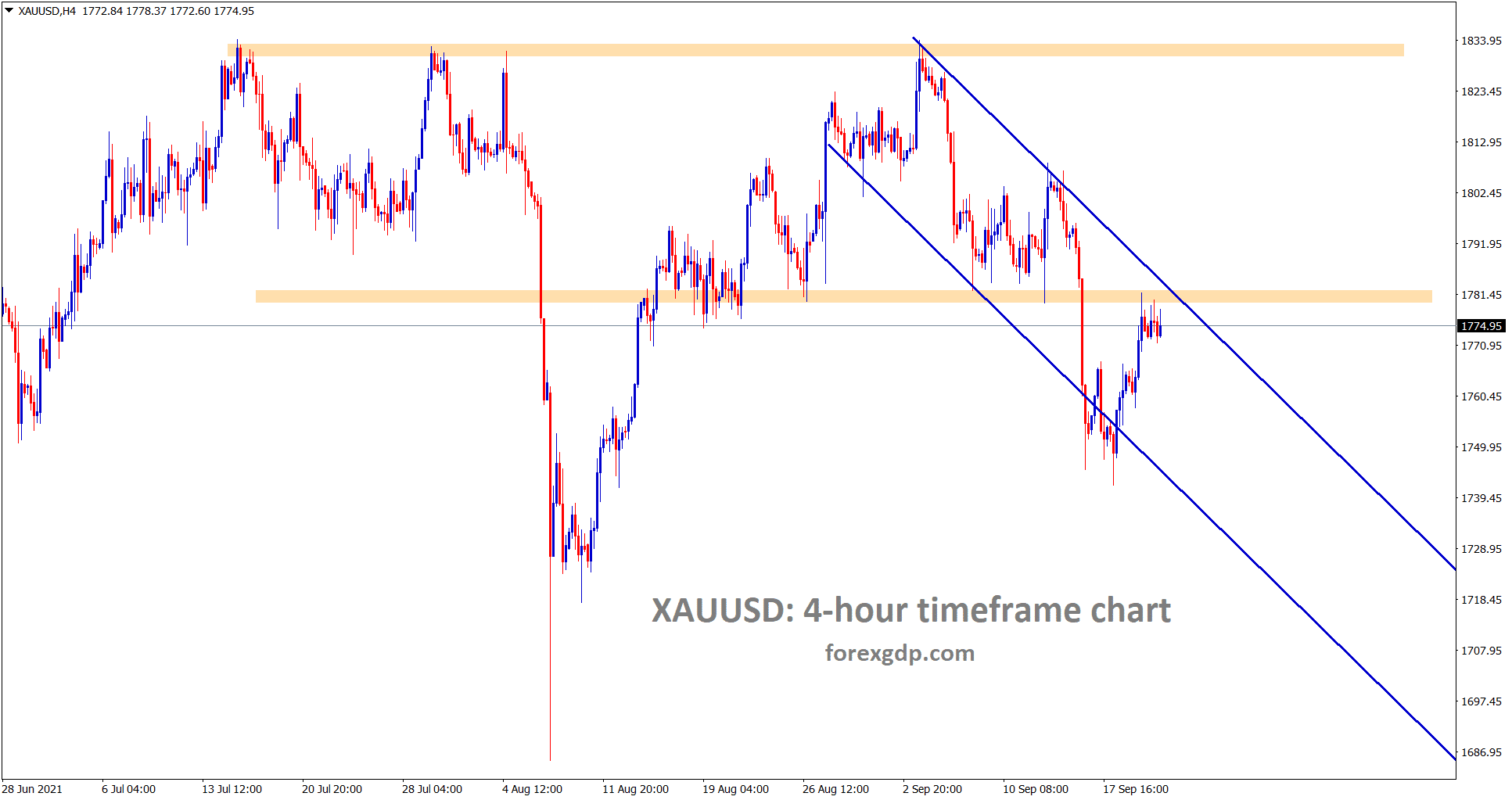

Gold: FOMC Projections and China Global Cues

Gold is moving in a descending channel and also hits the previous horizontal support area which have chances to convert into new resistance.

Gold prices are slightly higher in the market seems as Lower high correction in the market.

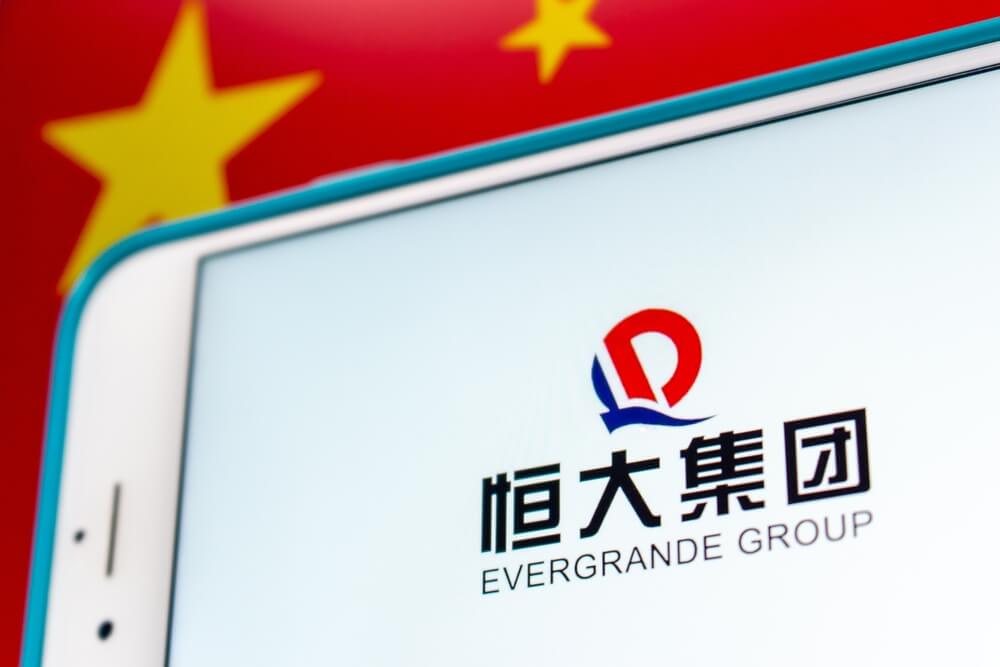

As China Debt company Evergrande said it will post coupon of Bond 2025 payments soon this week and not too afraid as the statement said.

This statement now cools investors and cheers to gold prices upside.

And FED meeting happening Today as all expected thing is tapering from FOMC outcome.

China Central bank announced more liquidity injections to the market as faced more economic difficulties.

Stimulus injections play support for the Chinese economy to retrieve from Debt crisis and Pandemic situation.

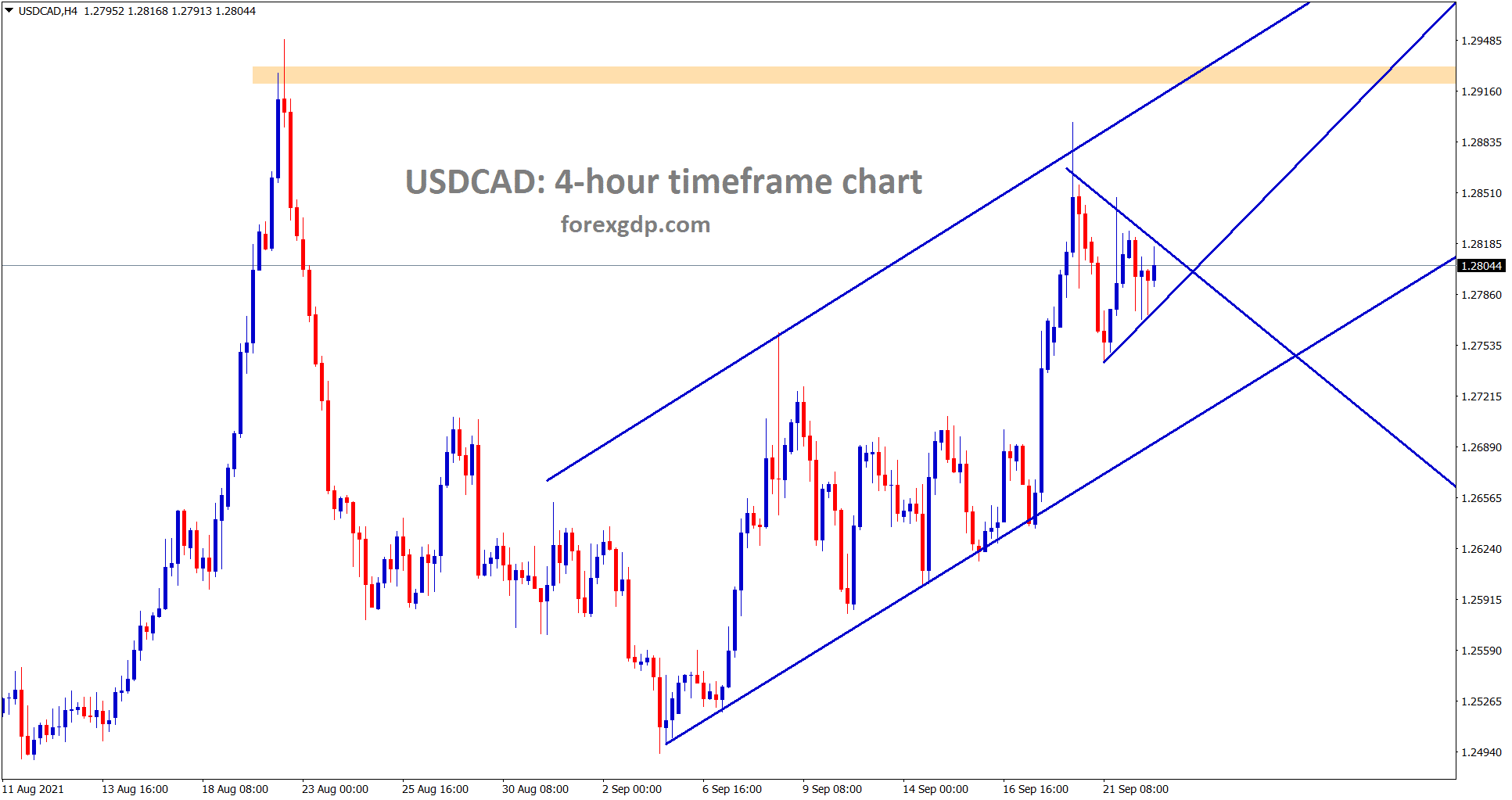

US DOLLAR: FED Projections by Survey participants

USDCAD is moving in an uptrend and recently formed a small symmetrical triangle – wait for breakout.

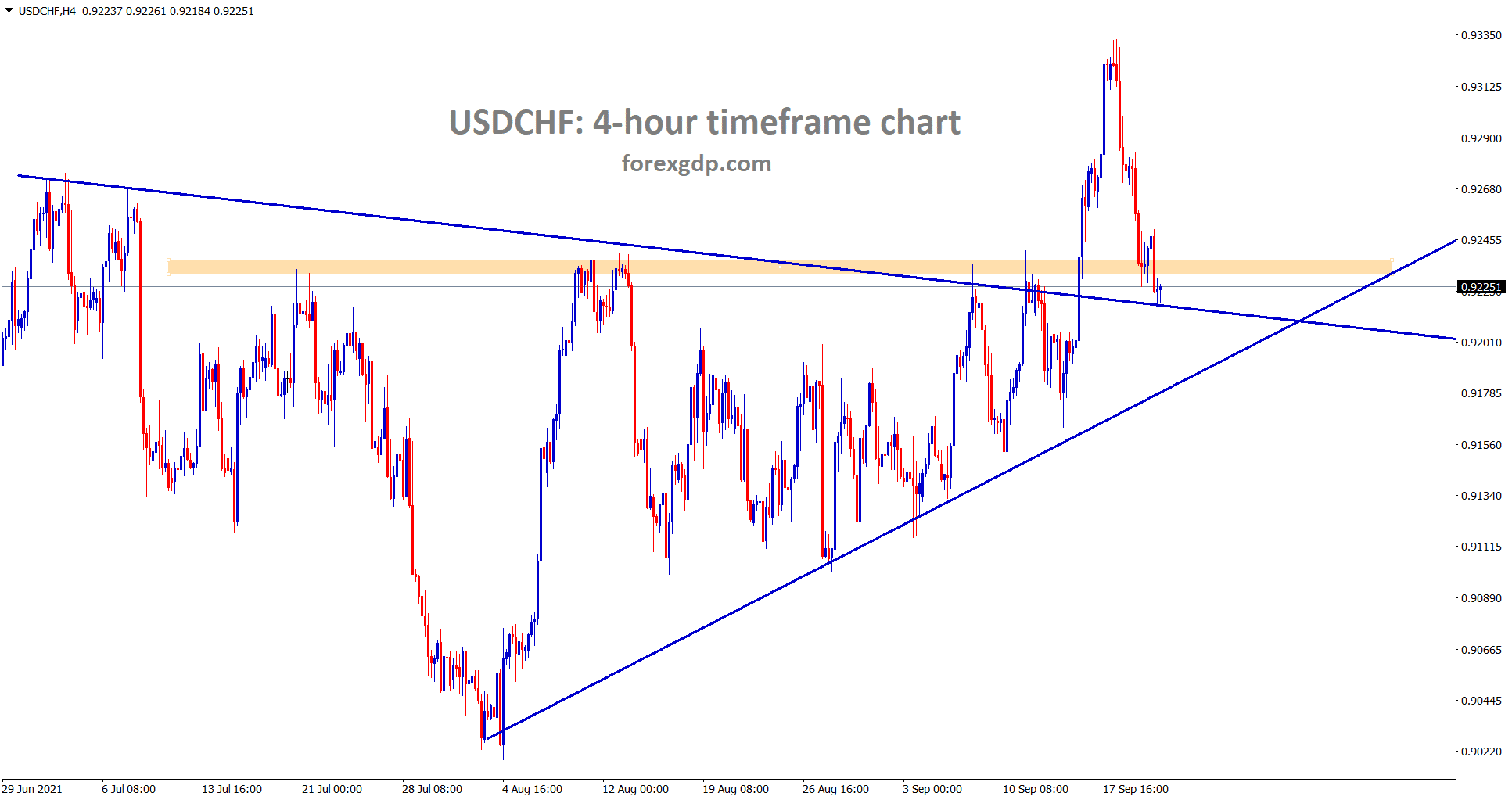

USDCHF retested the broken symmetrical triangle area.

According to CNBC FED Survey, FED will not do tapering Today or next month, it will plan to be announced in November month and From December month will have tapering.

Currently, 120 billion purchases assets per month are progressing, Now the plan for Reduction of at least $15 billion tapering’s per month will like to announce in December month.

And Rate hikes are not expected until Next year-end, But Two rate hikes are expected in 2023.

Annual Growth of US economy is Forecasted to 5.7% for 2021 and down from July Survey. Due to Delta variant Economy plunged to 0.65% in GDP as Forecasted in Survey.

US and UK Trade Deal talks

US Joe Biden said he was Strongly objected to the Northern Ireland protocol on closing Borders as Per BBC reporting news.

US and UK started to talks for Free trade agreement today, UK PM Johnson visits the US for trade deal.

And US President Joe Biden said Talks are progressing, soon may close the deal as Hopes.

This Joe Biden opinion from may be taken into serious effect in the market, once deals are reached Free trade agreement will be signed.

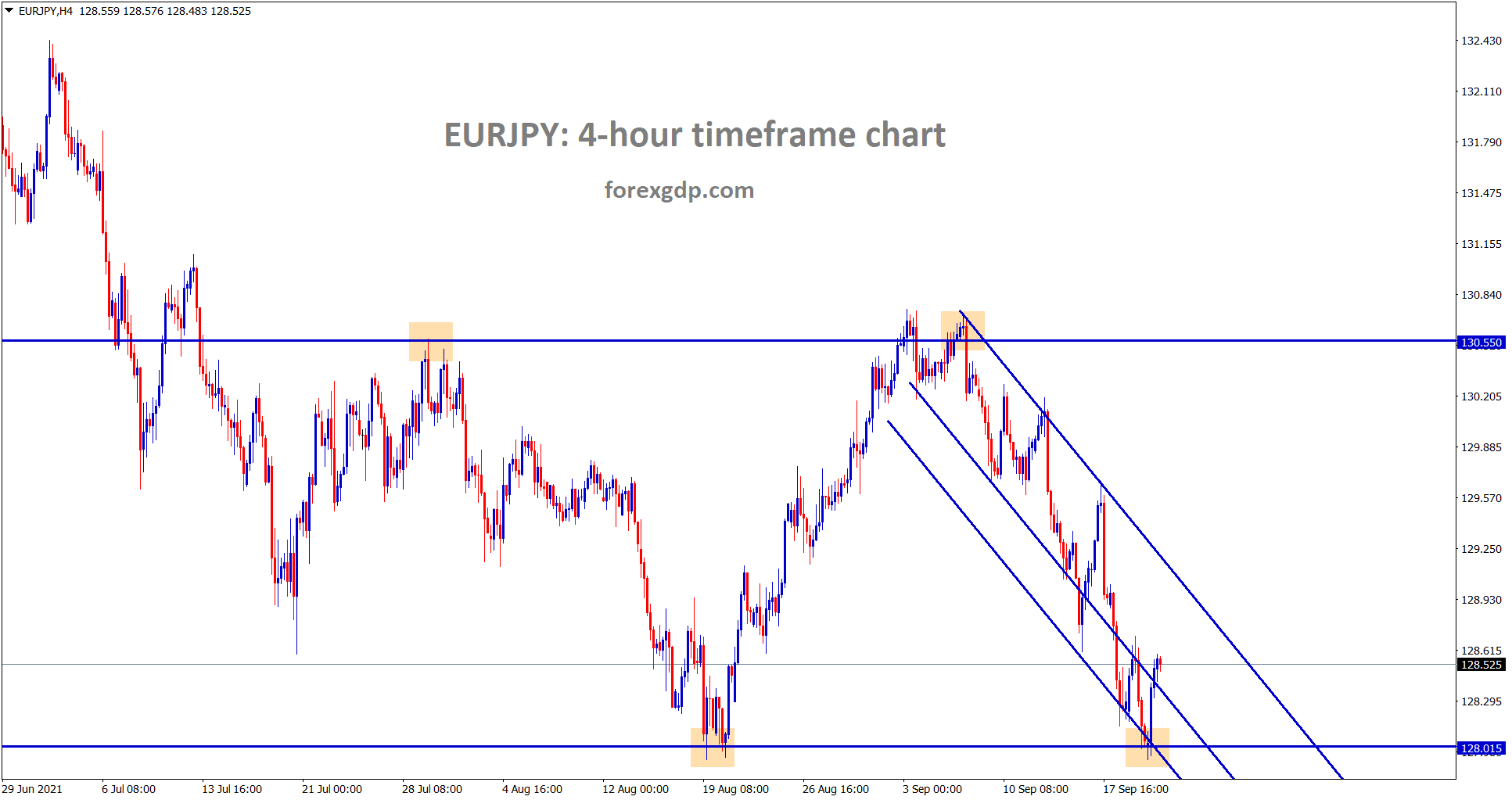

EURO: Divergence in EU and US monetary policies

EURJPY is still moving in a descending channel range and recently rebound from the support area.

FOMC meeting is happening today, all eyes are on FED Tapering view in today’s meeting.

And FED may announce tapering by December is all one Knows, but soon any tapering that may happen is expected as Hopes.

And first-Rate hikes will be done in late 2022 and following second rate hike in 2023 as previously projected by FED.

ECB Governing Council member Madis muller said ECB will not scale back asset purchases until March 2023, until ultra-loose monetary policy seems in the market.

This will alternatively plunge Euro prices into the market.

Excessive Stimulus made Euro Prices to be weaker in the market.

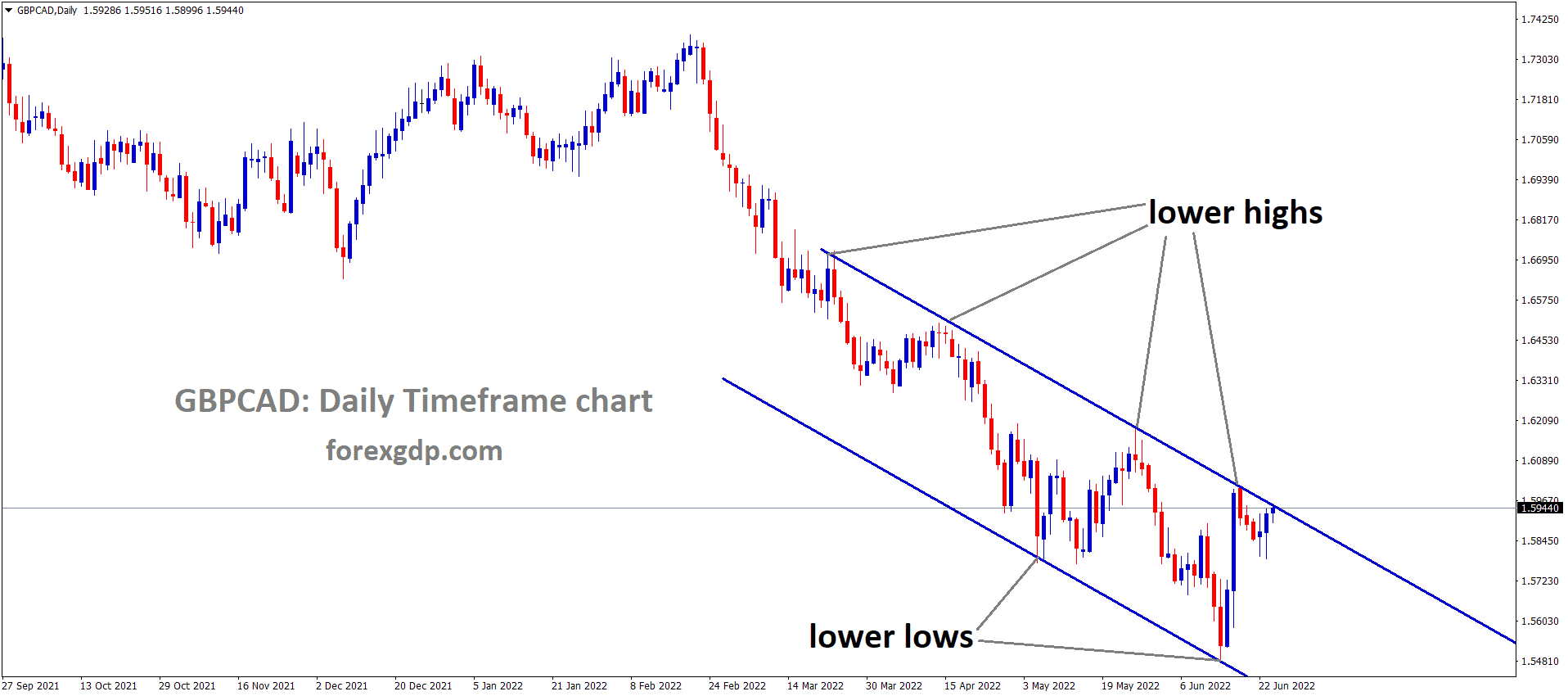

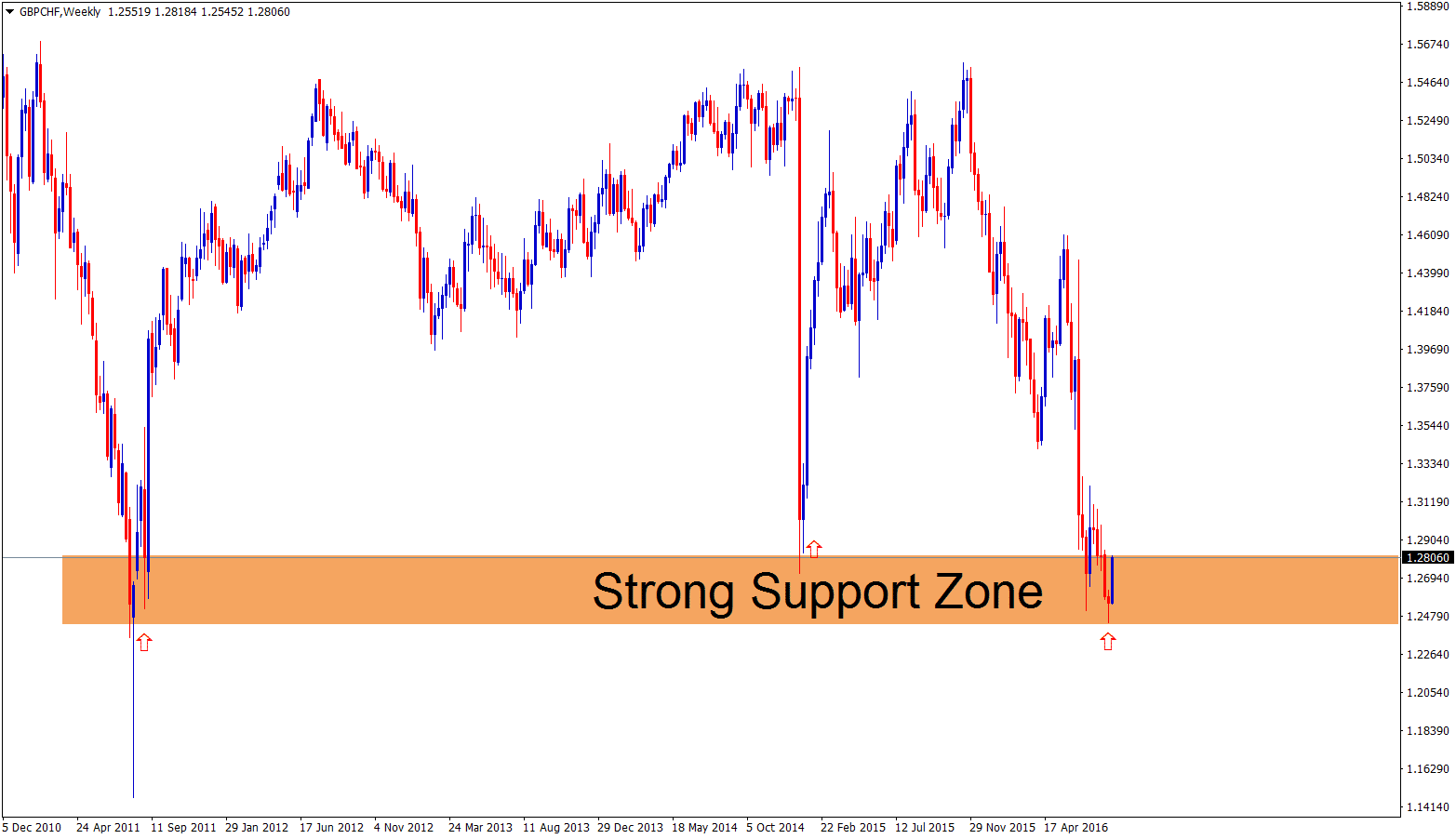

UK POUND: UK Joining for Free trade agreement

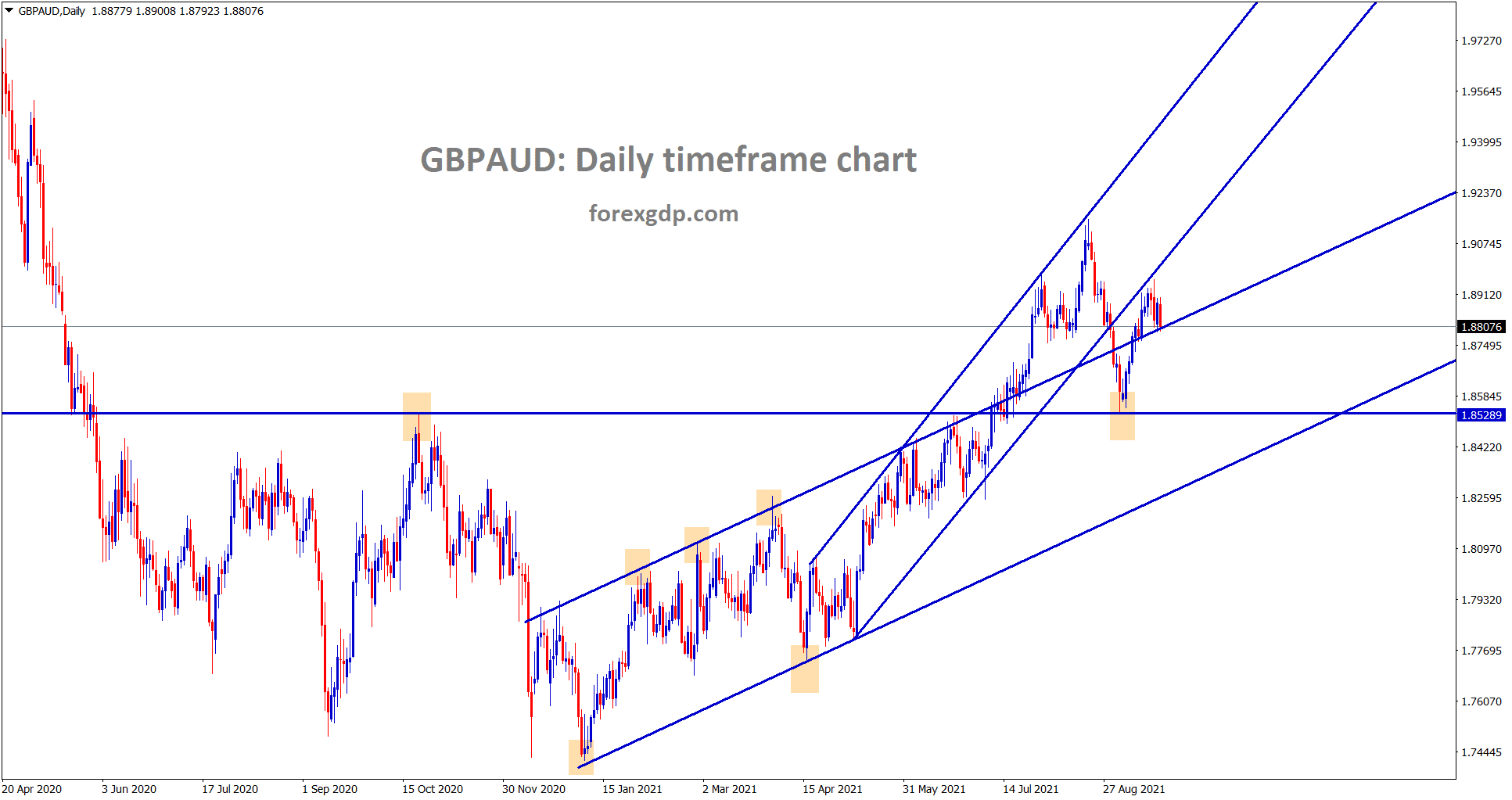

GBPAUD is consolidating at the retest zone of the uptrend lines.

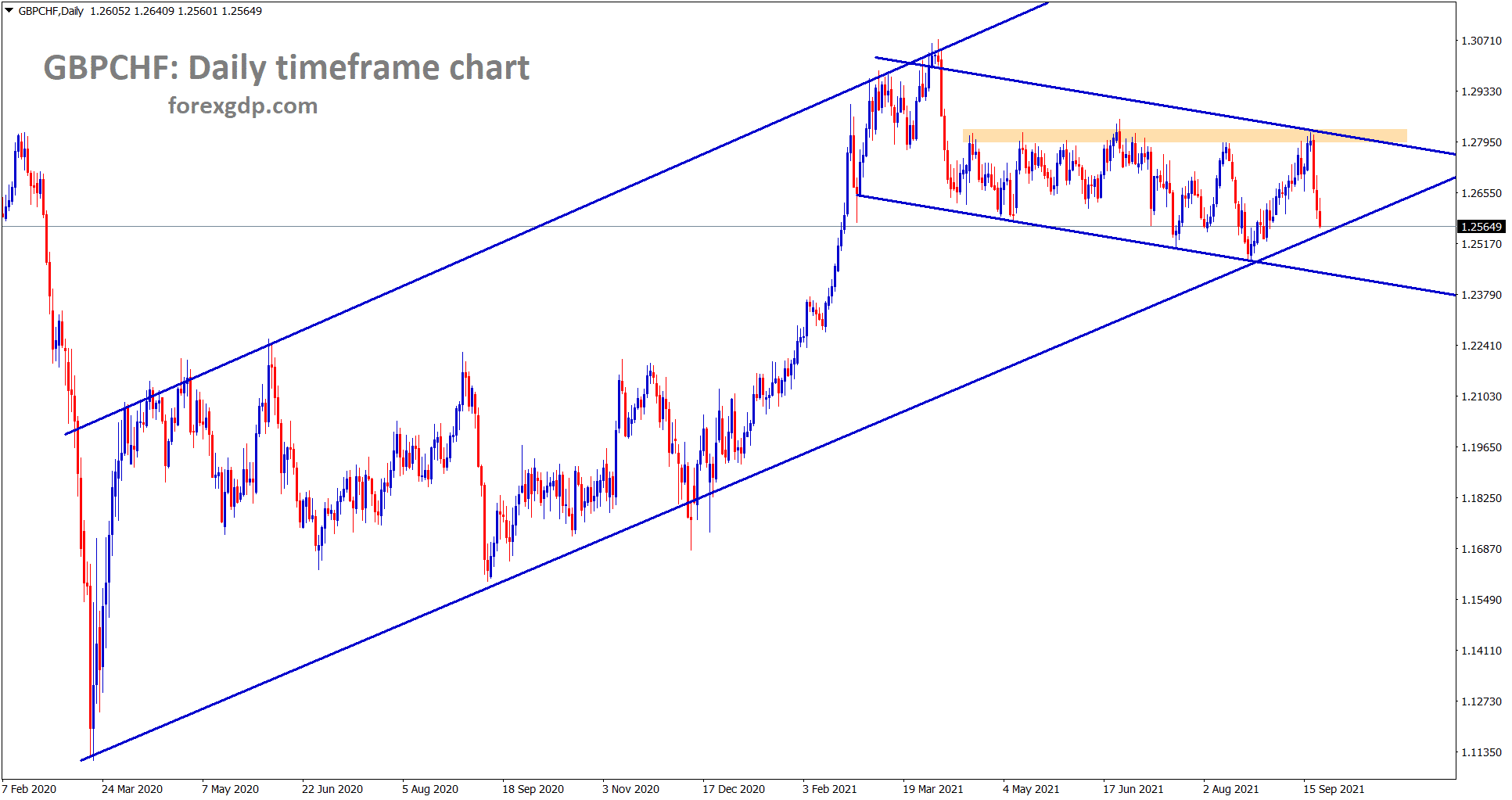

GBPCHF has fallen again to the higher low of the uptrend line.

Chinese Debt company Real-estate giant Evergrande made a meeting with Bond Holders and Said some compromise deal with Holders as Repayment will be done soon. This supportive initiation made All markets take a deep breath in action.

And People Bank of China said more stimulus is injecting to Banks for supportive measures to recover from Pandemic.

UK Pound made lower as US Dollar shows Dominant performance in the market.

From last 1.2 years, GBPUSD made higher from 1.17 to 1.42 level, and now made correction to 1.36 level as Previous support is expected.

FED meeting happening Today, if no tapering and rate hikes GBPUSD to move higher.

UK Joining hands with US, Mexico and Canada this week in Free trade agreement. This will support some efforts to UK Pound.

Canadian Dollar: China risks in Real estate curbs Oil Imports

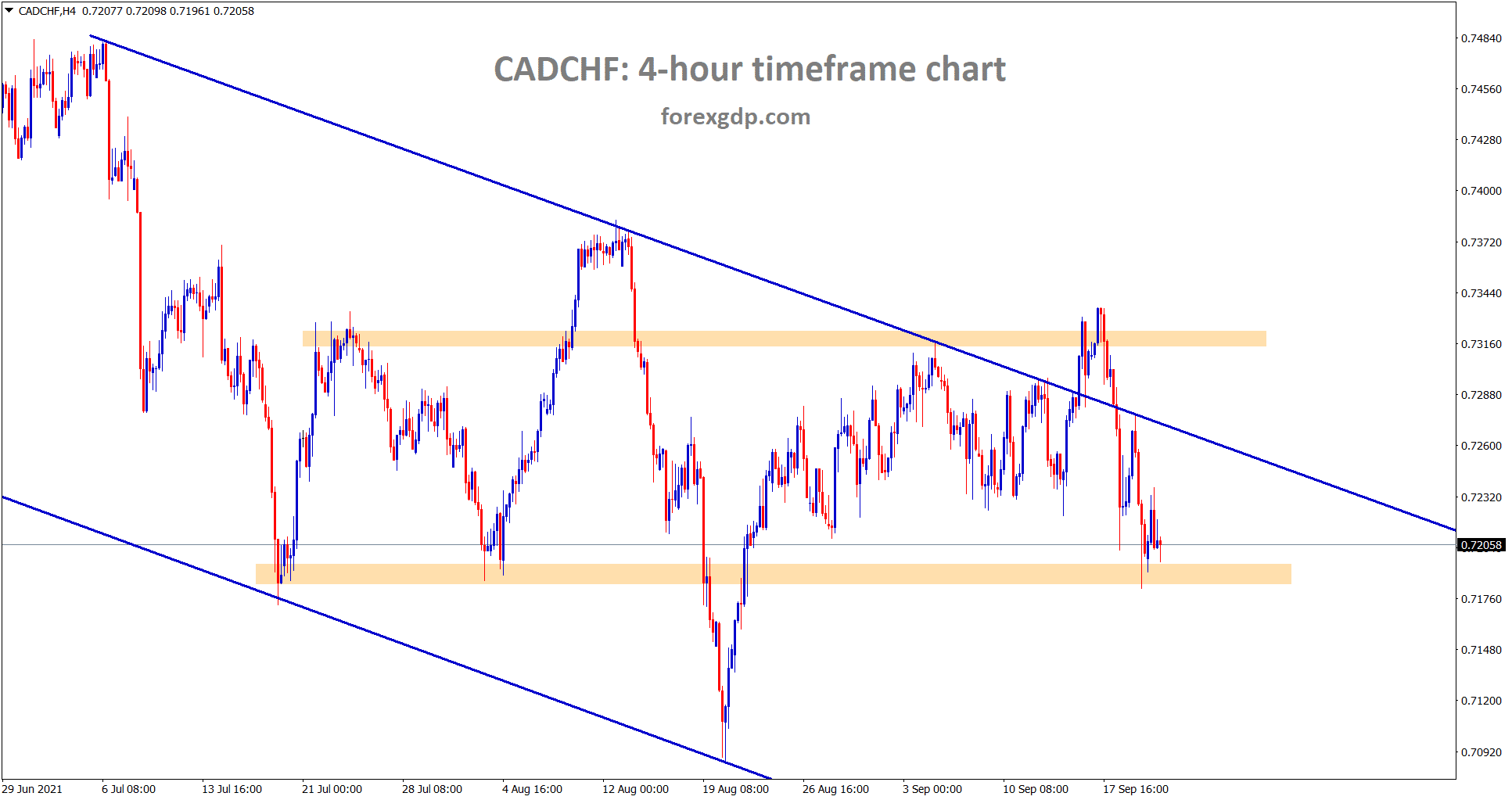

CADCHF is at the horizontal support area in a downtrend line.

Canadian Dollar faced downside risk as Canadian Election declared Current Incumbent is win over minority form of Government.

And More risks from China facing Real estate risks over Defaults to Creditors.

Now Oil Prices are rising upwards as Demand level increasing in Global level.

And IMF Chief economist Gita Gopinath said China have the talents to overcome the Defaults of Real estate risks and Settled to the Creditors side.

US Houses vote for Debt Limit increasing as 217-207 Favours for Funds rising and Debt limit increases.

Now Senate must decide for Voting to approve the Debt increasing limit.

Japanese Yen: Bank of Japan meeting Outcome

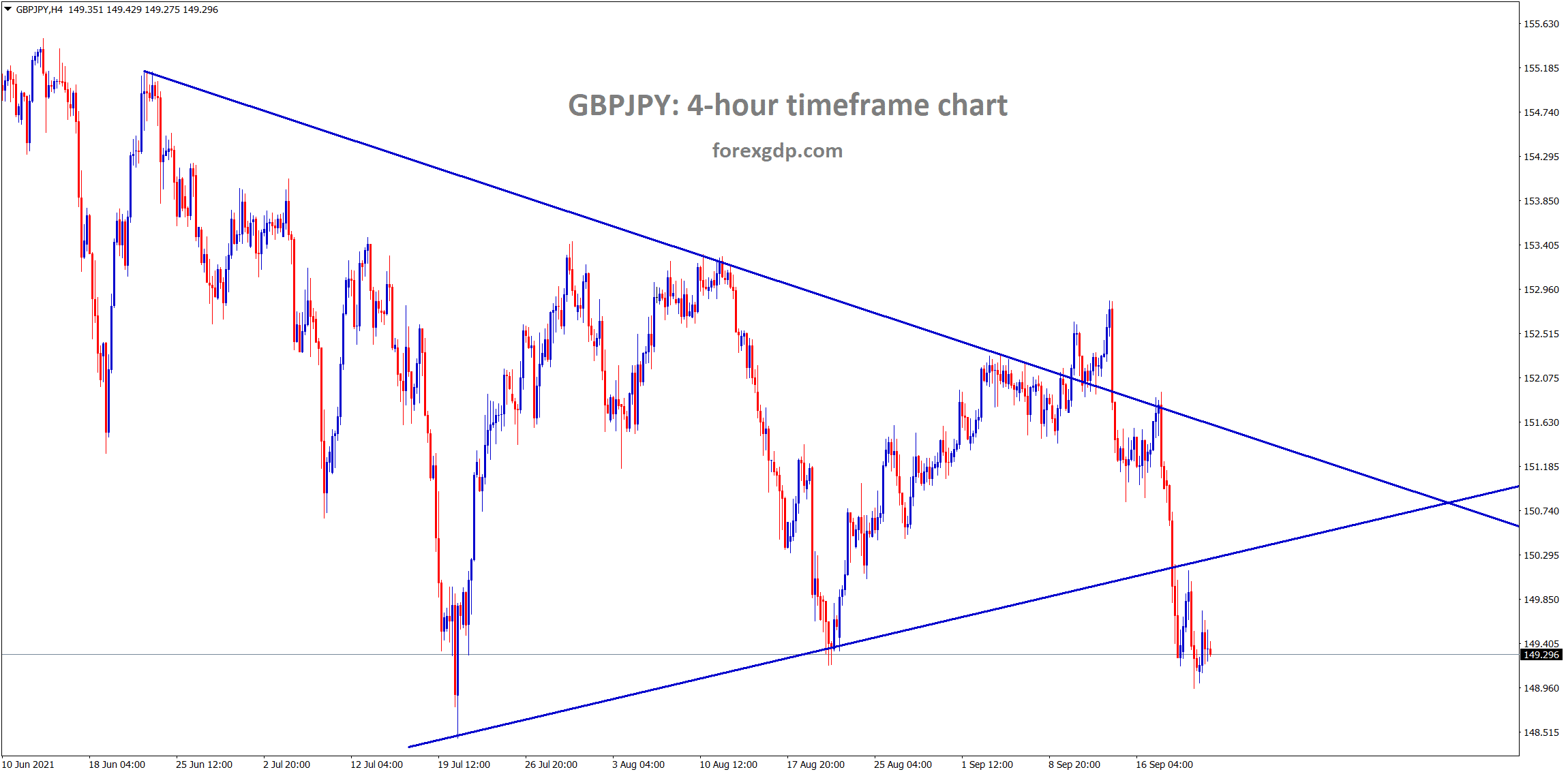

GBPJPY is at the horizontal support area breaking the symmetrical triangle pattern.

Bank of Japan holds rates steady at -0.10% without changing any stimulus reduction in Policy tools.

And Inflation remains under 2% target, Exports and industrial Output made lower due to the Pandemic situation from the Last year 2020.

A few weeks back Japanese PM Suga resignation made the other 3 contenders introduce more stimulus to the economy in the Manifesto speech if they win in the election.

So now the Japanese Yen is stronger in the market as New PM is waiting and will do something to revert economy to normal life as Japan People Hopes.

And China’s Evergrande Default issue is now taking serious by the Chinese Government, So Some results may be expected to revert defaults to Creditors as Hopes.

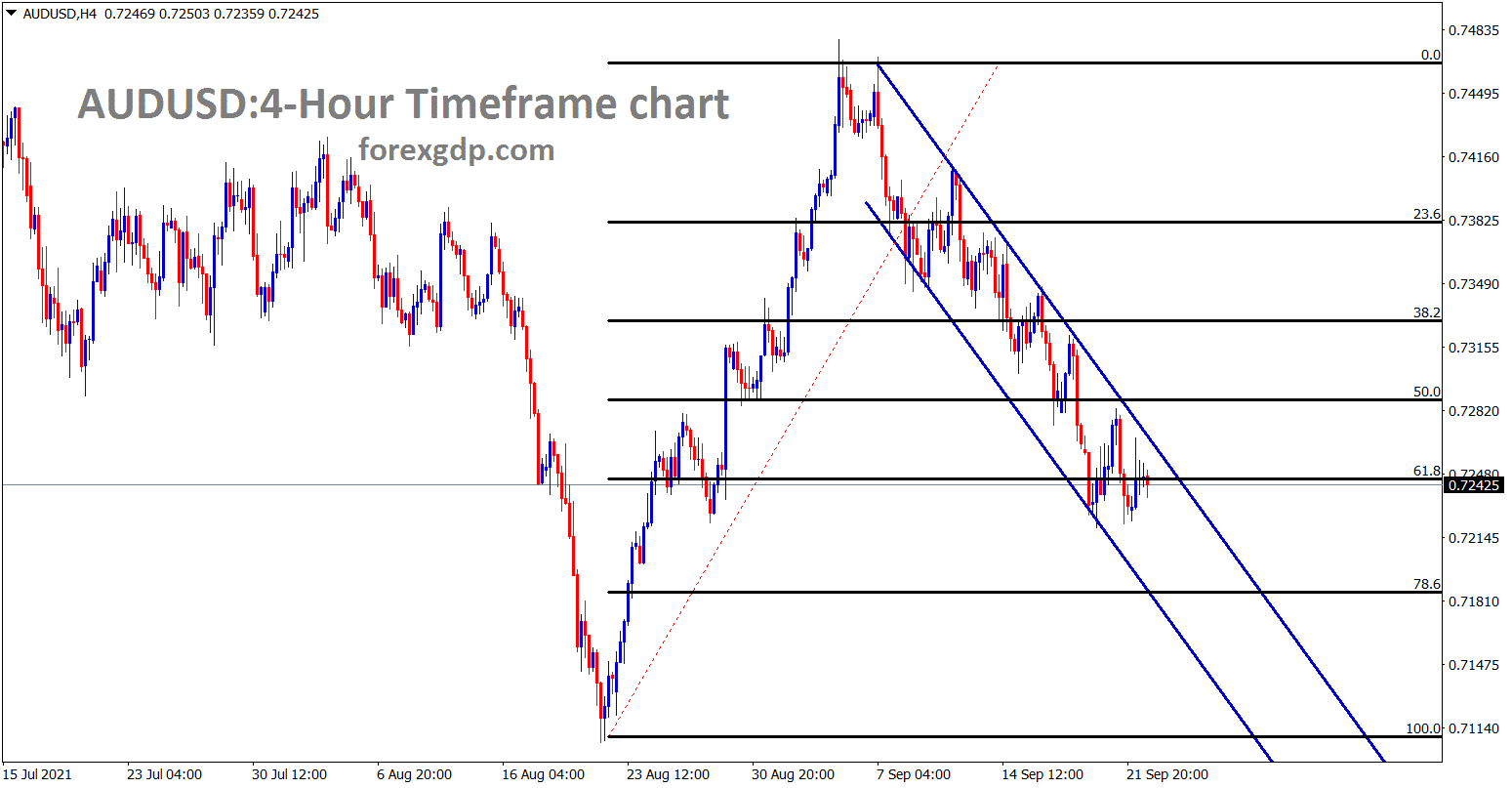

Australian Dollar: Global Cues made Pressure on Australian Dollar

AUDUSD is still moving in a descending channel range made 61.8% retracement.

Australian Dollar faces down ward pressure as Vaccinations is progressing moderately in Australia.

Victoria and New South Wales posted more Delta variant issues and now came into control.

So, we can expect any time lockdown releasing will be announced, But the China Evergrande issue makes more concern for Australia Exports to China.

As it is a real estate sector, Iron ore is a major consumption of Steel, so it might affect the Imports of Iron ore from Australia.

Due to these scenarios Australian Dollar weaken, any How Proper vaccination and Lockdown release in October may cheer Australian Dollar to flourish again in the market.

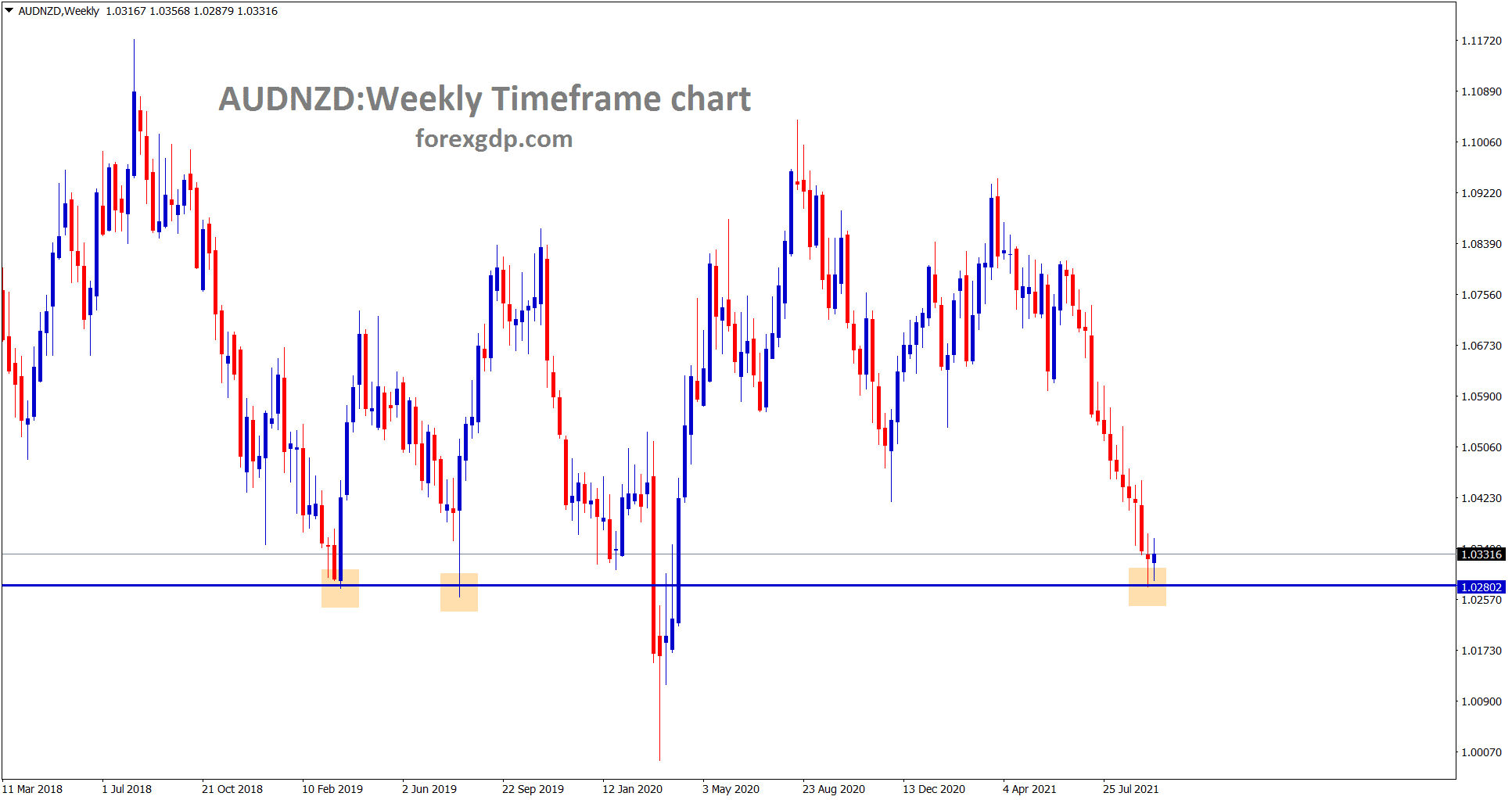

New Zealand Dollar: NZ Assistant Governor speech

AUDNZD hits the important support area – wait for reversal or breakout.

New Zealand GDT Price index fell to 1.0% from 4.0% as Weakness shown in Lockdown economy.

And New Zealand Assistant Governor Christian Hawksby said there is no change in the rate of interest in October month, because many regions facing lockdowns and Virus still spreading over many cities.

Vaccination is the proper way to handle the control of Covid-19 and once controlled the Delta variant, then we can see a lockdown release in New Zealand.

And New Zealand Dollar facing selling pressure as FOMC meeting today, any tapering or non-tapering will decide the further directions in New Zealand Dollar.

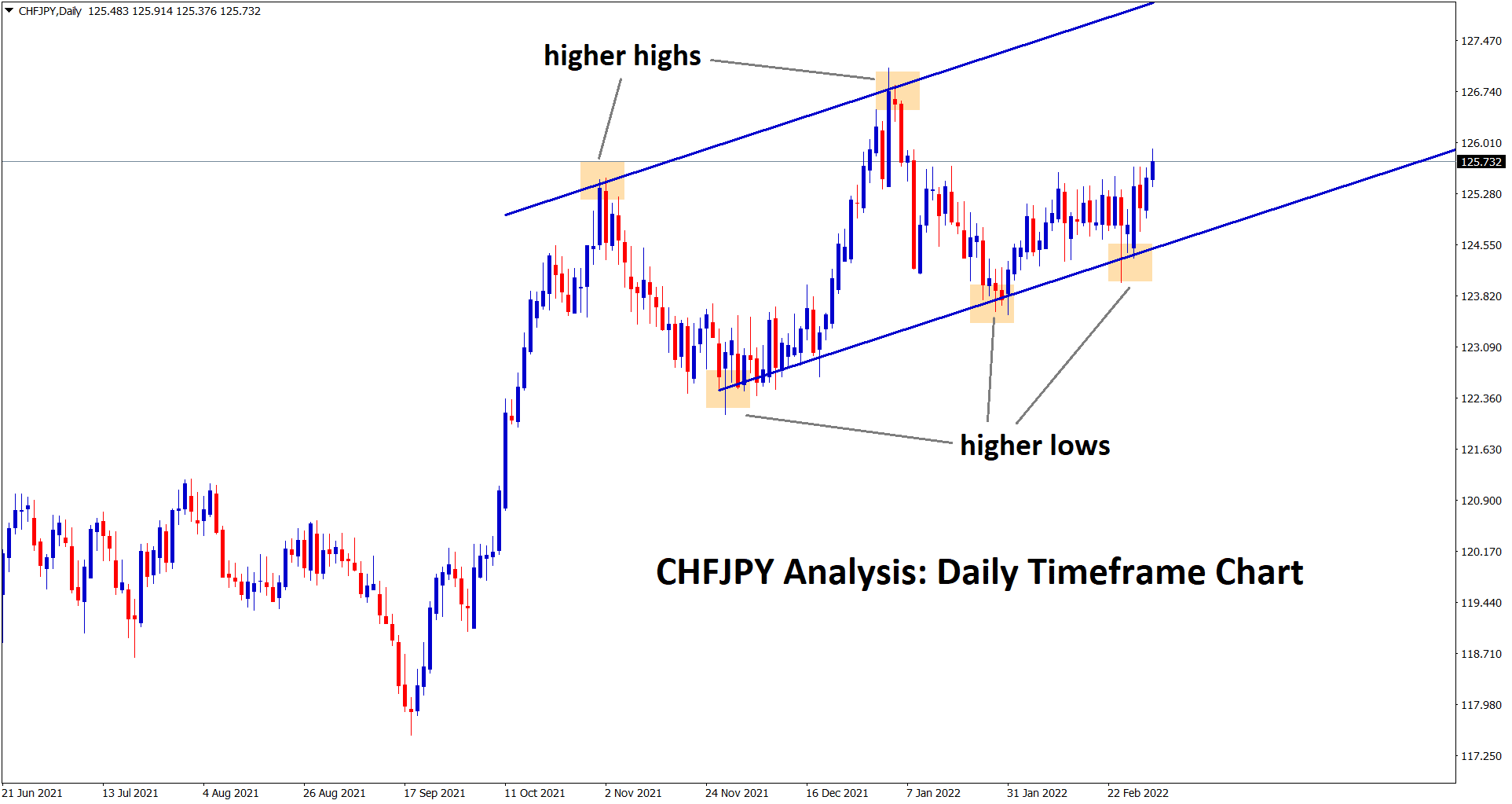

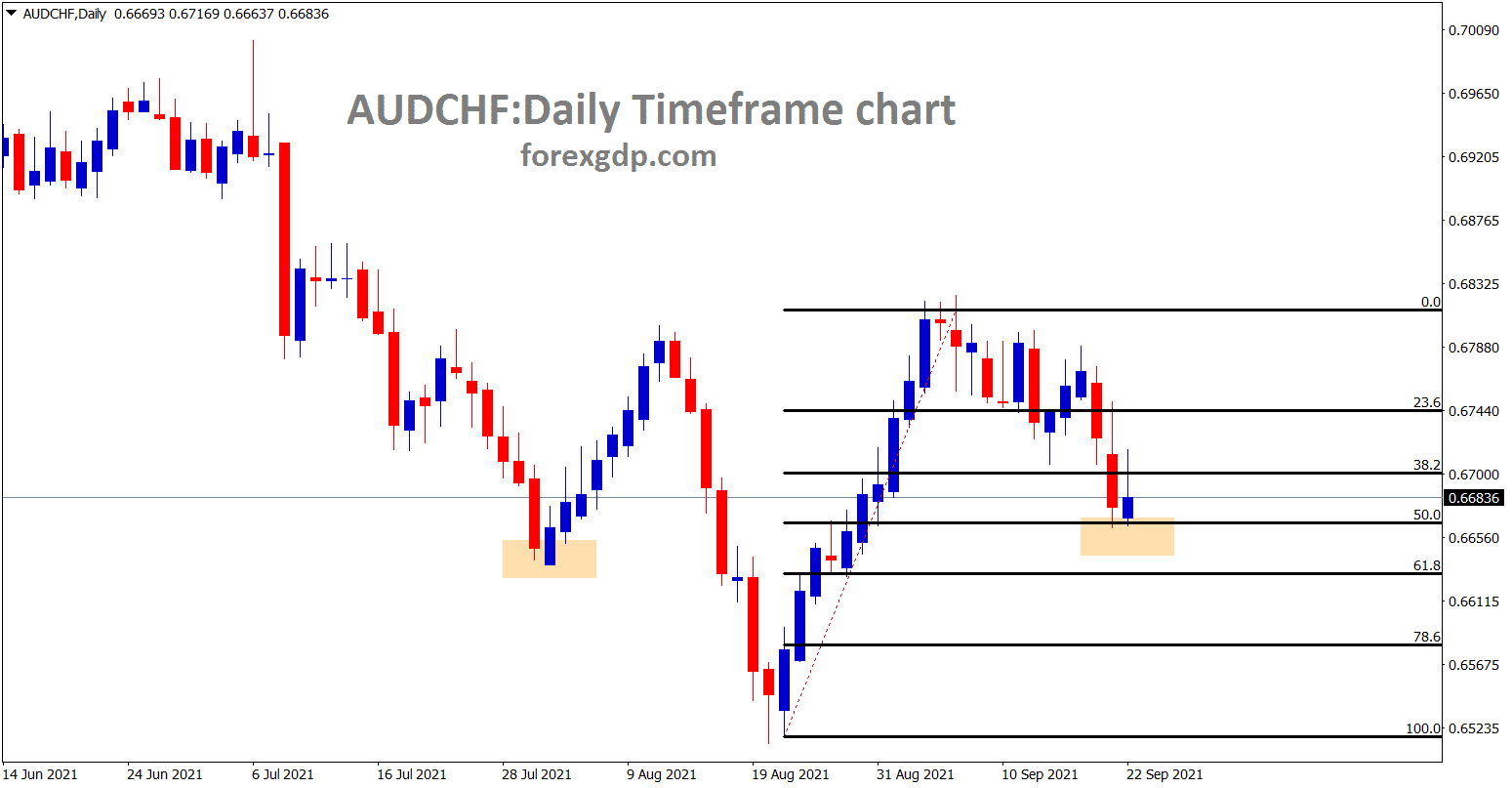

Swiss Franc: Swiss Trade surplus widened positive for CHF

AUDCHF made a retracement of 50%, wait for reversal. In another view, trying to form a inverse head and shoulder pattern.

The trade surplus for the Swiss economy is widened to CHF 4.5 billion in August comes from more exports data than imports happened in August month.

This reports shows Swiss economy is now recovering from pandemic and CHFJPY pair going to increase 1% .

And IMF Chief economist hopes on China Government to face risks in boldly on Evergrande Crisis and no more systematic risks are expected in Future.

China liquidity injections to the economy make Swiss Currency investments lower from an attractive valuation.

And Today FOMC meeting outcome will affect the USDCHF prices in the market.

Already 1% down from highs in the market as Swiss Domestic data shows recovery in the market. Swiss Current account and SNB Quarterly results are scheduled this week.

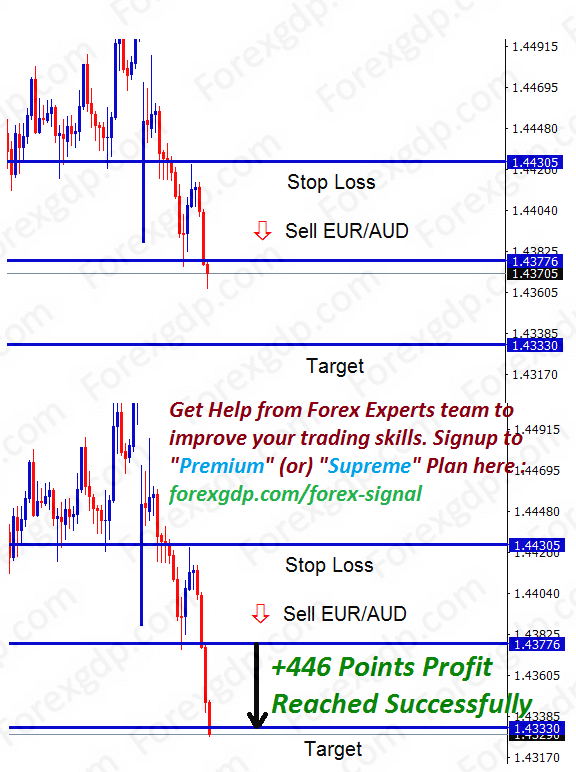

Don’t trade all the time, trade forex only at the confirmed trade setups.

Get more confirmed setups at premium or supreme plan here: https://signal.forexgdp.com/buy/