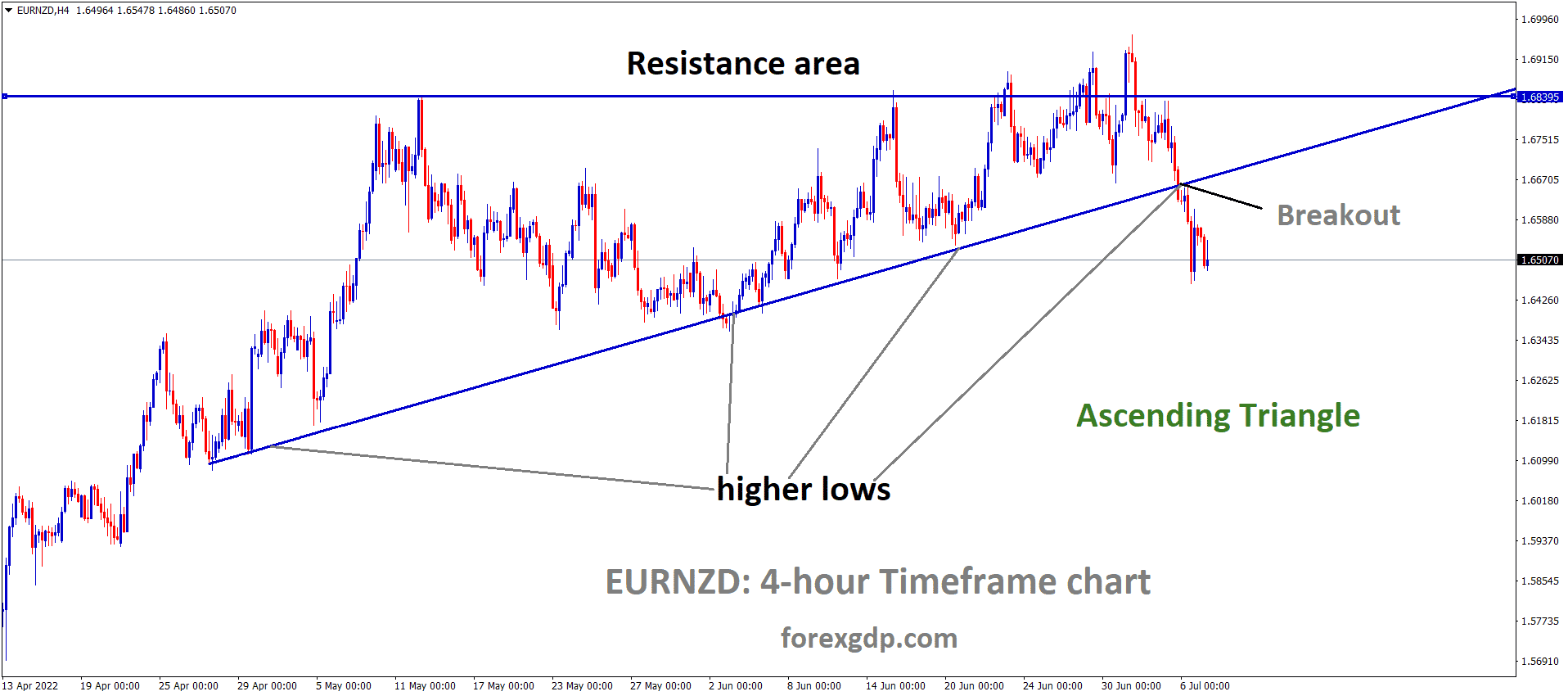

EURNZD has broken the ascending triangle pattern on the downside.

Where Is EURNZD Today

The EURNZD charts are quite unstable today as a result of the release of a speech by the ECB as well as tensions in the Pacific between China and New Zealand.

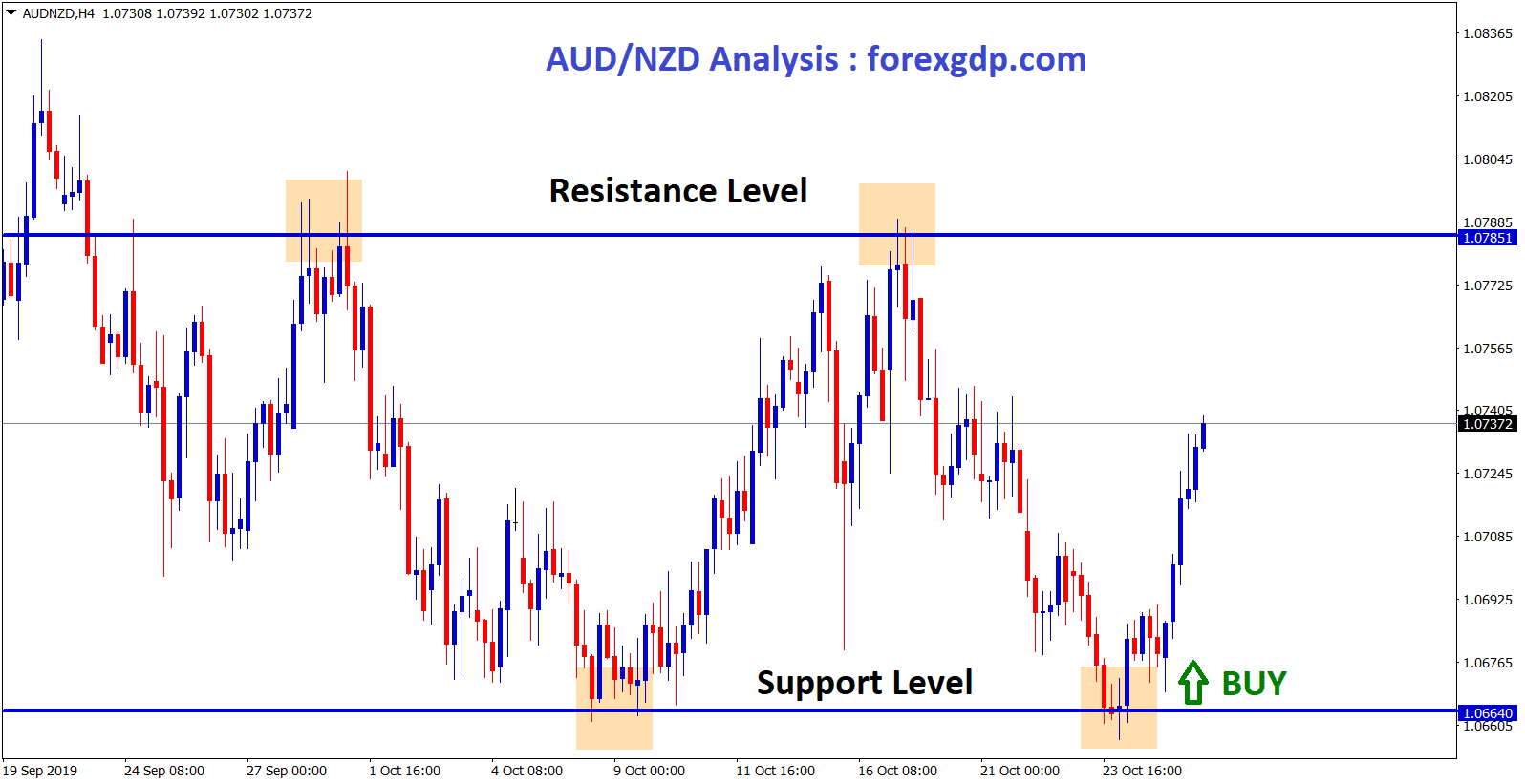

EURNZD is moving in the Descending channel and the Market has fallen from the lower high area of the channel

As a result of these releases, the EURNZD pair faced a sudden drop in its value and is now teasing around the 1.650 region. We may continue to see this pair be unstable throughout the day.

ECB Guindos Speech

The Vice President of the European Central Bank, Luis Guindos, recently held a speech at his third Summit where he discussed the economic outlook and the monetary policy for the region. He discussed why these measures were key in ensuring price stability which is a big concern at the moment. Guindos states, “Over the first half of this year, euro area inflation has continued to rise and has reached undesirably high levels. In June headline inflation rose to 8.6%, another record high, continuing to reflect surging energy and food prices, owing in part to Russia’s unjustified invasion of Ukraine. But price increases have not been limited to energy and food. In recent months we have seen inflationary pressures broaden and intensify across many goods and services. Elevated inflation will remain with us for some time, declining to just above target only at the end of our projection horizon. We expect that moderating energy costs, the easing of supply disruptions related to the pandemic, and the normalization of monetary policy will be conducive to inflation returning to our 2% target over the medium term. But the risks surrounding inflation are on the upside.”

He further states, “Economic activity is in turn affected by the war and its consequences. Rising prices are reducing disposable incomes, while intensified supply disruptions and greater uncertainty are also weighing on growth, particularly in the manufacturing sector. At the same time, developments in the services sector are supporting growth, with the lifting of pandemic-related restrictions and signs of a buoyant summer tourism season boosting activity. These developments are bolstering incomes and consumption, helping an already strong labor market to withstand the economic impact of the war. Our projections foresee growth above 2% throughout the projection horizon. But the war and the risk of further disruption in the energy supply to the euro area continue to be a significant downside risk to growth. In fact, the downside scenario in our June projections reflects this risk and implies a contraction of activity in 2023, following weaker but positive growth in 2022. While we are still expecting positive growth rates throughout our projection horizon, in the coming months we will have to navigate this challenging combination of shocks which is reducing growth and pushing up inflation.”

EURNZD is moving in an Ascending channel and the Market has rebounded from the higher low area of the channel

Pacific Tensions

Over the last couple of months, we’ve seen tensions between New Zealand and China get more worse. China is trying to take over control of the Pacific region and New Zealand which belongs to this region is not happy about it. President Arden of New Zealand has urged her people to not give heed to China as they are following standards that go against international law. This has angered China and made them further want to take over the Pacific. Arden is now trying to settle matters with China through a diplomatic approach to prevent any hard feelings.

Mathew Brockett from Bloomberg reveals, “Australia and New Zealand were shocked by the signing of a security agreement between the Solomon Islands and China in April, a major diplomatic victory for Beijing and its first such deal in the Pacific. Ardern told a NATO summit last week that China was becoming more assertive and more willing to challenge international rules and norms. Even as China becomes more assertive in the pursuit of its interests, there are still shared interests on which we can and should cooperate. The post-war order and the rules that underpin it have supported China’s rise, and as a permanent member of the Security Council, China has a crucial role to play in upholding that order.”

RBNZ Statement

The Reserve Bank of New Zealand recently introduced new legislation that replaced a previous one that was over 30 years old. The statement reads, “The new Act replaces previous legislation that was more than 30 years old, and ushers in a new statutory governance board responsible for all decision-making at Te Pūtea Matua (except decisions reserved for the Monetary Policy Committee). The eight-member governance board replaces the previous advisory board and is chaired by Professor Neil Quigley who, over the past nine months has also led the interim transition board overseeing preparations for the changes required under the Act. Professor Quigley said he was pleased and proud to be leading a group of such highly experienced, diverse, and talented directors, and that its strengthened governance arrangements would stand the Reserve Bank in good stead for the future. The Act also formalizes the role of Te Tai Ōhanga | The Treasury as our new monitoring agency and we welcome the additional oversight this will provide as we work to meet our agreed measures and targets.”

The statement further discloses, “The Reserve Bank Governor is a member of the new Board as well as RBNZ Chief Executive. Governor Adrian Orr said he wanted to thank and acknowledge the many people across the organization and at the Treasury who have worked hard to implement all the changes required under the Act. Our strengthened legislative foundations are a significant step in our wider transformation efforts under which Te Pūtea Matua is evolving into a modern, agile, fit-for-purpose central bank for Aotearoa. We have strong leadership and exceptionally capable people, and I have full confidence in our readiness to meet the increased levels of accountability and transparency required of us. This includes releasing our new Statement of Financial Risk Management, Statements of Prudential Policy, Intent, and Performance Expectations later this year. These key strategic documents set out how we approach our work, what we aim to achieve, and how we measure our performance.”