EURUSD and USDCHF Inverse Correlation Analysis

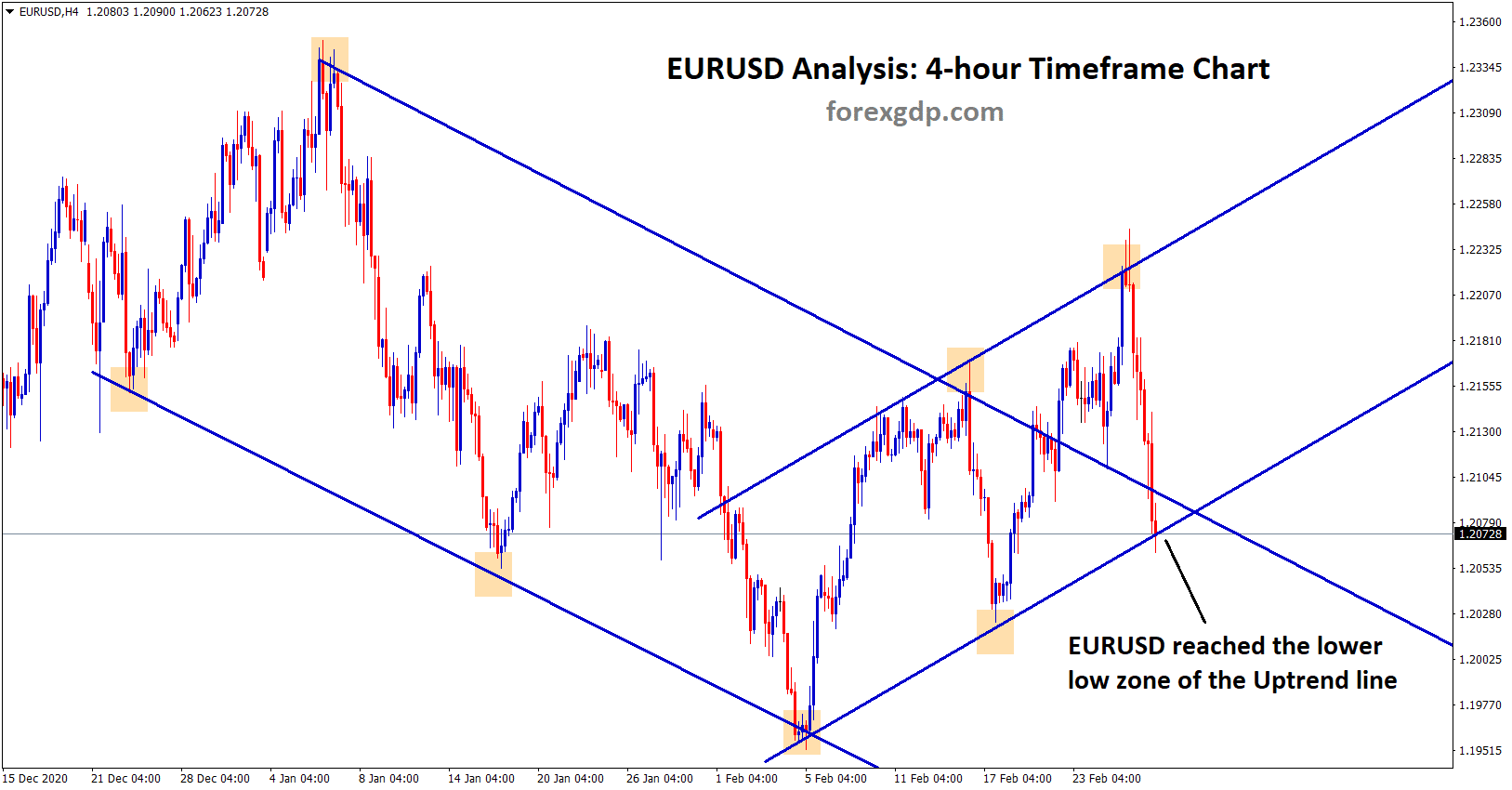

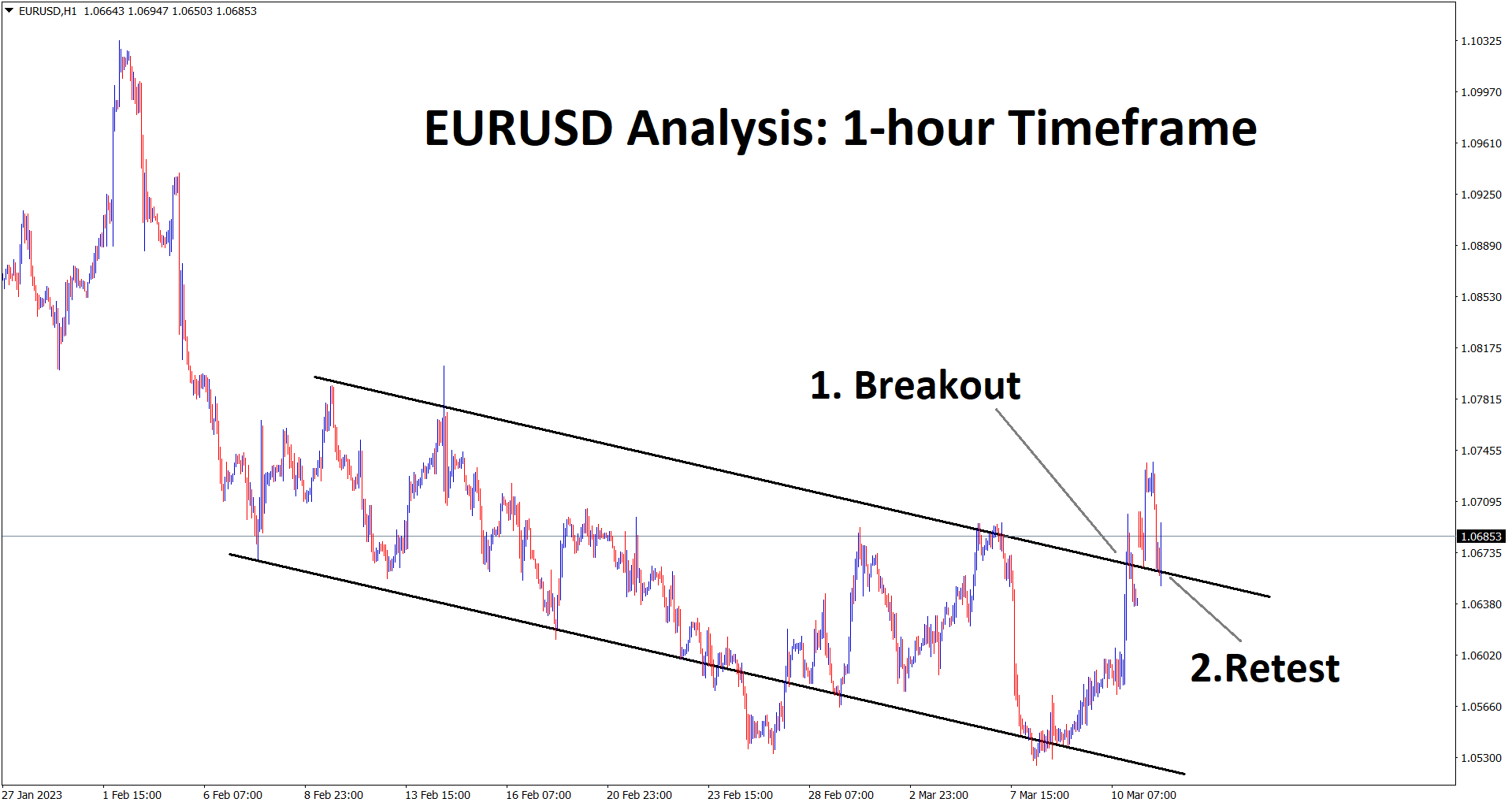

EURUSD is standing at the bottom level (higher low) of the trendline.

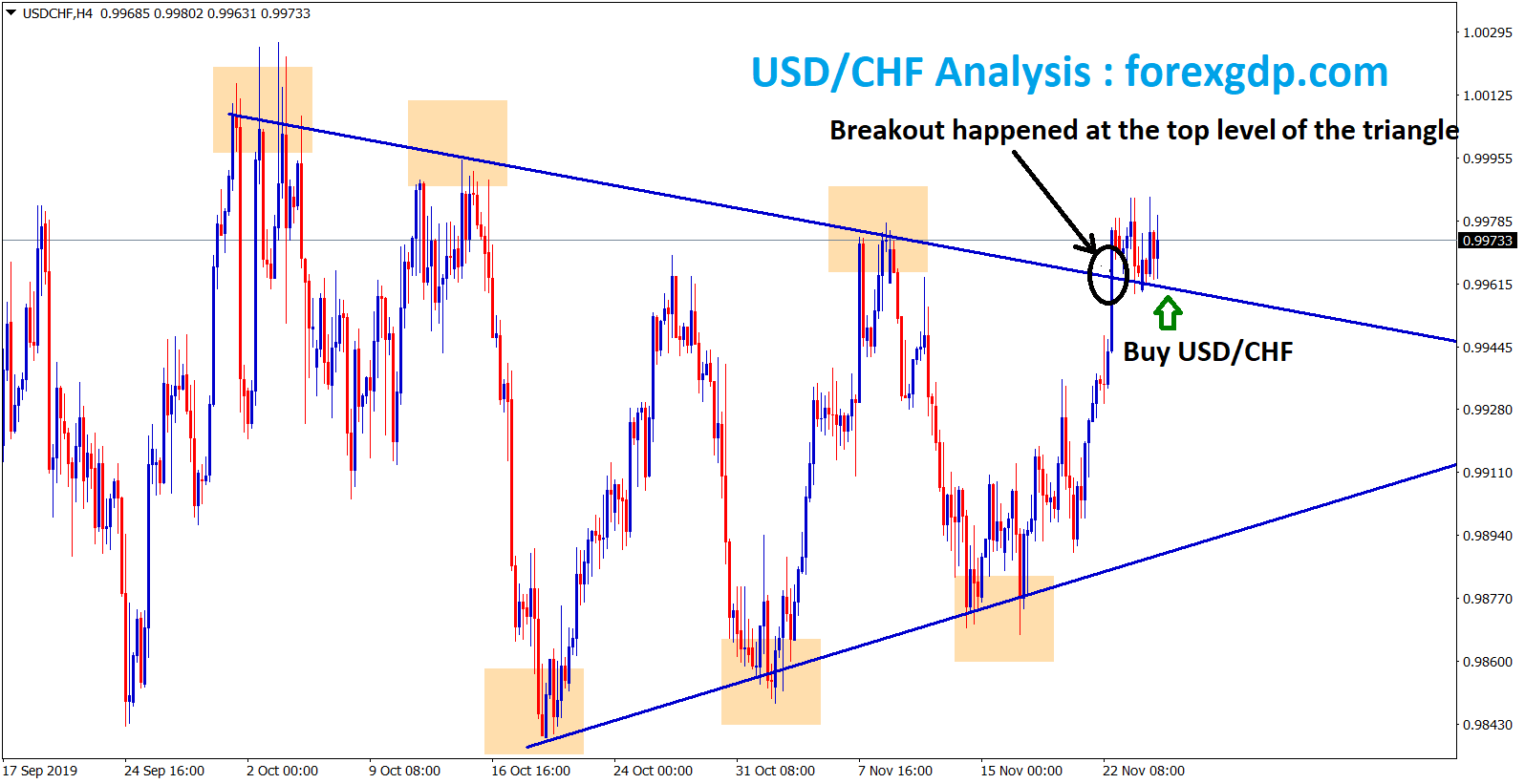

Opposite to EURUSD, the USDCHF is standing at the top level (higher high) of the trendline.

USDCHF standing now at the top and EURUSD standing at the bottom level. This shows the inverse correlation chart setups.

Inverse correlation means If the EURUSD goes down, then USDCHF will move up.

EURUSD and USDCHF are the inverse correlated asset for a long time.

Euro Currency

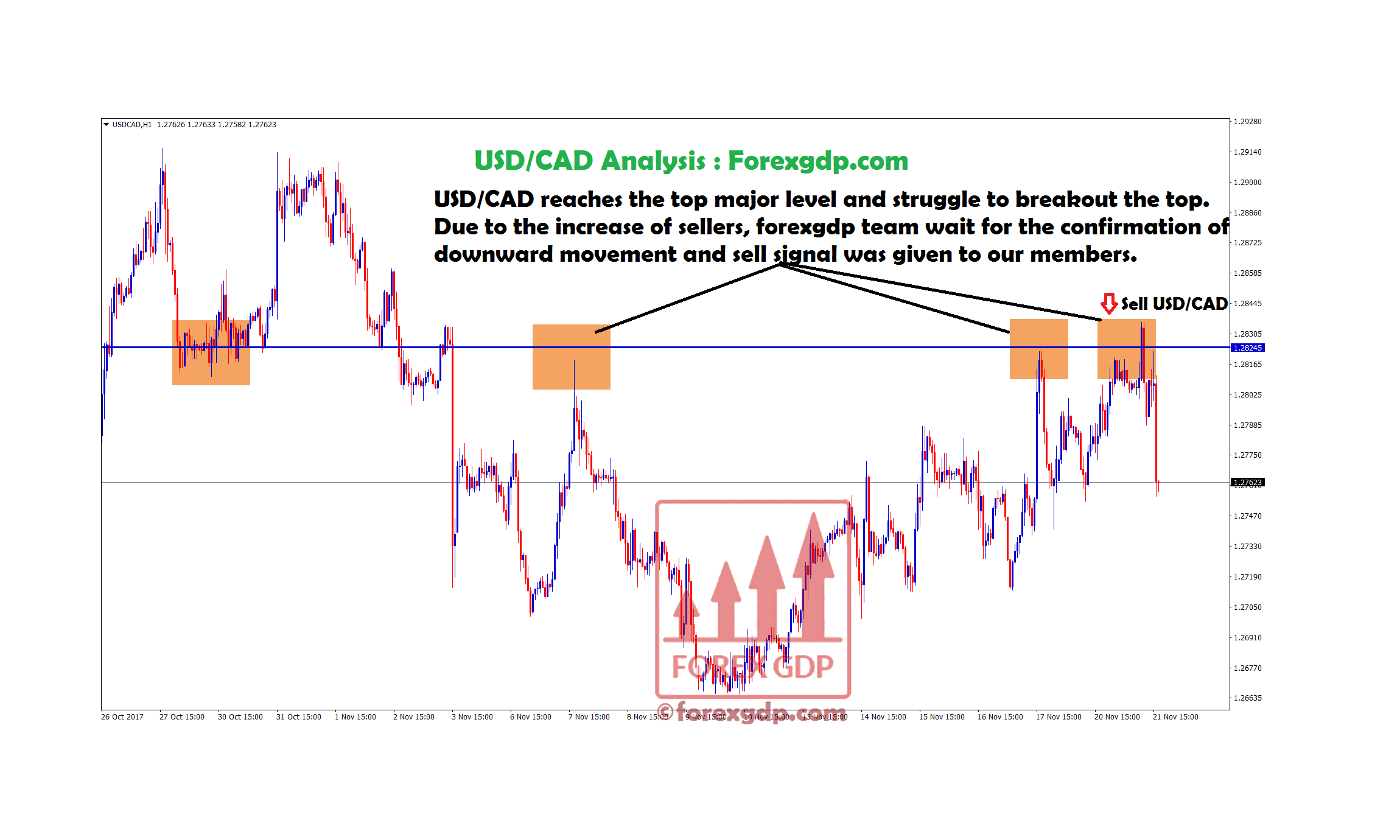

EURO prices remain lower as US Dollar prices higher.

The Vaccinations are still Progressing slowly in Euro, and this may drag Euro in the near term.

Global worries are reducing due to vaccine distribution

US Dollar moves higher against Swiss Franc as Global worries now calm down as Vaccination progressing well in the US.

Joe Biden’s trillion $ package pushes the US Dollar to get strong.

And US GDP will come in a positive result as Vaccination package issued this month.

Get Each trading signal with Chart Analysis and Reason for buying or selling the trade which helps you to Trade with confidence on your trading account.

Want to increase your profits in trading? Get the best trading signals at an accurate time. Try premium or supreme signals now: forexgdp.com/forex-signals/