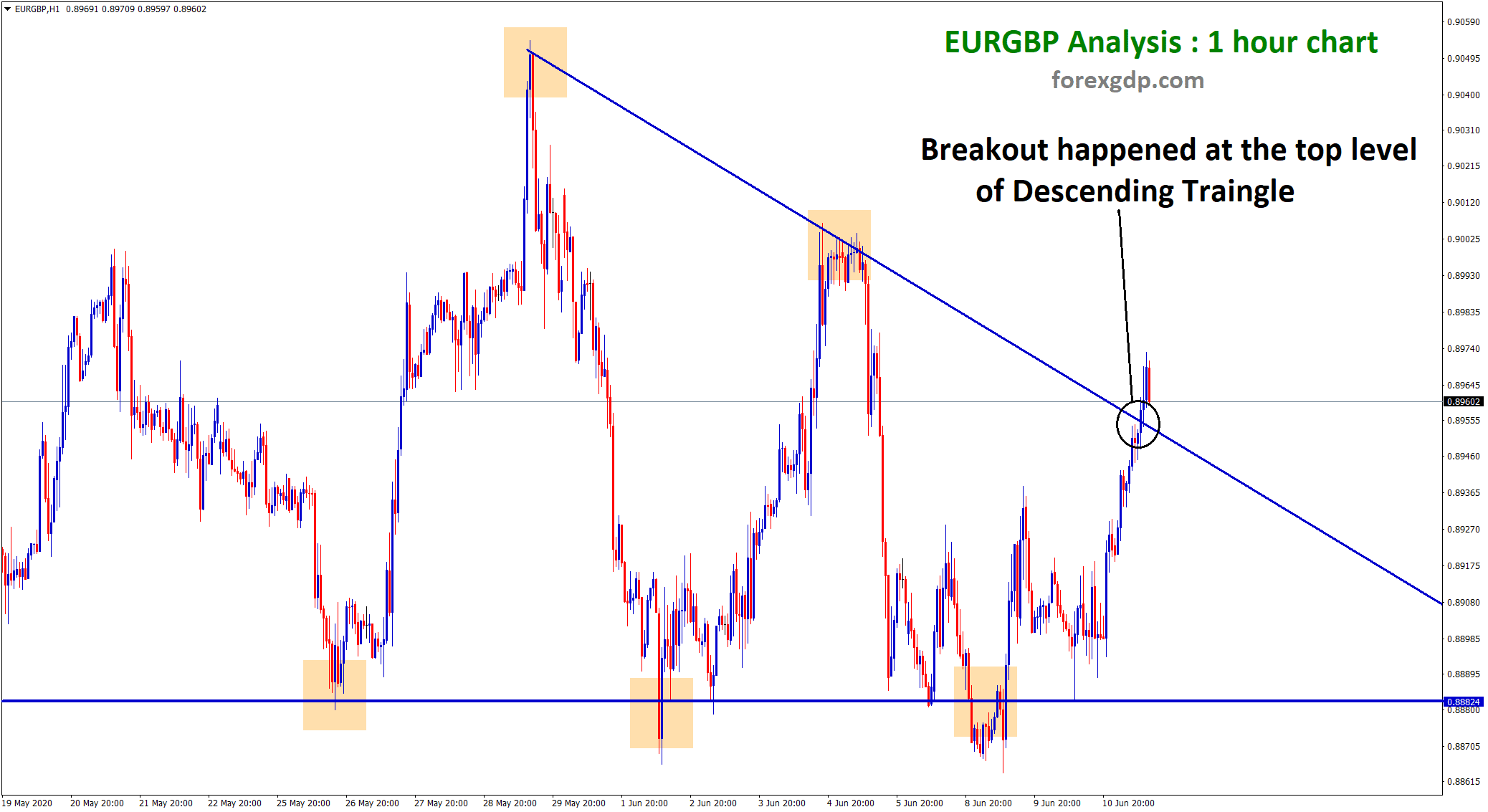

EURGBP Descending Triangle breakout

EURGBP broke the strong resistance zone recently after 45 days. Now the old resistance zone act as a new support zone for EURGBP. check the analysis here.

Today Descending Triangle pattern broken at the top level on EURGBP.

EUR/GBP price increased again due to yesterday’s FED outcome, pound gets weaker due to UK-EU BREXIT negotiations not in a smooth manner.

FED statement is given that there will be slow move in GDP from 2020 to 2022, the death toll of COVID 19 increases day by day in LONDON and created many worries for pound to boost up.

FED said continue buying $80 Billion of treasuries and $45 Billion of mortgage-backed securities per month shows not easing policy tool.

The FED news boosted EURUSD to 1.14 mark and GBPUSD to 1.28 mark, US dollar weakens and poor US economic outlook boost EURO currency.

Due to UK-EU Brexit negotiations hopes and stimulus packages for pandemic issue in BRITAIN favouring Pound in the current situation.

US threatened tariffs on EUROPE autos to push lobster tariffs on the USA to cut and it will create a problem in future.

If you like to receive the best forex signals at good trade setup, you can Try free forex signals. (or) if you need additional important trade signals with high accuracy, Join now in Supreme or Premium forex signals plan.

If you want to learn trading from 20+ years expert traders, Join forex trading course online now.

Thank you.

Thanks for nice information.