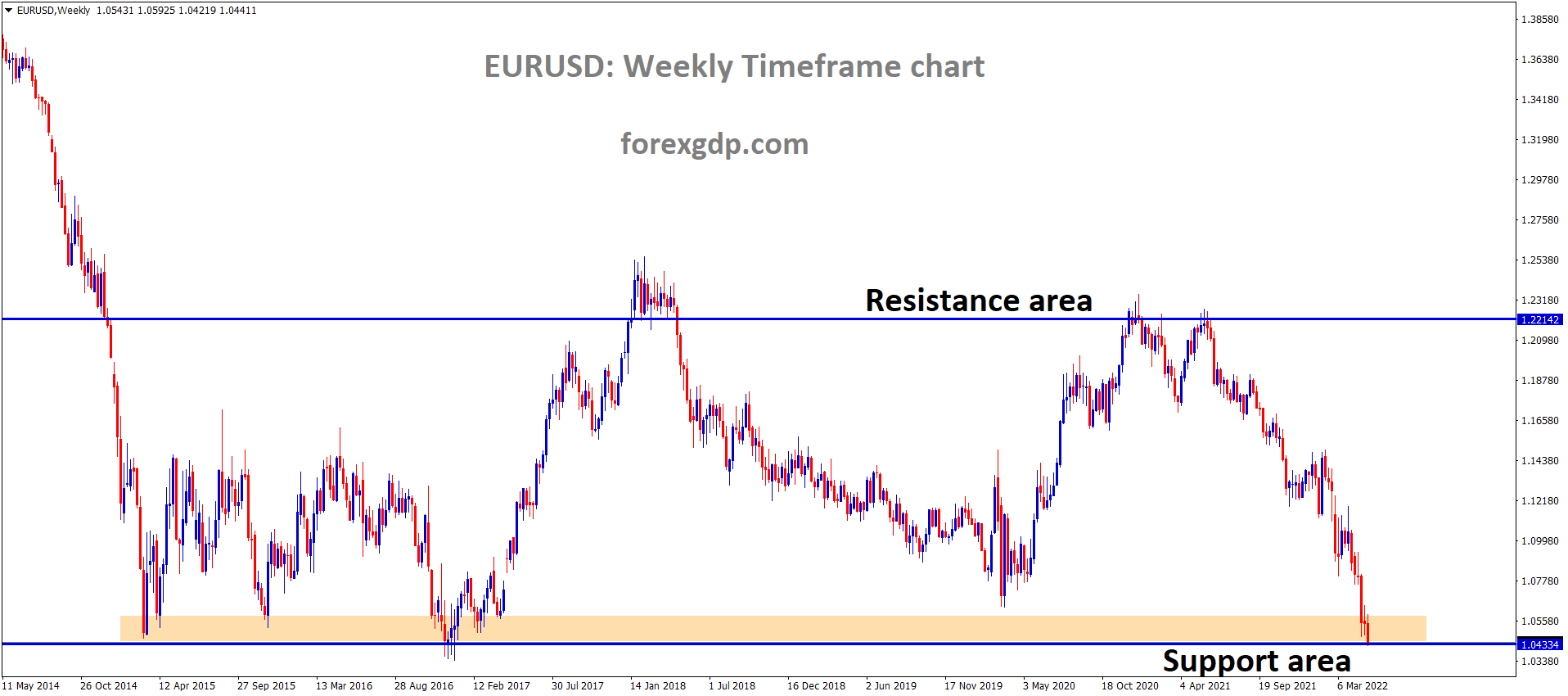

EURUSD Weekly Time Frame Analysis Market is moving in the Box Pattern and the Market has reached the Horizontal support area of the Box Pattern.

Where is EURUSD Today

Over this past week, we’ve witnessed EURUSD slowly but BNMGHJ consistently drop in its market value. This currency pair has been extremely unstable in light of the release of the US CPI as well as the ongoing war between Russia and Ukraine. EURUSD took the brunt of the impact of these events and faced a drop in its market value.

EURUSD H1 Time Frame Analysis Market has broken the Descending triangle pattern.

EURUSD M30 Time Frame Analysis Market has broken the Box Pattern.

It is now teasing around the 1.043 region and it seems as though it isn’t planning on waiting here any longer as its coming close to next support levels. We haven’t seen this area with the EURUSD in about 20 years. The last time we saw it was late 2002. It has truly broken records and we can blame the release of the US CPI data for its market conditions.

US CPI Data Report

The US released their CPI data early on Wednesday which significantly caused the US markets to become extremely unstable. The USD index reached the highest value it had seen in over two decades as a result of the release of the CPI report. This comes despite the fact that the CPI report revealed that inflation was still not under control despite the several huge interest rate hikes we’ve had to deal with these past few months. Analysts and economists are left having to refigure out why inflation is still on the rise in several industries. The public are also demanding a solution to this long standing ordeal but until we dig deep into the root of the problem, it is highly unlikely we’re going to find a solution.

Geoffery Smith, Analyst at Investing, has been following the release of the CPI report as well as the impact it has caused to businesses in the country. He reveals, “The reason for the overshoot was another bigger-than-expected rise in core prices, which strip out volatile food and energy price movements. The core CPI rose 0.6% on the month, rather than the 0.4% expected. That was twice the 0.3% increase posted in March and was the biggest increase for three months, suggesting that the recent trend in inflation is hardly improving, if at all. Prices for essentials such as shelter rose another 0.5%, the third month in a row they had risen by that much. Shelter costs are now up 5.1% on the year. New car prices also rose 1.1%, while the decline in used car prices slowed to only 0.4% from 3.8% in March.

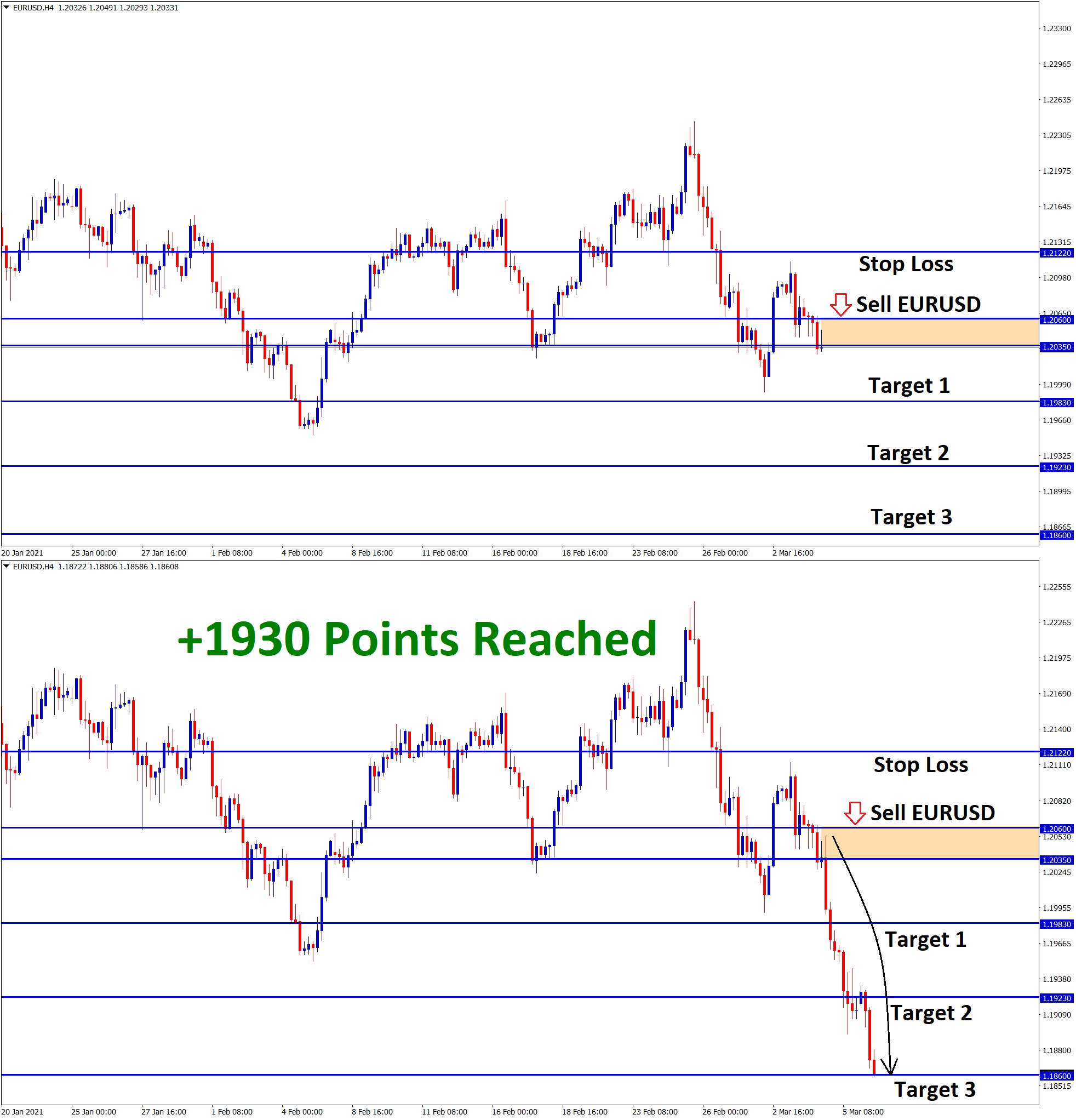

EURUSD H4 Time Frame Analysis Market is moving in the Descending channel and the market has fallen from the lower high area of the Channel.

Prices for services, in general, rose 0.7%, with transportation services rising a seasonally adjusted 3.1% from March as demand for both tourism and business travel rebounded. Airlines and hotel operators have both issued a string of upbeat forecasts for the rest of the year in their recent quarterly reports. Airfares alone rose an average of 18% on the month in April, for a 33% annual gain from last year’s pandemic-depressed levels.”

ECB Lagarde Speech

Just a couple of days ago, we had mentioned how ECB’s Lagarde is just one of those members who likes to maintain a neutral position without revealing too much information on the upcoming monetary policy decisions. It seems as though she heard the feedback of the community as just yesterday, she spoke in a conference where she discussed the upcoming monetary policy decision and that she believes the ECB is most likely going to increase the interest rates. Since quite a few ECB members had come out this week revealing the same stance, this speech was nothing new as we already knew this would happen. But what was knew was the fact that Lagarde actually gave up her neutral stance for the first time in order to reveal the possible new monetary policies for the upcoming term.

At the conference early on Wednesday, Christine Lagarde reveals, “The great financial crisis and the sovereign debt crisis delivered a much greater shock to the euro area than to other major economies. This was so because those crises had revealed – and exacerbated – the underlying weaknesses in the institutional architecture of the union. In particular, we saw that a monetary union cannot be stable – and a currency truly single – with a segmented regime of bank supervision and resolution. After all, most of the money that people use daily is not a central bank liability, but rather deposits issued by commercial banks.

EURUSD Monthly Time Frame Analysis Market has reached the Major Multi Year Monthly Support area of the Major Box Pattern.

EURUSD Monthly Time Frame Analysis Market has reached the Major Multi Year Monthly Support area of the Major Box Pattern.

In this setting, if financial markets fragment, it can lead to an asymmetric tightening of financing conditions and disrupt the transmission of monetary policy across the euro area. That is what we saw happening as the sovereign debt crisis progressed.”

Russian Oil Ban

For the first time since the war in Ukraine began, the EU can’t get access to Russian oil even if it wants to. Russia’s oil would previously be supplied through Ukraine’s capital, Kyiv. However, Kyiv claims that it is unable to reach the oil provided by Russia as military forces have blocked the area. The EU is now left to fend for themselves by finding alternative means of receiving oil for its daily use. This situation isn’t that alarming as of right now as the EU had already previously made a deal with the US to receive oil from them. So until the matter with Russia and Ukraine is resolved, the EU will have to survive on the generosity of the US. It is important to note that the US can only provide so much for all 28 states of the EU. Luckily the EU still has some oil reserves and is currently making use of them.

Analysts at Reuters have been following this story and have revealed key details on the situation. They state, “U.S. crude stocks rose by more than 8 million barrels in the most recent week, due to another large release from strategic reserves, the Energy Information Administration said. Commercial crude inventories have been growing as the White House has elected to flood the market with oil to offset the rise in prices. However, fuel prices have kept rising on the decline in refining capacity and surging demand for products worldwide – just as Russia’s exports have been curtailed. That has driven refining margins to near-record levels in the United States. Despite the build in crude stocks, gasoline inventories fell by 3.6 million barrels in the latest week.”