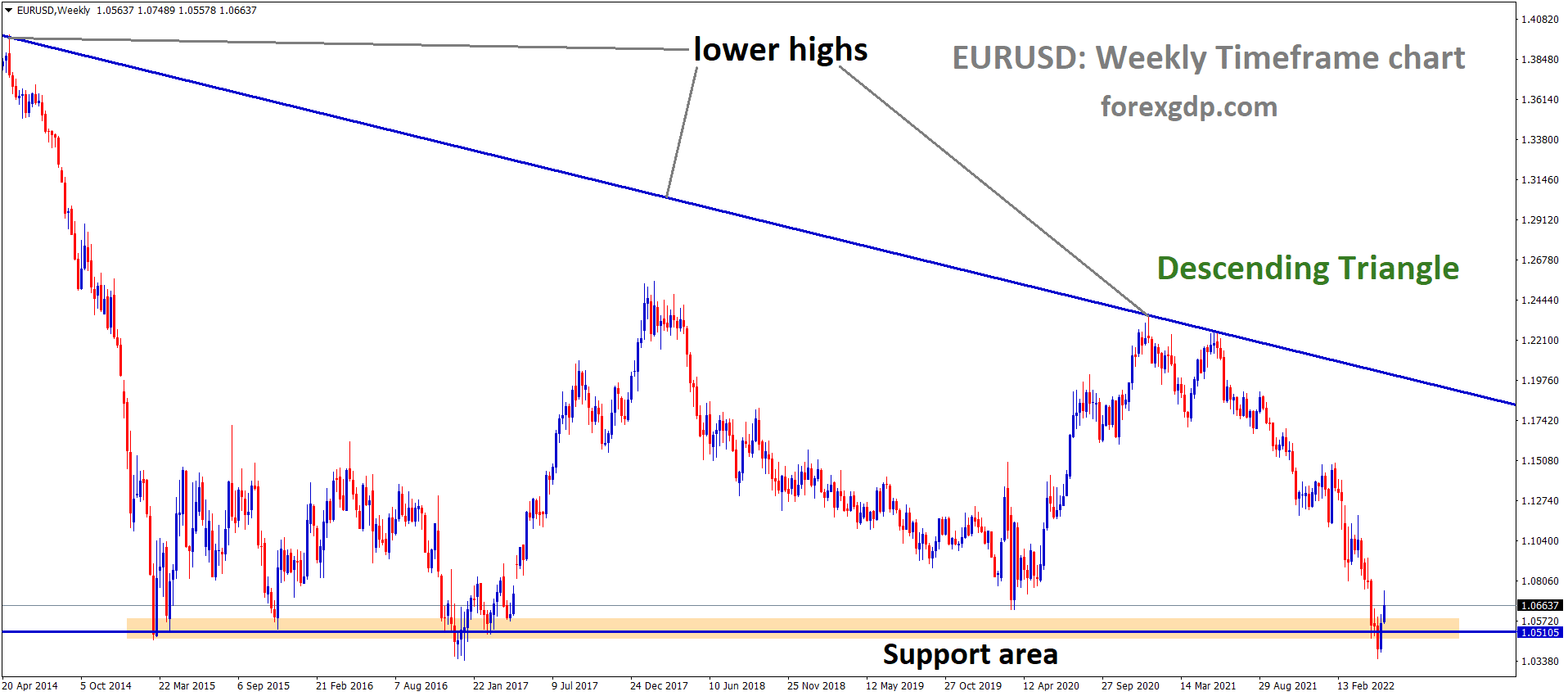

EURUSD is moving in the Descending triangle pattern and the Market has rebounded from the Horizontal Support area of the Pattern.

Where is EURUSD Today

The EURUSD currency pair is struggling to stay above support levels following the recent speech by ECB President Lagarde. Looking at each of the time frames, it is evident that this major pair is currently entering bearish market conditions as a result of the need for military aid by Ukraine. We can see that every now and then, the pair seems to recover slightly before falling back under hot waters.

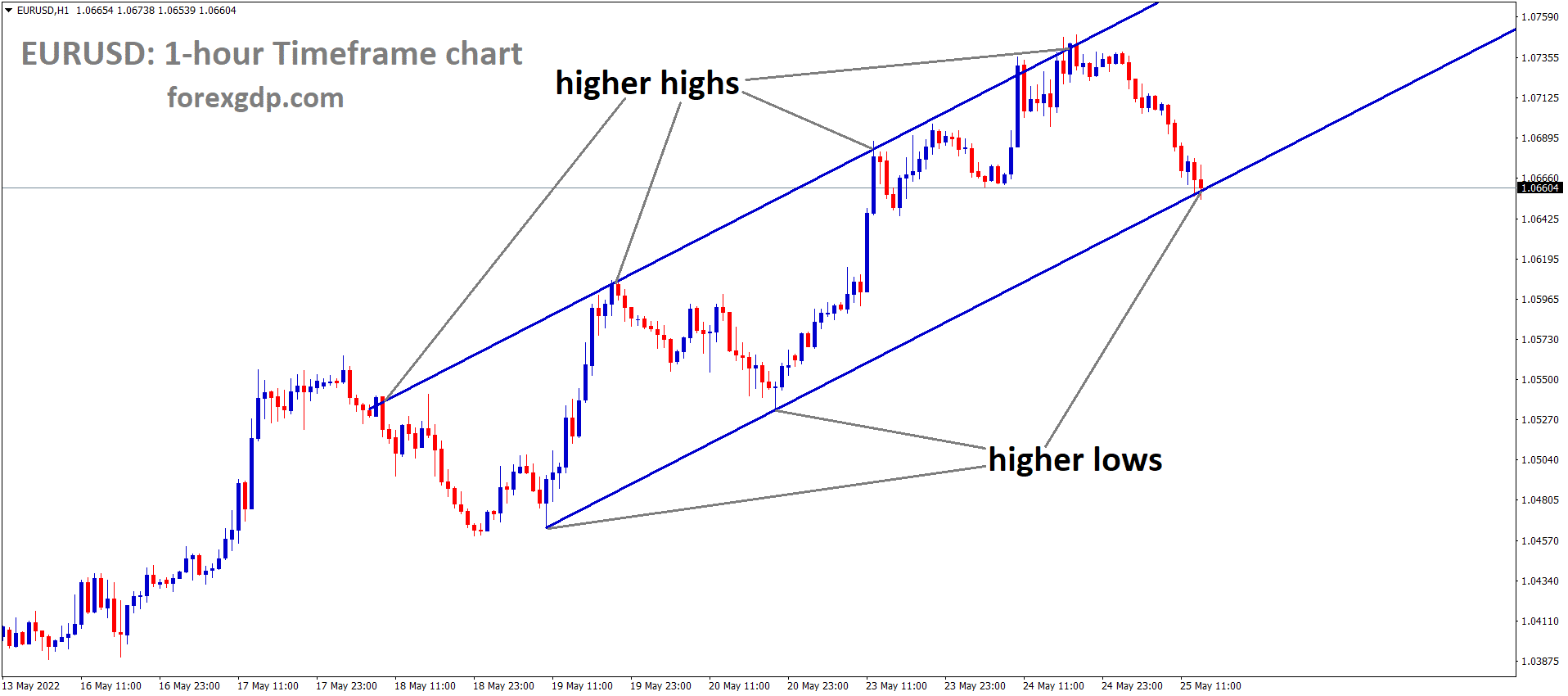

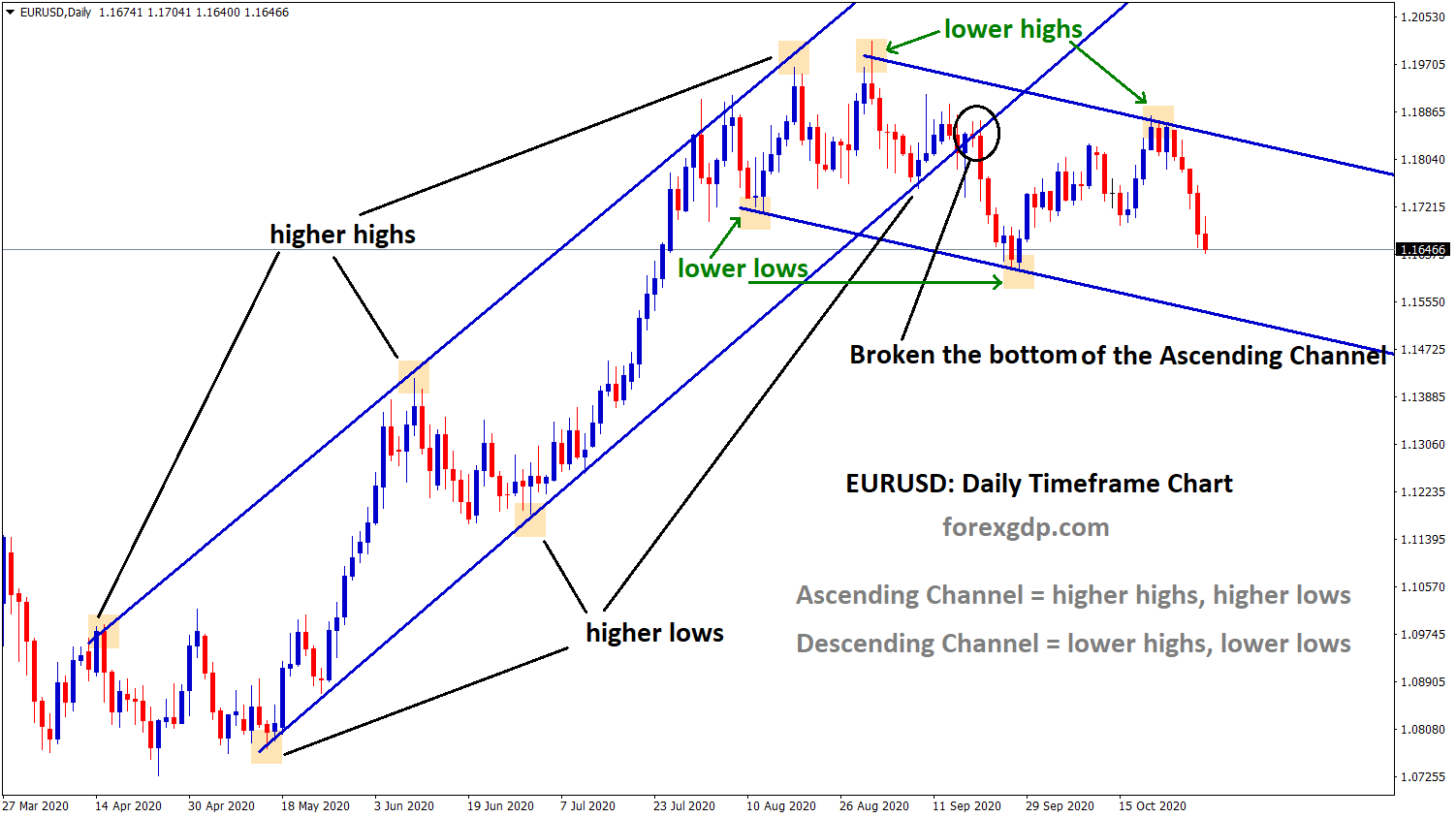

EURUSD is moving in an Ascending channel and the Market has reached the higher low area of the channel.

Just today, we have seen the EURUSD pair fall as low as 1.065. However, it has since slightly recovered again and is now teasing around the 1.066 region. At the moment, it seems as though this pair may continue to fall or struggle to hold at support. It is very unlikely that this pair will begin an upward trend into bullish markets.

ECB Lagarde Speech

ECB Lagarde’s speeches are known to cause the most turmoil in all the Euro charts. This is despite the fact that she barely reveals anything of any use to economists or analysts globally. Lagarde held a speech early on Wednesday at the World Economic Forum in Davos where she talked about how powerful the EU actually is which they hadn’t realized previously. She talks about how the current war in Europe between Ukraine and Russia has caused an economic catastrophe all around the world. This event has proven that Europe actually is a major stakeholder in the dynamics of the world. She urges the EU to take advantage of this newfound information to make better decisions for the betterment of the EU and its people. She believes that certain sectors in the EU definitely need a boost in order to perform at their full capacity.

In her speech, Lagarde reveals, “The war in Ukraine has shown Europe doesn’t understand how powerful it could be on the world stage and the bloc should flex its muscles more than it does. The EU’s monumental market means it can set the conditions of trade and its competition laws mean it can block mergers around the world. The potential strength of a unified purchasing group and huge pension fund resources could be better deployed. As often in Europe, united in diversity and rising in adversity. We are in that situation of adversity and we need to flex our muscles. We do have collective, incredible muscles. More needs to be done in some areas, such as boosting the services sector and overcoming the self-interests of nations. Europe can be a better moral power if it succeeds in putting values ahead of making cost savings, as it has done in the past. Europe is an incredible force but we score against our own team occasionally by slowing down the process and by looking at national interests instead of common ones.”

ECB Panetta Speech

ECB’s Panetta is known to be one of the realest members of the ECB. He’s a part of the Executive Board and often doesn’t sugarcoat anything he says in any of his speeches. Unlike other ECB members who pretend like the economy is not impacted by the current economic crisis, Panetta acknowledges that it is and explains ways they’re trying to resolve this issue. In his speech, Panetta says, “The current short-term inflationary pressure may spill over to inflation expectations, leading to more protracted inflationary pressures. These risks have to be carefully considered when we are deciding on both the pace and path of the withdrawal of accommodation. Although we have plenty of experience of how asset purchases and policy rates can reinforce each other as part of an easing strategy, we have no experience of the reverse scenario in the euro area. And the experience of other major central banks, limited as it is, is unlikely to be transferable to the euro area given the unique nature of our economic, financial, and institutional set-up.”

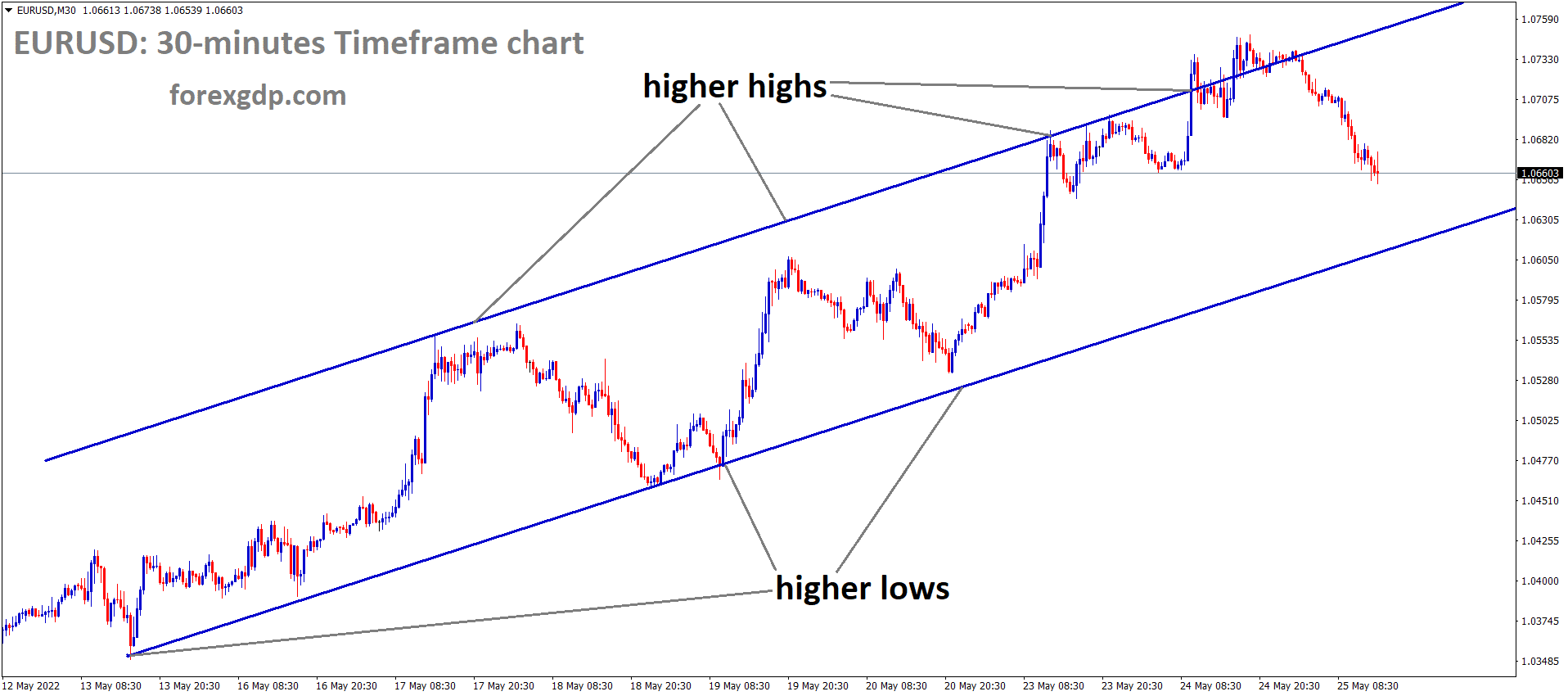

EURUSD is moving in an Ascending channel and the market has Fallen from the higher high area of the channel.

He further adds, “Subject to incoming data – we are and should remain data-driven – both the economic outlook and the principles I have outlined justify ending net asset purchases and then gradually exiting negative rates. This would allow us to continue to normalize policy by removing the part of our monetary accommodation that is no longer needed today. In particular, negative rates may imply distortions that were only necessary and proportionate when inflation was threatening to be too low over the medium term, relative to our target. The first adjustment is already underway. The ECB has already made two major announcements on asset purchases, first in December last year, and then again in March when we signaled our expectation that net asset purchases would be concluded in the third quarter of this year. At the same time, the stock effects associated with our reinvestment policy will ensure that accommodation is withdrawn gradually. This will avoid creating financial stability risks in an already very volatile and uncertain environment.”

Military Aid To Ukraine

With how the situation is progressing in Ukraine, it seems as though Russia is now at its most brutal stage yet. They have begun actively raiding Ukraine from the east and it seems as though they are being super reckless and leaving back a lot of casualties. Due to this developing scenario, Ukraine has once again requested military aid from the EU to help it survive this new attack. The EU is now being looked at by all international eyes as they’re waiting to see if the EU will actually provide support to Ukraine or if they’re just all talk.

The Ukrainian defense minister reveals, “Now, we are observing the most active phase of the full-scale aggression which Russia unfolded against our country. The situation on the [eastern] front is extremely difficult because the fate of this country is perhaps being decided [there] right now. The enemy has focused its efforts on carrying out an offensive in order to encircle Lysychansk and Severodonetsk. The intensity of fire on Severodonetsk has increased by multiple times, they are simply destroying the city. There is a request to have a Russian military base be permanently stationed in that area. And] as of Monday the Russian currency – the Roubles – is now being used in Kherson, the Russian language has been recognized as one of the official languages in the region, alongside Ukrainian.”