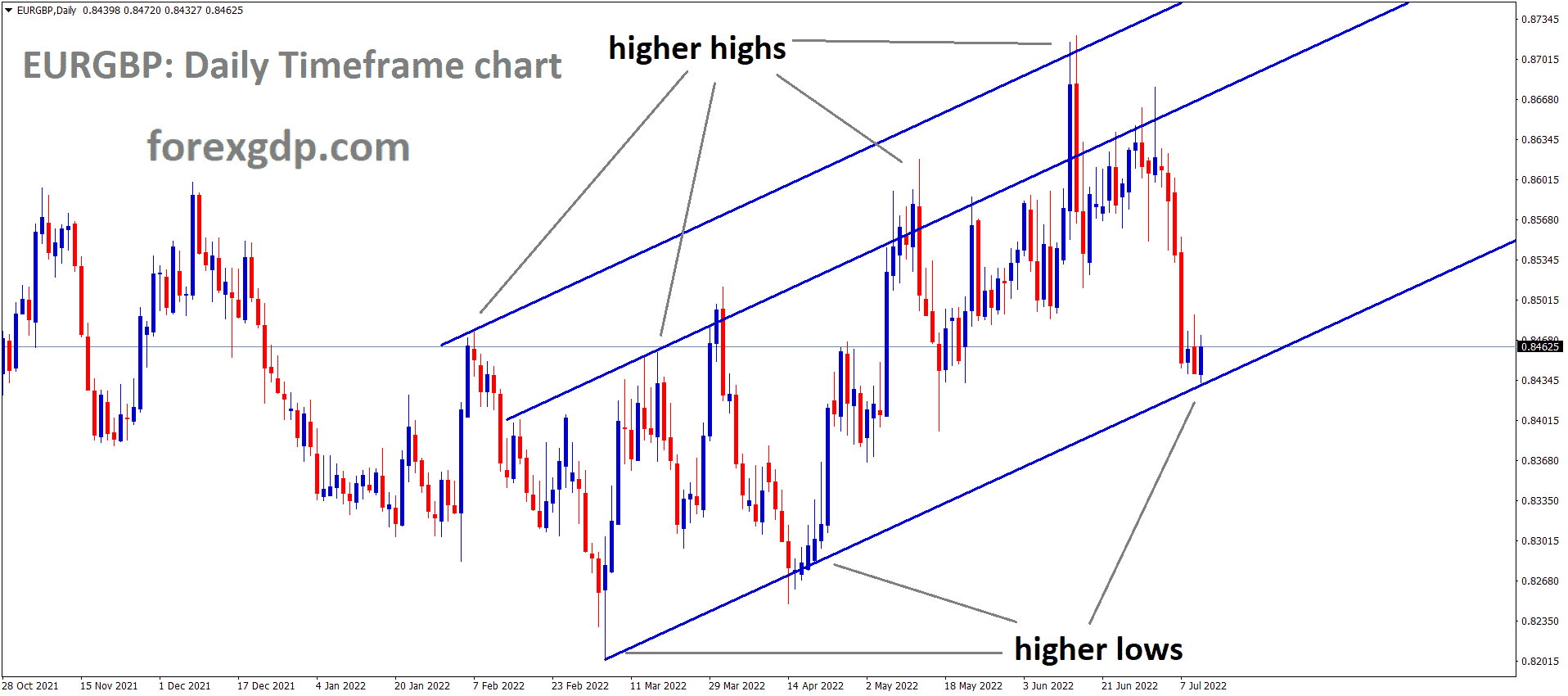

EURGBP is moving in an Ascending channel, and the Market has reached the Higher low area of the channel

Where Is EURGBP Today

The EURGBP charts are quite unstable today as a result of the release of the fact that the EU has finally sanctioned Russian gas which is going to cause a massive rise in inflation.

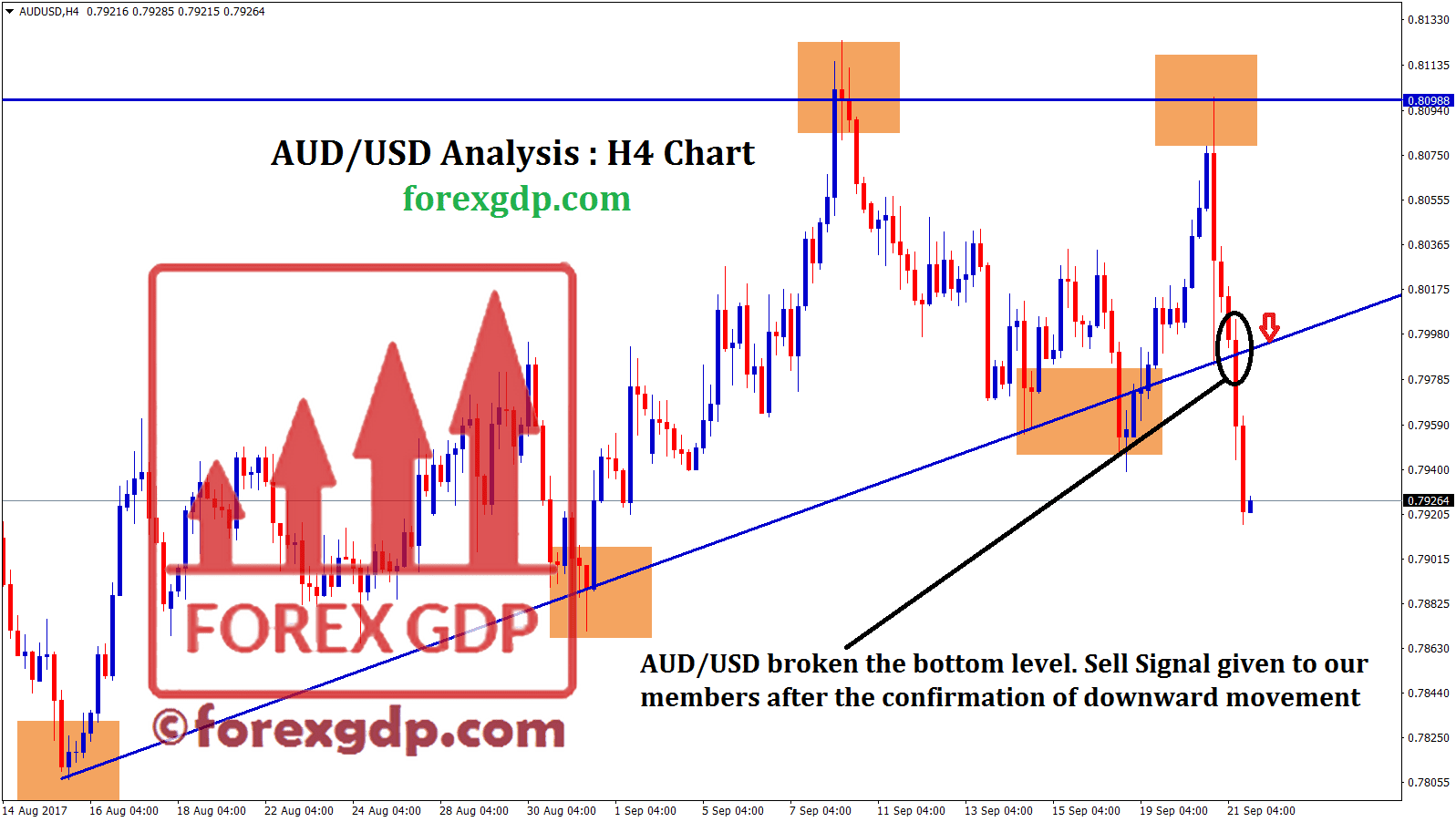

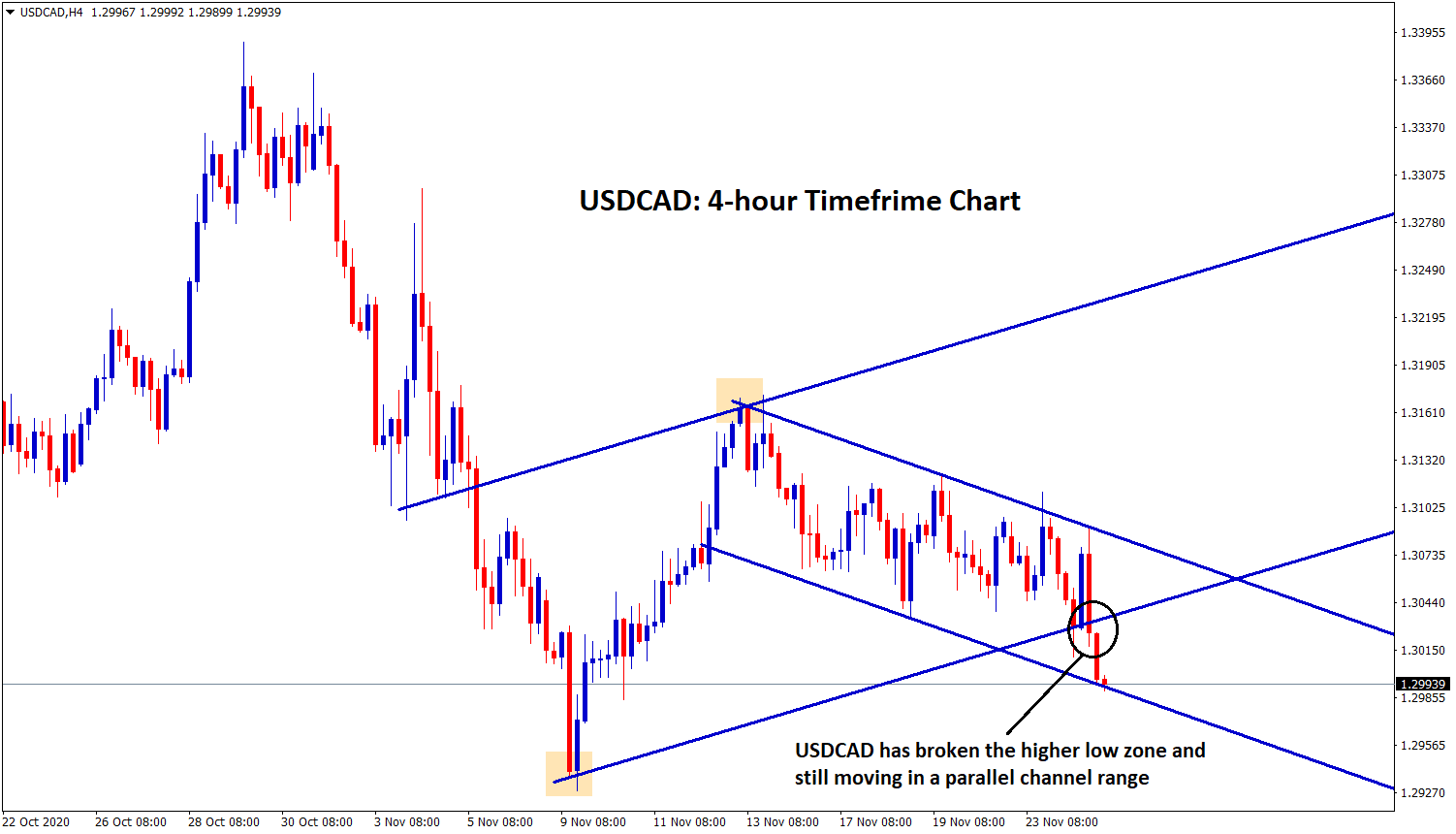

EURGBP moving in the Descending channel and the Market has reached the Lower high area of the channel

As a result of these releases, the EURGBP pair faced a sudden drop in its value and is now teasing around the 0.846 region. We may continue to see this pair be unstable throughout the day.

Russian Gas Cut

In these past couple of months, we’ve seen several sanctions being placed on Russia due to their war crimes in Ukraine. Of these sanctions, many other EU states were also impacted as they could no longer import important commodities from Russia. Now since the war doesn’t seem to be coming to an end any time soon, the EU is placing sanctions on Russian gas despite the fact that this is going to cause the EU a big loss as well. Due to this gas cut, the EU should expect a high rise in inflation once again.

Economists at CNBC reveal, “Europe has been under intense pressure in the wake of Russia’s invasion of Ukraine, with higher energy costs pushing up inflation across the region. This economic reality is unlikely to change anytime soon, with new forecasts pointing to an upward revision in consumer prices across the bloc. The commission is due to outline suggestions next week for how EU countries should prepare for the winter amid reduced gas supplies from Russia. Europe has been dependent on Russian gas supplies for several years and key industries rely on this commodity to work. This is the case in Germany, for instance, where chemical factories and steel production facilities use natural gas as a raw material. What could change the situation we are in and bring us into a more difficult economic situation are supply cuts and real shortages of supply.”

EURGBP is moving in the Descending channel and the Market has Fallen from the Lower high area of the channel

ECB Panetta Speech

Fabio Panetta who is a member of the European Central Bank recently held a speech at the European Parliament’s Innovation Day where he reveals, “This surge in prices does not reflect excess demand in the euro area. Consumption and investment remain below their pre-pandemic level and even further away from their pre-pandemic trend. With wages rising at a moderate pace, real incomes have been severely hit by the surge in import prices. Together with the war, this is further depressing consumption and confidence, despite the boost they have received from the reopening after the pandemic. Leading indicators of consumer confidence and business sentiment are deteriorating, and the growth outlook is being progressively revised downwards. Our projections now foresee activity remaining below its pre-pandemic trend throughout our projection horizon. As a result, there is already an adjustment working its way through the economy. Nominal yields and real rates have seen a material increase in recent months. Banks have started to tighten their credit conditions and expect to further tighten them markedly in the coming quarters.”

He further reveals, “Faced with several external shocks that have varying impacts on the economies of the euro area, we need to ensure that our policy stance is transmitted evenly, thereby preserving the singleness of our monetary policy. Monetary policy could otherwise be impaired by an excessive, self-fulfilling market reaction leading to an asymmetric tightening of financing conditions across the euro area. Action to prevent fragmentation is therefore not at odds with the normalization of monetary policy. On the contrary, it is a necessary condition for us to have the freedom to adjust our stance as needed to bring inflation back to 2%. This is required to ensure that the desired monetary policy stance is reflected not only in the financing conditions of countries perceived as vulnerable to fragmentation but also in the financing conditions of the other countries. In vulnerable countries, fragmentation would lead to capital outflows and an increase in yields, resulting in financing conditions that would be too tight. It could trigger self-fulfilling financial tensions.”

BOE Kashyap Speech

Anil Kashyap who is a member of the Bank of England recently held a speech where he highlights how these firms need to improve the way they report climate risks. And he sets out the questions that management boards need to ask to keep firms on the right track. He reveals, “It is something of an understatement to say that central banks have a lot on their plates these days. Globally this has led many prominent observers to question whether central banks are over-reaching in analyzing climate risk? I am going to explain why a proper analysis of climate risk is absolutely essential from a financial stability perspective. To make this tangible I will illustrate my argument by describing some of the findings from the climate change-focused Exploratory Exercise, known as the CBES, that the Bank of England has recently completed with the major UK banks and insurers. The results were published in May, and I am going to try to explain why I see them as one of the Bank’s most important publications of this year – perhaps I can even convince some of you to take a look.”

He further reveals, “A first response to the over-reach critique is to recognize that the industry could not do this on its own, involvement of the regulators was essential. Finalizing plausible scenarios required a dedicated team in the Bank, building on the extensive work from the Network for Greening the Financial System (NGFS), working for over a year and it involved 1000s of hours of work. This included consulting climate scientists, talking to the financial institutions themselves, and drawing on expertise from economists and other Bank staff. Importantly they had to make sure that the various assumptions were internally consistent. Having a regulator do this rather than an industry committee was undoubtedly a more rigorous and efficient way to proceed. Furthermore, because much of the interest is in seeing the aggregate results, making sure that all the major players participated was essential. Of course, we can walk and chew gum, so this work relied on different staff than the ones who support the monetary policy committee and therefore this exercise did not hinder the MPC.”