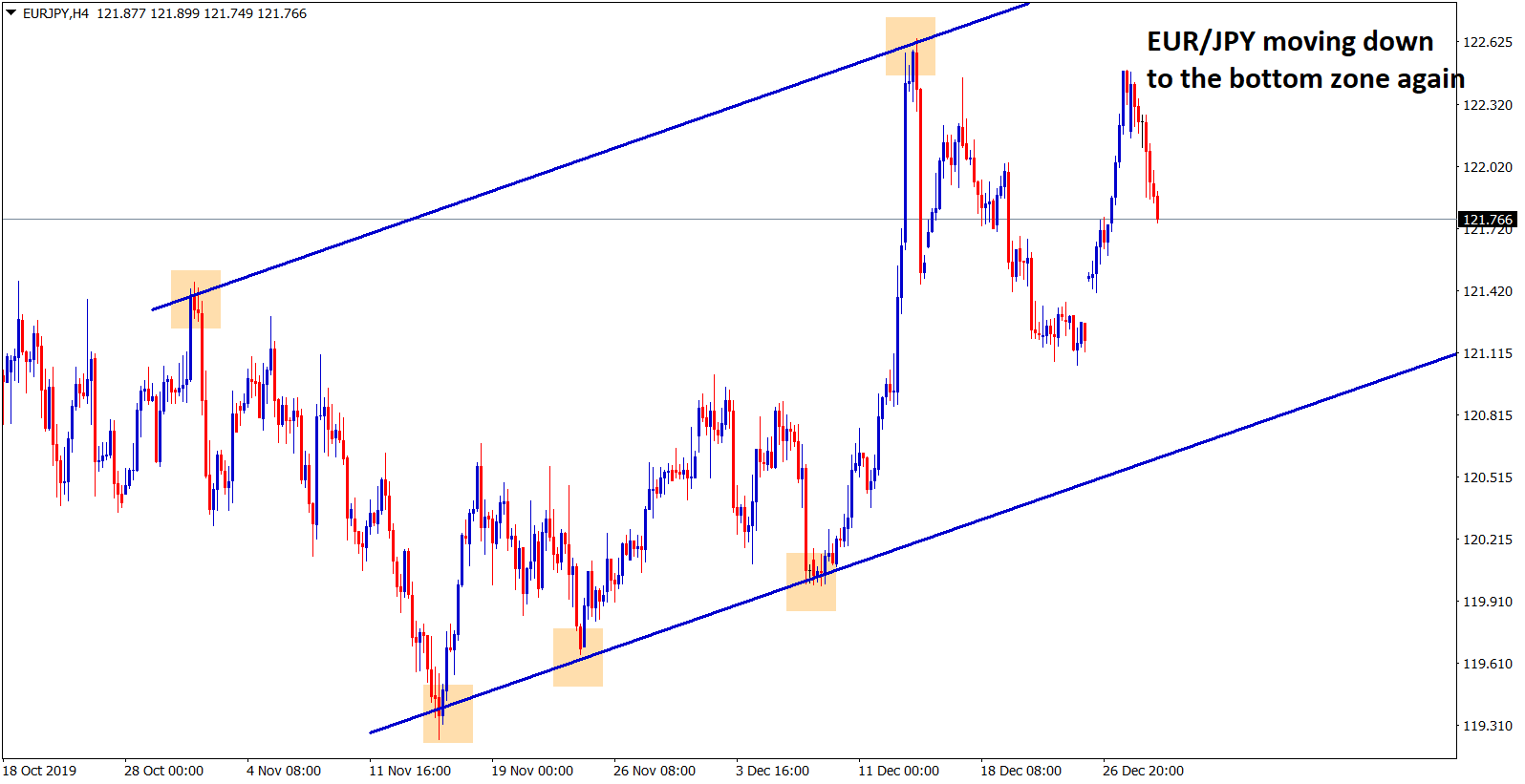

EURO: ECB meeting forecast

EURUSD is moving in a box pattern and now the price has reached the support area.

This week ECB monetary policy meeting will happen, and no tapering or rate hikes are expected. But Economy projections are expected from the ECB side.

And ECB has already told, that they will do tapering in late mid-2022 and mid of 2023 rate hike will start after Bank of England and US Federal Reserve.

This week German employment data and Eurozone inflation data are scheduled, significant readings will be appreciated for EURUSD, and Minor readings will depreciate EURUSD.

Germany impacted by Supply chain issues

Supply chain problems cause more trouble for companies and production capacities. Due to this manufacturing sector shows business sentiment and services are falling.

And Supply chain issues impacted stores, and the Auto sector capacity fell to 78.2 from 85.2.

German GDP to grow by 0.50% in Q4.

The rise in delta type of covid-19 does not affect Tourism, Hospitality and industry in October.

Prices raising is the main vision for Every German industrial company.

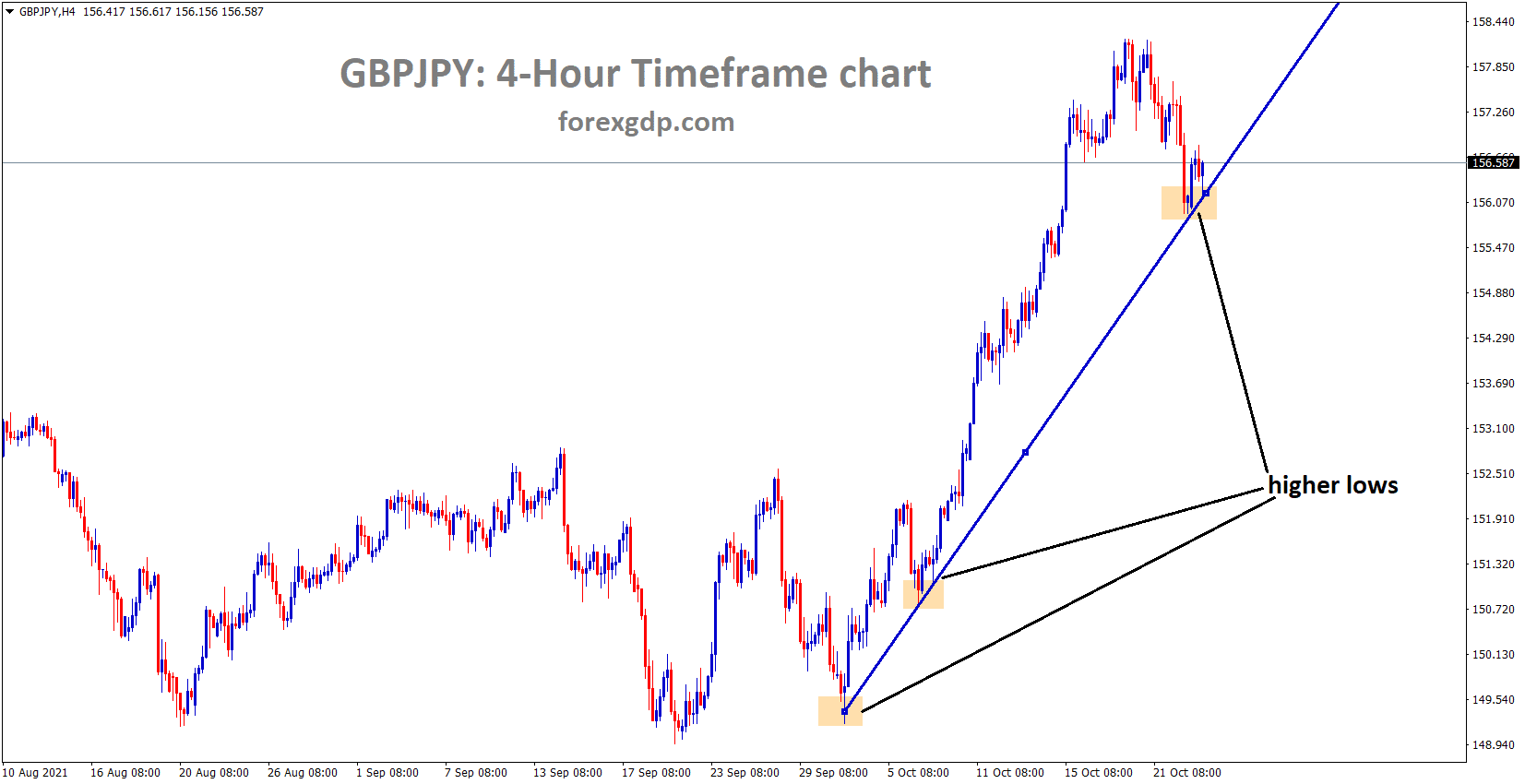

UK Pound: Brexit deal on Northern Ireland Protocol worsens

GBPJPY is moving in a bullish trend line and the price has reached the higher low area of the trend line.

European Union could terminate Post Brexit deal if UK’s Disagreement on Northern Ireland protocol deepens.

As the UK has suspended the Northern Ireland protocol speech between EU and UK, Already PM Johnson threatened Article 16 and affected Everyday life.

Now EU decided to Terminate Post Brexit deal is not a straightforward one, and it will be unusual for the other 27 EU countries.

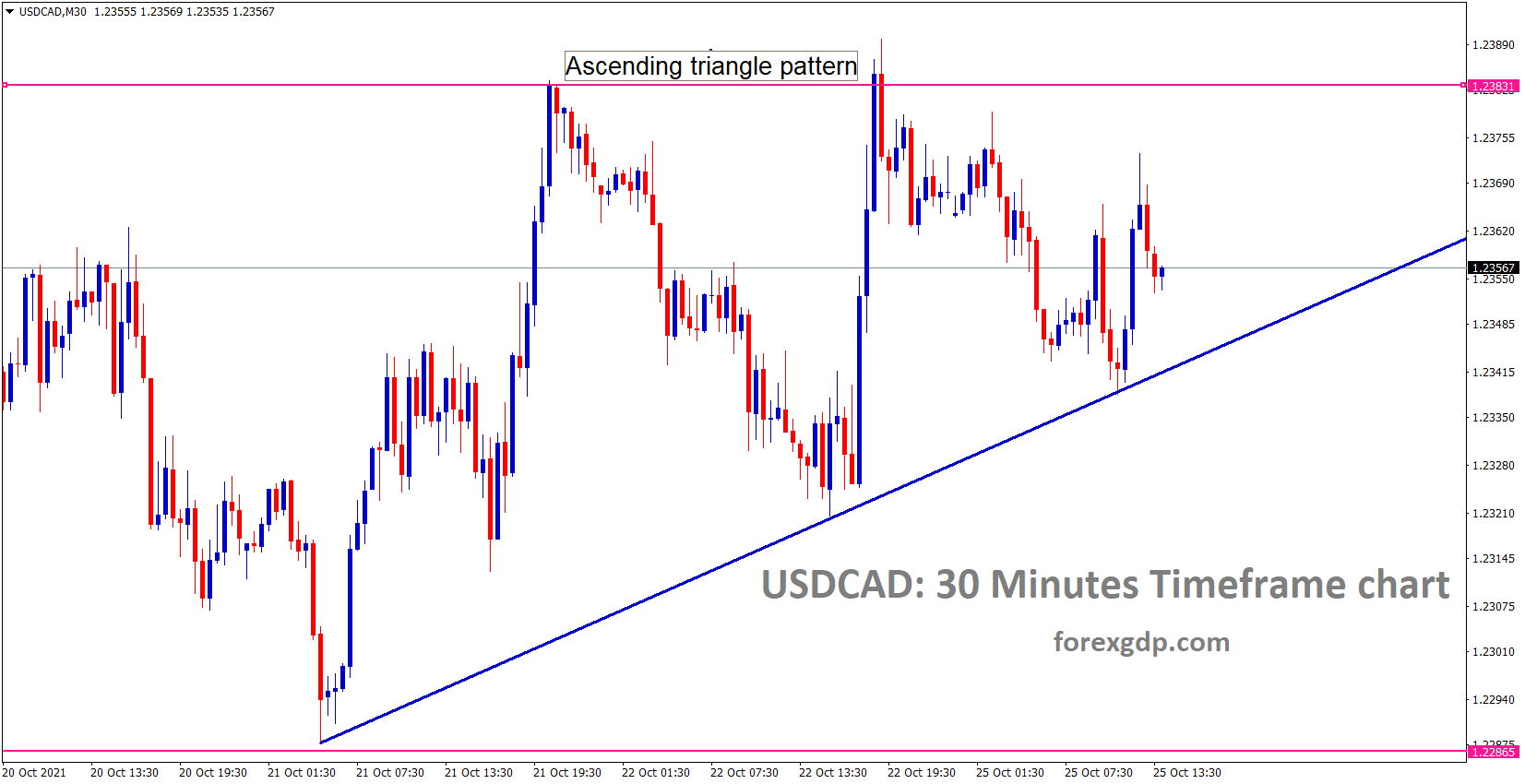

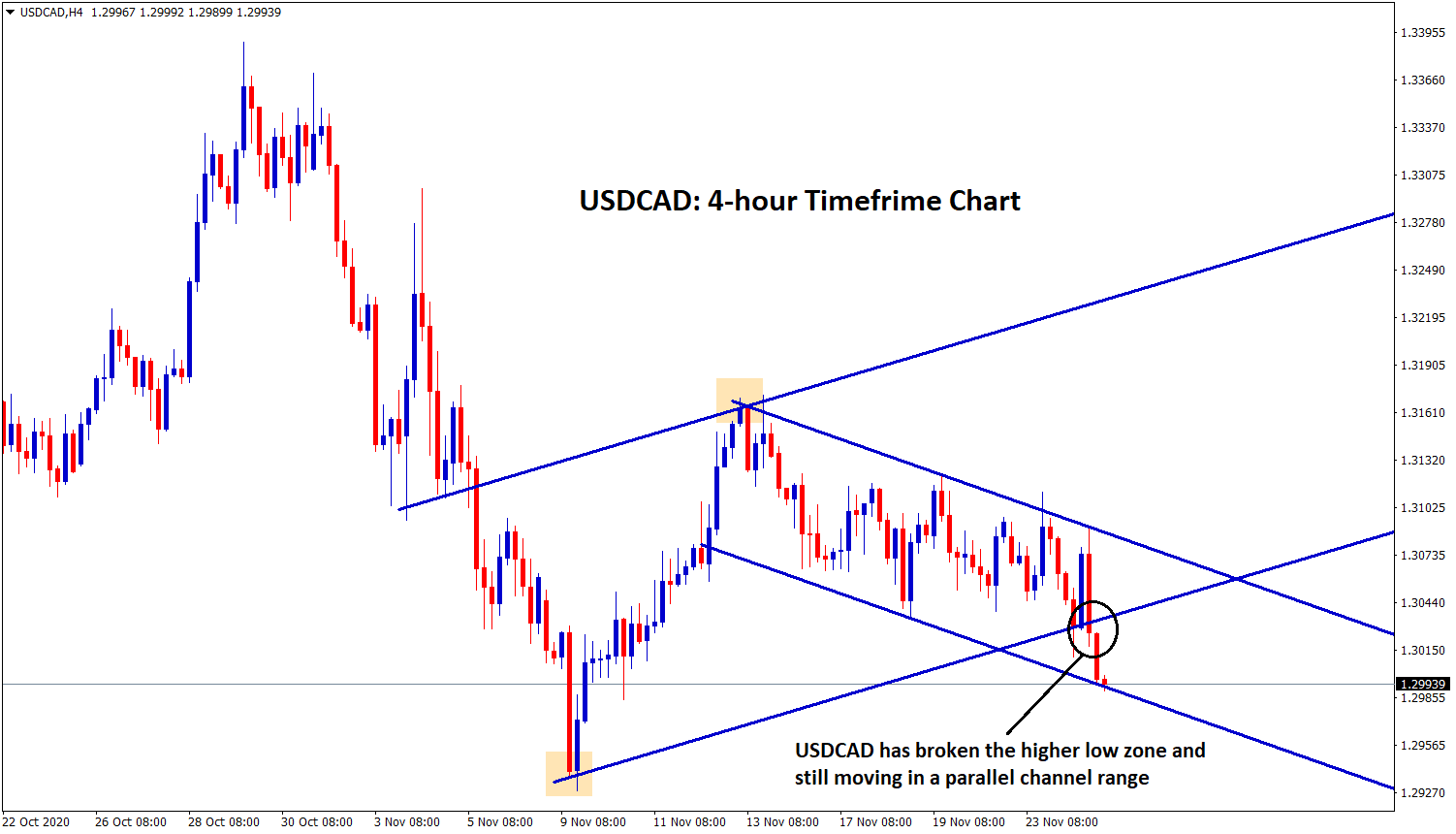

Canadian Dollar: Saudi cautiously increased Oil outputs

USDCAD is moving in an ascending triangle pattern and higher high progressing.

Crude oil is made higher day by day, and the Canadian Dollar hits strong resistance as a consolidation area.

And Bank of Canada monetary policy meeting happening this week, and we can expect rate hikes and tapering.

Saudi princess Salman said OPEC+ nations cautiously increased supply from our side because still, we have demand disruptions.

And USDCAD trying to reach the Previous resistance of 1.24 as a correction; otherwise, it may go for a support area of 1.23 level this week.

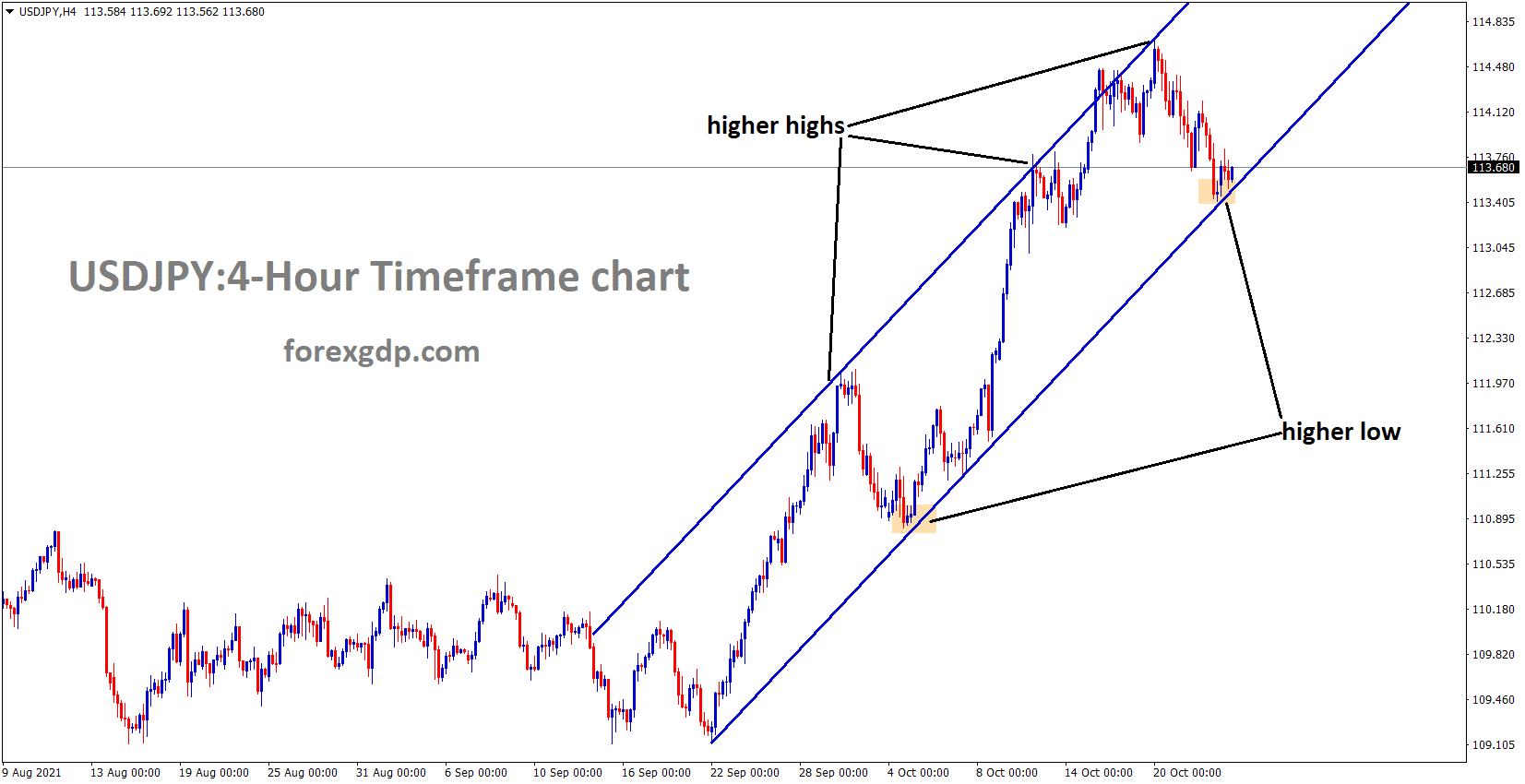

Japanese Yen: US Spending bill like to passing in next week

USDJPY is moving in an ascending channel forming higher highs and higher lows. now the price has reached the higher low area of the ascending channel.

US Joe Biden spending bill will pass in next week as Bipartisan senators ready to talks with Joe Biden this week.

And Japanese Government was ready to withdraw stimulus if covid-19 cases fell below higher levels.

Bank of Japan monetary policy meeting happening this week; no tapering or rate hikes are expected from this meeting.

USDJPY makes higher after Japanese Yen shows much weaker in the economy than other developed nations.

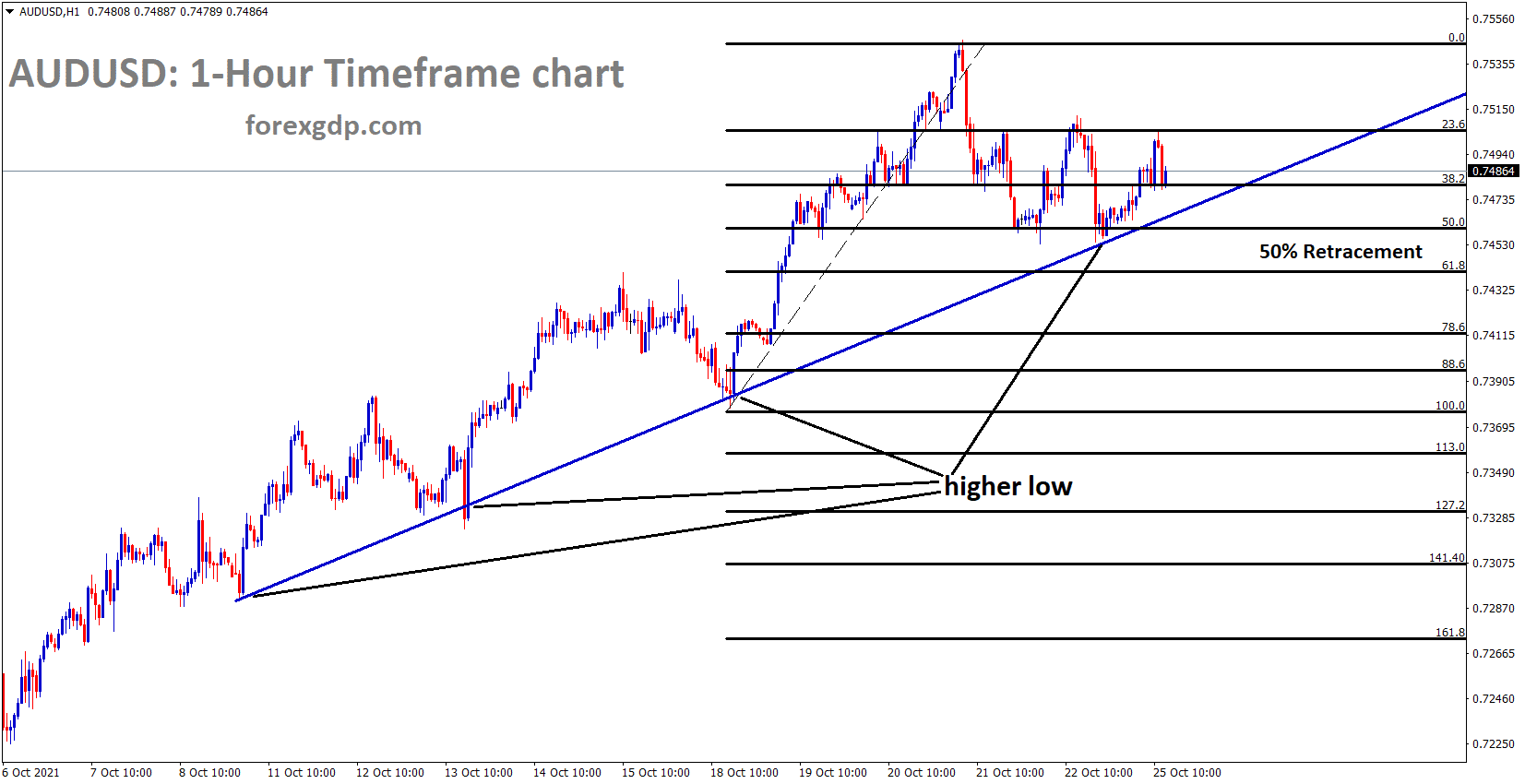

Australian Dollar: Coal exports improved in Australia

AUDUSD is moving in a bullish trendline and it’s rebounding after hitting the 50% retracement level and higher low area of the bullish trend line.

Australian Dollar makes higher as Coal exports higher to China as Electricity crisis prevailing in more regions.

As China had stopped excess supply of Coal from Australia in 2020, Now it has been released for more shortage of coal production in China itself.

This week US GDP data is scheduled; based on this data, the Australian Dollar will perform.

And Commodity prices lifted higher more for the Australian Dollar till year-end.

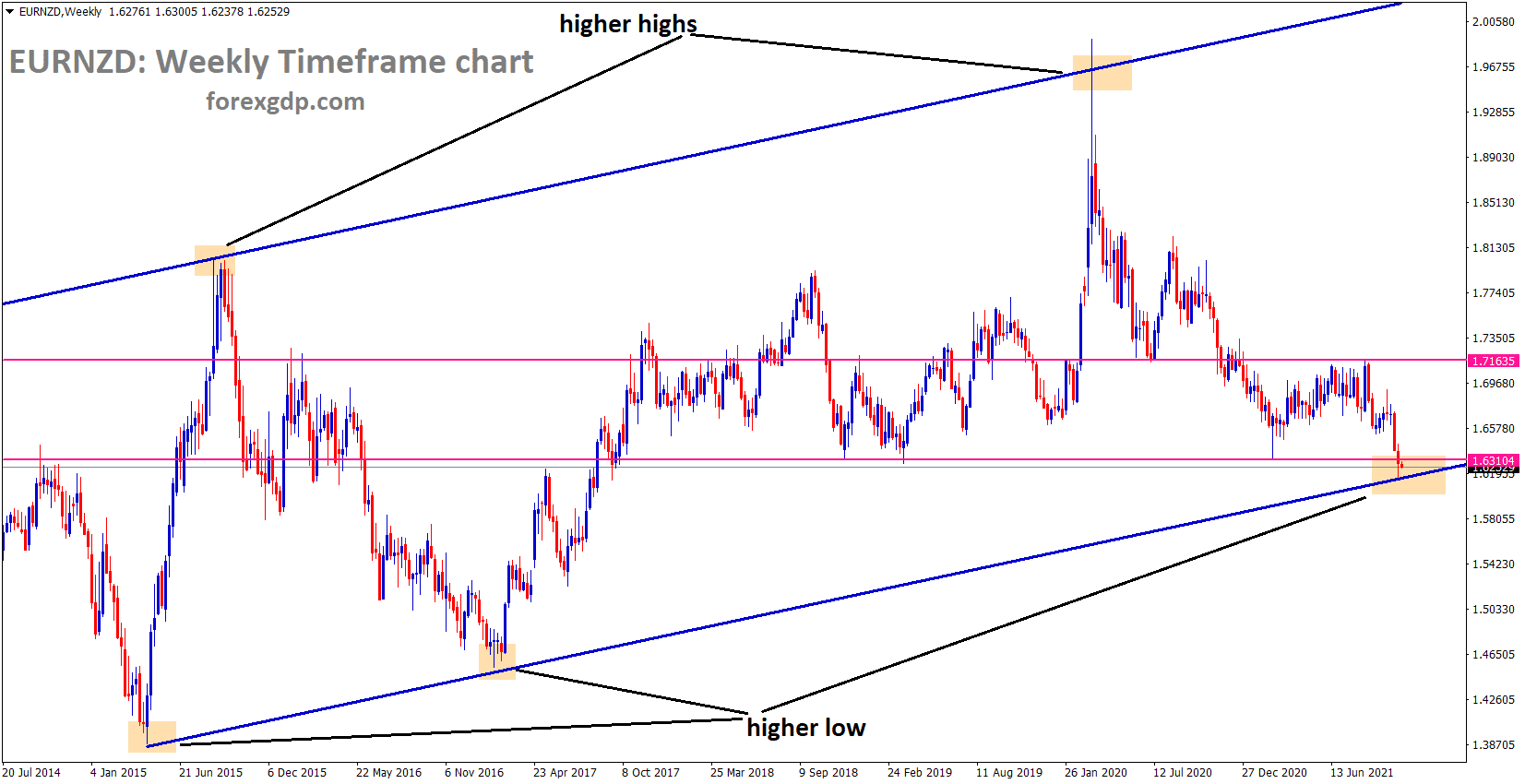

New Zealand Dollar: Auckland faced Tier 3 lockdown

EURNZD is moving in an Ascending channel range and now the market is standing at the higher low area of the channel line and horizontal support area

New Zealand Dollar stays stronger momentum in the market as Covid-19 cases decreased from higher. But still, Auckland facing Tier 3 lockdowns for an extension of 2 weeks.

China Evergrande is ready to settle $83.5 million in US Government bonds and puts less stress on US Dollar.

And FED Powell stated it’s time to taper and not to hike rates commented makes US Dollar start bull run by year-end.

And New Zealand Dollar seeks another rate hike from RBNZ in the next meeting as stronger numbers from Domestic data

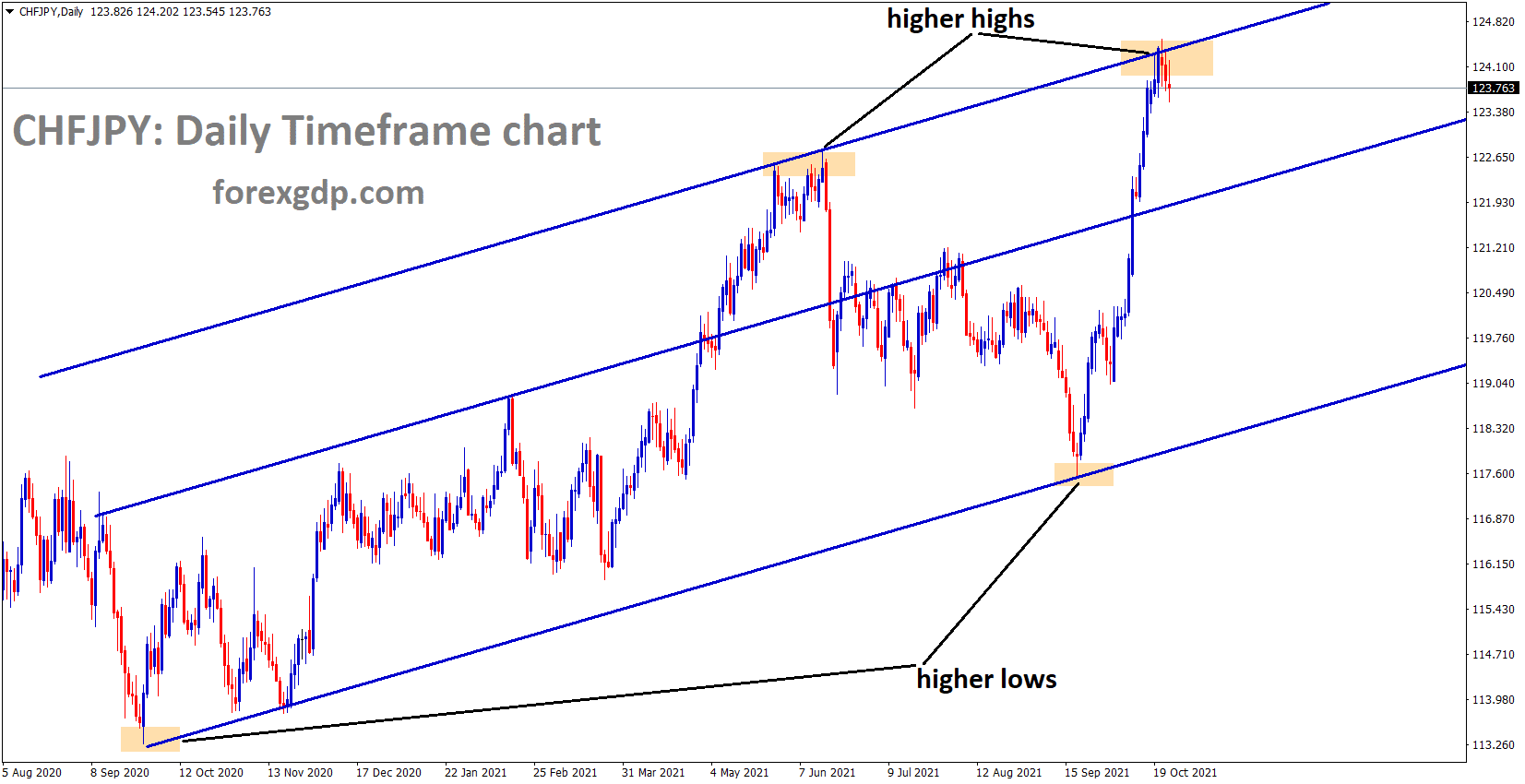

Swiss Franc: China Evergrande issue supports for Swiss Franc

CHFJPY is moving in an uptrend line and now the price is at the higher high area of the uptrend line.

Swiss Franc made higher after China Crisis of Electricity, Real estate and Covid-19. Investors pull out of Core countries to perimeter countries like the Swiss zone and US Zone.

US GDP data scheduled this week based on this reading Swiss France will perform.

And Swiss Zone shows moderate vaccination and easing lockdown more.

But inflation is still under the 2% target, and SNB shows no FX intervention.

Swiss Franc remains a dominant currency in Crisis time next to US Dollar as a stable currency.

Now China facing more financial trouble due to Real estate giant Evergrande default issue.

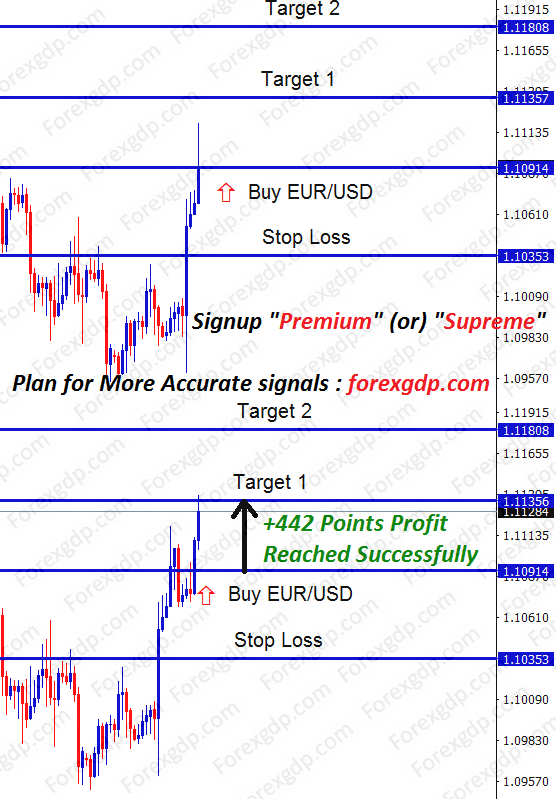

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/