The ECB delivered significant easing measures on Thursday, lowering its depo rate by 10bp, cutting its refi rate by 5bp, increasing the run rate of asset purchases, adding scope to purchase corporate debt and announcing additional long-term repo operations.

The breadth and depth of the measures go well beyond most published market consensus estimates. However, there was a broad sense in the market that the ECB needed to “overdeliver” at this meeting, and in a sense one could say that it is not surprising that they have done so.

The rates market reaction suggests markets were prepared, with the EUR 2-year swap rate and Euribor curve around 5bp. Reaction in credit and equity markets was more intuitive, but even there equity indices were unable to sustain the full extent of initial gains. With US rates well off their February lows and markets beginning to cautiously build in pricing for interest-rate hikes by the Federal Reserve, it would be tempting to revive the policy divergence theme which prevailed for much of 2015.

However, we think it would be a mistake to expect the downtrend in EURUSD to resume now and we still think risks to the pair remain skewed to the upside, forecasting a recovery to 1.16 by the end of June.

…The bottom line is that, in our view, there is no stable equilibrium for global financial markets that includes the USD is resuming its broad trend higher. Periods of building Fed hiking expectations are likely to be overwhelmed by deterioration in the risk environment. The process of periodic recovery in the risk environment followed by subsequent deterioration is expected to keep FX volatility high, supporting currencies with current account surpluses like the EUR and JPY, at the expense of currencies with deficits including the USD and commodity-exporting foreign exchange. We continue to see scope for EURUSD to reach 1.16 in H1.

The broad implication of the above is that the USD’s multi-year appreciation trend has now stalled, amid significant feedback from valuation constraints, similar to the pause that occurred at the same time in the previous 1985-2002 cycle. Then, a pause in USD appreciation lasted from January 1998 until August 1999 before it the dollar again through 2001. However, we note that while the previous cycle persisted for some time after rate divergence had peaked, cross-border M&A and FDI flows associated with the tail end of the tech boom at that time, were driving the final stages of USD appreciation. We see no indication that such a paradigm shift is poised to develop this time around.

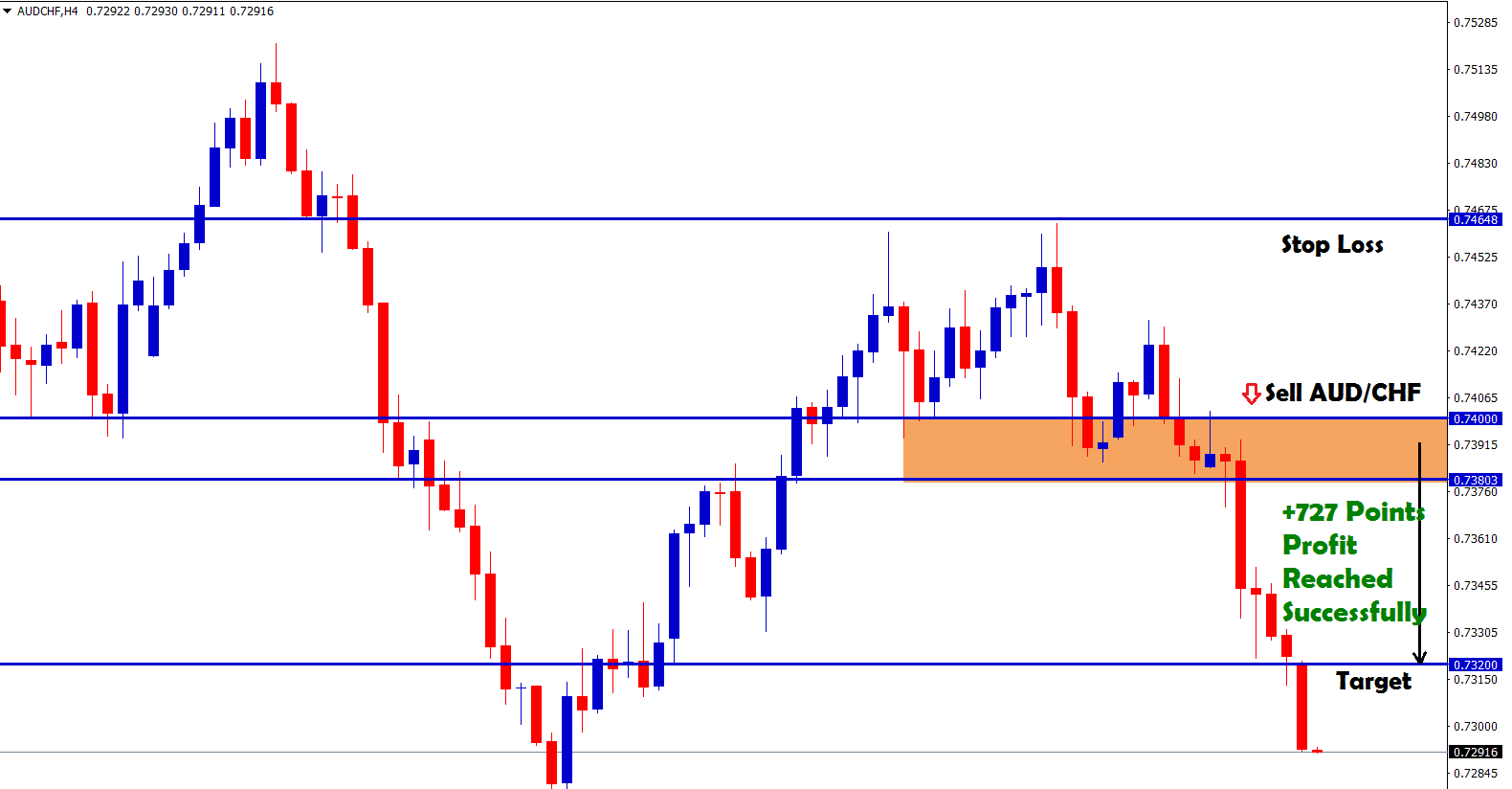

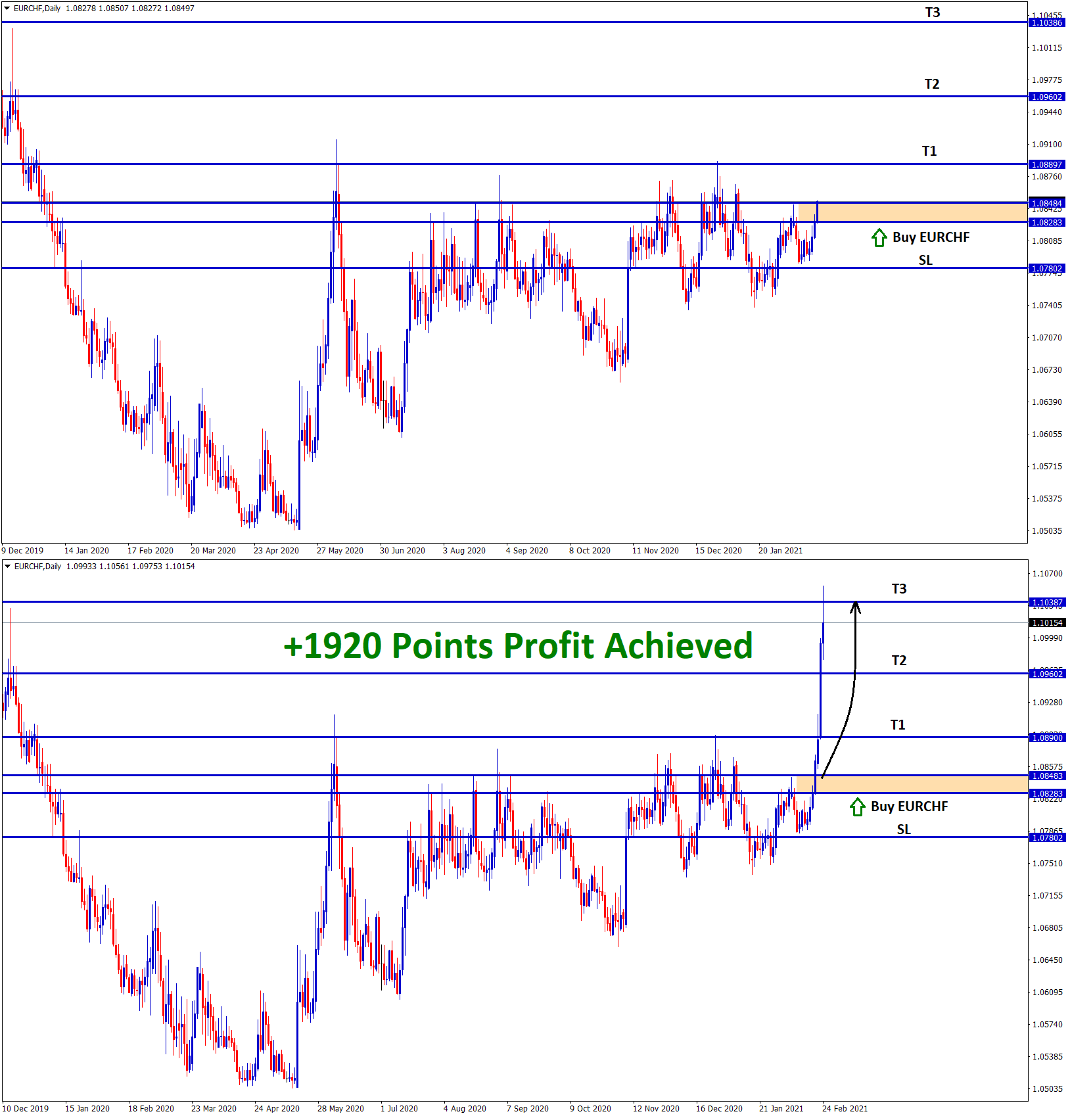

Don’t trade all the time, trade only at Best Setup. Join Free now. Let result speaks on your trading account. Start to receive the forex signals now: forexgdp.com/forex-signals/

Superb, what a weblog it is! This web site gives

useful information to us, keep it up.