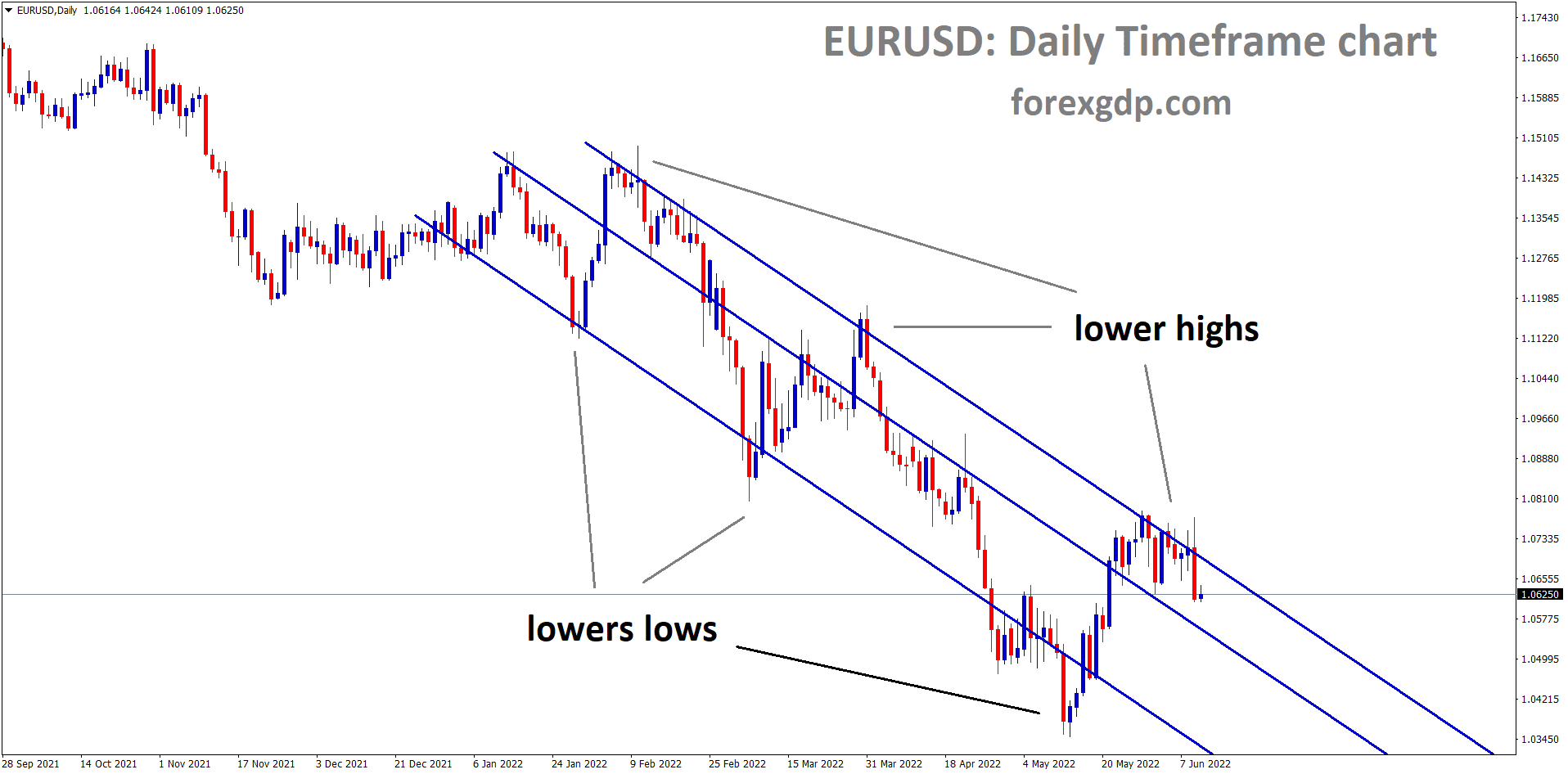

WHERE IS THE EURUSD TODAY

The EURUSD charts are on the mends today as a result of the release of the ECB interest rate decision and the US initial jobless claims report. As a result of these releases the EURUSD pair had faced an increase in its value and went as high as around the 1.064 mark. However, it has since dropped slightly and is now teasing at around the 1.062 region. We may continue to see this pair increase throughout the day.

EU INTEREST RATE DECISION

Early on Thursday, the European Central Bank revealed its new interest rates for the term. They revealed that the interest rate will continue the same as previous which is 0%. This comes as no surprise as even Lagarde mentioned in her speeches previously that they will probably raise the rates from July. Due to this, the ECB reveals, “Accordingly, and in line with the Governing Council’s policy sequencing, the Governing Council intends to raise the key ECB interest rates by 25 basis points at its July monetary policy meeting. In the meantime, the Governing Council decided to leave the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility unchanged at 0.00%, 0.25% and -0.50% respectively. Looking further ahead, the Governing Council expects to raise the key ECB interest rates again in September. The calibration of this rate increase will depend on the updated medium-term inflation outlook. If the medium-term inflation outlook persists or deteriorates, a larger increment will be appropriate at the September meeting.”

The ECB further added in its statement, “The Governing Council will continue to monitor bank funding conditions and ensure that the maturing of operations under the third series of targeted longer-term refinancing operations (TLTRO III) does not hamper the smooth transmission of its monetary policy. The Governing Council stands ready to adjust all of its instruments, incorporating flexibility if warranted, to ensure that inflation stabilizes at its 2% target over the medium term. The pandemic has shown that, under stressed conditions, flexibility in the design and conduct of asset purchases has helped to counter the impaired transmission of monetary policy and made the Governing Council’s efforts to achieve its goal more effective. Within the ECB’s mandate, under stressed conditions, flexibility will remain an element of monetary policy whenever threats to monetary policy transmission jeopardize the attainment of price stability.”

US INITIAL JOBLESS CLAIMS

In a not-so-surprising turn of events, it was recently revealed that the US is facing one of the highest initial jobless claims since last January. This comes as no surprise considering their economy is in shambles and it doesn’t seem to be getting any better any time soon. Businesses are laying off their employees as part of some cuts they have to make in order to sustain a profitable business model. It was becoming increasingly difficult to still maintain good profit margins with the new salary increase that was mandated. This comes despite the fact that this salary increase is still nowhere near enough to cover regular expenses, especially rent. We were expecting the initial jobless claims to be around 210,000 but it actually turned out to be 229,000. This was significantly a lot and it has a lot to say about the US economy.

Jeff Cox from CNBC reveals, “First-time filings for the week ended June 4 totaled 229,000, an increase of 27,000 from the upwardly revised level in the prior period and well ahead of the 210,000 Dow Jones estimate. The period covered includes the Memorial Day holiday; seasonal adjustments normally would lead to a lower number. The last time initial claims were that high was Jan. However, continuing claims, which run a week behind the headline number, were unchanged at just over 1.3 million, below the FactSet estimate of 1.35 million. The four-week moving average for continuing claims, which accounts for volatility in the numbers, declined slightly to 1.32 million, the lowest level since Jan. 10, 1970. The rise in claims comes less than a week after the Bureau of Labor Statistics reported that nonfarm payrolls increased by 390,000 in May, considerably better than expected.”

FEDS NEW BRANCH

Just early on Thursday, the Federal Reserve Bank released a press statement where they shared that they just got approval to open a new branch in Texas. This statement reveals, “The commenter observed that in United Texas Bank’s August 3, 2020, CRA performance evaluation, which was not the most current CRA performance evaluation of the bank, it received a rating of “Needs to Improve” under the lending test. The commenter also observed in reference to that performance evaluation that United Texas Bank’s penetration of loans among businesses of different sizes was poor, the geographic dispersion of the bank’s lending was poor given the performance context, and that the bank’s distribution of small business loans by business revenue size was poor. In addition, the commenter alleged that United Texas Bank’s small business lending to businesses with less than $1 million in revenue trailed in comparison to other non-credit card small business lenders in Dallas.”

The statement further reveals, “In evaluating the CRA performance of the involved institution, the Board generally considers the institution’s most recent CRA performance evaluation, as well as other information and supervisory views from the relevant federal financial supervisor, which in this case is the Federal Reserve Bank of Dallas (“Reserve Bank”). In addition, the Board considers information provided by the applicant and by any public commenters. The CRA requires that the appropriate federal financial supervisor for a depository institution prepare a written evaluation of the institution’s record of helping to meet the credit needs of its entire community, including LMI neighborhoods. An institution’s most recent CRA performance evaluation is a particularly important consideration in the applications process because it represents a detailed, on-site evaluation by the institution’s primary federal supervisor of the institution’s overall record of lending in its communities.